Current Report Filing (8-k)

November 15 2022 - 8:19AM

Edgar (US Regulatory)

0001762239

false

0001762239

2022-11-15

2022-11-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 15, 2022 (November 9, 2022)

Kaival Brands Innovations Group, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

000-56016 |

83-3492907 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

4460 Old Dixie Highway

Grant, Florida 32949

(Address of principal executive office, including

zip code)

Telephone: (833) 452-4825

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

KAVL |

The Nasdaq Stock Market, LLC |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On

November 9, 2022, Kaival Brands Innovations Group, Inc., a Delaware corporation (the “Company”), entered into

a Fourth Amendment to Service Agreement (the “Amendment”) with QuikfillRx, LLC (“QuikfillRx”), the third

party vendor responsible for executing the Company’s marketing and sales strategies. The Amendment amends that certain Service

Agreement, dated March 31, 2020, between the Company and QuikfillRx (as previously amended, the “Service Agreement”).

The Amendment provides for the following material changes to the Service Agreement:

1. The term of the Service

Agreement is extended for a three-year period ending October 31, 2025, subject to automatic one-year extensions, unless the Service

Agreement is terminated earlier pursuant to its terms.

2. QuikfillRx will adopt

“Kaival Marketing Services” as its “doing business as” name to more properly reflect the commitment of

QuikfillRx to the Company’s business.

3. QuikfillRx will be

entitled to a monthly cash fee of $125,000 (prior to the Amendment, the monthly cash fee was $150,000).

4. QuikfillRx was granted

a one-time, fully vested, ten-year non-qualified option award to purchase up to 250,000 shares of Company common stock with an

exercise price of $0.9869 per share (the closing price of the Company’s common stock on November 9, 2022) (the “Exercise

Price”). Such option grant was memorialized pursuant to a Nonqualified Option Agreement, dated November 9, 2022, between

the Company and QuikfillRx (the “Nonqualified Option Agreement”).

5. QuikfillRx was granted

a ten-year non-qualified option award to purchase up to 3,000,000 shares of Company common stock with an exercise price equal to

the Exercise Price, The options granted pursuant to this award are subject to annual vesting based on total net revenues and profit

margins (which metrics are subject to adjustment in certain cases involving the Company’s products) achieved by the Company

from QuickfillRx’s efforts over the term of the Service Agreement (as amended), with a maximum vesting to occur upon achievement

of $180,000,000 in total net revenues reported within the three-year term. Such option grant was memorialized pursuant to a Performance-Based

Nonqualified Option Agreement, dated November 9, 2022, between the Company and QuikfillRx (the “Performance-Based Option

Agreement”). The options granted pursuant to the Performance-Based Option Agreement will fully vest upon a change of control

event involving the Company (as described in the Performance-Based Option Agreement).

The options issued to QuickfillRx

pursuant to the Nonqualified Option Agreement and the Performance-Based Option Agreement were issued under and subject to the terms

of the Company’s Amended and Restated 2020 Stock and Incentive Compensation Plan.

The Amendment, the Nonqualified

Option Agreement and the Performance-Based Option Agreement are filed as Exhibits 10.1, 10.2 and 10.3, respectively, to this Current

Report on Form 8-K and are incorporated by reference herein.

On November 15, 2022, the

Company issued a press release regarding the execution of the Amendment. Such press release is filed as Exhibit 99.1 hereto and

incorporated by reference.

| Exhibit No. |

Description |

| 10.1+ |

Fourth Amendment to Service Agreement, dated November 9, 2022 between the Company and QuikfillRx |

| 10.2 |

Nonqualified Stock Option Grant Agreement, dated November 9, 2022, between the Company and QuikfillRx |

| 10.3 |

Performance-Based Option Agreement, dated November 9, 2022, between the Company and QuikfillRx |

| 99.1 |

Press release of the Company, dated November 15, 2022, announcing the Amendment |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

+ Certain

portions of this exhibit (indicated by “[***]”) have been omitted pursuant to Regulation S-K, Item 601(b)(10).as

the Company has determined they are both not material and are of the type that the Company treats as private or confidential.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| |

Kaival Brands Innovations Group, Inc. |

| |

|

|

| Dated: November 15, 2022 |

By: |

/s/ Eric Mosser |

| |

|

Eric Mosser |

| |

|

President and Chief Operating Officer |

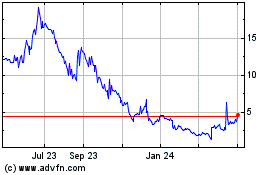

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

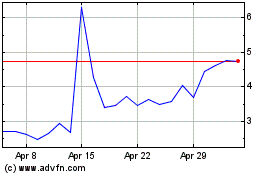

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Apr 2023 to Apr 2024