SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

F O R M 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2009

MAGAL SECURITY SYSTEMS LTD.

(Name of Registrant)

P.O. Box 70, Industrial Zone, Yahud 56100 Israel

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Indicate by check mark whether by furnishing the information contained

in this Form, the registrant is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes [ ] No [X]

If "Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82- _________

This Report on Form 6-K is incorporated by reference into the Registrant's Form

S-8 Registration Statements File Nos. 333-96929 and 333-127340.

Magal Security Systems Ltd.

6-K Items

1. Press Release re Magal Security Systems Reports Fourth Quarter 2008

and Year-End 2008 Financial Results dated July 13, 2009.

2. Press Release re Magal Security Systems Announces Filing of Annual

Report With the U.S. Securities and Exchange Commission dated July 13,

2009.

ITEM 1

Magal Security Systems Reports Fourth Quarter 2008 and

Year-End 2008 Financial Results

Press Release

Source: Magal Security Systems Ltd

On Monday July 13, 2009, 7:08 am EDT

YAHUD, Israel, July 13 /PRNewswire-FirstCall/ -- Magal Security Systems Ltd.

(NASDAQ GMS: MAGS, TASE: MAGS) today announced its consolidated financial

results for the three and twelve months periods ended December 31, 2008.

Management will hold an investors' conference call later today, at 10am ET Time,

5pm Israel time, to discuss the results.

FOURTH QUARTER 2008 RESULTS

Revenues for the fourth quarter of 2008 totaled US$29.9 million, an increase of

29.1% over the fourth quarter of 2007.

Gross profit for the fourth quarter of 2008 decreased by 22.8% compared with the

fourth quarter of 2007, reaching US$6.4 million, or 21.5% of revenues. Gross

margin for the quarter was negatively impacted by inventory write off of US$ 2.0

million, compared with US$646,000 in 2007 following the cancellation of a

project in Latin America and the write off of certain products and equipment in

the Company's North American R&D and manufacturing activities. Gross margin was

also impacted by the relatively low gross margin generated by the Company's

European system integration subsidiary, consolidated as of September 2007.

Operating loss for the fourth quarter of 2008 was US$21.4 million, compared with

operating income of US$763,000 in the fourth quarter of 2007. The quarterly

operating loss is attributable to the increase in cost of revenues, impairment

of goodwill and other intangible assets amounting to US$12.9 million as well as

one-time post employment and termination benefits expenses of US$2.1 million.

The impairment charges were primarily attributable to the European system

integration subsidiary (acquired in September 2007) and the reduction in the

fair value of our U.S. subsidiary.

Net loss in the fourth quarter of 2008, was US$24.0 million, compared with net

income of US$2.9 million in the fourth quarter of 2007. Loss per share for the

fourth quarter of 2008 was US$2.31, compared with diluted earnings per share of

US$0.28 in the same period last year.

FULL YEAR 2008 RESULTS

Revenues for the year ended December 31, 2008 was US$70.4 million, a 2.8%

decrease compared with the previous year. The decrease is primarily attributable

to the lower revenues generated by our Latin American subsidiary and a reduction

in revenues in the United States.

Gross profit for the year decreased by 26.7% to US$21.2 million, or 30.1% of

revenues, compared with US$28.9 million, or 39.9% of revenues, in 2007. This

decrease is mainly attributable to the afore-mentioned inventory write offs of

US$2.0 million in 2008, the contribution of our European subsidiary as indicated

above, the 12.8% appreciation of the Israeli Shekel ("NIS") during 2008 against

the U.S. dollar which increased the U.S. dollar value of the Company's NIS

denominated expenses as well as a loss provision attributable to two strategic

projects.

Operating loss for 2008 was US$28.6 million, compared with operating income of

US$2.7 million in 2007. The operating loss was primarily attributable to the

one-time impairment of goodwill and other intangible asset charges of US$12.9

million and one-time post employment and termination benefits expenses of US$2.6

million, the majority of which were recorded in the fourth quarter of 2008.

Net loss for 2008 was US$32.6 million compared with net income of US$1.9 million

in 2007. Net Loss per share for the year ended December 31, 2008 was US$3.14,

compared with diluted earnings per share of US$0.18 in the year 2007. Commenting

on the results, Mr. Yaacov Perry, the Chairman of the Board of Directors of the

Company, said: "Magal, a leading international provider of security, safety,

site management and intelligence analysis, has undergone deep refocusing

measures in recent months,. which were undertaken with a view to better equip

the company to continue to grow and expand and meeting the evolving market

demands through its premier portfolio. Looking ahead, Magal is now entering the

next stage of its development, and I wish the incoming CEO, Eitan Livneh, the

best of success in taking the company to the next echelon of growth and

success."

INVESTORS' CONFERENCE CALL INFORMATION:

The Company will host a conference call on July 13, 2009 at 10:00am ET. On the

call, management will review and discuss the results and will be available to

answer investor questions.

To participate, please call one of the following teleconferencing numbers.

Please begin placing your calls at least 10 minutes before the conference call

commences. If you are unable to connect using the toll-free numbers, please try

the international dial-in number.

US Dial-in Number: 1-888-668-9141

Israel Dial-in Number: 03-918-0610

UK Dial-in Number: 0-800-917-5108

International Dial-in Number: +972-3-918-0610

at: 10:00am Eastern Time; 3:00pm UK Time; 5:00pm Israel Time

A replay of the call will be available from the day after the call. The link to

the replay will be accessible from Magal's website at: http://www.magal-ssl.com.

About Magal Security Systems Ltd.:

Magal S3i is a leading international solution provider, in the business of

Security, Safety, Site Management and Intelligence analysis. Based on 35 years

of experience and interaction with customers, the company has developed a unique

set of solutions and products optimized for perimeter, outdoor and general

security applications. Magal S3i's turnkey solutions are typically integrated

and managed by single sophisticated modular command and control software,

supported by expert systems for real-time decision support. Magal S3i's broad

portfolio of critical infrastructure and site protection management technologies

includes a variety of smart barriers and fences, fence mounted detectors,

virtual gates, buried and concealed detection systems as well as a sophisticated

protection package for sub-surface intrusion. A world innovator in the

development of CCTV, IVA and motion detection technology for outdoor operation,

Magal S3i has successfully installed customized solutions and products in more

than 75 countries worldwide.

This press release contains forward-looking statements, which are subject to

risks and uncertainties. Such statements are based on assumptions and

expectations which may not be realized and are inherently subject to risks and

uncertainties, many of which cannot be predicted with accuracy and some of which

might not even be anticipated. Future events and actual results, financial and

otherwise, may differ from the results discussed in the forward-looking

statements. A number of these risks and other factors that might cause

differences, some of which could be material, along with additional discussion

of forward- looking statements, are set forth in the Company's Annual Report on

Form 20-F filed with the Securities and Exchange Commission.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(All numbers except EPS expressed in

thousands of US$)

Year Ended December Quarter Ended December

31, 31,

2008 2007 % 2008 2007 %

change change

Revenues 70,355 72,375 (2.8) 29,894 23,155 29.1

Cost of

revenues 49,205 43,510 13.1 23,476 14,837 58.2

Gross profit 21,150 28,865 (26.7) 6,418 8,318 (22.8)

Operating

expenses:

Research and

development,

net 6,195 5,764 7.5 1,418 1,879 (24.5)

Selling and

marketing 17,179 12,930 32.9 6,952 3,399 104.5

General and

administrative 10,888 6,561 66.0 4,378 2,333 87.7

Impairment of

goodwill and

other

intangible

assets 12,887 - 12,887 -

Post

employment and

termination

benefits 2,582 904 185.6 2,144 (56)

Total

operating

expenses 49,731 26,159 90.1 27,779 7,555 267.7

Operating

income (loss) (28,581) 2,706 (21,361) 763

Financial

expenses, net 2,006 2,137 (6.1) 224 710 (68.5)

|

Income (loss)

from

continuing

operations

before income

taxes (30,587) 569 (21,585) 53

Income tax

(tax benefit) 1,618 373 333.8 2,395 (804)

Net Income

from

continuing

operations (32,205) 196 (23,980) 857

Net Income

(loss) from

discontinued

operations (397) 1,686 (46) 2,022

Net income

(loss) (32,602) 1,882 (24,026) 2,879

Basic net

earnings per

share from

continuing

operations $(3.11) $0.02 $(2.31) $0.08

Basic net

earnings

(loss) per

share from

discontinued

operations $(0.03) $0.16 $(0.00) $0.20

Basic net

earnings

(loss) per

share $(3.14) $0.18 $(2.31) $0.28

Weighted average

number of shares

outstanding used

in computing

basic net

earnings per

share (in

thousands) 10,397 10,395 10,397 10,397

Diluted net

earnings per

share from

continuing

operations $(3.11) $0.02 $(2.31) $0.08

Diluted net loss

per share

from

discontinued

operations $(0.03) $0.16 $(0.00) $0.20

Diluted net

earnings

(loss) per

share $(3.14) $0.18 $(2.31) $0.28

Weighted average

number of

shares

outstanding

used in computing

diluted net

earnings per

share (in

thousands) 10,397 10,431 10,397 10,398

|

CONDENSED CONSOLIDATED QUARTERLY STATEMENTS

OF INCOME

(All numbers except EPS expressed in thousands of US$)

2008

Mar. Jun. Sept. Dec.

31, 30, 30, 31,

(In thousands

Revenues $13,735 $11,319 $15,407 $29,894

Cost of revenues 8,900 5,897 10,932 23,476

Gross profit 4,835 5,422 4,475 6,418

Operating expenses:

Research and development, net 1,625 1,529 1,623 1,418

Selling and marketing, net 3,142 3,432 3,653 6,952

General and administrative 2,095 2,467 1,948 4,378

Impairment of goodwill and other

intangible assets - - - 12,887

Post employment and termination

benefits 438 - - 2,144

Total operating expenses 7,300 7,428 7,224 27,779

Operating income (loss) (2,465) (2,006) (2,749) (21,361)

Financial expenses, net 984 415 383 224

Income (loss) before income taxes (3,449) (2,421) (3,132) (21,585)

Income taxes (tax benefit) (661) (374) 258 2,395

Income (loss) from continuing

operations (2,788) (2,047) (3,390) (23,980)

Loss from discontinued operations,

net (248) (61) (42) (46)

Net income (loss) (3,036) (2,108) (3,432) (24,026)

|

Management decided to change the accounting method applied to certain projects

to the completed-contracts method and to revise the results of operations

previously reported for the first three quarters of 2008.

CONDENSED CONSOLIDATED BALANCE SHEETS

(All numbers expressed in thousands of US$)

December 31, December 31,

2008 2007

CURRENT ASSETS:

Cash and cash equivalents $ 16,835 $ 9,205

Marketable securities 1,000 9,464

Short term bank deposits 1,228 11,220

Restricted deposit 3,223 -

Trade receivables 15,800 26,775

Unbilled accounts receivable 5,055 4,053

Other accounts receivable and prepaid expenses 5,214 5,753

Deferred income taxes 714 1,936

Inventories 12,728 23,785

Cost incurred on long term contracts 7,646 -

Total current assets 69,443 92,191

Long term investments and receivables:

Long-term trade receivables 1,839 2,019

Long-term loans 519 808

Long-term bank deposits 1,826 1,846

Escrow deposit 860 4,442

Severance pay fund 2,763 2,765

Total long-term investments and receivables 7,807 11,880

PROPERTY AND EQUIPMENT, NET 8,441 8,429

OTHER ASSETS, NET 2,925 7,803

GOODWILL 1,874 5,610

ASSETS ATRIBUTED TO DISCONTINUED OPERATION 47 244

Total assets $90,537 $126,157

CURRENT LIABILITIES:

Short-term bank credit $ 23,182 $ 16,434

Current maturities of long-term bank debt 813 4,303

Trade payables 13,145 7,344

Customer advances 1,735 11,703

Other accounts payable and accrued expenses 14,189 10,,881

Total current liabilities 53,064 50,665

LONG-TERM LIABILITIES:

Long-term bank debt 2,282 3,095

Deferred income taxes 482 2,097

Accrued severance pay 3,823 3,873

Total long-term liabilities 6,587 9,065

LIABILITIES ATRIBUTED TO DISCONTINUED OPERATION 168 849

SHAREHOLDERS' EQUITY 30,718 65,578

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $90,537 $126,157

|

For more information:

Magal Security Systems Ltd.

Zev Morgenstern, CFO

Tel: +972-3-539-1444

E-mail: zevm@magal-ssl.com.

Web: http://www.magal-ssl.com

GK Investor Relations

Ehud Helft/Kenny Green

Tel: (US) +1-646-201-9246

Int'l dial: +972-3-607-4717

E-mail: info@gkir.com.

ITEM 2

Magal Security Systems Announces Filing of Annual Report With the U.S.

Securities and Exchange Commission

Press Release

Source: Magal Security Systems Ltd

On Monday July 13, 2009, 9:35 am EDT

YAHUD, Israel, July 13 /PRNewswire-FirstCall/ -- Magal Security Systems Ltd.

(NASDAQ GMS: MAGS, TASE: MAGS), today announced that its annual report on Form

20-F containing audited consolidated financial statements for the year ended

December 31, 2008 has been filed with the U.S. Securities and Exchange

Commission. The annual report is available on the Company's website at

www.magal-ssl.com as well as on the SEC's website on www.sec.gov. Shareholders

may receive a hard copy of the annual report, free of charge, upon request.

About Magal Security Systems Ltd.:

Magal S3i is a leading international solution provider, in the business of

Security, Safety, Site Management and Intelligence analysis. Based on 35 years

of experience and interaction with customers, the company has developed a unique

set of solutions and products optimized for perimeter, outdoor and general

security applications. Magal S3i's turnkey solutions are typically integrated

and managed by single sophisticated modular command and control software,

supported by expert systems for real-time decision support. Magal S3i's broad

portfolio of critical infrastructure and site protection management technologies

includes a variety of smart barriers and fences, fence mounted detectors,

virtual gates, buried and concealed detection systems as well as a sophisticated

protection package for sub-surface intrusion. A world innovator in the

development of CCTV, IVA and motion detection technology for outdoor operation,

Magal S3i has successfully installed customized solutions and products in more

than 75 countries worldwide.

This press release contains forward-looking statements, which are subject to

risks and uncertainties. Such statements are based on assumptions and

expectations which may not be realized and are inherently subject to risks and

uncertainties, many of which cannot be predicted with accuracy and some of which

might not even be anticipated. Future events and actual results, financial and

otherwise, may differ from the results discussed in the forward-looking

statements. A number of these risks and other factors that might cause

differences, some of which could be material, along with additional discussion

of forward- looking statements, are set forth in the Company's Annual Report on

Form 20-F filed with the Securities and Exchange Commission.

For more information:

Magal Security Systems Ltd.

Zev Morgenstern, CFO

Tel: +972-(3)-539-1444

E-mail: zevm@magal-ssl.com

Web: http://www.magal-ssl.com

GK Investor Relations

Ehud Helft/Kenny Green

Tel: (US) +1-646-201-9246

Int'l dial: +972-3-607-4717

E-mail: info@gkir.com

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

MAGAL SECURITY SYSTEMS LTD.

(Registrant)

By: /s/Zeev Morgenstern

-------------------

Zeev Morgensten

Vice President - Finance,

Chief Financial Officer and Secretary

Date: July 14, 2009

|

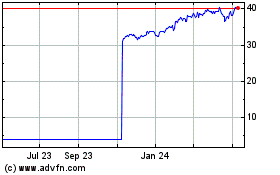

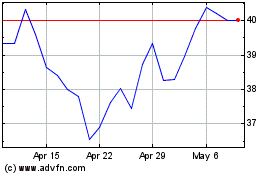

Listed Funds Trust Round... (NASDAQ:MAGS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Listed Funds Trust Round... (NASDAQ:MAGS)

Historical Stock Chart

From Sep 2023 to Sep 2024