Liberty Global to Sell Swiss Operation -- Update

February 27 2019 - 5:49PM

Dow Jones News

(Adds details on John Malone and Liberty Global's fourth-quarter

earnings.)

--Including dividends and equity proceeds, Liberty will have

nearly quadrupled its capital invested in Switzerland

--Liberty reported revenue from continuing operations grew 1.2%

to $2.95 billion in the fourth quarter

By Micah Maidenberg

Cable tycoon John Malone is cashing out of Switzerland.

Mr. Malone's Liberty Global PLC (LBTYA), a holding company for

European cable assets, said Wednesday that it will sell its Swiss

unit UPC Switzerland to Sunrise Communications Group AG in a deal

with an enterprise value of about $6.3 billion.

Liberty said it will receive roughly $2.6 billion cash from

Sunrise, a Swiss telecommunications firm. Sunrise will also take on

UPC's debt, which totaled about $3.7 billion at the end of

2018.

Mr. Malone, who is chairman of Liberty, has been looking to exit

some of his telecom investments in Europe. Last May, Liberty

announced the sale of its networks in Germany and parts of Eastern

Europe. In December 2017, the company said it would sell its

Austrian business.

Liberty Chief Executive Mike Fries said in prepared remarks that

the company bought UPC's predecessor in 2005, investing $1.6

billion. Including dividends and equity proceeds, Liberty will have

nearly quadrupled its capital invested in Switzerland, he said.

UPC's operation in Switzerland covers 2.3 million homes and

provides video, broadband or voice services to 1.1 million

customers, Liberty said.

"The combined company will have the scale to drive innovation,

invest in new services and pursue growth by providing innovative

and competitively priced offers," Sunrise said in a statement.

The deal is expected to be completed before the end of the

year.

Mr. Malone is known as a pioneer in the cable industry and a

deal maker. Another one of his holding companies owns a significant

stake in Charter Communications Inc. (CHTR), and Mr. Malone himself

has invested in Discovery Inc. (DISCA), which owns cable

channels.

Together, UPC and Zurich-based Sunrise would have recorded about

$3.17 billion in revenue and earnings before interest, taxes and

other costs of $1.33 billion in 2018.

Separately, Denver-based Liberty reported revenue from

continuing operations grew 1.2% to $2.95 billion in the fourth

quarter. Operating income rose 73% to $252.2 million.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

February 27, 2019 17:34 ET (22:34 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

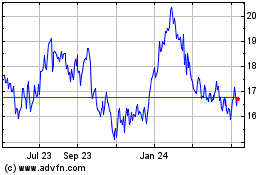

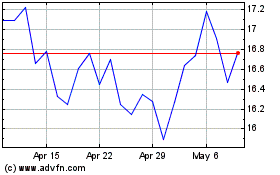

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Apr 2023 to Apr 2024