Liberty Global plc (NASDAQ: LBTYA, LBTYB and LBTYK) (“Liberty

Global,” the “Company,” “our” or “we”), one of the world’s leading

converged video, broadband and communications companies, today

announced that it commenced “modified Dutch Auction” tender offers

to invite its shareholders to tender an aggregate value of up to

$2.5 billion of its ordinary shares consisting of (i) up to $625

million of its issued and outstanding ordinary Class A shares,

nominal value $0.01 per share (each, a “Class A Share”), for

purchase by Credit Suisse Securities (USA) LLC and HSBC Securities

(USA) Inc., each acting as principal (each, a “Counterparty Bank,”

and together, the “Counterparty Banks”), at a price not greater

than $29.00 nor less than $25.25 per Class A Share, and (ii) up to

$1.875 billion of its issued and outstanding ordinary Class C

shares, nominal value $0.01 per share (each, a “Class C Share,” and

together with the Class A Shares, the “Shares”), for purchase by

the Counterparty Banks at a price not greater than $28.50 nor less

than $24.75 per Class C Share, in each case, in cash, less any

applicable withholding taxes and without interest. The tender

offers are made in accordance with the terms and subject to the

conditions described in the offer to purchase and other related

materials, as may be amended or supplemented from time to time.

To ensure compliance with English law, any Shares purchased in

the tender offers will initially be purchased by a Counterparty

Bank, acting as a principal and not as an agent, nominee or

trustee. In turn, each Counterparty Bank will sell, and Liberty

Global will purchase from the applicable Counterparty Bank, such

Shares at the price paid by such Counterparty Bank in the relevant

tender offer (along with certain other costs). The Company intends

to cancel the Shares purchased by it from the Counterparty

Banks.

The closing price of the Shares on the NASDAQ Global Select

Market on August 9, 2019, the last full trading day before the

commencement of the tender offers, was $25.98 per Class A Share and

$25.85 per Class C Share. The tender offers are scheduled to expire

at one (1) minute after 11:59 P.M., New York City time, on

September 9, 2019, unless the offers are extended or

terminated.

The tender offers are not contingent upon any minimum number of

Shares being tendered. However, the tender offers are subject to a

number of other terms and conditions, which are described in detail

in the offer to purchase filed today with the U.S. Securities and

Exchange Commission. Specific instructions and a complete

explanation of the terms and conditions of the tender offers are

contained in the offer to purchase, the applicable letter of

transmittal and other related materials, which will be mailed to

shareholders of record promptly after commencement of the tender

offer.

None of the Company, the members of its Board of Directors, the

Counterparty Banks, the dealer managers, the information agent or

the depositary makes any recommendation as to whether any

shareholder should participate or refrain from participating in the

tender offers or as to the purchase price(s) at which shareholders

may choose to tender their Shares in the tender offers.

The information agent for the tender offer is Innisfree M&A

Incorporated. The depositary for the tender offer is Computershare

Trust Company, N.A. The dealer managers for the tender offer are

Credit Suisse Securities (USA) LLC and HSBC Securities (USA) Inc.

For all questions relating to the tender offer, please call the

information agent, Innisfree M&A Incorporated, toll-free at

(888) 750-5834; banks and brokers may call either dealer manager,

Credit Suisse Securities (USA) LLC at (800) 318-8219 or HSBC

Securities (USA) Inc. at (888) 472-2456.

ABOUT LIBERTY GLOBAL

Liberty Global (NASDAQ: LBTYA, LBTYB and LBTYK) is one of the

world’s leading converged video, broadband and communications

companies, with operations in six European countries under the

consumer brands Virgin Media, Telenet and UPC. We invest in the

infrastructure and digital platforms that empower our customers to

make the most of the digital revolution. Our substantial scale and

commitment to innovation enable us to develop market-leading

products delivered through next-generation networks that connect 11

million customers subscribing to 25 million TV, broadband internet

and telephony services. We also serve 6 million mobile subscribers

and offer WiFi service through millions of access points across our

footprint.

In addition, Liberty Global owns 50% of VodafoneZiggo, a joint

venture in the Netherlands with 4 million customers subscribing to

10 million fixed-line and 5 million mobile services, as well as

significant investments in ITV, All3Media, ITI Neovision,

LionsGate, the Formula E racing series and several regional sports

networks.

ADDITIONAL INFORMATION REGARDING

THE TENDER OFFER

This press release is for informational purposes only. This

press release is not a recommendation to buy or sell Shares or any

other securities of Liberty Global, and it is neither an offer to

purchase nor a solicitation of an offer to sell Shares or any other

securities of Liberty Global. Liberty Global will be filing today a

tender offer statement on Schedule TO, including an offer to

purchase, letters of transmittal and other related materials, with

the United States Securities and Exchange Commission (the “SEC”).

The tender offers will only be made pursuant to the offer to

purchase, the applicable letter of transmittal and other related

materials filed as part of the issuer tender offer statement on

Schedule TO, in each case as may be amended or supplemented from

time to time. Shareholders should read carefully the offer to

purchase, the applicable letter of transmittal and other related

materials because they contain important information, including the

various terms of, and conditions to, the tender offer. Shareholders

will be able to obtain a free copy of the tender offer statement on

Schedule TO, the offer to purchase, the letters of transmittal and

other related materials that Liberty Global will be filing with the

SEC at the SEC’s website at www.sec.gov. In addition, free copies

of these documents may be obtained by contacting Innisfree M&A

Incorporated, the information agent for the tender offer, toll-free

at (888) 750-5834.

FORWARD-LOOKING STATEMENTS AND

DISCLAIMER

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including the expected size or other terms of the tender

offers and the Company’s ability to complete the tender offers.

These forward-looking statements involve certain risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by these statements. These risks

and uncertainties include events that are outside of our control,

such as the continued use by subscribers and potential subscribers

of our and our affiliates’ services and their willingness to

upgrade to our more advanced offerings; our and our affiliates’

ability to meet challenges from competition, to manage rapid

technological change or to maintain or increase rates to

subscribers or to pass through increased costs to subscribers; the

effects of changes in laws or regulation; general economic factors;

our and our affiliates’ ability to obtain regulatory approval and

satisfy regulatory conditions associated with acquisitions and

dispositions; our and affiliates’ ability to successfully acquire

and integrate new businesses and realize anticipated efficiencies

from acquired businesses; the availability of attractive

programming for our and our affiliates’ video services and the

costs associated with such programming; our and our affiliates’

ability to achieve forecasted financial and operating targets; the

outcome of any pending or threatened litigation; the ability of our

operating companies and affiliates to access cash of their

respective subsidiaries; the impact of our operating companies' and

affiliates’ future financial performance, or market conditions

generally, on the availability, terms and deployment of capital;

fluctuations in currency exchange and interest rates; the ability

of suppliers, vendors and contractors to timely deliver quality

products, equipment, software, services and access; our and our

affiliates’ ability to adequately forecast and plan future network

requirements including the costs and benefits associated with

network expansions; and other factors detailed from time to time in

our filings with the Securities and Exchange Commission, including

our most recently filed Form 10- K and Form 10-Q. Further,

estimated cash proceeds from pending dispositions are inherently

uncertain and represent management’s expectations and beliefs and

do not take into account the ultimate use of the proceeds or any

other changes in our capital structure or tax effects, directly or

indirectly related to the pending dispositions. The accuracy of our

expectations and predictions is also subject to the following risks

and uncertainties: (1) our ability to complete the tender offers;

and (2) the price and time at which we may make any additional

share repurchases following completion of the tender offers and the

number of Shares acquired in such repurchases. These

forward-looking statements speak only as of the date of this

release. We expressly disclaim any obligation or undertaking to

disseminate any updates or revisions to any forward-looking

statement contained herein to reflect any change in our

expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is

based.

For more information, please visit www.libertyglobal.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190812005270/en/

Investor Relations: Matt Coates, +44 20 8483 6333 John

Rea, +1 303 220 4238 Stefan Halters, +44 20 8483 6211 Corporate

Communications: Molly Bruce, +1 303 220 4202 Matt Beake, +44 20

8483 6428

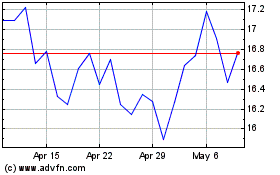

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

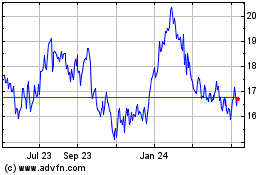

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Apr 2023 to Apr 2024