Infinera Corporation, provider of Intelligent Transport Networks,

today released financial results for its second quarter ended June

29, 2019.

GAAP revenue for the quarter was $296.3 million compared to

$292.7 million in the first quarter of 2019 and $208.2 million in

the second quarter of 2018.

GAAP gross margin for the quarter was 20.7% compared to 22.7% in

the first quarter of 2019 and 40.5% in the second quarter of 2018.

GAAP operating margin for the quarter was (36.6)% compared to

(38.2)% in the first quarter of 2019 and (10.4)% in the second

quarter of 2018.

GAAP net loss for the quarter was $113.7 million, or $(0.64) per

share, compared to a net loss of $121.6 million, or $(0.69) per

share, in the first quarter of 2019, and net loss of $21.9 million,

or $(0.14) per share, in the second quarter of 2018.

Non-GAAP revenue for the quarter was $306.9 million compared to

$295.6 million in the first quarter of 2019 and $208.2 million in

the second quarter of 2018.

Non-GAAP gross margin for the quarter was 30.7% compared to

35.3% in the first quarter of 2019 and 43.9% in the second quarter

of 2018. Non-GAAP operating margin for the quarter was (12.3)%

compared to (11.9)% in the first quarter of 2019 and (0.7)% in the

second quarter of 2018.

Non-GAAP net loss for the quarter was $42.0 million, or $(0.24)

per share, compared to a net loss of $41.2 million, or $(0.23) per

share, in the first quarter of 2019, and net loss of $1.3 million,

or $(0.01) per share, in the second quarter of 2018.

A further explanation of the use of non-GAAP financial

information and a reconciliation of the non-GAAP financial measures

to the GAAP equivalents can be found at the end of this

release.

“During the quarter, we significantly enhanced the longer-term

position of the New Infinera with strong customer traction led by

bookings from several new Tier-1 wins and the initial ramp of a new

internet content provider,” said Tom Fallon, Infinera CEO.

“Continued progress on our integration program, which we expect to

largely complete in the fourth quarter of 2019, is enabling

synergies to track ahead of prior commitments. Based on this

foundation, we expect to return to non-GAAP profitability and

positive cash flow in the fourth quarter of 2019."

Financial Outlook

Infinera's outlook for the quarter ending September

28, 2019 is as follows:

- GAAP revenue is expected to be $328

million +/- $10 million. Non-GAAP revenue is expected to be $330

million +/- $10 million.

- GAAP gross margin is expected to be

27% +/- 200 bps. Non-GAAP gross margin is expected to be 32% +/-

200 bps.

- GAAP operating expenses are expected

to be $150 million +/- $3 million. Non-GAAP operating

expenses are expected to be $130 million +/- $3

million.

- GAAP operating margin is expected to

be approximately (19)%. Non-GAAP operating margin is expected to be

approximately (7)%.

- GAAP EPS is expected to be $(0.40)

+/- $0.02. Non-GAAP EPS is expected to be $(0.17)

+/- $0.02.

Second Quarter 2019 Financial Commentary Available

Online

A CFO Commentary reviewing Infinera's second quarter of 2019

financial results will be furnished to the SEC on Form 8-K and

published on Infinera's Investor Relations website at

investors.infinera.com. Analysts and investors are encouraged to

review this commentary prior to participating in the conference

call webcast.

Conference Call Information

Infinera will host a conference call for analysts and investors

to discuss its results for the second quarter of 2019 and its

outlook for the third quarter of 2019 today at 5:00 p.m. Eastern

Time (2:00 p.m. Pacific Time). Interested parties may join the

conference call by dialing 1-866-373-6878 (toll free) or

1-412-317-5101 (international). A live webcast of the conference

call will also be accessible from the Events section of Infinera’s

website at investors.infinera.com. Replay of the audio webcast will

be available at investors.infinera.com approximately two hours

after the end of the live call.

About Infinera

Infinera provides Intelligent Transport Networks, enabling

carriers, cloud operators, governments and enterprises to scale

network bandwidth, accelerate service innovation and automate

optical network operations. Infinera’s end-to-end packet-optical

portfolio is designed for long-haul, subsea, data center

interconnect and metro applications. To learn more about Infinera

visit www.infinera.com, follow us on Twitter @Infinera and read our

latest blog posts at www.infinera.com/blog.

Forward-Looking Statements

This press release contains certain forward-looking statements

based on current expectations, forecasts and assumptions that

involve risks and uncertainties. Such forward-looking statements

include, without limitation, Infinera’s expectations regarding

integration; the level of synergies to be achieved; its ability to

return to non-GAAP profitability and positive cash flow in the

fourth quarter of 2019; and its financial outlook for the third

quarter of 2019.

Forward-looking statements can also be identified by

forward-looking words such as “anticipate,” “believe,” “could,”

“estimate,” “expect,” “intend,” “may,” “should,” “will,” and

"would” or similar words. These statements are based on information

available to Infinera as of the date hereof and actual results

could differ materially from those stated or implied due to risks

and uncertainties. The risks and uncertainties that could cause

Infinera’s results to differ materially from those expressed or

implied by such forward-looking statements include, the combined

company's ability to promptly and effectively integrate the

businesses; Infinera's ability to realize synergies in a timely

manner; market acceptance of the combined company's end-to-end

portfolio; Infinera’s future capital needs and its ability to

generate the cash flow or otherwise secure the capital necessary to

make anticipated capital expenditures; Infinera's ability to

service its debt obligations and pursue its strategic plan; the

diversion of management time on issues related to the integration;

delays in the development and introduction of new products or

updates to existing products and market acceptance of these

products; fluctuations in demand, sales cycles and prices for

products and services, including discounts given in response to

competitive pricing pressures, as well as the timing of purchases

by Infinera's key customers; the effect that changes in product

pricing or mix, and/or increases in component costs could have on

Infinera’s gross margin; the effects of customer consolidation;

Infinera’s ability to respond to rapid technological changes;

aggressive business tactics by Infinera’s competitors; Infinera's

reliance on single and limited source suppliers; Infinera’s ability

to protect Infinera’s intellectual property; claims by others that

Infinera infringes their intellectual property; Infinera’s ability

to successfully integrate its enterprise resource planning system

and other management systems; the effect of global macroeconomic

conditions, including tariffs, on Infinera's business; war,

terrorism, public health issues, natural disasters and other

circumstances that could disrupt the supply, delivery or demand of

Infinera's products; and other risks and uncertainties detailed in

Infinera’s SEC filings from time to time. More information on

potential factors that may impact Infinera’s business are set forth

in its Quarterly Report on Form 10-Q for the quarter ended on March

30, 2019 as filed with the SEC on May 9, 2019, as well as

subsequent reports filed with or furnished to the SEC from time to

time. These reports are available on Infinera’s website at

www.infinera.com and the SEC’s website at www.sec.gov. Infinera

assumes no obligation to, and does not currently intend to, update

any such forward-looking statements.

Use of Non-GAAP Financial Information

In addition to disclosing financial measures prepared in

accordance with U.S. Generally Accepted Accounting Principles

(GAAP), this press release and the accompanying tables contain

certain non-GAAP measures that exclude acquisition-related deferred

revenue and inventory adjustments, other customer related charges,

non-cash stock-based compensation expenses, amortization of

acquired intangible assets, acquisition and integration costs,

restructuring and related costs (credits), litigation charges,

amortization of debt discount on Infinera’s convertible senior

notes, impairment charge of non-marketable equity investments, gain

on non-marketable equity investments, and certain purchase

accounting adjustments related to Infinera's acquisitions, along

with related tax effects. For a description of these non-GAAP

financial measures and a reconciliation to the most directly

comparable GAAP financial measures, please see the section titled,

“GAAP to Non-GAAP Reconciliations.”

Infinera has included forward-looking non-GAAP information in

this press release, including an estimate of certain non-GAAP

financial measures for the third quarter of 2019 that exclude

non-cash stock-based compensation expenses, acquisition related

deferred revenue adjustments, acquisition and integration costs

related to Infinera's acquisition of Coriant, restructuring and

related expenses, amortization of acquired intangible assets and

related tax effects. Please see the section titled, “GAAP to

Non-GAAP Reconciliations of Financial Outlook” below on specific

adjustments.

Infinera believes these adjustments are appropriate to enhance

an overall understanding of its underlying financial performance

and also its prospects for the future and are considered by

management for the purpose of making operational decisions. In

addition, these results are the primary indicators management uses

as a basis for its planning and forecasting of future periods. The

presentation of this additional information is not meant to be

considered in isolation or as a substitute for gross margin,

operating margin, net loss, or basic and diluted net loss per share

prepared in accordance with GAAP. Non-GAAP financial measures are

not based on a comprehensive set of accounting rules or principles

and are subject to limitations.

A copy of this press release can be found on the Investor

Relations page of Infinera’s website at www.infinera.com.

Infinera and the Infinera logo are trademarks or registered

trademarks of Infinera Corporation. All other trademarks used or

mentioned herein belong to their respective owners.

Infinera CorporationCondensed

Consolidated Statements of Operations(In

thousands, except per share

data)(Unaudited)

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 29, 2019 |

|

June 30, 2018 |

|

June 29, 2019 |

|

June 30, 2018 |

|

Revenue: |

|

|

|

|

|

|

|

|

|

Product |

|

$ |

226,866 |

|

|

$ |

175,288 |

|

|

$ |

449,873 |

|

|

$ |

346,917 |

|

|

Services |

|

69,384 |

|

|

32,939 |

|

|

139,084 |

|

|

63,991 |

|

|

Total revenue |

|

296,250 |

|

|

208,227 |

|

|

588,957 |

|

|

410,908 |

|

|

Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product |

|

177,501 |

|

|

105,914 |

|

|

335,318 |

|

|

208,238 |

|

|

Cost of services |

|

36,831 |

|

|

13,039 |

|

|

73,507 |

|

|

25,870 |

|

|

Amortization of intangible assets |

|

8,098 |

|

|

4,943 |

|

|

16,350 |

|

|

10,284 |

|

|

Acquisition and integration costs |

|

10,700 |

|

|

— |

|

|

12,764 |

|

|

— |

|

|

Restructuring and related |

|

1,864 |

|

|

26 |

|

|

23,330 |

|

|

43 |

|

|

Total cost of revenue |

|

234,994 |

|

|

123,922 |

|

|

461,269 |

|

|

244,435 |

|

|

Gross profit |

|

61,256 |

|

|

84,305 |

|

|

127,688 |

|

|

166,473 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

73,937 |

|

|

56,158 |

|

|

147,597 |

|

|

114,839 |

|

|

Sales and marketing |

|

37,651 |

|

|

28,234 |

|

|

77,688 |

|

|

57,119 |

|

|

General and administrative |

|

35,672 |

|

|

18,365 |

|

|

68,716 |

|

|

36,201 |

|

|

Amortization of intangible assets |

|

6,745 |

|

|

1,487 |

|

|

13,802 |

|

|

3,094 |

|

|

Acquisition and integration costs |

|

12,164 |

|

|

— |

|

|

19,298 |

|

|

— |

|

|

Restructuring and related |

|

3,471 |

|

|

1,680 |

|

|

20,659 |

|

|

1,517 |

|

|

Total operating expenses |

|

169,640 |

|

|

105,924 |

|

|

347,760 |

|

|

212,770 |

|

|

Loss from operations |

|

(108,384 |

) |

|

(21,619 |

) |

|

(220,072 |

) |

|

(46,297 |

) |

|

Other income (expense), net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

183 |

|

|

629 |

|

|

949 |

|

|

1,526 |

|

|

Interest expense |

|

(7,280 |

) |

|

(2,501 |

) |

|

(14,843 |

) |

|

(6,184 |

) |

|

Other gain (loss), net: |

|

3,210 |

|

|

1,429 |

|

|

287 |

|

|

1,935 |

|

|

Total other income (expense), net |

|

(3,887 |

) |

|

(443 |

) |

|

(13,607 |

) |

|

(2,723 |

) |

|

Loss before income taxes |

|

(112,271 |

) |

|

(22,062 |

) |

|

(233,679 |

) |

|

(49,020 |

) |

|

Provision for (benefit from) income taxes |

|

1,385 |

|

|

(124 |

) |

|

1,578 |

|

|

(802 |

) |

|

Net loss |

|

(113,656 |

) |

|

(21,938 |

) |

|

(235,257 |

) |

|

(48,218 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share - basic and diluted: |

|

$ |

(0.64 |

) |

|

$ |

(0.14 |

) |

|

$ |

(1.33 |

) |

|

$ |

(0.32 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares used in computing net loss per common share

- basic and diluted: |

|

178,677 |

|

|

152,259 |

|

|

177,542 |

|

|

151,296 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Infinera CorporationGAAP to Non-GAAP

Reconciliations(In thousands, except percentages

and per share data)(Unaudited)

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 29, 2019 |

|

|

|

March 30, 2019 |

|

|

|

June 30, 2018 |

|

|

|

June 29, 2019 |

|

|

|

June 30, 2018 |

|

|

|

Reconciliation of Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. GAAP as reported |

$ |

296,250 |

|

|

|

|

$ |

292,707 |

|

|

|

|

$ |

208,227 |

|

|

|

|

$ |

588,957 |

|

|

|

|

$ |

410,908 |

|

|

|

|

Acquisition-related deferred revenue adjustment(1) |

2,530 |

|

|

|

|

2,905 |

|

|

|

|

— |

|

|

|

|

5,435 |

|

|

|

|

— |

|

|

|

|

Other customer related charges(2) |

|

8,100 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

8,100 |

|

|

|

|

|

— |

|

|

|

|

Non-GAAP as adjusted |

$ |

306,880 |

|

|

|

|

$ |

295,612 |

|

|

|

|

$ |

208,227 |

|

|

|

|

$ |

602,492 |

|

|

|

|

$ |

410,908 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Gross Profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. GAAP as reported |

$ |

61,256 |

|

|

20.7 |

% |

|

$ |

66,432 |

|

|

22.7 |

% |

|

$ |

84,305 |

|

|

40.5 |

% |

|

$ |

127,688 |

|

|

21.7 |

% |

|

$ |

166,473 |

|

|

40.5 |

% |

|

Acquisition-related deferred revenue adjustment(1) |

2,530 |

|

|

|

|

2,905 |

|

|

|

|

— |

|

|

|

|

5,435 |

|

|

|

|

— |

|

|

|

|

Other customer related charges(2) |

8,100 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

8,100 |

|

|

|

|

|

— |

|

|

|

|

Stock-based compensation(3) |

1,591 |

|

|

|

|

1,328 |

|

|

|

|

2,039 |

|

|

|

|

2,919 |

|

|

|

|

3,033 |

|

|

|

|

Amortization of acquired intangible assets(4) |

8,098 |

|

|

|

|

8,252 |

|

|

|

|

4,943 |

|

|

|

|

16,350 |

|

|

|

|

10,284 |

|

|

|

|

Acquisition and integration costs(5) |

10,700 |

|

|

|

|

2,064 |

|

|

|

|

— |

|

|

|

|

12,764 |

|

|

|

|

— |

|

|

|

|

Acquisition-related inventory adjustments(6) |

— |

|

|

|

|

1,778 |

|

|

|

|

— |

|

|

|

|

1,778 |

|

|

|

|

— |

|

|

|

|

Restructuring and related(7) |

1,864 |

|

|

|

|

21,466 |

|

|

|

|

26 |

|

|

|

|

23,330 |

|

|

|

|

43 |

|

|

|

|

Non-GAAP as adjusted |

$ |

94,139 |

|

|

30.7 |

% |

|

$ |

104,225 |

|

|

35.3 |

% |

|

$ |

91,313 |

|

|

43.9 |

% |

|

$ |

198,364 |

|

|

32.9 |

% |

|

$ |

179,833 |

|

|

43.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. GAAP as reported |

$ |

169,640 |

|

|

|

|

$ |

178,120 |

|

|

|

|

$ |

105,924 |

|

|

|

|

$ |

347,760 |

|

|

|

|

$ |

212,770 |

|

|

|

|

Stock-based compensation(3) |

11,456 |

|

|

|

|

7,385 |

|

|

|

|

10,005 |

|

|

|

|

18,841 |

|

|

|

|

19,994 |

|

|

|

|

Amortization of acquired intangible assets(4) |

6,745 |

|

|

|

|

7,057 |

|

|

|

|

1,487 |

|

|

|

|

13,802 |

|

|

|

|

3,094 |

|

|

|

|

Acquisition and integration costs(5) |

12,164 |

|

|

|

|

7,134 |

|

|

|

|

— |

|

|

|

|

19,298 |

|

|

|

|

— |

|

|

|

|

Restructuring and related(7) |

3,471 |

|

|

|

|

17,188 |

|

|

|

|

1,680 |

|

|

|

|

20,659 |

|

|

|

|

1,517 |

|

|

|

|

Litigation charges(8) |

4,050 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

4,050 |

|

|

|

|

— |

|

|

|

|

Non-GAAP as adjusted |

$ |

131,754 |

|

|

|

|

$ |

139,356 |

|

|

|

|

$ |

92,752 |

|

|

|

|

$ |

271,110 |

|

|

|

|

$ |

188,165 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Loss from Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. GAAP as reported |

$ |

(108,384 |

) |

|

(36.6 |

)% |

|

$ |

(111,688 |

) |

|

(38.2 |

)% |

|

$ |

(21,619 |

) |

|

(10.4 |

)% |

|

$ |

(220,072 |

) |

|

(37.4 |

)% |

|

$ |

(46,297 |

) |

|

(11.3 |

)% |

|

Acquisition-related deferred revenue adjustment(1) |

2,530 |

|

|

|

|

2,905 |

|

|

|

|

— |

|

|

|

|

5,435 |

|

|

|

|

— |

|

|

|

|

Other customer related charges(2) |

|

8,100 |

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

8,100 |

|

|

|

|

— |

|

|

|

|

Stock-based compensation(3) |

13,047 |

|

|

|

|

8,713 |

|

|

|

|

12,044 |

|

|

|

|

21,760 |

|

|

|

|

23,027 |

|

|

|

|

Amortization of acquired intangible assets(4) |

14,843 |

|

|

|

|

15,309 |

|

|

|

|

6,430 |

|

|

|

|

30,152 |

|

|

|

|

13,378 |

|

|

|

|

Acquisition and integration costs(5) |

22,864 |

|

|

|

|

9,198 |

|

|

|

|

— |

|

|

|

|

32,062 |

|

|

|

|

— |

|

|

|

|

Acquisition-related inventory adjustments(6) |

— |

|

|

|

|

1,778 |

|

|

|

|

— |

|

|

|

|

1,778 |

|

|

|

|

— |

|

|

|

|

Restructuring and related(7) |

5,335 |

|

|

|

|

38,654 |

|

|

|

|

1,706 |

|

|

|

|

43,989 |

|

|

|

|

1,560 |

|

|

|

|

Litigation charges(8) |

4,050 |

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

4,050 |

|

|

|

|

— |

|

|

|

|

Non-GAAP as adjusted |

$ |

(37,615 |

) |

|

(12.3 |

)% |

|

$ |

(35,131 |

) |

|

(11.9 |

)% |

|

$ |

(1,439 |

) |

|

(0.7 |

)% |

|

$ |

(72,746 |

) |

|

(12.1 |

)% |

|

$ |

(8,332 |

) |

|

(2.0 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

Six Months Ended |

|

|

June 29, 2019 |

|

|

|

|

March 30, 2019 |

|

|

|

|

June 30, 2018 |

|

|

|

|

June 29, 2019 |

|

|

|

|

June 30, 2018 |

|

|

|

|

Reconciliation of Net Loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. GAAP as reported |

$ |

(113,656 |

) |

|

|

|

|

$ |

(121,601 |

) |

|

|

|

|

$ |

(21,938 |

) |

|

|

|

|

$ |

(235,257 |

) |

|

|

|

|

(48,218 |

) |

|

|

|

|

Acquisition-related deferred revenue adjustment(1) |

2,530 |

|

|

|

|

|

2,905 |

|

|

|

|

|

— |

|

|

|

|

|

5,435 |

|

|

|

|

|

— |

|

|

|

|

|

Other customer related charges(2) |

8,100 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

8,100 |

|

|

|

|

|

— |

|

|

|

|

|

Stock-based compensation(3) |

13,047 |

|

|

|

|

|

8,713 |

|

|

|

|

|

12,044 |

|

|

|

|

|

21,760 |

|

|

|

|

|

23,027 |

|

|

|

|

|

Amortization of acquired intangible assets(4) |

14,843 |

|

|

|

|

|

15,309 |

|

|

|

|

|

6,430 |

|

|

|

|

|

30,152 |

|

|

|

|

|

13,378 |

|

|

|

|

|

Acquisition and integration costs(5) |

22,864 |

|

|

|

|

|

9,198 |

|

|

|

|

|

— |

|

|

|

|

|

32,062 |

|

|

|

|

|

— |

|

|

|

|

|

Acquisition-related inventory adjustments(6) |

— |

|

|

|

|

|

1,778 |

|

|

|

|

|

— |

|

|

|

|

|

1,778 |

|

|

|

|

|

— |

|

|

|

|

|

Restructuring and related(7) |

5,335 |

|

|

|

|

|

38,654 |

|

|

|

|

|

1,706 |

|

|

|

|

|

43,989 |

|

|

|

|

|

1,560 |

|

|

|

|

|

Litigation charges(8) |

4,050 |

|

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

4,050 |

|

|

|

|

|

|

— |

|

|

|

|

|

Amortization of debt discount(9) |

4,348 |

|

|

|

|

|

4,241 |

|

|

|

|

|

1,892 |

|

|

|

|

|

8,589 |

|

|

|

|

|

4,671 |

|

|

|

|

|

Gain/Loss on non-marketable equity investment(10) |

(1,009 |

) |

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

(1,009 |

) |

|

|

|

|

— |

|

|

|

|

|

Income tax effects(11) |

(2,470 |

) |

|

|

|

|

(426 |

) |

|

|

|

|

(1,415 |

) |

|

|

|

|

(2,896 |

) |

|

|

|

|

(2,944 |

) |

|

|

|

|

Non-GAAP as adjusted |

$ |

(42,018 |

) |

|

|

|

|

$ |

(41,229 |

) |

|

|

|

|

$ |

(1,281 |

) |

|

|

|

|

$ |

(83,247 |

) |

|

|

|

|

$ |

(8,526 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss per Common Share - Basic and

Diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. GAAP as reported |

$ |

(0.64 |

) |

|

|

|

|

$ |

(0.69 |

) |

|

|

|

|

$ |

(0.14 |

) |

|

|

|

|

$ |

(1.33 |

) |

|

|

|

|

$ |

(0.32 |

) |

|

|

|

|

Non-GAAP as adjusted |

$ |

(0.24 |

) |

|

|

|

|

$ |

(0.23 |

) |

|

|

|

|

$ |

(0.01 |

) |

|

|

|

|

$ |

(0.47 |

) |

|

|

|

|

$ |

(0.06 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Used in Computing Net Loss per Common Share

- Basic and Diluted: |

178,677 |

|

|

|

|

|

176,406 |

|

|

|

|

|

152,259 |

|

|

|

|

|

177,542 |

|

|

|

|

|

151,296 |

|

|

|

|

| _____________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Business combination accounting principles require Infinera to

write down to fair value its maintenance support contracts assumed

in the Coriant acquisition. The revenue for these support contracts

is deferred and typically recognized over a one-year period, so

Infinera's GAAP revenue for the one year period after the

acquisition will not reflect the full amount of revenue that would

have been reported if the acquired deferred revenue was not written

down to fair value. The non-GAAP adjustment eliminates the effect

of the deferred revenue write-down. Management believes these

adjustments to the revenue from these support contracts are useful

to investors as an additional means to reflect revenue trends of

Infinera's business. |

|

|

|

(2) Other customer related charges include one-time benefits and

charges that are not directly related to Infinera’s ongoing or core

business results. During the quarter, Infinera agreed to

reimburse a customer for certain expenses incurred by them in

connection with a network service outage that occurred during the

fourth quarter of fiscal 2018. Management has excluded the impact

of this charge in arriving at Infinera's non-GAAP results because

it is non-recurring, and management believes that this

reimbursement is not indicative of ongoing operating

performance. |

|

|

|

(3) Stock-based compensation expense is calculated in accordance

with the fair value recognition provisions of Financial Accounting

Standards Board Accounting Standards Codification Topic 718,

Compensation – Stock Compensation effective January 1, 2006.

The following table summarizes the effects of stock-based

compensation related to employees and non-employees (in

thousands): |

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 29,2019 |

|

March 30, 2019 |

|

June 30,2018 |

|

June 29,2019 |

|

June 30,2018 |

|

Cost of revenue |

|

$ |

663 |

|

|

$ |

538 |

|

|

$ |

624 |

|

|

$ |

1,201 |

|

|

$ |

502 |

|

|

Research and development |

|

6,127 |

|

|

3,603 |

|

|

4,192 |

|

|

9,730 |

|

|

8,516 |

|

|

Sales and marketing |

|

2,099 |

|

|

1,547 |

|

|

3,046 |

|

|

3,646 |

|

|

5,944 |

|

|

General and administration |

|

3,230 |

|

|

2,235 |

|

|

2,767 |

|

|

5,465 |

|

|

5,534 |

|

|

|

|

12,119 |

|

|

7,923 |

|

|

10,629 |

|

|

20,042 |

|

|

20,496 |

|

|

Cost of revenue - amortization from balance sheet* |

|

928 |

|

|

790 |

|

|

1,415 |

|

|

1,718 |

|

|

2,531 |

|

|

Total stock-based compensation expense |

|

$ |

13,047 |

|

|

$ |

8,713 |

|

|

$ |

12,044 |

|

|

$ |

21,760 |

|

|

$ |

23,027 |

|

|

______________________________________ |

|

* Stock-based compensation expense deferred to inventory and

deferred inventory costs in prior periods recognized in the current

period. |

|

|

|

(4) Amortization of acquired intangible assets consists of

developed technology, trade names, customer relationships and

backlog acquired in connection with the Coriant acquisition, which

closed during the fourth quarter of 2018. Amortization of acquired

intangible assets also consists of amortization of developed

technology, trade names and customer relationships acquired in

connection with the Transmode AB acquisition. U.S. GAAP accounting

requires that acquired intangible assets are recorded at fair value

and amortized over their useful lives. As this amortization is

non-cash, Infinera has excluded it from its non-GAAP gross profit,

operating expenses and net income measures. Management believes the

amortization of acquired intangible assets is not indicative of

ongoing operating performance and its exclusion provides a better

indication of Infinera's underlying business

performance. |

|

|

|

(5) Acquisition and integration costs consist of legal,

financial, IT, manufacturing-related costs, employee-related costs

and professional fees incurred in connection with Infinera's

acquisition of Coriant. These amounts have been adjusted in

arriving at Infinera's non-GAAP results because management believes

that these expenses are non-recurring, not indicative of ongoing

operating performance and their exclusion provides a better

indication of Infinera's underlying business performance. |

|

|

|

(6) Business combination accounting principles require

Infinera to measure acquired inventory at fair value. The fair

value of inventory reflects the acquired company’s cost of

manufacturing plus a portion of the expected profit margin. The

non-GAAP adjustment to Infinera's cost of sales excludes the

amortization of the acquisition-related step-up in carrying value

for units sold in the quarter. Additionally, in connection with the

Coriant acquisition, cost of sales excludes a one-time adjustment

in inventory as a result of renegotiated supplier agreements that

contained unusually higher than market pricing. Management believes

these adjustments are useful to investors as an additional means to

reflect ongoing cost of sales and gross margin trends of Infinera's

business. |

|

|

|

(7) Restructuring and related costs are associated with

Infinera's two restructuring initiatives implemented during the

fourth quarter of 2018 and during the fourth quarter of 2017, the

planned closure of the Company's Berlin, Germany manufacturing

facility and Coriant's historical restructuring plan associated

with their early retirement plan. In addition, management included

accelerated amortization on operating lease right-of-use assets due

to the cease use of certain facilities. Management has excluded the

impact of these charges in arriving at Infinera's non-GAAP results

as they are non-recurring in nature and its exclusion provides a

better indication of Infinera's underlying business

performance. |

|

|

|

(8) Litigation charges are associated with the preliminary

settlement of a litigation matter agreed to during the quarter

ended June 29, 2019. Management has excluded the impact of this

charge in arriving at Infinera's non-GAAP results because it is

non-recurring, and management believes that this expense is not

indicative of ongoing operating performance. |

|

|

|

(9) Under GAAP, certain convertible debt instruments that may

be settled in cash on conversion are required to be separately

accounted for as liability (debt) and equity (conversion option)

components of the instrument in a manner that reflects the issuer's

non-convertible debt borrowing rate. Accordingly, for GAAP

purposes, Infinera is required to amortize as debt discount an

amount equal to the fair value of the conversion option that was

recorded in equity as interest expense on the $402.5 million in

aggregate principal amount of its 2.125% convertible debt issuance

in September 2018 due September 2024 and the $150 million in

aggregate principal amount of its 1.75% convertible debt issuance

in May 2013 due June 2018, over the term of the respective notes.

Interest expense has been excluded from Infinera's non-GAAP results

because management believes that this non-cash expense is not

indicative of ongoing operating performance and provides a better

indication of Infinera's underlying business performance. |

|

|

|

(10) Management has excluded the gain on the sale related to

non-marketable equity investments in arriving at Infinera's

non-GAAP results because it is non-recurring, and management

believes that this income is not indicative of ongoing operating

performance |

|

|

|

(11) The difference between the GAAP and non-GAAP tax

provision is due to the net tax effects of the purchase accounting

adjustments, acquisition-related costs and amortization of acquired

intangible assets. |

|

|

Infinera CorporationCondensed

Consolidated Balance Sheets(In thousands, except

par values)(Unaudited)

|

|

June 29, 2019 |

|

December 29, 2018 |

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

109,034 |

|

|

$ |

202,954 |

|

|

Short-term investments |

1,497 |

|

|

26,511 |

|

|

Short-term restricted cash |

2,742 |

|

|

13,229 |

|

|

Accounts receivable, net of allowance for doubtful accounts of

$4,129 in 2019 and $3,680 in 2018 |

260,352 |

|

|

317,115 |

|

|

Inventory |

338,793 |

|

|

311,888 |

|

|

Prepaid expenses and other current assets |

109,817 |

|

|

85,400 |

|

|

Total current assets |

822,235 |

|

|

957,097 |

|

|

Property, plant and equipment, net |

159,210 |

|

|

342,820 |

|

|

Operating lease right-of-use assets |

64,740 |

|

|

— |

|

|

Intangible assets |

200,991 |

|

|

233,119 |

|

|

Goodwill |

229,281 |

|

|

227,231 |

|

|

Long-term restricted cash |

26,745 |

|

|

26,154 |

|

|

Other non-current assets |

10,817 |

|

|

14,849 |

|

|

Total assets |

$ |

1,514,019 |

|

|

$ |

1,801,270 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

194,882 |

|

|

$ |

191,187 |

|

|

Accrued expenses and other current liabilities |

158,617 |

|

|

131,891 |

|

|

Accrued compensation and related benefits |

77,152 |

|

|

71,152 |

|

|

Accrued warranty |

23,364 |

|

|

20,103 |

|

|

Deferred revenue |

78,417 |

|

|

88,534 |

|

|

Total current liabilities |

532,432 |

|

|

502,867 |

|

|

Long-term debt, net |

284,270 |

|

|

266,929 |

|

|

Long-term financing lease obligation |

1,413 |

|

|

193,538 |

|

|

Accrued warranty, non-current |

20,782 |

|

|

20,918 |

|

|

Deferred revenue, non-current |

28,510 |

|

|

31,768 |

|

|

Deferred tax liability |

10,094 |

|

|

13,347 |

|

|

Operating lease liabilities |

58,631 |

|

|

— |

|

|

Other long-term liabilities |

62,817 |

|

|

68,082 |

|

|

Commitments and contingencies (Note 19) |

|

|

|

|

Stockholders’ equity: |

|

|

|

|

Preferred stock, $0.001 par value Authorized shares – 25,000

and no shares issued and outstanding |

— |

|

|

— |

|

|

Common stock, $0.001 par value Authorized shares – 500,000 as of

June 29, 2019 and December 29, 2018 |

|

|

|

|

Issued and outstanding shares – 179,339 as of June 29, 2019 and

175,452 as of December 29, 2018 |

179 |

|

|

175 |

|

|

Additional paid-in capital |

1,715,657 |

|

|

1,685,916 |

|

|

Accumulated other comprehensive loss |

(32,236 |

) |

|

(25,300 |

) |

|

Accumulated deficit |

(1,168,530 |

) |

|

(956,970 |

) |

|

Total stockholders' equity |

515,070 |

|

|

703,821 |

|

|

Total liabilities and stockholders’ equity |

$ |

1,514,019 |

|

|

$ |

1,801,270 |

|

|

|

|

|

|

|

|

|

|

Infinera CorporationCondensed

Consolidated Statements of Cash Flows(In

thousands)(Unaudited)

|

|

|

Six Months Ended |

|

|

|

June 29, 2019 |

|

June 30, 2018 |

|

Cash Flows from Operating Activities: |

|

|

|

|

|

Net loss |

|

$ |

(235,257 |

) |

|

$ |

(48,218 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

Depreciation and amortization |

|

62,143 |

|

|

33,250 |

|

|

Non-cash restructuring charges and related (credits) |

|

18,172 |

|

|

(81 |

) |

|

Amortization of debt discount and issuance costs |

|

9,245 |

|

|

5,072 |

|

|

Operating lease amortization, net of accretion |

|

23,355 |

|

|

— |

|

|

Stock-based compensation expense |

|

21,760 |

|

|

23,027 |

|

|

Other loss |

|

10 |

|

|

167 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

Accounts receivable |

|

55,216 |

|

|

(22,015 |

) |

|

Inventory |

|

(30,640 |

) |

|

(8,703 |

) |

|

Prepaid expenses and other assets |

|

(30,958 |

) |

|

(1,809 |

) |

|

Accounts payable |

|

4,726 |

|

|

24,458 |

|

|

Accrued liabilities and other expenses |

|

(5,472 |

) |

|

(14,617 |

) |

|

Deferred revenue |

|

(12,267 |

) |

|

2,351 |

|

|

Net cash used in operating activities |

|

(119,967 |

) |

|

(7,118 |

) |

|

Cash Flows from Investing Activities: |

|

|

|

|

|

Purchase of available-for-sale investments |

|

— |

|

|

(2,986 |

) |

|

Proceeds from sales of available-for-sale investments |

|

— |

|

|

23,114 |

|

|

Proceeds from sale of non-marketable equity investments |

|

1,009 |

|

|

— |

|

|

Proceeds from maturities of investments |

|

25,085 |

|

|

98,112 |

|

|

Acquisition of business, net of cash acquired |

|

(10,000 |

) |

|

— |

|

|

Purchase of property and equipment |

|

(15,784 |

) |

|

(21,503 |

) |

|

Net cash provided by (used in) investing activities |

|

310 |

|

|

96,737 |

|

|

Cash Flows from Financing Activities: |

|

|

|

|

|

Proceeds from issuance of debt, net |

|

8,584 |

|

|

— |

|

|

Repayment of debt |

|

(96 |

) |

|

(150,000 |

) |

|

Proceeds from issuance of common stock |

|

7,740 |

|

|

11,066 |

|

|

Minimum tax withholding paid on behalf of employees for net share

settlement |

|

(354 |

) |

|

(964 |

) |

|

Net cash provided by (used in) financing activities |

|

15,874 |

|

|

(139,898 |

) |

|

Effect of exchange rate changes on cash and restricted cash |

|

(33 |

) |

|

(2,218 |

) |

|

Net change in cash, cash equivalents and restricted cash |

|

(103,816 |

) |

|

(52,497 |

) |

|

Cash, cash equivalents and restricted cash at beginning of

period |

|

242,337 |

|

|

121,486 |

|

|

Cash, cash equivalents and restricted cash at end of period(1) |

|

$ |

138,521 |

|

|

$ |

68,989 |

|

|

Supplemental disclosures of cash flow

information: |

|

|

|

|

|

Cash paid for income taxes, net of refunds |

|

$ |

13,606 |

|

|

$ |

2,210 |

|

|

Cash paid for interest |

|

$ |

4,687 |

|

|

$ |

1,328 |

|

|

Supplemental schedule of non-cash investing and financing

activities: |

|

|

|

|

|

Third-party manufacturer funding for transfer expenses

incurred |

|

$ |

3,327 |

|

|

$ |

— |

|

|

Transfer of inventory to fixed assets |

|

$ |

2,195 |

|

|

$ |

1,684 |

|

|

|

|

(1) Reconciliation of cash, cash equivalents and restricted cash to

the condensed consolidated balance sheets: |

|

|

June 29, 2019 |

|

June 30, 2018 |

|

|

|

|

|

|

|

(In thousands) |

|

Cash and cash equivalents |

$ |

109,034 |

|

|

$ |

63,308 |

|

|

Short-term restricted cash |

2,742 |

|

|

308 |

|

|

Long-term restricted cash |

26,745 |

|

|

5,373 |

|

|

Total cash, cash equivalents and restricted cash |

$ |

138,521 |

|

|

$ |

68,989 |

|

|

|

|

|

|

|

|

|

|

Infinera CorporationSupplemental

Financial Information(Unaudited)

|

|

Q3'17 |

|

Q4'17 |

|

Q1'18 |

|

Q2'18 |

|

Q3'18 |

|

Q4'18 |

|

Q1'19 |

|

Q2'19 |

|

GAAP Revenue ($ Mil) |

$ |

192.6 |

|

|

$ |

195.8 |

|

|

$ |

202.7 |

|

|

$ |

208.2 |

|

|

$ |

200.4 |

|

|

$ |

332.1 |

|

|

$ |

292.7 |

|

|

$ |

296.3 |

|

|

GAAP Gross Margin % |

|

35.2 |

% |

|

|

24.1 |

% |

|

|

40.5 |

% |

|

|

40.5 |

% |

|

|

35.0 |

% |

|

|

25.4 |

% |

|

|

22.7 |

% |

|

|

20.7 |

% |

|

Non-GAAP Gross Margin %(1) |

|

39.1 |

% |

|

|

37.5 |

% |

|

|

43.7 |

% |

|

|

43.9 |

% |

|

|

38.4 |

% |

|

|

31.8 |

% |

|

|

35.3 |

% |

|

|

30.7 |

% |

|

Revenue Composition: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic % |

|

59 |

% |

|

|

53 |

% |

|

|

64 |

% |

|

|

58 |

% |

|

|

49 |

% |

|

|

39 |

% |

|

|

45 |

% |

|

|

45 |

% |

|

International % |

|

41 |

% |

|

|

47 |

% |

|

|

36 |

% |

|

|

42 |

% |

|

|

51 |

% |

|

|

61 |

% |

|

|

55 |

% |

|

|

55 |

% |

|

Customers >10% of Revenue |

|

2 |

|

|

|

1 |

|

|

|

2 |

|

|

|

2 |

|

|

|

2 |

|

|

|

2 |

|

|

|

1 |

|

|

|

1 |

|

|

Cash Related Information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash from Operations ($ Mil) |

($ |

20.9 |

) |

|

($ |

1.0 |

) |

|

($ |

14.1 |

) |

|

$ |

7.0 |

|

|

($ |

20.4 |

) |

|

($ |

71.6 |

) |

|

($ |

56.2 |

) |

|

($ |

63.8 |

) |

|

Capital Expenditures ($ Mil) |

$ |

11.0 |

|

|

$ |

7.8 |

|

|

$ |

8.0 |

|

|

$ |

13.5 |

|

|

$ |

5.5 |

|

|

$ |

10.7 |

|

|

$ |

6.6 |

|

|

$ |

9.2 |

|

|

Depreciation & Amortization ($ Mil) |

$ |

16.8 |

|

|

$ |

16.6 |

|

|

$ |

17.0 |

|

|

$ |

16.3 |

|

|

$ |

17.1 |

|

|

$ |

50.2 |

|

|

$ |

31.0 |

|

|

$ |

31.2 |

|

|

DSOs |

|

65 |

|

|

|

59 |

|

|

|

73 |

|

|

|

65 |

|

|

|

70 |

|

|

|

87 |

|

|

|

83 |

|

|

|

80 |

|

|

Inventory Metrics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Raw Materials ($ Mil) |

$ |

35.8 |

|

|

$ |

27.4 |

|

|

$ |

30.3 |

|

|

$ |

30.5 |

|

|

$ |

33.6 |

|

|

$ |

74.5 |

|

|

$ |

82.5 |

|

|

$ |

70.4 |

|

|

Work in Process ($ Mil) |

$ |

84.3 |

|

|

$ |

59.6 |

|

|

$ |

66.5 |

|

|

$ |

61.6 |

|

|

$ |

56.4 |

|

|

$ |

57.2 |

|

|

$ |

63.0 |

|

|

$ |

59.5 |

|

|

Finished Goods ($ Mil) |

$ |

122.7 |

|

|

$ |

127.7 |

|

|

$ |

119.1 |

|

|

$ |

127.2 |

|

|

$ |

121.9 |

|

|

$ |

180.2 |

|

|

$ |

187.0 |

|

|

$ |

208.9 |

|

|

Total Inventory ($ Mil) |

$ |

242.8 |

|

|

$ |

214.7 |

|

|

$ |

215.9 |

|

|

$ |

219.3 |

|

|

$ |

211.9 |

|

|

$ |

311.9 |

|

|

$ |

332.5 |

|

|

$ |

338.8 |

|

|

Inventory Turns(2) |

|

1.9 |

|

|

|

2.3 |

|

|

|

2.1 |

|

|

|

2.1 |

|

|

|

2.3 |

|

|

|

2.9 |

|

|

|

2.3 |

|

|

|

2.5 |

|

|

Worldwide Headcount |

|

2,296 |

|

|

|

2,145 |

|

|

|

2,084 |

|

|

|

2,070 |

|

|

|

2,079 |

|

|

|

3,876 |

|

|

|

3,708 |

|

|

|

3,632 |

|

|

Weighted Average Shares Outstanding (in

thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

148,777 |

|

|

|

149,412 |

|

|

|

150,333 |

|

|

|

152,259 |

|

|

|

153,492 |

|

|

|

174,908 |

|

|

|

176,406 |

|

|

|

178,677 |

|

|

Diluted(3) |

|

149,714 |

|

|

|

150,098 |

|

|

|

151,633 |

|

|

|

154,777 |

|

|

|

154,228 |

|

|

|

175,629 |

|

|

|

176,602 |

|

|

|

179,343 |

|

|

|

|

(1) Non-GAAP adjustments include restructuring and related

costs (credit), non-cash stock-based compensation expense, certain

purchase accounting adjustments related to Infinera's acquisitions,

amortization of acquired intangible assets, other customer related

charges and certain other one-time charges. For a description of

this non-GAAP financial measure, please see the section titled,

“GAAP to Non-GAAP Reconciliations” of this press release for a

reconciliation to the most directly comparable GAAP financial

measures. |

|

|

|

(2) Infinera calculates non-GAAP inventory turns as annualized

non-GAAP cost of revenue before adjustments for restructuring and

related costs, non-cash stock-based compensation expense, and

certain purchase accounting adjustments, divided by the average

inventory for the quarter. |

|

|

|

(3) Diluted shares presented for information only. |

|

|

Infinera CorporationGAAP to Non-GAAP

Reconciliation of Financial Outlook(In millions,

except percentages and per share

data)(Unaudited)

The following amounts represent the midpoint of the expected

range:

|

|

|

Q3'19 |

|

|

|

Outlook |

|

Reconciliation of Revenue: |

|

|

|

U.S. GAAP |

|

$ |

328 |

|

|

Acquisition-related deferred revenue adjustment |

|

2 |

|

|

Non-GAAP |

|

$ |

330 |

|

|

|

|

|

|

Reconciliation of Gross Margin: |

|

|

|

U.S. GAAP |

|

27 |

% |

|

Acquisition-related deferred revenue adjustment |

|

1 |

% |

|

Stock-based compensation |

|

1 |

% |

|

Amortization of acquired intangible assets |

|

2 |

% |

|

Restructuring and related |

|

1 |

% |

|

Non-GAAP |

|

32 |

% |

|

|

|

|

|

Reconciliation of Operating Expenses: |

|

|

|

U.S. GAAP |

|

$ |

150 |

|

|

Stock-based compensation |

|

(9 |

) |

|

Amortization of acquired intangible assets |

|

(5 |

) |

|

Acquisition and integration costs |

|

(5 |

) |

|

Restructuring and related |

|

(1 |

) |

|

Non-GAAP |

|

$ |

130 |

|

|

|

|

|

|

Reconciliation of Operating Margin: |

|

|

|

U.S. GAAP |

|

(19 |

)% |

|

Acquisition-related deferred revenue adjustment |

|

1 |

% |

|

Stock-based compensation |

|

3 |

% |

|

Amortization of acquired intangible assets |

|

4 |

% |

|

Acquisition and integration costs |

|

3 |

% |

|

Restructuring and related |

|

1 |

% |

|

Non-GAAP |

|

(7 |

)% |

|

|

|

|

|

Reconciliation of Net Loss per Common Share: |

|

|

|

U.S. GAAP |

|

$ |

(0.40 |

) |

|

Acquisition-related deferred revenue adjustment |

|

0.01 |

|

|

Stock-based compensation |

|

0.06 |

|

|

Amortization of acquired intangible assets |

|

0.07 |

|

|

Acquisition and integration costs |

|

0.06 |

|

|

Restructuring and related |

|

0.01 |

|

|

Amortization of debt discount |

|

0.02 |

|

|

Non-GAAP |

|

$ |

(0.17 |

) |

|

|

|

|

|

|

Contacts:

Media: Anna VueTel. +1 (916) 595-8157avue@infinera.com

Investors:Ted MoreauTel: + 1 (408)

542-6205tmoreau@infinera.com

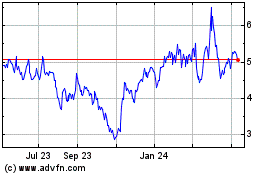

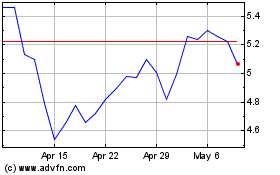

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Apr 2023 to Apr 2024