Statement of Changes in Beneficial Ownership (4)

September 07 2021 - 6:39PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

WHITEBOX ADVISORS LLC |

2. Issuer Name and Ticker or Trading Symbol

HYCROFT MINING HOLDING CORP

[

HYMC

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

3033 EXCELSIOR BLVD., SUITE 500 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

9/2/2021 |

|

(Street)

MINNEAPOLIS, MN 55416

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock, $0.0001 par value | 9/2/2021 | | S | | 3200000 | D | $1.85 | 8743317 | I | See Footnotes (1)(2) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Warrant | $11.5 | 9/3/2021 | | S | | | 327943 | 6/28/2020 (3)(4) | 5/29/2025 (3)(4) | Class A Common Stock, $0.0001 par value | 327943 | $0.3185 | 585074 | I | See Footnotes (1)(2) |

| Warrant | $11.5 | 9/7/2021 | | S | | | 272822 | 6/28/2020 (3)(4) | 5/29/2025 (3)(4) | Class A Common Stock, $0.0001 par value | 272822 | $0.2434 | 312252 | I | See Footnotes (1)(2) |

| Explanation of Responses: |

| (1) | These securities are directly owned by certain private investment funds (the "Private Funds") and may be deemed to be beneficially owned by (a) Whitebox Advisors LLC by virtue of its role as the investment manager of the Private Funds, and (b) Whitebox General Partner LLC by virtue of its role as the general partner of the Private Funds. |

| (2) | Each Reporting Person disclaims beneficial ownership of the reported securities except to the extent of its pecuniary interest therein, and this report shall not be deemed an admission that such Reporting Person is the beneficial owner of the securities for purposes of Section 16 of the Securities Exchange Act of 1934, as amended, or for any other purpose. |

| (3) | Each Warrant, also known as a PIPE Warrant (as defined in the Issuer's 8-K12B filed on June 4, 2020 (the "8-K12B")), gives the holder thereof the right to purchase one share of common stock, subject to certain exceptions. The PIPE Warrants have an initial exercise price of $11.50 per share of Class A Common Stock. The PIPE Warrants became exercisable on June 28, 2020 and expire May 29, 2025 or earlier upon their redemption or the liquidation of the Issuer. |

| (4) | Once exercisable, the PIPE Warrants may be redeemed, at a price of $0.01 per warrant, if the last sale price of the Class A Common Stock equals or exceeds $18.00 per share for any 20 trading days within a 30 trading day period ending on the third business day before the notice of redemption is sent to the warrant holders. The foregoing description of the PIPE warrants does not purport to be complete and are subject to and qualified in their entirety by reference to the Warrant Agreement included as Exhibit 4.3 of the Issuer's 8-K12B filed on June 4, 2020, which is incorporated by reference. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

WHITEBOX ADVISORS LLC

3033 EXCELSIOR BLVD.

SUITE 500

MINNEAPOLIS, MN 55416 |

| X |

|

|

WHITEBOX GENERAL PARTNER LLC

3033 EXCELSIOR BLVD.

SUITE 300

MINNEAPOLIS, MN 55416 |

| X |

|

|

Signatures

|

| Whitebox Advisors LLC By: /s/ Daniel Altabef, Title: General Counsel - Regulatory Affairs & Compliance | | 9/7/2021 |

| **Signature of Reporting Person | Date |

| Whitebox General Partner LLC By: /s/ Daniel Altabef, Title: General Counsel - Regulatory Affairs & Compliance | | 9/7/2021 |

| **Signature of Reporting Person | Date |

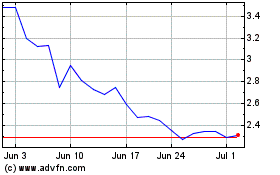

Hycroft Mining (NASDAQ:HYMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

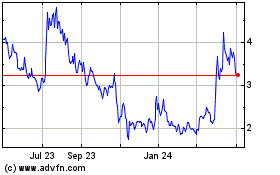

Hycroft Mining (NASDAQ:HYMC)

Historical Stock Chart

From Apr 2023 to Apr 2024