IDEX Biometrics ASA interim report for the fourth quarter and preliminary result for 2022

February 22 2023 - 2:00AM

Oslo, Norway – 22 February 2023 - IDEX

Biometrics ASA’s interim report for the fourth quarter and

preliminary annual result for 2022 is attached to this notice (link

below). The interim report is also available on the IDEX Biometrics

website: www.idexbiometrics.com/investors/interim-results/

A webcast presentation of the interim report will be held by

Vince Graziani, Chief Executive Officer, today at 13:00 CET. The

webcast presentation can be viewed at the following link:

https://channel.royalcast.com/landingpage/hegnarmedia/20230223_5/

2022 marked an inflection point in the biometric payment card

market with nine new biometric payment card programs launched with

banks on the IDEX Biometrics technology platform. This indicates an

acceleration in the deployment of biometric cards with banks and

issuers and commercial success for card manufacturers who have

selected IDEX Biometrics sensor solutions over the

competition.

Until recently, there were four biometric card manufacturers in

the market with cards based on IDEX Biometrics sensor technology.

In 2022, IDEX Biometrics significantly accelerated design wins with

card manufacturers, reaching twelve design wins with global and

regional card manufacturers across the globe. These card

manufacturers are in the process of obtaining LOA’s (Letters Of

Approval) from the major payment schemes and are preparing to

launch biometric smart cards based on the certified IDEX Biometrics

and Infineon Technologies solution offering, together with global

and regional banks and issuers.

Revenues in the fourth quarter were $1.1 million, increasing 15%

compared to third quarter revenues of $928 thousand. For the full

year the company recorded revenues of $4.1 million, a

year-over-year increase of 44%. We expect continued revenue growth

in 2023.

Gross margin increased to 33% in the fourth quarter, up from 12%

in the third quarter, and for the full year 2022 the gross margin

was 21%. The higher margin in the fourth quarter was due to

increased sales to high-margin customers. We expect the gross

margin in the first quarter of 2023 to be at similar levels as in

the fourth quarter of 2022.

Operating expenses excluding cost of materials and depreciation

decreased 12% this quarter to $7.0, down from $7.9 million in the

third quarter. The decrease in operating expenses partly reflects a

reduction of the number of employees implemented in the second half

of 2022. Development expenses were seasonally low in the fourth

quarter due to recognition of government support credits. We expect

to further decrease operating expenses in the first quarter of

2023.

For further information contact:Marianne Bøe,

Head of Investor Relations

E-mail: marianne.boe@idexbiometrics.com Tel: + 47 918

00186

About IDEX Biometrics

IDEX Biometrics ASA (OSE: IDEX and Nasdaq: IDBA)

is a global technology leader in fingerprint biometrics, offering

authentication solutions across payments, access control, and

digital identity to create unmatched convenience and uncompromised

security for users. Our solutions are based on patented and

proprietary sensor technologies, integrated circuit designs, and

software, targeting card-based applications for payments and

digital authentication. We partner with leading card manufacturers

and other industry experts to bring our solutions to market.

For more information, visit www.idexbiometrics.com

TRADEMARK STATEMENTIDEX, TrustedBio, IDEX

Biometrics and the IDEX logo are trademarks owned by IDEX

Biometrics ASA. All other brands or product names are the property

of their respective holders.

This information is subject to the disclosure requirements

pursuant to Section 5-12 the Norwegian Securities Trading Act

- IDEX 2022 Q4 Interim Report

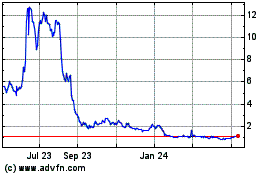

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Apr 2023 to Apr 2024