ETFs Focused on China Fall on Trade Concerns

May 06 2019 - 11:36AM

Dow Jones News

By Francesca Fontana

A number of exchange-traded funds with high exposure to China

fell sharply Monday after U.S. President Donald Trump suggested via

Twitter he could ramp up U.S. tariffs on $200 billion in Chinese

imports to 25% from the current 10%.

Among the ETFs trading lower were iShares China Large-Cap ETF

(FXI), Invesco Golden Dragon China ETF (PGJ), and First Trust

Chindia ETF (FNI).

The BlackRock-issued FXI tracks an index of the 50 largest and

most liquid Chinese stocks traded on the Hong Kong Stock Exchange,

according to ETF.com. Among its top ten holdings are Tencent

Holdings Ltd., China Construction Bank Corp., and Ping An Insurance

Company of China Ltd. FXI fell 2.9% to $43.62, according to

FactSet.

PGJ, issued by Invesco, tracks a market-cap-weighted index of

Chinese stocks and strictly holds U.S.-listed companies that derive

a majority of their revenues in China, according to ETF.com. Its

top ten holdings include Ctrip.com, NetEase Inc., and JD.com Inc.

PGJ fell 3.6% to $41.05.

FNI, issued by First Trust, tracks an index of stocks from China

and India screened by market cap and weighted in tiers, according

to ETF.com. Among its top ten holdings are JD.com Inc., Alibaba

Group Holding Ltd., and HDFC Bank Ltd. FNI fell 2.8% to $37.39.

Stock markets in the U.S., Europe and Asia slid after the

announcement, as investors became increasingly concerned about the

outcome of this week's scheduled trade talks. The Dow Jones

Industrial Average fell 0.8% to 26285, while the S&P 500 lost

0.9%. Ten of the 11 S&P 500 sectors dropped, led by declines in

materials and technology, which have heavy exposure to China.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

May 06, 2019 11:21 ET (15:21 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

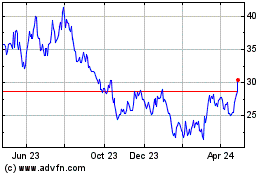

JD com (NASDAQ:JD)

Historical Stock Chart

From Mar 2024 to Apr 2024

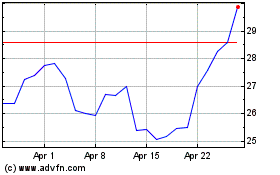

JD com (NASDAQ:JD)

Historical Stock Chart

From Apr 2023 to Apr 2024