Table of Contents

As filed with the Securities and Exchange Commission on November 12, 2019

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

InVivo Therapeutics Holdings Corp.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada

|

|

36-4528166

|

|

(State or Other Jurisdiction of Incorporation

or Organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

One Kendall Square, Suite B14402

Cambridge, MA

|

|

02139

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

InVivo Therapeutics Holdings Corp. 2015 Equity Incentive Plan

(Full Title of the Plan)

Richard Toselli, M.D.

President and Chief Executive Officer

InVivo Therapeutics Holdings Corp.

One Kendall Square, Suite B14402

Cambridge, MA 02139

(Name and Address of Agent For Service)

(617) 863-5500

(Telephone Number, Including Area Code, of Agent For Service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

|

Accelerated filer o

|

|

Non-accelerated filer x

|

|

Smaller reporting company x

|

|

|

|

Emerging growth company o

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

|

Title of Securities to be

Registered

|

|

Amount to be

Registered(1)

|

|

Proposed

Maximum

Offering Price Per

Share

|

|

Proposed

Maximum

Aggregate Offering

Price

|

|

Amount of

Registration Fee

|

|

|

Common stock, $0.00001 par value per share

|

|

14,304 shares (2)

|

|

$

|

0.47

|

(3)

|

$

|

6,723

|

(3)

|

$

|

0.87

|

|

|

Common stock, $0.00001 par value per share

|

|

116,500 shares (4)

|

|

$

|

0.47

|

(5)

|

$

|

54,755

|

(5)

|

$

|

7.11

|

|

|

Total

|

|

130,804 shares

|

|

$

|

0.47

|

|

$

|

61,478

|

|

$

|

7.98

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) In accordance with Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall be deemed to cover any additional securities that may from time to time be offered or issued to prevent dilution resulting from stock splits, stock dividends or similar transactions.

(2) Consists of (i) 2,508 shares issuable under the InVivo Therapeutics Holdings Corp. 2015 Equity Incentive Plan (the “2015 Plan”) and (ii) up to an additional 11,796 shares that may become issuable under the 2015 Plan upon the cancellation, forfeiture or expiration of awards issued and outstanding as of April 16, 2015 under the InVivo Therapeutics Holdings Corp. 2010 Equity Incentive Plan that remain outstanding as of the date of this registration statement.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rules 457(c) and 457(h) under the Securities Act, and based upon the average of the high and low prices of the Registrant’s common stock as reported on the Nasdaq Capital Market on November 5, 2019.

(4) Consists of (i) 69,000 shares held by Richard Toselli, M.D. that were issued pursuant to the 2015 Plan on September 25, 2019 and (ii) 47,500 shares held by Richard Christopher that were issued pursuant to the 2015 Plan on September 25, 2019.

(5) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act, and based upon the average of the high and low prices of the Registrant’s common stock as reported on the Nasdaq Capital Market on November 5, 2019.

Table of Contents

EXPLANATORY NOTE

InVivo Therapeutics Holdings Corp. (the “Company”) has prepared this registration statement in accordance with the requirements of Form S-8 under the Securities Act of 1933, as amended (the “Securities Act”), to register shares of its common stock that may be issued pursuant to awards granted under the InVivo Therapeutics Holdings Corp. 2015 Equity Incentive Plan (the “2015 Plan”) and shares of its common stock held by Richard Toselli, M.D. and Richard Christopher (together, the “Selling Stockholders”) that were issued to the Selling Stockholders pursuant to the 2015 Plan, which shares may be deemed to be “control securities” and “restricted securities” under the Securities Act, and which shares may be reoffered and resold by the Selling Stockholders on a continuous or delayed basis in the future pursuant to this registration statement.

This registration statement contains two prospectuses:

· a plan prospectus, consisting of the materials described in Part I, Items 1 and 2 of this registration statement, relating to (i) 2,508 shares of the Company’s common stock issuable under the 2015 Plan and (ii) up to an additional 11,796 shares of the Company’s common stock that may become issuable under the 2015 Plan upon the cancellation, forfeiture or expiration of awards issued and outstanding as of April 16, 2015 (the effective date of the 2015 Plan) under the InVivo Therapeutics Holdings Corp. 2010 Equity Incentive Plan; and

· a reoffer prospectus, consisting of the disclosure that follows Part I, Item 2 of this registration statement, up to but not including Part II of this registration statement, relating to the 116,500 shares of the Company’s common stock registered hereunder for reoffer and resale by the Selling Stockholders.

Table of Contents

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information.

The information required by Item 1 is included in documents sent or given to the participants in the 2015 Plan pursuant to Rule 428(b)(1) under the Securities Act.

Item 2. Registrant Information and Employee Plan Annual Information.

The written statement required by Item 2 is included in documents sent or given to the participants in the 2015 Plan pursuant to Rule 428(b)(1) under the Securities Act.

Table of Contents

REOFFER PROSPECTUS

116,500 Shares of Common Stock

The individuals named in this prospectus, or the Selling Stockholders, may offer and sell, from time to time, for their own accounts up to an aggregate of 116,500 shares of our common stock, $0.00001 par value per share, previously issued to such Selling Stockholders. We will not receive any proceeds from any sale of the shares pursuant to this reoffer prospectus. The Selling Stockholders acquired the shares pursuant to employee benefit plans as defined in Rule 405 under Regulation C of the Securities Act of 1933, as amended, or the Securities Act, and the Selling Stockholders may resell all, a portion, or none of the shares from time to time.

The shares are “restricted securities” under the Securities Act before their sale under this reoffer prospectus. This reoffer prospectus has been prepared for the purpose of registering the shares under the Securities Act to allow for future sales by the Selling Stockholders, on a continuous or delayed basis, to the public without restriction. Each Selling Stockholder who sells shares of common stock pursuant to this reoffer prospectus may be deemed to be an “underwriter” within the meaning of the Securities Act. Any commissions received by a broker or dealer in connection with resales of shares may be deemed to be underwriting commissions or discounts under the Securities Act.

You should read this reoffer prospectus and any accompanying prospectus supplement carefully before you make your investment decision. The sales may occur in transactions on the Nasdaq Capital Market at prevailing market prices or in negotiated transactions. We will not receive any proceeds from any of these sales. We are paying the expenses incurred in registering the shares, but all selling and other expenses incurred by each of the Selling Stockholders will be borne by that stockholder.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 4.

Our common stock is listed on the Nasdaq Capital Market under the trading symbol “NVIV.” The last reported sale price of our common stock on the Nasdaq Capital Market on November 8, 2019 was $0.47 per share.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this reoffer prospectus. Any representation to the contrary is a criminal offense.

The date of this reoffer prospectus is November 12, 2019.

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission, or the SEC. Our SEC filings are available to you on the SEC’s Internet site at www.sec.gov. Copies of certain information filed by us with the SEC are also available on our website at www.invivotherapeutics.com. The information on our website is not incorporated by reference in this reoffer prospectus.

This reoffer prospectus is part of a registration statement that we filed with the SEC. This reoffer prospectus does not contain all of the information included in the registration statement, including certain exhibits and schedules. You should review the information and exhibits in the registration statement for further information about us and the securities offered pursuant to this reoffer prospectus. Statements in this reoffer prospectus concerning any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified by reference to these filings. You should review the complete document to evaluate these statements. You can obtain a copy of the registration statement and exhibits from the SEC’s Internet site.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate” into this reoffer prospectus information and reports that we file with the SEC. This means that we can disclose important information to you by referring to other documents that contain that information. Any information that we incorporate by reference is considered part of this reoffer prospectus. The documents and reports that we list below are incorporated by reference into this reoffer prospectus, other than any portion of any such documents that are not deemed “filed” under the Securities Exchange Act of 1934, as amended, or the Exchange Act, in accordance with the Exchange Act and applicable SEC rules.

In addition, all documents and reports which we file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this reoffer prospectus and prior to the termination of the offering made hereby are incorporated by reference in this reoffer prospectus as of the respective filing dates of these documents and reports.

We have filed the following documents with the SEC. These documents are incorporated herein by reference as of their respective dates of filing:

(1) Our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, filed on April 1, 2019, including the information specifically incorporated by reference into the Annual Report on Form 10-K from our definitive proxy statement for the 2019 Annual Meeting of Stockholders, filed on April 25, 2019;

(2) Our Quarterly Reports on Form 10-Q for the quarter ended March 31, 2019, filed on May 10, 2019, for the quarter ended June 30, 2019, filed on August 13, 2019, and for the quarter ended September 30, 2019, filed on November 7, 2019;

(3) Our Current Reports on Form 8-K filed on January 4, 2019 (Item 8.01 only), January 14, 2019, June 14, 2019, July 5, 2019, July 12, 2019, July 19, 2019, September 27, 2019 and November 12, 2019; and

(4) The description of our common stock contained in our Registration Statement on Form 8-A filed on April 15, 2015, including any amendments or reports filed for the purpose of updating such description.

You may request a copy of these documents, which will be provided to you at no cost, by writing or telephoning us at:

InVivo Therapeutics Holdings Corp.

One Kendall Square, Suite B14402

Cambridge, Massachusetts 02139

Attn: Investor Relations

(617) 863-5500

1

Table of Contents

Statements contained in documents that we file with the SEC and that are incorporated by reference in this reoffer prospectus will automatically update and supersede information contained in this reoffer prospectus, including information in previously filed documents or reports that have been incorporated by reference in this reoffer prospectus, to the extent the new information differs from or is inconsistent with the old information. Any statement so modified or superseded will not be deemed to be a part of this reoffer prospectus, except as so modified or superseded. Because information that we later file with the SEC will update and supersede previously incorporated information, you should look at all of the SEC filings that we incorporate by reference to determine if any of the statements in this reoffer prospectus or in any documents previously incorporated by reference have been modified or superseded.

2

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This reoffer prospectus contains and incorporates “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E Exchange Act. These statements include statements made regarding our commercialization strategy, future operations, cash requirements and liquidity, capital requirements, and other statements on our business plans and strategy, financial position, and market trends. In some cases, you can identify forward-looking statements by terms such as “may,” “might,” “will,” “should,” “believe,” “plan,” “intend,” “anticipate,” “target,” “estimate,” “expect,” and other similar expressions. These forward-looking statements are subject to risks and uncertainties that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements, including factors such as our ability to raise substantial additional capital to finance our planned operations and to continue as a going concern; our ability to execute our strategy and business plan; our ability to obtain regulatory approvals for our products, including the Neuro-Spinal Scaffold™; our ability to successfully commercialize our current and future product candidates, including the Neuro-Spinal Scaffold; the progress and timing of our development programs; market acceptance of our products; our ability to retain management and other key personnel; our ability to promote, manufacture, and sell our products, either directly or through collaborative and other arrangements with third parties; and other factors detailed under “Risk Factors” in this reoffer prospectus and under “Risk Factors” in our most recent Annual Report on Form 10-K and our most recent Quarterly Report on Form 10-Q. These forward looking statements are only predictions, are uncertain, and involve substantial known and unknown risks, uncertainties, and other factors which may cause our actual results, levels of activity, or performance to be materially different from any future results, levels of activity, or performance expressed or implied by these forward looking statements. Such factors include, among others, the following:

· our limited operating history and history of net losses;

· our ability to raise substantial additional capital to finance our planned operations and to continue as a going concern;

· our ability to complete the INSPIRE 2.0 Study to support our existing Humanitarian Device Exemption application;

· our ability to execute our strategy and business plan;

· our ability to obtain regulatory approvals for our current and future product candidates, including our Neuro-Spinal Scaffold implant;

· our ability to successfully commercialize our current and future product candidates, including our Neuro-Spinal Scaffold implant;

· the progress and timing of our current and future development programs;

· our ability to successfully open, enroll and complete clinical trials and obtain and maintain regulatory approval of our current and future product candidates;

· our ability to protect and maintain our intellectual property and licensing arrangements;

· our reliance on third parties to conduct testing and clinical trials;

· market acceptance and adoption of our current and future technology and products;

· our ability to promote, manufacture and sell our current and future products, either directly or through collaborative and other arrangements with third parties; and

· our ability to attract and retain key personnel.

We cannot guarantee future results, levels of activity, or performance. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this reoffer prospectus. You are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions that are referenced under “Risk Factors” in this reoffer prospectus and under “Risk Factors” in our most recent Annual Report on Form 10-K and our most recent Quarterly Report on Form 10-Q. You should also carefully review the risk factors and cautionary statements described in the other documents we file from time to time with the SEC, specifically our most recent Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward looking statements to conform these statements to reflect actual results, later events or circumstances, or to reflect the occurrence of unanticipated events.

3

Table of Contents

ABOUT INVIVO THERAPEUTICS HOLDINGS CORP.

We are a research and clinical-stage biomaterials and biotechnology company with a focus on treatment of spinal cord injuries, or SCIs. Our mission is to redefine the life of the SCI patient, and we seek to develop treatment options intended to provide meaningful improvement in patient outcomes following SCI. Our approach to treating acute SCIs is based on our investigational Neuro-Spinal Scaffold™ implant, a bioresorbable polymer scaffold that is designed for implantation at the site of injury within a spinal cord and is intended to treat acute SCI. The Neuro-Spinal Scaffold implant incorporates intellectual property licensed under an exclusive, worldwide license from Boston Children’s Hospital, or BCH, and the Massachusetts Institute of Technology, or MIT. We also plan to evaluate other technologies and therapeutics that may be complementary to our development of the Neuro-Spinal Scaffold implant or offer the potential to bring us closer to our goal of redefining the life of the SCI patient.

InVivo Therapeutics Corporation was incorporated on November 28, 2005 under the laws of the State of Delaware and on October 26, 2010 completed a reverse merger transaction with and became a wholly owned subsidiary of InVivo Therapeutics Holdings Corporation, a company incorporated under the laws of the State of Nevada.

Our principal executive offices are located at One Kendall Square, Suite B14402, Cambridge, Massachusetts 02139, and our telephone number is (617) 863-5500. Our internet address is www.invivotherapeutics.com. The information on our web site is not incorporated by reference into this prospectus and should not be considered to be part of this reoffer prospectus.

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below and under the section titled “Risk Factors” in our most recent Annual Report on Form 10-K and our most recent Quarterly Report on Form 10-Q, which are incorporated by reference herein in their entirety, together with the other information contained in and incorporated by reference into this reoffer prospectus, before deciding whether to invest in our common stock. Such risks and uncertainties are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we believe are not material, may also become important factors that adversely affect our business. If any of such risks actually occurs, our business, financial condition, results of operations, and future prospects could be materially and adversely affected. In that event, the market price of our common stock could decline, and you could lose part or all of your investment.

4

Table of Contents

USE OF PROCEEDS

We will not receive any of the proceeds from any sale of the shares of common stock offered pursuant to this reoffer prospectus. All expenses of registration incurred in connection with this offering are being borne by us, but all selling and other expenses incurred by any Selling Stockholder will be borne by that Selling Stockholder.

5

Table of Contents

SELLING STOCKHOLDERS

The 116,500 shares of common stock to which this reoffer prospectus relates consist of shares of restricted stock that were acquired by the Selling Stockholders named below pursuant to our 2015 Equity Incentive Plan, which is an “employee benefit plan” as that term is defined in Rule 405 of Regulation C under the Securities Act. We are registering these shares for reoffers and resales by the Selling Stockholders named below. The Selling Stockholders may resell all, a portion, or none of the shares from time to time.

Each of the Selling Stockholders is an employee of the company as of the date of this reoffer prospectus, and inclusion in the table of such Selling Stockholders shall not be deemed to be an admission that any such Selling Stockholder is one of our affiliates.

Information regarding the Selling Stockholders, including the number of shares offered for sale, may change from time to time and any changed information will be set forth in a prospectus supplement to the extent required. The address of each Selling Stockholder is c/o InVivo Therapeutics Holdings Corp., One Kendall Square, Suite B14402, Cambridge, Massachusetts 02139.

|

Name of Selling Stockholder

|

|

Number of

Shares

Beneficially

Owned

|

|

Number of

Shares

Covered by

this Reoffer

Prospectus

|

|

Number of

Shares

Beneficially

Owned After

this Offering

|

|

Percentage of

Shares

Beneficially

Owned After

this Offering (3)

|

|

|

Richard Toselli, M.D.

|

|

79,628

|

|

69,000

|

(1)

|

10,628

|

|

*

|

%

|

|

Richard Christopher

|

|

47,500

|

|

47,500

|

(2)

|

0

|

|

—

|

|

* Percentage of shares beneficially owned does not exceed one percent.

|

(1)

|

Consists of shares of restricted stock that are scheduled to vest in full on September 25, 2022, as long as Dr. Toselli continues to provide service to our company through such vesting date.

|

|

(2)

|

Consists of shares of restricted stock that are scheduled to vest in full on September 25, 2022, as long as Mr. Christopher continues to provide service to our company through such vesting date.

|

|

|

|

|

(3)

|

Based on 9,519,570 shares of our common stock outstanding on September 30, 2019.

|

|

|

|

Any Selling Stockholder may from time to time sell under this reoffer prospectus any or all of the shares of common stock set forth opposite his name under the column titled “Number of Shares Covered by this Reoffer Prospectus” in the table above, provided that such shares have vested. The information included in the table assumes that each Selling Stockholder will elect to sell all of the shares set forth under “Number of Shares Covered by this Reoffer Prospectus” in the table above.

6

Table of Contents

PLAN OF DISTRIBUTION

The shares of common stock covered by this reoffer prospectus are being registered by us for the account of the Selling Stockholders.

The shares of common stock offered under this reoffer prospectus may be sold from time to time directly by or on behalf of the Selling Stockholders in or one more transactions on the Nasdaq Capital Market or on any stock exchange on which the common stock may be listed at the time of sale, in privately negotiated transactions, or through a combination of such methods, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at fixed prices (which may be changed) or at negotiated prices. The Selling Stockholders may sell shares through one or more agents, brokers or dealers or directly to purchasers. These brokers or dealers may receive compensation in the form of commissions, discounts or concessions from the Selling Stockholders and/or purchasers of the shares or both. This compensation as to a particular broker or dealer may be in excess of customary commissions.

In connection with sales of shares, a Selling Stockholder and any participating broker or dealer may be deemed to be “underwriters” within the meaning of the Securities Act, and any commissions they receive and the proceeds of any sale of the shares may be deemed to be underwriting discounts and commissions under the Securities Act.

We are bearing all costs relating to the registration of the shares of common stock to which this reoffer prospectus relates. Any commissions or other fees payable to broker-dealers in connection with any sale of the shares will be borne by the Selling Stockholder or other party selling the shares. In order to comply with certain states’ securities laws, if applicable, the shares may be sold in those jurisdictions only through registered or licensed brokers or dealers. In certain states, the shares may not be sold unless they have been registered or qualified for sale in that state, or unless an exemption from registration or qualification is available and is obtained or complied with. Sales of the shares must also be made by the Selling Stockholders in compliance with all other applicable state securities laws and regulations.

In addition to any shares sold under this reoffer prospectus, the Selling Stockholders may sell shares of common stock in compliance with Rule 144. There is no assurance that the Selling Stockholders will sell all or a portion of the shares offered under this reoffer prospectus.

The Selling Stockholders may agree to indemnify any broker-dealer or agent that participates in transactions involving sales of the shares against certain liabilities in connection with the offering of the shares arising under the Securities Act.

We have notified the Selling Stockholders of the need to deliver a copy of this reoffer prospectus in connection with any sale of the shares.

7

Table of Contents

CERTAIN ANTI-TAKEOVER AND INDEMNIFICATION PROVISIONS OF

OUR ARTICLES OF INCORPORATION, BY-LAWS AND NEVADA LAW

Anti-Takeover Effects of Provisions of Nevada State Law

We may be or in the future we may become subject to Nevada’s control share laws. A corporation is subject to Nevada’s control share law if it has more than 200 stockholders, at least 100 of whom are stockholders of record and residents of Nevada, and if the corporation does business in Nevada, including through an affiliated corporation. This control share law may have the effect of discouraging corporate takeovers. We currently have less than 100 stockholders of record who are residents of Nevada.

The control share law focuses on the acquisition of a “controlling interest,” which means the ownership of outstanding voting shares that would be sufficient, but for the operation of the control share law, to enable the acquiring person to exercise the following proportions of the voting power of the corporation in the election of directors: (1) one-fifth or more but less than one-third; (2) one-third or more but less than a majority; or (3) a majority or more. The ability to exercise this voting power may be direct or indirect, as well as individual or in association with others.

The effect of the control share law is that an acquiring person, and those acting in association with that person, will obtain only such voting rights in the control shares as are conferred by a resolution of the stockholders of the corporation, approved at a special or annual meeting of stockholders. The control share law contemplates that voting rights will be considered only once by the other stockholders. Thus, there is no authority to take away voting rights from the control shares of an acquiring person once those rights have been approved. If the stockholders do not grant voting rights to the control shares acquired by an acquiring person, those shares do not become permanent non-voting shares. The acquiring person is free to sell the shares to others. If the buyer or buyers of those shares themselves do not acquire a controlling interest, the shares are not governed by the control share law.

If control shares are accorded full voting rights and the acquiring person has acquired control shares with a majority or more of the voting power, a stockholder of record, other than the acquiring person, who did not vote in favor of approval of voting rights, is entitled to demand fair value for such stockholder’s shares.

In addition to the control share law, Nevada has a business combination law, which prohibits certain business combinations between Nevada corporations and “interested stockholders” for two years after the interested stockholder first becomes an interested stockholder, unless the corporation’s board of directors approves the combination in advance. For purposes of Nevada law, an interested stockholder is any person who is: (a) the beneficial owner, directly or indirectly, of 10% or more of the voting power of the outstanding voting shares of the corporation, or (b) an affiliate or associate of the corporation and at any time within the previous two years was the beneficial owner, directly or indirectly, of 10% or more of the voting power of the then-outstanding shares of the corporation. The definition of “business combination” contained in the statute is sufficiently broad to cover virtually any kind of transaction that would allow a potential acquirer to use the corporation’s assets to finance the acquisition or otherwise to benefit its own interests rather than the interests of the corporation and its other stockholders.

The effect of Nevada’s business combination law is to potentially discourage parties interested in taking control of the Company from doing so if it cannot obtain the approval of our board of directors.

Anti-Takeover Effects of Provisions of Our Articles of Incorporation and Bylaws

Our articles of incorporation provide for a classified board of directors. This provision could prevent a party who acquires control of a majority of our outstanding common stock from obtaining control of the board until our second annual stockholders meeting following the date the acquirer obtains the controlling stock interest. The classified board provision could have the effect of discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of us and could increase the likelihood that incumbent directors will retain their positions. In addition, under our amended and restated bylaws, directors may be removed only for cause and only by

8

Table of Contents

the affirmative vote of the holders of at least 80% of the voting power of our then outstanding shares of capital stock entitled to vote generally in the election of directors, voting together as a single class.

Our amended and restated bylaws also provide that stockholders may only act at meetings of stockholders and not by written consent in lieu of a stockholders’ meeting. Our amended and restated bylaws provide that stockholders may not call a special meeting of stockholders. Rather, only the Chairman of our Board, the President or the Board of Directors pursuant to a resolution approved by a majority of the entire Board of Directors are able to call special meetings of stockholders. Our amended and restated bylaws also provide that stockholders may only conduct business at special meetings of stockholders that was specified in the notice of the meeting. These provisions may discourage another person or entity from making a tender offer, even if it acquired a majority of our outstanding voting stock, because the person or entity could only take action at a duly called stockholders’ meeting relating to the business specified in the notice of meeting and not by written consent.

Indemnification of Directors and Officers

Nevada Revised Statutes, or NRS, Sections 78.7502 and 78.751 provide us with the power to indemnify any of our directors, officers, employees and agents. The person entitled to indemnification must have conducted himself in good faith, and must reasonably believe that his conduct was in, or not opposed to, our best interests. In a criminal action, the director, officer, employee or agent must also not have had reasonable cause to believe that his conduct was unlawful. In addition, any of our directors, officers, employees or agents are entitled to indemnification if such person is successful on the merits or otherwise in defense of any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative against actual and reasonable expenses incurred in connection with defending such action.

Under NRS Section 78.751, advances for expenses may be made by agreement if the director or officer affirms in writing to repay the expenses if it is determined that such officer or director is not entitled to be indemnified.

Our bylaws include an indemnification provision under which we have the power to indemnify our directors, officers, former directors and officers, employees and other agents (including heirs and personal representatives) against all costs, charges and expenses actually and reasonably incurred, including an amount paid to settle an action or satisfy a judgment to which a director or officer is made a party by reason of being or having been a director or officer of ours. Our bylaws further provide for the advancement of all expenses incurred in connection with a proceeding upon receipt of an undertaking by or on behalf of such person to repay such amounts unless it is determined that the party is entitled to be indemnified under our bylaws. No advance will be made by us to a party if it is determined that the party acted in bad faith. These indemnification rights are contractual, and as such will continue as to a person who has ceased to be a director, officer, employee or other agent, and will inure to the benefit of the heirs, executors and administrators of such a person. Unless our articles are amended to provide for greater liability, neither our directors nor officers are individually liable to us or our stockholders or creditors for any act or omission as a director or officer unless it is proven that: (i) such act or omission constituted a breach of such director’s or officer’s fiduciary duties; and (ii) such breach involved intentional misconduct, fraud or a knowing violation of law. These provisions may be sufficiently broad to indemnify such persons for liabilities arising under the Securities Act, in which case such provisions are against public policy as expressed in the Securities Act and are therefore unenforceable.

We maintain an insurance policy on behalf of our directors and officers, covering certain liabilities which may arise as a result of the actions of the directors and officers.

We have entered into an indemnification agreement with each of our officers and directors pursuant to which they will be indemnified by us, subject to certain limitations, for any liabilities incurred by them in connection with their role as officers and/or directors of ours.

9

Table of Contents

EXPERTS

The consolidated financial statements of InVivo Therapeutics Holdings Corp. and subsidiary as of December 31, 2018 and 2017 and for each of the years in the two-year period ended December 31, 2018 incorporated in this Prospectus by reference from the InVivo Therapeutics Holdings Corp.’s Annual Report on Form 10-K for the year ended December 31, 2018, have been audited by RSM US LLP, an independent registered public accounting firm, as stated in their report thereon (which report expresses an unqualified opinion and includes an explanatory paragraph relating to InVivo Therapeutics Holdings Corp.’s ability to continue as a going concern), incorporated herein by reference, and have been incorporated in this Prospectus and Registration Statement in reliance upon such report and upon the authority of such firm as experts in accounting and auditing.

LEGAL MATTERS

The validity of the securities in respect of which this reoffer prospectus is being delivered has been passed upon by Ballard Spahr LLP, Las Vegas, Nevada.

10

Table of Contents

REOFFER PROSPECTUS

116,500 Shares of Common Stock

November 12, 2019

Table of Contents

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The registrant is subject to the informational and reporting requirements of Sections 13(a), 14, and 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and in accordance therewith files reports, proxy statements and other information with the Securities and Exchange Commission, or the Commission. The following documents, which are on file with the Commission, are incorporated in this registration statement by reference:

(a) The registrant’s latest annual report filed pursuant to Section 13(a) or 15(d) of the Exchange Act or the latest prospectus filed pursuant to Rule 424(b) under the Securities Act that contains audited financial statements for the registrant’s latest fiscal year for which such statements have been filed.

(b) All other reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by the document referred to in (a) above.

(c) The description of the securities contained in the registrant’s registration statement on Form 8-A filed under the Exchange Act, including any amendment or report filed for the purpose of updating such description.

All documents subsequently filed by the registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this registration statement and to be part hereof from the date of the filing of such documents. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this registration statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this registration statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Ballard Spahr LLP has opined as to the legality of the securities being offered by this registration statement.

Item 6. Indemnification of Directors and Officers.

Our articles of incorporation require that we indemnify our officers, directors, employees, and agents to the full extent permitted by the laws of the State of Nevada. Nevada Revised Statutes, or NRS, Sections 78.7502 and 78.751 provide us with the power, and subject to certain conditions, the obligation to indemnify any of our directors, officers, employees and agents. The person entitled to indemnification must either not be liable for a breach of a fiduciary duty, pursuant to NRS Section 78.138, or have conducted himself in good faith, and must reasonably believe that his conduct was in, or not opposed to, our best interests. In a criminal action, the director, officer, employee or agent must not have had reasonable cause to believe that his conduct was unlawful.

In addition, any of our directors, officers, employees or agents are entitled to indemnification if such person is successful on the merits or otherwise in defense of any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative against actual and reasonable expenses incurred in connection with defending such action.

Under NRS Section 78.751, advances for expenses may be made by agreement if the director or officer affirms in writing to repay the expenses if it is determined by a court of competent jurisdiction that such officer or director is not entitled to be indemnified.

II- 1

Table of Contents

Our bylaws include an indemnification provision, supplementing such similar provisions under our articles of incorporation and the indemnification agreements we entered into with each of our officers and directors, under which we have the power to indemnify our directors, officers, former directors and officers, employees and other agents (including heirs and personal representatives) against all costs, charges and expenses actually and reasonably incurred, including an amount paid to settle an action or satisfy a judgment to which a director or officer is made a party by reason of being or having been a director or officer of the Company, except to the extent it is determined by a court of competent jurisdiction after exhaustion of all appeals therefrom in such action that such person was liable for gross negligence or willful misconduct. Our bylaws further provide for the advancement of all expenses incurred in connection with a proceeding upon receipt of an undertaking by or on behalf of such person to repay such amounts unless it is determined that the party is entitled to be indemnified under our bylaws. These indemnification rights are contractual, and as such will continue as to a person who has ceased to be a director, officer, employee or other agent, and will inure to the benefit of the heirs, executors and administrators of such a person. Unless our articles are amended to provide for greater liability, neither our directors nor officers are individually liable to us or our stockholders or creditors for any act or omission as a director or officer unless it is proven that: (i) such act or omission constituted a breach of such director’s or officer’s fiduciary duties; and (ii) such breach involved intentional misconduct, fraud or a knowing violation of law. These provisions may be sufficiently broad to indemnify such persons for liabilities arising under the Securities Act of 1933, as amended, in which case such provisions are against public policy as expressed such Act and are therefore unenforceable.

We maintain an insurance policy on behalf of our directors and officers, covering certain liabilities which may arise as a result of the actions of the directors and officers.

We have entered into an indemnification agreement with each of our officers and directors pursuant to which they will be indemnified by us, subject to certain limitations, for any liabilities incurred by them in connection with their role as officers or directors of the Company.

Item 7. Exemption from Registration Claimed.

The securities that are to be reoffered or resold pursuant to the reoffer prospectus were exempt from registration under the Securities Act in reliance upon Section 4(a)(2) of the Securities Act as transactions not involving any public offering.

Item 8. Exhibits.

|

Exhibit

Number

|

|

Description of Exhibit

|

|

4.1

|

|

Articles of Incorporation of InVivo Therapeutics Holdings Corp., as amended (incorporated by reference from Exhibit 3.1 to the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2016, as filed with the SEC on August 4, 2016)

|

|

|

|

|

|

4.2

|

|

Certificate of Change Pursuant to NRS 78.209 filed with Nevada Secretary of State, dated April 13, 2018 (incorporated by reference from Exhibit 3.1 to the Company’s Current Report on Form 8-K, as filed with the SEC on April 16, 2018)

|

|

|

|

|

|

4.3

|

|

Certificate of Amendment to Articles of Incorporation of InVivo Therapeutics Holdings Corp. (incorporated by reference from Exhibit 3.1 to the Company’s Current Report on Form 8-K, as filed with the SEC June 1, 2018)

|

|

|

|

|

|

4.4

|

|

Amended and Restated Bylaws of InVivo Therapeutics Holdings Corp. (incorporated by reference from Exhibit 3.1 to the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2016, as filed with the SEC on May 6, 2016)

|

|

|

|

|

|

5.1+

|

|

Opinion of Ballard Spahr LLP, counsel to InVivo Therapeutics Holdings Corp.

|

|

|

|

|

|

23.1

|

|

Consent of Ballard Spahr LLP (included in Exhibit 5.1)

|

II- 2

Table of Contents

+ Filed herewith

Item 9. Undertakings.

1. The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (i) and (ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the

II- 3

Table of Contents

registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

II- 4

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Cambridge, Commonwealth of Massachusetts, on November 12, 2019.

|

|

INVIVO THERAPEUTICS HOLDINGS CORP.

|

|

|

|

|

|

|

By:

|

/s/ RICHARD TOSELLI, M.D.

|

|

|

|

Richard Toselli, M.D.

|

|

|

|

President and Chief Executive Officer

|

SIGNATURES AND POWER OF ATTORNEY

We, the undersigned officers and directors of InVivo Therapeutics Holdings Corp., hereby severally constitute and appoint Richard Toselli and Richard Christopher, and each of them singly, our true and lawful attorneys with full power to either of them, and to each of them singly, to sign for us and in our names in the capacities indicated below the registration statement on Form S-8 filed herewith and any and all subsequent amendments to said registration statement and generally to do all such things in our names and on our behalf in our capacities as officers and directors to enable InVivo Therapeutics Holdings Corp. to comply with the provisions of the Securities Act of 1933, as amended, and all requirements of the Securities and Exchange Commission, hereby ratifying and confirming our signatures as they may be signed by our said attorneys, or any of them, to said registration statement and any and all amendments thereto.

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Richard Toselli

|

|

President, Chief Executive Officer and

|

|

November 12, 2019

|

|

Richard Toselli, M.D.

|

|

Director (Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Richard Christopher

|

|

Chief Financial Officer and Treasurer

|

|

November 12, 2019

|

|

Richard Christopher

|

|

(Principal Financial and Accounting Officer)

|

|

|

|

|

|

|

|

|

|

/s/ C. Ann Merrifield

|

|

Chair of the Board

|

|

November 12, 2019

|

|

C. Ann Merrifield

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Daniel R. Marshak

|

|

Director

|

|

November 12, 2019

|

|

Daniel R. Marshak

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Christina Morrison

|

|

Director

|

|

November 12, 2019

|

|

Christina Morrison

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Richard J. Roberts

|

|

Director

|

|

November 12, 2019

|

|

Richard J. Roberts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director

|

|

|

|

Robert J. Rosenthal

|

|

|

|

|

II- 5

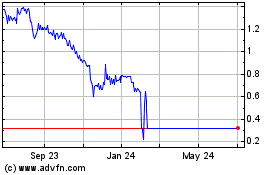

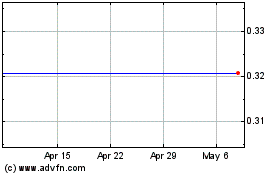

InVivo Therapeutics (NASDAQ:NVIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

InVivo Therapeutics (NASDAQ:NVIV)

Historical Stock Chart

From Apr 2023 to Apr 2024