Greenhill 4Q Advisory Revenue Surged 51%; Best Full-Year Advisory Revenue Since 2007

January 25 2012 - 5:19PM

Dow Jones News

Greenhill & Co. Inc. (GHL) said fourth quarter revenue from

advisory surged 51% and the firm had the highest full-year advisory

revenue since 2007.

Excluding an unusual compensation charge, fourth-quarter profit

of $20.4 million, or 67 cents a share, handily beat analyst

expectations, on revenue of $94.5 million.

For the full year, advisory revenue of $302.8 million rose 20%

from the prior year.

The report caps a tumultuous year for Greenhill, which began

2011 with a loss after the cost of paying its investment bankers

swamped revenue. The second and third quarters bounced back to

better-than-expected profitability as those costs reverted to

normal, but Chief Executive Scott Bok did find himself having to

respond to questions about the firm's business model.

On Wednesday, Greenhill said its client base had grown 14% in

2011 and those clients generating $1 million or more in revenue had

grown 30%. Less than two-thirds of advisory revenue came from the

completion of mergers and acquisitions transactions, a nod to the

firm's diverse sources of income despite criticism that it is too

skewed toward advisory services.

Of the independent Wall Street firms providing M&A advice,

Greenhill's business is nearly 100% advisory. Rivals Evercore

Partners (EVR) and Lazard Ltd. (LAZ) have trading or

asset-management businesses, too.

Shares of Greenhill tumbled 55% last year amid rocky markets and

uncertainty over the European debt crisis that muted deal activity

in the second half of the year. They are up 20% so far this

year.

Analysts had expected fourth-quarter earnings of $18.8 million,

or 61 cents a share, on revenue of $84 million. The quarter

included a charge for accelerated vesting of stock awards for two

managing directors, Jeff Buckalew and Rakesh Chawla, who died in a

plane crash in December. The crash also took the lives of

Buckalew's wife, Corinne, and their children, Jackson and

Meriwether.

Including that unusual charge, earnings per share were 53

cents.

Like other advisory firms, Greenhill books the most in fees when

deals close. Just two weeks before the end of the year, one of its

biggest deals unraveled. AT&T Inc. (T) said it was canceling

its $39 billion takeover of Deutsche Telekom's T-Mobile USA unit

after government opposition derailed the deal.

That cost the seven banks advising the various sides, including

Greenhill, as much as $150 million in fees collectively, according

to Thomson Reuters.

But Greenhill continues to get assignments. The firm is advising

Roche Holding Ltd. in its $5.7 billion hostile bid for Illumina

Inc. (ILMN) That transaction was announced Wednesday.

In October, the firm declared its plans to buy back stock using

the proceeds of the sale of its stake in satellite company Iridium

Communications Inc. (IRDM) through a plan designed to let holders

sell at regular intervals.

Sales of Iridium shares in the fourth quarter boosted revenue by

$14 million, partially offset by a $6 million write-down in the

value of the firm's remaining fund investments.

-By Liz Moyer, Dow Jones Newswires; 212-416-2512;

liz.moyer@dowjones.com

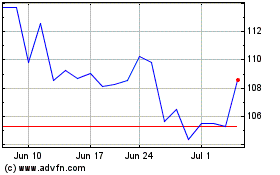

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Sep 2023 to Sep 2024