-Underwritten Public Offering and Nasdaq

Listing Completed in September 2020

-Positive Phase 3 Interim Analysis Reported

with an Estimated 37 percent More Recoveries Observed in the

Lenzilumab Arm Versus Current Standard of Care

Humanigen, Inc., (HGEN) (“Humanigen”), a clinical stage

biopharmaceutical company focused on preventing and treating an

immune hyper-response called ‘cytokine storm’ with its lead drug

candidate lenzilumab™, today reported financial results for the

third quarter and nine months ended September 30, 2020, provided an

overview of recent accomplishments and issued spending expense

guidance for the remainder of 2020.

“We’ve achieved many important milestones in the third quarter,

including completing a public offering to begin trading on Nasdaq,

being selected for the National Institutes of Health’s ACTIV-5/Big

Effect Trial, strengthening our management team, adding clinical

trial sites in Brazil for our Phase 3 clinical trial of lenzilumab

in patients with COVID-19, and expanding our manufacturing capacity

with new agreements with Catalent and Thermo Fisher,” said Cameron

Durrant, MD, MBA, chief executive officer of Humanigen. “For the

last two months of 2020, we remain focused on enrollment of the

Phase 3 trial of lenzilumab for patients hospitalized with

COVID-19, in which we recently announced a positive analysis of

interim Phase 3 data. As enrollment continues for this trial within

the United States and in Brazil, we anticipate applying for an EUA

in the first quarter of 2021. I’m pleased with how our team has

remained dedicated to advancing promising therapeutics for cytokine

storm and would like to thank the dedicated health care providers

and essential workers who continue to expose themselves to risk

during this pandemic.”

Third Quarter 2020 Review and Recent Corporate

Updates

- Completed an underwritten public offering and uplisted to the

Nasdaq Capital Market in September 2020. Humanigen raised net

proceeds of approximately $72.7 million from the sale of 9,200,000

shares in the offering, including 1,200,000 shares sold upon the

full exercise by the underwriters of their over-allotment option,

after deducting the underwriting discounts and commissions and

estimated offering costs.

- Announced execution of a Cooperative Research and Development

Agreement (CRADA) with the Department of Defense (DoD) in support

of Operation Warp Speed (OWS) to support the development of

lenzilumab as a potential treatment for patients with

COVID-19.

- Released an interim analysis of blinded data safety monitoring

board data from the Phase 3 study suggesting that lenzilumab had a

clinically meaningful impact on patient recovery, with an estimated

37 percent more recoveries observed in the lenzilumab arm of the

randomized, placebo-controlled, double-blinded study versus current

standard of care which includes antivirals and steroids.

- Selected to take part in the ACTIV-5 “Big Effect Trial” funded

by the National Institute of Allergy and Infectious Diseases

(NIAID), part of the National Institutes of Health (NIH) to

evaluate the combination of lenzilumab and remdesivir on treatment

outcomes versus placebo and remdesivir in hospitalized COVID-19

patients. The trial is currently enrolling up to 100 patients in

each arm of the study with an interim analysis for efficacy after

50 patients have been enrolled in each arm.

- Published a case-control study in the Mayo Clinic Proceedings

Journal that demonstrate that an 80% reduction in relative risk of

invasive mechanical ventilation (IMV) and/or death for patients

treated with lenzilumab compared to the matched control group.

- Strengthened our management team with the addition of Dr. Dale

Chappell as chief scientific officer, David Tousley as chief

accounting and administrative officer, Timothy Morris as chief

operating officer and chief financial officer, Bob Atwill as head

of Asia-Pacific region and Edward Jordan as chief commercial

officer.

- Expanded manufacturing capabilities for lenzilumab with supply

agreements with Catalent Biologics, Lonza and Thermo Fisher.

Third Quarter 2020 Financial Results

Net loss for the three months ended September 30, 2020 was $30.8

million or $0.71 per share as compared to $2.4 million or $0.11 per

share for the third quarter of 2019. The increase in net loss for

the quarter was primarily due to an increase in research and

development expenses of $21.9 million from $0.5 million for the

three months ended September 30, 2019 to $22.4 million for the

three months ended September 30, 2020. The increase is primarily

due to reservation fees, technology transfer expenses and material

manufacturing costs of lenzilumab for the Phase 3 clinical study

and in anticipation of filing for an Emergency Use Authorization

(EUA) in 2021 and increase in enrollment in the Phase 3 clinical

trial related to lenzilumab in hospitalized patients with COVID-19.

The increase in the net loss for the third quarter of 2020 was also

due an increase in general and administrative expenses of $6.8

million to $8.3 million from $1.5 million for the three months

ended September 30, 2019. The increase is primarily due to

increased compensation costs including stock based compensation

expense related to the hiring of a chief operating and financial

officer and a chief commercial officer, an increase in bonus

expense upon the completion of certain corporate milestones, and an

increase in legal, accounting and public and investor relations

expenses in preparation for the listing on Nasdaq including a

non-cash charge of $1.9 million for warrants issued to certain

consultants which became exercisable upon the completion of the

listing on Nasdaq.

Nine months ended September 30, 2020 Financial

Results

Net loss for the nine months ended September 30, 2020 was $57.2

million or $1.79 per share as compared to $8.3 million or $0.37 per

share for the first nine months of 2019. The increase in net loss

for the period was due to an increase in research and development

expenses of $42.1 million to $44.2 million from $2.1 million for

the nine months ended September 30, 2019. The increase is primarily

due to material manufacturing costs of lenzilumab for the Phase 3

clinical study and the initiation in May of 2020 of the Phase 3

clinical trial for lenzilumab in hospitalized patients with

COVID-19. The increase in the net loss for the nine months ending

September 30, 2020 was also due to an increase in general and

administrative expenses of $6.6 million to $11.7 million from $5.1

million for the nine months ended September 30, 2019. The increase

is primarily due to increased compensation costs including stock

based compensation expense related to the hiring of function heads

in the third quarter of 2020 and increased bonus expense upon the

completion of certain corporate milestones, and an increase in

legal, accounting and public and investor relations expenses in

connection with for the listing on Nasdaq.

Cash and cash equivalents

Net cash used in operating activities, net of balance sheet

changes, was $23.0 million for the third quarter of 2020. In the

third quarter of 2020 the company raised $72.7 million in net

proceeds from its underwritten public offering of common stock. As

of September 30, 2020, the Company had cash and cash equivalents of

$91.4 million.

Expense Guidance for the Fourth quarter and Full Year

2020

We expect our expenses to continue to increase significantly in

the remaining three months of 2020 as a result of securing

additional manufacturing capacity for the production of lenzilumab,

the expansion of enrollment of patients and sites for the clinical

trials for COVID-19 and the initiation of commercial preparation

activities in anticipation of submitting an EUA in the first

quarter of 2021.

“Spending for the third quarter 2020 was higher than consensus

due to an increase in manufacturing expenses as we secured

additional capacity for lenzilumab to support the clinical trials

and prepare for the filing for the EUA early next year. R&D

expense may double as we expand the Phase 3 clinical study and

continue the production of lenzilumab in the fourth quarter 2020,”

commented Timothy E. Morris, chief operating and financial officer

of Humanigen. “Our current cash balance is sufficient to complete

the phase 3 trial and file the EUA. Now that we are part of

Operation Warp Speed and following the announcement of the CRADA,

we will explore the possibility of financial assistance from the US

government to support development of lenzilumab.”

A summary of key financial highlights as of and for the periods

ended September 30, 2020 and 2019 is as follows ($ in

thousands):

Three Months Ended September 30, Nine Months Ended

September 30,

2020

2019

2020

2019

Research and development $

22,416

$

549

$

44,218

$

2,142

Selling, general and administrative

8,331

1,497

11,685

5,122

Loss from operations

(30,747)

(2,046)

(55,903)

(7,264)

Net loss

$

(30,751)

$

(2,389)

$

(57,240)

$

(8,268)

Net loss per common share $

(0.71)

$

(0.11)

$

(1.79)

$

(0.37)

Weighted average common shares

43,490,071

22,553,322

32,041,790

22,260,783

September 30, 2020

December 31, 2019

Cash and cash equivalents $

91,431

$

143

Current assets $

92,049

$

452

Current liabilities

14,869

13,594

Working Capital $

77,180

$

(13,142)

About Humanigen, Inc.

Humanigen, Inc. is developing its portfolio of clinical and

pre-clinical therapies for the treatment of cancers and infectious

diseases via its novel, cutting-edge GM-CSF neutralization and

gene-knockout platforms. We believe that our GM-CSF neutralization

and gene-editing platform technologies have the potential to reduce

the inflammatory cascade associated with coronavirus infection. The

company’s immediate focus is to prevent or minimize the cytokine

release syndrome that precedes severe lung dysfunction and ARDS in

serious cases of SARS-CoV-2 infection. The company is also focused

on creating next-generation combinatory gene-edited CAR-T therapies

using strategies to improve efficacy while employing GM-CSF gene

knockout technologies to control toxicity. In addition, the company

is developing its own portfolio of proprietary first-in-class

EphA3-CAR-T for various solid cancers and EMR1-CAR-T for various

eosinophilic disorders. The company is also exploring the

effectiveness of its GM-CSF neutralization technologies (either

through the use of lenzilumab as a neutralizing antibody or through

GM-CSF gene knockout) in combination with other CAR-T, bispecific

or natural killer (NK) T cell engaging immunotherapy treatments to

break the efficacy/toxicity linkage, including to prevent and/or

treat graft-versus-host disease (GvHD) in patients undergoing

allogeneic hematopoietic stem cell transplantation (HSCT).

Additionally, Humanigen and Kite, a Gilead Company, are evaluating

lenzilumab in combination with Yescarta® (axicabtagene ciloleucel)

in patients with relapsed or refractory large B-cell lymphoma in a

clinical collaboration. For more information, visit

www.humanigen.com.

Forward-Looking Statements

This release contains forward-looking statements.

Forward-looking statements reflect management's current knowledge,

assumptions, judgment and expectations regarding future performance

or events. Although management believes that the expectations

reflected in such statements are reasonable, they give no assurance

that such expectations will prove to be correct and you should be

aware that actual events or results may differ materially from

those contained in the forward-looking statements. Words such as

"will," "expect," "intend," "plan," "potential," "possible,"

"goals," "accelerate," "continue," and similar expressions identify

forward-looking statements, including, without limitation,

statements regarding our expectations for the Phase 3 study and the

potential future development of lenzilumab, our pathway to and

estimated timing for our intended submission for an Emergency Use

Authorization from FDA, statements regarding our intention to seek

financial assistance for the development of lenzilumab from the US

government, and statements regarding the potential for lenzilumab

to be used to prevent or treat GvHD and, as sequenced therapy with

Kite’s Yescarta, in CAR-T therapies. Forward-looking statements are

subject to a number of risks and uncertainties including, but not

limited to, the risks inherent in our lack of profitability; our

dependence on partners to further the development of our product

candidates; the costs and the uncertainties inherent in the

development, attainment of requisite regulatory approvals and

launch of any new pharmaceutical product; the outcome of pending or

future litigation; and the various risks and uncertainties

described in the "Risk Factors" sections and elsewhere in the

company's periodic and other filings with the Securities and

Exchange Commission.

All forward-looking statements are expressly qualified in their

entirety by this cautionary notice. You should not place undue

reliance on any forward-looking statements, which speak only as of

the date of this release. We undertake no obligation to revise or

update any forward-looking statements made in this press release to

reflect events or circumstances after the date hereof or to reflect

new information or the occurrence of unanticipated events, except

as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201111005239/en/

Media Cammy Duong Westwicke, an ICR company

Cammy.duong@westwicke.com 203-682-8380 Investors Alan Lada

Solebury Trout ALada@SoleburyTrout.com 617-221-8006

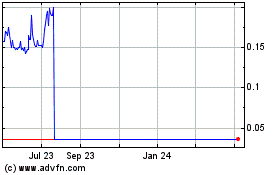

Humanigen (NASDAQ:HGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

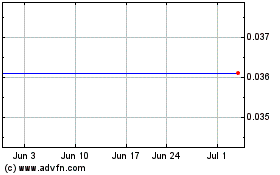

Humanigen (NASDAQ:HGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024