UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☑ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a- 6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material under §240.14a-12

|

INTERDIGITAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Dear shareholder,

InterDigital, Inc. is asking for your support at our 2020 Annual Meeting of Shareholders by voting in favor of all proposals. This supplement

contains information to complement the Compensation Discussion & Analysis section of our Proxy Statement dated April 17, 2020. We are providing this information to help you evaluate our executive compensation program with the benefit

of additional context, particularly with respect to the pre-defined performance metrics and rigorous goals employed in our annual short term incentive plan (“STIP”) and our long-term compensation

program (“LTCP”).

2019 Year in Review

As you probably know, last year was the culmination of a long and productive strategic journey for the company, punctuated by the sale of

Hillcrest Laboratories and the acquisition of Technicolor’s intellectual property licensing business and R&I research & development organization. That journey transformed the company from one focused on a single technology –

wireless – in a single market, cellular devices, to one focused on wireless, video and related technologies (like AI) and operating in two major markets: cellular devices and consumer electronics devices.

That is a very exciting and valuable opportunity; and we are already seeing the results. Over the past six months we have signed six new

licenses agreements, including one with Huawei, a market leader in smartphones. In doing so we have grown our revenue platform by nearly 20%. We have built a strong pipeline of licensing opportunities and have continued to drive new innovation, in

wireless, video, AI and machine learning technologies. And we have also already delivered on our cost goal, achieving two consecutive quarters with costs at our 2017 levels.

In short, we have transformed the company, and done so in a very valuable way. We are seeing the results and intend to hold our executives

responsible for executing on the strategy driving this transformation.

Executive Compensation Philosophy

As described in our Proxy Statement, the primary objective of our executive compensation program is to attract, retain, and motivate executive

officers that can drive our business forward effectively, and to align the compensation of these executives with the outcomes that our shareholders experience. The Compensation Committee holds our executives to rigorous expectations each year, and

their compensation depends on how well they meet those expectations.

When we look back over how our compensations programs performed in

furtherance of those objectives, we are confident that our Compensation Committee has put incentives in place that are effective in aligning our executives with shareholders – both when the company performs well, and when we fall below our own

expectations. We further believe that this supplementary disclosure will provide you with additional insight into how those incentive structures function, and confirm that our Compensation Committee is committed to creating effective executive

compensation programs that are well-aligned with the long term interests of you, our shareholders.

We believe that our executive

compensation program achieves our compensation objectives and is aligned with the interests of shareholders. Accordingly, we ask our shareholders to vote “FOR” Proposal 2: Advisory Resolution to Approve Executive Compensation.

InterDigital has consistently demonstrated pay and performance alignment

Each year, our Compensation Committee strives to develop an executive compensation framework that aligns our executives with the long-term

interests of our shareholders by rewarding executives with above-target compensation when they deliver performance that our Compensation Committee believes will lead to long-term value creation, and below-target compensation when they fall short of

expectations.

Over time, that pay-for-performance

framework has been shown to be effective. Shareholder returns were down in 2019, and by design, realized compensation for our CEO significantly lagged target granted compensation in 2019 as shown in the chart below. Of the long-term,

performance-based equity granted in 2017 (which measured its performance period at the end of 2019), no compensation was ultimately earned by our executives.

Overall Compensation Plan Design Philosophy

At a high level, the company uses three compensation components to attract, retain and appropriately reward its executives. The first is base

pay which obviously is not affected by performance in any year. The next two components – short term incentive pay, or STIP, and long-term incentive pay, or LTCP, – are impacted by performance and represent the vast majority of executive

compensation. These two components are based on different objectives:

|

|

•

|

|

STIP (the smaller of the two incentive pay vehicles) is tied to the achievement of operational and strategic

goals that build long term value. While these goals vary from year to year, they tend to focus on things like innovation, customer pipeline development, management team development, and business integration and transformation.

|

|

|

•

|

|

LTCP focuses entirely on the actual realization of that long-term value, measured through objective things like

cash flow, revenue and profitability achieved over the performance period of the plan. So, if the company performs well over that period, the long-term compensation will pay out; if the company does not meet the goals, then the plans do not pay,

regardless of the reason for lack of goal achievement.

|

Short-Term Incentive Plan

As disclosed in our proxy, STIP is designed to provide an annual cash reward for the achievement of corporate goals and individual

accomplishments during each fiscal year. Individual STIP payouts are determined based on performance against pre-determined strategic corporate goals and

pre-determined individual goals. The following disclosure provides additional details on the mechanics of program construction, payout calculation, metric achievement, and individual performance contributions.

Each executive’s target STIP opportunity is based on a percentage of their base salary. As disclosed in the Grants of Plan Based

Awards table, each executive’s actual payout can range between 0 percent and 200 percent of their target opportunity. The target STIP opportunity for each Named Executive Officer, expressed as a percentage of base salary, is as

follows:

|

|

|

|

|

|

|

NEO

|

|

2019 Target STIP Level

|

|

|

William J. Merritt

|

|

|

100

|

%

|

|

Richard J. Brezski

|

|

|

75

|

%

|

|

Jannie K. Lau

|

|

|

75

|

%

|

|

Kai O. Öistämö

|

|

|

100

|

%

|

Our STIP program is structured with two equally weighted portions: a corporate achievement component, and a

personal performance component. The corporate achievement component is based on the company’s achievement against pre-determined financial, strategic, and operational goals (detailed in this supplemental

filing). The personal performance component is further detailed below. The STIP payout is determined using the following methodology:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate Achievement

50% of Target STIP Amount

X

Corporate Strategic Goal Achievement

(0%-200%)

|

|

+

|

|

Personal Performance

50% Target STIP Amount

X

Personal Performance

Achievement

(0%-200%)

|

|

=

|

|

STIP Payout

|

Corporate Achievement Measured Against Rigorous Corporate Strategic Goals

The corporate achievement portion of the STIP is based on pre-determined metrics and rigorous goals.

These goals are intended to drive those components of the business that will deliver long term value over time. Each goal other than the Compensation Committee discretion goal had objectives defined and communicated to plan participants during the

first quarter of the fiscal year. The table below describes the components of the Corporate Achievement portion of the STIP.

|

|

|

|

|

|

|

|

|

Goal

(Target metric

weight)

|

|

Description

|

|

Objectives

|

|

Payout Mechanics

|

|

Core Exit Revenue

(20%)

|

|

Achieve specified amount of expected revenues over the following 12-month period based on existing contracts / relationships

|

|

[Target Range1] increase in estimated

contracted revenue for 2020 based on new contracts and renewals signed in 2019; excludes CE revenue (to prevent double-counting). Because InterDigital’s

revenue model involves a limited number of negotiations, many of which are significant enough to individually impact goal achievement, the company does not publicly disclose revenue-based goals.

|

|

Bonus element only pays if there is an increase in estimated 2020 contract revenue; if revenue holds constant or declines, no bonus will be

earned through this metric.

Threshold for this goal is the previous year actual

achievement; payout at threshold is 0%.

Payout increases pro-rata until target range is achieved. Up to 200% of target available for achieving double the revenue growth represented by the target range.

|

|

|

|

|

|

|

CE (Consumer Electronics) Exit Revenue

(10%)

|

|

Achieve specified amount of consumer electronics revenues over the following 12-month period based on existing contracts / relationships

|

|

[Target Range1] increase in estimated CE revenue for 2020 based on new contracts and renewals signed in 2019. Because InterDigital’s revenue model

involves a limited number of negotiations, many of which are significant enough to individually impact goal achievement, the company does not publicly disclose revenue-based goals.

|

|

Bonus element only pays if there is an increase in estimated 2020 CE revenue; if revenue holds constant or declines, no bonus will be earned

through this metric.

Threshold for this goal is the previous year actual

achievement; payout at threshold is 0%.

Payout increases pro-rata until target range is achieved. Up to 200% of target available for achieving double the revenue growth represented by the target range.

|

|

|

|

|

|

|

Business

Integration

(10%)

|

|

Successfully execute advancement of culture project; successfully advance system infrastructure optimization

|

|

System infrastructure optimization

• Overall pro forma expenses at 2017 levels plus wage inflation

• Core terminal unit pro

forma expenses at 2017 levels plus wage inflation

Other

Goals:

• Execute

on 2019 R&I collaboration and/or acquisition project plan

• Successfully execute the Patent Platform project

• Successful initial

deployment of a global, unified intellectual property management system (Unycom) as a replacement for the TCH legacy systems on or prior to 7/31/19

|

|

Bonus element pays out if specific pre-defined strategic accomplishments are achieved. Partial payouts available for accomplishing portions of the Business Integration

goals.

|

|

1

|

A range was selected for the target for both Core Exit Revenue and Consumer Electronics (CE) Exit Revenue,

rather than a point measure, due to the historic volatility of these measures as a result of the size of each individual contract. Those ranges are not disclosed because we believe doing so would create competitive harm as prospective licensees

(particularly large ones) could view the executives as under financial pressure to conclude a license agreement in a particular year and exploit the same

|

|

|

|

|

|

|

|

|

|

Business Transformation

(20%)

|

|

Successfully execute against integration objectives related to acquisition

|

|

• Continuation of culture work with an enhanced focus on global mindset

• Successful execution and

progress on China expansion

• Systems/Infrastructure/Process optimization to support globalization

• Video R&D capability

building/buying

• Business Integration/Optimization including executing strategic alternatives

• Leadership & overall organization capabilities obtained/integrated to

meet forward-looking objectives

• Successful buildout of an integrated communications/marketing function focused on China

• Successful buildout of a

Video R&D focused integrated communications/marketing offering

|

|

Bonus element pays out if specific pre-defined strategic accomplishments are achieved.

A scorecard approach was adopted for this metric, with each component equally weighted

but individually evaluated at the end of the performance period.

|

|

|

|

|

|

|

Innovation

(20%)

|

|

Generate specified numbers of patent filings as well as contributions to 5G, video and other standards; achieve external recognition of innovation success

|

|

• 5G/Video and other key standards contribution and objectively measured IPR

generation success

• Define and execute CTO roadmap process – staffing, collaboration with R&D,

collaboration with outside experts, and internal dissemination

• Execute in new technology areas driven by CTO roadmap via organic projects, continuing

collaboration with high performing partners, & new collaboration with internationally recognized laboratories/experts

• Innovation awards and third-party validation from industry-recognized expert sources.

• Industry/media recognition

as measured by: Speaking slots, leadership roles, testbed/demos, publications, EU and other project wins

• Execution on specific partner commitments

|

|

Bonus element pays out if specific pre-defined strategic accomplishments are achieved.

A scorecard approach was adopted for this metric, with each component equally weighted

but individually evaluated at the end of the performance period.

|

|

|

|

|

|

Compensation Committee Discretion

(20%)

|

|

Allow Compensation Committee to adjust performance upward or downward as a result of unexpected outcomes or circumstances

|

|

Bonus component pays out based on overall subjective evaluation of company performance.

|

Actual achievement against each of these performance goals was determined at the conclusion

of the fiscal year. The following table contains details of the achievement of each of the components of the STIP, along with the payout assigned to each component according to its level of achievement:

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate Strategic Goals

Outcomes

|

|

Goal

(Target metric

weight)

|

|

Threshold

Payout

|

|

Target

Payout

|

|

Maximum

Payout

|

|

Achievement

|

|

Component Payout

|

|

Core Exit Revenue

(20%)

|

|

0%

|

|

20%

|

|

40%

|

|

Increase in Core Exit revenue over 2019 of approximately 20% of target range

|

|

4%

|

|

|

|

|

|

|

|

|

CE (Consumer Electronics) Exit Revenue

(10%)

|

|

0%

|

|

10%

|

|

20%

|

|

Increase in CE revenue over 2019 of approximately 20% of target range

|

|

2%

|

|

|

|

|

|

|

|

|

Business Integration

(10%)

|

|

0%

|

|

10%

|

|

20%

|

|

Exceeded the expense goal pre-R&I acquisition

On target for post-R&I acquisition

adjusted expense goal

Completed Unycom project on schedule (integration

of TCH patent licensing platform)

|

|

10%

|

|

|

|

|

|

|

|

|

Business Transformation

(20%)

|

|

0%

|

|

20%

|

|

40%

|

|

Achievement on each goal is provided in parenthesis following the goal description:

• Continuation of culture work

with an enhanced focus on global mindset (100%)

• Successful execution and progress on China expansion (0%)

• Systems/Infrastructure/Process optimization to support globalization (100%)

• Video R&D capability

building/buying (75%)

• Business Integration/Optimization including executing strategic alternatives (80%)

• Leadership & overall

organization capabilities obtained/integrated to meet forward-looking objectives (100%)

• Successful buildout of an integrated communications/marking function focused on China (0%)

• Successful buildout of a

Video R&D focused integrated communications/marketing offering (125%)

|

|

14%

|

|

|

|

|

|

|

|

|

Innovation

(20%)

|

|

0%

|

|

20%

|

|

40%

|

|

Achievement on each goal is provided in parenthesis following the goal description:

• 5G/Video and other key

standards contribution and IPR generation success as measured by specific quantitative goals. (110%)

|

|

21%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• Define and execute CTO roadmap process – staffing, collaboration with

R&D, collaboration with outside experts, and internal dissemination (90%)

• Execute in new technology areas driven by CTO roadmap via organic projects, continuing

collaboration with high performing partners, & new collaboration with internationally recognized laboratories/experts (78%)

• Innovation awards and third-party validation from industry-recognized expert sources. (100%)

• Industry/media recognition as

measured by: Speaking slots, leadership roles, testbed/demos, publications, EU and other project wins (121%)

• Execution on specific partner commitments (118%)

|

|

|

|

|

|

|

|

|

|

|

Compensation Committee Discretion

(20%)

|

|

0%

|

|

20%

|

|

40%

|

|

Key considerations included:

HEVC and CE business negotiations:

For two major negotiations, we saw measurable value given to the HEVC portfolio. On the CE side, an addition of a TV customer late in 2019.

Government Relations Strength: Given a variety of global trade

issues, we saw the strength of the government relations team (which extends beyond that staff), including specific efforts that directly supported licensing success.

Organizational Strength: We drew on our bench a number of times during the year following the retirement of some long-term employees.

In each instance, we were able to transition the role so seamlessly, speaking to organizational strength.

|

|

20%

|

|

|

|

|

|

|

|

Overall Corporate Achievement

|

|

0%

|

|

100%

|

|

200%

|

|

71%

|

NEO Personal Performance Rigorously Evaluated

The second component of the STIP is based on the Compensation Committee’s evaluation of each NEO’s achievement against their

individual objectives during the year. This evaluation was conducted by the Compensation Committee and for the CEO included input from the full Board of Directors Despite strong operational and strategic performance in 2019, no executive received an

above-target payout based on personal performance due to the Compensation Committee’s practice of aligning executive outcomes with shareholder outcomes.

The Personal Performance component of each NEO’s STIP is based on pre-established criteria and

evaluated by the Compensation Committee at the end of the year. For the CEO, the Compensation Committee considered the Board’s assessment of performance, as reflected in the assessment of the

non-executive Chairman of the Board. For 2019, Mr. Merritt was assessed on performance on the following goals:

|

|

|

|

|

|

|

|

|

Goal

|

|

Weight

|

|

Performance Against Objectives

|

|

Outcome

|

|

Formulate Strategy

|

|

15%

|

|

In 2019, InterDigital completed its transformation from a single-technology company in a single market to a company with two major technology positions, more diversified and stronger R&D efforts, multiple markets and more ways

to engage with key customers.

|

|

15%

|

|

|

|

|

|

|

Position the Brand to Important Constituencies

|

|

10%

|

|

In 2019, Mr. Merritt and the Company navigated a challenging geopolitical environment and changing technical landscape, both with specific companies and in standards bodies, and established itself as a recognized

problem-solving brand in both 5G and video.

|

|

10%

|

|

|

|

|

|

|

Implement Strategy

|

|

20%

|

|

Mr. Merritt led the effort to maintain growth in the core business while integrating the Technicolor acquisitions, resolving China expansion,

successfully concluding litigation, maintaining expenses, and generating early results on the consumer electronics initiatives.

Component paid below target (50% of target) due to revenue and EBITDA performance below Board expectations.

|

|

10%

|

|

|

|

|

|

|

Transform Business Character and Customer Base

|

|

15%

|

|

By guiding and executing InterDigital’s evolution from a single-technology company with niche positions outside its core area to a strong multi-technology player with a greatly expanded R&D engine, Mr. Merritt positioned

the company to now credibly address multiple markets while maintaining strength in its core business.

|

|

15%

|

|

|

|

|

|

|

Leadership Development and Succession Planning

|

|

20%

|

|

In 2019, the Company’s diligent efforts focused on leadership development and succession planning bore fruit. The year saw multiple retirements of long-term executive staff, and careful succession planning enabled us to utilize

bench strength and allowed for virtually seamless transitions in these senior roles. Particularly notable given company’s relatively small employee count.

|

|

20%

|

|

|

|

|

|

|

Execute and Integrate Acquisition

|

|

20%

|

|

In 2019, InterDigital executed on this capability through our Technicolor R&A acquisition – the second of two transaction to expand the business. Mr. Merritt led the successful effort to complete due diligence.

Post-acquisition, the planning and execution of integration to capture synergies is on target, with integration of secondary areas underway.

|

|

20%

|

|

|

|

|

Total Personal Performance:

|

|

90%

|

Each NEO other than the CEO, received a similar assessment, with the performance evaluation performed by

Mr. Merritt. After completing the evaluations, the Compensation Committee determined that the achievement against objectives for each executive was as follows:

|

|

|

|

|

Named Executive Officer

|

|

Personal Performance

Factor (0%-200%)

|

|

William J. Merritt

|

|

90%

|

|

Richard J Brezski

|

|

90%

|

|

Jannie K. Lau

|

|

N/A2

|

|

Kai O. Öistämö

|

|

100%

|

|

2

|

Ms. Lau did not receive a payout under the 2019 STIP because her retirement date of December 31, 2019

was prior to the payout date; therefore, she was ineligible for payment pursuant to the STIP

|

STIP Payout Calculation

Using the formula presented above, the payout for each executive was based on both Corporate Achievement and Personal Performance. The

following table lays out the calculations for each Named Executive Officer for 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Named

Executive

Officer

|

|

2019 Base

Salary

($)

|

|

Target

bonus as

percentage

of

base

salary

|

|

Corporate

Achievement

(applies to

50% of

target

award)

|

|

Personal

Performance

(applies to

50% of

target

award)

|

|

Overall

achievement

as % of

target

|

|

Target

bonus

($)

|

|

Actual

Bonus

($)

|

|

Merritt

|

|

690,000

|

|

100%

|

|

71%

|

|

90%

|

|

81%

|

|

690,000

|

|

555,450

|

|

Brezski

|

|

402,500

|

|

75%

|

|

71%

|

|

90%

|

|

81%

|

|

301,875

|

|

243,009

|

|

Lau

|

|

390,988

|

|

75%

|

|

71%

|

|

N/A

|

|

N/A

|

|

293,241

|

|

—

|

|

Öistämö

|

|

609,000

|

|

100%

|

|

71%

|

|

100%

|

|

86%

|

|

609,000

|

|

520,695

|

As disclosed in our proxy, based on company performance and the Compensation Committee’s consideration of

shareholder outcomes, each executive earned a below-target payout on their STIP.

Long-Term Compensation Program

Compensation Committee is committed to performance-based compensation for executives; at least half of the CEO’s outstanding LTCP awards are strictly

performance-conditioned.

Performance-based long-term compensation is an important part of our compensation program and reinforces our

Compensation Committee’s pay-for-performance philosophy. We view performance-based long-term compensation as encompassing both performance-based restricted stock

units (“PSUs”) as well as stock options. While we understand conflicting viewpoints on the performance incentive nature of stock options, we believe that they provide a powerful addition to the basket of awards that we provided our CEO and

COO in 2019.

From time to time, we issue stock options with performance-based vesting conditions. We did so in 2018 and disclosed those

grants in our proxy statement filed in 2019. We granted performance-based options again earlier this year. The details of those options will be disclosed in next year’s proxy statement. In 2020, one-third

of our CEO’s LTCP grant was made in PSUs, one-third was made in performance-based stock options (both of which will vest based on performance achieved on metrics related to normalized cash flow and

revenue growth), and one-third was made in time-based restricted stock units (“RSUs”). More than half of our CEO’s total outstanding LTCP awards are strictly performance-conditioned, as detailed

in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proportion of CEO LTCP target value granted in:

|

|

|

LTCP Grant

Year

|

|

Performance-

Based Stock

Units

|

|

|

Performance-

Based Stock

Options

|

|

|

Time-Based

Stock

Options

|

|

|

RSUs

|

|

|

2020

|

|

|

33.3

|

%

|

|

|

33.3

|

%

|

|

|

|

|

|

|

33.3

|

%

|

|

2019

|

|

|

33.3

|

%

|

|

|

|

|

|

|

33.3

|

%

|

|

|

33.3

|

%

|

|

2018

|

|

|

33.3

|

%

|

|

|

33.3

|

%

|

|

|

|

|

|

|

33.3

|

%

|

|

|

|

|

|

|

|

3-year Average

|

|

|

33.3

|

%

|

|

|

22.2

|

%

|

|

|

11.1

|

%

|

|

|

33.3

|

%

|

|

|

|

|

|

|

Average Performance Based:

|

|

|

|

55.6

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Time-Based:

|

|

|

|

44.4

|

%

|

|

|

|

|

|

|

|

|

Rigorous adjustment to pro-forma EBITDA metric for 2017 and 2018

performance awards

As disclosed on page 36 of our Proxy Statement, the two Technicolor acquisitions and the divestiture of the

Hillcrest product business in 2019 created significant complexity in calculating a meaningful pro forma EBITDA target, threshold, and maximum goal. Our Compensation Committee modified the 2017 and 2018 performance awards and re-oriented the pro forma EBITDA from a traditional scaling metric to a gating metric.

The updated goal

was set rigorously. The pro forma EBITDA gate goal for the 2017 and 2018 awards was set significantly higher than 2019 actual pro forma EBITDA performance, and at the end of the performance period running from January 1, 2017 through

December 31, 2019 for the 2017 LTCP performance grants, the pro forma EBITDA gate value was not met. The gate prevented any of the 2017 PSUs awards from being earned at this interim measurement period. The awards remain eligible to vest based

on performance measured at the end of the January 1, 2017 through December 31, 2021 performance period. The board did not exercise discretion on these awards.

Competitive harm would result from disclosure of forward-looking LTCP performance goals

Our Compensation Committee believes in being making compensation as transparent as possible, without creating competitive harm to the company

or its shareholders. In years where a LTCP performance period and the company has generated sufficient performance to create a payout, we have disclosed those goals in our proxy. The most recent example of this was in our 2019, 2018, and 2017 proxy

statements, relating to the goals for the 2016, 2015, and 2014 LTCP awards respectively.

We do not disclose the goals for long-term

performance awards that are based on internally facing, absolute performance metrics. Our Compensation Committee believes that this is the market standard practice for these types of awards.

YOUR VOTE IS IMPORTANT, NO MATTER HOW MANY SHARES YOU OWN. WHETHER YOU PLAN TO ATTEND THE

ANNUAL MEETING OR NOT, PLEASE VOTE BY INTERNET, BY TELEPHONE, OR BY MAIL.

WE ASK FOR YOUR SUPPORT ON EACH BALLOT ITEM PRESENTED BASED ON THE RECOMMENDATION OF OUR

BOARD OF DIRECTORS, INCLUDING A VOTE “FOR” PROPOSAL TWO: ADVISORY RESOLUTION TO APPROVE

EXECUTIVE COMPENSATION.

Respectfully,

InterDigital, Inc. Compensation Committee

Jean F. Rankin, Chair

S. Douglas Hutcheson

Philip P. Trahanas

InterDigital 2019 Executive Compensation

May 2020

On June 3, 2020, InterDigital, Inc. will

hold our annual shareholder meeting. Concerns have been raised about our executive compensation program in relation to the upcoming Say-on-Pay vote. We are committed to good disclosure regarding compensation and an open dialogue with investors. We

are providing you with this additional relevant information to assist you in making your Say-on-Pay voting decision. © 2020 InterDigital, Inc. All Rights Reserved Overview

Background: InterDigital’s 2019

Performance InterDigital’s stock has been impacted by China-US trade issues. Since new sanctions were announced by the Trump administration on May 2, 2019, our stock has performed roughly in line with the MCSI China ETF

(CHIX) and the iShares China Large-Cap ETF (FXI). 2019 was about long-term positioning vs. short-term gain. 2019 marked the expansion of our technology and licensing opportunities through M&A, a move intended to provide greater negotiating

strength and open new markets. In fact, this expansion produced results, with 6 licensees signed in 6 months (from Q4 2019 to Q2 2020), including Huawei. Cash flow and revenue not aligned. Changes in operating cash flow reflect

the payment schedules of long-term fixed licenses and do not track with revenues. Further, while IDCC’s operating cash flow can be volatile, absolute performance (measured by dollars and margin) is very strong. © 2020

InterDigital, Inc. All Rights Reserved

Executive Compensation Philosophy Our

Executive Compensation program is intended to hold our executive officers accountable for business results and reward them for strong corporate performance and value creation. It consists of the following: Base salary Annual incentive bonus

(STIP), tied to in-year operational milestones Long term compensation (LTCP), tied to long-term performance Comprised of time-based RSUs, performance-based RSUs and stock options © 2020 InterDigital,

Inc. All Rights Reserved 85% of CEO compensation is variable based on the company’s performance

Compensation Linked to Company Performance

Our compensation structure aligns executive compensation to corporate performance, and our CEO's actual pay in 2019 demonstrates that our compensation programs are working © 2020 InterDigital, Inc. All Rights Reserved Realized

(Actual) Pay – a measure of how much compensation was ultimately banked – is a more accurate indication of pay for performance CEO’s target compensation for 2019 was $4.6m (base salary, target STIP and grant date target value of

the 2019 LTCP). His realized pay, or actual pay, was about a third of that amount, or $1.5m 2019 STIP payed out at 81% of target 2017 LTCP equity grant, which pays for the performance period ending December 31, 2019, vested at 11% of grant date

target value (see annex). Only the time-based vesting portion of the award was realized

Addressing Specific Compensation Concerns

Overall STIP calculation methodology Details on STIP Corporate Strategic Goals Details on STIP Personal Performance Goals Calculations for STIP payouts for each executive Concentration of strictly performance-conditioned awards in our CEO’s

compensation program Conversion of the pro-forma EBITDA metric for 2017 and 2018 performance awards Disclosure of forward-looking long-term performance goals on internal, absolute performance metrics © 2020 InterDigital, Inc.

All Rights Reserved Proxy advisory services have raised a number of questions regarding our compensation programs This document contains additional information, as documented in our supplemental proxy filing, to give more detail on each of

these issues The numbered list corresponds to page headings on subsequent pages to address each area Issues clarified in this document:

1. Short-Term Incentive Program

Calculation STIP payout is based on a calculation that equally weights corporate performance and personal performance Corporate achievement is based on performance against a pre-defined set of rigorous goals Personal performance is assessed

based on delivered achievement against a set of pre-defined criteria © 2020 InterDigital, Inc. All Rights Reserved Corporate Achievement 50% of Target STIP Amount X Corporate Strategic Goal Achievement (0%-200%) Personal Performance

50% of Target STIP Amount X Personal Performance Achievement (0%-200%) + = STIP Payout (0%-200% of target)

2. Corporate Strategic Goals © 2020

InterDigital, Inc. All Rights Reserved Corporate strategic goals hold executives accountable for managing short-term items that the Compensation Committee believes lead to long-term value creation for shareholders 80% of the corporate

strategic goal target is based on objective pre-defined metrics and goals Metrics are in one of three types: Continuous, Scorecard, or Subjective. Each type is illustrated on a subsequent page, and details on each are located in our

supplemental proxy filing. Metric Metric Weight (Target) Metric Type Description Core Exit Revenue 20% Continuous Achieve specified amount of additional expected revenues over the following 12-month period based on existing contracts / relationships

CE (Consumer Electronics) Exit Revenue 10% Continuous Achieve specified amount of additional consumer electronics revenues over the following 12-month period based on existing contracts / relationships Business Integration 10% Scorecard Successfully

execute advancement of culture project; successfully advance system infrastructure optimization Business Transformation 20% Scorecard Successfully execute against integration objectives related to acquisition Innovation 20% Scorecard Generate

specified numbers of patent filings as well as contributions to 5G, video and other standards; achieve external recognition of innovation success Compensation Committee Discretion 20% Subjective Allow Compensation Committee to adjust performance

upward or downward as a result of unexpected outcomes or circumstances

2. Corporate Strategic Goals: Continuous

© 2020 InterDigital, Inc. All Rights Reserved 2019 Actual Core Exit Revenue Payout (Percentage of Target) 2020 Expected Core Exit Revenue Range Double the growth implied by 2020 Expected Core Exit Revenue Range 100% 0% 200% Executives

don’t earn payout until there is revenue growth Actual payout reflected growth below target range Maximum (200% of target) payout would have been received for 200% of target range growth Example: Core Exit Revenue Metric (20% of STIP) Payout

Diagram Core Exit Revenue Objective STIP metrics function exactly as shareholders expect Pre-defined threshold, target range, and maximum values determine potential payouts No payout occurs until revenue exceeds the previous year level

2. Corporate Strategic Goals: Scorecard

© 2020 InterDigital, Inc. All Rights Reserved Example: Business Transformation Metric Scorecard Component Result Continuation of culture work with an enhanced focus on global mindset 100% Successful execution and progress on China

expansion 0% Systems/Infrastructure/Process optimization to support globalization 100% Video R&D capability building/buying 75% Business Integration/Optimization including executing strategic alternatives 80% Leadership & overall

organization capabilities obtained/integrated to meet forward-looking objectives 100% Successful buildout of an integrated communications/marketing function focused on China 0% Successful buildout of a Video R&D focused integrated

communications / marketing offering 125% Overall (Simple Average of 72.5% X Target of 20%) 14% Scorecard STIP metrics contain specific pre-defined and communicated objectives Each factor in the scorecard is weighed equally The Compensation

Committee evaluates completion of each scorecard metric against a defined set of criteria to determine the overall result

2. Corporate Strategic Goals: Subjective

© 2020 InterDigital, Inc. All Rights Reserved 2019 Discretionary STIP Component Considerations The Compensation Committee retains flexibility through a discretionary component This component is designed to be exercised

when formulaic outputs do not adequately reflect business outcomes In 2019, the committee elected not to exercise discretion to deviate from target payout HEVC and CE business negotiations: For two major negotiations, we saw measurable value given

to the HEVC portfolio, On the CE side, we saw the addition of a TV customer late in 2019. Government Relations Strength: Given a variety of global trade issues, we saw the strength of the government relations team (which extends beyond that

staff), including specific efforts that directly supported licensing success. Organizational Strength: We drew on our bench a number of times during the year in response to the retirement of some long-term employees. In each instance, we were

able to transition the role seamlessly.

2. Corporate Strategic Goals: Outcome

© 2020 InterDigital, Inc. All Rights Reserved 2019 Discretionary STIP Component Considerations Corporate Strategic Goal outcome is based on the sum of the results of each individual category Although revenues for both the

core business and the CE business grew, they did not meet goals. The resulting payout aligned shareholders with executives Overall, the Corporate Strategic Goals resulted in a below-target payout for executives Metric Metric Weight (Target)

Description Payout Outcome Core Exit Revenue 20% Achieve specified amount of additional expected revenues over the following 12-month period based on existing contracts / relationships 4% CE (Consumer Electronics) Exit Revenue 10% Achieve specified

amount of additional consumer electronics revenues over the following 12-month period based on existing contracts / relationships 2% Business Integration 10% Successfully execute advancement of culture project; successfully advance system

infrastructure optimization 10% Business Transformation 20% Successfully execute against integration objectives related to acquisition 14% Innovation 20% Generate specified numbers of patent filings as well as contributions to 5G, video and other

standards; achieve external recognition of innovation success 21% Compensation Committee Discretion 20% Allow Compensation Committee to adjust performance upward or downward as a result of unexpected outcomes or circumstances 20% Overall Corporate

Strategic Goal Outcome (on a 0%-200% of target range) 71%

3. Personal Performance © 2020

InterDigital, Inc. All Rights Reserved CEO Personal Performance Objectives and Performance Goal Weight Performance Against Objective Out-come Formulate Strategy 15% In 2019, InterDigital completed its transformation from a

single-technology company in a single market to a company with two major technology positions, more diversified and stronger R&D efforts, multiple markets and more ways to engage

with key customers. 15% Position the Brand to Important Constituencies 10% In 2019, Mr. Merritt and the Company navigated a challenging geopolitical environment and changing technical

landscape, both with specific companies and in standards bodies, and established itself as a recognized problem-solving brand in both 5G and video. 10% Implement Strategy 20% Mr. Merritt

led the effort to maintain growth in the core business while integrating the Technicolor acquisitions, resolving China expansion, successfully concluding litigation, maintaining expenses, and generating early results on the consumer

electronics initiatives. Component paid below target (50% of target) due to revenue and EBITDA performance below Board expectations. 10% Transform Business Character and Customer Base 15% By guiding and

executing InterDigital’s evolution from a single-technology company with niche positions outside its core area to a strong multi-technology player with a greatly expanded R&D engine, Mr. Merritt positioned the

company to now credibly address multiple markets while maintaining strength in its core business. 15% Leadership Development and Succession Planning 20% In 2019, the Company’s diligent efforts focused on leadership

development and succession planning bore fruit. The year saw multiple retirements of long-term executive staff, and careful succession planning enabled us to utilize bench strength and allowed for virtually seamless

transitions in these senior roles. Particularly notable given company’s relatively small employee count. 20% Execute and Integrate Acquisition 20% In 2019, InterDigital executed on this capability through our Technicolor

R&A acquisition – the second of two transaction to expand the business. Mr. Merritt led the successful effort to complete due diligence. Post-acquisition, the planning and execution of integration

to capture synergies is on target, with integration of secondary areas underway. 20% Overall 90% Personal Performance component based on pre-set objectives The Compensation Committee evaluates

performance against the personal objectives at the end of the year No executive received above target payout on the Personal Performance component in 2019

4. Final STIP Calculations ©

2020 InterDigital, Inc. All Rights Reserved All executives earned below-target payouts Final STIP payout calculations for each Named Executive Officer follow the methodology previously described Ms. Lau did not receive a bonus payout due to

her retirement before the payout date Named Executive Officer 2019 Base Salary ($) Target bonus as percentage of base salary Corporate Achieve-ment (applies to 50% of target award) Personal Performance (applies to 50% of target award) Overall

achieve-ment as % of target Target bonus ($) Actual Bonus ($) Merritt 690,000 100% 71% 90% 81% 690,000 555,450 Brezski 402,500 75% 71% 90% 81% 301,875 243,009 Lau 390,988 75% 71% N/A N/A 293,241 N/A Öistämö 609,000 100% 71% 100% 86%

609,000 520,695

5. CEO Performance-Based Compensation

© 2020 InterDigital, Inc. All Rights Reserved A majority of our CEO’s outstanding LTCP awards are in the form of performance-based equity awards In each of 2018 and 2020, one-third of our CEO’s target equity awards has been in

performance-based stock options Over the last three years, an average of 55% of our CEO’s long-term compensation has been granted in performance-based equity Proportion of CEO LTCP target value granted in: LTCP Grant Year

Performance-Based RSUs Performance-Based Stock Options Time-Based Stock Options RSUs 2020 33.3% 33.3% 33.3% 2019 33.3% 33.3% 33.3% 2018 33.3% 33.3% 33.3% 3-year Average 33.3% 22.2% 11.1% 33.3% Average Performance Based: 55.6% Average Time-Based:

44.4%

6. Conversion of Pro Forma EBITDA Metric

© 2020 InterDigital, Inc. All Rights Reserved Our Technicolor acquisitions and the divestiture of the Hillcrest product business in 2019 created significant complexity in calculating a meaningful and rigorous pro forma EBITDA threshold,

target, and max goal. However, profitability level is still important to our Company and to our shareholders. The Compensation Committee decided to convert the pro forma EBITDA goal from a continuous goal (as previously described in this

document) to a gate metric. In the gate metric, a minimum level of pro forma EBITDA had to be achieved in order to earn any value from LTCP performance grants. The pro forma EBITDA gate goal was set rigorously, at a level higher previous year

actual pro forma EBITDA performance. The gate metric was not met for the 2017 LTCP awards; all 2017 performance-based LTCP awards were forfeit due missing the pro forma EBITDA gate.

7. Disclosure of Forward-Looking Goals

© 2020 InterDigital, Inc. All Rights Reserved We believe that disclosing performance goals associated with long-term, absolute, internally-focused goals is inappropriate and could cause us competitive harm When long-term performance

compensation is earned, we clearly disclose the goals that were used to compute the associated payout Proxy-Disclosed Long-Term Performance Goals 2019 Proxy Statement 2018 Proxy Statement 2017 Proxy Statement

Additional Say-on-Pay Considerations

Public Disclosure of Goals Could Affect Negotiating Leverage. InterDigital is a company with a revenue model that relies on challenging, high-stakes, often multi-year negotiations. As a result, while InterDigital's goals are

clearly defined internally and reflected in performance metrics, the company understands that it is in the best interest of shareholders to avoid public disclosure of time-based goals. © 2020 InterDigital, Inc. All

Rights Reserved

Please Vote Your Shares

InterDigital’s compensation programs reflect our pay for performance philosophy and is heavily performance-based We ask: If you haven't voted, we ask that you support our Say-on-Pay proposal If you have already voted against, we ask that you

recast your vote “FOR” our Say-on-Pay proposal Thank you © 2020 InterDigital, Inc. All Rights Reserved

Annex: 2017 LTCP Details

2017 Long Term Compensation Plan In

2017, our CEO was granted equity with a 3 - 5 year performance period (January 1, 2017 through December 31, 2021); the interim measurement period ended December 31, 2019 The 2017 LTCP Equity grant consisted of time-based RSUs, performance-based RSUs

and options Time-based RSUs cliff vested on March 15, 2020; vest date value $269,364 Performance-based RSUs were eligible to vest on March 15, 2020, based on achievement of goals measured at the interim measurement date of December 31, 2019,

reflecting performance over the prior 3-year period; the company did not achieve the threshold pro forma EBITDA goal, as a result, 0% of the 2017 performance-based awards vested Stock options granted as part of the 2017 LTCP vested annually

over the three-year period, however, their strike price is $85.85, so they have zero value Realized value of equity granted under the 2017 LTCP totaled $269,364 or approximately 11% of FMV grant date value of $2,500,000 ©

2020 InterDigital, Inc. All Rights Reserved

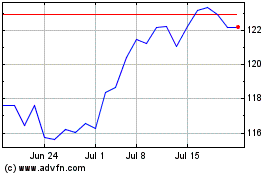

InterDigital (NASDAQ:IDCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

InterDigital (NASDAQ:IDCC)

Historical Stock Chart

From Apr 2023 to Apr 2024