Statement of Changes in Beneficial Ownership (4)

October 01 2020 - 4:27PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

ICAHN CARL C |

2. Issuer Name and Ticker or Trading Symbol

ICAHN ENTERPRISES L.P.

[

IEP

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director __X__ 10% Owner

_____ Officer (give title below) __X__ Other (specify below)

Chairman of the Board |

|

(Last)

(First)

(Middle)

C/O ICAHN ENTERPRISES L.P., 16690 COLLINS AVE, SUITE PH-1 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

9/29/2020 |

|

(Street)

SUNNY ISLES BEACH, FL 33160

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Depositary Units (1)(2) | 9/29/2020 (3) | | J(5) | | 8528504 (3) | A | $48.0889 (4) | 213591832 | I | Please see all footnotes (7)(8)(9)(10)(11)(12) |

| Depositary Units (1)(2) | 10/1/2020 (6) | | S(6) | | 202758 (6) | D | $49.32 (6) | 213389074 | I | Please see all footnotes (7)(8)(9)(10)(11)(12) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Depository Units representing limited partner interests in Icahn Enterprises L.P. (the "Issuer"). |

| (2) | Comprised of Depositary Units held indirectly through CCI Onshore LLC ("CCI Onshore"), Gascon Partners ("Gascon"), High Coast Limited Partnership ("High Coast"), Highcrest Investors LLC ("Highcrest") and Thornwood Associates Limited Partnership ("Thornwood"). |

| (3) | Represents the date on which dividend amounts are determined based on the election of each holder and the volume weighted average trading price of units on NASDAQ during five consecutive trading days following the election date. |

| (4) | Represents the amount foregone in exchange for each Depository Unit received as a dividend. |

| (5) | The reporting person received 8,528,504 Depositary Units as a payment-in-kind dividend on 205,063,328 Depositary Units owned on the dividend record date in a transaction exempt from Section 16(b) liability pursuant to Rule 16(b)-3(d) promulgated under the Securities Exchange Act of 1934, as amended. |

| (6) | On October 1, 2020, High Coast entered into a Depositary Unit Purchase Agreement with Brett Icahn, the son of Carl C. Icahn, pursuant to which High Coast sold 202,758 Depositary Units to Brett Icahn. A copy of the Depositary Unit Purchase Agreement was filed as Exhibit 1 to Amendment No. 58 to Schedule 13D filed by Carl C. Icahn and affiliates on October 1, 2020. |

| (7) | CCI Onshore beneficially owns 49,721,044 Depository Units. High Coast is the sole member of CCI Onshore. Little Meadow Corp. ("Little Meadow") is the general partner of High Coast. Carl C. Icahn beneficially owns 100% of Little Meadow. Pursuant to Rule 16a-1(a)(2) under the Exchange Act, each of Mr. Icahn, Little Meadow and High Coast (by virtue of their relationships to CCI Onshore) may be deemed to indirectly beneficially own the Depository Units which CCI Onshore owns. Each of Mr. Icahn, Little Meadow and High Coast disclaims beneficial ownership of such Depository Units except to the extent of their pecuniary interest therein. |

| (8) | Gascon beneficially owns 29,281,771 Depository Units. Little Meadow is the managing general partner of Gascon. Carl C. Icahn beneficially owns 100% of Little Meadow. Pursuant to Rule 16a-1(a)(2) under the Exchange Act, each of Mr. Icahn and Little Meadow (by virtue of their relationships to Gascon) may be deemed to indirectly beneficially own the Depository Units which Gascon owns. Each of Mr. Icahn and Little Meadow disclaims beneficial ownership of such Depository Units except to the extent of their pecuniary interest therein. |

| (9) | High Coast beneficially owns 102,535,566 Depository Units. Little Meadow is the general partner of High Coast. Carl C. Icahn beneficially owns 100% of Little Meadow. Pursuant to Rule 16a-1(a)(2) under the Exchange Act, each of Mr. Icahn and Little Meadow (by virtue of their relationships to High Coast) may be deemed to indirectly beneficially own the Depository Units which High Coast owns. Each of Mr. Icahn and Little Meadow disclaims beneficial ownership of such Depository Units except to the extent of their pecuniary interest therein. |

| (10) | Highcrest beneficially owns 23,898,869 Depository Units. Starfire Holding Corporation ("Starfire") beneficially owns 100% of Highcrest. Carl C. Icahn beneficially owns 100% of Starfire. Pursuant to Rule 16a-1(a)(2) under the Exchange Act, each of Mr. Icahn and Starfire (by virtue of their relationships to Highcrest) may be deemed to indirectly beneficially own the Depository Units which Highcrest owns. Each of Mr. Icahn and Starfire disclaims beneficial ownership of such Depository Units except to the extent of their pecuniary interest therein. |

| (11) | Thornwood beneficially owns 7,951,824 Depository Units. Barberry Corp. ("Barberry") is the general partner of Thornwood. Carl C. Icahn beneficially owns 100% of Barberry. Pursuant to Rule 16a-1(a)(2) under the Exchange Act, each of Mr. Icahn and Barberry (by virtue of their relationships to Thornwood) may be deemed to indirectly beneficially own the Depository Units which Thornwood owns. Each of Mr. Icahn and Barberry disclaims beneficial ownership of such Depository Units except to the extent of their pecuniary interest therein. |

| (12) | Mr. Icahn may be deemed to indirectly beneficially own the 12,000 Depository Units owned by Gail Golden, his wife, which are not included in the total reported in column 5. Mr. Icahn disclaims beneficial ownership of such Depositary Units for all purposes. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

ICAHN CARL C

C/O ICAHN ENTERPRISES L.P.

16690 COLLINS AVE, SUITE PH-1

SUNNY ISLES BEACH, FL 33160 |

| X |

| Chairman of the Board |

Signatures

|

| /S/ Carl C. Icahn | | 10/1/2020 |

| **Signature of Reporting Person | Date |

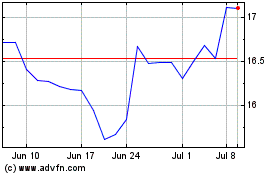

Icahn Enterprises (NASDAQ:IEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Icahn Enterprises (NASDAQ:IEP)

Historical Stock Chart

From Apr 2023 to Apr 2024