NAME OF REGISTRANT:

The Kraft Heinz

Company

NAME OF PERSON RELYING ON EXEMPTION:

The Green Century Equity Fund

ADDRESS OF PERSON RELYING ON EXEMPTION:

114 State Street, Suite 200, Boston, MA 02109

Written materials are

submitted pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934. Submission is not required of

this filer under the terms of the Rule but is made voluntarily in the interest of public disclosure and consideration of these

important issues.

Shareholder Proposal No. 4 on The Kraft

Heinz Company 2019 Proxy Statement:

SHAREHOLDER PROPOSAL – PROTEIN

DIVERSIFICATION

The Kraft Heinz Company Symbol: KHC

Filed by: The Green Century Equity Fund

The Green Century Equity Fund seeks your

support for Proposal 4 on The Kraft Heinz Company’s (“Kraft Heinz” or “the Company”) 2019 proxy statement

asking the Board to issue a report at reasonable cost, omitting confidential information, detailing the Company’s long-term

strategy towards protein diversification within its product catalogue. We believe shareholders would benefit from a report outlining

Kraft Heinz’s perspective on the opportunities and challenges regarding protein diversification within its portfolio of products

by serving to address business risks related to changing consumer preferences, reputational damage, and the broader environmental

and societal impacts from its supply chain, while serving the long-term interests of the Company.

Resolved:

Shareholders

of Kraft Heinz request the Board to issue a report at reasonable cost, omitting confidential information, detailing the Company’s

long-term strategy towards protein diversification within its product catalogue.

RATIONALE FOR A “YES” VOTE:

Failure to adequately respond to consumer

trends could impact market share.

One of the fastest growing trends within the food industry is the rise of plant-based proteins,

driven by a rise in ‘flexitarians’ seeking to add more plant-based products to their diets.

1

Competitors such as Unilever and Conagra have publicly discussed a company-wide strategy to increase offerings of alternative protein

products. Insufficient response to changing consumer preferences by companies in the food industry could lead to loss of market

share.

Current practices and reporting are

inadequate to inform shareholders of the Company’s long-term approach to protein diversification.

Currently, Kraft Heinz

mentions plant-based protein once within its publicly available materials as a component of the company’s push towards “Better

Nutrition.” This page of the sustainability report simply has pictures of products Kraft Heinz produces that fall under the

category of ‘plant-based’ without discussion of the Company’s broader goals and strategies. Kraft Heinz’s

portfolio is largely reliant on animal protein-based products and has yet to reformulate existing products to offer plant-based

alternatives like many of its competitors.

Greater focus on plant-based proteins

would significantly reduce the impact of the Company’s supply chain

. Livestock production is responsible for 14.5% of

global GHG emissions and research has shown that it will be impossible to limit the global temperature increase to the critical

target of 1.5˚C if meat and dairy consumption continues at current levels.

2

A study published in Public Health Nutrition found that it takes 18 times less land, 10 times less water, nine times less fuel,

12 times less fertilizer, and 10 times less pesticide to produce 1kg of protein from kidney beans, in comparison to producing 1kg

of protein from beef.

3

This is not

a solicitation of authority to vote your proxy. Please DO NOT send us your proxy card; The Green Century Equity Fund is not able

to vote your proxies, nor does this communication contemplate such an event. The Green Century Equity Fund urges shareholders to

vote for Item number 4 following the instruction provided on the management’s proxy mailing.

2

|

Page

BACKGROUND

Consumers across the globe are eating less

meat and demanding alternative proteins for a wide variety of reasons including concern about the environmental impacts of meat

production, animal welfare, and/or their own health. Failure to adopt an effective protein diversification strategy that reduces

supply-chain impacts such as greenhouse gas emissions and water use could lead to a loss of market share as consumers shift their

purchasing habits towards products with smaller footprints.

|

|

1.

|

FAILURE TO ADEQUATELY RESPOND TO CONSUMER TRENDS COULD IMPACT MARKET SHARE

|

One of the fastest growing trends within

the food sector is the demand for alternative proteins. Replacing traditional animal proteins in faux meats, beverages, and snack

foods, plant-based foods have been identified as a top trend for the restaurant industry,

4

major retailers,

5

,

6

and food and beverage manufacturers.

7

Sales of plant-based products are growing

rapidly.

|

|

·

|

In 2018, retail sales of plant-based alternatives to traditionally animal-based foods grew by 11%

over 2017 figures, more than five times the growth of total food sales, and accounted for $4.5 billion in sales in the United States

alone.

8

|

|

|

·

|

Segment growth for plant-based products is expected to increase by 7.7% annually over the next

5 years and is projected to make up one third of the protein market by 2054.

9

|

|

|

·

|

Non-dairy milk sales have increased 61% over the past five years, while overall sales in the dairy

milk category have decreased 15% since 2012.

10

|

|

|

·

|

Grubhub, a leading web-based food ordering platform, reports that orders of vegan-friendly dishes

increased by 25% so far this year compared to the same time period last year. Orders of the Impossible Burger, a leading plant-based

burger substitute, jumped by 82% overall, with the largest gains observed in the Midwest (326% increase) and the West (194% increase).

11

|

|

|

·

|

Plant-based meat alternatives sales had a compounded annual growth rate (CAGR) of about 21% from

2015-2018,

12

and JPMorgan analysts model a total addressable

market (TAM) at $100 billion in 15 years.

13

Kraft

Heinz may see lower growth in sales as more consumers seek to include plant-based options within diets.

|

|

|

·

|

A recent study found that about 52% of US consumers are eating more plant-based foods through vegan,

vegetarian, and flexitarian diets, and about 17% of all US consumers eat a predominantly plant-based diet.

14

|

Consumer demand for products with smaller

ecological and health impacts is growing, and people are willing to pay more.

|

|

·

|

A global survey of 30,000 consumers found that 66% of global consumers are willing to pay more

for products with sustainability attributes with 73% of Millennials indicating a willingness to pay more.

15

Another survey by Nielsen found that almost half of U.S. consumers, and 75% of Millennials say they are changing their consumption

habits to benefit the environment and prioritizing those that are “healthy for me and healthy for the world.”

16

|

|

|

·

|

A 2019 global survey found that 67% of consumers support the idea of a recognizable carbon label

to demonstrate that products have been made with a commitment to measuring and reducing their carbon footprint.

17

|

|

|

·

|

A 2018 survey found that 93% of consumers feel compelled to eat ‘healthy’ at least

some of the time and 63% percent say they try to eat healthy most, if not all, of the time. The consumption of animal products,

particularly meat, is linked to negative health implications, such as obesity, cardiovascular disease, diabetes, and cancer.

18

|

|

|

·

|

A recent study found that 70% of the world’s population is either reducing meat consumption

or forgoing animal protein altogether. According to an analyst for the research firm that conducted the study, “The shift

toward plant-based foods is being driven by millennials, who are most likely to consider the food source, animal welfare issues,

and environmental impacts when making their purchasing decisions.”

19

|

3

|

Page

Lack of strategic direction could reduce market share in

a changing consumer landscape.

|

|

·

|

Walmart, the world’s largest brick-and-mortar retailer, is Kraft Heinz’s largest customer,

representing 21% of Kraft Heinz net sales in 2017.

20

In 2017, Walmart began asking its suppliers to provide more plant-based products, specifically citing the growing demand it was

observing in the marketplace.

21

Failure to heed the

call of its largest customer could damage Kraft Heinz’s relationship with Walmart and position it behind other food manufacturers

who are able to meet Walmart’s demand.

|

|

|

·

|

The opportunities posed by the soaring demand for plant-based products come at a critical time

for Kraft Heinz. The Company made headlines in February of 2019 when it disclosed a Securities and Exchange Commission investigation

into its accounting practices and subsequently wrote down the value of its Kraft and Oscar Meyer brands by an astounding $15.4

billion, resulting in a net loss of $12.6 billion for the quarter ending December 29, 2018.

22

|

|

|

·

|

Kraft Heinz revenue growth has been stagnant since the beginning of 2016, with $26.076 billion

in revenue in 2017 representing a 0.85% decline from 2016 and $26.268 billion in revenue in 2018 representing a 0.74% increase

from 2017.

23

|

|

|

·

|

A June 2019 televised segment on CNBC, Seymour Asset Management CIO Timothy Seymour specifically

cited Kraft Heinz as being one of the obvious food manufacturers that should be seeking to capitalize on the burgeoning trend for

alternative proteins to prevent upstart companies like Beyond Meat and Impossible Foods from imposing on the Company’s protein

market share.

24

|

|

|

2.

|

Current practices and reporting are inadequate to inform

shareholders of the Company’s long-term approach to protein diversification

|

Relative to its peers, Kraft Heinz’s publicly stated goals

and ambitions regarding plans to increase exposure to plant-based food products within its portfolio is woefully inadequate. While

peers such as Unilever and Conagra publicly discuss intentions to facilitate growth by deepening exposure to plant-based products,

companies such as Kellogg’s are reformulating existing products to be entirely plant-based to widen appeal and increase market

share.

Current discussion of plant-based offerings

and ambition is extremely limited.

|

|

·

|

Currently, Kraft Heinz mentions plant-based protein once within its publicly available materials

as a component of the company’s push towards “Better Nutrition”. This page of the sustainability report simply

has pictures of products Kraft Heinz produces that fall under the category of plant-based without discussion of the Company’s

broader goals and strategies.

|

|

|

·

|

The FAIRR Initiative, an investor coalition supported by institutions representing over $5.3 trillion

in assets under management calling for diversification in protein sourcing away from a reliance on animals, reported in 2017 that

Kraft Heinz’s corporate practices and disclosure lag behind many peers with respect to goals on protein, targets on agricultural

emissions, involvement in cross-sectoral collaborations, reformulation of existing products, dedicated marketing and promotion

strategies, tracking data on the proportion of animal protein sourced, tracking data on the proportion of sales in alternative

protein products, and external data reporting.

25

A

2019 update to the report ranked Kraft Heinz’s approach to sustainable protein supply chains as 17

th

out of the

25 leading global retailers and food manufacturers.

26

|

|

|

·

|

Despite having acquired the BOCA brand twenty years ago, Kraft Heinz has failed to effectively

translate this plant-based business into market growth amidst evolving competition in the plant-based meat alternative space (market

share of BOCA branded products has decreased every year since 2013, falling from 7.3% in 2013 to 3.8% in 2018). Although Kraft

Heinz once publicly reported on BOCA sales within its annual reporting, it has since stopped this practice and has correspondingly

not disclosed to investors how the recent BOCA brand ‘refresh’ has fared in the market.

27

|

Many competitors are outlining specific

strategies to capitalize on the growing demand for plant-based proteins.

|

|

·

|

Unilever explicitly cites “more plant-based products” as one of its major strategies

for sustainable growth. Unilever also features a devoted webpage to its efforts to expand plant-based options, discussing the growing

consumer demand and citing scientific studies linking plant-based diets to improved health. Unilever has also worked to provide

plant-based versions of popular items including Hellmann’s vegan mayo, vegan Magnum ice cream, vegan Ben & Jerry’s,

and vegan Cornetto ice cream. In December of 2018 Unilever acquired the Dutch maker of plant-based protein The Vegetarian Butcher

to “[respond] to the growing trend among consumers to increasingly opt for vegetarian and vegan meals.”

|

4

|

Page

|

|

·

|

Conagra CEO Sean Connolly detailed the Company’s plans to expand its plant-based strategy

on a recent earnings call, noting that “Based on our analysis of product substitution in other categories, almond milk for

cow's milk as an example, we can reasonably predict the opportunity for plant-based meat alternatives. And here is where it gets

really exciting because the opportunity shouldn’t be viewed as just a percentage of fresh meat. We think the opportunity

is a percentage of all foods that contain meat. Based on this view, our analysis shows that plant-based meat alternatives could

achieve a 15% share of both of these market segments. That means the opportunity here could be in the range of $30 billion just

in the U.S. And you know, there’s even more opportunity internationally.” Connolly noted that the company was planning

to produce meatless burger, hot dog, and sausage products to remain competitive within the industry.

28

|

|

|

·

|

Carlos Barroso, senior vice-president of Global Research and Development and Quality at Campbell

Soup, was quoted as saying that the Company is “literally scouring the earth” for new sources of protein. He noted

that the Company is pursuing greater exposure to plant-based offerings through innovation, new product development and reformulation,

acquisitions, and investments in food start-ups through its venture capital fund, Acre Venture Partners.

29

|

|

|

·

|

Nestlé has a corporate commitment around promoting sustainable consumption to “provide

meaningful and accurate environmental information and dialogue.” As a part of this effort, Nestlé says its brands

are offering more sustainable choices, including plant-based version of Lean Cuisine meals, smoothies, and Haagen-Dazs ice cream.

Furthermore, Nestlé conducted a lifecycle analysis of its Garden Gourmet brand to understand the greatest opportunities

for reducing the environmental impact of its offerings, identifying the outsized impact of animal-based ingredients as justification

for a focus on vegan products in the future.

30

Finally,

Nestlé has an internal research and development network focused on protein innovation, with over a quarter of R&D investment

dedicated to discovery projects on plant proteins.

31

|

|

|

·

|

Kellogg’s is transitioning its MorningStar Farms brand to be 100% plant-based by 2021, expanding

the accessibility of its plant-based products and eliminating the use of over 300 million egg whites per year. MorningStar Farms

already claims nearly 17% of the meat substitute market, versus Kraft Heinz’s 3.8% market share. Melissa Cash, head of global

marketing, strategy and innovation for plant-based protein and natural brands at Kellogg’s, has noted that more is in store

from the company in the near future, stating “We have a pipeline of products…Last year, we launched two vegan burgers

in the front half of the year and then we came out with some chorizo crumbles after that, so you could assume the same kind of

pacing as we go forward.”

32

|

|

|

·

|

Hormel, one of the largest meat producers in the United States, recently entered the plant-based

protein space, announcing the development of a vegan pizza topping along with other plant-based offerings. Hormel CEO Jim Snee

was quoted as saying "The consumer seems to be speaking about having plant-based as a choice...We understand that it is a

shiny new toy. We get that. It is one of our shiny new toys as well. It is something that is certainly on our minds, like it is

everyone else, and there is a lot of work happening both in the market and behind the scenes."

33

|

|

|

3.

|

Greater focus on plant-based proteins would significantly

reduce the environmental impact of the Company’s supply chain

|

As consumer preferences continue to evolve,

investors fear that Kraft Heinz may be falling behind its peers regarding protein diversification. Failure to adopt an effective

protein diversification strategy that helps to reduce supply-chain emissions could lead to a loss of market share as consumers

shift their purchasing habits towards products with smaller footprints.

A protein diversification strategy supports

the Company’s anticipated supply-chain emission reduction goals.

|

|

·

|

According to a Kraft Heinz press release from July 31, 2018, the Company has been working with

the Science Based Targets Initiative to set a science-based greenhouse gas reduction goal including the Company’s supply

chain (Scope 3 emissions).

34

This target has not yet

been published, and we believe that protein diversification could be a key part of the Company’s broader strategy to reduce

emissions.

|

5

|

Page

|

|

·

|

The World Resources Institute found that producing food for the average American requires nearly

one hectare of agricultural land, and emits 1.4 tons of carbon dioxide equivalent.

35

|

|

|

·

|

Beef and cattle-milk are responsible for the greatest proportion of emissions in the livestock

sector, at 41 percent and 20 percent of the sector’s emissions respectively.

36

|

|

|

·

|

Although poultry is the least emissions-intensive major animal protein, it still produces sixty-five

times more greenhouse gas emissions per unit of protein than the average plant-based protein.

37

|

A protein diversification strategy also

supports the Company’s goal to reduce its water consumption by 15% by 2020.

|

|

·

|

In its 2017 Corporate Social Responsibility report, Kraft Heinz reports its goal to reduce water

consumption by 15% by 2020, using 2015 baseline levels. In 2016, the Company had a 1.4% reduction in water consumption.

38

|

|

|

·

|

Research demonstrates that beef production requires, on average, about 1800 gallons of water to

produce one pound of beef,

39

or 29 gallons per gram

of protein, whereas vegetables use about 7 gallons of water per gram of protein and legumes use about 5 gallons of water per gram

of protein.

40

These figures suggest that one quarter-pound

hamburger requires about 450 gallons of water to produce.

41

|

|

|

·

|

A study from Impossible Burger, a leading plant-based beef alternative, found that its plant-based

burger uses 87% less water, 96% less land, and 92% less aquatic pollutants to produce when compared to a traditional beef burger.

Water consumption was reduced as a result of avoiding irrigation used to produce feed crops for beef cattle feed.

42

|

|

|

·

|

Water use within Kraft Heinz’s supply chain represents a tangible reputational and financial

risk. The company’s Philadelphia Cream Cheese factory uses about 80 percent of the water supply within the town of Lowville,

New York.

43

In the summer of 2018, Lowville experienced

severe water shortages causing local officials to impose restrictions on washing cars, watering lawns, and filling swimming pools.

44

The Lowville factory used more than a million gallons of water in a day, but the town’s water filtration plant could only

filter 1.3 million gallons in a 24-hour period.

45

To pay for upgrades that would enhance water supply, the town’s water users, including Kraft-Heinz, must pay a 15 percent

rate increase.

46

For reference, 668 gallons of water

are needed on average to produce one pound of cheese.

47

|

|

|

·

|

Sales of plant-based “spreads, dips, sour cream and sauces” in 2018 increased

52%

over 2017 sales figures, representing the fastest growing category in the plant-based foods industry.

48

|

4.

KHC’s current efforts fail to address risk and meet expectations for transparency

In its opposition statement, Kraft Heinz acknowledges that the

company is aware of increasing consumer demand for plant-based proteins. However, the Company has yet to adequately demonstrate

to its stakeholders that it is responding quickly and comprehensively enough to this emerging trend, potentially foregoing significant

opportunities for growth.

|

|

·

|

Kraft Heinz cites its BOCA brand as an example of the Company’s investment and innovation

in plant-based protein offerings. Despite having acquired the brand twenty years ago, Kraft Heinz has failed to effectively translate

this business into market growth (market share of BOCA branded products has decreased every year since 2013, falling from 7.3%

in 2013 to 3.8% in 2018). Although Kraft Heinz once publicly reported on BOCA sales within its annual reporting, it has since stopped

this practice and has correspondingly not disclosed to investors how the recent BOCA brand ‘refresh’ has fared in the

market.

49

|

|

|

·

|

Kraft Heinz also cites its Springboard Incubator platform as an example of supporting “disruptive”

food startups. While the Springboard Incubator program is not a program specifically for plant-based startups (it has also supported

products such as Ayoba-Yo meat jerky and Quevos egg-white chips), it has supported some plant-based products in its second round

of funding. But Kraft Heinz’s investments in this space seem to pale in comparison to similar incubator programs run by competitors.

Start-ups involved in the Springboard Incubator receive an initial $50,000 in funding at the start of the 16 week program and have

the opportunity to earn an additional $50,000 throughout the course of the program, and Kraft Heinz does not take equity stakes

in the companies.

50

These figures are significantly

less than incubator programs run by competitors including General Mills’ 301 Inc. (lead investor in $17 million investment

of Urban Remedy, a fresh juice and plant-based meal producer)

51

and Kellogg’s Eighteen94 Capital (invests $1 to $3 million in a typical deal with a publicly stated goal of investing $100

million over a five year period).

52

|

6

|

Page

|

|

·

|

Although the Company claims that its CSR Report published in 2017 “reflect[s] our commitment

to improve and diversify our product categories to satisfy a broad spectrum of consumer preferences,” we note that Kraft

Heinz mentions plant-based protein once within this CSR Report as a component of the company’s push towards “Better

Nutrition.” This page of the sustainability report simply has pictures of products Kraft Heinz produces that fall under the

category of ‘plant-based’ without discussion of the Company’s broader goals and strategies. Therefore, the disclosure

requested within the proposal is not redundant of the Company’s current practices as intimated in the opposition statement.

|

|

|

·

|

Despite multiple letters sent to the Company over the previous calendar year, Kraft Heinz has never

responded to Green Century’s inquiries on the topic.

|

CONCLUSION

Kraft Heinz lacks sufficient transparency

to address the risks posed by the rapid growth in demand for plant-based products among consumers. While many of its competitors

have specifically incorporated a focus on increasing plant-based offerings within growth strategies, Kraft Heinz has remained notably

silent on its ambitions and goals. Shareholders believe that greater discussion regarding our Company’s approach to this

growing trend is necessary to build brand and shareholder value, demonstrate adequate management of risk, and to instill consumer

trust. As consumers increasingly shift their purchasing habits towards products with smaller environmental footprints, reduced

impact on animal welfare, and/or enhanced health benefits, food companies must remain nimble in order to secure market share and

achieve continued growth.

In its 10-K, the Company notes that its

financial success “depends on our ability to correctly predict, identify, and interpret changes in consumer preferences and

demand, to offer new products to meet those changes, and to respond to competitive innovation.” The company also cites the

highly competitive food industry and the need to expand its brand image with new product offerings as risk factors that could adversely

impact its business and financial condition. By failing to demonstrate an ambition to keep pace with peers in response to changing

consumer preferences, Kraft Heinz risks a loss of market share and exposure to reputational and financial risk. Reporting on the

company’s long-term strategy towards protein diversification within its product catalogue, including details regarding capital

allocation for research and development along with quantitative goals to diversify protein sources, is instrumental in addressing

these risks.

Shareholders are urged to vote FOR Proposal

4 asking the Board to issue a report at reasonable cost, omitting confidential information, detailing the Company’s long-term

strategy towards protein diversification within its product catalogue.

For questions regarding Kraft Heinz

Proposal 4, please contact Jared Fernandez, Green Century Capital Management, (617) 482-0800, jfernandez@greencentury.com.

This is not

a solicitation of authority to vote your proxy. Please DO NOT send us your proxy card; The Green Century Equity Fund is not able

to vote your proxies, nor does this communication contemplate such an event. The Green Century Equity Fund urges shareholders to

vote for Item number x following the instruction provided on the management’s proxy mailing.

__________________________

1

https://www.foodnavigator-usa.com/News/Promotional-Features/Double-digit-growth-in-plant-based-meat-alternatives

2

http://www.fairr.org/wp-content/uploads/FAIRR-and-ShareAction-Protein-Briefing-September-2016.pdf

3

https://www.cambridge.org/core/journals/public-health-nutrition/article/div-classtitlethe-environmental-cost-of-protein-food-choicesdiv/DB40E5C12D662913CC342D3C19F85F7D

4

https://restaurant.org/research/reports/foodtrends

5

https://www.gfi.org/kroger-walmart-increase-plant-based-offerings

6

https://media.wholefoodsmarket.com/news/whole-foods-market-unveils-top-10-food-trends-for-2019

7

|

Page

7

https://www.fooddive.com/news/from-cbd-to-plant-based-4-trends-that-dominated-expo-west-in-2019/550150/

8

https://www.foodbusinessnews.net/articles/14129-plant-based-sales-surge-to-45-billion

9

https://www.globenewswire.com/news-release/2015/02/24/920807/0/en/Alternative-Proteins-to-Claim-a-Third-of-the-Market-by-2054.html

10

https://www.fooddive.com/news/majority-of-consumers-prefer-the-taste-of-dairy-to-alternatives/520347/

11

https://www.restaurantdive.com/news/grubhub-trend-report-shows-staggering-growth-of-plant-based-meat-orders/557835/

12

https://www.hartman-group.com/newsletters/127750186/saying-no-to-meat-what-s-behind-the-rising-interest-in-plant-based-protein

13

https://www.marketwatch.com/story/beyond-meat-is-a-disruptor-as-plant-based-meat-industry-sales-poised-to-reach-100-billion-2019-05-28

14

https://www.fooddive.com/news/plant-based-eating-makes-consumers-feel-healthier-study-says/542175/

15

https://www.inc.com/melanie-curtin/73-percent-of-millennials-are-willing-to-spend-more-money-on-this-1-type-of-product.html

16

https://www.nielsen.com/us/en/insights/article/2018/was-2018-the-year-of-the-influential-sustainable-consumer/

17

https://www.carbontrust.com/news/2019/04/footprint-labelling/

18

https://www.researchgate.net/publication/267932856_The_Environmental_Cost_of_Protein_Food_Choices_-_CORRIGENDUM

19

https://www.forbes.com/sites/michaelpellmanrowland/2018/03/23/millennials-move-away-from-meat/#4f71e3f0a4a4

20

https://www.sec.gov/Archives/edgar/data/1637459/000163745918000015/form10-k2017.htm

21

https://www.cookinglight.com/healthy-living/walmart-plant-based-products

22

https://www.reuters.com/article/us-kraft-heinz-results/kraft-heinz-discloses-sec-probe-15-billion-write-down-shares-dive-20-percent-idUSKCN1QA2W1

23

https://www.macrotrends.net/stocks/charts/KHC/kraft-heinz/revenue

24

https://www.cnbc.com/video/2019/06/21/beyond-meat-down-after-consumer-group-warns-of-chemicals-in-fake-meat.html?__source=sharebar%7Ctwitter&par=sharebar

25

https://www.fairr.org/article/plant-based-profits-investment-risks-opportunities-sustainable-food-systems/#corporate-actions-supporting-protein-diversification

26

https://www.fairr.org/dashboard/

27

https://www.chicagobusiness.com/news/why-isnt-boca-burger-beyond-meat

28

https://www.foodbusinessnews.net/articles/14046-conagra-brands-has-big-plans-for-meat-alternatives

29

https://www.foodbusinessnews.net/articles/11450-campbell-soup-scouring-the-earth-for-new-sources-of-plant-protein

30

https://www.nestle.com/csv/impact/environment/information-dialogue

31

https://static1.squarespace.com/static/59d1440029f1874f709cc95b/t/5a8c7f30f9619a3b63e36945/1519157050945/FAIRR+Report.pdf

32

https://www.fooddive.com/news/why-kelloggs-morningstar-farms-is-going-100-plant-based/550244/

33

http://www.startribune.com/hormel-says-it-s-been-thinking-about-plant-based-protein-too/511148392/

34

https://news.kraftheinzcompany.com/press-release/corporate/kraft-heinz-expands-environmental-commitments-include-sustainable-packaging-

35

https://wriorg.s3.amazonaws.com/s3fs-public/Shifting_Diets_for_a_Sustainable_Food_Future_1.pdf

36

http://www.fao.org/news/story/en/item/197623/icode/

37

https://www.ciwf.com/media/7433280/the-business-case-for-protein-diversification-and-expansion-may-2018docx.pdf

38

https://www.kraftheinzcompany.com/pdf/KHC_CSR_2017_Full.pdf

39

https://www.watercalculator.org/water-use/meat-portions-900-gallons/

40

https://waterfootprint.org/en/water-footprint/product-water-footprint/water-footprint-crop-and-animal-products/

41

https://www.watercalculator.org/water-use/meat-portions-900-gallons/

42

https://impossiblefoods.com/if-pr/LCA-Update-2019/

43

https://www.ceres.org/sites/default/files/Food%20and%20Bev%20Water%20Risk%20Examples%20-%20Q2%202019.pdf

44

https://www.vice.com/en_us/article/ywyq8b/string-cheese-is-threatening-this-new-york-towns-water-supply

45

https://www.environmentalleader.com/2017/08/cream-cheese-plant-uses-unsustainable-disruptive-amounts-water/

46

https://www.ceres.org/sites/default/files/Food%20and%20Bev%20Water%20Risk%20Examples%20-%20Q2%202019.pdf

47

https://www.vice.com/en_us/article/ywyq8b/string-cheese-is-threatening-this-new-york-towns-water-supply

48

https://www.foodbusinessnews.net/articles/14129-plant-based-sales-surge-to-45-billion

49

https://www.chicagobusiness.com/news/why-isnt-boca-burger-beyond-meat

50

https://www.fooddive.com/news/kraft-heinz-launches-second-incubator-class-of-disruptive-brands/549866/

51

https://www.fooddive.com/news/general-mills-vc-arm-leads-17m-investment-in-urban-remedy/514999/

52

https://techcrunch.com/2016/06/20/kelloggs-creates-a-new-fund-1894-to-back-food-and-related-startups/

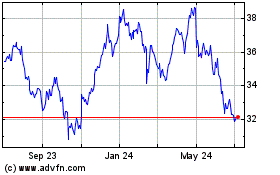

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

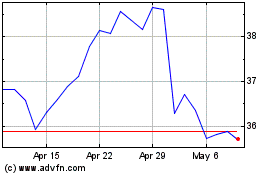

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Apr 2023 to Apr 2024