- Total revenue of $34.4 million compared with $50.2

million from the prior year quarter.

- GAAP Operating Income improves to income of $18.6

million from a loss of $94.6 million in the prior year

quarter. Adjusted EBITDA margin improves to 59% from 49% in

the prior year quarter.

- Signed 111 license deals year to date, representing $79

million of aggregate guaranteed minimum royalties.

Iconix Brand Group, Inc. (Nasdaq: ICON) ("Iconix" or the

"Company") today reported financial results for the second quarter

ended June 30, 2019.

Bob Galvin, CEO commented, “Results for the second quarter of

2019 were as expected, as we continue to stabilize the business and

our operational cost structure. Our focus on the business and

costs helped to improve our EBITDA margin to 59% from 49% in the

prior year quarter. We also continue to build the pipeline of

our future business, as we have signed 111 deals year to date for

aggregate guaranteed minimum royalties of approximately $79

million.”

Second Quarter 2019 Financial Results

GAAP Revenue by Segment(000’s)

| |

For the Three MonthsEnded

June 30, |

|

|

For the Six MonthsEnded

June 30, |

| |

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

Licensing revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Women's |

$ |

8,171 |

|

|

$ |

16,871 |

|

|

$ |

16,538 |

|

|

$ |

33,469 |

| Men's |

|

6,614 |

|

|

|

10,526 |

|

|

|

17,550 |

|

|

|

20,470 |

| Home |

|

4,285 |

|

|

|

6,961 |

|

|

|

7,775 |

|

|

|

13,473 |

| International |

|

15,324 |

|

|

|

15,854 |

|

|

|

28,473 |

|

|

|

31,349 |

| |

$ |

34,394 |

|

|

$ |

50,212 |

|

|

$ |

70,336 |

|

|

$ |

98,761 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the second quarter of 2019, total revenue was $34.4 million,

a 31% decline, compared to $50.2 million in the second quarter of

2018. Such decline was expected, principally as a result of the

transition of our Danskin and Mossimo direct to retail licenses in

our Women’s segment, as previously announced. Our revenue for the

second quarter of 2019 was also impacted by the effect of the Sears

bankruptcy on our Joe Boxer and Bongo brands in Women’s and the

Cannon brand in Home. While we recently signed new agreements with

the new Sears and Kmart for the Cannon and Joe Boxer brands, the

overall revenue for the Cannon and Joe Boxer brands was down year

over year. Our Men’s segment revenue decreased 37% in the second

quarter of 2019, compared to the prior year quarter primarily from

the Buffalo brand. Our International segment declined 3% in

the second quarter of 2019 primarily as a result of performance in

China.

For the six months ended June 30, 2019, total revenue was

$70.3 million, a 29% decline, compared to $98.8 million

in the six months ended June 30, 2018.

SG&A Expenses:

Total SG&A expenses in the second quarter of 2019 were $16.4

million, a 43% decline compared to $28.6 million in the second

quarter of 2018. Most of the decline for the quarter was a decrease

in compensation, advertising, bad debt expense and professional

expenses. The decrease in compensation was part of the Company’s

continued efforts to reduce costs as well as the prior year

included severance costs related to the former CEO. Additionally,

expenses for the second quarter of 2018 included $2.9 million in

costs associated with a debt refinancing. Total SG&A expenses

in the six months ended June 30, 2019 were $34.5 million,

a 45% decline compared to $62.2 million in the six months

ended June 30, 2018.

Operating Income and Adjusted EBITDA (1):

Adjusted EBITDA is a non-GAAP metric, and a reconciliation table

is included below.

Operating income for the second quarter of 2019 was

$18.6 million, as compared to operating loss of $94.6 million

in the second quarter of 2018. Adjusted EBITDA in

the second quarter of 2019 was $20.3 million which represents

operating income of $18.6 million excluding net charges of

$1.7 million. Adjusted EBITDA in the second quarter of

2018 was $24.6 million which represents operating loss of

$94.6 million excluding net charges of $119.2 million, which was

primarily related to impairment charges of $111.1 million.

The change period over period in Adjusted EBITDA is primarily as a

result of the change in revenue as outlined above, which was

somewhat offset by the cost reduction initiative. Refer to footnote

1 below for a full detailed reconciliation of operating income to

Adjusted EBITDA.

Operating income for the six months ended

June 30, 2019 was $37.0 million, as compared to

operating loss of $79.1 million in the six months ended

June 30, 2018. Adjusted EBITDA for the six months

ended June 30, 2019 was $38.8 which represents

operating income of $37.0 million excluding net charges of

$1.8 million. Adjusted EBITDA for the six months ended

June 30, 2018 was $47.1 million which represents

operating loss of $79.1 million excluding net charges of

$126.0 million. The change period over period in Adjusted EBITDA is

primarily as a result of the change in revenue as outlined

above. Refer to footnote 1 below for a full detailed

reconciliation of operating income to Adjusted

EBITDA.

| |

|

|

|

|

|

|

| Adjusted EBITDA by

Segment (1) |

For the Three Months Ended

June 30, |

|

|

|

For the Six Months Ended

June 30, |

|

| (000's) |

2019 |

|

2018 |

|

%

Change |

|

|

|

2019 |

|

2018 |

|

%

Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Women's |

$ |

8,622 |

|

$ |

15,481 |

|

|

-44 |

% |

|

|

$ |

16,249 |

|

$ |

30,020 |

|

|

-46 |

% |

| Men's |

|

3,478 |

|

|

3,259 |

|

|

7 |

% |

|

|

|

7,544 |

|

|

6,684 |

|

|

13 |

% |

| Home |

|

3,783 |

|

|

6,596 |

|

|

-43 |

% |

|

|

|

6,790 |

|

|

12,347 |

|

|

-45 |

% |

| International |

|

9,306 |

|

|

6,806 |

|

|

37 |

% |

|

|

|

17,300 |

|

|

12,707 |

|

|

36 |

% |

| Corporate |

|

(4,860 |

) |

|

(7,516 |

) |

|

35 |

% |

|

|

|

(9,109 |

) |

|

(14,663 |

) |

|

38 |

% |

| Adjusted

EBITDA |

$ |

20,329 |

|

$ |

24,626 |

|

|

-17 |

% |

|

|

$ |

38,774 |

|

$ |

47,095 |

|

|

-18 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA Margin

(2) |

|

59 |

% |

|

49 |

% |

|

|

|

|

|

|

55 |

% |

|

48 |

% |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA margin in the second quarter of 2019

was 59% as compared to adjusted EBITDA margin in

the second quarter of 2018 of 49%. The change

period over period in adjusted EBITDA margin is primarily as a

result of the Company’s decrease in expenses which outpaced the

decrease in revenues.

Adjusted EBITDA margin in the six months ended

June 30, 2019 was 55% as compared to adjusted EBITDA margin in

the six months ended June 30, 2018 of 48%. The

change period over period in adjusted EBITDA margin is primarily as

a result of the Company’s decrease in expenses which outpaced the

decrease in revenues.

Interest Expense and Other Income:

Interest expense in the second quarter of 2019 was $14.5

million as compared to $14.8 million in the second quarter of

2018. In the second quarter of 2019, the Company

recognized a $0.3 million gain as compared to a $32.1 million gain

in the second quarter of 2018. These gains result from the

Company's accounting for the 5.75% Convertible Notes, which

requires recording the fair value of this debt at the end of each

period with any change from the prior period accounted for as other

income or loss in the respective period's income statement.

Interest expense in the six months ended June 30, 2019 was

$29.0 million as compared to $29.4 million in the six months

ended June 30, 2018.

Provision for Income Taxes:

The effective income tax rate for the second quarter of 2019 is

approximately -4%, which resulted in a $0.1 million income

tax benefit, as compared to an effective income tax rate

of 4% in the second quarter of 2018, which resulted in

a $2.8 million income tax benefit. The change in

the effective tax rate was due to trademark impairment recorded in

the Prior Year Quarter, for which the Company recognized a tax

benefit against a pretax loss.

The effective income tax rate for the six months ended

June 30, 2019 is approximately 7%, which resulted in a

$1.8 million income tax provision, as compared to an effective

income tax rate of 3% in the six months ended June 30,

2018, which resulted in a $1.2 million income

tax benefit. The increase in tax expense is due to

trademark impairment recorded in the Prior Year Six Months, for

which the Company recognized a tax benefit.

GAAP Net Income and GAAP Diluted EPS:

GAAP net income attributable to Iconix for the second quarter of

2019 reflects income of $ 1.3 million, compared to loss of

$79.4 million for the second quarter of 2018. GAAP diluted EPS for

the second quarter of 2019 reflects income of $0.04,

compared to loss of $12.55 for the second quarter of 2018.

GAAP net income attributable to Iconix for the six months ended

June 30, 2019 reflects income of $19.2 million, compared to

a loss of $51.7 million for the six months ended

June 30, 2018. GAAP diluted EPS for the six months

ended June 30, 2019 reflects income of $0.10 compared to

a loss of $ 9.06 for the six months ended

June 30, 2018.

Adjusted EBITDA (1):

Adjusted EBITDA for the second quarter of 2019 was $20.3

million, compared to $24.6 million for the second quarter of

2018. Adjusted EBITDA for the six months ended June 30,

2019 was $38.8 million, compared to $47.1 million for the six

months ended June 30, 2018.

| |

|

|

|

|

| Adjusted EBITDA:

(1) |

|

|

|

|

| (000's) |

|

|

|

|

| |

|

|

|

|

| |

For the Three Months Ended

June 30, |

|

|

|

2019 |

|

2018 |

|

% Change |

|

| |

|

|

|

|

|

GAAP Operating Income (Loss) |

$18,572 |

|

$(94,586 |

) |

120% |

|

| |

|

|

|

|

| Add: |

|

|

|

|

|

stock-based compensation expense |

258 |

|

499 |

|

|

|

|

depreciation and amortization |

482 |

|

632 |

|

|

|

|

costs associated with debt financings |

- |

|

2,905 |

|

|

|

|

loss on termination of licenses |

- |

|

5,650 |

|

|

|

|

impairment charges |

- |

|

111,147 |

|

|

|

|

special charges |

3,198 |

|

2,677 |

|

|

|

|

non-controlling interest |

(2,174 |

) |

(4,291 |

) |

|

|

|

non-controlling interest related to D&A |

(7 |

) |

(7 |

) |

|

|

|

|

1,757 |

|

119,212 |

|

|

|

| |

|

|

|

|

| Adjusted

EBITDA |

$20,329 |

|

$24,626 |

|

-17% |

|

| Adjusted EBITDA Margin

(2) |

59 |

% |

49 |

% |

|

|

| |

|

|

|

|

| |

|

|

|

|

| Adjusted EBITDA:

(1) |

|

|

|

|

| (000's) |

|

|

|

|

| |

|

|

|

|

| |

For the Six Months Ended

June 30, |

|

|

|

2019 |

|

2018 |

|

% Change |

|

|

|

|

|

|

|

|

GAAP Operating Income (Loss) |

$36,971 |

|

$(79,050 |

) |

147% |

|

| |

|

|

|

|

| Add: |

|

|

|

|

|

stock-based compensation expense |

399 |

|

1,518 |

|

|

|

|

depreciation and amortization |

974 |

|

1,286 |

|

|

|

|

costs associated with debt financings |

- |

|

8,344 |

|

|

|

|

loss on termination of licenses |

- |

|

5,650 |

|

|

|

|

impairment charges |

- |

|

111,147 |

|

|

|

|

special charges |

5,978 |

|

5,382 |

|

|

|

|

non-controlling interest |

(5,535 |

) |

(7,148 |

) |

|

|

|

non-controlling interest related to D&A |

(13 |

) |

(34 |

) |

|

|

|

|

1,803 |

|

126,145 |

|

|

|

| |

|

|

|

|

| Adjusted

EBITDA |

$38,774 |

|

$47,095 |

|

-18% |

|

| Adjusted EBITDA Margin

(2) |

55 |

% |

48 |

% |

|

|

| |

|

|

|

|

Balance Sheet and Liquidity:

| (000's) |

June 30, 2019 |

|

December 31, 2018 |

|

| Cash

Summary: |

|

|

|

|

|

Unrestricted Domestic Cash (wholly owned) |

$ |

33,944 |

|

$ |

45,936 |

|

| Unrestricted Domestic Cash (in

consolidated JV's) |

|

8,896 |

|

|

8,460 |

|

| Unrestricted International

Cash |

|

9,585 |

|

|

12,213 |

|

| Restricted Cash |

|

14,633 |

|

|

16,026 |

|

| |

|

|

|

|

| Total Cash |

$ |

67,058 |

|

$ |

82,635 |

|

| |

|

|

|

|

| Debt Summary: |

|

|

|

|

| Senior Secured Notes due January 2043* |

$ |

353,163 |

|

$ |

365,481 |

|

| 5.75% Convertible Notes due August 2023 |

|

94,580 |

|

|

109,715 |

|

| Variable Funding Note due January 2043 |

|

100,000 |

|

|

100,000 |

|

| 2017 Senior Secured Term Loan due August 2022 |

|

187,492 |

|

|

189,421 |

|

| |

|

|

|

|

| Total Debt (Face Value) |

$ |

735,235 |

|

$ |

764,617 |

|

| |

|

|

|

|

| *- The Company’s

Senior Secured Notes include a test that measures the amount of

principal and interest required to be paid on the debt to the

approximate cash flow available to pay such principal and interest;

the test is referred to as the debt service coverage ratio

(“DSCR”). As a result of a decline in royalty collections

during the twelve months ended March 31, 2019, the DSCR fell below

1.10x as of March 31, 2019. Beginning April 1, 2019, the Senior

Secured Notes are in a Rapid Amortization Event pursuant to the

Securitization Notes Indenture. In rapid amortization, the

residual will immediately be used to pay down the principal.

Iconix will continue to receive its management fee from the

Securitization Notes and the Company does not believe the loss of

our residual, if any, will have a significant impact on our

operations. |

|

| |

|

|

|

|

The Company currently projects compliance with its financial

covenants under its senior secured term loan and the interest only

DSCR under the Securitization indenture for 2019.

Conference Call

The Company will host a conference call today at 5:00 PM ET. The

call can be accessed on the Company's website at

www.iconixbrand.com or by telephone at 844-286-1555 or 270-823-1180

(conference ID: 8539908). A written transcript will be posted

online as soon as available.

About Iconix Brand Group, Inc.

Iconix Brand Group, Inc. owns, licenses and markets a portfolio

of consumer brands including: CANDIE'S ®, BONGO ®, JOE

BOXER ®, RAMPAGE ®, MUDD ®, MOSSIMO ®, LONDON

FOG ®, OCEAN PACIFIC ®, DANSKIN ®, ROCAWEAR ®,

CANNON ®, ROYAL VELVET ®, FIELDCREST ®,

CHARISMA ®, STARTER ®, WAVERLY ®, ZOO YORK ®,

UMBRO ®, LEE COOPER ®, ECKO UNLTD. ®, MARC

ECKO ®, ARTFUL DODGER ®, and HYDRAULIC®. In addition,

Iconix owns interests in the MATERIAL GIRL ®, ED HARDY ®,

TRUTH OR DARE ®, MODERN AMUSEMENT ®, BUFFALO ® and

PONY ® brands. The Company licenses its brands to a network of

retailers and manufacturers. Through its in-house business

development, merchandising, advertising and public relations

departments, Iconix manages its brands to drive greater consumer

awareness and brand loyalty.

Forward-Looking Statements

In addition to historical information, this press release

contains forward-looking statements within the meaning of the

federal securities laws. Such forward-looking statements include

projections regarding the Company's beliefs and expectations about

future performance and, in some cases, may be identified by words

like "anticipate," "assume," "believe," "continue," "could,"

"estimate," "expect," "intend," "may," "plan," "potential,"

"predict," "project," "future," "will," "seek" and similar terms or

phrases. These statements are based on the Company's beliefs and

assumptions, which in turn are based on information available as of

the date of this press release. Forward-looking statements involve

known and unknown risks and uncertainties, which could cause actual

results to differ materially from those contained in any

forward-looking statement and could harm the Company's business,

prospects, results of operations, liquidity and financial condition

and cause its stock price to decline significantly. Many of these

factors are beyond the Company's ability to control or predict.

Important factors that could cause the Company's actual results to

differ materially from those indicated in the forward-looking

statements include, among others: the ability of the Company's

licensees to maintain their license agreements or to produce and

market products bearing the Company's brand names, the Company's

ability to retain and negotiate favorable licenses, the Company's

ability to meet its outstanding debt obligations and the events and

risks referenced in the sections titled "Risk Factors" in the

Company's Annual Report on Form 10‑K for the year ended

December 31, 2018 and subsequent Quarterly Reports on

Form 10‑Q and in other documents filed or furnished with the

Securities and Exchange Commission. Our forward-looking statements

do not reflect the potential impact of any acquisitions, mergers,

dispositions, business development transactions, joint ventures or

investments we may enter into or make in the future. Given these

uncertainties, you should not place undue reliance on these

forward-looking statements. These forward-looking statements are

made only as of the date hereof and the Company undertakes no

obligation to update or revise publicly any forward-looking

statements, except as required by law.

Media contact: John T. McClain Executive Vice

President and Chief Financial Officer Iconix Brand

Group, Inc. jmcclain@iconixbrand.com

212-730-0030

Unaudited Consolidated Statement of

Operations(000’s, except earnings per share data)

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

Licensing revenue |

$ |

34,394 |

|

|

$ |

50,212 |

|

|

$ |

70,336 |

|

|

$ |

98,761 |

|

| Selling, general and

administrative expenses |

|

16,435 |

|

|

|

28,643 |

|

|

|

34,528 |

|

|

|

62,241 |

|

| Loss on termination of

licenses |

|

— |

|

|

|

5,650 |

|

|

|

— |

|

|

|

5,650 |

|

| Depreciation and

amortization |

|

482 |

|

|

|

632 |

|

|

|

974 |

|

|

|

1,286 |

|

| Equity earnings on joint

ventures |

|

(1,095 |

) |

|

|

(1,149 |

) |

|

|

(2,137 |

) |

|

|

(1,245 |

) |

| Gain on sale of

trademarks |

|

— |

|

|

|

(125 |

) |

|

|

— |

|

|

|

(1,268 |

) |

| Goodwill impairment |

|

— |

|

|

|

37,812 |

|

|

|

— |

|

|

|

37,812 |

|

| Trademark impairment |

|

— |

|

|

|

73,335 |

|

|

|

— |

|

|

|

73,335 |

|

| Operating income (loss) |

|

18,572 |

|

|

|

(94,586 |

) |

|

|

36,971 |

|

|

|

(79,050 |

) |

| Other expenses (income): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

14,465 |

|

|

|

14,827 |

|

|

|

28,970 |

|

|

|

29,376 |

|

|

Interest income |

|

(90 |

) |

|

|

(92 |

) |

|

|

(162 |

) |

|

|

(214 |

) |

|

Other income, net |

|

1,140 |

|

|

|

(32,083 |

) |

|

|

(18,795 |

) |

|

|

(58,215 |

) |

|

Gain on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4,473 |

) |

|

Foreign currency translation (gain) loss |

|

(258 |

) |

|

|

704 |

|

|

|

369 |

|

|

|

152 |

|

|

Other expenses (income) – net |

|

15,257 |

|

|

|

(16,644 |

) |

|

|

10,382 |

|

|

|

(33,374 |

) |

| Income (loss) before income

taxes |

|

3,315 |

|

|

|

(77,942 |

) |

|

|

26,589 |

|

|

|

(45,676 |

) |

| (Benefit) provision for income

taxes |

|

(130 |

) |

|

|

(2,804 |

) |

|

|

1,838 |

|

|

|

(1,154 |

) |

| Net income (loss) |

|

3,445 |

|

|

|

(75,138 |

) |

|

|

24,751 |

|

|

|

(44,522 |

) |

| Less: Net income attributable

to non-controlling interest |

|

2,174 |

|

|

|

4,291 |

|

|

|

5,535 |

|

|

|

7,148 |

|

| Net income (loss) attributable

to Iconix Brand Group, Inc. |

$ |

1,271 |

|

|

$ |

(79,429 |

) |

|

$ |

19,216 |

|

|

$ |

(51,670 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.04 |

|

|

$ |

(12.55 |

) |

|

$ |

2.13 |

|

|

$ |

(9.06 |

) |

|

Diluted |

$ |

0.04 |

|

|

$ |

(12.55 |

) |

|

$ |

0.10 |

|

|

$ |

(9.06 |

) |

| Weighted average number of

common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

10,377 |

|

|

|

6,598 |

|

|

|

9,426 |

|

|

|

6,257 |

|

|

Diluted |

|

10,377 |

|

|

|

6,598 |

|

|

|

44,779 |

|

|

|

6,257 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Footnotes

(1) Adjusted EBITDA is a non-GAAP financial measure which

represents operating income excluding stock-based compensation

(benefit) expense, depreciation and amortization, costs associated

with recent financings, special charges related to professional

fees incurred as a result of the correspondence with the Staff of

the SEC, the SEC and related SDNY investigations, internal

investigations, the previously disclosed class action and

derivative litigations, costs related to the transition of Iconix

management, but including gains on sales of trademarks and

non-controlling interest. The Company believes Adjusted EBITDA is a

useful financial measure in evaluating its financial condition

because it is more reflective of the Company's business purpose,

operations and cash expenses. Uses of cash flows that are not

reflected in Adjusted EBITDA include interest payments and debt

principal repayments, which can be significant. As a result,

Adjusted EBITDA should not be considered as a measure of our

liquidity. Other companies that provide Adjusted EBITDA

information may calculate EBITDA and Adjusted EBITDA differently

than we do. The definition of Adjusted EBITDA may not be the same

as the definitions used in any of our debt agreements.

| |

|

| Adjusted EBITDA Reconciliation For the

Three Months Ended June 30,

(1): |

|

| |

GAAP Operating Income |

|

ImpairmentCharges |

|

Special Charges |

|

Costsassociated with debt financings |

|

Loss on Terminationof

Licenses |

|

Depreciation & Amortization |

|

Stock Compensation |

|

Non-controlling Interest, net |

|

Adjusted EBITDA |

|

|

($, 000s) |

2019 |

|

2018 |

|

|

2019 |

2018 |

|

2019 |

2018 |

|

2019 |

2018 |

|

2019 |

2018 |

|

2019 |

2018 |

|

2019 |

2018 |

|

2019 |

|

2018 |

|

|

2019 |

|

2018 |

|

|

| Women's |

8,622 |

|

(95,694 |

) |

|

- |

111,147 |

|

- |

- |

|

- |

- |

|

- |

- |

|

- |

- |

|

- |

28 |

|

- |

|

- |

|

|

8,622 |

|

15,481 |

|

|

| Men's |

4,952 |

|

664 |

|

|

- |

- |

|

- |

- |

|

- |

- |

|

- |

5,650 |

|

13 |

13 |

|

- |

- |

|

(1,487 |

) |

(3,068 |

) |

|

3,478 |

|

3,259 |

|

|

| Home |

3,782 |

|

6,589 |

|

|

- |

- |

|

- |

- |

|

- |

- |

|

- |

- |

|

- |

- |

|

1 |

7 |

|

- |

|

- |

|

|

3,783 |

|

6,596 |

|

|

| International |

10,766 |

|

8,082 |

|

|

- |

- |

|

- |

- |

|

- |

- |

|

- |

- |

|

72 |

110 |

|

3 |

74 |

|

(1,535 |

) |

(1,460 |

) |

|

9,306 |

|

6,806 |

|

|

| Corporate |

(9,550 |

) |

(14,227 |

) |

|

- |

- |

|

3,198 |

2,677 |

|

- |

2,905 |

|

- |

- |

|

397 |

509 |

|

254 |

390 |

|

841 |

|

230 |

|

|

(4,860 |

) |

(7,516 |

) |

|

| Total

Income |

18,572 |

|

(94,586 |

) |

|

- |

111,147 |

|

3,198 |

2,677 |

|

- |

2,905 |

|

- |

5,650 |

|

482 |

632 |

|

258 |

499 |

|

(2,181 |

) |

(4,298 |

) |

|

20,329 |

|

24,626 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA Reconciliation For the Six

Months Ended June 30,

(1): |

|

| |

GAAP Operating Income |

|

Impairment Charges |

|

Special Charges |

|

Costsassociated with debt financings |

|

Loss on Terminationof

Licenses |

|

Depreciation & Amortization |

|

Stock Compensation |

|

Non-controlling Interest, net |

|

Adjusted EBITDA |

|

|

($, 000s) |

2019 |

|

2018 |

|

|

2019 |

2018 |

|

2019 |

2018 |

|

2019 |

2018 |

|

2019 |

2018 |

|

2019 |

2018 |

|

2019 |

2018 |

|

2019 |

|

2018 |

|

|

2019 |

|

2018 |

|

|

| Women's |

16,249 |

|

(81,066 |

) |

|

- |

111,147 |

|

- |

- |

|

- |

- |

|

- |

- |

|

- |

- |

|

- |

56 |

|

- |

|

(117 |

) |

|

16,249 |

|

30,020 |

|

|

| Men's |

12,498 |

|

6,538 |

|

|

- |

- |

|

- |

- |

|

- |

- |

|

- |

5,650 |

|

25 |

65 |

|

- |

- |

|

(4,979 |

) |

(5,569 |

) |

|

7,544 |

|

6,684 |

|

|

| Home |

6,787 |

|

12,332 |

|

|

- |

- |

|

- |

- |

|

- |

- |

|

- |

- |

|

- |

- |

|

3 |

15 |

|

- |

|

- |

|

|

6,790 |

|

12,347 |

|

|

| International |

19,189 |

|

14,569 |

|

|

- |

- |

|

- |

- |

|

- |

- |

|

- |

- |

|

161 |

248 |

|

7 |

148 |

|

(2,057 |

) |

(2,258 |

) |

|

17,300 |

|

12,707 |

|

|

| Corporate |

(17,752 |

) |

(31,423 |

) |

|

- |

- |

|

5,978 |

5,382 |

|

- |

8,344 |

|

- |

- |

|

788 |

973 |

|

389 |

1,299 |

|

1,488 |

|

762 |

|

|

(9,109 |

) |

(14,663 |

) |

|

| Total

Income |

36,971 |

|

(79,050 |

) |

|

- |

111,147 |

|

5,978 |

5,382 |

|

- |

8,344 |

|

- |

5,650 |

|

974 |

1,286 |

|

399 |

1,518 |

|

(5,548 |

) |

(7,182 |

) |

|

38,774 |

|

47,095 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Adjusted EBITDA margin is a non-GAAP financial measure which

represents Adjusted EBITDA as a percentage of revenue. The

Company believes Adjusted EBITDA margin is a useful financial

measure in evaluating its financial condition because it is more

reflective of the Company's business purpose, operations and cash

expenses. Uses of cash flows that are not reflected in

Adjusted EBITDA margin include interest payments and debt principal

repayments, which can be significant. As a result, Adjusted

EBITDA margin should not be considered as a measure of our

liquidity. Other companies that provide Adjusted EBITDA

margin information may calculate EBITDA margin and Adjusted EBITDA

margin differently than we do. The definition of Adjusted EBITDA

margin may not be the same as the definitions used in any of our

debt agreements.

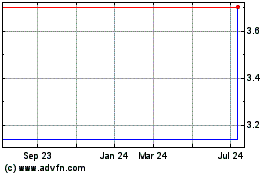

Iconix Brand (NASDAQ:ICON)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iconix Brand (NASDAQ:ICON)

Historical Stock Chart

From Apr 2023 to Apr 2024