Mondelez, Kraft Heinz Cry Foul Over Regulator's Comments

August 15 2019 - 4:24PM

Dow Jones News

By Micah Maidenberg

Two of the largest food manufacturers in the U.S. said the

federal government's commodities regulator failed to hold up its

end of a deal that settled a 2015 lawsuit related to alleged

manipulation of the wheat futures market.

Mondelez International Inc. and Kraft Heinz Co. said statements

made by the U.S. Commodity Futures Trading Commission on Thursday

violated the terms of a consent order agreed to this week that

settled the lawsuit.

The consent order says parties involved in the case would

refrain from publicly commenting about it, other than referring to

"the terms of this settlement agreement or public documents filed

in this case."

On Thursday, the regulator announced the settlement with

entities connected to Mondelez and Kraft that allegedly manipulated

the market for wheat futures.

"Market manipulation inflicts real pain on farmers by denying

them the fair value of their hard work and crops," Heath Tarbert,

chair of the commission, said in a press statement. "It also hurts

American families by raising the costs of putting food on the

table.

Mondelez and Kraft plan to seek relief in court over the

commission's messages about the cases, the companies said in

separate statements.

"The commission's statement is fully compliant with the terms of

the consent order," a spokesman for the regulator said.

Four years ago, the agency sued the entities, claiming they

developed a plan in 2011 to purchase December-dated wheat futures

contracts, thus signaling that food makers and grain processors

planned to buy large quantities of wheat at the end of that

year.

The prices to purchase physical wheat before December fell,

permitting the Mondelez and Kraft entities to take profits and save

money, the commission said in the lawsuit. Both entities have

denied manipulating the market, according to a court filing.

The settlement requires the Mondelez entity to pay a $16 million

fine and abide by an injunction prohibiting violations of a law

governing commodity trading, according to court documents. The

predecessor company of Kraft Heinz must also follow the injunction,

but doesn't have to pay a fine, according to an order.

Deerfield, Ill.-based Mondelez International was formed in

October 2012, when its former parent company spun off the Kraft

North American grocery business into a separate company. That

company in 2015 completed a merger with H.J. Heinz Co., forming

Kraft Heinz.

Two members of the Commodity Futures Trading Commission said it

was unusual for the regulator to be limited in what it can say

about any particular case.

Commissioners Dan Berkovitz and Rostin Behnam also said the

language of the consent order in question doesn't restrict

individual commissioners from commenting on the matter.

"In our view, in future situations, the commission should not

accept any confidentiality provisions or restrictions on the

commission's ability to make public statements," the two

commissioners said in a joint statement.

Both voted in favor of the agreement.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

August 15, 2019 16:09 ET (20:09 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

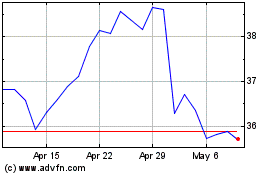

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

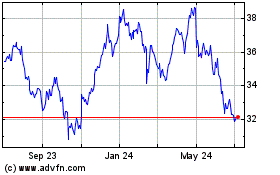

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Apr 2023 to Apr 2024