Current Report Filing (8-k)

January 28 2021 - 4:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 27, 2021

HOOKER FURNITURE CORPORATION

(Exact name of registrant as specified in its charter)

|

Virginia

|

000-25349

|

54-0251350

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission

File No.)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

440 East Commonwealth Boulevard,

Martinsville, Virginia

|

24112

|

(276) 632-2133

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(Registrant’s telephone number,

including area code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, no par value

|

HOFT

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On January 27, 2021, Hooker Furniture Corporation (the “Company”) and its wholly owned subsidiaries, Bradington-Young, LLC, Sam Moore Furniture LLC and Home Meridian Group, LLC (together with the Company, the “Borrowers”), entered into a Third Amendment to the Second Amended and Restated Loan Agreement (the “Amendment”) with Bank of America, N.A. (“BofA”). The Second Amended and Restated Loan Agreement dated as of September 29, 2017 was amended by a First Amendment to Second Amended and Restated Loan Agreement dated as of January 31, 2019, and a Second Amendment to Second Amended and Restated Loan Agreement dated as of November 4, 2020 (as so amended, the “Existing Loan Agreement”).

Under this Amendment, the Existing $30 million Unsecured Revolving Credit Facility (the “Existing Revolver”) is increased to $35 million, and such revised amount is available between the date of this Amendment and February 1, 2026. Any amounts outstanding under the Existing Revolver will bear interest at a rate, equal to the then current LIBOR monthly rate (adjusted periodically) plus 1.00%. The Company must pay a fee quarterly equal the actual daily amount of the undrawn amounts of the letters of credit during the specified period times a per annum rate equal to 1.00%. The Company will also pay a quarterly fee at a rate of 0.15% on any difference between the Existing Revolver and the amount of credit it actually uses under the Existing Revolver, determined by the actual daily amount of credit outstanding during the specified period. The Company may, on a one-time basis, request an increase in the Existing Revolver by an amount not to exceed $30 million at the Lenders’ discretion. Also, in connection with the Amendment, the Company repaid in full the $24.3 million in term loans outstanding under the Existing Loan Agreement.

The foregoing description of the Amendment is qualified in its entirety by the full text of the same, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of the Registrant

The information disclosed in Item 1.01 above is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

*Filed herewith.

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

HOOKER FURNITURE CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Paul A. Huckfeldt

|

|

|

|

|

Paul A. Huckfeldt

|

|

|

|

|

Chief Financial Officer and

Senior Vice-President – Finance and Accounting

|

|

Date: January 28, 2021

false

0001077688

0001077688

2021-01-27

2021-01-27

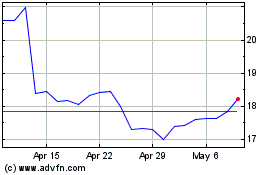

Hooker Furnishings (NASDAQ:HOFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

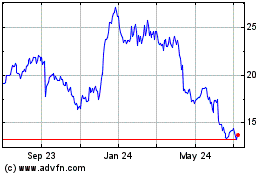

Hooker Furnishings (NASDAQ:HOFT)

Historical Stock Chart

From Apr 2023 to Apr 2024