Filed by Ideanomics, Inc.

pursuant to Rule 425 under the Securities Act

of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Ideanomics, Inc.

Commission File No. 001-35561

This filing relates to the proposed

transaction involving Ideanomics, Inc., Longboard Merger Corp., and VIA Motors International, Inc. pursuant to the terms of that

certain Agreement and Plan of Merger, dated August 30, 2021, by and among Ideanomics, Inc., a Nevada corporation, Longboard Merger

Corp., a Delaware corporation, and VIA Motors International, Inc., a Delaware corporation.

Barron’s

Another Electric Truck Maker Is Going Public

Through an Acquisition

August 30, 2021 03:10 PM Eastern Daylight Time

By Al Root

Electric vehicles for commercial

uses are ready for prime time. One sign is the roughly $80 billion valuation that electric truck maker Rivian is looking

for when it goes public soon. Another is simply the rash of electric truck and van startups vying for a piece of the EV pie.

And another electric trucking

company popped up on investors’ radar Monday. Via Motors agreed to be bought by EV conglomerate Ideanomics (ticker:

IDEX) in a $600 million all-stock deal that still has to be approved by shareholders.

The deal has shares of Ideanomics (ticker:

IDEX) on the move. The stock was up 4.4% in afternoon trading. The S&P 500 was up 0.6%. The Dow Jones Industrial Average was

flat.

Via Motors is focused on producing

class 2 to class 5 electric trucks and vans. A class 2 can be a full-size pickup or delivery van; a class 5 can be a large moving truck.

For comparison’s sake, a car is a class 1 and a semi is a class 8.

Other EV startups working on commercial

vehicles include Rivian, Workhorse (WKHS), Lordstown Motors (RIDE), Arrival (ARVL), and Canoo (GOEV).

At $600 million, the Via-Ideanomics

deal is one of the less expensive commercial EV plays. Lordstown’s market capitalization is about $1 billion. Canoo comes

in with a $1.7 billion market cap. Arrival’s market cap stands far above, about $7.2 billion.

One reason that Via is less expensive

is because it isn’t ready to ship trucks yet; production is planned for 2023.

But Via has an ace up its sleeve:

CEO Bob Purcell, who ran General Motors (GM) electric vehicle business in the 1990s. He is the father of the legendary GM EV1,

the first mass-produced EV and the first one that GM designed to be a plug-in from the beginning.

“We were the car that started

it all …I was very proud of my group,” Purcell told Barron’s after Via and Ideanomics announced their

deal. “We invented that technology…things like torque vector control for motors, battery management systems…none of

that existed before the EV1.”

Now, Purcell has turned to commercial

electric vehicles. Via could have pursued a traditional initial public offering or a merger with a special purpose acquisition company,

or SPAC. Instead, the start-up went with Ideanomics, which focuses on EV charging, storage, and EV production.

“We have all the [electrical]

grid augmentation, charging capabilities …we have component and subcomponent manufacturers,” Ideanomics CEO Alf Poor explained

to Barron’s. “This is one of the key pieces to bring in to be close to those major commercial fleet operators

like the Amazon ‘s [and] Walmart ‘s.”

Ideanomics shareholders still

have to sign off on the deal. But based on the stock market’s reaction on Monday, the deal should be received with enthusiasm.

Write to Al Root at allen.root@dowjones.com

Cautionary Statement Regarding Forward-Looking

Statements

This

communication relates to a proposed transaction between Ideanomics, Inc. (the “Company”) and VIA Motors International, Inc.

(“VIA Motors”). This communication includes forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact

included herein are "forward-looking statements." These forward-looking statements are often identified by the use of forward-looking

terminology such as "believes," "expects" or similar expressions, involve known and unknown risks and uncertainties,

and include statements regarding our proposed acquisition of VIA Motors, statements about the expected benefits of the transaction, our

business strategy and planned product offerings, and potential future financial results. Although the Company believes that the expectations

reflected in such forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations

may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of

this communication. The Company's actual results could differ materially from those anticipated in these forward-looking statements as

a result of a variety of risks and uncertainties, such as risks related to: our ability to consummate the proposed transaction on a timely

basis or at all; our ability to successfully integrate VIA Motor’s operations and personnel; our ability to implement our plan,

forecasts and other expectations with respect to VIA Motor’s business after the completion of the transaction and realize expected

synergies; our need to raise substantial capital in order to support the combined company’s business plan; the satisfaction of

the conditions precedent to consummation of the proposed transaction; our ability to secure regulatory approvals on the terms expected

in a timely manner or at all; our ability to realize the anticipated benefits of the proposed transaction, including the possibility

that the expected benefits from the proposed transaction will not be realized or will not be realized within the expected time period;

disruption from the transaction making it more difficult to maintain business and operational relationships; any negative effects of

the announcement or the consummation of the proposed transaction on the market price of our common stock or on our operating results;

the impact of significant transaction costs and unknown liabilities on our operating results; the risk of litigation and/or regulatory

actions related to the proposed transaction; the exertion of management’s time and our resources, and other expenses incurred in

connection with the transaction; the effect of the announcement or pendency of the transaction on the Company’s and VIA Motor’s

business relationships, operating results, and business generally; the transformation of our business model; fluctuations in our operating

results; strain to our personnel management, financial systems and other resources as we grow our business; our ability to attract and

retain key employees and senior management; competitive pressure; our international operations. These risks, as well as other risks related

to the proposed transaction, will be described in the registration statement on Form S-4 and proxy statement/prospectus that will be

filed with the SEC in connection with the proposed transaction. While the list of factors presented here is, and the list of factors

to be presented in the registration statement on Form S-4 are, considered representative, no such list should be considered to be a complete

statement of all potential risks and uncertainties. For additional information about other factors that could cause actual results to

differ materially from those described in the forward-looking statements, please refer to our periodic reports and other filings with

the SEC, including the risk factors identified in our most recent Quarterly Reports on Form 10-Q and Annual Report on Form 10-K; and

other risks and uncertainties disclosed under the sections entitled “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” in our most recent Form 10-K and Form 10-Q filed with the Securities

and Exchange Commission, and similar disclosures in subsequent reports filed with the SEC, , which are available on the SEC website at

www.sec.gov. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified

in their entirety by these risk factors. Other than as required under the securities laws, the Company does not assume a duty to update

these forward-looking statements.

No Offer or Solicitation

This communication is not intended to and

shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote

or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except

by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information About the Merger

and Where to Find It

In connection with the

proposed transaction, the Company intends to file with the SEC a registration statement on Form S-4 that will include a prospectus and

proxy statement of the Company. The Company may also file other relevant documents with the SEC regarding the proposed transaction. This

document is not a substitute for the proxy statement/prospectus or registration statement or any other document that the Company may

file with the SEC. The definitive proxy statement/prospectus (if and when available) will be mailed to stockholders of the Company and

VIA Motors. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT

DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY

IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors

and security holders will be able to obtain free copies of the registration statement and proxy statement/prospectus (if and when available)

and other documents containing important information about the Company, VIA Motors and the proposed transaction, once such documents

are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the

SEC by the Company will be available free of charge on the Company’s website at Ideanomics.com or by contacting the Company’s

Investor Relations department at IR@Ideanomics.com.

Participants in the Solicitation

The Company, VIA Motors and certain of their

respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed

transaction. Information about the directors and executive officers of the Company, including a description of their direct or indirect

interests, by security holdings or otherwise, is set forth in the Company’s Annual Report on Form 10-K for the year ended December

31, 2020, which was filed with the SEC on March 31, 2021. Other information regarding the participants in the proxy solicitation and a

description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus

and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors

should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may

obtain free copies of these documents from the Company or VIA Motors using the sources indicated above.

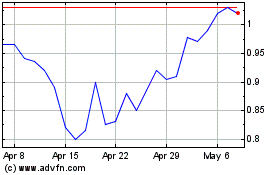

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

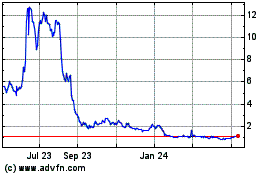

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Apr 2023 to Apr 2024