As Coronavirus Spreads, Banks Face Tough Call on Branch Closures -- 2nd Update

March 19 2020 - 7:30PM

Dow Jones News

By Orla McCaffrey

The coronavirus pandemic is forcing U.S. banks to begin closing

branches indefinitely, an unprecedented measure that could curb the

virus's spread but rattle customers who expect instant access to

their money.

JPMorgan Chase & Co. said it would close 20% of its nearly

5,000 branches starting Thursday. The bank already had scaled back

weekday hours at its branches. Capital One Financial Corp. on

Monday closed about a quarter of its 461 branches -- about half in

New York City -- to "minimize health risks from the

coronavirus."

Truist Financial Corp. and PNC Financial Services Group Inc.

will restrict branch access to drive-through lanes and

appointments, except at some key branches that lack drive-throughs.

Regions Financial Corp., Huntington Bancshares Inc. and Fifth Third

Bancorp also plan to limit contact at branches to drive-throughs

and appointments.

"We were having several dozen people in our branch lobbies, and

we couldn't control it," said Huntington Chief Executive Stephen

Steinour. "We had customers say they didn't feel safe with that

kind of crowd."

As the coronavirus pandemic spreads throughout the U.S., banks

occupy a unique position. They are among the few businesses deemed

essential and not subject to government-ordered shutdowns.

Yet banks that choose to close must strike a delicate balance --

taking measures to keep employees safe while assuring customers

they can access their money through a full slate of digital

services or at a nearby branch. The greatest risk for banks is how

the closures are perceived, industry analysts said.

"You can't separate people from their money and maintain the

confidence of the person in the banking system," said banking

analyst Dick Bove.

The top three federal banking regulators reminded banks last

week that short-term shutdowns are permissible when the

circumstances are out of their control. The Office of the

Comptroller of the Currency advised banks to "provide alternative

service options when possible, and reopen affected facilities when

it is safe to do so."

Lightly staffed locations near other branches are easier to

close. Those with drive-through lanes that put distance between

customers and employees are more likely to stay open. Capital One

said it prioritized closing locations that lack the lanes or

protective glass to separate tellers from customers.

Community banks and those near early clusters of coronavirus

were among the first to close branches.

Wintrust Financial Corp. said this week it would close or alter

services at 50 of its branches in Illinois and Wisconsin. Heritage

Bank, a 67-branch bank in Washington state, told customers that,

beginning Wednesday, it would close all branch lobbies through the

end of March.

Many banks are providing customer-facing employees with

additional paid time off and advising high-risk staffers to stay

home. Some are reimbursing child-care costs for workers dealing

with school closings.

The decision to keep branches open is putting some workers on

edge. At a Wells Fargo & Co. location in the Seattle area, more

tellers than usual are calling out sick, according to a branch

employee. Some higher-level staffers have been asked to fill in,

handling transactions at the teller window and counting money in

the back office.

The employee said his manager denied a request to work from

home, even though his clients have canceled meetings and stopped

walking into the branch. He said he is concerned about transmission

because almost all staffers at his branch are in the office each

day.

Wells Fargo stopped using many of its drive-throughs earlier

this year as part of a push to encourage customers to use its apps

and otherdigital services. A spokeswoman said the bank is using

drive-throughs in some locations to limit interaction.

Wells Fargo said it is working to reduce the staff count at its

branches, directing most employees who don't interact with

customers to work from home and staggering shifts for

customer-facing workers.

"We are following national- and local-government-issued

guidelines, and we are providing regular updates to our employees

as the situation evolves," the spokeswoman said.

Write to Orla McCaffrey at orla.mccaffrey@wsj.com

(END) Dow Jones Newswires

March 19, 2020 19:15 ET (23:15 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

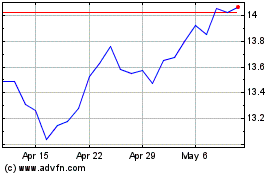

Huntington Bancshares (NASDAQ:HBAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

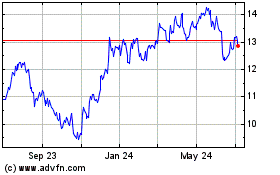

Huntington Bancshares (NASDAQ:HBAN)

Historical Stock Chart

From Apr 2023 to Apr 2024