As filed with the Securities and Exchange

Commission on May 21, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

INSMED

INCORPORATED

(Exact name of Registrant as specified in

its charter)

Virginia

(State or other jurisdiction of

incorporation or organization)

|

54-1972729

(I.R.S. Employer

Identification Number)

|

700 US Highway 202/206

Bridgewater, New Jersey 08807

(908) 977-9900

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

William H. Lewis

Chief Executive Officer

700 US Highway 202/206

Bridgewater, New Jersey 08807

(908) 977-9900

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

|

Copies to:

|

Christine Pellizzari, Esq.

Chief Legal Officer

700 US Highway 202/206

Bridgewater, New Jersey 08807

(908) 977-9900

|

Michael J. Riella

Covington & Burling LLP

One CityCenter

850 Tenth Street, NW

Washington, DC 20001

(202) 662-6000

|

Approximate date of commencement of proposed

sale to the public:

From time to time after this registration

statement becomes effective.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box: ¨

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans,

check the following box: x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering: ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall

become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box:

x

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box: ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x

|

Accelerated filer ¨

|

Non-accelerated filer ¨

|

Smaller

reporting company ¨

Emerging growth company ¨

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ¨

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities

to be Registered

|

Amount to be

Registered

|

Proposed Maximum

Offering Per Price

Unit

|

Proposed Maximum

Aggregate Offering

Price

|

Amount of

Registration Fee

|

|

Common Stock, $0.01 par value per share

|

(1)

|

(1)

|

(1)

|

(2)

|

|

Debt

Securities

|

(1)

|

(1)

|

(1)

|

(2)

|

|

|

(1)

|

Omitted pursuant to Form S-3 General Instruction II.E. Such indeterminate number or amount of securities is being

registered as may from time to time be offered at indeterminate prices, including an indeterminate number or amount of securities

that may be issued upon the exercise, settlement, exchange or conversion of securities offered hereunder. Separate consideration

may or may not be received for securities that are issuable upon conversion of, or in exchange for, or upon exercise of, convertible

or exchangeable securities.

|

|

|

(2)

|

In accordance with Rules 456(b) and 457(r) under the Securities Act of 1933, as amended (the “Securities Act”),

the registrant is deferring payment of the registration fee. Registration fees will be paid subsequently on a pay as you go basis

in accordance with Rule 456(b) of the Securities Act.

|

PROSPECTUS

Common Stock

Debt Securities

We or any selling securityholder may from

time to time offer to sell the securities identified above in amounts, at prices and on terms determined at the time of the offering

and described in one or more supplements to this prospectus. Each time we or any selling securityholders sell securities pursuant

to this prospectus, the specific terms and any other information relating to a specific offering and, if applicable, the selling

securityholders, will be set forth in a prospectus supplement.

Our

securities may be offered and sold in the same offering or in separate offerings to or through one or more underwriters, dealers,

and agents, directly to purchasers, or through a combination of these methods. The names and compensation of any underwriter, dealer

or agent involved in the sale of our securities will be described in the applicable prospectus supplement. See “Plan of Distribution”

on page 15 of this prospectus for additional information.

Our

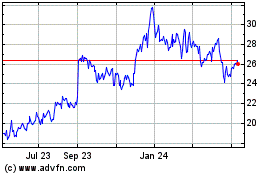

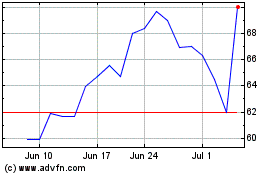

common stock is listed on The Nasdaq Global Select Market under the symbol “INSM.” The last reported sale price for

our common stock on The Nasdaq Global Select Market on May 20, 2020 was $26.05.

Our principal executive offices are located

at 700 US Highway 202/206, Bridgewater, NJ 08807, and our telephone number is (908) 977-9900.

Investing

in our securities involves a high degree of risk. You should carefully consider the risk factors incorporated in this prospectus

by reference and described under the heading “Risk Factors” on page 2 of this prospectus.

Neither the Securities and Exchange Commission

(“SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 21, 2020.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration

statement that we filed with the SEC, utilizing a “shelf” registration process as a “well-known seasoned issuer,”

as defined in Rule 405 under the Securities Act. Under this shelf registration process, we and any selling securityholders

may offer and sell from time to time in one or more offerings the securities described in this prospectus.

This prospectus provides you with a general

description of our securities. Each time we or any selling securityholders sell securities pursuant to this prospectus, we and

the selling securityholders will provide a prospectus supplement, which will be delivered with this prospectus, that will contain

specific information about the offering and the terms of the particular securities offered. The prospectus supplement, or information

incorporated by reference in this prospectus or any prospectus supplement that is of a more recent date, may also add to, update

or change information contained in this prospectus. To the extent that any statement that we or any selling securityholders make

in a prospectus supplement or incorporate by reference from a future SEC filing is inconsistent with statements made in this prospectus,

the statements made in this prospectus will be deemed modified or superseded by those made in the prospectus supplement or such

incorporated document. This prospectus may not be used to consummate a sale of our securities unless it is accompanied by a prospectus

supplement. We and the selling securityholders may also authorize one or more free writing prospectuses to be provided to you that

may contain material information relating to an offering of our securities. You should carefully read this prospectus, any applicable

prospectus supplement and any relevant free writing prospectus, together with the information incorporated herein by reference,

prior to making any decision regarding an investment in our securities.

We have not, and no selling securityholder

has, authorized anyone to provide you with different or additional information from that contained in this prospectus. We take

no responsibility for, and can provide no assurance as to the reliability of, any information that others may give. We are not,

and no selling securityholder is, making offers to sell or seeking offers to buy our securities in any jurisdiction where the offer

or sale is not permitted. You should assume that the information contained in this prospectus, any prospectus supplement, the documents

incorporated by reference and any related free writing prospectus is accurate only as of the respective dates of such documents.

Our business, financial condition, results of operations and prospects may have changed materially since those dates.

Unless the context otherwise indicates,

references in this prospectus to “Insmed”, the “Company”, “we”, “us” and “our”

refer to Insmed Incorporated, a Virginia corporation, together with its consolidated subsidiaries. Insmed and ARIKAYCE are trademarks

of Insmed Incorporated. Our logos and trademarks are the property of Insmed. All other brand names or trademarks appearing in this

prospectus are the property of their respective holders. Use or display by us of other parties’ trademarks or trade dress

in this prospectus is not intended to, and does not, imply a relationship with, or endorsements or sponsorship of, us by the trademark

or trade dress owners.

INSMED

INCORPORATED

We are a global biopharmaceutical company

on a mission to transform the lives of patients with serious and rare diseases. We were incorporated in the Commonwealth of Virginia

on November 29, 1999. On December 1, 2010, we completed a business combination with Transave, Inc., a privately

held New Jersey based company focused on the development of differentiated and innovative inhaled pharmaceuticals for the site

specific treatment of serious lung diseases.

Our first commercial product, ARIKAYCE,

received accelerated approval in the United States in September 2018 for the treatment of Mycobacterium avium complex (“MAC”)

lung disease as part of a combination antibacterial drug regimen for adult patients with limited or no alternative treatment options

in a refractory setting, as defined by patients who do not achieve negative sputum cultures after a minimum of six consecutive

months of a multidrug background regimen therapy. Nontuberculous mycobacterial (“NTM”) lung disease caused by MAC,

which we refer to as MAC lung disease, is a rare and often chronic infection that can cause irreversible lung damage and can be

fatal. Our clinical-stage pipeline includes brensocatib (formerly known as INS1007) and treprostinil palmitil (formerly known as

INS1009). Brensocatib is a novel oral, reversible inhibitor of dipeptidyl peptidase 1 with therapeutic potential in bronchiectasis

and other inflammatory diseases. Treprostinil palmitil is an inhaled formulation of a treprostinil prodrug that may offer a differentiated

product profile for rare pulmonary disorders, including pulmonary arterial hypertension. Our earlier-stage pipeline includes preclinical

compounds that we are evaluating in multiple rare diseases of unmet medical need, including gram positive pulmonary infections

in cystic fibrosis, NTM lung disease and refractory localized infections involving biofilm. To complement our internal research

and development, we actively evaluate in-licensing and acquisition opportunities for a broad range of rare diseases.

Our principal executive offices are located

at 700 US Highway 202/206, Bridgewater, NJ 08807, and our telephone number is (908) 977-9900. Our Internet address is

www.insmed.com. The information on our web site is not incorporated by reference into this prospectus or any applicable prospectus

supplement and should not be considered to be part of this prospectus or any applicable supplement.

RISK

FACTORS

An investment in our securities involves

risks. Prior to making a decision about investing in our securities, you should carefully consider the specific risks discussed

under “Risk Factors” in our Annual Report on Form 10-K for our most recent fiscal year, as updated by our Quarterly

Reports on Form 10-Q and other SEC filings subsequent thereto, pursuant to Sections 13(a), 13(c), 14 or 15(d) of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in any applicable prospectus supplement. The

risks and uncertainties described in any applicable prospectus supplement and in our SEC filings are not the only ones we face.

Each of these risks could materially and adversely affect our business, financial condition, results of operations and prospects,

resulting in a complete or partial loss of your investment.

NOTE

REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains, and the information

incorporated by reference herein and any applicable prospectus supplement may contain, forward-looking statements within the meaning

of Section 27A of the Securities Act, and Section 21E of the Exchange Act. “Forward-looking statements,”

as that term is defined in the Private Securities Litigation Reform Act of 1995, are statements that are not historical facts and

involve a number of risks and uncertainties. Words such as “may,” “will,” “should,” “could,”

“would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,”

“projects,” “predicts,” “intends,” “potential,” “continues,” and similar

expressions (as well as other words or expressions referencing future events, conditions or circumstances) identify forward-looking

statements.

Forward-looking statements are based on

our current expectations and beliefs, and involve known and unknown risks, uncertainties and other factors, which may cause our

actual results, performance and achievements and the timing of certain events to differ materially from the results, performance,

achievements or timing discussed, projected, anticipated or indicated in any forward-looking statements. Such risks, uncertainties

and other factors include, among others, the following:

|

|

·

|

failure to successfully commercialize or maintain U.S. approval for ARIKAYCE (amikacin liposome inhalation suspension), our

only approved product;

|

|

|

·

|

uncertainties in the degree of market acceptance of ARIKAYCE by physicians, patients, third-party payors and others in the

healthcare community;

|

|

|

·

|

our inability to obtain full approval of ARIKAYCE from the U.S. Food and Drug Administration (“FDA”), including

the risk that we will not timely and successfully complete the study to validate a patient reported outcome tool and the confirmatory

post-marketing study required for full approval;

|

|

|

·

|

inability of us, PARI Pharma GmbH (“PARI”) or our third-party manufacturers to comply with regulatory requirements

related to ARIKAYCE or the Lamira Nebulizer System;

|

|

|

·

|

our inability to obtain adequate reimbursement from government or third-party payors for ARIKAYCE or acceptable prices for

ARIKAYCE;

|

|

|

·

|

development of unexpected safety or efficacy concerns related to ARIKAYCE;

|

|

|

·

|

inaccuracies in our estimates of the size of the potential markets for ARIKAYCE or in data we have used to identify physicians,

expected rates of patient uptake, duration of expected treatment, or expected patient adherence or discontinuation rates;

|

|

|

·

|

our inability to create an effective direct sales and marketing infrastructure or to partner with third parties that offer

such an infrastructure for distribution of ARIKAYCE;

|

|

|

·

|

failure to obtain regulatory approval to expand ARIKAYCE’s indication to a broader patient population;

|

|

|

·

|

risks that the full set of data from the WILLOW study, our six-month Phase 2 trial of brensocatib in patients with non-CF bronchiectasis,

will not be consistent with the top-line results of the study;

|

|

|

·

|

the risk that brensocatib does not prove effective or safe for patients in the STOP-COVID19 study;

|

|

|

·

|

failure to successfully conduct future clinical trials for ARIKAYCE and our product candidates, including due to our limited

experience in conducting preclinical development activities and clinical trials necessary for regulatory approval and our inability

to enroll or retain sufficient patients to conduct and complete the trials or generate data necessary for regulatory approval;

|

|

|

·

|

risks that our clinical studies will be delayed or that serious side effects will be identified during drug development;

|

|

|

·

|

failure to obtain, or delays in obtaining, regulatory approvals for ARIKAYCE outside the U.S. or for our product candidates

in the U.S., Europe, Japan or other markets, including the United Kingdom as a result of the United Kingdom's recent exit from

the European Union;

|

|

|

·

|

failure of third parties on which we are dependent to manufacture sufficient quantities of ARIKAYCE or our product candidates

for commercial or clinical needs, to conduct our clinical trials, or to comply with our agreements or laws and regulations that

impact our business or agreements with us;

|

|

|

·

|

our inability to attract and retain key personnel or to effectively manage our growth;

|

|

|

·

|

our inability to adapt to our highly competitive and changing environment;

|

|

|

·

|

business or economic disruptions due to catastrophes or other events, including natural disasters or public health crises;

|

|

|

·

|

impact of the novel coronavirus (COVID-19) pandemic and efforts to reduce its spread on our business, employees, including

key personnel, patients, partners and suppliers;

|

|

|

·

|

our inability to adequately protect our intellectual property rights or prevent disclosure of our trade secrets and other proprietary

information and costs associated with litigation or other proceedings related to such matters;

|

|

|

·

|

restrictions or other obligations imposed on us by agreements related to ARIKAYCE or our product candidates, including our

license agreements with PARI and AstraZeneca AB, and failure to comply with our obligations under such agreements;

|

|

|

·

|

the cost and potential reputational damage resulting from litigation to which we are or may become a party, including product

liability claims;

|

|

|

·

|

limited experience operating internationally;

|

|

|

·

|

changes in laws and regulations applicable to our business, including any pricing reform, and failure to comply with such laws

and regulations;

|

|

|

·

|

inability to repay our existing indebtedness and uncertainties with respect to our ability to access future capital; and

|

|

|

·

|

delays in the execution of plans to build out an additional FDA-approved third-party manufacturing facility and unexpected

expenses associated with those plans.

|

We caution readers not to place undue reliance

on any such forward-looking statements, which speak only as of the date they were made. Any forward-looking statement is based

on information current as of the date of this prospectus and speaks only as of the date on which such statement is made. Actual

events or results may differ materially from the results, plans, intentions or expectations anticipated in these forward-looking

statements as a result of a variety of factors, many of which are beyond our control. More information on factors that could cause

actual results to differ materially from those anticipated are described under the heading “Risk Factors” in our Annual

Report on Form 10-K for the our most recent fiscal year, as updated from time to time in our Quarterly Reports on Form 10-Q

and other SEC filings subsequent thereto, including any applicable prospectus supplement. We disclaim any obligation, except as

specifically required by law, and the rules of the SEC, to publicly update or revise any such statements to reflect any change

in our expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the

likelihood that actual results will differ from those set forth in such forward-looking statements.

You should read this prospectus, the registration

statement of which this prospectus forms a part, any applicable prospectus supplement, and the documents incorporated by reference

herein and therein, in their entirety and with the understanding that our actual future results may be materially different from

those expressed in forward-looking statements.

USE

OF PROCEEDS

We will retain broad discretion over the

use of the net proceeds from the sale of our securities offered under this prospectus. Unless we indicate otherwise in the applicable

prospectus supplement, we anticipate that any net proceeds will be used for working capital and general corporate purposes. We

will not receive proceeds from sales of securities by selling securityholders except as otherwise stated in an applicable prospectus

supplement.

DESCRIPTION OF COMMON STOCK

The following is a summary of the material

terms of our common stock, which is based upon, and is qualified in its entirety by reference to, our Articles of Incorporation,

as amended (the “Articles of Incorporation”), our Amended and Restated Bylaws (the “Bylaws”) and applicable

provisions of the Virginia Stock Corporation Act (“VSCA”). This summary may not contain all the information that is

important to you; you can obtain additional information regarding our Articles of Incorporation and Bylaws by referring to such

documents, copies of which are included as exhibits to the registration statement of which this prospectus forms a part.

General

Under our Articles of Incorporation, we

have authority to issue 500,000,000 shares of common stock, par value $0.01 per share. As of May 10, 2020, there were 101,044,828

shares of common stock issued and outstanding. All shares of common stock will, when issued pursuant to this prospectus, be duly

authorized, fully paid and nonassessable.

Dividend

Rights

Subject to the rights of the holders of

any of our preferred stock then outstanding, the holders of our common stock are entitled to receive ratably such dividends, if

any, as may be declared from time to time by our board of directors out of legally available funds. As of the date of this prospectus,

we have not declared or paid any dividends on our shares of common stock, and there were no shares of preferred stock outstanding,

although our board of directors is authorized to issue preferred stock with rights senior to those of the common stock without

any further vote or action by the holders of our common stock.

Rights

Upon Liquidation

In the event we are liquidated, dissolved

or our affairs are wound up, after we pay or make adequate provision for all of our known debts and liabilities, each holder of

common stock will receive distributions pro rata out of assets that we can legally use to pay distributions, subject to the rights

of the holders of any of our preferred stock then outstanding.

Voting

Rights

Holders of our common stock are entitled

to one vote per share and will have the exclusive power to vote on all matters presented to our shareholders, including the election

of directors, except as otherwise provided by the VSCA and subject to the rights of the holders of any of our preferred stock then

outstanding. An election of directors by our shareholders will be determined by a plurality of the votes cast by the shareholders

entitled to vote on the election, although we have a director resignation policy applicable to director nominees in uncontested

elections. Our Articles of Incorporation do not provide for cumulative voting. In accordance with our Articles of Incorporation,

our board is divided into three classes serving staggered three-year terms, with one class being elected each year at our annual

meeting of shareholders.

Subject to certain exceptions set forth

in the VSCA, matters other than the election of directors generally will be approved if the votes cast by our shareholders favoring

the action exceed the votes cast opposing the action. Subject to the rights of the holders of any of our preferred stock then outstanding,

however, the affirmative vote of at least 75% of the voting power of the outstanding shares of our capital stock entitled to vote

generally in the election of directors, voting together as a single group, will be required to take the following actions:

|

|

·

|

remove a director, which may only be done for cause; and

|

|

|

·

|

alter, amend, repeal, or adopt any provision inconsistent with, the provisions of (1) our Articles of Incorporation that

provide for a classified board, director removal only for cause, filling of newly created or vacant directorships, or bylaw amendments

or (2) our Bylaws.

|

Other Rights

Holders of our common stock will have no

preference, appraisal or exchange rights, except for any appraisal rights provided by the VSCA. Furthermore, holders of our common

stock have no conversion, sinking fund or redemption rights, or preemptive rights to subscribe for any of our securities.

Potential Anti-Takeover Effects of Certain Provisions

of Virginia Law and Our Organizational Documents

Certain provisions of the VSCA, our Articles

of Incorporation and our Bylaws could hamper a third-party’s acquisition of, or discourage a third-party from attempting

to acquire control of, us or limit the price that investors might be willing to pay for shares of our common stock. These provisions

or arrangements include:

|

|

·

|

The ability to issue preferred stock with rights senior to those of our common stock without any further vote or action by

the holders of our common stock. The issuance of preferred stock could decrease the amount of earnings and assets available for

distribution to the holders of our common stock or could adversely affect the rights and powers, including voting rights, of the

holders of our common stock. In certain circumstances, such issuance could have the effect of decreasing the market price of our

common stock.

|

|

|

·

|

The existence of a staggered board of directors in which there are three classes of directors serving staggered three-year

terms, thus expanding the time required to change the composition of a majority of directors.

|

|

|

·

|

The requirement that shareholders provide advance notice when nominating director candidates to serve on our board of directors.

|

|

|

·

|

The inability of shareholders to convene a shareholders’ meeting without the chairman of the board, the president or

a majority of the board of directors first calling the meeting.

|

|

|

·

|

The prohibition against entering into a business combination with the beneficial owner of 10% or more of our outstanding voting

stock for a period of three years after the 10% or greater owner first reached that level of stock ownership, unless certain criteria

are met.

|

Transfer

Agent and Registrar

The transfer agent and registrar for our

common stock is Broadridge Investor Communication Solutions, Inc. Its address is 1717 Arch Street, Suite 1300, Philadelphia,

PA 19103.

Listing

Our common stock is listed on The Nasdaq

Global Select Market under the symbol “INSM.”

DESCRIPTION OF DEBT SECURITIES

We

may issue, separately or together with, or upon conversion, exercise or exchange of other securities, debt securities, including

debentures, notes, bonds and other evidences of indebtedness as set forth in the applicable prospectus supplement. The debt

securities will be our direct obligations, either secured or unsecured, and may include convertible debt securities. The debt securities

may be our senior, senior subordinated or subordinated obligations. The debt securities will be issued under an indenture between

us and Wells Fargo Bank, National Association, as trustee, which we may amend or supplement from time to time. This prospectus,

together with the applicable prospectus supplement, will describe the terms of a particular series of debt securities that we may

offer from time to time. The indenture has been qualified under the Trust Indenture Act of 1939, as amended (the “Trust Indenture

Act”).

The

following summary of the material provisions of the indenture and the debt securities does not purport to be complete and is subject

to, and is qualified in its entirety by reference to, the provisions of the indenture and certificate evidencing the applicable

debt securities. Therefore, you should carefully consider the indenture that is filed as an exhibit to the registration statement

that includes this prospectus. Other specific terms of the indenture and debt securities will be described in the applicable prospectus

supplement. If any particular terms of the indenture or debt securities described in a prospectus supplement differ from any of

the terms described below, then the terms described below will be deemed to have been superseded by that prospectus supplement.

In this description of the debt securities, the words “we,” “us” or “our” refer only to Insmed

Incorporated and not to our subsidiaries, unless we otherwise expressly state or the context otherwise requires.

General

Debt

securities may be issued in one or more series without limitation as to aggregate principal amount. We may specify a maximum aggregate

principal amount for the debt securities of any series. We are not limited as to the amount of debt securities that we may issue

under the indenture. The terms of each series of debt securities will be established by or pursuant to a resolution of our

board of directors and set forth or determined in the manner provided in a resolution of our board of directors, in an officer’s

certificate or by a supplemental indenture. The prospectus supplement relating to a particular series of debt securities will set

forth the material terms of the debt securities being offered, including:

|

|

·

|

the title of the debt securities;

|

|

|

·

|

the principal amount being offered, and if a series, the total amount authorized and the total amount outstanding;

|

|

|

·

|

any limit on the aggregate principal amount that may be issued;

|

|

|

·

|

the person to whom any interest on a debt security will be payable, if other than the person in whose name that debt security

is registered at the close of business on the record date for such interest;

|

|

|

·

|

the date or dates on which the principal of any debt securities is payable;

|

|

|

·

|

the interest rate or rates (which may be fixed or variable) at which the debt securities will bear interest, if any, the date

or dates from which any such interest will accrue, the interest payment dates on which any such interest will be payable and the

record date for any such interest payable on any interest payment date (or the method of determining the dates or rates);

|

|

|

·

|

the place or places where the principal of and any premium and interest on the debt securities will be payable;

|

|

|

·

|

the period or periods within which, the price or prices at which and the terms and conditions upon which the debt securities

may be redeemed, in whole or in part, at our option and, if other than by a resolution of the board of directors, the manner in

which any election by us to redeem the debt securities will be evidenced;

|

|

|

·

|

the obligation, if any, of ours to redeem or repurchase the debt securities pursuant to any sinking fund or analogous provisions

or at the option of a holder and the period or periods within which, the price or prices at which and the terms and conditions

upon which the debt securities will be redeemed or repurchase, in whole or in part, pursuant to such obligation;

|

|

|

·

|

if other than in denominations of $1,000 or any integral multiple thereof, the denominations in which the debt securities will

be issuable;

|

|

|

·

|

if the amount of principal of or any premium or interest on the debt securities may be determined with reference to an index

or pursuant to a formula, the manner in which such amounts will be determined;

|

|

|

·

|

if other than U.S. currency, the currency, currencies or currency units in which the principal of or any premium or interest

on the debt securities will be payable and the manner of determining the equivalent thereof in U.S. currency for any purpose, and

whether we or a holder may elect payment to be made in a different currency;

|

|

|

·

|

if the principal of or any premium or interest on the debt securities is to be payable, at our election or the election of

a holder, in one or more currencies or currency units other than that or those in which such debt securities are stated to be payable,

the currency, currencies or currency units that the principal of or any premium or interest on such debt securities as to which

such election is made will be payable, the periods within which and the terms and conditions upon which such election is to be

made and the amount so payable (or the manner in which such amount will be determined);

|

|

|

·

|

if other than the entire principal amount thereof, the portion of the principal amount of the debt securities that will be

payable upon declaration of acceleration of maturity thereof;

|

|

|

·

|

if the principal amount payable at stated maturity of the debt securities will not be determinable as of any one or more dates

prior to stated maturity, the amount which will be deemed to be the principal amount of such debt securities as of any such date

for any purpose, including the principal amount thereof that will be due and payable upon maturity other than the state maturity

or that will be deemed to be outstanding as of any date prior to the stated maturity (or, in each case, the manner that such amount

deemed to be the principal amount will be determined);

|

|

|

·

|

if applicable, whether the debt securities will be subject to the defeasance provisions described below under “Satisfaction

and Discharge; Defeasance” or such other defeasance provisions specified in the applicable prospectus supplement for the

debt securities and, if other than by a resolution of the board of directors, the manner in which any election by us to defease

such debt securities will be evidenced;

|

|

|

·

|

if applicable, the terms of any right or obligation to convert or exchange debt securities, including, if applicable, the conversion

or exchange rate or price, the conversion or exchange period, provisions as to whether conversion or exchange will be mandatory,

at the option of a holder or at our option, the events requiring an adjustment of the conversion price or exchange price and provisions

affecting conversion or exchange if such debt securities are redeemed;

|

|

|

·

|

whether or not the debt securities rank as senior debt, senior subordinated debt, subordinated debt or any combination thereof,

and the terms of any subordination;

|

|

|

·

|

the forms of the debt securities and whether the debt securities will be issuable in whole or in part in the form of one or

more global securities, and if so, the respective depositaries for such global securities, the form of any legend or legends that

will be borne by any such global securities in addition to or in lieu of that set forth in the indenture and any circumstances

in addition to or in lieu of those set forth in the indenture in which any such global security may be exchanged in whole or in

part for debt securities registered, and any transfer of such global security in whole or in part may be registered, in the name

or names of the persons other than the depositary for such global security or a nominee thereof;

|

|

|

·

|

any deletion of, addition to or change in the events of default which applies to the debt securities and any change in the

right of the trustee or the requisite holders of such debt securities to declare the principal amount thereof due and payable pursuant

to the indenture;

|

|

|

·

|

any deletion of, addition to or change in the covenants set forth in the indenture which apply to the debt securities;

|

|

|

·

|

any authenticating agents, paying agents, security registrars or such other agents necessary in connection with the issuance

of the debt securities, including exchange rate agents and calculations agents;

|

|

|

·

|

if applicable, any terms of any security provided for the debt securities, including any provisions regarding the circumstances

under which collateral may be released or substituted;

|

|

|

·

|

if applicable, the terms of any guaranties for the debt securities and any circumstances under which there may be additional

obligors on the debt securities; and

|

|

|

·

|

any other terms of such debt securities.

|

If we denominate the purchase price of any

of the debt securities in a foreign currency or currencies, or if the principal of or premium, if any, or interest on any series

of debt securities is payable in a foreign currency or currencies, we will include in the applicable prospectus supplement information

on the restrictions, elections, material federal income tax considerations, specific terms and other information with respect to

that issue of debt securities and the foreign currency or currencies.

Unless otherwise specified in the applicable

prospectus supplement, the debt securities will be registered debt securities. Debt securities may be sold at a substantial discount

below their stated principal amount, bearing no interest or interest at a rate which at the time of issuance is below market rates.

The U.S. federal income tax considerations applicable to debt securities sold at a discount will be described in the applicable

prospectus supplement.

Exchange and Transfer

Debt securities may be transferred or exchanged

at the office of the security registrar or at the office of any transfer agent designated by us for this purpose.

We will not impose a service charge for

any transfer or exchange, but we may require holders to pay any tax or other governmental charges associated with any transfer

or exchange.

In

the event of any partial redemption of debt securities of any series, we will not be required to:

|

|

·

|

issue, register the transfer of or exchange any debt security of that series during a period beginning at the opening of business

15 days before the day of sending a notice of redemption and ending at the close of business on the day of sending such notice;

or

|

|

|

·

|

register the transfer of or exchange any debt security of that series selected for redemption, in whole or in part, except

the unredeemed portion being redeemed in part.

|

Initially, we will appoint the trustee as

the security registrar. Any transfer agent, in addition to the security registrar initially designated by us, will be named in

the applicable prospectus supplement. We may designate additional transfer agents or change transfer agents or change the office

of the transfer agent. However, we will be required to maintain a transfer agent in each place of payment for the debt securities

of each series.

Global Securities

The debt securities of any series may be

represented, in whole or in part, by one or more global securities. Each global security will:

|

|

·

|

be registered in the name of a depositary, or its nominee, that we will identify in a prospectus supplement;

|

|

|

·

|

be delivered to the depositary or nominee or custodian;

|

|

|

·

|

bear any required legends; and

|

|

|

·

|

constitute a single debt security.

|

No global security may be exchanged in whole

or in part for debt securities registered in the name of any person other than the depositary or any nominee unless:

|

|

·

|

the depositary has notified us that it is unwilling or unable to continue as depositary or has ceased to be qualified to act

as depositary;

|

|

|

·

|

an event of default has occurred and is continuing with respect to the debt securities of the applicable series; or

|

|

|

·

|

any other circumstance described in the applicable prospectus supplement has occurred permitting or requiring the issuance

of any such security.

|

Conversion or Exchange

If any debt securities being offered are

convertible into or exchangeable for our common stock or other securities, the relevant prospectus supplement will set forth the

terms of conversion or exchange. Those terms will include, as applicable, the conversion or exchange price or rate, the conversion

or exchange period, provisions as to whether conversion or exchange is mandatory, at the option of the holder or at our option,

the number of shares of common stock or other securities, or the method of determining the number of shares of common stock or

other securities, to be received by the holder upon conversion or exchange, the events requiring an adjustment of the conversion

price or exchange price and provisions affecting conversion or exchange if such series of debt securities are redeemed. These provisions

may allow or require the number of shares of our common stock or other securities to be received by the holders of such series

of debt securities to be adjusted.

Payment and Paying Agents

Unless otherwise indicated in the prospectus

supplement applicable to a series of debt securities, the provisions described in this paragraph will apply to the debt securities.

Payment of interest on a debt security on any interest payment date will be made to the person in whose name the debt security

is registered at the close of business on the regular record date. Payment on debt securities of a particular series will be payable

at the office of a paying agent or paying agents designated by us. However, at our option, we may pay interest by mailing a check

or by wire transfer to the record holder. The trustee will be designated as our initial paying agent.

We may also name any other paying agents

in the prospectus supplement applicable to a series of debt securities. We may designate additional paying agents, change paying

agents or change the office of any paying agent. However, we will be required to maintain a paying agent in each place of payment

for the debt securities of a particular series.

All moneys paid by us to a paying agent

for payment on any debt security that remain unclaimed for a period ending the earlier of:

|

|

·

|

10 business days prior to the date the money would be turned over to the applicable state; and

|

|

|

·

|

at the end of two years after such payment was due, will be repaid to us thereafter. The holder may look only to us for such

payment.

|

No Protection in the Event of a Change of

Control

Unless otherwise indicated in a prospectus

supplement with respect to a particular series of debt securities, the debt securities will not contain any provisions that may

afford holders of the debt securities protection in the event we have a change in control or in the event of a highly leveraged

transaction, whether or not such transaction results in a change in control.

Covenants

We

will set forth in the prospectus supplement any financial or restrictive covenants applicable to any issue of a particular series

of debt securities.

Consolidation, Merger and Sale of Assets

Unless otherwise indicated in a prospectus

supplement with respect to a particular series of debt securities, we may not consolidate with or merge into any other person,

in a transaction in which we are not the surviving corporation, or sell, convey, transfer or lease all or substantially all our

properties and assets to, any entity, unless:

|

|

·

|

the successor entity, if any, is a corporation, limited liability company, partnership, trust or other business entity existing

under the laws of the United States, any State within the United States or the District of Columbia;

|

|

|

·

|

the successor entity assumes our obligations under the debt securities and the applicable indenture;

|

|

|

·

|

immediately after giving effect to the transaction, no default or event of default shall have occurred and be continuing; and

|

|

|

·

|

certain other conditions specified in the indenture are met regarding our delivery of our officer’s certificate and opinion

of counsel to trustee.

|

Notwithstanding the above, any of our subsidiaries

may consolidate with, merge into, sell or transfer all or part of its properties to us.

Events of Default

Unless we indicate otherwise in a prospectus

supplement with respect to a particular series of debt securities, the following will be events of default for any series of debt

securities under the indenture:

|

|

(1)

|

we fail to pay any interest on any debt security of that series when it becomes due and we subsequently fail to pay such interest

for 30 days;

|

|

|

(2)

|

we fail to pay principal of or any premium on any debt security of that series when due;

|

|

|

(3)

|

we fail to perform, or breach, any other covenant or warranty in the applicable indenture and such failure continues for 90

days after we are given the notice required in the indenture; and

|

|

|

(4)

|

certain bankruptcy, insolvency or reorganization events with respect to us.

|

Additional or different events of default

applicable to a series of debt securities may be described in the prospectus supplement for that series. An event of default for

one series of debt securities is not necessarily an event of default for any other series of debt securities.

Within 90 days after the occurrence of any

default under the indenture with respect to the debt securities of any series that is known to a responsible officer of the trustee,

the trustee will give the holders of the debt securities of such series notice of such default as and to the extent provided by

the Trust Indenture Act.

The trustee may withhold notice to the holders

of any default, except defaults in the payment of principal, premium, if any, interest, any sinking fund installment on, or with

respect to any conversion right of, the debt securities of such series. However, the trustee must consider it to be in the interests

of the holders of the debt securities of such series to withhold this notice.

Unless we indicate otherwise in a prospectus

supplement, if an event of default, other than an event of default described in clause (4) above, shall occur and be continuing

with respect to any series of debt securities, either the trustee or the holders of at least 25% in aggregate principal amount

of the outstanding securities of that series may declare the principal amount and premium, if any, of the debt securities of that

series, or if any debt securities of that series are original issue discount securities, such other amount as may be specified

in the applicable prospectus supplement, in each case together with accrued and unpaid interest, if any, thereon, to be due and

payable immediately.

If an event of default described in clause

(4) above shall occur, the principal amount and premium, if any, of all the debt securities of that series, or if any debt securities

of that series are original issue discount securities, such other amount as may be specified in the applicable prospectus supplement,

in each case together with accrued and unpaid interest, if any, thereon, will automatically become immediately due and payable

without any declaration or other action on the part of the trustee or any holder.

After

acceleration, the holders of a majority in aggregate principal amount of the outstanding securities of that series may, under certain

circumstances, rescind and annul such acceleration if all events of default, other than the non-payment of accelerated principal,

or other specified amounts or interest, have been cured or waived.

Other than the duty to act as a prudent

person during an event of default, the trustee will not be obligated to exercise any of its rights or powers at the request of

the holders unless the holders shall have offered to the trustee indemnity reasonably satisfactory to it. Generally, the holders

of a majority in aggregate principal amount of the outstanding debt securities of any series will have the right to direct the

time, method and place of conducting any proceeding for any remedy available to the trustee or exercising any trust or power conferred

on the trustee.

A holder of debt securities of any series

will not have any right to institute any proceeding under the indenture, or for the appointment of a receiver or a trustee, or

for any other remedy under the indenture, unless:

|

|

(1)

|

the holder has previously given to the trustee written notice of a continuing event of default with respect to the debt securities

of that series;

|

|

|

(2)

|

the holders of at least a majority in aggregate principal amount of the outstanding debt securities of that series have made

a written request to the trustee and have offered to the trustee security or indemnity reasonably satisfactory to the trustee to

institute the proceeding; and

|

|

|

(3)

|

the trustee has failed to institute the proceeding and has not received direction inconsistent with the original request from

the holders of a majority in aggregate principal amount of the outstanding debt securities of that series within 60 days after

the original request.

|

Holders may, however, sue to enforce the

payment of principal, premium or interest on any debt security on or after the due date or to enforce the right, if any, to convert

any debt security (if the debt security is convertible) without following the procedures listed in clauses (1) through (3) immediately

above.

To the extent any debt securities are outstanding,

we will furnish the trustee an annual statement as to whether or not we are in default in the performance of the conditions and

covenants under the indenture and, if so, specifying all known defaults.

Modification and Waiver

Unless we indicate otherwise in a prospectus

supplement, we and the applicable trustee may make modifications and amendments to an indenture with the consent of the holders

of a majority in aggregate principal amount of the outstanding securities of each series affected by the modification or amendment.

We may also make modifications and amendments

to the indenture for the benefit of holders without their consent, for certain purposes including, but not limited to:

|

|

·

|

providing for our successor to assume the covenants under the indenture;

|

|

|

·

|

adding covenants and/or events of default;

|

|

|

·

|

making certain changes to facilitate the issuance of the debt securities;

|

|

|

·

|

securing the debt securities, including provisions relating to the release or substitution of collateral;

|

|

|

·

|

providing for guaranties of, or additional obligors on, the debt securities;

|

|

|

·

|

providing for a successor trustee or additional trustees;

|

|

|

·

|

curing any ambiguities, defects or inconsistencies;

|

|

|

·

|

conforming the terms to the description of the terms of the securities in an offering memorandum, prospectus supplement or

other offering document;

|

|

|

·

|

any other changes that do not adversely affect the rights or interest of any holder;

|

|

|

·

|

complying with the requirements of the SEC in order to effect or maintain the qualification of the Indenture under the Trust

Indenture Act; and

|

|

|

·

|

complying with the applicable procedures of the applicable depositary.

|

However, neither we nor the trustee may

make any modification or amendment without the consent of the holder of each outstanding debt security affected by the modification

or amendment if such modification or amendment would:

|

|

·

|

change the stated maturity of any debt security;

|

|

|

·

|

reduce the principal, premium, if any, or interest on any debt security or any amount payable upon redemption or repurchase,

whether at our option or the option of any holder, or reduce the amount of any sinking fund payments;

|

|

|

·

|

reduce the principal of an original issue discount security or any other debt security payable on acceleration of maturity;

|

|

|

·

|

change the currency in which any debt security is payable;

|

|

|

·

|

impair the right to enforce any payment after the stated maturity or redemption date of such debt security;

|

|

|

·

|

reduce the percentage in principal amount of outstanding securities of any series required for the consent of holders for any

supplemental indenture or for any waiver provided for in the indenture;

|

|

|

·

|

adversely affect the right to convert any debt security if the debt security is a convertible debt security; or

|

|

|

·

|

change the provisions in the indenture that relate to modifying or amending the indenture, except to increase any such percentage

or to provide that certain other provisions of the indenture cannot be modified or waived without the consent of the holder of

each outstanding debt security affected thereby.

|

Except for certain specified provisions,

the holders of at least a majority in principal amount of the outstanding debt securities of any series may on behalf of the holders

of all debt securities of that series waive our compliance with provisions of the indenture. The holders of not less than a majority

in principal amount of the outstanding debt securities of any series may on behalf of the holders of all the debt securities of

such series waive any past default under the indenture with respect to that series and its consequences, except:

|

|

·

|

a default in the payment of the principal of or any premium or interest on any debt security of that series as and when the

same will become due and payable by the terms thereof, otherwise than by acceleration; or

|

|

|

|

|

|

|

·

|

in respect of a covenant or provision of the Indenture which cannot be modified or amended without the consent of the holder

of each outstanding security of such series affected by such default.

|

Satisfaction and Discharge; Defeasance

We may be discharged from our obligations

under the debt securities of any series that have matured or will mature or be redeemed within one year, subject to limited exceptions,

if we deposit enough money with the trustee to pay all of the principal, interest and any premium due to the stated maturity date

or redemption date of the debt securities.

The indenture contains a provision that

permits us to elect either or both of the following:

|

|

·

|

We may elect to be discharged from all of our obligations, subject to limited exceptions, with respect to any series of debt

securities then outstanding. If we make this election, the holders of the debt securities of the series will not be entitled to

the benefits of the indenture, except for the rights of holders to receive payments on debt securities or the registration of transfer

and exchange of debt securities and replacement of lost, stolen or mutilated debt securities.

|

|

|

|

|

|

|

·

|

We may elect to be released from our obligations under some or all of any financial or restrictive covenants applicable to

the series of debt securities to which the election relates and from the consequences of an event of default resulting from a breach

of those covenants.

|

To make either of the above elections, we

must irrevocably deposit in trust with the trustee enough money to pay in full the principal, interest and premium on the debt

securities and satisfy certain other conditions described in the indenture. This amount may be deposited in cash and/or U.S. government

obligations or, in the case of debt securities denominated in a currency other than U.S. dollars, cash in the currency in which

such series of securities is denominated and/or foreign government obligations. As one of the conditions to either of the above

elections, for debt securities denominated in U.S. dollars, we must deliver to the trustee an opinion of counsel that the holders

of the debt securities will not recognize income, gain or loss for U.S. federal income tax purposes as a result of the action.

“Foreign

government obligations” means, with respect to debt securities of any series that are denominated in a currency other than

United States dollars:

|

|

·

|

direct obligations of the government that issued or caused to be issued the currency in which such securities are denominated

and for the payment of which obligations its full faith and credit is pledged, or, with respect to debt securities of any series

which are denominated in euros, direct obligations of certain members of the European Union for the payment of which obligations

the full faith and credit of such members is pledged, which in each case are not callable or redeemable at the option of the issuer

thereof;

|

|

|

|

|

|

|

·

|

obligations of a person controlled or supervised by or acting as an agency or instrumentality of a government described in

the bullet above, the timely payment of which is unconditionally guaranteed as a full faith and credit obligation by such government,

which are not callable or redeemable at the option of the issuer thereof; or

|

|

|

|

|

|

|

·

|

any depository receipt issued by a bank as custodian with respect to any obligation specified in the first two bullet points

and held by such bank for the account of the holder of such deposit any receipt, or with respect to any such obligation which is

so specified and held.

|

“U.S.

government obligations” means:

(1) any security which is:

|

|

·

|

a direct obligation of the United States of America for the payment of which the full faith and credit of the United States

of America is pledged, which is not callable or redeemable at the option of the issuer thereof or

|

|

|

|

|

|

|

·

|

an obligation of a person controlled or supervised by or acting as an agency or instrumentality of the United States of America

the payment of which is unconditionally guaranteed as a full faith and credit obligation by the United States of America, which

is not callable or redeemable at the option of the issuer thereof; and

|

(2)

any depository receipt issued by a bank as custodian with respect to any U.S. government obligation specified in the two bullet

points above and held by such bank for the account of the holder of such deposit any receipt, or with respect to any specific payment

of principal of or interest on any U.S. government obligation which is so specified and held, provided that (except as required

by law) such custodian is not authorized to make any deduction from the amount payable to the holder of such depositary receipt

from any amount received by the custodian in respect of the U.S. government obligation or the specific payment of principal or

interest evidenced by such depositary receipt.

Notices

Notices to holders will be delivered in

person, mailed by first-class mail (registered or certified, return receipt requested), sent by facsimile transmission, email or

overnight air courier guaranteeing next day delivery. If any debt securities are in the form of global securities, notices will

be sent in accordance with the applicable rules and procedures of the depositary.

Governing Law; Wavier of Jury Trial; Jurisdiction

The indenture and the debt securities will

be governed by, and construed under, the laws of the State of New York.

The indenture will provide that we, the

trustee and the holders of the debt securities (by their acceptance of the debt securities) irrevocably waive, to the fullest extent

permitted by applicable law, any and all right to trial by jury in any legal proceeding arising out of or relating to the indenture,

the debt securities or the transactions contemplated thereby.

The

indenture will provide that any legal suit, action or proceeding arising out of or based upon the indenture, the securities or

the transactions contemplated thereby may be instituted in the Federal courts of the United States of America located in the City

of New York or the courts of the State of New York in each case located in the City of New York, and we, the trustee and the holder

of the debt securities irrevocably submit to the non-exclusive jurisdiction of such courts in any such suit, action or proceeding.

The indenture will further provide that service of any process, summons, notice or document by any method permitted under the indenture

(to the extent allowed under any applicable statute or rule of court) to such party’s address set forth in the indenture

will be effective service of process for any suit, action or other proceeding brought in any such court. The indenture will further

provide that we, the trustee and the holders of the debt securities (by their acceptance of the debt securities) irrevocably and

unconditionally waive any objection to the laying of venue of any suit, action or other proceeding in the courts specified above

and irrevocably and unconditionally waive and agree not to plead or claim any such suit, action or other proceeding has been brought

in an inconvenient forum.

No Personal Liability of Directors, Officers,

Employees and Shareholders

No incorporator, shareholder, employee,

agent, officer, director or subsidiary of ours will have any liability for any obligations of ours, or because of the creation

of any indebtedness, under the debt securities, the indenture, or in any board resolution, officer’s certificate or supplemental

indenture. The indenture provides that all such liability is expressly waived and released as a condition of, and as a consideration

for, the execution of such indenture and the issuance of the debt securities.

Regarding the Trustee

The accompanying prospectus supplement will

specify the trustee for the particular series of debt securities to be issued under the indenture.

The indenture will limit the right of the

trustee, should it become our creditor, to obtain payment of claims or secure its claims.

The trustee is permitted to engage in certain

other transactions with us. However, if the trustee acquires any conflicting interest, and there is a default under the debt securities

of any series for which it is trustee, the trustee must eliminate the conflict or resign.

SELLING SECURITYHOLDERS

Selling securityholders are persons or entities

that, directly or indirectly, have acquired or will from time to time acquire from us, our securities in various private transactions.

Such selling securityholders may be parties to registration rights agreements with us, or we otherwise may have agreed or will

agree to register their securities for resale. The initial purchasers of our securities, as well as their transferees, pledgees,

donees or successors, all of whom we refer to as “selling securityholders,” may from time to time offer and sell the

securities pursuant to this prospectus and any applicable prospectus supplement.

The applicable prospectus supplement will

set forth the name of each selling securityholder and the number of and type of securities beneficially owned by such selling securityholder

that are covered by such prospectus supplement. The applicable prospectus supplement also will disclose whether any of the selling

securityholders have held any position or office with, have been employed by or otherwise have had a material relationship with

us during the three years prior to the date of the prospectus supplement.

PLAN

OF DISTRIBUTION

We and any selling securityholders may sell

the securities registered pursuant to this prospectus in the following ways:

|

|

·

|

to or through underwriters;

|

|

|

·

|

directly to purchasers;

|

|

|

·

|

in at-the-market offerings into an existing trading market in accordance with Rule 415(a)(4) under the Securities Act to or

through a broker or brokers, or an underwriter or underwriters, acting as principal or agent;

|

|

|

·

|

through a combination of any of the foregoing methods; or

|

|

|

·

|

through any other method described in the applicable prospectus supplement.

|

We and any selling securityholders reserve

the right to sell directly to or exchange our securities directly with investors on our own behalf in those jurisdictions where

we are authorized to do so.

We and any selling securityholders may distribute

such securities from time to time in one or more transactions:

|

|

·

|

at a fixed price or prices, which may be changed from time to time;

|

|

|

·

|

at market prices prevailing at the time of sale;

|

|

|

·

|

at prices related to such prevailing market prices; or

|

We and any selling securityholders, or the

purchasers of the securities for whom the underwriters may act as agents, may compensate underwriters in the form of underwriting

discounts or commissions in connection with the sale of the securities. Underwriters may sell our securities to or through dealers,

and those dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters and/or commissions

from the purchasers for whom they may act as agents. Unless otherwise indicated in the applicable prospectus supplement, an agent

will be acting on a best efforts basis and a dealer will purchase our securities as a principal and may then resell such securities

at varying prices to be determined by the dealer.

We and any selling securityholders will

name any underwriter, dealer or agent involved in the offer and sale of securities in the applicable prospectus supplement. In

addition, we and any selling securityholders will describe in the applicable prospectus supplement the public offering or purchase

price and the proceeds we and any selling securityholders will receive from the sale of our securities, any compensation we and

any selling securityholders will pay to underwriters, dealers or agents in connection with such offering of our securities, any

discounts, concessions or commissions allowed or re-allowed by underwriters to participating dealers, and any exchanges on which

our securities will be listed. Dealers and agents participating in the distribution of the securities may be deemed to be underwriters,

and any discounts and commissions received by them and any profit realized by them on resale of the securities may be deemed to

be underwriting discounts and commissions. We and any selling securityholders may enter into agreements to indemnify underwriters,

dealers and agents against certain civil liabilities, including liabilities under the Securities Act, and to reimburse these persons

for certain expenses. We and any selling securityholders may also agree to contribute to payments that the underwriters, dealers

or agents or any of their controlling persons may be required to make in respect of such liabilities. We and any selling securityholders

may grant underwriters who participate in the distribution of the securities being registered pursuant to this prospectus an option

to purchase additional securities in connection with a subsequent distribution. Certain underwriters, dealers or agents and their

associates may engage in transactions with and perform services for us in the ordinary course of our business.

To facilitate the offering of our securities,

certain persons participating in the offering may engage in transactions that stabilize, maintain or otherwise affect the price

of our securities. Such transactions may include over-allotments or short sales of our securities, which involve the sale by persons

participating in the offering of more securities than we and any selling securityholders sold to them. In these circumstances,

these persons would cover such over-allotments or short positions by making purchases in the open market or by exercising their

option to purchase additional securities, if any. In addition, these persons may stabilize or maintain the price of our securities

by bidding for or purchasing such securities in the open market or by imposing penalty bids, whereby selling concessions allowed

to dealers participating in the offering may be reclaimed if the securities sold by them are repurchased in connection with stabilization

transactions. Should these transactions be undertaken, they may be discontinued at any time.

LEGAL

MATTERS

Unless the applicable prospectus supplement

indicates otherwise, the legality of the securities being offered by this prospectus will be passed upon for us by Covington &

Burling LLP, Washington, D.C. and/or Hunton Andrews Kurth LLP, Richmond, Virginia.

EXPERTS

Ernst & Young LLP, independent

registered public accounting firm, has audited our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2019, and the effectiveness of our internal control over financial reporting as of December 31,

2019, as set forth in their reports, which are incorporated by reference in this prospectus and elsewhere in the registration statement

of which this prospectus forms a part. Our financial statements are incorporated by reference in reliance on Ernst & Young LLP’s

reports, given on their authority as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. Our SEC filings are available to the public from the SEC’s website at

www.sec.gov. We maintain a website at www.insmed.com. The information on our website is not incorporated by reference into this

prospectus or any applicable prospectus supplement and should not be considered to be part of this prospectus or any applicable

supplement. We have filed with the SEC a registration statement under the Securities Act with respect to the securities registered

pursuant hereto. This prospectus omits some information contained in the registration statement in accordance with SEC rules and

regulations. For further information with respect to us and the securities registered pursuant to this prospectus, you should review

the registration statement, the applicable prospectus supplement, the information incorporated herein and therein, and the exhibits

included herein and therein.

INCORPORATION

BY REFERENCE

The SEC allows us to “incorporate

by reference” the information we file with it, which means that we can disclose important information to you by referring

to those publicly available documents. The information that we incorporate by reference is considered to be part of this prospectus.

We incorporate by reference the documents listed below (File No. 000-30739) and any future filings we make with the SEC under

Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (in each case, other than those documents or the portions of those

documents not deemed to be filed) between the date of this registration statement and, in the case of any particular offering of

our securities, the date such offering is terminated:

|

|

·

|