As filed with the Securities and Exchange Commission on October 26, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

KINTARA THERAPEUTICS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada

(State or other jurisdiction

of incorporation or organization)

|

99-0360497

(I.R.S. Employer

Identification No.)

|

12707 High Bluff Dr., Suite 200

San Diego, CA 92130

Telephone: (858) 350-4364

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal

Executive Offices)

Saiid Zarrabian

Chief Executive Officer

Kintara Therapeutics, Inc.

12707 High Bluff Dr., Suite 200

San Diego, CA 92130

Telephone: (858) 350-4364

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Steven M. Skolnick, Esq.

Michael J. Lerner, Esq.

Lowenstein Sandler LLP

1251 Avenue of the Americas

New York, NY 10020

Telephone: (212) 262-6700

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer: ☐

|

Accelerated filer: ☐

|

|

Non-accelerated filer: ☒

|

Smaller reporting company: ☒

|

|

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of each class of

securities to be

registered

|

|

Amount To Be

Registered (1)(2)

|

|

|

Proposed Maximum

Offering Price Per

Share

|

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

|

Amount of

Registration Fee

|

|

|

Common Stock, $0.001 par value

|

|

|

34,990,252

|

|

|

$

|

1.48

|

(3)

|

|

$

|

51,785,572.96

|

|

|

$

|

5,649.81

|

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also includes an indeterminate number of additional shares of common stock as may from time to time become issuable by reason of stock splits, stock dividends, recapitalizations or other similar transaction

|

|

(2)

|

Represents 34,990,252 shares of our common stock, $0.001 par value per share (the “Common Stock”) consisting of (i) 16,303,502 shares of the registrant’s Common Stock issuable upon conversion of outstanding shares of Series C-1 Preferred Stock; (ii) 1,490,960 shares of the registrant’s Common Stock issuable upon conversion of outstanding shares of Series C-2 Preferred Stock; (iii) 2,787,847 shares of the registrant’s Common Stock issuable upon conversion of outstanding shares of Series C-3 Preferred Stock; (iv) up to 11,412,674 shares of Common Stock payable as dividends on the Series C-1 Preferred Stock; (v) up to 1,043,727 shares of Common Stock payable as dividends on the Series C-2 Preferred Stock; and (vi) up to 1,951,542 shares of Common Stock payable as dividends on the Series C-3 Preferred Stock.

|

|

(3)

|

Estimated solely for purposes of calculating the amount of the registration fee pursuant to Rule 457(c) of the Act, based upon the average of the high and low sales prices of the registrant’s Common Stock as reported on the Nasdaq Capital Market on October 22, 2020.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated October 26, 2020

PROSPECTUS

34,990,252 SHARES OF COMMON STOCK

The selling stockholders identified in this prospectus may offer from time to time up to 34,990,252 shares of our common stock, $0.001 par value per share (the “Common Stock”), consisting of (i) 16,303,502 shares of the registrant’s Common Stock issuable upon conversion of outstanding shares of Series C-1 Preferred Stock; (ii) 1,490,960 shares of the registrant’s Common Stock issuable upon conversion of outstanding shares of Series C-2 Preferred Stock; (iii) 2,787,847 shares of the registrant’s Common Stock issuable upon conversion of outstanding shares of Series C-3 Preferred Stock; (iv) up to 11,412,674 shares of Common Stock payable as dividends on the Series C-1 Preferred Stock; (v) up to 1,043,727 shares of Common Stock payable as dividends on the Series C-2 Preferred Stock; and (vi) up to 1,951,542 shares of Common Stock payable as dividends on the Series C-3 Preferred Stock. We sold the shares of Series C-1 Preferred Stock, Series C-2 Preferred Stock and Series C-3 Preferred Stock to the selling stockholders through a series of three private placement closings, which we completed on August 19, 2020, August 24, 2020 and August 31, 2020, respectively.

This prospectus describes the general manner in which the shares may be offered and sold by the selling stockholders. If necessary, the specific manner in which the shares may be offered and sold will be described in a supplement to this prospectus. Certain of the selling stockholders and intermediaries, who are identified as broker-dealers in the footnotes to the selling stockholder table contained in this prospectus, through whom such securities are sold are deemed “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the securities offered hereby, and any profits realized or commissions received may be deemed underwriting compensation. We believe that all securities purchased by broker-dealers or affiliates of broker-dealers were purchased by such persons and entities in the ordinary course of business and at the time of purchase, such purchasers did not have any agreements or understandings, directly or indirectly, with any person to distribute such securities.

We will not receive any proceeds from the sale of the shares by the selling stockholders. We will pay the expenses of registering these shares.

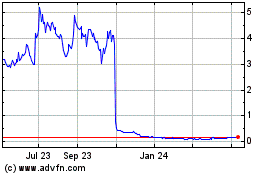

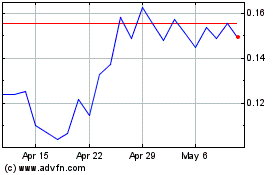

Our Common Stock is traded on the Nasdaq Capital Market under the symbol “KTRA.” On October 22, 2020, the last reported sale price of our Common Stock was $1.50 per share.

Investing in our Common Stock involves risks. See “Risk Factors” beginning on page 4 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2020.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus describes the general manner in which the selling stockholders identified in this prospectus may offer from time to time up to 34,990,252 shares of our Common Stock. If necessary, the specific manner in which the shares may be offered and sold will be described in a supplement to this prospectus, which supplement may also add, update or change any of the information contained in this prospectus. To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in this prospectus or any prospectus supplement—the statement in the document having the later date modifies or supersedes the earlier statement.

You should rely only on the information contained in this prospectus, any prospectus supplement and the documents incorporated by reference, or to which we have referred you. Neither we nor the selling stockholders have authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus and any prospectus supplement does not constitute an offer to sell, or a solicitation of an offer to purchase, the Common Stock offered by this prospectus and any prospectus supplement in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. You should not assume that the information contained in this prospectus, any prospectus supplement or any document incorporated by reference is accurate as of any date other than the date on the front cover of the applicable document.

Neither the delivery of this prospectus nor any distribution of Common Stock pursuant to this prospectus shall, under any circumstances, create any implication that there has been no change in the information set forth or incorporated by reference into this prospectus or in our affairs since the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since such date.

When used herein, unless the context requires otherwise, references to the “Company,” “we,” “our” and “us” refer to Kintara Therapeutics, Inc., a Nevada corporation, and its subsidiaries.

1

OUR COMPANY

This summary highlights information contained in the documents incorporated herein by reference. Before making an investment decision, you should read the entire prospectus, and our other filings with the Securities and Exchange Commission, or the SEC, including those filings incorporated herein by reference, carefully, including the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.”

Corporate Overview

Kintara Therapeutics, Inc. (formerly DelMar Pharmaceuticals, Inc.) is a clinical stage, biopharmaceutical company focused on the development and commercialization of new cancer therapies. We are dedicated to the development of novel cancer therapies for patients with unmet medical needs. Our mission is to benefit patients by developing and commercializing anti-cancer therapies for patients whose solid tumors exhibit features that make them resistant to, or unlikely to respond to, currently available therapies, with particular focus on orphan cancer indications.

Our two lead candidates are VAL-083, a novel, validated, DNA-targeting agent, for the treatment of drug-resistant solid tumors such as glioblastoma multiforme (“GBM”) and potentially other solid tumors, including ovarian cancer, non-small cell lung cancer (“NSCLC”), and diffuse intrinsic pontine glioma (“DIPG”) and REM-001, a late-stage photodynamic therapy (“PDT”) for the treatment of cutaneous metastatic breast cancer (“CMBC”). PDT is a treatment that uses light sensitive compounds, or photosensitizers, that, when exposed to specific wavelengths of light, act as a catalyst to produce a form of oxygen that induces local tumor cell death.

Private Placement

In conjunction with the closing of the previously announced acquisition of Adgero Biopharmaceuticals Holdings, Inc., and through a series of three private placement closings, we issued a total of 25,028 shares of Series C Convertible Preferred Stock (the “Series C Preferred Stock”) at a purchase price of $1,000 per share for total aggregate gross proceeds of approximately $25 million, or net proceeds of approximately $21.7 million (the “Private Placement”). Each closing of the Private Placement was priced at-the-market under the rules of the Nasdaq Stock Market.

The Series C Preferred Stock was issued in three series (C-1, C-2, and C-3) at conversion prices equal to $1.16, $1.214 and $1.15, respectively. As result, we issued a total of 25,028 shares of Series C Preferred Stock, which will be convertible into an aggregate of 21,516,484 shares of Common Stock. The Series C Preferred Stock will be entitled to receive dividends, payable in shares of Common Stock at a rate of 10%, 15%, 20% and 25% of the number of shares of Common Stock payable upon conversion of the Series C Preferred Stock, on the 12th, 24th, 36th and 48th month, anniversary of the initial closing of the Private Placement, which occurred on August 19, 2020; provided, that the holder of such shares has not converted the shares of Series C Preferred Stock prior to the applicable anniversary date of the initial closing of the Private Placement.

In addition, in connection with the Private Placement, we entered into a registration rights agreement with the selling stockholders (the “Registration Rights Agreement”), in which we agreed to prepare and file with the Securities and Exchange Commission (the “SEC”) a registration statement with respect to resales of the shares of Common Stock issuable upon conversion of, and payable as dividends on, the Series C Preferred Stock purchased by the selling stockholders. Accordingly, as required by the Registration Rights Agreement, the registration statement of which this prospectus is a part, relates to the offer and resale of the shares of Common Stock issuable upon conversion of, and payable as dividends on, the Series C Preferred Stock issued to the selling stockholders.

Corporate Information

Our address is 12707 High Bluff Dr., Suite 200, San Diego, CA 92130 and our telephone number is (858) 350-4364. Our corporate website is: www.kintara.com. The content of our website shall not be deemed incorporated by reference in this prospectus and you should not consider such information as part of this prospectus.

2

THIS OFFERING

This prospectus relates to the resale by the selling stockholders identified in this prospectus of up to 34,990,252 shares of our common stock, $0.001 par value per share (the “Common Stock”) purchased in our private placement offering, which had three closings between August 19, 2020 and August 31, 2020 (the “Private Placement”), consisting of (i) 16,303,502 shares of Common Stock issuable upon conversion of outstanding shares of Series C-1 Preferred Stock; (ii) 1,490,960 shares of Common Stock issuable upon conversion of outstanding shares of Series C-2 Preferred Stock; (iii) 2,787,847 shares of Common Stock issuable upon conversion of outstanding shares of Series C-3 Preferred Stock; (iv) up to 11,412,674 shares of Common Stock payable as dividends on the Series C-1 Preferred Stock; (v) up to 1,043,727 shares of Common Stock payable as dividends on the Series C-2 Preferred Stock; and (vi) up to 1,951,542 shares of Common Stock payable as dividends on the Series C-3 Preferred Stock. All of the shares, when sold, will be sold by these selling stockholders. The selling stockholders may sell their shares of Common Stock from time to time at prevailing market prices. We will not receive any proceeds from the sale of the shares of Common Stock by the selling stockholders.

|

Common Stock Offered by the Selling Stockholders:

|

|

Up to 34,990,252 shares of Common Stock.

|

|

|

|

|

|

Common Stock Outstanding at October 20, 2020:

|

|

24,662,299 shares

|

|

|

|

|

|

Terms of the Offering:

|

|

The selling stockholders will determine when and how they will sell the Common Stock offered in this prospectus, as described in the “Plan of Distribution.”

|

|

|

|

|

|

Use of Proceeds:

|

|

We will not receive any proceeds from the sale of the shares of Common Stock subject to resale by the selling stockholders under this prospectus.

|

|

|

|

|

|

Risk Factors:

|

|

An investment in the Common Stock offered under this prospectus is highly speculative and involves substantial risk. Please carefully consider the “Risk Factors” section and other information in this prospectus for a discussion of risks. Additional risks and uncertainties not presently known to us or that we currently deem to be immaterial may also impair our business and operations.

|

|

|

|

|

|

Nasdaq Symbol:

|

|

“KTRA”

|

3

RISK FACTORS

An investment in our Common Stock involves significant risks. You should carefully consider the risk factors contained in any prospectus supplement and in our filings with the SEC, including our Annual Report on Form 10-K for the fiscal year ended June 30, 2020 as well as all of the information contained in this prospectus, any prospectus supplement and the documents incorporated by reference herein or therein, before you decide to invest in our Common Stock. Our business, prospects, financial condition and results of operations may be materially and adversely affected as a result of any of such risks. The value of our Common Stock could decline as a result of any of these risks. You could lose all or part of your investment in our Common Stock. Some of our statements in sections entitled “Risk Factors” are forward-looking statements. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business, prospects, financial condition and results of operations.

The Series C Preferred Stock will have rights, preferences and privileges that will not be held by, and will be preferential to, the rights of holders of our Common Stock, which could adversely affect the liquidity and financial condition of the Company, and may result in the interests of the holders of Series C Preferred Stock differing from those of the holders of our Common Stock.

The Series C Preferred Stock will rank on parity with the shares of the Company’s Series A Preferred Stock and Series B Preferred Stock with respect to liquidation preferences. Upon any dissolution, liquidation or winding up, whether voluntary or involuntary, holders of Series C Preferred Stock will be entitled to receive distributions out of the Company’s assets in an amount per share equal to $1,000 plus all accrued and unpaid dividends, whether capital or surplus before any distributions shall be made on any shares of Common Stock.

In addition, holders of Series C Preferred Stock will be entitled to dividends, payable in shares of Common Stock, at a rate of 10%, 15%, 20% and 25% of the number of shares of Common Stock payable upon conversion of the Series C Preferred Stock, on the 12th, 24th, 36th and 48th month, anniversary of the initial closing of the Private Placement. Dividends will be payable in shares of Common Stock and will only be payable to those holders that continue to hold Series C Preferred Stock on the respective anniversary dates of the initial closing of the Private Placement, which occurred on August 19, 2020.

These dividend obligations to the holders of Series C Preferred Stock could limit the Company’s ability to obtain additional financing, which could have an adverse effect on its financial condition. The preferential rights described above could also result in divergent interests between the holders of shares of Series C Preferred Stock and the holders of our Common Stock.

Any issuance of our Common Stock upon conversion of the Series C Preferred Stock will cause dilution to the Company’s then existing stockholders and may depress the market price of our Common Stock.

The Series C Preferred Stock accrues dividends in shares of Common Stock at an initial minimum rate of 10% per annum and following the forty eight month anniversary of the initial closing of the Private Placement, such dividend rate could increase to as high as 25% per annum. Each class of Series C Preferred Stock has a Conversion Price that is equal to the lesser of (i) the closing price of the Company’s Common Stock on Nasdaq on the date immediately preceding the signing of the applicable binding agreements for the applicable closing date of the Private Placement for which the Series C Preferred Stock is issued or (ii) the average closing price of the Company’s Common Stock on Nasdaq for the five trading days immediately preceding the signing of the applicable binding agreements for the applicable closing date of the Private Placement for which the Series C Preferred Stock is issued, subject to adjustment. The Conversion Prices for the Series C-1 Preferred Stock, Series C-2 Preferred Stock and Series C-3 Preferred Stock are $1.16, $1.214 and $1.15, respectively.

The issuance of Common Stock upon conversion of the Series C Preferred Stock and as payment of dividends on the Series C Preferred Stock will result in immediate and substantial dilution to the interests of holders of our Common Stock, and such dilution will increase over time in connection with the accrual of dividends on the Series C Preferred Stock.

4

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any prospectus supplement and the documents we incorporate by reference contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws, regarding our business, clinical trials, financial condition, expenditures, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “planned expenditures,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this prospectus, any prospectus supplement and the documents we incorporate by reference. Additionally, statements concerning future matters are forward-looking statements.

These forward-looking statements are neither promises nor guarantees of future performance due to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those indicated by these forward-looking statements, including, without limitation, risks relating to:

|

|

•

|

our ability to raise funds for general corporate purposes and operations, including our research activities and clinical studies;

|

|

|

•

|

the impact of the recent outbreak of COVID-19 on our business and operations or on the economy generally;

|

|

|

•

|

our ability to recruit qualified management and technical personnel;

|

|

|

•

|

the cost, timing, scope and results of our clinical studies;

|

|

|

•

|

our ability to expand our international business;

|

|

|

•

|

our ability to obtain and maintain required regulatory approvals for our products;

|

|

|

•

|

our expectations regarding the use of our existing cash;

|

|

|

•

|

our ability to realize the anticipated benefits from the acquisition of Adgero Biopharmaceuticals Holdings, Inc.;

|

|

|

•

|

our ability to obtain or maintain patents or other appropriate protection for the intellectual property utilized in our current and planned products;

|

|

|

•

|

our ability to develop and commercialize products without infringing the intellectual property rights of third parties; and

|

|

|

•

|

other risks more fully discussed in the “Risk Factors” section in this prospectus, the section of any accompanying prospectus supplement entitled “Risk Factors” and the risk factors and cautionary statements described in other documents that we file from time to time with the SEC, specifically under “Risk Factors” and elsewhere in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q.

|

You should refer to the “Risk Factors” section contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus, for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. Given these risks, uncertainties and other factors, many of which are beyond our control, we cannot assure you that the forward-looking statements in this prospectus and any prospectus supplement will prove to be accurate, and you should not place undue reliance on these forward-looking statements. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all.

Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to revise any forward-looking statements to reflect events or developments occurring after the date of this prospectus, even if new information becomes available in the future.

5

USE OF PROCEEDS

We will not receive any proceeds from the sale of the 34,990,252 shares of Common Stock subject to resale by the selling stockholders under this prospectus. We will incur all costs associated with the preparation and filing of the registration statement of which this prospectus is a part. Brokerage fees, commissions and similar expenses, if any, attributable to the sale of shares offered hereby will be borne by the applicable selling stockholders.

6

SELLING STOCKHOLDERS

The shares of Common Stock being offered by the selling stockholders listed below (or their successors and assigns) were issued, or may be issued, as the case may be, upon conversion of, or payable as dividends on, the Series C Preferred Stock sold in the Private Placement. In connection with the Private Placement, we have agreed to file this registration statement covering the resale of the shares of Common Stock.

Between August 19, 2020 to August 31, 2020, we entered into subscription agreements with accredited investors relating to an offering and the sale of an aggregate of (i) 19,587 shares of Series C-1 Preferred Stock, with a conversion price of $1.16 per share, convertible into 16,885,345 shares of Common Stock, (ii) 2,185 shares of Series C-2 Preferred Stock, with a conversion price of $1.214 per share, convertible into 1,799,835 shares of Common Stock and (iii) 3,256 shares of Series C-3 Preferred Stock, with a conversion price of $1.15 per share, convertible into 2,831,304 shares of Common Stock.

The Series C Preferred Stock will be entitled to receive dividends, payable in shares of Common Stock at a rate of 10%, 15%, 20% and 25% of the number of shares of Common Stock issuable upon conversion of the Series C Preferred Stock, on the 12th, 24th, 36th and 48th month anniversary, respectively, of the initial closing of the Private Placement, which occurred on August 19, 2020. Dividends will be payable in shares of Common Stock and will only be payable to those holders who continue to hold the Series C Preferred Stock on the respective anniversary dates of the initial closing of the Private Placement. The Series C Preferred Stock, assuming that each holder continues to hold the Series C Preferred Stock until the 48th month anniversary of the initial closing of the Private Placement, accrues dividends in an amount of (i) up to 11,819,741 shares of Common Stock payable as dividends on the Series C-1 Preferred Stock, (ii) up to 1,259,885 shares of Common Stock payable as dividends on the Series C-2 Preferred Stock and (iii) up to 1,981,913 shares of Common Stock payable as dividends on the Series C-3 Preferred Stock.

The Series C Preferred Stock contains limitations that prevent the holder of any Series C Preferred Stock from acquiring shares upon conversion of the Series C Preferred Stock that would result in the number of shares beneficially owned by it and its affiliates exceeding 9.99% of the total number of shares of our Common Stock then issued and outstanding. The number of shares in the third column reflects this limitation. The selling stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

Within the past three years, other than the relationships described herein, none of the selling stockholders has held a position as an officer a director of ours, nor has any selling stockholder had any material relationship of any kind with us or any of our affiliates. All information with respect to share ownership has been furnished by the selling stockholders, unless otherwise noted.

Certain of the selling stockholders and intermediaries, who are identified as broker-dealers in the footnotes to the selling stockholder table, through whom such securities are sold are deemed “underwriters” within the meaning of the Securities Act, with respect to the securities offered hereby, and any profits realized or commissions received may be deemed underwriting compensation. We believe that all securities purchased by broker-dealers or affiliates of broker-dealers were purchased by such persons and entities in the ordinary course of business and at the time of purchase, such purchasers did not have any agreements or understandings, directly or indirectly, with any person to distribute such securities.

The term “selling stockholders” also includes any transferees, pledgees, donees, or other successors in interest to the selling stockholders named in the table below. Unless otherwise indicated, to our knowledge, each person named in the table below has sole voting and investment power (subject to applicable community property laws) with respect to the shares of Common Stock set forth opposite such person’s name. We will file a supplement to this prospectus (or a post-effective amendment hereto, if necessary) to name successors to any named selling stockholders who are able to use this prospectus to resell the Common Stock registered hereby.

7

The table below sets forth, as of October 20, 2020, the following information regarding the selling stockholders:

|

|

•

|

the number of shares of Common Stock beneficially owned by each selling stockholder prior to this offering, including shares of Common Stock assuming that each selling stockholder will hold the Series C Preferred Stock until the 48th month anniversary of the initial closing of the Private Placement;

|

|

|

•

|

the number of shares of Common Stock to be offered by each selling stockholder in this offering;

|

|

|

•

|

the number of shares of Common Stock to be beneficially owned by each selling stockholder assuming the sale of all of the Common Stock covered by this prospectus; and

|

|

|

•

|

the percentage of our issued and outstanding Common Stock to be owned by each selling stockholder assuming the sale of all of the shares of Common Stock covered by this prospectus based on the number of shares of Common Stock issued and outstanding as of October 20, 2020, and assuming that each selling stockholder will hold the Series C Preferred Stock until the 48th month anniversary of the initial closing of the Private Placement.

|

|

Name of Selling Stockholder

|

|

Shares

Beneficially

Owned

Before the

Offering (1)

|

|

|

Maximum

Number of

Shares to be

Offered in the

Offering

|

|

|

Shares Beneficially

Owned Immediately After Sale of

Maximum Number of Shares in

the Offering

|

|

|

|

|

|

|

|

|

|

|

|

|

# of Shares

(1)(2)

|

|

|

% of Class

(1)(2)

|

|

|

Gregg D. Rock D.P.M., P.C. Defined Benefit Plan (3)

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Artem Perchenok

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Preston E. Cloke

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Felicidad Coopersmith

|

|

|

21,986

|

|

|

|

21,986

|

|

|

-

|

|

|

-

|

|

|

GDR Associates GP (4)

|

|

|

219,831

|

|

|

|

219,831

|

|

|

-

|

|

|

-

|

|

|

Dale Myer

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

Jeffrey S. Coopersmith

|

|

|

29,314

|

|

|

|

29,314

|

|

|

-

|

|

|

-

|

|

|

Gregg D. Rock

|

|

|

512,934

|

|

|

|

512,934

|

|

|

-

|

|

|

-

|

|

|

Aimee E. Coopersmith 2010 Trust (5)

|

|

|

21,986

|

|

|

|

21,986

|

|

|

-

|

|

|

-

|

|

|

Lee Brandon

|

|

|

95,261

|

|

|

|

95,261

|

|

|

-

|

|

|

-

|

|

|

Ralph Hagedorn

|

|

|

108,290

|

|

|

|

108,290

|

|

|

-

|

|

|

-

|

|

|

Kin Shing Wong

|

|

|

71,652

|

|

|

|

71,652

|

|

|

-

|

|

|

-

|

|

|

Orkun Gumusayak

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Zemel Family Trust (6)

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

Robert Crames

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Northlea Partners, LLLP (7)

|

|

|

52,379

|

|

|

|

36,640

|

|

|

|

15,739

|

|

|

*

|

|

|

William Havlik & Deborah Havlik

|

|

|

43,969

|

|

|

|

43,969

|

|

|

-

|

|

|

-

|

|

|

Antonyk Ter-Gevondyan

|

|

|

58,623

|

|

|

|

58,623

|

|

|

-

|

|

|

-

|

|

|

Brian Summer

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Manny Family Revocable Trust (8)

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Dana Erik Lambert

|

|

|

50,646

|

|

|

|

50,646

|

|

|

-

|

|

|

-

|

|

|

Theodore J. Flocco

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Matthew Grodin

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Ronald D. Wenger Trust (9)

|

|

|

29,314

|

|

|

|

29,314

|

|

|

-

|

|

|

-

|

|

|

Cheryl Hintzen

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Emerald Shoals Ventures LLC (10)

|

|

|

3,498,115

|

|

|

|

2,931,036

|

|

|

|

567,079

|

|

|

|

4.9

|

%

|

|

Geoffrey Hoguet

|

|

|

366,382

|

|

|

|

366,382

|

|

|

-

|

|

|

-

|

|

|

Daniel S. Messina

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

Infinity Capital Ventures LLC (11)

|

|

|

190,519

|

|

|

|

190,519

|

|

|

-

|

|

|

-

|

|

|

Tim Turner & Vivian Turner

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

Mark Grindol

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Anthony Intenzo & Valerie Intenzo

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Thomas A. Masci Jr.

|

|

|

293,106

|

|

|

|

293,106

|

|

|

-

|

|

|

-

|

|

|

Charles Richard Scott

|

|

|

29,314

|

|

|

|

29,314

|

|

|

-

|

|

|

-

|

|

|

Sonny Lee

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Joseph A. Barberi

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Daniel P. Hafeman

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Donald P. Sesterhenn

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Patrick de Cavaignac

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

Jose M. Figueroa Robles

|

|

|

21,986

|

|

|

|

21,986

|

|

|

-

|

|

|

-

|

|

8

|

Name of Selling Stockholder

|

|

Shares

Beneficially

Owned

Before the

Offering (1)

|

|

|

Maximum

Number of

Shares to be

Offered in the

Offering

|

|

|

Shares Beneficially

Owned Immediately After Sale of

Maximum Number of Shares in

the Offering

|

|

|

|

|

|

|

|

|

|

|

|

|

# of Shares

(1)(2)

|

|

|

% of Class

(1)(2)

|

|

|

Philip M. Cannella

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Charles Klein & Helene Klein

|

|

|

219,831

|

|

|

|

219,831

|

|

|

-

|

|

|

-

|

|

|

Michael Delaney

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Imran Ullah Khan

|

|

|

21,986

|

|

|

|

21,986

|

|

|

-

|

|

|

-

|

|

|

Richard Ruscio

|

|

|

43,969

|

|

|

|

43,969

|

|

|

-

|

|

|

-

|

|

|

Moises Benzaquen

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Kurtis D. Hughes

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

Melville E. Ingalls

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

Stephen R. Shumpert

|

|

|

366,382

|

|

|

|

366,382

|

|

|

-

|

|

|

-

|

|

|

John C. Boyer & Marilyn L. Boyer (12)

|

|

|

124,246

|

|

|

|

109,917

|

|

|

|

14,329

|

|

|

*

|

|

|

Diana and David Freshwater Living Trust, dated January 20, 2004 (13)

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Michael Sokoloff

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

GYO Ventures LLC (14)

|

|

|

134,831

|

|

|

|

134,831

|

|

|

-

|

|

|

-

|

|

|

Burt Stangarone

|

|

|

58,623

|

|

|

|

58,623

|

|

|

-

|

|

|

-

|

|

|

David S. Nagelberg 2003 Revocable Trust (15)

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Yandle Family Revocable Trust September 5, 2001 (16)

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Mazen Hanna

|

|

|

293,106

|

|

|

|

293,106

|

|

|

-

|

|

|

-

|

|

|

Bradley C. Karp & Belinda Karp

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Omar Haroon

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Adolfo Carmona & Donna Carmona

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Rishi Krishan Sharma

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

Declaration of Trust of Bernard D. Paul, dated December 23, 1976, as amended (17)

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

Rafael Rayek & Sara Rayek

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Jaden T. Feldman Irrevocable Trust (18)

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Jasper M. Feldman Irrevocable Trust (19)

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Philip A. Romm MD PC (20)

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

College Trader Co. (21)

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Major American Marketing International Company (22)

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Isaac H. Isakow and Jennifer L. Isakow 2014 Revocable Living Trust (23)

|

|

|

219,831

|

|

|

|

219,831

|

|

|

-

|

|

|

-

|

|

|

Daren Hornig

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Andrew Fisher & Melissa Fisher

|

|

|

178,034

|

|

|

|

146,554

|

|

|

|

31,480

|

|

|

*

|

|

|

James A. Herzoff & Deborah M. Herzoff

|

|

|

58,623

|

|

|

|

58,623

|

|

|

-

|

|

|

-

|

|

|

John S. Solberger

|

|

|

21,986

|

|

|

|

21,986

|

|

|

-

|

|

|

-

|

|

|

The Blackfelner Family Trust (24)

|

|

|

122,669

|

|

|

|

43,969

|

|

|

|

78,700

|

|

|

*

|

|

|

Jason D. Klein

|

|

|

29,314

|

|

|

|

29,314

|

|

|

-

|

|

|

-

|

|

|

AJ Corso Jr.

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

The Duane and Andrea Blech Revocable Trust dated August 10, 2005 (25)

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Clifford Berger

|

|

|

293,106

|

|

|

|

293,106

|

|

|

-

|

|

|

-

|

|

|

William C. Stone (26)

|

|

|

149,337

|

|

|

|

73,278

|

|

|

|

76,059

|

|

|

*

|

|

|

EME Kikirov, Inc. (27)

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

First Riverside Investors, LP (28)

|

|

|

1,548,130

|

|

|

|

1,471,894

|

|

|

|

76,236

|

|

|

|

1.5

|

%

|

|

Scott Minuta

|

|

|

879,314

|

|

|

|

879,314

|

|

|

-

|

|

|

-

|

|

|

Wincorp Universal Limited (29)

|

|

|

102,588

|

|

|

|

102,588

|

|

|

-

|

|

|

-

|

|

|

The Roger C. Clarke Revocable Trust dated April 28, 2009 (30)

|

|

|

29,314

|

|

|

|

29,314

|

|

|

-

|

|

|

-

|

|

|

Lamb Superannuation Fund (31)

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Stone Tower Investments LLC (32)

|

|

|

109,917

|

|

|

|

109,917

|

|

|

-

|

|

|

-

|

|

|

John Alexander Palesty

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

John V. Boulger

|

|

|

178,034

|

|

|

|

146,554

|

|

|

|

31,480

|

|

|

*

|

|

|

Barbara S. Feingold Irrevocable Trust – 2015 (33)

|

|

|

732,761

|

|

|

|

732,761

|

|

|

-

|

|

|

-

|

|

|

The Samantha M. Feingold 2014 Irrevocable Trust B (34)

|

|

|

732,761

|

|

|

|

732,761

|

|

|

-

|

|

|

-

|

|

|

Glen S. Feingold Irrevocable Trust – 2015 (35)

|

|

|

732,761

|

|

|

|

732,761

|

|

|

-

|

|

|

-

|

|

|

Eric I. Feingold Irrevocable Trust – 2015 (36)

|

|

|

732,761

|

|

|

|

732,761

|

|

|

-

|

|

|

-

|

|

|

Ana Luisa Ponti Ferrari

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

9

|

Name of Selling Stockholder

|

|

Shares

Beneficially

Owned

Before the

Offering (1)

|

|

|

Maximum

Number of

Shares to be

Offered in the

Offering

|

|

|

Shares Beneficially

Owned Immediately After Sale of

Maximum Number of Shares in

the Offering

|

|

|

|

|

|

|

|

|

|

|

|

|

# of Shares

(1)(2)

|

|

|

% of Class

(1)(2)

|

|

|

SVKPTS Capital LLC (37)

|

|

|

183,191

|

|

|

|

183,191

|

|

|

-

|

|

|

-

|

|

|

Christopher Hayes

|

|

|

14,659

|

|

|

|

14,659

|

|

|

-

|

|

|

-

|

|

|

Goldie Holdings Inc. (38)

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

John Scott Bradley & Jenny Bradley

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

Rishi K. Patel

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Joel Yanowitz and Amy B. Metzenbaum, Trustees of the YanowitzMetzenbaum Family Trust - 2003, u/t/a dated July 22, 2003 (39)

|

|

|

43,969

|

|

|

|

43,969

|

|

|

-

|

|

|

-

|

|

|

Sakumzi Justice Macozoma

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Dennis F. Trainor

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

David Saferstein

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

Richard Patrick Mulkerrins

|

|

|

21,986

|

|

|

|

21,986

|

|

|

-

|

|

|

-

|

|

|

Richard Roth (40)

|

|

|

53,498

|

|

|

|

36,640

|

|

|

|

16,858

|

|

|

*

|

|

|

Douglas Scott Aaron

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

Amy J. Genovese

|

|

|

439,659

|

|

|

|

439,659

|

|

|

-

|

|

|

-

|

|

|

David Dent

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

JAPS CAPITAL LLC (41)

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Vista Capital Investments, LLC (42)

|

|

|

293,106

|

|

|

|

293,106

|

|

|

-

|

|

|

-

|

|

|

Hurricane Capital Management LLC (43)

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

Paul Herzoff

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

Inwoody LP (44)

|

|

|

278,452

|

|

|

|

278,452

|

|

|

-

|

|

|

-

|

|

|

C. James Prieur & Karen A. Prieur JTWROS

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Stephen Gao

|

|

|

354,991

|

|

|

|

354,991

|

|

|

-

|

|

|

-

|

|

|

Mark Wemett

|

|

|

147,512

|

|

|

|

147,512

|

|

|

-

|

|

|

-

|

|

|

Maurice Berkower

|

|

|

36,640

|

|

|

|

36,640

|

|

|

-

|

|

|

-

|

|

|

JEB Partners, L.P. (45)

|

|

|

732,761

|

|

|

|

732,761

|

|

|

-

|

|

|

-

|

|

|

Lester Petracca (46)

|

|

|

901,287

|

|

|

|

732,761

|

|

|

|

168,526

|

|

|

|

1.5

|

%

|

|

Reichenberg Superannuation Fund (47)

|

|

|

73,278

|

|

|

|

73,278

|

|

|

-

|

|

|

-

|

|

|

Christopher Reynolds

|

|

|

209,780

|

|

|

|

36,640

|

|

|

|

173,140

|

|

|

*

|

|

|

James Besser

|

|

|

146,554

|

|

|

|

146,554

|

|

|

-

|

|

|

-

|

|

|

Michael Pierce (48)

|

|

|

347,986

|

|

|

|

219,831

|

|

|

|

128,155

|

|

|

*

|

|

|

Blackwell Partners LLC - Series A (49)

|

|

|

1,093,278

|

|

|

|

1,093,278

|

|

|

-

|

|

|

-

|

|

|

Nantahala Capital Partners Limited Partnership (49)

|

|

|

467,500

|

|

|

|

467,500

|

|

|

-

|

|

|

-

|

|

|

Nantahala Capital Partners II Limited Partnership (49)

|

|

|

1,361,469

|

|

|

|

1,361,469

|

|

|

-

|

|

|

-

|

|

|

Nantahala Capital Partners SI LP (49)

|

|

|

3,486,469

|

|

|

|

3,486,469

|

|

|

-

|

|

|

-

|

|

|

NCP QR LP (49)

|

|

|

568,623

|

|

|

|

568,623

|

|

|

-

|

|

|

-

|

|

|

Silver Creek CS SAV, L.L.C. (49)

|

|

|

350,261

|

|

|

|

350,261

|

|

|

-

|

|

|

-

|

|

|

Jamey Gelardi

|

|

|

35,012

|

|

|

|

35,012

|

|

|

-

|

|

|

-

|

|

|

Sandra Shapiro TOD Andrew Shapiro & Deborah Shapiro

|

|

|

35,012

|

|

|

|

35,012

|

|

|

-

|

|

|

-

|

|

|

Harold S. Reisenfeld Trust 2/20/91 (50)

|

|

|

70,020

|

|

|

|

70,020

|

|

|

-

|

|

|

-

|

|

|

IRAR Trust FBO Bruce Inglis IRA 35-39056 (51)

|

|

|

21,007

|

|

|

|

21,007

|

|

|

-

|

|

|

-

|

|

|

Dennis Moylan

|

|

|

219,797

|

|

|

|

219,797

|

|

|

-

|

|

|

-

|

|

|

Ordian Limited (52)

|

|

|

35,012

|

|

|

|

35,012

|

|

|

-

|

|

|

-

|

|

|

Bryan Musk

|

|

|

35,012

|

|

|

|

35,012

|

|

|

-

|

|

|

-

|

|

|

Radha Freese (53)

|

|

|

92,230

|

|

|

|

88,223

|

|

|

|

4,007

|

|

|

*

|

|

|

Elvis Rizvic

|

|

|

35,012

|

|

|

|

35,012

|

|

|

-

|

|

|

-

|

|

|

Richard Lennon

|

|

|

35,012

|

|

|

|

35,012

|

|

|

-

|

|

|

-

|

|

|

Beacon Investments, LLC (54)

|

|

|

140,036

|

|

|

|

140,036

|

|

|

-

|

|

|

-

|

|

|

Blue Citi LLC (55)

|

|

|

210,051

|

|

|

|

210,051

|

|

|

-

|

|

|

-

|

|

|

Michael J. Cutler

|

|

|

35,012

|

|

|

|

35,012

|

|

|

-

|

|

|

-

|

|

|

Jon Vogler

|

|

|

16,806

|

|

|

|

16,806

|

|

|

-

|

|

|

-

|

|

|

Richard Kempski

|

|

|

36,747

|

|

|

|

21,007

|

|

|

|

15,740

|

|

|

*

|

|

|

R. Douglas Armstrong (56)

|

|

|

70,020

|

|

|

|

70,020

|

|

|

-

|

|

|

-

|

|

|

Jacqui Marucci

|

|

|

35,012

|

|

|

|

35,012

|

|

|

-

|

|

|

-

|

|

|

Jason M. Halpern

|

|

|

70,020

|

|

|

|

70,020

|

|

|

-

|

|

|

-

|

|

|

Frederick B. Polak (57)

|

|

|

52,987

|

|

|

|

35,012

|

|

|

|

17,975

|

|

|

*

|

|

|

Margrit Polak

|

|

|

50,752

|

|

|

|

35,012

|

|

|

|

15,740

|

|

|

*

|

|

|

Robin Model-Lornitzo

|

|

|

35,012

|

|

|

|

35,012

|

|

|

-

|

|

|

-

|

|

10

|

Name of Selling Stockholder

|

|

Shares

Beneficially

Owned

Before the

Offering (1)

|

|

|

Maximum

Number of

Shares to be

Offered in the

Offering

|

|

|

Shares Beneficially

Owned Immediately After Sale of

Maximum Number of Shares in

the Offering

|

|

|

|

|

|

|

|

|

|

|

|

|

# of Shares

(1)(2)

|

|

|

% of Class

(1)(2)

|

|

|

James G. Kelley Revocable Trust (58)

|

|

|

101,500

|

|

|

|

70,020

|

|

|

|

31,480

|

|

|

*

|

|

|

Alpha Capital Anstalt (59)

|

|

|

1,190,282

|

|

|

|

1,190,282

|

|

|

-

|

|

|

-

|

|

|

Michael Berlinger

|

|

|

35,012

|

|

|

|

35,012

|

|

|

-

|

|

|

-

|

|

|

David Swerdloff

|

|

|

28,009

|

|

|

|

28,009

|

|

|

-

|

|

|

-

|

|

|

Emerald Shoals Targeted Opportunities Fund, LP (60)

|

|

|

221,741

|

|

|

|

221,741

|

|

|

-

|

|

|

-

|

|

|

Clayton A. Struve (61)

|

|

|

364,092

|

|

|

|

332,612

|

|

|

|

31,480

|

|

|

*

|

|

|

Debra Reuben Trust (62)

|

|

|

205,703

|

|

|

|

147,829

|

|

|

|

57,874

|

|

|

*

|

|

|

Ira Kalfus

|

|

|

59,133

|

|

|

|

59,133

|

|

|

-

|

|

|

-

|

|

|

Jeffrey Funk

|

|

|

105,395

|

|

|

|

73,915

|

|

|

|

31,480

|

|

|

*

|

|

|

Christy Ericson

|

|

|

147,829

|

|

|

|

147,829

|

|

|

-

|

|

|

-

|

|

|

Barry Fries

|

|

|

184,785

|

|

|

|

184,785

|

|

|

-

|

|

|

-

|

|

|

David James Southwood

|

|

|

147,829

|

|

|

|

147,829

|

|

|

-

|

|

|

-

|

|

|

Tim T. Issac

|

|

|

73,915

|

|

|

|

73,915

|

|

|

-

|

|

|

-

|

|

|

Dennis Keating

|

|

|

36,958

|

|

|

|

36,958

|

|

|

-

|

|

|

-

|

|

|

Mark Edwards

|

|

|

29,568

|

|

|

|

29,568

|

|

|

-

|

|

|

-

|

|

|

Ronald Gress, Jr.

|

|

|

81,308

|

|

|

|

81,308

|

|

|

-

|

|

|

-

|

|

|

Robert R. Gonzalez

|

|

|

73,915

|

|

|

|

73,915

|

|

|

-

|

|

|

-

|

|

|

James S. Kiening

|

|

|

36,958

|

|

|

|

36,958

|

|

|

-

|

|

|

-

|

|

|

Kenneth Embley

|

|

|

147,829

|

|

|

|

147,829

|

|

|

-

|

|

|

-

|

|

|

Thomas Greenwell & Tracy Greenwell

|

|

|

59,133

|

|

|

|

59,133

|

|

|

-

|

|

|

-

|

|

|

Mark F. Bailey (63)

|

|

|

369,568

|

|

|

|

369,568

|

|

|

-

|

|

|

-

|

|

|

Nicholas Lordi

|

|

|

73,915

|

|

|

|

73,915

|

|

|

-

|

|

|

-

|

|

|

David DiQuollo

|

|

|

73,915

|

|

|

|

73,915

|

|

|

-

|

|

|

-

|

|

|

Robert M. Herbst

|

|

|

273,749

|

|

|

|

147,829

|

|

|

|

125,920

|

|

|

*

|

|

|

John Pinion

|

|

|

147,829

|

|

|

|

147,829

|

|

|

-

|

|

|

-

|

|

|

Robert Hayes

|

|

|

147,829

|

|

|

|

147,829

|

|

|

-

|

|

|

-

|

|

|

Eugene A. Bauer

|

|

|

52,698

|

|

|

|

36,958

|

|

|

|

15,740

|

|

|

*

|

|

|

George R. Murphy

|

|

|

73,915

|

|

|

|

73,915

|

|

|

-

|

|

|

-

|

|

|

Todd Zahnow

|

|

|

52,698

|

|

|

|

36,958

|

|

|

|

15,740

|

|

|

*

|

|

|

Martyn Oliver

|

|

|

88,698

|

|

|

|

88,698

|

|

|

-

|

|

|

-

|

|

|

Nikhil Rajwade

|

|

|

36,958

|

|

|

|

36,958

|

|

|

-

|

|

|

-

|

|

|

Arnie Ross

|

|

|

91,846

|

|

|

|

88,698

|

|

|

|

3,148

|

|

|

*

|

|

|

Darren Brock

|

|

|

59,133

|

|

|

|

59,133

|

|

|

-

|

|

|

-

|

|

|

Marcos Pagani (64)

|

|

|

147,829

|

|

|

|

147,829

|

|

|

-

|

|

|

-

|

|

|

Michael Rapoport

|

|

|

73,915

|

|

|

|

73,915

|

|

|

-

|

|

|

-

|

|

|

Kenneth Larsen

|

|

|

36,958

|

|

|

|

36,958

|

|

|

-

|

|

|

-

|

|

|

(1)

|

Beneficial ownership is determined in accordance with SEC rules and generally includes voting or investment power with respect to securities. Shares of Common Stock subject to stock options or warrants currently exercisable, or exercisable within 60 days of October 20, 2020, and shares of Common Stock payable as dividends on our Series B Preferred Stock within 60 days of October 20, 2020, are counted as outstanding for computing the percentage of the selling stockholder holding such options, warrants or Series B Preferred Stock but are not counted as outstanding for computing the percentage of any other selling stockholder. Notwithstanding the foregoing, certain selling stockholders may not have voting or investment power over such shares, and therefore may not beneficially own such shares, due to their inability to exercise warrants or convert shares of preferred stock as a result of certain contractual beneficial ownership limitations contained therein.

|

|

(2)

|