Kaival Brands Innovations Group, Inc. (NASDAQ:

KAVL) (“Kaival Brands,” the “Company” or “we,” “our” or

similar terms), the exclusive distributor of all products

manufactured by Bidi Vapor, LLC ("Bidi Vapor"), including the BIDI®

Stick electronic nicotine delivery system (ENDS), which are

intended for adults 21 and over, today announced its financial

results for the fiscal 2023 first quarter ended January 31, 2023.

Recent Business During and Subsequent to

the Fiscal First Quarter 2023

- On March 9, 2023, the Company

announced it had signed an agreement with a prominent national

broker, increasing distribution by upwards of 40,000 retail

stores.

- On March 7, 2023, the Company

announced it entered into new retail distribution agreements

representing potential new distribution to approximately 13,500

locations, with an immediate activation in 700 locations, with

1,500 more within 90 days.

- On December 7, 2022, Kaival

Marketing Services (“KMS”), the third-party vendor responsible for

executing Kaival Brands’ marketing and sales strategies, hired Dean

Simmons, a former Vice President of Sales of Swisher International,

in preparation for an expected resurgence of revenue growth

following a pivotal legal victory for Bidi Vapor on August 23,

2022.

- On November 15, 2022, the Company

announced it had reached a three-year extension agreement with

QuikfillRx, LLC, the third-party vendor responsible for executing

Kaival Brands’ marketing and sales strategies. The three-year

extension with KMS was executed in preparation to support the

anticipated improved sales volumes arising from this decision and

the increase of BIDI® Stick sales and marketing activities.

Eric Mosser, President and Chief Operating

Officer of Kaival Brands, stated, “With our two recent distribution

announcements, totaling up to 53,500 doors, we are looking forward

to expanding our national footprint. Despite a slight decrease in

revenues versus the comparable quarter last year and our fiscal

fourth quarter, primarily due to an unusually large amounts of

credits, discounts, and rebates to customers, which we do not

expect to continue, we are continuing to focus on broadening

distribution channels and driving revenue, all with the goal of

materially expanding our business and increasing shareholder

value.”

Financial Results for Fiscal First

Quarter 2023

Revenues: Revenues for the

first quarter of fiscal year 2023 were approximately $2.5 million,

compared to approximately $2.8 million in the same period of the

prior fiscal year. Revenues decreased in the first quarter of 2023,

primarily due to credits/discounts/rebates issued to customers. We

do not anticipate this trend to continue as renewed distribution

ramps up and sales of non-tobacco flavored BIDI® Sticks increase,

and even more so now that FDA’s previous Marketing Denial Order (or

MDO) issued to the non-tobacco flavored BIDI® Sticks was vacated in

August 2022, which allows us to continue marketing and selling

BIDI® Sticks, subject to the FDA’s enforcement discretion.

Cost of Revenue, Net, and Gross Profit

(Loss): Gross profit in the first quarter of fiscal year

2023 was approximately $0.5 million, or approximately 21.4% of

revenues, net, compared to approximately a ($0.7) million gross

loss or approximately (24.3%), of revenues, net, for the first

quarter of fiscal year 2022. Total cost of revenue, net was

approximately $2.0 million, or approximately 78.6% of revenue, net

for the first quarter of fiscal year 2023, compared to

approximately $3.5 million, or approximately 124.3% of revenue, net

for the first quarter of fiscal year 2022. The increase in gross

profit is primarily driven by the improvement in overall unit

pricing, being offset by the credits/discounts/rebates issued to

customers, totaling approximately $0.7 million, during the first

quarter of fiscal year 2023.

Operating Expenses: Total

operating expenses were approximately $3.5 million for the first

quarter of fiscal year 2023, compared to approximately $2.1 million

for the first quarter of fiscal year 2022. For the first quarter of

fiscal year 2023, operating expenses consisted primarily of

advertising and promotion fees of approximately $0.6 million,

non-cash stock option expense of approximately $1.4 million,

professional fees of approximately $0.6 million, and all other

general and administrative expenses of approximately $0.9 million.

General and administrative expenses in the first quarter of fiscal

year 2023 consisted primarily of salaries and wages, stock option

expense, insurance, lease expense, project expenses, banking fees,

business fees and state and franchise taxes. For the first quarter

of fiscal year 2022, operating expenses were approximately $2.1

million, consisting primarily of advertising and promotion fees of

approximately $0.6 million, stock option expense of approximately

$0.3 million, professional fees totaling approximately $0.5

million, and all other general and administrative expenses of

approximately $0.7 million. General and administrative expenses

consisted primarily of salaries and wages, insurance, banking fees,

business fees, and other service fees. We expect future operating

expenses to increase while we increase the footprint of our

business and seek to generate increased sales growth.

Net Loss: As a result of the

items noted above, the net loss for the first quarter of fiscal

year 2023 was approximately $3.0 million, or $0.05 basic and

diluted net loss per share, compared to a net loss of approximately

$2.8 million, or $0.09 basic and diluted net loss per share, for

the first quarter of fiscal year 2022. The increase in the net loss

for the first quarter of fiscal year 2023, as compared to the first

quarter of fiscal year 2022, is primarily attributable to the

decrease revenues and increase in customer

credits/discounts/rebates, as noted above.

Cash Position: As of January

31, 2023, we had working capital of approximately $6.6 million and

total cash of approximately $3.8 million.

Additional information regarding the Company’s

results of operations for the first quarter ended January 31, 2023

will be available in the Company’s Quarterly Report on Form 10-Q

for such reporting period, which report will be filed with the

Securities and Exchange Commission.

ABOUT KAIVAL BRANDS

Based in Grant-Valkaria, Florida, Kaival Brands

is a company focused on incubating innovative and profitable

products into mature and dominant brands, with a current focus on

the distribution of electronic nicotine delivery systems (ENDS)

also known as “e-cigarettes”. Our business plan is to seek to

diversify into distributing other nicotine and non-nicotine

delivery system products (including those related to hemp-derived

cannabidiol (known as CBD) products. Kaival Brands and Philip

Morris Products S.A. (via sublicense from Kaival Brands) are the

exclusive global distributors of all products manufactured by Bidi

Vapor.

Learn more about Kaival Brands at

https://ir.kaivalbrands.com/overview/default.aspx.

ABOUT BIDI VAPOR

Based in Melbourne, Florida, Bidi Vapor

maintains a commitment to responsible, adult-focused marketing,

supporting age-verification standards and sustainability through

its BIDI® Cares recycling program. Bidi Vapor's premier device, the

BIDI® Stick, is a premium product made with high-quality

components, a UL-certified battery and technology designed to

deliver a consistent vaping experience for adult smokers 21 and

over. Bidi Vapor is also adamant about strict compliance with all

federal, state and local guidelines and regulations. At Bidi Vapor,

innovation is key to its mission, with the BIDI® Stick promoting

environmental sustainability, while providing a unique vaping

experience to adult smokers.

Nirajkumar Patel, the Company’s Chief Science

and Regulatory Officer and director, owns and controls Bidi Vapor.

As a result, Bidi Vapor is considered a related party of the

Company.

For more information, visit

www.bidivapor.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release and the statements of the

Company’s management and partners included herein and related to

the subject matter herein includes statements that constitute

“forward-looking statements” (as defined in Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended), which are statements

other than historical facts. You can identify forward-looking

statements by words such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,”

“position,” “should,” “strategy,” “target,” “will,” and similar

words. All forward-looking statements speak only as of the date of

this press release. Although we believe that the plans, intentions,

and expectations reflected in or suggested by the forward-looking

statements are reasonable, there is no assurance that these plans,

intentions, or expectations will be achieved. Therefore, actual

outcomes and results (including, without limitation, the results of

the Company’s sales and marketing efforts as described herein and

the impact of such efforts on the Company’s results of operations)

could materially and adversely differ from what is expressed,

implied, or forecasted in such statements. Our business may be

influenced by many factors that are difficult to predict, involve

uncertainties that may materially affect results, and are often

beyond our control. Factors that could cause or contribute to such

differences include, but are not limited to: (i) future actions by

the FDA in response to the 11th Circuit Court’s decision that could

impact our business and prospects, (ii) the outcome of FDA’s

scientific review of Bidi Vapor’s pending FDA Premarket Tobacco

Product Applications, (iii) the results of international marketing

and sales efforts by Philip Morris International, the Company’s

international distribution partner, (iv) how quickly domestic and

international markets adopt our products, (v) the scope of future

FDA enforcement of regulations in the ENDS industry, (vi) the FDA’s

approach to the regulation of synthetic nicotine and its impact on

our business, (vii) potential federal and state flavor bans and

other restrictions on ENDS products, (viii) the duration and scope

of the COVID-19 pandemic and impact on the demand for the products

we distribute, (ix) general economic uncertainty in key global

markets and a worsening of global economic conditions or low levels

of economic growth, (x) the effects of steps that we could take to

reduce operating costs, (xi) our inability to generate and sustain

profitable sales growth, including sales growth in U.S. and

international markets, (xii) circumstances or developments that may

make us unable to implement or realize anticipated benefits, or

that may increase the costs, of our current and planned business

initiatives, (xiii) significant changes in our relationships with

our distributors or sub-distributors and (xiv) other factors

detailed by us in our public filings with the Securities and

Exchange Commission, including the disclosures under the heading

“Risk Factors” in our Annual Report on Form 10-K for the fiscal

year ended October 31, 2022, filed with the Securities and Exchange

Commission on January 27, 2023 and accessible at www.sec.gov.

All forward-looking statements included in this press release are

expressly qualified in their entirety by such cautionary

statements. Except as required under the federal securities laws

and the Securities and Exchange Commission’s rules and regulations,

we do not have any intention or obligation to update any

forward-looking statements publicly, whether as a result of new

information, future events, or otherwise.

Investor Relations:Stephen Sheriff, Director of

Communications and

AdministrationIr.kaivalbrands.cominvestors@kaivalbrands.com

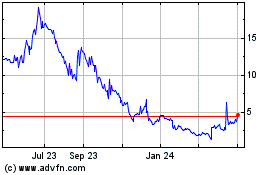

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

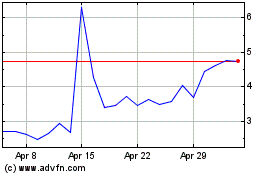

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Apr 2023 to Apr 2024