Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

As filed with the Securities and Exchange Commission on July 31, 2019.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Leap Therapeutics, Inc.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

Delaware

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

2834

(Primary Standard Industrial

Classification Code Number)

|

|

27-4412575

(I.R.S. Employer

Identification Number)

|

47 Thorndike Street

Suite B1-1

Cambridge, MA 02141

(617) 714-0360

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

Christopher K. Mirabelli, Ph.D.

Chairman, President and Chief Executive Officer

Leap Therapeutics, Inc.

47 Thorndike Street

Suite B1-1

Cambridge, MA 02141

(617) 714-0360

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

Julio E. Vega, Esq.

Morgan, Lewis & Bockius LLP

One Federal Street

Boston, MA 02110

(617) 951-8000

Approximate date of commencement of the proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act,

check the following box.

ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an

emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

(Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

o

|

|

Accelerated filer

o

|

|

Non-accelerated filer

ý

|

|

Smaller reporting company

ý

Emerging growth company

ý

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

o

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount to be

Registered(1)

|

|

Proposed Maximum

Offering Price Per

Share(2)

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

Amount of

Registration Fee

|

|

|

|

Common Stock, $0.001 par value per share

|

|

5,587,461

|

|

$2.285

|

|

$12,767,348.40

|

|

$1,547.40

|

|

|

-

(1)

-

Represents

5,257,461 shares of common stock that are issued or issuable pursuant to a purchase agreement with the selling stockholder named herein and 330,000 shares

of common stock previously issued to the selling stockholder named herein pursuant to such purchase agreement. Pursuant to Rule 416(a) of the Securities Act of 1933, as amended, this

Registration Statement also covers any additional shares of common stock which may become issuable to prevent dilution from stock splits, stock dividends and similar events.

-

(2)

-

Pursuant

to Rule 457(c) of the Securities Act of 1933, as amended, calculated on the basis of the high and low prices per share of the registrant's common

stock as reported by the Nasdaq Global Market on July 30, 2019.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall

file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as

amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. The selling stockholder may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and the selling stockholder is not soliciting offers to buy these securities

in any state or other jurisdiction where the offer or sale of these securities is not permitted.

SUBJECT TO COMPLETION, DATED July 31, 2019

PROSPECTUS

5,587,461 Shares

Common Stock

This prospectus relates to the sale of up to 5,587,461 shares of our common stock by Lincoln Park Capital Fund, LLC, or Lincoln Park.

Lincoln Park is also referred to in this prospectus as the selling stockholder.

We

will not receive proceeds from the sale of the shares by the selling stockholder. However, we may receive proceeds of up to $20.0 million from the sale of our common stock to

the selling stockholder, pursuant to a purchase agreement entered into with the selling stockholder on July 10, 2019, once the registration statement of which this prospectus is a part is

declared effective.

The

selling stockholder is an "underwriter" within the meaning of the Securities Act of 1933, as amended. Lincoln Park may sell the shares of common stock described in this prospectus in

a number of different ways and at varying prices. See "Plan of Distribution" for more information about how the selling stockholder may sell the shares of common stock being registered pursuant to

this prospectus.

We

will pay the expenses of registering these shares, but all selling and other expenses incurred by the selling stockholder will be paid by the selling stockholder. See "Plan of

Distribution".

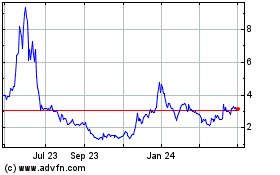

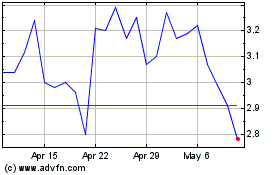

Our

common stock is listed on the Nasdaq Global Market under the symbol "LPTX." On July 30, 2019, the last reported sale price per share of our common stock on the Nasdaq Global

Market was $2.36 per share.

We

are an "emerging growth company" under applicable federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements for this

prospectus supplement and future filings.

You

should read this prospectus, together with additional information described under the headings "Incorporation of Certain Information by Reference" and "Where You Can Find More

Information", carefully before you invest in any of our securities.

Investing in our securities involves a high degree of risk. See "Risk Factors" on page 7 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these

securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2019.

Table of Contents

TABLE OF CONTENTS

We

incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions under the

section of this prospectus entitled "Where You Can Find More Information". You should carefully read this prospectus as well as additional information described under the section of this prospectus

entitled "Incorporation of Certain Information by Reference," before deciding to invest in our common shares.

Unless

the context otherwise requires, the terms "Leap," "we," "us" and "our" in this prospectus refer to Leap Therapeutics, Inc., and "this offering" refers to the offering

contemplated in this prospectus.

Neither

we nor the selling stockholder authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing

prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may

give you. This prospectus is an offer to sell only the shares offered hereby, but only under the circumstances and in the jurisdictions where it is lawful to do so. The information contained in this

prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of shares of our common stock. Our business, financial condition,

results of operations and prospects may have changed since that date. We are not, and the selling stockholder is not, making an offer of these securities in any jurisdiction where such offer is not

permitted.

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the information incorporated by reference herein contain forward-looking statements within the meaning of Section 27A

of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that involve a number of risks and

uncertainties and that are intended to be covered by the "safe harbor" created by those sections. Although our forward-looking statements reflect the good faith judgment of our management, these

statements can only be based on facts and factors currently known by us. Consequently, these forward-looking statements are inherently subject to known and unknown risks, uncertainties and other

factors that may cause actual results and outcomes to differ materially from results and outcomes discussed in the forward-looking statements.

Forward-looking

statements can generally be identified by the use of forward-looking terms such as "believe," "hope," "expect," "may," "will," "should," "could," "would," "seek,"

"intend," "plan," "estimate," "anticipate" and "continue," or other comparable terms (including their use in the negative), or by discussions of future matters. All statements other than statements of

historical facts included in this prospectus and the documents incorporated by reference herein are forward-looking statements. These statements include but are not limited to statements under the

captions "Prospectus Summary—The Company," "Risk Factors," "Use of Proceeds" and "The Lincoln Park Transaction" and in other sections included in this prospectus or incorporated by

reference from our

Annual Report on Form 10-K

and

Quarterly Reports on Form 10-Q

, as applicable, as well as our other

filings with the SEC. You should be aware that the occurrence of any of the events discussed under the heading "Risk Factors" in this prospectus and any documents incorporated by reference herein

could substantially harm our business, operating results and financial condition and that if any of these events occurs, it could adversely affect the value of an investment in our securities.

The

cautionary statements made in this prospectus supplement are intended to be applicable to all related forward-looking statements wherever they may appear in this prospectus or any

documents incorporated by reference herein. We urge you not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. Except as required by law, we

assume no obligation to update our forward-looking statements, even if new information becomes available in the future.

Table of Contents

PROSPECTUS SUMMARY

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. Because

it is only a summary, it does not contain all of the information you should consider before investing in our common stock and it is qualified in its entirety by, and should be read in conjunction

with, the more detailed information included elsewhere in this prospectus. Before you decide whether to purchase shares of our common stock, you should read this entire prospectus carefully, including

the risks of investing in our securities discussed under the section of this prospectus entitled "Risk Factors" and similar headings in the other documents that are incorporated by reference into this

prospectus. You should also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits to the registration statement of which

this prospectus is a part.

The Company

Leap Therapeutics, Inc. is a biopharmaceutical company focused on developing novel therapies designed to treat patients with cancer by

inhibiting fundamental tumor-promoting pathways and by harnessing the immune system to attack cancer cells. Our strategy is to identify, acquire, and develop molecules that will rapidly translate into

high impact therapeutics that generate durable clinical benefit and enhanced patient outcomes.

Our

two clinical stage programs are:

-

•

-

DKN-01: A monoclonal antibody that inhibits Dickkopf-related protein 1, or DKK1. DKK1 is a protein that modulates the Wnt signaling pathways

and enables tumor cells to proliferate and spread, as well as suppresses the immune system from attacking the tumor. When DKN-01 binds to DKK1, an anti-tumor effect can be generated. DKN-01-based

therapies have generated responses and clinical benefit in several patient populations. We are currently studying DKN-01 in multiple ongoing clinical trials in patients with esophagogastric cancer,

hepatobiliary cancer, gynecologic cancers, and prostate cancer.

-

•

-

TRX518: A monoclonal antibody targeting the glucocorticoid-induced tumor necrosis factor-related receptor, or GITR. GITR is a receptor found on

the surface of a wide range of immune cells. GITR stimulation activates tumor fighting white blood cells and decreases the activity of potentially tumor-protective immunosuppressive cells. TRX518 has

been specifically engineered to enhance the immune system's anti-tumor response by activating GITR signaling without causing the immune cells to be destroyed. We are conducting clinical trials of

TRX518 in patients with advanced solid tumors, in combination with chemotherapy and with cancer immunotherapies.

We

intend to apply our extensive experience identifying and developing transformational products to aggressively develop these antibodies and build a pipeline of programs that has the

potential to change the practice of cancer medicine.

We

commenced business operations in 2011. Our operations to date have been limited to organizing and staffing our company, business planning, raising capital, undertaking preclinical

studies and clinical trials of DKN-01 and TRX518, protecting our intellectual property and providing general and administrative support for these operations. To date, we have not generated any

revenue, have incurred significant losses from operations and have primarily financed our operations through public offerings and private placements of our equity securities, business development

activities, convertible note financings, and our merger with Macrocure Ltd., or Macrocure, which was completed in January 2017. We expect to continue to incur operating losses for the

foreseeable future as we develop our product candidates.

For

a complete description of our business, financial condition, results of operations and other important information, we refer you to our filings with the SEC that are incorporated by

reference in

2

Table of Contents

this

prospectus, including our

Annual Report on Form 10-K for the year ended

December 31, 2018

and our

Quarterly

Report on Form 10-Q for the period ended March 31, 2019

. For instructions on how to find copies of these documents, see the section of this prospectus entitled "Where You

Can Find More Information".

Corporate Information

We were incorporated in the state of Delaware on January 3, 2011 and changed our name to Leap Therapeutics, Inc. effective

November 16, 2015. During 2015, HealthCare Pharmaceuticals Pty Ltd. ("HCP Australia") was formed and is our wholly owned subsidiary.

Our

principal executive office is located at 47 Thorndike Street, Suite B1-1, Cambridge, MA 02141. Our telephone number is 617-714-0360, and our website address is www.leaptx.com

(the information contained therein or linked thereto shall not be considered incorporated by reference in this prospectus).

Status as an Emerging Growth Company

We are an "emerging growth company", or EGC, as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. The JOBS Act

permits an "emerging growth company" such as us to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies until those

standards would otherwise apply to private companies. We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the

JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to

private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

We

may take advantage of these reporting exemptions until we are no longer an emerging growth company, which in certain circumstances could be for up to five years. We will remain an

"emerging growth company" until the earliest of (a) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion, (b) the date that we become a

"large accelerated filer" as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our shares that are held by non-affiliates exceeds $700 million as of

the last business day of our most recently completed second fiscal quarter, (c) the date on which we have issued more than $1.0 billion in nonconvertible debt during the preceding

three-year period, and (d) the last day of our 2022 fiscal year containing the fifth anniversary of the date on which shares of our Common Stock became publicly traded in the United States. As

of June 30, 2019, we remain an EGC.

3

Table of Contents

THE OFFERING

|

|

|

|

|

Common Stock Being Offered by the Selling Stockholder

|

|

5,587,461 shares of common stock

|

|

Common Stock Outstanding Before the Offering

|

|

24,038,799 shares (as of July 25, 2019)

|

|

Common Stock Outstanding After the Offering

|

|

29,296,260 shares (assuming the issuance after the date of this prospectus by us to the selling stockholder pursuant to the

purchase agreement described below of all of the shares that are being offered by this prospectus)

|

|

Use of proceeds

|

|

The selling stockholder will receive all of the proceeds from the sale of the shares offered for sale by it under this

prospectus. We will not receive proceeds from the sale of the shares by the selling stockholder. However, we may receive proceeds of up to $20.0 million from the sale of our common stock to the selling stockholder under the purchase agreement

described below. Any proceeds from the selling stockholder that we receive under the purchase agreement are expected to be used for general corporate purposes, which may include, without limitation, funding clinical trials of DKN-01 and TRX518 and

the continuation of ongoing studies, capital expenditures, working capital and general and administrative expenses.

|

|

Risk factors

|

|

Investing in our securities involves a high degree of risk. See "Risk Factors" beginning on page 7 and the other

information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock.

|

|

Nasdaq Global Market Symbol

|

|

"LPTX"

|

On

July 10, 2019, we entered into a purchase agreement, or the Purchase Agreement, and a registration rights agreement, or the Registration Rights Agreement, with Lincoln Park.

Under the Purchase Agreement, we have the right to sell to Lincoln Park up to $20.0 million in shares of common stock, subject to certain limitations and conditions set forth in the Purchase

Agreement. As consideration for Lincoln Park's commitment to purchase shares of common stock pursuant to the Purchase Agreement, we issued to Lincoln Park 330,000 shares of common stock, or the

Commitment Shares. We did not receive any cash proceeds from the issuance of such shares.

As

of July 25, 2019, there were 24,038,799 shares of our common stock outstanding (16,931,700 shares held by non-affiliates), which includes the 330,000 Commitment Shares, but

excludes the 5,257,461 shares of common stock that we may issue to Lincoln Park pursuant to the Purchase Agreement after the registration statement of which this prospectus is a part is declared

effective under the Securities Act. If all of such 5,257,461 shares of our common stock offered hereby were issued and outstanding as of July 25, 2019, such shares would represent 17.95% of the

total outstanding common stock. If all such 5,587,461 shares of our common stock offered hereby were issued and outstanding as of July 25, 2019, such shares would represent 25.18% of the

outstanding shares of common stock held by non-affiliates as of July 25, 2019. The number of shares of our common stock ultimately offered for

4

Table of Contents

sale

by Lincoln Park is dependent upon the number of shares purchased by Lincoln Park under the Purchase Agreement. The number of shares of our common stock outstanding as of July 25, 2019 does

not include:

-

•

-

4,058,962 shares of Common Stock issuable upon exercise of outstanding stock options as of July 25, 2019 under our Amended and Restated

2012 Equity Incentive Plan, our 2016 Equity Incentive Plan and the assumed Macrocure 2013 Plan and 2008 Plan, with a weighted average exercise price of $7.50 per share;

-

•

-

2,334,477 shares of Common Stock available for future issuance as of July 25, 2019 under our Amended and Restated 2012 Equity Incentive

Plan and our 2016 Equity Incentive Plan;

-

•

-

10,369,752 shares of Common Stock issuable upon exercise of outstanding warrants as of July 25, 2019, with a weighted average exercise

price of $1.89 per share; and

-

•

-

181,000 shares of Common Stock issuable upon vesting of outstanding restricted stock units as of July 25, 2019, with a weighted average

grant date fair value of $1.74.

Unless

otherwise indicated, all information in this prospectus assumes no exercise of our outstanding stock options or warrants and assumes no issuance of shares of our common stock

pursuant to any of our outstanding restricted stock units.

Upon

the satisfaction of the conditions in the Purchase Agreement, including that a registration statement that we agreed to file with the SEC pursuant to the Registration Rights

Agreement is declared effective by the SEC and a final prospectus in connection therewith is filed with the SEC, or the Commencement, we will have the right, from time to time at our sole discretion

over the 24-month period from and after the Commencement, to direct Lincoln Park to purchase up to 50,000 shares of common stock on any business day (subject to certain limitations contained in the

Purchase Agreement), with such amounts increasing based on certain threshold prices set forth in the Purchase Agreement; however, not to exceed $1,500,000 in total purchase proceeds per purchase date.

The purchase price of shares of common stock that we elect to sell to Lincoln Park pursuant to the Purchase Agreement will be based on the market prices of the common stock at the time of such

purchases as set forth in the Purchase Agreement. We have filed the registration statement of which this prospectus is a part in accordance with our obligations under the Registration Rights

Agreement.

In

addition to regular purchases, as described above, we may also direct Lincoln Park to purchase additional amounts as accelerated purchases or as additional accelerated purchases if

the closing sale price of the common stock is not below certain threshold prices, as set forth in the Purchase Agreement and as more specifically described in the section of this prospectus entitled

"The Lincoln Park Transaction". In all instances, we may not sell shares of our common stock to Lincoln Park under the Purchase Agreement if it would result in Lincoln Park beneficially owning more

than 9.99% of the common stock, or the Beneficial Ownership Cap.

There

are no restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement or Registration Rights Agreement

other than a prohibition on entering into a "Variable Rate Transaction," as defined in the Purchase Agreement, and as more specifically described in the section of this prospectus entitled "The

Lincoln Park Transaction".

Lincoln

Park has agreed not to cause, or engage in any manner whatsoever, any direct or indirect short selling or hedging of the common stock. There is no upper limit on the price per

share that Lincoln Park could be obligated to pay for the common stock under the Purchase Agreement. The purchase price per share will be equitably adjusted for any reorganization, recapitalization,

non-cash dividend, stock split, or other similar transaction occurring during the business days used to compute such price.

5

Table of Contents

Under

the applicable rules of the Nasdaq Global Market, in no event may we issue more than 4,609,169 shares of our common stock, including the 330,000 Commitment Shares and the 571,429

shares of common stock we issued to Lincoln Park pursuant to a purchase agreement, dated July 11, 2019, which represents 19.99% of the shares of our common stock outstanding immediately prior

to the execution of the Purchase Agreement, or the Exchange Cap, unless (i) we obtain stockholder approval to issue shares of our common stock in excess of the Exchange Cap or (ii) the

average price of all applicable sales of our common stock to Lincoln Park under the Purchase Agreement equals or exceeds the average of the closing price of our common stock on the Nasdaq Global

Market for the five business days immediately preceding the signing of the Purchase Agreement plus an incremental amount, such that the transactions contemplated by the Purchase Agreement are exempt

from the Exchange Cap limitation under applicable Nasdaq rules. In any event, the Purchase Agreement specifically provides that we may not issue or sell any shares of our common stock under the

Purchase

Agreement if such issuance or sale would breach any applicable rules or regulations of the Nasdaq Global Market.

We

have the right to terminate the Purchase Agreement at any time at no cost or penalty. Actual sales of shares of common stock to Lincoln Park under the Purchase Agreement will depend

on a variety of factors to be determined by us from time to time, including, among others, market conditions, the trading price of the common stock and determinations by us as to the appropriate

sources of funding for our company and our operations.

We

do not know what the purchase price for our common stock will be and therefore cannot be certain as to the number of shares we might issue to Lincoln Park under the Purchase Agreement

after the date of this prospectus.

6

Table of Contents

RISK FACTORS

Before you make a decision to invest in our securities, you should consider carefully the risks described below,

together with other information in this prospectus and the information incorporated by reference herein, including those risks identified under "Item 1A. Risk Factors" in our

Annual Report on Form 10-K for the year ended December 31, 2018, as filed with

the SEC on April 1, 2019

, and our

Quarterly Report on Form 10-Q

for the period ended March 31, 2019, as filed with the SEC on May 15, 2019

, which are incorporated by reference in this prospectus and which may be amended, supplemented

or superseded by other reports that we subsequently file with the SEC. If any of the following events actually occur, our business, operating results, prospects or financial condition could be

materially and adversely affected. This could cause the trading price of our common stock to decline and you may lose all or part of your investment. The risks described below are not the only ones

that we face. Additional risks not presently known to us or that we currently deem immaterial may also significantly

impair our business operations and could result in a complete loss of your investment. Please also read carefully the section entitled "Special Note Regarding Forward-Looking

Statements."

Risks Related to This Offering

The sale or issuance of our common stock to Lincoln Park may cause dilution and the sale of the shares of

common stock acquired by Lincoln Park, or the perception that such sales may occur, could cause the price of our common stock to fall.

On July 10, 2019, we entered into the Purchase Agreement with Lincoln Park, pursuant to which Lincoln Park has committed to purchase up

to $20.0 million of our common stock, subject to certain limitations. Upon the execution of the Purchase Agreement, we issued 330,000 Commitment Shares to Lincoln Park in consideration for its

commitment to purchase shares of our common stock under the Purchase Agreement. The remaining shares of our common stock that may be issued under the Purchase Agreement may be sold by us to Lincoln

Park at our discretion from time to time over a 24-month period commencing after the satisfaction of certain conditions set forth in the Purchase Agreement, including that the SEC has declared

effective the registration statement of which this prospectus is a part and that such registration statement remains effective. The purchase price for the shares that we may sell to Lincoln Park under

the Purchase Agreement will fluctuate based on the price of our common stock. Depending on market liquidity at the time, sales of such shares may cause the trading price of our common stock to fall.

We

generally have the right to control the timing and amount of any future sales of our shares to Lincoln Park. Additional sales of our common stock, if any, to Lincoln Park will depend

upon market conditions and other factors to be determined by us. We may ultimately decide to sell to Lincoln Park all, some, or none of the additional shares of our common stock that may be available

for us to sell pursuant to the Purchase Agreement. If and when we do sell shares to Lincoln Park, after Lincoln Park has acquired the shares, Lincoln Park may resell all or some of those shares at any

time or from time to time in its discretion. Therefore, sales to Lincoln Park by us could result in substantial dilution to the interests of other holders of our common stock. Additionally, the sale

of a substantial number of shares of our common stock to Lincoln Park, or the anticipation of such sales, could make it more difficult for us to sell equity or equity-related securities in the future

at a time and at a price that we might otherwise wish to effect sales.

7

Table of Contents

We may not be able to access the full amounts available under the Purchase Agreement, which could prevent us

from accessing the capital we need to continue our operations, which could have an adverse effect on our business.

Our ability to direct Lincoln Park to purchase up to $20.0 million of shares of our common stock over a 24-month period is subject to the

satisfaction of certain conditions, including that the registration statement of which this prospectus is a part is declared effective by the SEC.

Thereafter,

on any trading day selected by us, we will have the right to direct Lincoln Park to purchase up to 50,000 shares of our common stock (subject to certain limitations contained

in the Commitment Purchase Agreement), with such amounts increasing based on certain threshold prices set forth in the Purchase Agreement. The purchase price of shares of common stock that we elect to

sell to Lincoln Park pursuant to the Purchase Agreement will be based on the market prices of our common stock at the time of such purchases as set forth in the Purchase Agreement. Although there are

no upper limits on the per share price Lincoln Park may pay to purchase our common stock, we may not sell more than $1.5 million in shares of our common stock to Lincoln Park per any individual

regular purchase. In addition to regular purchases, as described above, we may also direct Lincoln Park to purchase additional amounts as accelerated purchases or as additional accelerated purchases

if the closing sale price of the our common stock is not below certain threshold prices, as set forth in the Purchase Agreement. See "The Lincoln Park Transaction—Purchase of Sales Under

the Purchase Agreement" on page 9 of this prospectus for a more detailed description of the regular purchases, accelerated purchased and additional accelerated purchases permitted under the

Purchase Agreement.

Depending

on the prevailing market price of our common stock, we may not be able to sell shares to Lincoln Park for the maximum $20.0 million over the term of the Purchase

Agreement.

For

example, under the applicable rules of the Nasdaq Global Market, in no event may we issue more than the Exchange Cap, unless (i) we obtain stockholder approval to issue shares

of our common stock in excess of the Exchange Cap or (ii) the average price of all applicable sales of our common stock to Lincoln Park under the Purchase Agreement equals or exceeds the

average of the closing price of our common stock on the Nasdaq Global Market for the five business days immediately preceding the signing of the Purchase Agreement plus an incremental amount, such

that the transactions contemplated by the Purchase Agreement are exempt from the Exchange Cap limitation under applicable Nasdaq rules. We are also not required or permitted to issue or sell any

shares of our common stock under the Purchase Agreement if such issuance or sale would breach any applicable rules or regulations of the Nasdaq Global Market. In addition, Lincoln Park will not be

required to

purchase any shares of our common stock if such sale would result in Lincoln Park's beneficial ownership exceeding the Beneficial Ownership Cap.

Our

inability to access a portion or the full amount available under the Purchase Agreement, in the absence of any other financing sources, could have a material adverse effect on our

business.

8

Table of Contents

USE OF PROCEEDS

The 330,000 Commitment Shares currently outstanding that are being offered for resale by Lincoln Park, the selling stockholder, will be sold for

the account of Lincoln Park. As a result, all proceeds from the sales of the 330,000 shares of common stock currently outstanding and offered for resale hereby will go to Lincoln Park and we will not

receive any proceeds from the resale of those shares of common stock by Lincoln Park.

We

may receive up to $20.0 million in gross proceeds if we issue to Lincoln Park all of the additional shares issuable pursuant to the Purchase Agreement. All such proceeds are

currently expected to be used for general corporate purposes, which may include, without limitation, funding new clinical trials of DKN-01 and TRX518 and the continuation of ongoing studies, capital

expenditures, working capital and general and administrative expenses. As we are unable to predict the timing or amount of potential issuances of all of the additional shares issuable purchase to the

Purchase Agreement, we cannot specify with certainty all of the particular uses for the net proceeds that we will have from the sale of such additional shares. Accordingly, our management will have

broad discretion in the application of the net proceeds. We may use the proceeds for purposes that are not contemplated at the time of this offering. It is possible that no additional shares will be

issued under the Purchase Agreement.

After

the issuance of any of the shares issuable under the Purchase Agreement, we would not receive any proceeds from the resale of those shares by Lincoln Park because those shares will

be sold for the account of Lincoln Park.

We

will incur all costs associated with this prospectus and the registration statement of which it is a part.

9

Table of Contents

THE LINCOLN PARK TRANSACTION

General

On July 10, 2019, we entered into the Purchase Agreement and the Registration Rights Agreement with Lincoln Park. Pursuant to the terms

of the Purchase Agreement, Lincoln Park has agreed to purchase from us up to $20,000,000 of our common stock (subject to certain limitations) from time to time during the term of the Purchase

Agreement. Pursuant to the terms of the Registration Rights Agreement, we have filed with the SEC the registration statement of which this prospectus is a part to register for resale under the

Securities Act the shares that have been or may be

issued to Lincoln Park under the Purchase Agreement. The registration statement of which this prospectus is a part may not register all of the shares issuable pursuant to the Purchase Agreement. To

sell additional shares to Lincoln Park under the Purchase Agreement, we may have to file one or more additional registration statements for those shares. Pursuant to the terms of the Purchase

Agreement, we issued 330,000 Commitment Shares to Lincoln Park on July 10, 2019 as consideration for its commitment to purchase shares of our common stock under the Purchase Agreement.

We

may, from time to time and at our sole discretion, direct Lincoln Park to purchase shares of our common stock upon the satisfaction of certain conditions set forth in the Purchase

Agreement at a purchase price per share based on the market price of our common stock at the time of sale as computed under the Purchase Agreement. Lincoln Park may not assign or transfer its rights

and obligations under the Purchase Agreement.

Under

applicable rules of the Nasdaq Global Market, in no event may we issue or sell to Lincoln Park under the Purchase Agreement shares of our common stock in excess of the Exchange

Cap, unless (i) we obtain stockholder approval to issue shares of our common stock in excess of the Exchange Cap or (ii) the average price of all applicable sales of our common stock to

Lincoln Park under the Purchase Agreement equals or exceeds the average of the closing price of our common stock on the Nasdaq Global Market for the five business days immediately preceding the

signing of the Purchase Agreement plus an incremental amount, such that the transactions contemplated by the Purchase Agreement are exempt from the Exchange Cap limitation under applicable Nasdaq

rules. In any event, the Purchase Agreement specifically provides that we may not issue or sell any shares of our common stock under the Purchase Agreement if such issuance or sale would breach any

applicable rules or regulations of the Nasdaq Global Market.

The

Purchase Agreement also prohibits us from directing Lincoln Park to purchase any shares of our common stock if those shares, when aggregated with all other shares of our common stock

then beneficially owned by Lincoln Park, would result in Lincoln Park and its affiliates exceeding the Beneficial Ownership Cap.

Purchase of Shares under the Purchase Agreement

Regular Purchases

Under the Purchase Agreement, on any business day selected by us, we may direct Lincoln Park to purchase up to 50,000 shares of our common stock

on such business day (or the purchase date), which we refer to as a Regular Purchase, provided, however, that (i) the Regular Purchase may be increased to up to 100,000 shares, provided that

the closing sale price is not below $1.00 on the applicable purchase date, (ii) the Regular Purchase may be increased to up to 150,000 shares, provided that the closing sale price is not below

$2.00 on the applicable purchase date, (iii) the Regular Purchase may be increased to up to 200,000, provided that the closing sale price is not below $3.00 on the applicable purchase date, and

(iv) the Regular Purchase may be increased to up to 250,000 shares, provided that the closing sale price is not below $4.00 on the applicable purchase date (in each case, such dollar and share

amounts subject to adjustment for any reorganization, recapitalization, non-cash dividend, stock

10

Table of Contents

split

or other similar transaction). In each case, the maximum amount of any single Regular Purchase may not exceed $1,500,000 per purchase. We may direct Lincoln Park to purchase shares in a Regular

Purchase as often as every business day, so long as we have delivered all purchased shares for all prior Regular Purchases, accelerated purchases or additional accelerated purchases and all such

shares have been received by Lincoln Park in accordance with the terms of the Purchase Agreement.

The

purchase price per share for each such Regular Purchase will be equal to the lesser of:

-

•

-

the lowest sale price for our common stock on the purchase date of such shares; and

-

•

-

the average of the three lowest closing sale prices for our common stock during the 10 consecutive business days prior to the purchase

date of such shares.

Accelerated Purchases

We may also direct Lincoln Park, on any business day on which we have properly submitted a Regular Purchase notice, to purchase an additional

amount of our common stock, which we refer to as an Accelerated Purchase, of up to the lesser of:

-

•

-

three times the number of shares purchased pursuant to the corresponding Regular Purchase; and

-

•

-

30% of the aggregate shares of our common stock traded during all, or, if certain trading volume or market price thresholds specified in the

Purchase Agreement are crossed on the applicable Accelerated Purchase date, the portion, of the normal trading hours on the applicable Accelerated Purchase date prior to such time that any one of such

thresholds is crossed, which period of time on the applicable Accelerated Purchase date we refer to as the "Accelerated Purchase Measurement Period".

The

purchase price per share for each such Accelerated Purchase will be equal to the lesser of:

-

•

-

95% of the volume-weighted average price of our common stock during the applicable Accelerated Purchase Measurement Period on the applicable

Accelerated Purchase date; and

-

•

-

the closing sale price of our common stock on the applicable Accelerated Purchase date.

Additional Accelerated Purchases

We may also direct Lincoln Park on any business day on which an Accelerated Purchase has been completed and all of the shares to be purchased

thereunder have been properly delivered to Lincoln Park in accordance with the Purchase Agreement, to purchase an additional amount of our common stock, which we refer to as an Additional Accelerated

Purchase, of up to the lesser of:

-

•

-

three times the number of shares purchased pursuant to the corresponding Regular Purchase; and

-

•

-

30% of the aggregate shares of our common stock traded during a certain portion of the normal trading hours on the applicable Additional

Accelerated Purchase date as determined in accordance with the Purchase Agreement, which period of time on the applicable Additional Accelerated Purchase date we refer to as the Additional Accelerated

Purchase Measurement Period.

The

purchase price per share for each such Additional Accelerated Purchase will be equal to the lower of:

-

•

-

95% of the volume weighted average price of our common stock during the applicable Additional Accelerated Purchase Measurement Period on the

applicable Additional Accelerated Purchase date; and

11

Table of Contents

-

•

-

the closing sale price of our common stock on the applicable Additional Accelerated Purchase date.

We

may, in our sole discretion, submit multiple Regular, Accelerated or Additional Accelerated Purchase notices to Lincoln Park on a single Accelerated Purchase date, provided that all

prior Regular Purchases, Accelerated Purchases and Additional Accelerated Purchases (including those that have occurred earlier on the same day) have been completed and all of the shares to be

purchased thereunder have been properly delivered to Lincoln Park in accordance with the Purchase Agreement.

In

the case of the Regular Purchases, Accelerated Purchases and Additional Accelerated Purchases, the purchase price per share will be equitably adjusted for any reorganization,

recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction occurring during the business days used to compute the purchase price.

Other

than as described above, there are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any sales of our common

stock to Lincoln Park.

Events of Default

Events of default under the Purchase Agreement include the following:

-

•

-

the effectiveness of the registration statement of which this prospectus is a part lapses for any reason (including, without limitation, the

issuance of a stop order), or the registration statement of which this prospectus is a part is unavailable to Lincoln Park for the resale of our common stock offered hereby, and such lapse or

unavailability continues for a period of 10 consecutive business days or for more than an aggregate of 30 business days in any 365-day period, but excluding a lapse or unavailability where

(i) we terminate a registration statement after Lincoln Park has confirmed in writing that all of the shares of our common stock covered thereby have been resold or (ii) we supersede one

registration statement with another registration statement, including (without limitation) by terminating a prior registration statement when it is effectively replaced with a new registration

statement covering the shares of our common stock covered by the Purchase Agreement (provided in the case of this clause (ii) that all of the shares of our common stock covered by the

superseded (or terminated) registration statement that have not theretofore been resold are included in the superseding (or new) registration statement);

-

•

-

suspension by our principal market of our common stock from trading for a period of one business day;

-

•

-

the de-listing of our common stock from the Nasdaq Global Market, our principal market, provided our common stock is not immediately thereafter

trading on the New York Stock Exchange, the Nasdaq Capital Market, the Nasdaq Global Select Market, the NYSE American, the NYSE Arca, the OTC Bulletin Board, the OTCQX operated by the OTC Markets

Group, Inc., or the OTC Markets Group, Inc. (or any other comparable market);

-

•

-

if at any time the Exchange Cap is reached and our stockholders have not approved the transactions contemplated by the Purchase Agreement in

accordance with the applicable rules and regulations of the Nasdaq Stock Market, to the extent applicable;

-

•

-

the failure for any reason by our transfer agent to issue purchase shares of our common stock to Lincoln Park within three business days after

the Regular Purchase date, Accelerated Purchase date or Additional Accelerated Purchase date, as applicable, on which Lincoln Park is entitled to receive such shares;

-

•

-

any breach of the representations, warranties, covenants or other terms or conditions contained in the Purchase Agreement or Registration

Rights Agreement that has or could have a Material

12

Table of Contents

Lincoln

Park does not have the right to terminate the Purchase Agreement upon any of the events of default set forth above, however, the Purchase Agreement will automatically terminate

upon initiation of insolvency or bankruptcy proceedings by or against us. During an event of default, all of which are outside of Lincoln Park's control, we may not direct Lincoln Park to purchase any

shares of our common stock under the Purchase Agreement.

Our Termination Rights

We have the unconditional right, at any time, for any reason and without any payment or liability to us, to give notice to Lincoln Park to

terminate the Purchase Agreement.

No Short-Selling or Hedging by Lincoln Park

Lincoln Park has agreed that neither it nor any of its affiliates shall engage in any direct or indirect short-selling or hedging of our common

stock during any time prior to the termination of the Purchase Agreement.

Prohibitions on Variable Rate Transactions

Subject to specified exceptions included in the Purchase Agreement, we are limited in our ability to enter into specified variable rate

transactions during the term of the Purchase Agreement. Such transactions include, among others, the issuance of convertible securities with a conversion or exercise price that is based upon or varies

with the trading price of our common stock after the date of issuance or entry into any new "equity line of credit" or "at the market offering."

Effect of Performance of the Purchase Agreement on our Stockholders

All shares registered in this offering that have been or may be issued or sold by us to Lincoln Park under the Purchase Agreement are expected

to be freely tradable. Shares registered in this offering may be sold by us to Lincoln Park over a period of up to 24 months commencing on the date of this registration statement of which this

prospectus is a part becomes effective. The resale by Lincoln Park of a significant amount of shares registered in this offering at any given time, or the perception that these sales may occur, could

cause the market price of our common stock to decline and to be highly volatile. Sales of our common stock to Lincoln Park, if any, will depend upon market conditions and other factors to be

determined by us. We may ultimately decide to sell to Lincoln Park all, some or none of the additional shares of our common stock that may be available for us to sell pursuant to the Purchase

Agreement. If and when we do sell shares to Lincoln Park, after Lincoln Park has acquired the shares, Lincoln Park may resell all, some or none of those shares at any time or from time to time in its

discretion. Therefore, sales to Lincoln Park by us under the Purchase Agreement may result in substantial dilution to the interests of other holders of our common stock. In addition, if we sell a

substantial number of shares to Lincoln Park under the Purchase Agreement, or if investors expect that we will do so, the actual sales of shares or the mere existence of our arrangement with Lincoln

Park may make it more difficult for us to sell equity or equity-related securities in the future at

a time and at a price that we might otherwise wish to effect such sales. However, we have the right to control the

13

Table of Contents

timing

and amount of any additional sales of our shares to Lincoln Park and the Purchase Agreement may be terminated by us at any time at our discretion without any cost to us.

Pursuant

to the terms of the Purchase Agreement, we have the right, but not the obligation, to direct Lincoln Park to purchase up to $20,000,000 of our common stock, subject to certain

limitations and exclusive of the 330,000 Commitment Shares issued to Lincoln Park on the date of the Purchase Agreement. We have registered only a portion of the shares issuable under the Purchase

Agreement and, therefore, we may seek to issue and sell to Lincoln Park under the Purchase Agreement more shares of our common stock than are offered under this prospectus. If we choose to do so, we

must first register for resale under the Securities Act any such additional shares, which could cause additional substantial dilution to our stockholders. The number of shares ultimately offered for

resale under this prospectus is dependent upon the number of shares we direct Lincoln Park to purchase under the Purchase Agreement.

The

following table sets forth the amount of gross proceeds we would receive from Lincoln Park from our sale of shares to Lincoln Park under the Purchase Agreement at varying purchase

prices:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assumed Average

Purchase Price Per Share

|

|

Number of Registered

Shares to be Issued if Full

Purchase(1)

|

|

Percentage of Outstanding

Shares After Giving Effect

to the Issuance to Lincoln

Park(2)

|

|

Gross Proceeds from the

Sale of Shares to Lincoln

Park Under the Purchase

Agreement

|

|

|

$

|

0.75

|

|

|

3,707,404

|

|

|

13.36

|

%

|

$

|

2,780,805

|

|

|

$

|

1.00

|

|

|

3,707,404

|

|

|

13.36

|

%

|

$

|

3,707,740

|

|

|

$

|

2.00

|

|

|

3,707,404

|

|

|

13.36

|

%

|

$

|

7,415,480

|

|

|

$

|

2.36

|

(3)

|

|

5,257,461

|

|

|

17.95

|

%

|

$

|

12,407,608

|

|

|

$

|

3.00

|

|

|

5,257,461

|

|

|

17.95

|

%

|

$

|

15,772,383

|

|

|

$

|

4.00

|

|

|

5,000,000

|

|

|

17.22

|

%

|

$

|

20,000,000

|

|

|

$

|

5.00

|

|

|

4,000,000

|

|

|

14.27

|

%

|

$

|

20,000,000

|

|

-

(1)

-

Although

the Purchase Agreement provides that we may sell up to $20.0 million of our common stock to Lincoln Park, we are only registering 5,587,461 shares

(inclusive of the 330,000 Commitment Shares issued to Lincoln Park) under this prospectus, which may or may not cover all of the shares we ultimately sell to Lincoln Park under the Purchase Agreement.

The number of registered shares to be issued as set forth in this column (i) excludes the 330,000 Commitment Shares previously issued and registered because no proceeds will be attributable to

such shares, (ii) gives effect to the Exchange Cap and (iii) is without regard for the Beneficial Ownership Cap.

-

(2)

-

The

denominator is based on 24,038,799 shares outstanding as of July 25, 2019, and the number of shares set forth in the adjacent column that we would have

sold to Lincoln Park, assuming the average purchase price in the first column. The numerator is based on the number of shares issuable under the Purchase Agreement (that are the subject of this

offering) at the corresponding assumed average purchase price set forth in the first column.

-

(3)

-

The

closing sale price of our common stock on July 30, 2019.

14

Table of Contents

SELLING STOCKHOLDER

The selling stockholder may from time to time offer and sell any or all of the shares of our common stock set forth below pursuant to this

prospectus. When we refer to the "selling

stockholder" in this prospectus, we mean Lincoln Park Capital Fund, LLC, and its respective pledgees, donees, permitted transferees, assignees, successors and others who later come to hold any

of the selling stockholder's interests in shares of our common stock other than through a public sale.

The

following table sets forth, as of the date of this prospectus, the name of the selling stockholder for whom we are registering shares for sale to the public, the number of shares of

common stock beneficially owned by the selling stockholder prior to this offering, the total number of shares of common stock that the selling stockholder may offer pursuant to this prospectus and the

number of shares of common stock that the selling stockholder will beneficially own after this offering. The percentages in the table below reflect the shares beneficially owned by the selling

stockholder as a percentage of the 24,038,799 shares of common stock outstanding as of July 25, 2019, adjusted as required by rules promulgated by the SEC. These rules attribute beneficial

ownership of shares of common stock issuable upon conversion of convertible securities or upon exercise of warrants that are convertible or exercisable, as applicable, either immediately or on or

before the date that is 60 days after July 25, 2019. These shares are deemed to be outstanding and beneficially owned by the person holding such convertible securities or warrants for

the purpose of computing the percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Except as noted

below, the selling stockholder does not have, or within the past three years has not had, any material relationship with us or any of our predecessors or affiliates and the selling stockholder is not

or was not affiliated with registered broker-dealers.

Based

on the information provided to us by the selling stockholder, assuming that the selling stockholder sells all of the shares of our common stock beneficially owned by it that have

been registered by us and does not acquire any additional shares during the offering, the selling stockholder will not own any shares other than those appearing in the column entitled "Beneficial

Ownership After This Offering." We cannot advise you as to whether the selling stockholder will in fact sell any or all of such shares of common stock. In addition, the selling stockholder may have

sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, the shares of our common stock in transactions exempt from the

registration requirements of the Securities Act after the date on which it provided the information set forth in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beneficial Ownership

Prior to this Offering

|

|

|

|

|

|

|

|

|

|

|

|

Beneficial

Ownership

After this

Offering(1)

|

|

|

|

Number of

Shares

Beneficially

Owned

Before this

Offering

|

|

|

|

|

|

|

|

|

|

Shares of

Common

Stock

Being

Offered

|

|

|

Name

|

|

%

|

|

Number of

Shares

|

|

%

|

|

|

Lincoln Park Capital Fund, LLC

|

|

|

1,199,536(2

|

)

|

|

4.99

|

|

|

5,587,461

|

|

|

1,021,429

|

|

|

3.21

|

|

-

(1)

-

Assumes

the sale of all shares of common stock registered pursuant to this prospectus, although the selling stockholder is under no obligation known to us to sell

any shares of common stock at this time.

-

(2)

-

As

of the date of this prospectus, 330,000 shares of our common stock have been acquired by Lincoln Park under the Purchase Agreement, consisting of shares we issued

to Lincoln Park as a commitment fee and 571,429 shares of common stock Lincoln Park has acquired in other purchases. Lincoln Park also holds warrants to purchase 450,000 shares of common stock that

are currently exercisable, which warrants are subject to a blocker provision that restricts the exercise of the warrants if, as a result of such exercise, the warrant holder, together with its

affiliates and any

15

Table of Contents

other

person whose beneficial ownership of common stock would be aggregated with the warrant holder's for purposes of Section 13(d) of the Exchange Act, would beneficially own in excess of

4.99% of our then issued and outstanding shares of common stock (including the shares of common stock issuable upon such exercise). We may elect in our sole discretion to sell to Lincoln Park up to an

additional 5,257,461 shares under the Purchase Agreement (subject to the Exchange Cap), but Lincoln Park does not presently beneficially own those shares as determined in accordance with the rules of

the SEC.

16

Table of Contents

PLAN OF DISTRIBUTION

An aggregate of up to 5,587,461 shares of our common stock may be offered by this prospectus by Lincoln Park pursuant to the Purchase Agreement.

The common stock may be sold or distributed from time to time by Lincoln Park directly to one or more purchasers or through brokers, dealers, or underwriters who may act solely as agents at market

prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or at fixed prices, which may be changed. The sale of the common stock offered by this

prospectus could be effected in one or more of the following methods:

-

•

-

ordinary brokers' transactions;

-

•

-

transactions involving cross or block trades;

-

•

-

through brokers, dealers, or underwriters who may act solely as agents;

-

•

-

"at the market" into an existing market for the common stock;

-

•

-

in other ways not involving market makers or established business markets, including direct sales to purchasers or sales effected through

agents;

-

•

-

in privately negotiated transactions; or

-

•

-

any combination of the foregoing.

In

order to comply with the securities laws of certain states, if applicable, the shares may be sold only through registered or licensed brokers or dealers. In addition, in certain

states, the shares may not be sold unless they have been registered or qualified for sale in the state or an exemption from the state's registration or qualification requirement is available and

complied with.

Lincoln

Park is an "underwriter" within the meaning of Section 2(a)(11) of the Securities Act.

Lincoln

Park has informed us that it intends to use an unaffiliated broker-dealer to effectuate all sales, if any, of the common stock that it may purchase from us pursuant to the

Purchase Agreement. Such sales will be made at prices and at terms then prevailing or at prices related to the then current market price. Each such unaffiliated broker-dealer will be an underwriter

within the meaning of Section 2(a)(11) of the Securities Act. Lincoln Park has informed us that each such broker-dealer will receive commissions from Lincoln Park that will not exceed customary

brokerage commissions.

Brokers,

dealers, underwriters or agents participating in the distribution of the shares as agents may receive compensation in the form of commissions, discounts, or concessions from

Lincoln Park and/or purchasers of the common stock for whom the broker-dealers may act as agent. The compensation paid to a particular broker-dealer may be less than or in excess of customary

commissions. Neither we nor Lincoln Park can presently estimate the amount of compensation that any agent will receive. We know of no existing arrangements between Lincoln Park or any other

stockholder, broker, dealer, underwriter or agent relating to the sale or distribution of the shares offered by this prospectus. At the time a particular offer of shares is made, a prospectus

supplement, if required, will be distributed that will set forth the names of any agents, underwriters or dealers and any compensation from Lincoln Park, and any other required information.

We

will pay the expenses incident to the registration, offering, and sale of the shares to Lincoln Park. We have agreed to indemnify Lincoln Park and certain other persons against

certain liabilities in connection with the offering of shares of common stock offered hereby, including liabilities arising under the Securities Act or, if such indemnity is unavailable, to contribute

amounts required to be paid in respect of such liabilities. Lincoln Park has agreed to indemnify us against liabilities under the Securities Act that may arise from certain written information

furnished to us by Lincoln Park

17

Table of Contents

specifically

for use in this prospectus or, if such indemnity is unavailable, to contribute amounts required to be paid in respect of such liabilities.

Lincoln

Park has represented to us that at no time prior to the Purchase Agreement has it or its agents, representatives or affiliates engaged in or effected, in any manner whatsoever,

directly or indirectly, any short sale (as such term is defined in Rule 200 of Regulation SHO of the Exchange Act) of our common stock or any hedging transaction, which establishes a net short

position with respect to our common stock. Lincoln Park has agreed that during the term of the Purchase Agreement, it, its agents, representatives or affiliates will not enter into or effect, directly

or indirectly, any of the foregoing transactions.

We

have advised Lincoln Park that it is required to comply with Regulation M promulgated under the Exchange Act. With certain exceptions, Regulation M precludes Lincoln

Park, any affiliated purchasers, and any broker-dealer or other person who participates in the distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase

any security which is the subject of the distribution until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price of a

security in connection with the distribution of that security. All of the foregoing may affect the marketability of the securities offered by this prospectus.

This

offering will terminate on the date that all shares offered by this prospectus have been sold by Lincoln Park.

18

Table of Contents

DESCRIPTION OF CAPITAL STOCK

The description below of our capital stock and provisions of our amended and restated certificate of incorporation and amended and restated

bylaws are summaries and are qualified by reference to the amended and restated certificate of incorporation, the amended and restated bylaws, and the applicable provisions of Delaware law.

General

Our amended and restated certificate of incorporation authorizes us to issue up to 100,000,000 shares of common stock, $0.001 par value per

share, and 10,000,000 shares of undesignated

preferred stock, $0.001 par value per share, the rights and preferences of which may be established from time to time by our board of directors.

As

of July 25, 2019, there were 24,038,799 shares of common stock outstanding, no shares of preferred stock outstanding, and warrants for the purchase of up to 10,369,752 shares

of our common stock outstanding.

Common Stock

Voting rights.

Each holder of our common stock is entitled to one vote for each share on all matters submitted to a vote of the

stockholders,

including the election of directors. Our stockholders do not have cumulative voting rights in the election of directors. An election of directors by our stockholders shall be determined by a plurality

of votes cast by the stockholders entitled to vote on the election.

Dividends.

Subject to preferences that may be applicable to any then outstanding preferred stock, holders of our common stock are

entitled to receive

dividends, if any, as may be declared from time to time by our board of directors out of legally available funds.

Liquidation.

In the event of our liquidation, dissolution or winding up, holders of our common stock will be entitled to share

ratably in proportion

to the number of shares held by them in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities and the satisfaction of any

liquidation preference granted to the holders of any then outstanding shares of preferred stock.

Rights and preferences.

Holders of common stock have no preemptive, conversion or subscription rights and there are no

redemption or sinking fund

provisions applicable to the common stock. The rights, preferences and privileges of the holders of common stock are subject to, and may be adversely

affected by, the rights of the holders of shares of any series of preferred stock that we may designate in the future.

Fully paid and nonassessable.

All of our outstanding shares of common stock are, and the shares of common stock to be issued in

this offering, if

any, will be, fully paid and nonassessable.

Preferred Stock

Under our amended and restated certificate of incorporation, our board of directors has the authority, without further action by the

stockholders (unless such stockholder action is required by applicable law or the rules of any stock exchange or market on which our securities are then traded), to designate and issue up to

10,000,000 shares of preferred stock in one or more series, to establish from time to time the number of shares to be included in each such series, to fix the rights, preferences and privileges of the

shares of each wholly unissued series and any qualifications, limitations or restrictions thereon and to increase or decrease the number of shares of any such series, but not below the number of

shares of such series then outstanding. We will fix the designations, voting powers, preferences and

19

Table of Contents

rights

of the preferred stock of each series, as well as the qualifications, limitations or restrictions thereof, in a certificate of designation relating to that series.

Our

board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of the

common stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and other corporate purposes, could, among other things, have the effect of

delaying, deferring or preventing a change in our control that may otherwise benefit holders of our common stock and may adversely affect the market price of the common stock and the voting and other

rights of the holders of common stock.

Warrants

As of July 25, 2019, we had 10,369,752 outstanding warrants to purchase shares of our capital stock.

On

November 14, 2017, the Company entered into purchase agreements, or the 2017 Purchase Agreements, with certain purchasers, or the 2017 Purchasers. Each 2017 Purchase Agreement

was on terms and conditions substantially similar to each other 2017 Purchase Agreement and pursuant to such 2017 Purchase Agreements, the Company, in a private placement, agreed to issue and sell to

the 2017 Purchasers an aggregate of 2,958,094 shares of unregistered common stock, at a price per share of $6.085, each share issued with a warrant to purchase one share of common stock at an exercise

price of $6.085, or the 2017 Warrants. HealthCare Ventures IX, L.P. and Eli Lilly and Company, each a more than 5% direct holder of the Company's common stock, purchased common stock and

warrants in the private placement. Each of HealthCare Ventures IX, L.P. and Eli Lilly and Company agreed to purchase the common stock and warrants on the same terms and conditions as the other

2017 Purchasers. Three of our directors and executive officers are affiliated with HealthCare Ventures IX, L.P. and its affiliates. Our stockholders approved the inclusion of a full ratchet

anti-dilution feature as a term of the 2017 Warrants. As a result, if we issue common stock, options or common stock equivalents at a price less than the exercise price of the 2017 Warrants, subject

to certain customary exceptions or amend the terms of any outstanding security of the Company, the exercise price of the 2017 Warrants will be reduced to that lower price. Such a decrease in exercise

price may cause holders to exercise the 2017 Warrants which could result in dilution to our existing stockholders at an accelerated rate. As a result of the consummation of our public offering in

February 2019 described below, the exercise price of the 2017 Warrants automatically was adjusted pursuant to, and in accordance with, their terms to $1.75 per share.

On

February 5, 2019, the Company completed a public offering whereby the Company issued 7,557,142 shares of its common stock at a price of $1.75 per share, each share issued with

a warrant to purchase one share of common stock. Each warrant has an exercise price of $1.95 per share with an exercise period expiring seven years from the date of issuance, or on February 5,

2026. HealthCare Ventures IX, L.P. purchased common stock and warrants in the February 2019 public offering on the same terms and conditions as the other purchasers.

Registration Rights

We agreed to provide certain registration rights to certain holders of our common stock pursuant to the terms of the agreements filed as

Exhibits 4.2, 4.3, 4.6 and 10.21 to this registration statement.

Anti-Takeover Effects of Provisions of Delaware Law and Our Amended and Restated Certificate of

Incorporation and Amended and Restated Bylaws

Our amended and restated certificate of incorporation and amended and restated bylaws contain certain provisions that are intended to enhance

the likelihood of continuity and stability in the

20

Table of Contents

composition

of the board of directors and which may have the effect of delaying, deferring or preventing a future takeover or change in control of the Company unless such takeover or change in control

is approved by the board of directors. These provisions include:

No Cumulative Voting.

Under Delaware law, the right to vote cumulatively does not exist unless the certificate of incorporation