Intercept Pharmaceuticals Announces Summary of Key Actions in Strategic Financial Repositioning

September 21 2022 - 7:30AM

Intercept Pharmaceuticals, Inc. (Nasdaq:ICPT), a

biopharmaceutical company focused on the development and

commercialization of novel therapeutics to treat progressive

non-viral liver diseases, today announced a summary of the actions

it has taken to improve its capital position, including the

recently announced private repurchases of senior secured

convertible notes.

As a result of the following strategic financial moves to

improve its capital structure, Intercept is well-positioned to grow

its existing business in PBC, progress its NASH program, and

advance and expand its pipeline.

- August 2021 Secured Convertible Notes Exchange

- July 1st 2022 Sale of International Business

- August / September 2022 Secured Convertible Notes

Repurchases

The result of these activities has been to lower principal debt

outstanding by 54% or $388.9 million to $336.3 million and decrease

annual cash interest expense by 58% or $13.6 million to $9.8 on an

annual basis. In addition, these activities reduced overall

potential shareholder dilution associated with the secured

convertible notes, which was a key objective.

Intercept used a combination of cash from the sale of its

international business as well as stock to fund the 2022

transactions. The net result has allowed the Company to grow its

cash position to over $500 million, driving an improvement in net

debt (principal debt outstanding minus total cash) of approximately

$450 million.

|

Summary (In USD Millions) |

|

|

6/30/21 |

6/30/22 |

6/30/22 (Adjusted)* |

|

Total Cash** |

422.5 |

412.3 |

> 500.0 |

|

Principal Debt Outstanding |

690.0 |

725.2 |

336.3 |

|

Annual Cash Interest Expense |

19.6 |

23.4 |

9.8 |

|

* Based on Form 10-Q for June 30, 2022, adjusted for subsequent

activities including the sale of the international business (July

1st) and note repurchases (August / September).** Cash, cash

equivalents, restricted cash, and investment debt securities

available for sale. |

“This is a transformational time on several fronts here at

Intercept,” said Jerry Durso, President and Chief Executive Officer

of Intercept. “Now, through this series of strategic financial

transactions, we have transformed our capital structure and are

well positioned for the future. We are net debt positive for the

first time since 2019 and have the financial flexibility to propel

our business forward focusing on our core strategic imperatives of

growing our PBC franchise, progressing our NASH development

program, and advancing our pipeline products.”

About InterceptIntercept is a biopharmaceutical

company focused on the development and commercialization of novel

therapeutics to treat progressive non-viral liver diseases,

including primary biliary cholangitis (PBC) and nonalcoholic

steatohepatitis (NASH). For more information, please

visit www.interceptpharma.com or connect with the company

on Twitter and LinkedIn.

Contact For more information about Intercept,

please contact:

For investors: Nareg Sagherian, Executive Director, Global

Investor Relations Investors@interceptpharma.com

For media: Karen Preble, Executive Director, Global

Corporate Communications Media@interceptpharma.com

Intercept Pharmaceuticals (NASDAQ:ICPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

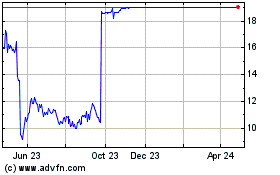

Intercept Pharmaceuticals (NASDAQ:ICPT)

Historical Stock Chart

From Apr 2023 to Apr 2024