As filed with the Securities and Exchange Commission on June 4, 2021

Registration No. 333-256282

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-10/A

(AMENDMENT NO. 1)

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

LARGO RESOURCES LTD.

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Registrant's name into English (if applicable))

|

Ontario, Canada

|

|

1400

|

|

Not applicable

|

|

(Province or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number

(if applicable))

|

|

(I.R.S. Employer Identification

Number (if applicable))

|

55 University Avenue

Suite 1105

Toronto, Ontario M5J 2H7

Telephone: (416) 861-9797

(Address and telephone number of Registrant's principal executive offices)

C T Corporation System

1015 15th Street N.W., Suite 1000

Washington, D.C., 20005

Telephone: (202) 572-3111

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

Copies to:

|

R. Ian Mitchell

Gowling WLG (Canada) LLP

1 First Canadian Place, 100 King Street West

Suite 1600

Toronto, Ontario M5X 1G5

Canada

Telephone: (416) 862-3546

|

Ernest Cleave

Largo Resources Ltd.

55 University Avenue, Suite 1105

Toronto, Ontario M5J 2H7

Canada

Telephone: (416) 861-9797

|

Thomas M. Rose

Troutman Pepper Hamilton Sanders LLP

401 9th Street, N.W., Suite 1000

Washington, DC 20004

United States

Telephone: (757) 687-7715

|

Approximate date of commencement of proposed sale of the securities to the public:

From time to time after the effective date of this Registration Statement.

Province of Ontario, Canada

(Principal jurisdiction regulating this offering (if applicable))

It is proposed that this filing shall become effective (check appropriate box)

|

A.

|

☐

|

upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada).

|

|

|

|

|

|

B.

|

☒

|

at some future date (check appropriate box below)

|

|

|

|

|

|

|

1.

|

☐

|

pursuant to Rule 467(b) on (date) at (time) (designate a time not sooner than 7 calendar days after filing).

|

|

|

|

|

|

|

|

2.

|

☐

|

pursuant to Rule 467(b) on (date) at (time) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on (date).

|

|

|

|

|

|

|

|

3.

|

☒

|

pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto.

|

|

|

|

|

|

|

|

4.

|

☐

|

after the filing of the next amendment to this Form (if preliminary material is being filed).

|

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction's shelf prospectus offering procedures, check the following box. ☒

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registration Statement shall become effective as provided in Rule 467 under the Securities Act or on such date as the U.S. Securities and Exchange Commission (the "Commission"), acting pursuant to Section 8(a) of the Act, may determine.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

This short form base shelf prospectus has been filed under legislation in each of the provinces and territories of Canada that permits certain information about these securities to be determined after this prospectus has become final and that permits the omission from this prospectus of that information. The legislation requires the delivery to purchasers of a prospectus supplement containing the omitted information within a specified period of time after agreeing to purchase any of these securities, except in cases where an exemption from such delivery requirement is available.

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the United States Securities and Exchange Commission but is not yet effective. These securities may not be offered or sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This short form base shelf prospectus shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This short form base shelf prospectus constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by the persons permitted to sell such securities.

Information has been incorporated by reference in this short form base shelf prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Chief Financial Officer of the Company at our head office located at Suite 1105 - 55 University Avenue, Toronto, Ontario, M5J 2H7, Telephone 416-861-9797, and are also available electronically at www.sedar.com.

|

New Issue and Secondary Offering

|

June 4, 2021

|

SHORT FORM BASE SHELF PROSPECTUS

LARGO RESOURCES LTD.

C$750,000,000

Common Shares

Warrants

Units

Debt Securities

Subscription Receipts

This short form base shelf prospectus ("Prospectus") relates to the offering for sale by Largo Resources Ltd. (the "Company") and/or certain securityholders of the Company (the "Selling Securityholders") from time to time, during the 25-month period that this Prospectus, including any of amendments thereto, remains valid, of up to C$750,000,000 in the aggregate of: (i) common shares ("Common Shares") in the capital of the Company; (ii) warrants ("Warrants") to purchase other Securities (as defined below) of the Company; (iii) units ("Units") comprising of one or more of the other Securities, (iv) senior and subordinated debt securities, including debt securities convertible or exchangeable into other securities of the Company (collectively, "Debt Securities"), and (v) subscription receipts ("Subscription Receipts" and together with the Common Shares, Warrants, Units and Debt Securities, collectively referred to herein as the "Securities"). The Securities may be offered separately or together, in amounts, at prices and on terms determined based on market conditions at the time of the sale and as set forth in an accompanying prospectus supplement ("Prospectus Supplement").

All shelf information permitted under applicable laws to be omitted from this Prospectus will be contained in one or more Prospectus Supplements that will be delivered to purchasers together with this Prospectus, except in cases where an exemption from such delivery requirements has been obtained. Each Prospectus Supplement containing the specific terms of any Securities will be incorporated by reference into this Prospectus for the purposes of securities legislation as of the date of the Prospectus Supplement and only for the purposes of the distribution of the Securities to which the Prospectus Supplement pertains.

The Company will provide the specific terms of any offering of Securities, including the specific terms of the Securities with respect to a particular offering and the terms of such offering, in one or more Prospectus Supplements to this Prospectus. The Securities may be offered separately or together or in any combination, and as separate series. One or more Selling Securityholders may also offer and sell Securities under this Prospectus. See "Plan of Distribution - Secondary Offering".

The Securities may be sold through underwriters or dealers, directly by us, and/or by Selling Securityholders in the case of Common Shares and Warrants, pursuant to applicable statutory exemptions, or through designated agents from time to time. See "Plan of Distribution". The Prospectus Supplement relating to a particular offering of Securities will identify each underwriter, dealer or agent, as the case may be, involved in the offering and sale of the Securities, and will set forth the terms of the offering of such Securities, including, to the extent applicable, any fees, discounts or any other compensation payable to underwriters, dealers or agents in connection with the offering, the method of distribution of the Securities, the initial issue price (in the event that the offering is a fixed price distribution), the net proceeds to us and/or to any Selling Securityholder, and any other material terms of the plan of distribution.

The Securities may be sold from time to time in one or more transactions at a fixed price or prices or at non-fixed prices. This Prospectus may qualify an "at-the-market distribution", as defined in National Instrument 44-102 - Shelf Distributions ("NI 44-102"). If offered on a non-fixed price basis, the Securities may be offered at market prices prevailing at the time of sale, at prices determined by reference to the prevailing price of a specified security in a specified market or at prices to be negotiated with purchasers, including sales in transactions that are deemed to be "at-the-market distributions", including sales made directly on the Toronto Stock Exchange (the "TSX") or other existing trading markets for the Securities, and as set forth in an accompanying Prospectus Supplement, in which case the compensation payable to an underwriter, dealer or agent in connection with any such sale will be decreased by the amount, if any, by which the aggregate price paid for the Securities by the purchasers is less than the gross proceeds paid by the underwriter, dealer or agent to the Company. The price at which the Securities will be offered and sold may vary from purchaser to purchaser and during the period of distribution. See "Plan of Distribution".

This Prospectus does not qualify the issuance of Debt Securities in respect of which the payment of principal and/or interest may be determined, in whole or in part, by reference to one or more underlying interests including, for example, an equity or debt security, a statistical measure of economic or financial performance including, but not limited to, any currency, consumer price or mortgage index, or the price or value of one or more commodities, indices or other items, or any other item or formula, or any combination or basket of the foregoing items. For greater certainty, this Prospectus may qualify for issuance Debt Securities in respect of which the payment of principal and/or interest may be determined, in whole or in part, by reference to published rates of a central banking authority or one or more financial institutions, such as a prime rate or bankers' acceptance rate, or to recognized market benchmark interest rates such as LIBOR, EURIBOR or a United States federal funds rate.

No underwriter or dealer involved in an “at-the-market distribution” under this Prospectus, no affiliate of such an underwriter or dealer and no person or company acting jointly or in concert with such an underwriter or dealer will over-allot Securities in connection with such distribution or effect any other transactions that are intended to stabilize or maintain the market price of the Securities, including selling an aggregate number of principal amount of Securities that would result in the underwriter creating an over-allocation position in the Securities.

In connection with any offering of Securities (unless otherwise specified in the applicable Prospectus Supplement), subject to applicable laws and other than an "at-the-market distribution", the underwriters, dealers or agents, as the case may be, may over-allot or effect transactions which stabilize, maintain or otherwise affect the market price of the Securities offered at a level other than those which otherwise might prevail on the open market. Such transactions may be commenced, interrupted or discontinued at any time. See "Plan of Distribution".

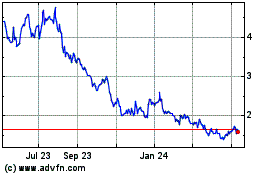

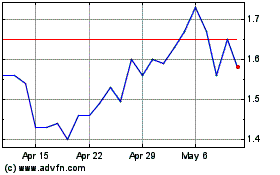

The Common Shares are listed on the TSX under the trading symbol "LGO" and on the Nasdaq Stock Market ("Nasdaq") under the trading symbol "LGO". On June 3, 2021, the last trading day prior to the filing of this Prospectus, the closing prices of the Common Shares listed on the TSX and the Nasdaq were C$18.88 and US$15.61 respectively.

Unless otherwise specified in the applicable Prospectus Supplement, Securities other than Common Shares will not be listed on any securities exchange. There is no market through which the Warrants, Units, Debt Securities or Subscription Receipts may be sold and purchasers may not be able to resell the Warrants, Units, Debt Securities or Subscription Receipts purchased under this Prospectus and the applicable Prospectus Supplement. This may affect the pricing of the Warrants, Units, Debt Securities, or Subscription Receipts in the secondary market, the transparency and availability of trading prices, the liquidity of the Warrants, Units, Debt Securities, or Subscription Receipts, and the extent of issuer regulation. See "Risk Factors".

ii

An investment in the Securities is subject to a number of risks, including those risks described in this Prospectus and documents incorporated by reference into this Prospectus. See "Risk Factors" in this Prospectus and in the Company's Annual Information Form and "Risks and Uncertainties" in the Interim MD&A incorporated by reference herein.

We are permitted under a multijurisdictional disclosure system ("MJDS") adopted by the securities regulatory authorities in Canada and the United States to prepare this Prospectus in accordance with the disclosure requirements of Canada. Prospective investors in the United States should be aware that such requirements are different from those of the United States. Financial statements included or incorporated by reference in this Prospectus have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board and subject to Canadian auditing and auditor independence standards and thus may not be comparable to financial statements of United States companies.

No underwriter has been involved in the preparation of this Prospectus or performed any review of the contents hereof.

Purchasers of Securities should be aware that the acquisition of Securities may have tax consequences both in the United States and in Canada. Such consequences may not be described fully herein. Purchasers of Securities should read the tax discussion contained in the applicable Prospectus Supplement with respect to a particular offering of Securities and consult your own tax advisor with respect to your own particular circumstances.

The enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely by the fact that we are incorporated under the laws of the Province of Ontario, Canada, some of our officers and directors may be residents of a country other than the United States, and some or all of the experts, underwriters, dealers or agents named in this Prospectus or any Prospectus Supplement may be residents of a country other than the United States, and a substantial portion of the assets of the Company and such persons may be located outside of the United States.

NEITHER THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE "SEC"), NOR ANY STATE SECURITIES REGULATOR HAS APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

Each of the following persons resides outside of Canada, and has appointed Gowling WLG (Canada) LLP, 1 First Canadian Place, 100 King Street West, Suite 1600, Toronto, Ontario M5X 1G5, as their agent for service of process in Canada, respectively:

|

Name

|

|

Relationship to the Company

|

|

Paulo Misk

|

|

CEO, President and Director

|

|

Daniel R. Tellechea

|

|

Director

|

|

Jonathan Lee

|

|

Director

|

|

Alberto Arias

|

|

Director

|

|

Porfirio Cabaleiro Rodriguez

|

|

Qualified Person

|

|

Leonardo Apparicio da Silva

|

|

Qualified Person

|

|

Fábio Valério Cậmara Xavier

|

|

Qualified Person

|

Prospective purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the party has appointed an agent for service of process. See "Risk Factors".

iii

An investment in Securities involves significant risks that should be carefully considered by prospective investors before purchasing Securities. The risks outlined in this Prospectus and in the documents incorporated by reference herein, including the applicable Prospectus Supplement, should be carefully reviewed and considered by prospective investors in connection with any investment in Securities. See "Cautionary Note Regarding Forward-Looking Information" and "Risk Factors".

The Company's head office and registered office is located at Suite 1105 - 55 University Avenue, Toronto, Ontario, M5J 2H7.

iv

TABLE OF CONTENTS

Page

GENERAL MATTERS

In this Prospectus, references to the "Company", "we", "us" and "our" refer to Largo Resources Ltd. and/or, as applicable, one or more of its subsidiaries. Investors should rely only on the information contained in or incorporated by reference into this Prospectus or any applicable Prospectus Supplement. The Company has not authorized anyone to provide investors with different information. The Company takes no responsibility for, and can provide no assurance as to the reliability of any other information that others may give to readers of this Prospectus.

This Prospectus is part of a registration statement on Form F-10 that we are filing with the SEC under the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act"), relating to the Securities (the "Registration Statement"). Under the Registration Statement, we may, from time to time, offer any combination of the Securities described in this Prospectus in one or more offerings of up to an aggregate principal amount of C$750,000,000 (or the equivalent in other currencies). This Prospectus provides you with a general description of the Securities that we may offer. Each time we offer Securities under the Registration Statement, we will provide a Prospectus Supplement that will contain specific information about the terms of that offering. The Prospectus Supplement may also add, update or change information contained in this Prospectus. Before you invest, you should read both this Prospectus and any applicable Prospectus Supplement, together with additional information described under the heading "Documents Incorporated By Reference". This Prospectus does not contain all of the information set forth in the Registration Statement, certain parts of which are omitted in accordance with the rules and regulations of the SEC. You may refer to the Registration Statement and the exhibits to the Registration Statement for further information with respect to us and the Securities.

The Company is not making an offer to sell or seeking an offer to buy the Securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this Prospectus, any applicable Prospectus Supplement and the documents incorporated by reference herein and therein is accurate as of any date other than the date on the front of this Prospectus, any applicable Prospectus Supplement or the respective dates of the documents incorporated by reference herein and therein, regardless of the time of delivery of such documents or of any sale of the Securities. Our business, financial condition, results of operations and prospects may have changed since those dates. Information contained on the Company's website is not incorporated by reference into this Prospectus or any applicable Prospectus Supplement and prospective investors should not rely upon such information for the purpose of determining whether to invest in the Securities.

CAUTIONARY NOTE TO UNITED STATES INVESTORS CONCERNING DISCLOSURE REQUIREMENTS AND ESTIMATES OF MEASURED, INDICATED AND INFERRED MINERAL RESOURCES

This Prospectus, including the documents incorporate by reference herein, uses the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "mineral resource", "measured mineral resource", "indicated mineral resource" and "inferred mineral resource", which are Canadian mining terms as defined in, and required to be disclosed in accordance with, National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"), which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves ("CIM Standards"), adopted by the CIM Council, as amended. The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the United States Securities Exchange Act of 1934, as amended (the "U.S. Exchange Act"). These amendments became effective February 25, 2019 (the "SEC Modernization Rules") with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical disclosure requirements for mining registrants that were included in SEC Industry Guide 7. As a foreign private issuer that files its annual report on Form 40-F with the SEC pursuant to the MJDS, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Standards. If the Company ceases to be a foreign private issuer or loses its eligibility to file its annual report on Form 40-F pursuant to the MJDS, then the Company will be subject to the SEC Modernization Rules which differ from the requirements of NI 43-101 and the CIM Standards.

United States investors are cautioned that there are differences in the definitions under the SEC Modernization Rules and the CIM Standards. There is no assurance any mineral resources that the Company may report as "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the resource estimates under the standards adopted under the SEC Modernization Rules. United States investors are also cautioned that while the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any "measured mineral resources", "indicated mineral resources" or "inferred mineral resources" that the Company reports are or will be economically or legally mineable. Further, "inferred mineral resources" have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the "inferred mineral resources" exist. In accordance with Canadian securities laws, estimates of "inferred mineral resources" cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101. In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM definitions. United States investors are cautioned that a preliminary economic assessment cannot support an estimate of either "proven mineral reserves" or "probable mineral reserves" and that no feasibility studies have been completed on the Company's mineral properties.

Accordingly, information contained in this Prospectus, any Prospectus Supplement and the documents incorporated by reference herein and therein describing the Company's mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This Prospectus, including the documents incorporated by reference herein, contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities laws (together, "forward-looking information") concerning the offering of the Securities, the Company's projects, capital, anticipated financial performance, business prospects and strategies and other general matters. These statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those included in the forward-looking information. The use of words such as "intend", "anticipate", "continue", "estimate", "expect", "may", "will", "project", "should", "believe" and similar expressions are intended to identify forward-looking information. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may constitute forward-looking information. Statements relating to mineral resources are also forward-looking information, as they involve the implied assessment, based on certain estimates and assumptions that the mineral resources described can be profitably produced in the future. There is no certainty that it will be commercially viable to produce any portion of the mineral resources.

Forward-looking information includes statements with respect to:

• the Company's sales operations and anticipated sales of vanadium products;

• the Company's goals regarding development of its projects and further exploration and development of its properties;

• the Company's proposed plans for advancing its projects, and potential future exploration and development projects;

• the Company's expectations regarding the timing for completion of, resulting production from, and anticipated benefits of, and the vanadium trioxide processing plant to be constructed at the Maracás Mine (the “Vanadium Trioxide Plant”);

• the Company's expectations and proposed plans for Largo Clean Energy Corp. (“Largo Clean Energy”) and its vertically integrated vanadium redox flow battery business;

• the Company's expectations regarding the results of the initial chemical pilot plant tests and the potential to produce titanium dioxide;

• the Company’s expectations regarding cash flow from operating activities;

• expectations regarding the continuity of mineral deposits;

• future prices of vanadium, vanadium pentoxide, ferrovanadium and vanadium trioxide;

• the extent and overall impact of the COVID-19 pandemic;

• future production at our Maracás Menchen vanadium mine in Bahia State, Brazil (the "Maracás Mine");

• the results in our technical report entitled "An Updated Mine Plan, Mineral Reserve and Preliminary Economic Assessment of the Inferred Resources," dated October 26, 2017, and with an effective date of May 2, 2017, prepared for the Company by GE21 Ltda. (the "Technical Report"), including resource estimates;

• expectations regarding any environmental issues that may affect planned or future exploration and development programs and the potential impact of complying with existing and proposed environmental laws and regulations;

• receipt and timing of third party approvals;

• government regulation of mineral exploration and development operations in Brazil;

• expectations regarding any social or local community issues in Brazil that may affect planned or future exploration and development programs; and

• statements in respect of vanadium demand and supply.

These statements and information are only predictions based on current information and knowledge, some of which may be attributed to third party industry sources. Actual future events or results may differ materially. Undue reliance should not be placed on such forward-looking information, as there can be no assurance that the plans, intentions or expectations upon which they are based will occur. By its nature, forward-looking information involves numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections and other forward-looking information will not be realized.

The following are some of the assumptions upon which forward-looking information is based:

• that general business and economic conditions will not change in a material adverse manner;

• demand for, and stable or improving price of vanadium, vanadium pentoxide, ferrovanadium and vanadium trioxide;

• that the Company will enter into agreements for the sales of vanadium products on favourable terms and for the sale of substantially all of its annual production capacity;

• receipt of regulatory and governmental approvals, permits and renewals in a timely manner;

• that the Company will not experience any material accident, labour dispute or failure of plant or equipment or other material disruption in the Company's operations at the Maracás Mine;

• the availability of financing for operations and development;

• the Company's ability to procure equipment and operating supplies in sufficient quantities and on a timely basis;

• that the Vanadium Trioxide Plant will be completed on budget and in a reasonable timeframe;

• that the estimates of the resources and reserves at the Maracás Mine are within reasonable bounds of accuracy (including with respect to size, grade and recovery);

• that the Company's current expansion of development programs and objectives can be achieved;

• the Company's ability to attract and retain skilled personnel and directors; and

• the accuracy of the Company's mineral resource estimates (including size, grade and recoverability) and the geological, operational and price assumptions on which these are based.

Actual results could differ materially from those anticipated in this forward-looking information as a result of the risks and uncertainties including, without limitation:

• volatility in prices of, and demand for, vanadium, vanadium pentoxide, ferrovanadium and vanadium trioxide;

• risks inherent in mineral exploration and development;

• uncertainties associated with estimating mineral resources and mineral reserves;

• uncertainties related to title to the Company's mineral projects;

• revocation of government approvals;

• tightening of the credit markets, global economic uncertainty and counterparty risk;

• failure of plant, equipment or processes to operate as anticipated;

• unexpected events and delays during construction and development;

• competition for, among other things, capital and skilled personnel;

• geological, technical and drilling problems;

• fluctuations in foreign exchange or interest rates and stock market volatility;

• rising costs of labour and equipment;

• risks associated with political and/or economic instability in Brazil;

• inherent uncertainties involved in the legal dispute resolution process, including in foreign jurisdictions;

• our ability to build, finance and operate our vanadium redox flow battery business;

• changes in income tax and other laws of foreign jurisdictions; and

• other factors discussed under "Risk Factors" in this Prospectus, as well as those risk factors discussed or referred to in the Annual Information Form, Annual MD&A and Interim MD&A (each as defined herein).

Assumptions relating to the potential mineralization of the Maracás Mine are discussed in the Technical Report which is available under the Company's profile on SEDAR, and at www.sec.gov as an exhibit to the registration statement filed with the SEC on Form 40-F on April 14, 2021.

Additional risks and uncertainties not currently known to the Company, or that the Company currently deems to be immaterial, may also materially and adversely affect the Company's business and prospects. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. The reader is cautioned not to place undue reliance on forward-looking information.

The forward-looking information is presented for the purpose of assisting investors in understanding the Company's plans, objectives and expectations in making an investment decision and may not be appropriate for other purposes. This forward-looking information is expressly qualified in its entirety by this cautionary statement. Forward-looking information contained in this Prospectus or documents incorporated herein by reference are made as of the date of this Prospectus or the document incorporated herein by reference, as applicable, and are accordingly subject to change after such date. The Company disclaims any obligation to update any such forward-looking information to reflect events or circumstances after the date of such information, or to reflect the occurrence of anticipated or unanticipated events, except as required by law.

EXEMPTION

Pursuant to a decision of the Autorité des marchés financiers dated May 17, 2021, the Company was granted a permanent exemption from the requirement to translate into French this Prospectus as well as the documents incorporated by reference therein and any Prospectus Supplement to be filed in relation to an “at-the-market distribution”. This exemption is granted on the condition that this Prospectus and any Prospectus Supplement (other than in relation to an “at-the-market distribution”) be translated into French if the Company offers Securities to Québec purchasers in connection with an offering of Securities other than in relation to an “at-the-market distribution”.

MARKET AND INDUSTRY DATA

Market and industry data contained and incorporated by reference in this Prospectus or any applicable Prospectus Supplement concerning economic and industry trends is based upon good faith estimates of our management or derived from information provided by industry sources. The Company believes that such market and industry data is accurate and that the sources from which it has been obtained are reliable. However, we cannot guarantee the accuracy of such information and we have not independently verified the assumptions upon which projections of future trends are based.

SCIENTIFIC AND TECHNICAL INFORMATION

The scientific and technical information relating to the Company's mineral projects contained in the documents identified under the heading "Documents Incorporated by Reference" is based on the Technical Report The full text of the Technical Report has been filed with Canadian securities regulatory authorities pursuant to NI 43-101 guidelines and can be viewed under the Company's profile on SEDAR, and at www.sec.gov as an exhibit to the registration statement filed with the SEC on Form 40-F on April 14, 2021. If, after the date of this Prospectus, the Company is required by Section 4.2(1)(j) of NI 43-101 to file a technical report to support scientific or technical information that relates to a mineral project on a property material to the Company, the Company will file such technical report in accordance with Section 4.2(5)(a)(i) of NI 43-101 as if the words "short form prospectus" refer to a "shelf prospectus supplement".

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

In this Prospectus, unless stated otherwise or the context requires otherwise, all dollar amounts are expressed in Canadian dollars. All references to "US$" or "U.S. dollars" are to the lawful currency of the United States, all references to "C$," or "Canadian dollars" are to the lawful currency of Canada.

The following table sets forth the high, low and average daily exchange rates for the years ended December 31, 2020 and 2019 and for the three months ended March 31, 2021 as reported by the Bank of Canada. These rates are set forth as Canadian dollars per US$1.00.

|

|

Year ended December 31

|

3 months ended

March 31, 2021

|

|

|

2019

|

2020

|

|

High

|

1.3600

|

1.4496

|

1.2828

|

|

Low

|

1.2988

|

1.2718

|

1.2455

|

|

Average

|

1.3269

|

1.3415

|

1.2660

|

On June 3, 2021, the daily average exchange rate for Canadian dollars in terms of the United States dollar, as quoted by the Bank of Canada, was US$1.00 = C$1.2103.

MARKETING MATERIALS

Any template version of marketing materials (as such terms are defined in National Instrument 41-101 – General Prospectus Requirements) that are utilized in connection with the distribution of Securities will be filed under the Company's profile on SEDAR. In the event that such marketing materials are filed after the date of the applicable Prospectus Supplement for the offering and before termination of the distribution of such Securities, such filed versions of the marketing materials will be deemed to be incorporated by reference into the applicable Prospectus Supplement for the purposes of the distribution of the Securities to which the Prospectus Supplement pertains.

NON-GAAP FINANCIAL MEASURES

The Annual MD&A and the Interim MD&A each contain references to certain financial measures that are not defined under IFRS. Management uses non-GAAP financial measures such as Revenues Per Pound, Cash Operating Costs Per Pound and Total Cash Cost, together with measures determined in accordance with IFRS, to provide investors with a supplemental measure to evaluate the underlying performance of the Company. Management also believes that securities analysts, investors and other interested parties frequently use non-GAAP financial measures in the evaluation of issuers. Management also uses non-GAAP financial measures in order to facilitate operating performance comparisons from period to period, prepare annual operating budgets, and to assess its ability to meet future debt service, capital expenditure, and working capital requirements. Non-GAAP financial measures do not have standardized meanings and are unlikely to be comparable to any similar measures presented by other companies. A reconciliation of non-GAAP financial measures related to the Company can be found under the heading "Non-GAAP Measures" in the Annual MD&A and the Interim MD&A.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this Prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Chief Financial Officer of the Company at Suite 1105 - 55 University Avenue, Toronto, Ontario, M5J 2H7, Telephone 416-861-9797, and are also available electronically at www.sedar.com.

The following documents of the Company filed with the securities commissions or similar authorities in Canada are incorporated by reference in this Prospectus:

1. the Company's revised annual information form originally dated as of March 17, 2021, revised as of June 4, 2021, in respect of the fiscal year ended December 31, 2020 (the "Annual Information Form");

2. the audited consolidated financial statements of the Company and the notes thereto as at and for the fiscal years ended December 31, 2020 and 2019, together with the auditor's report thereon (the "Annual Financial Statements");

3. the management's discussion and analysis of financial conditions and operations of the Company for the fiscal years ended December 31, 2020 and 2019 (the "Annual MD&A");

4. the unaudited condensed interim consolidated financial statements as at and for the three months ended March 31, 2021 and related notes thereto (the "Interim Financial Statements");

5. the management's discussion and analysis for the three months ended March 31, 2021 (the "Interim MD&A");

6. the management information circular of the Company dated January 25, 2021 in connection with the special meeting of shareholders held on March 1, 2021;

7. the material change report of the Company dated March 5, 2021, regarding the consolidation of the Common Shares on the basis of one (1) post-consolidation Common Shares for every ten (10) pre-consolidation Common Shares; and

8. the management information circular of the Company dated May 12, 2021 in connection with the annual and special meeting of shareholders to be held on June 17, 2021.

Any document of the type referred to in Section 11.1 of Form 44-101F1 - Short Form Prospectus Distributions filed by the Company with a securities commission or similar regulatory authority in Canada after the date of this Prospectus and prior to 25 months from the date hereof shall be deemed to be incorporated by reference in this Prospectus.

In addition, to the extent that any document or information incorporated by reference into this Prospectus is included in any report on Form 6-K, Form 40-F or Form 20-F (or any respective successor form) that is filed with or furnished to the SEC after the date of this Prospectus, such document or information shall be deemed to be incorporated by reference as an exhibit to the Registration Statement of which this Prospectus forms a part. In addition, the Company may incorporate by reference into this Prospectus, or the Registration Statement of which it forms a part, other information from documents that the Company will file with or furnish to the SEC pursuant to Section 13(a) or 15(d) of the U.S. Exchange Act, if and to the extent expressly provided therein.

A Prospectus Supplement containing the specific terms of any offering of our Securities will be delivered to purchasers of our Securities together with this Prospectus and will be deemed to be incorporated by reference in this Prospectus as of the date of the Prospectus Supplement and only for the purposes of the offering of our Securities to which the Prospectus Supplement pertains.

Any statement contained in this Prospectus or in a document incorporated or deemed to be incorporated by reference in this Prospectus shall be deemed to be modified or superseded for the purposes of this Prospectus to the extent that a statement contained herein or in any subsequently filed document which also is or is deemed to be incorporated by reference in this Prospectus modifies or supersedes that statement. Any statement so modified or superseded shall not constitute a part of this Prospectus except as so modified or superseded. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

Upon our filing of a new annual information form and the related annual financial statements and management's discussion and analysis with applicable securities regulatory authorities during the duration of this Prospectus, the previous annual information form, the previous annual financial statements and management's discussion and analysis and all interim financial statements, supplemental information, material change reports and information circulars filed prior to the commencement of our financial year in which the new annual information form is filed will be deemed no longer to be incorporated into this Prospectus for purposes of future offers and sales of our Securities under this Prospectus. Upon interim consolidated financial statements and the accompanying management's discussion and analysis and material change report being filed by us with the applicable securities regulatory authorities during the duration of this Prospectus, all interim consolidated financial statements and the accompanying management's discussion and analysis filed prior to the new interim consolidated financial statements shall be deemed no longer to be incorporated into this Prospectus for purposes of future offers and sales of Securities under this Prospectus.

References to our website in any documents that are incorporated by reference into this Prospectus do not incorporate by reference the information on such website into this Prospectus, and we disclaim any such incorporation by reference.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been, or will be, filed with the SEC as part of the Registration Statement on Form F-10 relating to the Securities, of which this Prospectus forms a part: (1) the documents listed under "Documents Incorporated by Reference"; (2) the consent of PricewaterhouseCoopers LLP; (3) the powers of attorney from certain of the Company's directors and officers; (4) the consents of the "qualified persons" referred to in this Prospectus under "Interest of Experts"; and (5) the form of debt indenture. A copy of the form of any applicable warrant indenture, subscription receipt agreement or statement of eligibility of trustee on Form T-1, as applicable, will be filed by post-effective amendment or by incorporation by reference to documents filed or furnished with the SEC under the U.S. Exchange Act.

RISK FACTORS

An investment in the Securities involves a high degree of risk and must be considered speculative due to the nature of the Company's business and present stage of exploration and development of its mineral properties. Before making an investment decision, prospective purchasers should carefully consider the risks and uncertainties described below, as well as the other information contained in or incorporated by reference in this Prospectus, including without limitation the risk factors described under the section "Risk Factors" in the Annual Information Form and under "Risks and Uncertainties" in the Annual MD&A and the Interim MD&A. Additional risks and uncertainties of which the Company currently is unaware or that are unknown or that it currently deems to be immaterial could have a material adverse effect on the Company's business, financial condition and results of operation. The Company cannot assure you that it will successfully address any or all of these risks. There is no assurance that any risk management steps taken will avoid future loss due to the occurrence of the risks described herein, in the Annual Information Form, in the other documents incorporated by reference herein or in the applicable Prospectus Supplement or other unforeseen risks.

Risks Related to any Offering under this Prospectus

An investment in the Securities is speculative and you may lose your entire investment

An investment in the Securities is speculative and may result in the loss of an investor's entire investment. Only potential investors who are experienced in high risk investments and who can afford to lose their entire investment should consider an investment in the Company.

There can be no assurance that an active or liquid market for the Securities will be developed or sustained

No assurance can be given that an active or liquid trading market for the Common Shares will be sustained. If an active or liquid market for the Common Shares fails to be sustained, the prices at which such Securities trade may be adversely affected. Whether or not the Common Shares will trade at lower prices depends on many factors, including the liquidity of the Common Shares, prevailing interest rates, the markets for similar securities, general economic conditions and the Company's financial condition, historic financial performance and future prospects.

There is currently no market through which the Securities (other than the Common Shares) may be sold and purchasers may not be able to resell such Securities. This may affect the pricing of such Securities in the secondary market, the transparency and availability of trading prices, the liquidity of such Securities and the extent of issuer regulation.

The market price of the Securities may fluctuate significantly

The trading price of the Common Shares and any other Securities offered hereunder that become listed and posted for trading on the TSX, Nasdaq or any other stock exchange may be subject to large fluctuations. The trading prices may increase or decrease in response to a number of events and factors, including:

• the price of metals and minerals;

• the Company's operating performance and the performance of competitors and other similar companies;

• exploration and development of the Company's properties;

• the public's reaction to the Company's press releases, other public announcements and the Company's filings with the various securities regulatory authorities;

• changes in earnings estimates or recommendations by research analysts who track the Common Shares or the shares of other companies in the resource sector;

• changes in general economic conditions;

• changes in prevailing interest rates;

• changes or perceived changes in our creditworthiness;

• the number of Common Shares to be publicly traded after the completion of any offering of Securities;

• the arrival or departure of key personnel; and

• acquisitions, strategic alliances or joint ventures involving the Company or its competitors.

In addition, the market price of the Common Shares and any other Securities offered hereunder that become listed and posted for trading on the TSX, Nasdaq or any other stock exchange may be affected by many variables not directly related to the Company's results and not within the Company's control, including developments that affect the market for all resource sector shares, the breadth of the public market for the Common Shares other any other Securities offered hereunder that become listed and posted for trading on the TSX, Nasdaq, or any other stock exchange, and the attractiveness of alternative investments. In addition, securities markets have recently experienced an extreme level of price and volume volatility, and the market price of securities of many companies has experienced wide fluctuations which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. As a result of these and other factors, the Company's share price may be volatile in the future and may decline below the price paid for Securities offered hereunder. Accordingly, investors may not be able to sell their Securities at or above the price paid for Securities offered hereunder.

Negative Cash Flow from Operating Activities in 2020

The Company had negative cash flow from operating activities for the year ended December 31, 2020. The negative cash follow from operating activities in 2020 resulted from two non-recurring events related to the Company’s termination of its offtake agreement in April 2020. As a result of the Company’s negative cash flow from operating activities in 2020, the Company relied on cash on hand. The Company had positive cash flow from operating activities for the year ended December 31, 2019 and for the three-month period ended March 31, 2021 and anticipates that it will continue to do so moving forward.

While the events that caused negative cash flow from operating activities in 2020 were non-recurring, the Company cannot guarantee it will have continued positive cash flow from operating activities in the future. If and to the extent that Company has negative cash flow from operating activities in future periods, the Company may need to allocate a portion of its cash reserves to fund such negative cash flow from operating activities. The Company may also be required to raise additional funds through the issuance of equity or debt securities. There can be no assurance that additional capital or other types of financing will be available on terms favourable to the Company when and if required.

Debt Securities may rank junior or be subordinated to secured or senior indebtedness

If the Debt Securities are unsecured, they will rank equally in right of payment with all of our other existing and future unsecured debt. Holders of secured indebtedness of the Company would have a claim on the assets securing such indebtedness that effectively ranks prior to the claim of holders of Debt Securities and would have a claim that ranks equal with the claim of holders of senior Debt Securities and senior to the claim of holders of subordinated Debt Securities to the extent that such security did not satisfy the secured indebtedness. Furthermore, although covenants given by the Company in various agreements may restrict incurring secured indebtedness, such indebtedness may, subject to certain conditions, be incurred by us in the future.

The Debt Securities may be either senior or subordinated indebtedness as described in the relevant Prospectus Supplement. In the event of the insolvency or winding-up of the Company, any subordinated Debt Securities would be subordinated and postponed in right of payment to the prior payment in full of all other liabilities and indebtedness of the Company, other than indebtedness that, by its terms, ranks equally with, or subordinate to, such subordinated Debt Securities.

Payments on Debt Securities will be subject to the financial health of the Company

The likelihood that purchasers of Debt Securities will receive payments owing to them under the terms of the Debt Securities will depend on the financial health of the Company and its creditworthiness. The ability of the Company to satisfy its payment obligations under the Debt Securities, other than the conversion or payment of interest in Common Shares, as the case may be, will be dependent on its ability to generate cash flows or its ability to raise additional financing.

The Company may issue additional securities which would dilute existing investors

Additional financing needed to continue funding the development and expansion of the Maracás Mine, Largo Clean Energy, and other properties or divisions of the Company may require the issuance of additional securities of the Company. The issuance of additional equity securities, and the exercise of Warrants, stock options and other securities convertible into equity securities, will result in dilution of the equity interests of any persons who are or may become holders of Common Shares. Sales or issuances of a substantial number of equity securities, or the perception that such sales could occur, may adversely affect prevailing market prices for the Common Shares. With any additional sale or issuance of equity securities, investors may suffer dilution of their voting power and it could reduce the value of their investment.

The Company will have broad discretion in the use of the net proceeds of any offering of Securities

Management of the Company will have broad discretion with respect to the application of net proceeds received from the sale of Securities from the capital of the Company under this Prospectus and a future Prospectus Supplement and may spend such proceeds in ways that do not improve the Company's results of operations or enhance the value of the Common Shares or its other Securities issued and outstanding from time to time. Any failure by management to apply these funds effectively could result in financial losses that could have a material adverse effect on the Company's business or cause the price or value of the Company's issued and outstanding securities to decline.

As a foreign private issuer, the Company is subject to different U.S. securities laws and rules than a U.S. domestic issuer, which may limit the information publicly available to U.S. investors

The Company is a "foreign private issuer", under applicable U.S. federal securities laws, and is, therefore, not subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Under the U.S. Exchange Act, the Company is subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. As a result, the Company does not file the same reports that a U.S. domestic issuer would file with the SEC, although the Company is required to file with or furnish to the SEC the continuous disclosure documents that it is required to file in Canada under Canadian securities laws. In addition, the Company's officers, directors, and principal shareholders are exempt from the reporting and short-swing profit recovery provisions of Section 16 of the U.S. Exchange Act. Therefore, the Company's shareholders may not know on as timely a basis when the Company's officers, directors and principal shareholders purchase or sell Common Shares, as the reporting periods under the corresponding Canadian insider reporting requirements are longer. As a foreign private issuer, the Company is exempt from the rules and regulations under the U.S. Exchange Act related to the furnishing and content of proxy statements. The Company is also exempt from Regulation FD, which prohibits issuers from making selective disclosures of material non-public information. While the Company complies with the corresponding requirements relating to proxy statements and disclosure of material non-public information under Canadian securities laws, these requirements differ from those under the U.S. Exchange Act and Regulation FD and shareholders should not expect to receive the same information at the same time as such information is provided by U.S. domestic companies. In addition, the Company may not be required under the U.S. Exchange Act to file annual and quarterly reports with the SEC as promptly as U.S. domestic companies whose securities are registered under the U.S. Exchange Act. In addition, as a foreign private issuer, the Company has the option to follow certain Canadian corporate governance practices, except to the extent that such laws would be contrary to U.S. securities laws, and provided that the Company disclose the requirements it is not following and describe the Canadian practices it follows instead. The Company may in the future elect to follow home country practices in Canada with regard to certain corporate governance matters. As a result, the Company's shareholders may not have the same protections afforded to shareholders of U.S. domestic companies that are subject to all corporate governance requirements.

The Company may lose its foreign private issuer status in the future, which could result in significant additional costs and expenses to the Company

In order to maintain its status as a foreign private issuer, a majority of the Company's Common Shares must be either directly or indirectly owned by non-residents of the U.S. unless the Company also satisfies one of the additional requirements necessary to preserve this status. The Company may in the future lose its foreign private issuer status if a majority of its Common Shares are held in the U.S. and if the Company fails to meet the additional requirements necessary to avoid loss of its foreign private issuer status. The regulatory and compliance costs under U.S. federal securities laws as a U.S. domestic issuer may be significantly more than the costs incurred as a Canadian foreign private issuer eligible to use the MJDS. If the Company is not a foreign private issuer, it would not be eligible to use the MJDS or other foreign issuer forms and would be required to file periodic and current reports and registration statements on U.S. domestic issuer forms with the SEC, which are more detailed and extensive than the forms available to a foreign private issuer, and would be required to file financial statements prepared in accordance with United States generally accepted accounting principles. In addition, the Company may lose the ability to rely upon exemptions from Nasdaq corporate governance requirements that are available to foreign private issuers.

The Company relies upon certain accommodations available to it as an "emerging growth company"

The Company is an "emerging growth company" as defined in section 3(a) of the U.S. Exchange Act (as amended by the JOBS Act, enacted on April 5, 2012), and the Company will continue to qualify as an emerging growth company until the earliest to occur of: (a) the last day of the fiscal year during which the Company has total annual gross revenues of US$1,070,000,000 (as such amount is indexed for inflation every five years by the SEC) or more; (b) the last day of the fiscal year of the Company following the fifth anniversary of the date of the first sale of common equity securities of the Company pursuant to an effective registration statement under the U.S. Securities Act; (c) the date on which the Company has, during the previous three year period, issued more than US$1,000,000,000 in non-convertible debt; and (d) the date on which the Company is deemed to be a "large accelerated filer", as defined in Rule 12b-2 under the U.S. Exchange Act. The Company will qualify as a large accelerated filer (and would cease to be an emerging growth company) at such time when on the last business day of its second fiscal quarter of such year the aggregate worldwide market value of its common equity held by non-affiliates will be US$700,000,000 or more. For so long as the Company remains an emerging growth company, it is permitted to and intends to rely upon exemptions from certain disclosure requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act. The Company cannot predict whether investors will find the Common Shares less attractive because the Company relies upon certain of these exemptions. If some investors find the Common Shares less attractive as a result, there may be a less active trading market for the Common Shares and the Common Share price may be more volatile. On the other hand, if the Company no longer qualifies as an emerging growth company, the Company would be required to divert additional management time and attention from the Company's development and other business activities and incur increased legal and financial costs to comply with the additional associated reporting requirements, which could negatively impact the Company's business, financial condition and results of operations.

THE COMPANY

General

The Company is a corporation existing under the Business Corporations Act (Ontario). The Company was originally incorporated under the name Kaitone Holdings Ltd. in the Province of British Columbia on April 18, 1988. On September 3, 1991, the Company changed its name to Consolidated Kaitone Holdings Ltd. On May 8, 2003, the Company changed its name to Largo Resources Ltd. On June 10, 2004, the Company continued to the Province of Ontario and filed articles of amendment to amend its authorized share capital to an unlimited number of Common Shares. Effective October 17, 2014, the Company consolidated its issued and outstanding Common Shares on a 10:1 basis. Effective March 4, 2021, the Company consolidated its issued and outstanding Common Shares on a 10:1 basis.

Summary of the Business

The Company is a Canadian natural resource production company with an emerging energy storage system division listed on the TSX and Nasdaq. Our principal operating asset is the Maracás Mine located in Bahia, Brazil, which accounted for all of our revenues since it commenced operations. According to the Technical Report, as of May 2, 2017, the Maracás Mine had one of the world's highest grade vanadium deposits with proven mineral reserves of 17.57 million tonnes with an average grade of 1.14 % V2O5 and probable mineral reserves of 1.44 million tonnes with an average grade of 1.26% V2O5. The Maracás Mine produces high purity vanadium pentoxide products and had a mine life of over 10 years, based on its proven mineral reserves and probable mineral reserves as of May 2, 2017. The Maracás Mine is the only mineral property material to the Company.

The mine produces vanadium-rich ore which is sent to an on-site processing plant which produced 11,825 tonnes of vanadium pentoxide flake in 2020. Currently, the Maracás Mine is fully licensed. The current operation license (LO) - which is the main license for the Company's operation, was initially valid until October 6th, 2020. The renewal process commenced in May 2020, however, due to the COVID-19 pandemic, the Brazilian Instituto do Meio Ambiente e Recursos Hídricos, in the State of Bahia ("INEMA") has been unable to visit the Maracás Mine to complete its audit. As a result, the LO has been automatically extended until INEMA can complete their review and inspection process.

We currently mine and sell three primary products: vanadium pentoxide flake, high purity vanadium pentoxide flake and high purity vanadium pentoxide powder. We are currently one of the lowest cost producers of vanadium pentoxide in the world due to the characteristics of the Maracás Mine's ore body and our operating efficiency. The Company also employs certain third party conversion facilities to covert some of its vanadium pentoxide flake into ferrovanadium for sale by the Company. Since the termination of our prior offtake agreement with Glencore effective (April 30, 2020), we have been solely responsible for the sales, distribution and marketing of our vanadium products.

In July 2020, the Company began construction of a Vanadium Trioxide Plant at the Maracás Mine, which is estimated to be completed in the second half of 2021. When complete, the Vanadium Trioxide Plant is anticipated is expected to increase sales for the high-purity aerospace market, the chemical industry and for vanadium electrolyte used for vanadium redox flow batteries.

In December 2020, the Company announced the launch of Largo Clean Energy as a new business unit. The launch of Largo Clean Energy was aimed at creating a vertically integrated energy storage system provider for the growing renewable energy storage market. In working to build a vanadium redox flow battery business, the Company is building downstream capabilities in order to diversify its product and customer base and increase its flexibility in any vanadium price environment.The Company’s primary business objectives with respect to Largo Clean Energy between now and December 2022 are:

-

Achieve production readiness for its vanadium redox flow battery (“VRFB”) system.

-

Deploy an aggregate of 5 MW in generating capacity.

As of the date hereof, the Company anticipates it will be required to spend approximately US$19.85 million to achieve the foregoing business objectives between now and December 31, 2022 which amount it anticipates being funded through existing capital resources and anticipated future operating revenue. The significant events and anticipated related costs that need to occur for the preceding business objectives to be accomplished are as follows:

-

Validate the Company’s VCHARGE± VRFB system design over Q2/Q3 2021 which requires upgrading a few system components and testing to qualify the power output at a 600kW level – approximately, US$4.43 million.

-

Move into a dedicated manufacturing facility in Q2/Q3 2021 to enable more flexibility in system design, permit electrolyte purification, and provide stack production capacity – approximately, US$11.01 million.

-

Establish manufacturing supply chain over Q2 to Q4 2021 – approximately, US$2.2 million.

-

Secure Underwriter Laboratories (UL) certification (UL1973 and UL9540) for the VCHARGE± VRFB system in the United States and secure Conformitè Europëenne (CE) certification in the European Economic Area by end of Q4 2021 – approximately, US$0.94 million.

-

Enter into one or more sales contracts for VRFB systems in 2021 and deliver and commission at least one VRFB system prior to December 31, 2022 – approximately, US$1.27 million.

Recent Developments

On March 4, 2021, the Company consolidated it's Common Shares on the basis of one (1) post-consolidation Common Shares for every ten (10) pre-consolidation Common Shares.

The Company listed the Common Shares for trading on the Nasdaq commencing April 19, 2021 after filing a registration statement on Form 40-F under the U.S. Exchange Act with the SEC on April 14, 2021.

COVID-19 Pandemic

Notwithstanding the COVID-19 pandemic, the Maracás Mine continued operations during the year ended December 31, 2020. The Company continues to monitor the evolving COVID-19 pandemic and has taken preventative measures at its mine site and corporate offices to mitigate potential risks. Although there have been some challenges with logistics, there continues to be no significant impact on the Company's production or on the shipment of products out of the Maracás Mine. To date, there continues to be no significant disruption to the Company's supply chain for its operations and the level of critical consumables continues to be at normal levels. In addition, the restrictions imposed by the government in Brazil have not significantly impacted operations. The Company continues to follow the recommendations provided by health authorities and all corporate office personnel have been instructed to work from home where possible. The Company continues to staff critical functions at the Maracás Mine and has encouraged those in non-essential roles to work from home.

The Company's 2021 guidance continues to be presented on a "business as usual" basis. The Company continues to monitor measures being imposed by governments globally to reduce the spread of COVID-19 and the impact that this may have on the Company's operations, sales and guidance for 2021. Although these restrictions have not, to date, had a material impact on the Company's operations and sales, the potential future impact of COVID-19 both in Brazil and globally could have a significant impact on the Company's operations, sales efforts and logistics. The Company is continuing to monitor the rapidly developing impacts of the COVID-19 pandemic and will take all possible actions to help minimize the impact on the Company and its people. However, these actions may significantly change the guidance and forecasts presented and will, if and when necessary, update its guidance accordingly.

CONSOLIDATED CAPITALIZATION

There have been no material changes in the Company's capital structure on a consolidated basis since the date of the Interim Financial Statements. The applicable Prospectus Supplement will describe any material change, and the effect of such material change, on the share and loan capitalization of the Company that will result from the issuance of Securities pursuant to such Prospectus Supplement.

USE OF PROCEEDS

The use of proceeds from the sale of Securities will be described in a Prospectus Supplement relating to a specific issuance of Securities. Among other potential uses, the Company may use the net proceeds from the sale of Securities to repay indebtedness outstanding from time to time, for capital expenditures and for general corporate purposes.

There may be circumstances where, on the basis of results obtained or for other sound business reasons, a re-allocation of funds may be necessary or prudent. Accordingly, management of the Company will have broad discretion in the application of the proceeds of an offering of Securities. The actual amount that the Company spends in connection with each intended use of proceeds may vary significantly from the amounts specified in the applicable Prospectus Supplement and will depend on a number of factors, including those referred to under "Risk Factors" and any other factors set forth in the applicable Prospectus Supplement.

The Company will not receive any proceeds from the sale of Securities by any Selling Securityholder. See "Plan of Distribution - Secondary Offering".

DESCRIPTION OF SECURITIES BEING DISTRIBUTED

The following is a brief summary of certain general terms and provisions of the Securities that may be offered pursuant to this Prospectus. This summary does not purport to be complete. The particular terms and provisions of the Securities as may be offered pursuant to this Prospectus will be set forth in the applicable Prospectus Supplement pertaining to such offering of Securities, and the extent to which the general terms and provisions described below may apply to such Securities will be described in the applicable Prospectus Supplement.

Common Shares

The authorized capital of the Company consists of unlimited number of Common Shares. As at June 3, 2021, the Company had 64,572,769 Common Shares issued and outstanding.

The Common Shares of the Company entitle holders thereof to receive dividends as and when declared by the Board of Directors of the Company. In the event of liquidation, dissolution or winding-up of the Company, the holders of Common Shares are entitled to receive all the remaining property and assets of the Company. The holders of Common Shares are entitled to receive notice of and to attend and to vote at all meetings of the shareholders of the Company and each Common Share, when represented at any meeting of the shareholders of the Company, carries the right to one vote.

Common Shares may be sold separately or together with certain other Securities under this Prospectus. Common Shares may also be issuable on conversion, exchange, exercise or maturity of certain other Securities qualified for issuance under this Prospectus.

Description of Warrants

Warrants may be offered separately or together with other Securities, as the case may be. Each series of Warrants may be issued under a separate warrant indenture or warrant agency agreement to be entered into between the Company and one or more banks or trust companies acting as Warrant agent or may be issued as stand-alone contracts. The applicable Prospectus Supplement will include details of the Warrant agreements, if any, governing the Warrants being offered. The Warrant agent, if any, will be expected to act solely as the agent of the Company and will not assume a relationship of agency with any holders of Warrant certificates or beneficial owners of Warrants. The following sets forth certain general terms and provisions of the Warrants that may be offered under this Prospectus. The specific terms of the Warrants, and the extent to which the general terms described in this section apply to those Warrants, will be set forth in the applicable Prospectus Supplement.

A copy of any warrant indenture or any warrant agency agreement relating to an offering of Warrants will be filed by the Company with the relevant securities regulatory authorities in Canada after it has been entered into by the Company.

Each applicable Prospectus Supplement will set forth the terms and other information with respect to the Warrants being offered thereby, which may include, without limitation, the following (where applicable):

-

the designation of the Warrants;

-

the aggregate number of Warrants offered and the offering price;

-

the designation, number and terms of the other Securities purchasable upon exercise of the Warrants, and procedures that will result in the adjustment of those numbers;

-

the exercise price of the Warrants;

-

the dates or periods during which the Warrants are exercisable;

-

the designation and terms of any securities with which the Warrants are issued;

-