Life Technologies Beats on Robust Top Line - Analyst Blog

October 26 2011 - 10:15AM

Zacks

Life Technologies Corporation (LIFE) reported an

EPS of 94 cents in the third quarter of fiscal 2011, beating both

the Zacks Consensus Estimate of 88 cents and the year-ago quarter’s

adjusted EPS of 87 cents.

Revenues increased 7% year over year to $929 million, surpassing

the Zacks Consensus Estimate of $916 million. Excluding the impact

of foreign exchange movement, revenue growth for the quarter was

4%. On a geographical basis, revenue growth was witnessed across

Europe – 5%, Asia-Pacific – 14% and the Americas – 2%. However,

revenues derived from Japan declined 2%.

Life Technologies has witnessed improvement in Greater China

business along with robust performance of Ion Torrent products. The

company had witnessed temporary slack in business in China in the

second quarter but expected the situation to improve in the second

half. Funding pressures for academic and government funded projects

are expected to continue in the US and Europe.

Adjusted gross margin during the quarter was 66.1%, down 70 basis

points (bps) from the year-ago quarter due to the negative impact

from higher instrument sales and lower royalty revenue, partially

offset by the positive impact from productivity and price. Adjusted

operating margin was 29.4% in the reported quarter, 40 bps higher

than the prior-year quarter on the back of the company’s continued

focus on operational efficiencies.

Operating expenses (adjusted basis) were $343.9 million compared to

$340.6 million in the year-ago quarter, owing to a 1% rise in

selling, general and administrative expenses to $253.3 million

though research and development expenses declined by the same

magnitude to $90.6 million. While research and development expenses

remained almost unchanged at $89.6 million, selling, general and

administrative expenses increased 5% to $250.6 million.

Consequently, operating expenses inched up 3.8% to $$340.3

million.

Life Technologies exited the quarter with $635.9 million in the

form of cash and short-term investments, lower than $854.8 million

at the end of December 2010. Free cash flow during the nine months

of the fiscal was $427.4 million with $493.2 million of cash flow

from operating activities and $65.8 million of capital

expenditure.

Segments

Life Technologies earns revenues primarily from three divisions –

Molecular Biology Systems, Genetic Systems and Cell Systems, which

recorded adjusted revenues of $426 million (up 3% year over year),

$256 million (up 12%) and $244 million (up 10%), respectively.

The Cell Systems division witnessed robust growth across the

portfolio with low double-digit growth in BioProduction business.

In Genetic Systems, strong sales of Ion Torrent PGM and growth of

forensic instrument placements were partially offset by lower sales

of the 5500 instrument and consumables.

Guidance

Life Technologies reiterated its outlook for 2011. The company

expects revenue growth (excluding currency) of 2-4% resulting in

adjusted EPS of $3.70-$3.80.

Recommendation

Life Technologies enjoys a strong position in the life sciences

market. We are impressed with the company’s improved performance

during the reported quarter after second quarter’s disappointment.

The company continues to be affected by funding pressures in US and

Europe, although several strategies are being implemented to

address these challenges. The company also faces increased

competition from players like,

Thermo Fisher

Scientific (TMO),

Illumina (ILMN) among

others.

We are currently Neutral on the stock, in line with Thermo Fisher.

Both stocks carry short term Zacks #3 Ranks (Hold).

ILLUMINA INC (ILMN): Free Stock Analysis Report

LIFE TECHNOLOGS (LIFE): Free Stock Analysis Report

THERMO FISHER (TMO): Free Stock Analysis Report

Zacks Investment Research

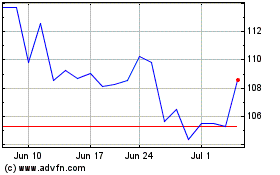

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Sep 2023 to Sep 2024