Kraft Heinz Replaces Finance Chief -- 2nd Update

August 26 2019 - 12:39PM

Dow Jones News

By Heather Haddon and Micah Maidenberg

Kraft Heinz Co. replaced its chief financial officer and made

other executive changes, the latest attempts to address accounting

errors and weak sales that have slashed the value of the food

giant's brands and shares.

The Chicago-based company said on Monday that finance chief

David Knopf, 31 years old, will return to 3G Capital, the

private-equity firm that worked with Warren Buffett's Berkshire

Hathaway Inc. to create Kraft Heinz through a merger in 2015.

Berkshire Hathaway and 3G remain top shareholders in Kraft

Heinz.

Mr. Knopf will be replaced on Sept. 1 by Paulo Basilio, 44 years

old, who became finance chief of H.J. Heinz Holding Corp. in 2013

and retained that title for Kraft Heinz after the merger. In 2017,

he became president of Kraft Heinz's U.S. commercial business and

last month became chief business planning and development

officer.

Kraft Heinz's shares, down 41% this year, were roughly flat on

Monday.

The company has struggled to generate sales growth in its stable

of well-known brands, such as Oscar Mayer hot dogs and Kraft

macaroni and cheese, that in many cases are out of step with trends

toward more natural or healthful products. A big cost-cutting drive

after the merger has also diminished its bandwidth to promote new

or improved products, some former employees say.

Chief Executive Miguel Patricio, a former executive at

Anheuser-Busch InBev SA who took the top job at Kraft Heinz in

June, has said that he wants to revive sales growth in well-known

brands without straying from 3G's focus on keeping down costs. Some

3G executives are also invested in Anheuser-Busch InBev.

"We have many opportunities ahead of us at Kraft Heinz as we

chart a new course and rebuild our business momentum with a focus

on driving long-term profitable growth," Mr. Patricio said in an

email Monday morning to employees about the management changes.

Some investors have urged Kraft Heinz to look beyond its own

staff and other 3G companies for new leaders. Mr. Basilio has been

a partner at 3G since 2012, and Mr. Knopf has been a partner there

since 2015.

"3G is again rotating talent," John Baumgartner, a food industry

analyst at Wells Fargo, wrote in a research note.

Kraft Heinz has marked down the value of its brands by nearly

$17 billion this year after reporting slowing sales and a federal

investigation into the accounting errors. That investigation

remains ongoing.

The company has restated financial earnings as far back as 2016

after disclosing that it had understated costs of goods sold across

roughly three years by $208 million. The understatements were

related to how the company booked rebates and expenses related to

contracts with suppliers, the company has said.

Mr. Basilio was CFO during part of the period when those

misstatements were made. Kraft Heinz has said that top officials

didn't know about the errors at the time and that it fired some

employees that were responsible.

A Kraft Heinz spokesman declined to comment further on the

procurement problems.

Mr. Knopf, who worked at Goldman Sachs after a graduating from

Princeton University, joined Kraft Heinz as a vice president of

finance in 2015. When he became CFO in Oct. 2017 at the age of 29,

he was the youngest CFO of a Fortune 500 company.

Mr. Knopf faced pointed questions from investors during the

company's delayed earnings reports this year. Kraft Heinz earlier

this month reduced the value of assets, including international

divisions and its U.S. refrigerated-foods unit by $1.22 billion.

Those impairments came on top of $15.4 billion in write-downs on

the value of its Oscar Mayer and Kraft Heinz brands in

February.

"We are dissatisfied with our financial performance

year-to-date," Mr. Knopf told analysts earlier this month.

Mr. Patricio told employees that he wanted a seasoned veteran in

the finance job and that Mr. Knopf will work with his replacement

to help in the transition.

The food giant reported net sales fell 5% in the first half of

this year compared with the first two quarters of 2018 to $12.37

billion.

Sales of older brands including Maxwell House coffee and

Velveeta cheese are also weak, according to Nielsen data cited by

analysts at Guggenheim Securities LLC.

During the four weeks ending Aug. 10, retail sales of Kraft

products fell 0.5%, according to Guggenheim.

Kraft also said Monday that Nina Barton, currently the company's

top executive for Canada and digital growth initiatives, will be

promoted to chief growth officer, a new position. Carlos Piani,

head of strategic initiatives and mergers and acquisitions, is

leaving Kraft Heinz to pursue other opportunities, Mr. Patricio

said in his note.

Write to Heather Haddon at heather.haddon@wsj.com and Micah

Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

August 26, 2019 12:24 ET (16:24 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

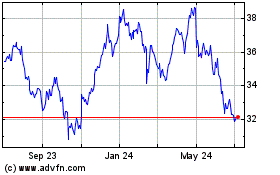

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

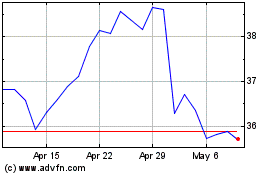

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Apr 2023 to Apr 2024