InterDigital Issues Expense Guidance for Second Quarter 2021

June 17 2021 - 8:30AM

InterDigital, Inc. (NASDAQ:IDCC), a mobile and video technology

research and development company, today provided expense guidance

for second quarter 2021.

In order to increase focus on core technologies

and markets, the company anticipates taking a non-recurring, net

charge of approximately $28-$32 million, with approximately

two-thirds of the charge expected to be recognized in second

quarter 2021 and the remaining one-third expected to be recognized

in second half 2021. This charge includes a $12-14 million non-cash

impairment associated with a consolidated partially owned

subsidiary’s anticipated disposal of assets. Beginning in fourth

quarter 2021, the company expects these actions will drive annual

operating expense savings of approximately $15 million prior to any

reinvestments.

As a result of the above non-recurring, net

charge, the company expects total second quarter 2021 operating

expenses to be $91-96 million.

About InterDigital®

InterDigital develops mobile and video technologies that are at

the core of devices, networks, and services worldwide. We solve

many of the industry's most critical and complex technical

challenges, inventing solutions for more efficient broadband

networks, better video delivery, and richer multimedia experiences

years ahead of market deployment. InterDigital has licenses and

strategic relationships with many of the world's leading technology

companies. Founded in 1972, InterDigital is listed on NASDAQ and is

included in the S&P SmallCap 600® index.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended. Such statements include information regarding the

company’s current expectations with respect to second quarter 2021

revenue. Words such as “expects,” “projects,” “forecasts,”

“anticipates,” and variations of such words or similar expressions

are intended to identify such forward-looking statements.

Forward-looking statements are subject to risks and

uncertainties. Actual outcomes could differ materially from those

expressed in or anticipated by such forward-looking statements due

to a variety of factors, including, but not limited to: (i) the

outcome of discussions with the works council in France; (ii) the

entry into additional patent license, patent sales or technology

solutions agreements; (iii) the accuracy of market sales

projections of the company’s licensees or our estimates of sales by

our per-unit licensees; (iv) delays in payments from our licensees;

(v) amounts of royalties payable following routine audits, if any,

and the timely receipt of such amounts; (vi) the timing, expenses,

and outcome of the company’s litigation and arbitration proceedings

and the timely receipt of any related awards; (vii) new

developments in the company’s litigation or arbitration

proceedings; and (viii) the potential effects that the ongoing

COVID-19 pandemic could have on our financial position, results of

operations and cash flows. We undertake no duty to update publicly

any forward-looking statement, whether as a result of new

information, future events or otherwise except as may be required

by applicable law, regulation or other competent legal

authority.

InterDigital is a registered trademark of InterDigital, Inc.

For more information, visit: www.interdigital.com.

InterDigital Contact:Tiziana

FiglioliaEmail: tiziana.figliolia@interdigital.com+1 (302)

300-1857

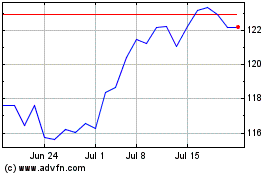

InterDigital (NASDAQ:IDCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

InterDigital (NASDAQ:IDCC)

Historical Stock Chart

From Apr 2023 to Apr 2024