Table of Contents

Filed pursuant to Rule 424(b)(3)

Registration No. 333-238635

Prospectus

InVivo Therapeutics Holdings Corp.

1,826,731 Shares of Common Stock

This prospectus relates to the resale by the selling stockholders identified in this prospectus of up to 1,826,731 shares of our common stock that

are issuable upon the exercise of certain outstanding warrants, or the warrants, to purchase shares of our common stock, or the warrant shares.

We

are not selling any shares of common stock and will not receive any proceeds from the sale of the warrant shares by the selling stockholders under this prospectus. Upon the exercise

of the warrants for all 1,826,731 shares of our common stock by payment of cash, however, we will receive aggregate gross proceeds of approximately $3.0 million.

We

have agreed to bear all of the expenses incurred in connection with the registration of these warrant shares. The selling stockholders will pay or assume brokerage commissions and

similar charges, if any, incurred for the sale of the warrant shares.

The

selling stockholders identified in this prospectus may offer the shares from time to time through public or private transactions at fixed prices, at prevailing market prices, at

varying prices determined at the time of sale, or at privately negotiated prices. We provide more information about how the selling stockholders may sell their shares of common stock in the section

titled "Plan of Distribution" beginning on page 19 of this prospectus. We will not be paying any underwriting discounts or commissions in connection with any offering of warrant shares under this

prospectus.

Our

common stock is listed on The Nasdaq Capital Market under the ticker symbol "NVIV." On June 3, 2020, the last reported sale price per share of our common stock was $1.53 per

share.

You

should read this prospectus, together with additional information described under the headings "Incorporation of Certain Information by Reference" and "Where You Can Find More

Information," carefully before you invest in any of our securities.

Investing in the offered securities involves a high degree of risk. See "Risk Factors" beginning on page 6 of this

prospectus and the section entitled "Risk Factors"

included in our most recent Annual Report on Form 10-K, as revised or supplemented by our

subsequent Quarterly Reports on Form 10-Q, which are incorporated herein by reference, for a discussion of information that you should consider before investing in our

securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these

securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated June 4, 2020

TABLE OF CONTENTS

i

Table of Contents

ABOUT THIS PROSPECTUS

The registration statement we filed with the Securities and Exchange Commission (the "SEC") includes exhibits that provide more detail of the

matters discussed in this prospectus. You should read this prospectus, the related exhibits filed with the SEC, and the documents incorporated by reference herein before making your investment

decision. You should rely only on the information provided in this prospectus and the documents incorporated by reference herein or any amendment thereto. In addition, this prospectus contains

summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their

entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of

which this prospectus is a part, and you may obtain copies of those documents as described below under the heading "Where You Can Find Additional Information."

The

selling stockholders may from time to time sell up to 1,826,731 shares of common stock, as described in this prospectus, in one or more offerings. This prospectus also covers any

shares of common stock that may become issuable as a result of stock splits, stock dividends or similar transactions. We have agreed to pay the expenses incurred in registering these shares, including

legal and accounting fees.

We

have not, and the selling stockholders have not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus, the

documents incorporated by reference herein or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no

assurance as to the reliability of, any other information that others may give you. The information contained in this prospectus, the documents incorporated by reference herein or in any applicable

free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of our securities. Our business, financial condition, results of operations and prospects may

have changed since that date.

The selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only under circumstances and in jurisdictions where it is

lawful to do so. The selling stockholders are not making an offer to sell these securities in any state or jurisdiction where the offer or sale is not permitted.

All

other trademarks, trade names and service marks appearing in this prospectus or the documents incorporated by reference herein are the property of their respective owners. Use or

display by us of other parties' trademarks, trade dress or products is not intended to and does not imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress

owner. Solely for convenience, trademarks, tradenames and service marks referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended

to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and trade names.

1

Table of Contents

PROSPECTUS SUMMARY

This summary provides an overview of selected information contained elsewhere or incorporated by reference in this

prospectus and does not contain all of the information you should consider before investing in our securities. You should carefully read the prospectus, the information incorporated by reference and

the registration statement of which this prospectus is a part in their entirety before investing in our securities, including the information discussed under "Risk Factors" in this prospectus and the

documents incorporated by reference and our financial statements and notes thereto that are incorporated by reference in this prospectus. Some of the statements in this prospectus and the documents

incorporated by reference herein constitute forward-looking statements that involve risks and uncertainties. See information set forth under the section "Special Note Regarding Forward-Looking

Statements." Except where the context otherwise requires, the terms "we," "us," "our," "InVivo" or "the Company" refer to the business of InVivo Therapeutics Holdings Corp., a Nevada corporation, and

its wholly-owned subsidiary.

Business Overview

Overview

We are a research and clinical-stage biomaterials and biotechnology company with a focus on treatment of spinal cord injuries, or SCIs. Our

mission is to redefine the life of the SCI patient, and we seek to develop treatment options intended to provide meaningful improvement in patient outcomes following SCI. Our approach to treating

acute SCIs is based on our investigational Neuro-Spinal ScaffoldTM implant, a bioresorbable polymer scaffold that is designed for implantation at the site of injury within a spinal cord

and is intended to treat acute SCI. The Neuro-Spinal Scaffold implant incorporates intellectual property licensed under an exclusive, worldwide license from Boston Children's Hospital, or BCH, and the

Massachusetts Institute of Technology, or MIT. We also plan to evaluate other technologies and therapeutics that may be complementary to our development of the Neuro-Spinal Scaffold implant or offer

the potential to bring us closer to our goal of redefining the life of the SCI patient.

The

current standard of care for acute management of spinal cord injuries focuses on preventing further injury to the spinal cord. However, the current standard of care does not address

repair of the spinal cord.

For

additional information regarding our business, see the section entitled "Business" included in our

Annual Report on Form 10-K for the fiscal year ended December 31,

2019, as well as the sections entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our financial statements and the related notes thereto

included in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2019 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, each of which is incorporated by reference into this prospectus.

Our Clinical Program

We currently have one clinical development program for the treatment of acute SCI.

Our

Neuro-Spinal Scaffold implant is an investigational bioresorbable polymer scaffold that is designed for implantation at the site of injury within a spinal cord. The Neuro-Spinal

Scaffold implant is intended to promote appositional, or side-by-side, healing by supporting the surrounding tissue after injury, minimizing expansion of areas of necrosis, and providing a biomaterial

substrate for the body's own healing/repair processes following injury. We believe this form of appositional healing may spare white matter, increase neural sprouting, and diminish post-traumatic cyst

formation.

2

Table of Contents

The

Neuro-Spinal Scaffold implant is composed of two biocompatible and bioresorbable polymers that are cast to form a highly porous

investigational product:

-

•

-

Poly lactic-co-glycolic acid, a polymer that is widely used in resorbable sutures and provides the biocompatible support for Neuro-Spinal Scaffold

implant; and

-

•

-

Poly-L-Lysine, a positively charged polymer commonly used to coat surfaces in order to promote cellular attachment.

Because

of the complexity of SCIs, it is likely that multi-modal therapies will be required to maximize positive outcomes in SCI patients. In the future, we may attempt to further

enhance the performance of our Neuro-Spinal Scaffold implant through multiple combination strategies involving electrostimulation devices, additional biomaterials, drugs approved by the

U.S. Food and Drug Administration, or FDA, or growth factors. We expect the Neuro-Spinal Scaffold implant to be regulated by the FDA as a Class III medical device.

INSPIRE 2.0 Study

Our Neuro-Spinal Scaffold implant has been approved to be studied under our approved Investigational Device Exemption, or IDE, in the INPSIRE

2.0 Study, which is titled the "Randomized, Controlled, Single-blind Study of Probable Benefit of the Neuro-Spinal Scaffold™ for Safety and Neurologic Recovery in Subjects with Complete

Thoracic AIS A Spinal Cord Injury as Compared to Standard of Care." The purpose of the INSPIRE 2.0 Study is to assess the overall safety and probable benefit of the Neuro-Spinal Scaffold for the

treatment of neurologically complete thoracic traumatic acute SCI. The INSPIRE 2.0 Study is designed to enroll 10 subjects into each of the two study arms, which we refer to as the Scaffold Arm and

the Comparator Arm. Patients in the Comparator Arm will receive the standard of care, which is spinal stabilization without dural opening or myelotomy. The INSPIRE 2.0 Study is a single blind study,

meaning that the patients and assessors are blinded to treatment assignments. The FDA approved the enrollment of up to 35 patients in this study so that there would be at least 20 evaluable patients

(10 in each study arm) at the primary endpoint analysis, accounting for events such as screen failures or deaths that would prevent a patient from reaching the primary endpoint visit. We estimate that

enrollment in the INSPIRE 2.0 Study will be complete in the fourth quarter of 2020, with the final patient enrolled in the INSPIRE 2.0 study reaching their six-month primary endpoint visit in the

second quarter of 2021.

The

primary endpoint is defined as the proportion of patients achieving an improvement of at least one AIS grade at six months post-implantation. Assessments of AIS grade are at hospital

discharge, three

months, six months, 12 months and 24 months. The definition of study success for INSPIRE 2.0 is that the difference in the proportion of subjects who demonstrate an improvement of at

least one grade on AIS assessment at the six-month primary endpoint follow-up visit between the Scaffold Arm and the Comparator Arm must be equal to or greater than 20%. In one example, if 50% of

subjects in the Scaffold Arm have an improvement of AIS grade at the six-month primary endpoint and 30% of subjects in the Comparator Arm have an improvement, then the difference in the proportion of

subjects who demonstrated an improvement is equal to 20% (50% minus 30% equals 20%) and the definition of study success would be met. In another example, if 40% of subjects in the Scaffold Arm have an

improvement of AIS grade at the six-month primary endpoint and 30% of subjects in the Comparator Arm have an improvement, then the difference in the proportion of subjects who demonstrated an

improvement is equal to 10% (40% minus 30% equals 10%) and the definition of study success would not be met. Additional endpoints include measurements of changes in NLI, sensory levels and motor

scores, bladder, bowel and sexual function, pain, Spinal Cord Independence Measure, and quality of life.

Although

The INSPIRE Study is structured with the an Objective Performance Criterion, or OPC, as the primary component for demonstrating probable benefit, the OPC is not the only

variable that

3

Table of Contents

the

FDA would evaluate when reviewing a future HDE application. Similarly, while our INSPIRE 2.0 Study is structured with a definition of study success requiring a minimum difference between study

arms in the proportion of subjects achieving improvement, that success definition is not the only factor that the FDA would evaluate in the future HDE application. Approval is not guaranteed if the

OPC is met for our prior clinical trial, The INSPIRE Study, or the definition of study success is met for the INSPIRE 2.0 Study, and even if the OPC or definition of study success are not met, the FDA

may approve a medical device if probable benefit is supported by a comprehensive review of all clinical endpoints and preclinical results, as demonstrated by the sponsor's body of evidence.

In

2016, the FDA accepted our proposed HDE modular shell submission and review process for the Neuro-Spinal Scaffold implant. The HDE

modular shell is comprised of three modules: a preclinical studies module, a manufacturing module, and a clinical data module. As part of its review process, the FDA reviews each module, which are

individual sections of the HDE submission, on a rolling basis. Following the submission of each module, the FDA reviews and provides feedback, typically within 90 days, allowing the applicant

to receive feedback and potentially resolve any deficiencies during the

review process. Upon receipt of all three modules, which constitutes the complete HDE submission, the FDA makes a filing decision that may trigger the review clock for an approval decision. We

submitted the first module in March 2017 and received feedback in June 2017. We submitted an updated first module in the fourth quarter of 2019. The HDE submission will not be complete until the

manufacturing and clinical modules are also submitted.

Corporate Information

We were incorporated on April 2, 2003, under the name of Design Source, Inc. On October 26, 2010, we acquired the business

of InVivo Therapeutics Corporation, which was founded in 2005, and we are continuing the existing business operations of InVivo Therapeutics Corporation as our wholly-owned subsidiary.

Our

principal executive offices are located in leased premises at One Kendall Square, Suite B14402, Cambridge, Massachusetts 02139. Our telephone number is (617) 863-5500.

We maintain a website at www.invivotherapeutics.com. Information contained on, or accessible through, our website is not a part of, and is not incorporated by reference into, this prospectus.

4

Table of Contents

THE OFFERING

|

|

|

|

|

Common Stock offered by the Selling Stockholders:

|

|

1,826,731 shares.

|

|

Use of proceeds

|

|

We will not receive any proceeds from the sale of common stock in this offering.

|

|

Nasdaq Capital Market symbol

|

|

Our common stock is listed on the Nasdaq Capital Market under the symbol "NVIV."

|

5

Table of Contents

RISK FACTORS

An investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you

should consider carefully the risks and uncertainties described below and in the section entitled "Risk Factors" included in our

most recent Annual Report on Form 10-K, as revised or supplemented by our subsequent

Quarterly Reports on Form 10-Q, which are incorporated herein by reference, and other filings we make with the Securities and Exchange Commission, or SEC, from time to time, which are

incorporated by reference herein in their entirety, together with the other information in this prospectus and the information incorporated by reference herein and in any free writing prospectus that

we may authorize for use in connection with this offering. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could suffer materially. In such

event, the trading price of our common stock could decline and you might lose all or part of your investment.

6

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain "forward-looking statements" within the meaning of Section 27A

of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements include statements

made regarding our commercialization strategy, future operations, cash requirements and liquidity, capital requirements, and other statements on our business plans and strategy, financial position,

and market trends. In some cases, you can identify forward-looking statements by terms such as "may," "might," "will," "should," "believe," "plan," "intend," "anticipate," "target," "estimate,"

"expect," and other similar expressions. These forward-looking statements are subject to risks and uncertainties that could cause actual results or events to differ materially from those expressed or

implied by the forward-looking statements, including factors such as our ability to raise substantial additional capital to finance our planned operations and to continue as a going concern; our

ability to execute our strategy and business plan; our ability to obtain regulatory approvals for our products, including the Neuro-Spinal Scaffold; our

ability to successfully commercialize our current and future product candidates, including the Neuro-Spinal Scaffold; the progress and timing of our

development programs; market acceptance of our products; our ability to retain management and other key personnel; our ability to promote, manufacture, and sell our products, either directly or

through collaborative and other arrangements with third parties; and other factors detailed under "Risk Factors" in this prospectus and in the section entitled "Risk Factors" included in our

most recent Annual Report on Form 10-K, as revised or supplemented by our subsequent

Quarterly Reports on Form 10-Q, which are incorporated herein by reference, and other filings we make with the SEC from time to time, which are incorporated herein by reference. These

forward-looking statements are only predictions, are uncertain, and involve substantial known and unknown risks, uncertainties, and other factors which may cause our actual results, levels of

activity, or performance to be materially different from any future results, levels of activity, or performance expressed or implied by these forward-looking statements. Such factors include, among

others, the following:

-

•

-

our limited operating history and history of net losses;

-

•

-

our ability to raise substantial additional capital to finance our planned operations and to continue as a going concern;

-

•

-

our ability to complete the INSPIRE 2.0 Study to support our existing Humanitarian Device Exemption application;

-

•

-

our ability to execute our strategy and business plan;

-

•

-

our ability to obtain regulatory approvals for our current and future product candidates, including our Neuro-Spinal

Scaffold implant;

-

•

-

our ability to successfully commercialize our current and future product candidates, including our Neuro-Spinal

Scaffold implant;

-

•

-

the impact of the COVID-19 pandemic on our business;

-

•

-

the progress and timing of our current and future development programs;

-

•

-

our ability to successfully open, enroll and complete clinical trials and obtain and maintain regulatory approval of our current and future

product candidates;

-

•

-

our ability to protect and maintain our intellectual property and licensing arrangements;

-

•

-

our reliance on third parties to conduct testing and clinical trials;

-

•

-

market acceptance and adoption of our current and future technology and products;

7

Table of Contents

-

•

-

our ability to promote, manufacture and sell our current and future products, either directly or through collaborative and other arrangements

with third parties; and

-

•

-

our ability to attract and retain key personnel.

We

cannot guarantee future results, levels of activity, or performance. You should not place undue reliance on these forward-looking statements, which speak only as of the respective

dates as of which they were made. You are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions that are referenced in the

section of this prospectus entitled "Risk Factors." You should also carefully review the risk factors and cautionary statements described in the other documents we file from time to time with the SEC,

specifically our most recent Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K. Except as required by applicable law, including the securities

laws of the United States, we

do not intend to update any of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances, or to reflect the occurrence of unanticipated

events.

8

Table of Contents

USE OF PROCEEDS

We are filing the registration statement of which this prospectus forms a part to permit the holders of certain outstanding warrants to

purchase shares of our common stock described in the section titled "Selling Stockholders" to resell such shares of common stock issuable upon exercise of such warrants, or the warrant shares.

The

selling stockholders will receive all of the net proceeds from sales of the warrant shares sold pursuant to this prospectus and we will not receive any proceeds from the resale of

any warrant shares offered by this prospectus by the selling stockholders. However, upon the exercise of the warrants for 1,826,731 shares of our common stock by payment of cash, we will receive

aggregate gross proceeds of approximately $3.0 million. Any proceeds from the exercise of the warrants will be used for working capital, business development activities, and general corporate

purposes. We cannot predict when or if the warrants will be exercised, and it is possible that the warrants may expire and never be exercised.

We,

and not the selling stockholders, will pay the costs, expenses and fees in connection with the registration and sale of the warrant shares covered by this prospectus, but the selling

stockholders will pay all discounts, commissions or brokers' fees or fees of similar securities industry professionals and transfer taxes, if any, attributable to sales of the warrant shares.

9

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of April 30, 2020 with respect to the beneficial ownership of our common stock

by:

-

•

-

each person or group of affiliated persons known by us to be the beneficial owner of more than 5% of our common stock;

-

•

-

each of our directors;

-

•

-

each of our named executive officers; and

-

•

-

all of our current executive officers and directors as a group.

Unless

otherwise indicated in the footnotes to the following table, each person named in the table has sole voting and investment power, and his or her address is c/o InVivo Therapeutics

Holdings Corp., One Kendall Square, Suite B14402, Cambridge, MA 02139. Shares of our common stock subject to options or warrants currently exercisable or exercisable within 60 days of

April 30, 2020 are deemed outstanding for computing the share ownership and percentage of the person holding such options and warrants, but are not deemed outstanding for computing the

percentage of any other person. The percentage ownership of our common stock of each person or entity named in the following table is based on 4,847,370 shares of our common stock outstanding as of

April 30, 2020.

|

|

|

|

|

|

|

|

|

|

Name of Beneficial Owner

|

|

Number of Shares

of Common Stock

Beneficially Owned

|

|

Percentage of

Common Stock

Beneficially

Owned

|

|

|

5% Stockholders

|

|

|

|

|

|

|

|

|

Entities affiliated with Sabby Volatility Warrant Master Fund, Ltd.(1)

|

|

|

1,394,429

|

|

|

22.3

|

%

|

|

Entities affiliated with Armistice Capital Master Fund, Ltd.(2)

|

|

|

1,458,061

|

|

|

24.1

|

%

|

|

CVI Investments, Inc.(3)

|

|

|

497,221

|

|

|

9.3

|

%

|

|

Intracoastal Capital, LLC(4)

|

|

|

305,715

|

|

|

5.9

|

%

|

|

Directors and Named Executive Officers

|

|

|

|

|

|

|

|

|

Richard Toselli, M.D.(5)

|

|

|

10,072

|

|

|

|

*

|

|

Richard Christopher(6)

|

|

|

9,856

|

|

|

|

*

|

|

C. Ann Merrifield(7)

|

|

|

7,360

|

|

|

|

*

|

|

Richard J. Roberts, Ph.D.(8)

|

|

|

443

|

|

|

|

*

|

|

Daniel R. Marshak, Ph.D.(9)

|

|

|

85

|

|

|

|

*

|

|

Christina Morrison(10)

|

|

|

68

|

|

|

|

*

|

|

Robert J. Rosenthal, Ph.D.(11)

|

|

|

—

|

|

|

—

|

|

|

All current directors and executive officers as a group (7 persons)(12)

|

|

|

27,884

|

|

|

|

*

|

-

*

-

Percentage

of shares beneficially owned does not exceed one percent.

-

(1)

-

Consists

of 1,394,429 shares of common stock underlying warrants that are exercisable as of April 30, 2020, which are held directly by Sabby Volatility

Warrant Master Fund, Ltd. ("SVWMF"). Certain of the warrants are subject to a beneficial ownership limitation of 4.99%, which does not permit SVWMF to exercise that portion of the warrants that

would result in SVWMF and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The amounts and percentages in the table do not

give effect to the beneficial ownership limitation. Hal Mintz is the manager of Sabby Management, LLC, which acts as the investment manager

10

Table of Contents

of

SVWMF. As a result, Mr. Mintz may be deemed to beneficially own the securities held by SVWMF. The address of each of SVWMF, Sabby Management LLC and Mr. Mintz is

c/o Sabby Management, LLC, 10 Mountainview Road, Suite 205, Upper Saddle River, New Jersey 07458.

-

(2)

-

Consists

of (a) 254,597 shares of common stock and (b) 1,203,464 shares of common stock underlying warrants that are exercisable as of April 30,

2020, which are held directly by Armistice Capital Master Fund Ltd. ("Armistice Fund"). Certain of the warrants are subject to a beneficial ownership limitation of 4.99%, which does not permit

Armistice Fund to exercise that portion of the warrants that would result in Armistice Fund and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial

ownership limitation. The amounts and percentages in the table do not give effect to the beneficial ownership limitation. Steven Boyd is the Managing Member of Armistice Capital, LLC, which

acts as the investment manager of Armistice Fund. As a result, Mr. Boyd may be deemed to beneficially own the securities held by Armistice Fund. The address of Armistice Fund is

c/o dms Corporate Services ltd., 20 Genesis Close, P.O. Box 314, Grand Cayman KY1-1104, Cayman Islands, and the address of each of Armistice Capital LLC and

Mr. Boyd is 510 Madison Avenue, 7th Floor, New York, NY 10022.

-

(3)

-

Consists

of 497,221 shares of common stock underlying warrants held by CVI Investments, Inc. ("CVI") that are exercisable as of April 30, 2020. Certain

of the warrants are subject to a beneficial ownership limitation of 4.99%, which does not permit CVI to exercise that portion of the warrants that would result in CVI and its affiliates owning, after

exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The amounts and percentages in the table do not give effect to the beneficial ownership limitation.

Heights Capital Management, Inc. ("Heights"), the authorized agent of CVI, has discretionary authority to vote and dispose of the shares held by CVI and may be deemed to be the beneficial owner

of these shares. Martin Kobinger, in his capacity as Investment Manager of Heights, may also be deemed to have investment discretion and voting power over the shares held by CVI. Mr. Kobinger

disclaims any such beneficial ownership of the shares. CVI's address is c/o Heights Capital Management, Inc., 101 California Street, Suite 3250, San Francisco,

CA 94111.

-

(4)

-

Consists

of 305,715 shares of common stock underlying warrants that are exercisable as of April 30, 2020, which are held directly by Intracoastal

Capital, LLC ("Intracoastal"). The warrants are subject to a beneficial ownership limitation of 9.99%, which does not permit Intracoastal to exercise that portion of the warrants that would

result in Intracoastal and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The amounts and percentages in the table do not

give effect to the beneficial ownership limitation. Mitchell P. Kopin and Daniel B. Asher, each of whom are managers of Intracoastal, have shared voting control and investment discretion over

the securities reported herein that are held by Intracoastal. As a result, each of Mr. Kopin and Mr. Asher may be deemed to beneficially own the securities held by Intracoastal. The

address of each of Mr. Kopin and Intracoastal is 245 Palm Trail, Delray Beach, Florida 33483. The address of Mr. Asher is 111 W. Jackson Boulevard,

Suite 2000, Chicago, Illinois 60604.

-

(5)

-

Consists

of (a) 3,769 shares of common stock owned by Dr. Toselli, (b) 317 shares of common stock underlying options held by Dr. Toselli

that are exercisable as of April 30, 2020 or will become exercisable within 60 days after such date, (c) 3,636 shares of common stock underlying warrants held by

Dr. Toselli that are exercisable as of April 30, 2020, (d) 50 shares of restricted stock units granted to Dr. Toselli that will vest within

11

Table of Contents

60 days

after April 30, 2020, and (e) 2,300 shares of restricted common stock granted to Dr. Toselli.

-

(6)

-

Consists

of (a) 3,636 shares of common stock owned by Mr. Christopher, (b) 1,000 shares of common stock underlying options held by

Mr. Christopher that are exercisable as of April 30, 2020 or will become exercisable within 60 days after such date, (c) 3,636 shares of common stock underlying warrants

held by Mr. Christopher that are exercisable as of April 30, 2020, and (d) 1,584 shares of restricted common stock granted to Mr. Christopher.

-

(7)

-

Consists

of (a) 3,639 shares of common stock owned by Ms. Merrifield, (b) 85 shares of common stock underlying options held by

Ms. Merrifield that are exercisable as of April 30, 2020 or will become exercisable within 60 days after such date, and (c) 3,636 shares of common stock underlying warrants

held by Ms. Merrifield that are exercisable as of April 30, 2020.

-

(8)

-

Consists

of (a) 290 shares of common stock owned by Dr. Roberts and (b) 153 shares of common stock underlying options held by Dr. Roberts

that are exercisable as of April 30, 2020 or will become exercisable within 60 days after such date.

-

(9)

-

Consists

solely of shares of common stock underlying options held by Dr. Marshak that are exercisable as of April 30, 2020 or will become exercisable

within 60 days after such date.

-

(10)

-

Consists

solely of shares of common stock underlying options held by Ms. Morrison that are exercisable as of April 30, 2020 or will become exercisable

within 60 days after such date.

-

(11)

-

Mr. Rosenthal

does not own any shares of common stock the Company.

-

(12)

-

Consists

of (a) 11,334 shares of common stock owned by all current executive officers and directors as a group (b) 1,708 shares of common stock

underlying options that are exercisable as of April 30, 2020 or will become exercisable within 60 days after such date, (c) 10,908 shares of common stock underlying warrants that

are exercisable as of April 30, 2020, (d) 50 shares of restricted stock units that will vest within 60 days after April 30, 2020, and (e) 3,884 shares of restricted

common stock.

12

Table of Contents

DESCRIPTION OF OUR CAPITAL STOCK

General

The following description of our capital stock is intended as a summary only and therefore is not a complete description of our capital stock.

This description is based upon, and is qualified by reference to, applicable provisions of the Nevada Revised Statutes (the "NRS"), our articles of incorporation, as amended, and our amended and

restated bylaws and, which are filed as exhibits to the registration statement of which this prospectus forms a part.

Authorized Capital Stock

Our authorized capital stock consists of 16,666,667 shares of common stock, par value $0.00001 per share. As of April 30, 2020, 4,847,370

shares of common stock were outstanding. Our common stock is registered under Section 12(b) of the Exchange Act.

Common Stock

Voting Rights. The holders of our common stock are entitled to one vote per share on all matters submitted to a vote of the stockholders,

including

the election of directors. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be

cast by all shares of common stock that are present in person or represented by proxy. Except as otherwise provided by law, amendments to our articles of incorporation generally must be approved by a

majority of the votes entitled to be cast by all outstanding shares of common stock. Our articles of incorporation do not provide for cumulative voting in the election of directors.

Dividends. Except as provided by law or in our articles of incorporation, the holders of common stock will be entitled to such cash

dividends as may

be declared from time to time by our board of directors from funds available.

Liquidation, Dissolution and Winding Up. Upon liquidation, dissolution or winding up of our Company, the holders of common stock will

be entitled to

receive pro rata all assets available for distribution to such holders after payment of our liabilities.

Other Rights. The holders of common stock have no preferential or preemptive right and no subscription, redemption or conversion

privileges with

respect to the issuance of additional shares of our common stock.

Provisions of Our Articles of Incorporation and Bylaws and the NRS That May Have Anti-Takeover Effects

We may be or in the future we may become subject to Nevada's control share laws. A corporation is subject to Nevada's control share law if it

has more than 200 stockholders, at least 100 of whom are stockholders of record and residents of Nevada, and if the corporation does business in Nevada, including through an affiliated corporation.

This control share law may have the effect of discouraging corporate takeovers. We currently have less than 100 stockholders of record who are residents of Nevada.

The

control share law focuses on the acquisition of a "controlling interest," which means the ownership of outstanding voting shares that would be sufficient, but for the operation of

the control share law, to enable the acquiring person to exercise the following proportions of the voting power of the corporation in the election of directors: (1) one-fifth or more but less

than one-third; (2) one-third

13

Table of Contents

or

more but less than a majority; or (3) a majority or more. The ability to exercise this voting power may be direct or indirect, as well as individual or in association with others.

The

effect of the control share law is that an acquiring person, and those acting in association with that person, will obtain only such voting rights in the control shares as are

conferred by a resolution of the

stockholders of the corporation, approved at a special or annual meeting of stockholders. The control share law contemplates that voting rights will be considered only once by the other stockholders.

Thus, there is no authority to take away voting rights from the control shares of an acquiring person once those rights have been approved. If the stockholders do not grant voting rights to the

control shares acquired by an acquiring person, those shares do not become permanent non-voting shares. The acquiring person is free to sell the shares to others. If the buyer or buyers of those

shares themselves do not acquire a controlling interest, the shares are not governed by the control share law.

If

control shares are accorded full voting rights and the acquiring person has acquired control shares with a majority or more of the voting power, a stockholder of record, other than

the acquiring person, who did not vote in favor of approval of voting rights, is entitled to demand fair value for such stockholder's shares.

In

addition to the control share law, Nevada has a business combination law, which prohibits certain business combinations between Nevada corporations and "interested stockholders" for

two years after the interested stockholder first becomes an interested stockholder, unless the corporation's board of directors approves the combination in advance. For purposes of Nevada law, an

interested stockholder is any person who is: (a) the beneficial owner, directly or indirectly, of 10% or more of the voting power of the outstanding voting shares of the corporation, or

(b) an affiliate or associate of the corporation and at any time within the previous two years was the beneficial owner, directly or indirectly, of 10% or more of the voting power of the

then-outstanding shares of the corporation. The definition of "business combination" contained in the statute is sufficiently broad to cover virtually any kind of transaction that would allow a

potential acquirer to use the corporation's assets to finance the acquisition or otherwise to benefit its own interests rather than the interests of the corporation and its other stockholders.

The

effect of Nevada's business combination law is to potentially discourage parties interested in taking control of the Company from doing so if it cannot obtain the approval of our

board of directors.

Our articles of incorporation provide for a classified board of directors. This provision could prevent a party who acquires control of a

majority of our outstanding common stock from obtaining control of the board until our second annual stockholders meeting following the date the acquirer obtains the controlling stock interest. The

classified board provision could have the effect of discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of us and could increase the likelihood that

incumbent directors will retain their positions. In addition, under our amended and restated bylaws, directors may be removed only for cause and only by the affirmative vote of the holders of at least

80% of the voting power of our then outstanding shares of capital stock entitled to vote generally in the election of directors, voting together as a single class.

Our

amended and restated bylaws also provide that stockholders may only act at meetings of stockholders and not by written consent in lieu of a stockholders' meeting. Our amended and

restated bylaws provide that stockholders may not call a special meeting of stockholders. Rather, only the Chairman of our board of directors, the President, or the board of directors pursuant to a

resolution approved by a majority of the entire board of directors are able to call special meetings of stockholders. These provisions may discourage another person or entity from making a tender

offer, even if it acquired a majority of our outstanding voting stock, because the person or entity could only

14

Table of Contents

take

action at a duly called stockholders' meeting relating to the business specified in the notice of meeting and not by written consent.

Our

amended and restated bylaws also provide that stockholders may only conduct business at special meetings of stockholders that was specified in the notice of the meeting, and a

stockholder must notify us in writing, within timeframes specified in our bylaws, of any stockholder nomination of a director and of any other business that the stockholders intends to bring at a

meeting of stockholders. Our amended and restated bylaws also provide that our bylaws may be amended by our board of directors or by the affirmative vote of at least 80% of our voting stock then

outstanding. These provisions could have the effect of discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of us because the foregoing provisions may

limit the proposals that may be acted upon at a stockholders' meeting, and the amendment provisions in our bylaws make such provisions difficult to change.

Listing on The Nasdaq Capital Market

Our common stock is listed on the Nasdaq Capital Market under the symbol "NVIV." On June 3, 2020, the reported closing price per share of

our common stock on the Nasdaq Capital Market was $1.53.

Authorized but Unissued Shares

The authorized but unissued shares of common stock are available for future issuance without stockholder approval, subject to any limitations

imposed by the listing requirements of the Nasdaq Capital Market. These additional shares may be used for a variety of corporate finance transactions, acquisitions and employee benefit plans. The

existence of authorized but unissued and unreserved common stock could make it more difficult or discourage an attempt to obtain control of us by means of a proxy contest, tender offer, merger or

otherwise.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Continental Stock Transfer & Trust Company.

15

Table of Contents

SELLING STOCKHOLDERS

On April 15, 2020, we entered into a securities purchase agreement with certain institutional and accredited investors, pursuant to which

we agreed to sell and issue, in a registered direct offering offered pursuant to an effective shelf registration statement on Form S-3, an aggregate of 1,715,240 shares of common stock, for

aggregate gross proceeds of approximately $3.0 million, before deducting fees to the placement agents and other offering expenses payable by us.

In

a concurrent private placement, pursuant to the purchase agreement, we offered and sold to the investors common stock purchase warrants to purchase an aggregate of 1,715,240 shares of

our common stock, or the purchase warrants. The purchase warrants have an exercise price per share equal to $1.62, are immediately exercisable and expire on October 17, 2025.

Pursuant

to a letter agreement dated as of April 15, 2020, or the engagement letter, we engaged H.C. Wainwright & Co., LLC, or Wainwright, to act as the

exclusive placement agent in connection with the registered direct and private placement transaction. We issued placement agent warrants to purchase an aggregate of 111,491 shares of our common stock,

or the placement agent warrants. The placement agent warrants have an exercise price of $2.1875 per share, are immediately exercisable and expire April 15, 2025. The shares of common stock

underlying the placement agent warrants and the purchase warrants are referred to collectively as the warrant shares.

Pursuant

to the securities purchase agreement and the engagement letter, we agreed to file the registration statement of which this prospectus is a part to cover the resale of the shares

of common stock underlying the warrants and to keep such registration statement effective until the date that is six months after no selling stockholder owns any warrants.

We

are registering the resale of the warrant shares to permit each of the selling stockholders identified below to resell or otherwise dispose of the warrant shares in the manner

contemplated under "Plan of Distribution" in this prospectus (as may be supplemented and amended). The term "selling stockholders" includes donees, pledgees, assignees, transferees or other

successors-in-interest selling shares received after the date of this prospectus from a selling stockholder as a gift, pledge, partnership distribution or other non-sale related transfer. Throughout

this prospectus, when we refer to the shares of our common stock being registered on behalf of the selling stockholders, we are referring to the warrant shares, and when we refer to the selling

stockholders in this prospectus, we are referring to the purchasers of the warrants and holders of the placement agent warrants.

The

selling stockholders may sell some, all or none of their warrant shares. We do not know how long the selling stockholders will hold the warrant shares before selling them, and we

currently have no agreements, arrangements or understandings with the selling stockholders regarding the sale or other disposition of any of the warrant shares. The warrant shares covered hereby may

be offered from time to time by the selling stockholders.

The

following table sets forth the name of each selling stockholder, the number and percentage of our outstanding shares of common stock beneficially owned by the selling stockholders as

of April 30, 2020, the number of warrant shares that may be offered under this prospectus, and the number and percentage of our outstanding shares of common stock beneficially owned by the

selling stockholders assuming all of the warrant shares covered hereby are sold. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with

respect to our common stock. Generally, a person "beneficially owns" shares of our common stock if the person has or shares with others the right to vote those shares or to dispose of them, or if the

person has the right to acquire voting or disposition rights within 60 days. The number of shares in the column "Shares of Common Stock being Offered" represents all of the warrant shares that

a selling stockholder may offer and sell from time to time under this prospectus.

All

information contained in the table below and the footnotes thereto is based upon information provided to us by the selling stockholders. The selling stockholders may have sold or

transferred, in

16

Table of Contents

transactions

exempt from the registration requirements of the Securities Act, some or all of their warrant shares or other securities since the date on which the information in the table below if

presented. Information about the selling stockholders may change over time. The percentage of shares owned after the offering is based on 4,847,370 shares of common stock outstanding as of

April 30, 2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beneficial Ownership After this Offering(1)

|

|

|

|

Shares of

Common Stock

Beneficially

Owned Prior to

this Offering

|

|

|

|

|

|

Shares of

Common Stock

Offered

Hereby

|

|

|

Name

|

|

Number of

Shares

|

|

%

|

|

|

Intracoastal Capital, LLC(2)

|

|

|

305,715

|

|

|

305,715

|

|

|

—

|

|

|

—

|

|

|

CVI Investments, Inc.(3)

|

|

|

497,221

|

|

|

457,143

|

|

|

40,078

|

|

|

*

|

|

|

Entities affiliated with Armistice Capital Master Fund Ltd.(4)

|

|

|

1,458,061

|

|

|

476,191

|

|

|

981,870

|

|

|

17.6

|

|

|

Entities affiliated with Sabby Volatility Warrant Master Fund, Ltd.(5)

|

|

|

1,394,429

|

|

|

476,191

|

|

|

918,238

|

|

|

16.4

|

|

|

Noam Rubinstein(6)(7)

|

|

|

92,016

|

|

|

35,120

|

|

|

56,896

|

|

|

1.2

|

|

|

Craig Schwabe(6)(8)

|

|

|

5,418

|

|

|

3,763

|

|

|

1,655

|

|

|

*

|

|

|

Michael Vasinkevich(6)(9)

|

|

|

187,374

|

|

|

71,493

|

|

|

115,881

|

|

|

2.3

|

|

|

Charles Worthman(6)(10)

|

|

|

6,851

|

|

|

1,115

|

|

|

5,736

|

|

|

*

|

|

-

*

-

Less

than one percent

-

(1)

-

Assumes

the exercise in full of the warrants and sale of all warrant shares registered pursuant to this prospectus, although the selling stockholders are under no

obligation known to us to sell any shares of common stock at this time.

-

(2)

-

Before

offering includes purchase warrants to purchase 305,715 shares of common stock, all of which are held directly by Intracoastal Capital, LLC

("Intracoastal"). The purchase warrants are subject to a beneficial ownership limitation of 9.99%, which does not permit Intracoastal to exercise that portion of the purchase warrants that would

result in Intracoastal and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The amounts and percentages in the table do not

give effect to the beneficial ownership limitation. Mitchell P. Kopin and Daniel B. Asher, each of whom are managers of Intracoastal, have shared voting control and investment discretion over the

securities reported herein that are held by Intracoastal. As a result, each of Mr. Kopin and Mr. Asher may be deemed to beneficially own the securities held by Intracoastal. The address

of each of Mr. Kopin and Intracoastal is 245 Palm Trail, Delray Beach, Florida 33483. The address of Mr. Asher is 111 W. Jackson Boulevard, Suite 2000, Chicago, Illinois 60604.

-

(3)

-

Before

offering includes (i) purchase warrants to purchase 457,143 shares of common stock and (ii) other warrants to purchase 40,078 shares of common

stock, all of which are directly held by CVI Investments, Inc. ("CVI"). Certain of the warrants are subject to a beneficial ownership limitation of 4.99%, which does not permit CVI to exercise

that portion of the warrants that would result in CVI and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The amounts and

percentages in the table do not give effect to the beneficial ownership limitation. Heights Capital Management, Inc. ("Heights"), the authorized agent of CVI, has discretionary authority to

vote and dispose of the shares held by CVI and may be deemed to be the beneficial owner of these shares. Martin Kobinger, in his capacity as Investment Manager of Heights may also be deemed to have

investment discretion and voting power over the shares held by CVI. Mr. Kobinger disclaims any such beneficial ownership of the shares. CVI's address is c/o Heights Capital

Management, Inc., 101 California Street, Suite 3250, San Francisco, CA 94111.

-

(4)

-

Before

offering includes (i) 254,597 shares of common stock, (ii) purchase warrants to purchase 476,191 shares of common stock and (iii) other

warrants to purchase 727,273 shares of common

17

Table of Contents

stock,

all of which are held directly by Armistice Capital Master Fund Ltd. ("Armistice Fund"). Certain of the warrants are subject to a beneficial ownership limitation of 4.99%, which does not

permit Armistice Fund to exercise that portion of the warrants that would result in Armistice Fund and its affiliates owning, after exercise, a number of shares of common stock in excess of the

beneficial ownership limitation. The amounts and percentages in the table do not give effect to the beneficial ownership limitation. Steven Boyd is the Managing Member of Armistice

Capital, LLC, which acts as the investment manager of Armistice Fund. As a result, Mr. Boyd may be deemed to beneficially own the securities held by Armistice Fund. The address of

Armistice Fund is c/o dms Corporate Services ltd., 20 Genesis Close, P.O. Box 314, Grand Cayman KY1-1104, Cayman Islands, and the address of each of Armistice Capital LLC

and Mr. Boyd is 510 Madison Avenue, 7th Floor, New York, NY 10022.

-

(5)

-

Before

offering includes (i) purchase warrants to purchase 476,191 shares of common stock and (ii) other warrants to purchase 918,238 shares of common

stock, all of which are held directly by Sabby Volatility Warrant Master Fund, Ltd. ("SVWMF"). Certain of the warrants are subject to a beneficial ownership limitation of 4.99%, which does not

permit SVWMF to exercise that portion of the warrants that would result in SVWMF and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership

limitation. The amounts and percentages in the table do not give effect to the beneficial ownership limitation. Hal Mintz is the manager of Sabby Management, LLC, which acts as the investment

manager of SVWMF. As a result, Mr. Mintz may be deemed to beneficially own the securities held by SVWMF. The address of each of SVWMF, Sabby Management LLC and Mr. Mintz is c/o

Sabby Management, LLC, 10 Mountainview Road, Suite 205, Upper Saddle River, New Jersey 07458.

-

(6)

-

The

selling stockholder is an affiliate of a registered broker-dealer.

-

(7)

-

Before

the offering includes placement agent warrants to purchase 35,120 shares of common stock and other warrants to purchase 56,896 shares of common stock. The

address of Mr. Rubinstein is c/o H.C. Wainwright & Co., LLC, 430 Park Avenue, 3rd Floor, New York, New York 10022.

-

(8)

-

Before

the offering reflects placement agent warrants to purchase 3,763 shares of common stock and other warrants to purchase 1,655 shares of common stock. The

address of Mr. Schwabe is c/o H.C. Wainwright & Co., LLC, 430 Park Avenue, 3rd Floor, New York, New York 10022.

-

(9)

-

Before

the offering reflects placement agent warrants to purchase 71,493 shares of common stock and other warrants to purchase 115,881 shares of common stock. The

address of Mr. Vasinkevich is c/o H.C. Wainwright & Co., LLC, 430 Park Avenue, 3rd Floor, New York, New York 10022.

-

(10)

-

Before

the offering reflects placement agent warrants to purchase 1,115 shares of common stock and other warrants to purchase 5,736 shares of common stock. The

address of Mr. Worthman is c/o H.C. Wainwright & Co., LLC, 430 Park Avenue, 3rd Floor, New York, New York 10022.

Other Relationships with the Selling Stockholders

Messrs. Rubinstein, Schwabe, Vasinkevich, and Worthman, selling stockholders, are each affiliated with Wainwright, which acted as the

placement agent in the concurrent private placement of the purchase warrants for which we are registering the underlying shares in the registration statement of which this prospectus forms a

part, and received the placement agent warrants for which we are registering the underlying shares in the registration statement of which this prospectus forms a part as compensation in

connection therewith. From time to time, Wainwright may provide in the future various advisory, investment and commercial banking and other services to us in the ordinary course of business, for which

they have received and may continue to receive customary fees and commissions. Wainwright acted as exclusive financial advisor for our November 2019 public offering and March 2020 public offering, for

which it received compensation. Except with respect to the foregoing, none of the selling stockholders has, or within the past three years has had, any position, office or other material relationship

with us, other than as a result of the ownership of our shares or other securities.

18

Table of Contents

PLAN OF DISTRIBUTION

We are registering the warrant shares issuable to the selling stockholders to permit the resale of these shares of common stock by the selling

stockholders from time to time from after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling stockholders of the warrant shares. We will bear the fees

and expenses incident to our obligation to register the shares of common stock, however the selling stockholders will bear legal and advisor fees, commissions and discounts, if any, attributable to

their respective sales of the warrant shares.

Each

selling stockholder may, from time to time, sell any or all of its warrant shares covered hereby on The Nasdaq Capital Market or any other stock exchange, market or trading facility

on which the shares can be traded or in private transactions. These sales may be at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale,

or privately negotiated prices. A selling stockholder may use any one or more of the following methods when selling shares:

-

•

-

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

-

•

-

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as

principal to facilitate the transaction;

-

•

-

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

-

•

-

an exchange distribution in accordance with the rules of the applicable exchange;

-

•

-

privately negotiated transactions;

-

•

-

underwritten transactions;

-

•

-

settlement of short sales, to the extent permitted by law;

-

•

-

in transactions through broker-dealers that agree with the selling stockholders to sell a specified number of such shares at a stipulated price

per share;

-

•

-

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

-

•

-

through the distribution of the common stock by any selling stockholder to its partners, members or stockholders;

-

•

-

a combination of any such methods of sale; or

-

•

-

any other method permitted pursuant to applicable law.

The

selling stockholders may also sell the shares of common stock under Rule 144 under the Securities Act, if available, rather than under this prospectus.

If

underwriters are used in the sale, the shares of common stock will be acquired by the underwriters for their own account and may be resold from time to time in one or more

transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined at the time of sale. In connection with any such underwritten sale of shares of common

stock, underwriters may receive compensation from the selling stockholders, for whom they may act as agents, in the form of discounts, concessions or commissions. If the selling stockholders use an

underwriter or underwriters to effectuate the sale of shares of common stock, we and/or they will execute an underwriting agreement with those underwriters at the time of sale of those shares of

common stock. To the extent required by law, the names of the underwriters will be set forth in a prospectus supplement or, if appropriate, a post-effective amendment to the registration statement

that includes the prospectus supplement and the accompanying prospectus used by the underwriters to sell those securities. The obligations of the underwriters to purchase those shares of common stock

will be subject to certain

19

Table of Contents

conditions

precedent, and unless otherwise specified in a prospectus supplement, the underwriters will be obligated to purchase all the shares of common stock offered by such prospectus supplement if

any of such shares of common stock are purchased. Any public offering price and any discounts or concessions allowed or re-allowed or paid to dealers may be changed from time to time.

Broker-dealers

engaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling

stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the

case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2121.

In

connection with the sale of the shares of common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the shares of common stock in the course of hedging the positions they assume. The selling stockholders may also sell the shares of common

stock short and deliver these securities to close out their short positions or to return borrowed shares in connection with such short sales, or loan or pledge the shares of common stock to

broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or create one or

more derivative securities which require the delivery to such broker-dealer or other financial institution of shares of common stock offered by this prospectus, which shares such broker-dealer or

other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

selling stockholders and any broker-dealers or agents that are involved in selling the shares of common stock may be deemed to be "underwriters" within the meaning of the Securities

Act in connection with such sales. In such event, any commissions received by such selling stockholders, broker-dealers or agents and any profit on the resale of the shares purchased by them may be

deemed to be underwriting commissions or discounts under the Securities Act. Selling stockholders who are "underwriters" within the meaning of Section 2(11) of the Securities Act will be

subject to the prospectus delivery requirements of the Securities Act and may be subject to certain statutory liabilities of, including but not limited to, Sections 11, 12 and 17 of the

Securities Act and Rule 10b-5 under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

We

are required to pay certain fees and expenses incurred by us incident to the registration of the shares of common stock of the selling stockholders. We have also agreed to indemnify

the selling stockholders holding purchase warrants against losses, claims, damages and liabilities, including liabilities under the Securities Act, with respect to the registration statement of which

this prospectus forms a part.

The

selling stockholders will be subject to the prospectus delivery requirements of the Securities Act, including Rule 172 thereunder, unless an exemption therefrom is available.

We

agreed to cause the registration statement of which this prospectus is a part to remain effective until the date on which no selling stockholder owns any purchase warrants or common

stock issuable upon exercise thereof. The shares of common stock will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in

certain states, the shares of common stock covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or

qualification requirement is available and is complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the shares of common stock may not simultaneously engage in market making

activities with respect to the shares of common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling

stockholders will

20

Table of Contents

be

subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of shares of common

stock by the selling stockholders or any other person. We will make copies of this prospectus available to the selling stockholders and have informed them of the need to deliver a copy of this

prospectus at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

The

selling stockholders may decide not to sell any or all of the shares of common stock we registered on behalf of the selling stockholders pursuant to the registration statement of

which this prospectus forms a part.

Once

sold under the registration statement of which this prospectus forms a part, the shares of common stock will be freely tradable in the hands of persons other than our

affiliates.

21

Table of Contents

LEGAL MATTERS

The validity of the common stock offered by this prospectus will be passed upon for us by Ballard Spahr LLP, Las Vegas, Nevada.

EXPERTS

The consolidated financial statements of InVivo Therapeutics Holdings Corp. and subsidiary as of December 31, 2019 and 2018 and for the

years then ended, incorporated in this Prospectus by reference from the InVivo Therapeutics Holdings Corp.'s Annual Report on Form 10-K for the year ended December 31, 2019 have been

audited by RSM US LLP, an independent registered public accounting firm, as stated in their report thereon (which report expresses an unqualified opinion and includes an explanatory paragraph

relating to InVivo Therapeutics Holdings Corp.'s ability to continue as a going concern), incorporated herein by reference, and have been incorporated in this Prospectus and Registration Statement in

reliance upon such report and upon the authority of such firm as experts in accounting and auditing.

22

Table of Contents

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet site that

contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC; it is available at http://www.sec.gov. Our SEC filings are available

to you on the SEC's Internet site. Copies of certain information filed by us with the SEC are also available on our website at www.invivotherapeutics.com. The information on our Internet website is not

incorporated by reference in this prospectus.

This

prospectus is part of a registration statement that we filed with the SEC. This prospectus does not contain all of the information included in the registration statement, including

certain exhibits and schedules. You should review the information and exhibits in the registration statement for further information about us and the securities we are offering. Statements in this

prospectus concerning any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified by reference to

these filings. You should review the complete document to evaluate these statements. You can obtain a copy of the registration statement and exhibits from the SEC's Internet site.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to incorporate by reference into this prospectus information and reports that we file with the SEC. This means that we can

disclose important information to you by referring to other documents that contain that information. Any information that we incorporate by reference is considered part of this prospectus. The

documents and reports that we list below are incorporated by reference into this prospectus, other than any portion of any such documents that are not deemed "filed" under the Exchange Act in

accordance with the Exchange Act and applicable SEC rules.

In

addition, all documents and reports which we file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus and prior to the

termination of the offering made hereby are incorporated by reference in this prospectus as of the respective filing dates of these documents and reports.

We

have filed the following documents with the SEC. These documents are incorporated in this prospectus by reference as of their respective dates of filing:

-

(1)

-

Our Annual Report on Form 10-K for the fiscal

year ended December 31, 2019, filed with the SEC on February 20, 2020;

-

(2)

-

Our Quarterly Report on Form 10-Q for the quarter

ended March 31, 2020 filed with the SEC on May 13, 2020;

-

(3)

-

Our

Current Reports on Form 8-K filed on

January 16, 2020,

January 24, 2020,

February 3, 2020,

February 11, 2020,

February 24, 2020,

March 2, 2020;

March 11, 2020, and

April 16, 2020; and

-

(4)

-

The description of our common stock contained in our

Registration Statement on Form 8-A filed on April 15, 2015, including any amendments or reports filed for the purpose of updating such description.

23

Table of Contents

You

may request a copy of these documents, which will be provided to you at no cost, by writing or telephoning us at:

InVivo

Therapeutics Holdings Corp.

One Kendall Square, Suite B14402

Cambridge, Massachusetts 02139

Attn: Investor Relations

(617) 863-5500

Statements

contained in documents that we file with the SEC and that are incorporated by reference in this prospectus will automatically update and supersede information contained in

this prospectus,

including information in previously filed documents or reports that have been incorporated by reference in this prospectus, to the extent the new information differs from or is inconsistent with the

old information. Any statement so modified or superseded will not be deemed to be a part of this prospectus, except as so modified or superseded. Because information that we later file with the SEC

will update and supersede previously incorporated information, you should look at all of the SEC filings that we incorporate by reference to determine if any of the statements in this prospectus or in

any documents previously incorporated by reference have been modified or superseded.

24

Table of Contents

1,826,731 Shares of Common Stock

Prospectus

June 4, 2020

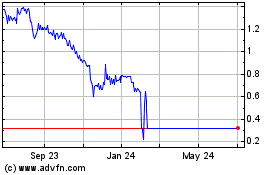

InVivo Therapeutics (NASDAQ:NVIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

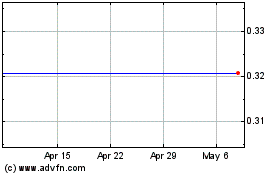

InVivo Therapeutics (NASDAQ:NVIV)

Historical Stock Chart

From Apr 2023 to Apr 2024