UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-10/A

(Amendment No. 1)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

HIGH TIDE INC.

|

|

(Exact name of Registrant as specified in its charter)

|

|

Alberta, Canada

|

5990

|

Not Applicable

|

|

(Province or other jurisdiction

|

(Primary Standard Industrial

|

(I.R.S. Employer

|

|

of incorporation or organization)

|

Classification Code Number)

|

Identification Number)

|

|

Unit 112, 11127 - 15 Street N.E.

Calgary, Alberta

Canada T3K 2M4

(403) 770-9435

|

|

(Address and telephone number of Registrant's principal executive offices)

|

|

|

|

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

telephone 1-800-221-0102

|

|

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

|

|

Copy to:

|

|

Raj Grover, President & CEO

High Tide Inc.

Unit 112, 11127 - 15 Street N.E.

Calgary, Alberta

Canada T3K 2M4

(403) 770-9435

|

Daniel D. Nauth

Nauth LPC

217 Queen Street West, Suite 401

Toronto, Ontario

Canada M5V 0R2

(416) 477-6031

|

Approximate date of commencement of proposed sale of the securities to the public:

From time to time after this Registration Statement becomes effective.

Province of Alberta, Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box below):

A. ☐ upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada).

B. ☒ at some future date (check appropriate box below)

1. ☐ pursuant to Rule 467(b) on (date) at (time) (designate a time not sooner than 7 calendar days after filing).

2. ☒ pursuant to Rule 467(b) on September 20, 2021 at 4:30pm Eastern Time because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on April 22, 2021.

3. ☐ pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto.

4. ☐ after the filing of the next amendment to this Form (if preliminary material is being filed).

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction's shelf prospectus offering procedures, check the following box. ☒

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities

to be registered(1)

|

Amount to be

registered(3)

|

Proposed maximum

aggregate offering

price(2)(3)

|

Amount of registration

fee(3)(4)

|

|

Common Shares

|

|

|

|

|

Warrants

|

|

|

|

|

Units

|

|

|

|

|

Subscription Receipts

|

|

|

|

|

Debt Securities

|

|

|

|

|

Total

|

$100,000,000

|

$100,000,000

|

$10,910

|

(1) Includes an indeterminate number of common shares, common share purchase warrants, subscription receipts, debt securities for any combination thereof or units of any combination thereof. This registration statement on Form F-10 (this "Registration Statement") also covers (i) common shares that may be issued upon exercise of warrants, (ii) common shares, warrants or units that may be issued upon conversion of subscription receipts, (iii) common shares, warrants, subscription receipts or units that may be issued upon conversion of debt securities, and (iv) such indeterminate amount of securities as may be issued in exchange for, or upon conversion of, as the case may be, the securities registered hereunder. No separate consideration will be received for any securities issued upon conversion or exchange. In addition, any securities registered hereunder may be sold separately or as units with other securities registered hereunder. The securities which may be offered pursuant to this Registration Statement include, pursuant to Rule 416 of the Securities Act of 1933, as amended (the "U.S. Securities Act"), such additional number of common shares of the Registrant that may become issuable as a result of any stock split, stock dividends or similar event.

(2) Represents the initial offering price of all securities sold up to an aggregate public offering price not to exceed $100,000,000 or the equivalent thereof in foreign currencies, foreign currency units or composite currencies to the Registrant.

(3) Rule 457(o) under the U.S. Securities Act permits the registration fee to be calculated on the basis of the maximum aggregate offering price of all of the securities listed and, therefore, the table does not specify by each class information as to the amount to be registered or the proposed maximum offer price per security. The proposed maximum initial offering price per security will be determined, from time to time, by the Registrant.

(4) Based on the SEC's registration fee of $109.10 per $1,000,000 of securities registered.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until this Registration Statement shall become effective as provided in Rule 467 under the U.S. Securities Act, or on such date as the Commission, acting pursuant to Section 8(a) of the U.S. Securities Act, may determine.

I-1

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

The information contained herein is subject to completion and amendment. A registration statement relating to these securities has been filed with the United States Securities and Exchange Commission. These securities may not be offered or sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any state of the United States in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state of the United States.

This short form base shelf prospectus (this "Prospectus") is a base shelf prospectus. This Prospectus has been filed under legislation in each of the provinces and territories of Canada that permit certain information about these securities to be determined after this Prospectus has become final and that permit the omission of that information from this Prospectus. The legislation requires the delivery to purchasers of a prospectus supplement containing the omitted information within a specified period of time after agreeing to purchase any of these securities.

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This Prospectus constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons authorized to sell such securities.

The securities offered under this Prospectus have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or the securities laws of any state of the United States of America (the "United States" or "U.S."), and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. Persons (as defined in Regulation S under the U.S. Securities Act) ("U.S. Persons") unless exemptions from the registration requirements of the U.S. Securities Act and the securities laws of the applicable state of the United States are available. This Prospectus does not constitute an offer to sell or a solicitation or an offer to buy any of the securities offered hereby within the United States or to, or for the benefit of, U.S. Persons. See "Plan of Distribution".

Information has been incorporated by reference in this Prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Chief Financial Officer of High Tide Inc., at Unit 112, 11127-15 Street N.E. Calgary, Alberta T3K 2M4, Telephone: 1-403-703-4272, Email: ir@hightideinc.com, and are also available electronically on the System for Electronic Document Analysis and Retrieval ("SEDAR") at www.sedar.com.

SHORT FORM BASE SHELF PROSPECTUS

HIGH TIDE INC.

$100,000,000

Common Shares

Warrants

Units

I-1

Subscription Receipts

Debt Securities

This Prospectus relates to the offering for sale of: (i) common shares (the "Common Shares"); (ii) warrants (the "Warrants") to purchase other Securities (as defined hereinafter); (iii) units (the "Units") comprised of one or more of the other Securities; (iv) subscription receipts (the "Subscription Receipts"); and (v) debt securities (the "Debt Securities" and together with the Common Shares, Warrants, Units and Subscription Receipts, collective referred to herein as the "Securities") by High Tide Inc. (the "Corporation") from time to time, during the 25-month period that the Prospectus, including any amendments hereto, remains effective, in one or more series or issuances, with a total offering price of the Securities in the aggregate, of up to $100,000,000. The Securities may be offered for sale separately or in combination with one or more other Securities and may be sold from time to time in one or more transactions at a fixed price or prices (which may be changed) or at market prices prevailing at the time of sale, at prices determined by reference to such prevailing market prices or at negotiated prices.

The specific terms of any Securities offered will be described in one or more shelf prospectus supplements (collectively or individually, as the case may be, a "Prospectus Supplement"), including, where applicable: (i) in the case of Common Shares, the number of Common Shares offered, the offering price (or the manner of determination thereof if offered on a non-fixed price basis, including sales in transactions that are deemed to be "at-the-market distributions", as such term is defined under National Instrument 44-102 - Shelf Distributions ("NI 44-102")), whether the Common Shares are being offered for cash, and any other specific terms; (ii) in the case of Warrants, the number of Warrants being offered, the offering price (in the event the offering is a fixed price distribution), the manner of determining the offering price(s) (in the event the offering is a non-fixed price distribution), the designation, number and terms of the other Securities purchasable upon exercise of the Warrants, and any procedures that will result in the adjustment of those numbers, the exercise price, the dates and periods of exercise and any other specific terms; (iii) in the case of Units, the number of Units offered, the offering price, the designation, number and terms of the other Securities comprising the Units, and any other specific terms; (iv) in the case of Subscription Receipts, the number of Subscription Receipts being offered, the offering price (in the event the offering is a fixed price distribution), the manner of determining the offering price(s) (in the event the offering is a non-fixed price distribution), the terms, conditions and procedures for the conversion of the Subscription Receipts into other Securities, the designation, number and terms of such other Securities, and any other specific terms; and (v) in the case of Debt Securities, the designation of the Debt Securities, the aggregate principal amount of the Debt Securities being offered, the currency or currency unit in which the Debt Securities may be purchased, authorized denominations, whether payment on the Debt Securities will be senior or subordinated to the Corporation's other liabilities and obligations, the nature and priority of any security for the Debt Securities, any limit on the aggregate principal amount of the Debt Securities of the series being offered, the issue and delivery date, the maturity date, the offering price (at par, discount or at a premium), the interest rate or method of determining the interest rate, the interest payment date(s), any conversion or exchange rights that are attached to the Debt Securities, any redemption provisions, any repayment provisions, any arrangements with the trustee for the Debt Securities, and any other specific terms. Where required by statute, regulation or policy, and where Securities are offered in currencies other than Canadian dollars, appropriate disclosure of foreign exchange rates applicable to the Securities will be included in the Prospectus Supplement describing the Securities. A Prospectus Supplement may include specific variable terms pertaining to the Securities that are not within the alternatives and parameters described in this Prospectus.

All shelf information permitted under applicable laws to be omitted from this Prospectus will be contained in one or more Prospectus Supplements that will be delivered to purchasers together with this Prospectus (except where an exemption from such delivery has been obtained). Each Prospectus Supplement will be incorporated by reference to this Prospectus for the purposes of securities legislation as of the date of the Prospectus Supplement and only for the purposes of the distribution of the Securities to which the Prospectus Supplement pertains. Investors should read the Prospectus and any applicable Prospectus Supplement carefully before investing in the Securities.

The Corporation and/or any selling securityholders may offer and sell the Securities to or through underwriters or dealers purchasing as principals, and may also sell directly to one or more purchasers or through agents or pursuant to applicable statutory exemptions. See "Plan of Distribution". A Prospectus Supplement relating to a particular offering of Securities will identify each underwriter, dealer, agent or selling securityholder, as the case may be, involved in the sale of our Securities, the amounts, if any, to be purchased by underwriters, the plan of distribution of such Securities, including, to the extent applicable, any fees, discounts or any other compensation payable to underwriters, dealers or agents in connection with the offering, the initial issue price (in the event that the offering is a fixed price distribution), the net proceeds that we will receive and any other material terms of the plan of distribution.

The Securities may be sold from time to time in one or more transactions at a fixed price or prices or at non-fixed prices, such as market prices prevailing at the time of sale (including, without limitation, sales deemed to be "at-the-market distributions" as defined in NI 44-102, including sales made directly on the TSX Venture Exchange (the "TSXV") or other existing trading markets for the Securities, provided that the requirements of Part 9 of NI 44-102 are complied with in connection with the filing of a Prospectus Supplement for an "at-the-market" distribution), prices related to such prevailing market prices or prices to be negotiated with purchasers, which prices may vary as between purchasers and during the period of distribution of the Securities. If offered on a non-fixed price basis, the Securities may be offered at market prices prevailing at the time of sale, at prices determined by reference to the prevailing price of a specified security in a specified market or at prices to be negotiated with purchasers, in which case the compensation payable to an underwriter, dealer or agent in connection with any such sale will be decreased by the amount, if any, by which the aggregate price paid for the Securities by the purchasers is less than the gross proceeds paid by the underwriter, dealer or agent to us. The price at which the Securities will be offered and sold may vary from purchaser to purchaser and during the period of distribution.

In connection with any offering of Securities other than an "at-the-market distribution" (as defined under applicable Canadian legislation) (unless otherwise specified in the relevant Prospectus Supplement), the underwriters, dealers or agents, as the case may be, may over-allot or effect transactions which stabilize, maintain or otherwise affect the market price of the Securities at a level other than those which otherwise might prevail on the open market. Such transactions may be commenced, interrupted or discontinued at any time. See "Plan of Distribution". No underwriter of an at-the-market distribution, and no person or company acting jointly or in concert with an underwriter, may, in connection with the distribution, enter into any transaction that is intended to stabilize or maintain the market price of the Securities or securities of the same class as the Securities distributed under this Prospectus, including selling an aggregate number or principal amount of Securities that would result in the underwriter creating an over-allocation position in the Securities.

This offering is made by a foreign issuer that is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this prospectus in accordance with the disclosure requirements of its home country. Prospective investors should be aware that such requirements are different from those of the United States. Financial statements included or incorporated herein, if any, have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board and thus may not be comparable to financial statements of United States companies.

Prospective investors should be aware that the acquisition of the securities described herein may have tax consequences both in the United States and in the home country of the Corporation. Such consequences for investors who are resident in, or citizens of, the United States may not be described fully herein.

The enforcement by investors of civil liabilities under the federal securities laws may be affected adversely by the fact that the Corporation is incorporated or organized under the laws of a foreign country, that some or all of its officers and directors may be residents of a foreign country, that some or all of the underwriters or experts named in this Registration Statement may be residents of a foreign country, and that all or a substantial portion of the assets of the Corporation and said persons may be located outside the United States.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION NOR HAS THE COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

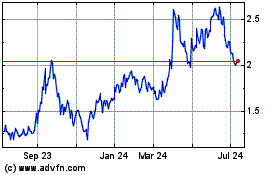

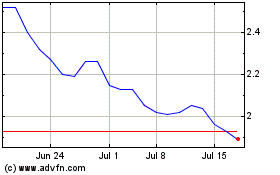

The Corporation's outstanding Common Shares are listed and posted for trading on the TSXV under the symbol "HITI", on the on the OTCQB Venture Market (the "OTC") under the symbol "HITIF" and on the Frankfurt Stock Exchange (the "FSE") under the symbol "2LY". Effective November 19, 2020, certain warrants of the Corporation and the Corporation's unsecured convertible debentures (the "Unsecured Convertible Debentures") began trading on the TSXV under the symbols "HITI.WT" and "HITI.DB", respectively. Effective February 25, 2021, the 2021 Warrants (as defined hereinafter) issued pursuant to the Bought Deal Offering (as defined hereinafter) began trading on the TSXV under the symbol "HITI.WR". The closing price of the Common Shares on the TSXV, OTC, and FSE on April 21, 2021, the last trading date prior to the date of this Prospectus was $0.61, US$0.49, and €0.40 per Common Share, respectively. On April 21, 2021, the last trading date prior to the date of this Prospectus, the closing price of the Unsecured Convertible Debentures on the TSXV was $100 per Unsecured Convertible Debenture and the closing price of HITI.WT and HITI.WR on the TSXV was $0.32, and $0.285 per warrant, respectively. The offering of any Securities under this Prospectus and any Prospectus Supplement is subject to approval of certain legal matters by Garfinkle Biderman LLP.

Unless otherwise specified in the applicable Prospectus Supplement, each series or issue of Securities (other than Common Shares) will be a new issue of Securities with no established trading market. Accordingly, there is currently no market through which the Securities (other than Common Shares) may be sold and purchasers may not be able to resell such Securities purchased under this Prospectus. This may affect the pricing of such Securities in the secondary market, the transparency and availability of trading prices, the liquidity of such Securities and the extent of issuer regulation. See "Risk Factors".

Prospective investors should be aware that the purchase of Securities may have tax consequences that may not be fully described in this Prospectus or in any Prospectus Supplement, and should carefully review the tax discussion, if any, in the applicable Prospectus Supplement and in any event consult with a tax adviser.

An investment in the Securities is subject to a number of risks. See "Risk Factors" herein and in the annual information form of the Corporation dated March 5, 2021 (the "Annual Information Form") for a more complete discussion of these risks.

No underwriter has been involved in the preparation of this Prospectus or performed any review of the contents hereof.

In accordance with subsections 4.1(1) and 5.5(7) of NI 44-102, the Corporation will file, with this Prospectus, an undertaking with the securities regulatory authorities in each of the provinces and territories of Canada that the Corporation will not distribute Securities that, at the time of distribution, are novel specified derivatives or novel asset-backed securities, without first pre-clearing with the applicable regulator the disclosure to be contained in any Prospectus Supplement pertaining to the distribution of the novel specified derivatives or asset-backed securities.

The Corporation's head and registered office is located at Unit 112, 11127-15 Street N.E. Calgary, Alberta T3K 2M4.

The Corporation indirectly derives a portion of its revenues from the cannabis industry in certain states, including the states of Illinois, Michigan, California, and Ohio, which industry is illegal under U.S. federal law. As of the date of this Prospectus, the Corporation and its subsidiaries are not directly or indirectly engaged in the manufacture, importation, possession, use, sale or distribution of cannabis in the recreational or medical cannabis industry in the U.S. However, the Corporation and its subsidiaries may be considered to have ancillary involvement in the U.S. cannabis industry in the following respects: (i) in the U.S. cannabis industry at large, by virtue of (A) the operations of Valiant Distribution Inc. ("Valiant") and Valiant Distribution Canada Inc. ("Valiant Canada"), which involve the manufacture and distribution of branded consumption accessories in states such as Illinois, Michigan, California, and Ohio, in compliance with applicable laws, (B) the operations of the Grasscity Entities (as defined hereinafter) and Smoke Cartel USA, Inc. ("Smoke Cartel"), which involve the distribution of consumption accessories (such as grinders, rolling papers, glass bongs, smoking pipes, oil rigs and bubblers), through Grasscity.com and Smokecartel.com, respectively, in states such as Illinois, Michigan, California, and Ohio, in compliance with applicable laws, and (ii) the U.S. Industrial Hemp (as defined hereinafter) and Industrial Hemp-based cannabidiol ("CBD") industry, by virtue of the operations of the Grasscity Entities, which involve the distribution of CBD oils and capsules, CBD skin care products, CBD edibles, and CBD smoking accessories such as vaporizers and cartridges, through CBDCity.com, in states such as Illinois, Michigan, California, and Ohio, in compliance with applicable laws. Approximately 21% of the Corporation's balance sheet for the financial year of the Corporation ended October 31, 2020 related to the U.S. cannabis industry. As at the date of this Prospectus, the Corporation estimates that its balance sheet and operating statement exposure to U.S. cannabis-related activities is approximately 12%.

In the U.S., cannabis is largely regulated at the state level with certain states having authorized the medical and/or adult use of, and activities relating to, cannabis under certain circumscribed circumstances. However, as of the date of this Prospectus, the cultivation, distribution, possession, and use of cannabis is illegal under U.S. federal law pursuant to the Controlled Substance Act of 1970 (United States) (the "U.S. CSA"), subject to limited exceptions in respect of Industrial Hemp under certain circumscribed circumstances. The U.S. CSA classifies cannabis as a Schedule I controlled substance with a high potential for abuse and no currently accepted medical use, which cannot be safely prescribed (the United States Food and Drug Administration has also not approved cannabis as a safe and effective drug for any indication as of the date of this Prospectus). Consequently, a range of activities, including cultivation and the personal use of cannabis, are prohibited by U.S. federal law notwithstanding the existence of state-level laws permitting such activities in respect of medical and/or adult use cannabis at the state-level in the U.S. Such activities, as well as attempting or conspiring to violate the U.S. CSA, or aiding and abetting in a violation of the U.S. CSA, are criminal acts under U.S. federal law.

The supremacy clause in Article VI of the U.S. Constitution (the "Supremacy Clause") establishes that the U.S. Constitution and federal laws made pursuant to it are paramount, and in case of conflict between federal and state law, the federal law is paramount. In respect of the U.S. cannabis industry, the conflict between U.S. federal law and state-level laws amid the presence of the Supremacy Clause has significant implications for the U.S. cannabis industry at large. In particular, there is a significant risk that U.S. federal prosecutors may enforce U.S. federal laws and seek to prosecute actors involved in activities related to cannabis in the U.S. despite the fact that such activities may be in compliance with applicable state-level laws. Any enforcement of current U.S. federal laws by U.S. federal prosecutors could cause significant financial damage to the Corporation and the shareholders of the Corporation.

On January 4, 2018, former U.S. Attorney General Jeff Sessions issued a memorandum to U.S. district attorneys (the "Sessions Memorandum") which rescinded previous guidance from the U.S. Department of Justice ("DOJ") specific to cannabis enforcement in the U.S., including the Cole Memorandum and the 2014 Cole Memorandum (each, as defined hereinafter). With the Cole Memorandum and the 2014 Cole Memorandum rescinded, U.S. federal prosecutors have been given discretion in determining whether to prosecute cannabis related violations of U.S. federal law, subject to budgetary constraints. Mr. Sessions resigned on November 7, 2018, at the request of former U.S. President, Donald Trump. Following Mr. Sessions' resignation and the brief tenure of Matthew Whitaker as Acting U.S. Attorney General, William Barr was confirmed as the U.S. Attorney General on February 14, 2019. To the knowledge of the Corporation, the DOJ did not take a formal position on the enforcement of U.S. federal laws relating to cannabis under the leadership of Mr. Barr, or his successors, Acting U.S. Attorney Generals, Jeffery A. Rosen and John Demers, and further, has not taken a formal position on federal enforcement of laws relating to cannabis under the leadership of current Acting U.S. Attorney General, Monty Wilkinson. The current U.S. President, Joseph Biden has nominated Merrick Garland to succeed Mr. Wilkinson as the U.S. Attorney General. It is unclear what impact, if any, the new administration will have on U.S. federal government enforcement policy on cannabis.

There can be no assurance that U.S. state laws legalizing and regulating the sale and use of cannabis will not be repealed or overturned, or that local governmental authorities will not limit the applicability of state laws within their respective jurisdictions. Unless and until the U.S. Congress ("Congress") amends the U.S. CSA with respect to medical and/or adult use cannabis (and as to the timing or scope of any such potential amendments, there can be no assurance), there is a risk that U.S. federal prosecutors may enforce current U.S. federal law (even in states where the sale and use of cannabis is currently legal under applicable U.S. state laws), or that existing state laws governing cannabis and cannabis-related activities could be repealed or curtailed. Any such occurrence could have a Material Adverse Effect (as defined hereinafter).

In light of the political and regulatory uncertainty surrounding the treatment of U.S. cannabis-related activities, including the rescission of the Cole Memorandum (as defined hereinafter) and the 2014 Cole Memorandum, discussed above, on February 8, 2018, the Canadian Securities Administrators published Staff Notice 51-352 (Revised) - Issuers with U.S. Marijuana-Related Activities ("Staff Notice 51-352") setting out the Canadian Securities Administrator's disclosure expectations for specific risks facing issuers with cannabis-related activities in the U.S. Staff Notice 51-352 includes additional disclosure expectations that apply to all issuers with U.S. cannabis-related activities, including those with ancillary involvement in the U.S. cannabis industry. See "U.S. Cannabis-Related Activities Disclosure".

For the foregoing reasons, the nature of the Corporation's involvement in the U.S. cannabis industry may subject the Corporation and its subsidiaries to heightened scrutiny by regulators, stock exchanges, clearing agencies and other U.S. and Canadian authorities. There can be no assurance that such heightened scrutiny will not, in turn, lead to the imposition of certain restrictions on the ability of the Corporation and its subsidiaries to operate in the U.S. or any other jurisdiction. There are a number of risks associated with the business, operations, and activities of the Corporation and its subsidiaries (the "Business"). See "Risk Factors" in the Annual Information Form for further details.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This Prospectus, and documents incorporated by reference herein, contains "forward-looking statements" and "forward-looking information" (collectively, "forward-looking statements") within the meaning of applicable Canadian securities laws and applicable U.S. securities laws. All statements, other than statements of historical facts, included in this Prospectus that addresses activities, events or developments that the Corporation expects or anticipates will or may occur in the future are forward-looking statements. In certain cases, forward-looking statements can be identified by the words such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative of these terms or comparable terminology.

Forward-looking statements in this Prospectus and in documents incorporated by reference herein include, or may include, but are not limited to, statements with respect to:

• the Corporation's business objectives and milestones and the anticipated timing of, and costs in connection with, the execution or achievement of such objectives and milestones;

• the Corporation's future growth prospects and intentions to pursue one or more viable business opportunities;

• the development of the Business and future activities following the date of this Prospectus;

• expectations relating to market size and anticipated growth in the jurisdictions within which the Corporation may from time to time operate or contemplate future operations;

• expectations with respect to economic, business, regulatory and/or competitive factors related to the Corporation or the cannabis industry generally;

• the impact of the novel coronavirus disease pandemic ("COVID-19") on the Corporation's current and future operations;

• the market for the Corporation's current and proposed product offerings, as well as the Corporation's ability to capture market share;

• the Corporation's strategic investments and capital expenditures, and related benefits;

• the distribution methods expected to be used by the Corporation to deliver its product offerings;

• the competitive landscape within which the Corporation operates and the Corporation's market share or reach;

• the performance of the Business;

• the number of additional cannabis retail store locations the Corporation and/or its subsidiaries proposes to add to the Business;

• the Corporation's ability to generate cash flow from operations and from financing activities;

• the Corporation's intention to pursue a listing of its Common Shares on the Nasdaq Stock Market (the "Nasdaq Exchange");

• the Corporation's ability to obtain, maintain, and renew or extend, applicable Authorizations (as defined hereinafter), including the timing and impact of the receipt thereof; and

• the realization of cost savings, synergies or benefits from the Corporation's recent and proposed acquisitions, and the Corporation's ability to successfully integrate the operations of any business acquired within the Business.

Forward-looking statements are subject to certain risks and uncertainties. Although management of the Corporation ("Management") believes that the expectations reflected in these forward-looking statements are reasonable in light of, among other things, its perception of trends, current conditions and expected developments, as well as other factors that Management believes to be relevant and reasonable in the circumstances at the date that such statements are made, readers are cautioned not to place undue reliance on forward looking statements, as forward looking statements may prove to be incorrect. A number of factors could cause actual results to differ materially from a conclusion, forecast or projection contained in the forward-looking statements. Importantly, forward-looking statements contained in this Prospectus and in documents incorporated by reference are based upon certain assumptions that Management believes to be reasonable based on the information currently available to Management, including, but not limited to, the assumptions that:

• current and future members of Management will abide by the business objectives and strategies from time to time established by the Corporation;

• the Corporation will retain and supplement its board of directors (the "Board") and Management, or otherwise engage consultants and advisors having knowledge of the industries (or segments thereof) within which the Corporation may from time to time participate;

• the Corporation will have sufficient working capital and the ability to obtain the financing required in order to develop and continue its business and operations;

• the Corporation will continue to attract, develop, motivate and retain highly qualified and skilled consultants and/or employees, as the case may be;

• no adverse changes will be made to the regulatory framework governing cannabis, taxes and all other applicable matters in the jurisdictions in which the Corporation conducts business and any other jurisdiction in which the Corporation may conduct business in the future;

• the Corporation will be able to generate cash flow from operations, including, where applicable, distribution and sale of cannabis and cannabis products;

• the Corporation will be able to execute on its business strategy as anticipated;

• the Corporation will be able to meet all applicable requirements necessary to obtain and/or maintain its permits and licences;

• general economic, financial, market, regulatory, and political conditions, including the impact of COVID-19, will not negatively affect the Corporation or its Business;

• the Corporation will be able to successfully compete in the cannabis industry; and

• cannabis prices will not decline materially.

By their very nature forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Corporation to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Although Management believes that the expectations reflected in, and assumptions underlying, such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. New factors emerge from time to time, and it is not possible for Management to predict all of those factors or to assess in advance the impact of each such factor on the Business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. Some of the risks that could cause results to differ materially from those expressed in forward-looking statements in this Prospectus and in documents incorporated by reference include:

• the Corporation's inability to attract and retain qualified members of Management to grow its Business;

• unanticipated changes in economic and market conditions (including changes resulting from COVID-19) or in applicable laws;

• the impact of the publications of inaccurate or unfavourable research by securities analysts or other third parties;

• the Corporation's failure to complete future acquisitions or enter into strategic business relationships;

• interruptions or shortages in the supply of cannabis from time to time available to support the Corporation's operations from time to time;

• unanticipated changes in the cannabis industry in the jurisdictions within which the Corporation may from time to time conduct its business and operations, including he Corporations inability to respond or adapt to such changes;

• the Corporation's inability to secure or maintain favourable lease arrangements or the required approvals and permits necessary to conduct its business and operations and meet its targets;

• the Corporation's inability to secure desirable retail cannabis store locations on favourable terms; and

• risks relating to projections of the Corporation's operations.

Readers are cautioned that the foregoing list of factors are not exhaustive. The Corporation provides no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements (including those in the documents incorporated herein by reference), and in evaluating forward-looking statements, readers should specifically consider various factors, including the risks outlined under "Risk Factors", which may cause actual results to differ materially from the results, performance or achievements of the Corporation expressed or implied by any forward-looking statements.

The forward-looking statements contained in this Prospectus are made as of the date of this Prospectus, and except as required by applicable Canadian securities laws, the Corporation does not intend, and does not assume any obligation, to update these forward-looking statements.

CAUTIONARY NOTE REGARDING FUTURE ORIENTED FINANCIAL INFORMATION

This Prospectus, and documents incorporated by reference herein, may contain future oriented financial information ("FOFI") within the meaning of applicable Canadian securities laws and applicable U.S. securities laws, about prospective results of operations, financial position or cash flows, based on assumptions about future economic conditions and courses of action, which FOFI is not presented in the format of a historical balance sheet, income statement or cash flow statement. The FOFI has been prepared by Management to provide an outlook of the Corporation's activities and results, and has been prepared based on a number of assumptions including the assumptions discussed under the heading "Cautionary Note Regarding Forward-Looking Information" and assumptions with respect to the costs and expenditures to be incurred by the Corporation, capital expenditures and operating costs, taxation rates for the Corporation and general and administrative expenses. Management does not have, or may not have had at the relevant date, firm commitments for all of the costs, expenditures, prices or other financial assumptions which may have been used to prepare the FOFI or assurance that such operating results will be achieved and, accordingly, the complete financial effects of all of those costs, expenditures, prices and operating results are not, or may not have been at the relevant date of the FOFI, objectively determinable.

Importantly, the FOFI contained in this Prospectus, and in documents incorporated by reference herein are, or may be, based upon certain additional assumptions that Management believes to be reasonable based on the information currently available to Management, including, but not limited to, assumptions about: (i) the future pricing for the Corporation's products, (ii) the future market demand and trends within the jurisdictions in which the Corporation may from time to time conduct the Business, and (iii) the Corporation's ongoing inventory levels, and operating cost estimates. The FOFI or financial outlook contained in this Prospectus, and in documents incorporated by reference herein do not purport to present the Corporation's financial condition in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board, and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. The actual results of operations of the Corporation and the resulting financial results will likely vary from the amounts set forth in the analysis presented in any such document, and such variation may be material (including due to the occurrence of unforeseen events occurring subsequent to the preparation of the FOFI). The Corporation and Management believe that the FOFI has been prepared on a reasonable basis, reflecting Management's best estimates and judgments as at the applicable date. However, because this information is highly subjective and subject to numerous risks including the risks discussed under the heading "Risk Factors", FOFI or financial outlook within this Prospectus, and in documents incorporated by reference herein, should not be relied on as necessarily indicative of future results.

Readers are cautioned not to place undue reliance on the FOFI or financial outlook contained in this this Prospectus, and in documents incorporated by reference herein. Except as required by applicable Canadian securities laws, the Corporation does not intend, and does not assume any obligation, to update such FOFI.

GENERAL MATTERS

You should rely only on the information contained in or incorporated by reference in this Prospectus or any applicable Prospectus Supplement. References to this "Prospectus" refer to this short form base shelf prospectus, including the documents incorporated by reference herein. We have not authorized anyone to provide you with information that is different than the information contained herein. The information contained on our website is not a part of this Prospectus and is not incorporated by reference into this Prospectus despite any references to such information in this Prospectus or the documents incorporated by reference, and prospective investors should not rely on such information when deciding whether or not to invest in the Securities. We are not making an offer of these Securities where the offer is not permitted by law.

Unless otherwise specified or the context otherwise requires, in this Prospectus, (i) all references to the "Corporation", "High Tide", "we", "us" and "our" refer to High Tide Inc., (ii) "Material Adverse Effect" means a material adverse effect on the business, the properties, assets, liabilities (including contingent liabilities), results of operations, financial performance, financial condition, or the market and trading price of the securities, of the Corporation and its subsidiaries, taken as a whole, and (iii) "Industrial Hemp" means cannabis and any part of that plant (including the seeds thereof), and all derivatives, extracts, cannabinoids, isomers, acids, salts, and salts of isomers, whether growing or not, with a tetrahydrocannabinol ("THC") concentration of not more than 0.3% on a dry weight basis.

We may, from time to time, sell any combination of the Securities described in this Prospectus in one or more offerings up to an aggregate amount of $100,000,000. This Prospectus provides a general description of the Securities that we may offer. All information permitted under applicable laws to be omitted from this Prospectus will be contained in one or more Prospectus Supplements that will be delivered to purchasers together with this Prospectus. Each Prospectus Supplement containing the specific terms of any Securities will be incorporated by reference into this Prospectus for the purposes of securities legislation as of the date of the Prospectus Supplement and only for the purposes of the distribution of the Securities to which the Prospectus Supplement pertains.

Before purchasing any Securities, prospective investors should carefully read both this Prospectus and the applicable accompanying Prospectus Supplement, together with the additional information provided in the documents incorporated by reference herein as described under the heading "Documents Incorporated by Reference".

FINANCIAL INFORMATION AND CURRENCY PRESENTATION

The financial statements of the Corporation incorporated by reference in this Prospectus are reported in Canadian dollars and have been prepared in accordance with IFRS. Unless otherwise specified or the context otherwise requires, all references to "$"and "dollars" refer to Canadian dollars.

MARKET AND INDUSTRY DATA

Unless otherwise indicated, information contained in this Prospectus (or in a document incorporated or deemed to be incorporated by reference herein) concerning the industry and the markets in which the Corporation operates, including its general expectations and market position, market opportunities and market share, is, or may be, based on information from independent industry organizations, other third-party sources (including industry publications, surveys and forecasts) and the studies and estimates of Management.

Unless otherwise indicated, the Corporation's estimates are derived from publicly available information released by independent industry analysts and third-party sources as well as data from the Corporation's internal research, and include assumptions made by Management which Management believe to be reasonable based on their knowledge of the relevant industry and markets. Such internal research and assumptions have not been verified by any independent source, and the Corporation and Management have not independently verified any third party information. While Management believes the market position, market opportunity and market share information included, or which may be included, in this Prospectus or in a document incorporated or deemed to be incorporated by reference herein is generally reliable, such information is inherently imprecise. In addition, projections, assumptions and estimates of the Corporation's future performance and the future performance of the industry and markets in which the Corporation operates are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described under the headings "Cautionary Note Regarding Forward-Looking Information" and "Risk Factors".

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this Prospectus from documents filed with the various securities commissions or similar regulatory authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Chief Financial Officer of the Corporation at Unit 112, 11127-15 Street N.E. Calgary, Alberta T3K 2M4, Telephone: 1-403-703-4272, Email: ir@hightideinc.com, and are also accessible under the Corporation's issuer profile on SEDAR at www.sedar.com.

The following documents, filed with the various securities commission or similar securities regulatory authorities in Canada are specifically incorporated by reference in, and form an integral part of, this Prospectus:

(a) the management information circular of the Corporation dated June 19, 2020, prepared in connection with the annual general and special meeting of the shareholders of the Corporation held on July 30, 2020;

(b) the management information circular of Meta Growth Corp. ("Meta Growth") dated September 23, 2020 (the "2020 Meta Circular"), prepared in connection with the special meeting of the shareholders of Meta Growth held on October 27, 2020 (the "Meta Special Meeting") to approve the components of the Arrangement (as defined hereinafter), excluding the following sections, schedules and appendices of, or information in, as applicable, the 2020 Meta Circular:

(i) Appendix "C" - "Fairness Opinion", being the fairness opinion of Echelon dated as of August 20, 2020 and delivered to the board of directors of Meta Growth;

(ii) Appendix "F" - "Pro Forma Financial Statements of High Tide", being the unaudited pro forma financial statements for the Corporation as at and for the period ended July 31, 2020 and for the year ended October 31, 2019, prepared strictly for use in connection with the Meta Special Meeting;

(iii) Schedule "B" to Appendix "D" - "U.S. Cannabis-Related Activities Disclosure";

(iv) any information in the 2020 Meta Circular that has been specifically revised, corrected and supplanted under the heading "Revisions to Certain Previously Disclosed Information"; and

(v) in each case of (i) through to and including (iv) above, any summary information or information derived therefrom in the 2020 Meta Circular;

(c) the material change report of the Corporation dated November 25, 2020, in respect of the completion of the Arrangement (as such term is defined in the Annual Information Form);

(d) the audited consolidated financial statements of the Corporation for the years ended October 31, 2020 and 2019 and the notes thereto, together with the auditor's report thereon (the "Annual Financial Statements");

(e) the management's discussion and analysis of the Corporation for the Annual Financial Statements;

(f) the Annual Information Form;

(g) the business acquisition report of the Corporation dated January 15, 2021 (the "Meta Growth BAR"), in respect of the Corporation's acquisition of Meta Growth pursuant to the Arrangement;

(h) The Smoke Cartel Acquisition Agreement (as such term defined in the Annual Information Form);

(i) the interim financial statements of the Corporation for the three months ended January 31, 2021 and 2020 and the notes thereto (the "Interim Financial Statements"); and

(j) the management's discussion and analysis of the Corporation for the Interim Financial Statements.

Any documents of the type required by National Instrument 44-101 - Short Form Prospectus Distributions to be incorporated by reference in a short form prospectus including certain material change reports (excluding material change reports filed on a confidential basis), comparative interim financial statements, comparative annual financial statements and the auditors' report thereon, management's discussion and analysis of financial condition and results of operations, information circulars, annual information forms, marketing materials (as such term is defined in National Instrument 41-101 - General Prospectus Requirements ("NI 41-101") and business acquisition reports filed by the Corporation with the securities commissions or similar authorities in the provinces of Canada during the term of this Prospectus are deemed to be incorporated by reference in this Prospectus.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this Prospectus to the extent that a statement contained herein or in any other subsequently filed document which also is, or is deemed to be, incorporated by reference herein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that was required to be stated or that was necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Prospectus.

Upon a new annual information form and the related annual financial statements being filed by the Corporation with, and, where required, accepted by the securities commissions and similar authorities in the provinces and territories of Canada during the currency of this Prospectus, the previous annual information form, the previous annual financial statements and all interim financial statements, material change reports and annual filings or information circulars filed before the commencement of the Corporation's fiscal year in which the new annual information form is filed will be deemed no longer to be incorporated by reference into this Prospectus for purposes of future offers and sales of Securities under this Prospectus.

A Prospectus Supplement containing the specific terms in respect of any Securities, updated disclosure of earnings interest coverage ratios (if applicable) and any additional or updated information that the Corporation may elect to include (provided that such information does not describe a material change that has not already been the subject of a material change report or a prospectus amendment) will be delivered to purchasers of such Securities, together with this Prospectus, and will be deemed to be incorporated into this Prospectus as of the date of such Prospectus Supplement, but only for the purposes of the offering of such Securities.

Any template version of any "marketing materials" (as such terms are defined in NI 41-101) filed after the date of a Prospectus Supplement and before the termination of the distribution of the Securities offered pursuant to such Prospectus Supplement (together with this Prospectus) is deemed to be incorporated by reference in such Prospectus Supplement.

WHERE YOU CAN FIND MORE INFORMATION

The Corporation is subject to the full informational requirements of the securities commissions or similar regulatory authority in all provinces and territories of Canada. Purchasers are invited to read and copy any reports, statements or other information, other than confidential filings, that Lightspeed files with the Canadian provincial and territorial securities commissions or similar regulatory authority. These filings are also electronically available from SEDAR at www.sedar.com and from EDGAR at www.sec.gov. Except as expressly provided herein, documents filed on SEDAR or on EDGAR are not, and should not be considered, part of this Prospectus.

The Corporation has filed with the SEC under the Securities Act this Registration Statement relating to the securities being offered hereunder, of which this Prospectus forms a part. This Prospectus does not contain all of the information set forth in this Registration Statement, certain items of which are contained in the exhibits to this Registration Statement as permitted or required by the rules and regulations of the SEC. Items of information omitted from this Prospectus Supplement but contained in this Registration Statement will be available on the SEC's website at www.sec.gov.

As a foreign private issuer, the Corporation is exempt from the rules under the United States Securities Exchange Act of 1934 (the "Exchange Act") prescribing the furnishing and content of proxy statements, and the Corporation's officers and directors are exempt from the reporting and short swing profit recovery provisions contained in Section 16 of the Exchange Act. The Corporation's reports and other information filed or furnished with or to the SEC are available from EDGAR at www.sec.gov, as well as from commercial document retrieval services.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

In addition to the documents specified in this Prospectus under "Documents Incorporated by Reference", above, the following documents have been or will be filed with the SEC as part of the registration statement of which this Prospectus forms a part:

1. the documents set out under the heading "Documents Incorporated by Refernce";

2. the consents of the Corporation's auditor, legal counsel and any experts identified herein, if applicable; and

2. the powers of attorney from the directors and certain officers of the Corporation.

A copy of the form of any warrant indenture, subscription receipt agreements or statement of eligibility of trustee on Form T-1, as applicable, will be filed by post-effective amendment or by incorporation by reference to documents filed or furnished with or furnished to the SEC under the Exchange Act.

ENFORCEABILITY OF CIVIL LIABILITIES BY U.S. INVESTORS

The Corporation is a corporation existing under the Business Corporations Act (Alberta). Some of our directors and officers, and some of the experts named in this Prospectus, are residents of Canada or otherwise reside outside the United States, and all or a substantial portion of their assets, and a majority of our assets, are located outside the United States. We have appointed an agent for service of process in the United States, but it may be difficult for U.S. investors to effect service within the United States upon those directors, officers and experts who are not residents of the United States. It may also be difficult for U.S. investors to realize upon judgments of courts of the United States predicated upon the Corporation's civil liability and the civil liability of its directors, officers and experts under the United States federal securities laws.

You should not assume that Canadian courts would enforce judgments of United States courts obtained in actions against us or such persons predicated on the civil liability provisions of the United States federal securities laws or the securities or "blue sky" laws of any state within the United States or would enforce, in original actions, liabilities against us or such persons predicated on the United States federal securities or any such state securities or "blue sky" laws. We have been advised that a judgement of a United States court predicated solely upon civil liability under United States federal securities laws would probably be enforceable in Canada if the United States court in which the judgment was obtained has a basis for jurisdiction in the matter that would be recognized by a Canadian court for the same purposes. We have also been advised, however, that there is substantial doubt whether an action could be brought in Canada in the first instance on the basis of liability predicated solely upon United States federal securities laws.

We have filed with the SEC, concurrently with our Registration Statement on Form F-10, an appointment of agent for service of process on Form F-X. Under the Form F-X, we appointed Cogency Global Inc. as our agent for service of process in the United States in connection with any investigation or administrative proceeding conducted by the SEC, and any civil suit or action brought against or involving the Corporation in a United States court arising out of, related to, or concerning this offering.

SUMMARY DESCRIPTION OF THE BUSINESS

General

The Corporation is an Alberta-based, retail-focused cannabis company enhanced by the manufacturing and wholesale distribution of consumption accessories. As of the date of this Prospectus, the Corporation is one of the largest cannabis retailers in Canada, with 84 operating retail cannabis locations (including jointly-owned and branded retail store locations) across Canada. As a vertically-integrated company, the Corporation is engaged in the Canadian cannabis market through a portfolio of subsidiaries, including Canna Cabana Inc. ("Canna Cabana"), KushBar Inc. ("KushBar"), and META Growth (which together represent the retail segment of the Business), and Valiant Canada and Valiant (which represents the wholesale segment of the Business).

As of the date of this Prospectus, the Corporation operates a total of 84 cannabis retail stores, consisting of (i) 55 cannabis retail stores in the Province of Alberta, (ii) 17 cannabis retail stores in the Province of Ontario, (iii) 3 cannabis retail stores in the Province of Saskatchewan, and (iv) 9 cannabis retail stores in the Province of Manitoba. Each cannabis retail store is operated in accordance with applicable laws, and in particular, in compliance with the applicable consents, licenses, registrations, permits, authorizations, permissions, orders, and/or approvals (collectively, "Authorizations") required to engage in the retail sale and distribution of adult-use cannabis and cannabis products at licensed premises (such Authorizations, the "Retail Store Authorizations"). All cannabis and cannabis products offered for sale by the Corporation and its subsidiaries are offered for sale in strict compliance with the various regulatory frameworks in the respective jurisdictions governing adult-use cannabis.

The Corporation is a reporting issuer in Canada, in the provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland, North West Territories, Yukon and Nunavut. The Common Shares are listed on the TSXV, under the trading symbol "HITI", on the FSE, under the trading symbol "2LY", and on the OTC, under the trading symbol "HITIF". Effective November 19, 2020, the Warrants and the Unsecured Convertible Debentures began trading on the TSXV under the symbols "HITI.WT" and "HITI.DB", respectively. Effective February 25, 2021, the Warrants issued pursuant to the Bought Deal Offering began trading on the TSXV under the symbol "HITI.WR".

History

The Corporation was incorporated under the Business Corporations Act (Alberta) ("ABCA") on February 8, 2018, under the name "High Tide Ventures Inc.". Effective October 4, 2018, the Corporation amended its articles of incorporation and changed its name to "High Tide Inc." Since its inception, the Corporation has grown, both organically and via strategic acquisitions (including, its most recent acquisition of Meta Growth and Smoke Cartel), to emerge as a leader in the evolving cannabis market within Canada. As one of Canada's largest and fastest-growing retail-focused cannabis companies, the Corporation continues to pursue rapid growth to expand its presence across various jurisdictions in Canada, with its principal business segment focused on the distribution and sale of cannabis and cannabis products in the provinces of Alberta, Ontario, Saskatchewan, and Manitoba.

Intercorporate Relationships

As at the date of this Prospectus, the Corporation has 10 direct and 19 indirect, wholly-owned subsidiaries, and two indirect, majority-owned subsidiaries. The Corporation also holds a 50% direct interest in Saturninus Partners, a general partnership existing under the laws of the Province of Ontario, and 49% indirect interest in four partnerships existing under the laws of the Province of Manitoba.

As at the date of this Prospectus, the Corporation operates the Business through the following material wholly-owned subsidiaries:

• Valiant Canada, a wholly-owned subsidiary of the Corporation formed under the ABCA on November 1, 2020, pursuant to articles of amalgamation filed in respect of the amalgamation of RGR Canada Inc. ("RGR Canada") and Famous Brandz Inc. ("Famous Brandz"), both of which were wholly-owned subsidiaries of the Corporation.

• Canna Cabana, a wholly-owned subsidiary of the Corporation formed under the ABCA on November 1, 2020, pursuant to articles of amalgamation filed in respect of the amalgamation of Canna Cabana Inc. (as constituted at such time, "Old Canna Cabana") and Canna Cabana (SK) Inc. ("Canna SK"), both of which were wholly-owned subsidiaries of the Corporation.

• KushBar, a wholly-owned subsidiary of the Corporation incorporated under the ABCA on January 9, 2018.

• Valiant, a wholly-owned subsidiary of the Corporation incorporated under the laws of the State of Delaware on April 6, 2019.

• 2680495 Ontario Inc., a wholly-owned subsidiary of the Corporation formed incorporated under the Business Corporations Act (Ontario) on February 11, 2019.

• High Tide Inc. B.V., a wholly-owned subsidiary of the Corporation incorporated under the laws of the Netherlands on November 20, 2018.

• Meta Growth, a wholly-owned subsidiary of the Corporation incorporated under the ABCA on June 18, 2015.

• Smoke Cartel, a wholly-owned subsidiary of the Corporation incorporated under the laws of New York.

The following chart sets out the material intercorporate relationships of the Corporation as at the date of this Prospectus:

Note:

1. Saturninus Partners is a general partnership established in the Province of Ontario, in which the Corporation holds a direct 50% interest.

The following chart sets out the material intercorporate relationships of Meta Growth, a wholly-owned subsidiary of the Corporation, as at the date of this Prospectus:

Below is a summary of the business and operations of the Corporation's material subsidiaries within the retail and wholesale segments of the Business, as at the date of this Prospectus.

Canna Cabana

Canna Cabana is the successor entity to Old Canna Cabana and Canna SK, both of which were wholly-owned subsidiaries of the Corporation, and were amalgamated in November 2020 pursuant to the ABCA to form Canna Cabana. Canna Cabana is the Corporation's primary retail cannabis business, offering for retail sale various cannabis products and accessories through its provincially-authorized cannabis retail store locations. As of the date of this Prospectus, Canna Cabana operates a retail cannabis chain with 45 branded stores operating across Canada, in the provinces of Alberta, Ontario and Saskatchewan.

Canna Cabana's flagship retail concept is designed to expose customers to a unique, consistent and scalable retail design and customer experience, and to emphasize the holistic and natural qualities of cannabis. Through its in-store displays, its highly trained and knowledgeable staff, and a tailored store atmosphere, Canna Cabana aims at creating a sophisticated yet playful customer experience, while educating customers and providing them with insight and guidance with respect to its product offerings.

Meta Growth

Meta Growth is the Corporation's secondary retail cannabis business (and its most recently added retail cannabis chain), offering for retail sale various cannabis products and accessories through its provincially-authorized cannabis retail store locations. As of the date of this Prospectus, Meta Growth operates 35 branded stores across Canada, in the provinces of Ontario, Manitoba, and Saskatchewan. The Meta Growth retail cannabis chain offers a curated selection of top-shelf quality cannabis and accessories, both online and through retail spaces that are cool, comfortable, and designed to enhance customer experience. Through its network of recreational cannabis retail stores, Meta Growth strives to enable the public to gain knowledgeable access to Canada's network of persons duly authorized under applicable laws to engage in the cultivation, production, growth and/or distribution of cannabis (such persons, "Licensed Producers"). As of the date of this Prospectus, Meta Growth operates its retail cannabis stores under the brand names "META" and "NewLeaf", in the provinces of Alberta, Saskatchewan, Ontario, and Manitoba. Meta Growth intends to establish its presence in the Province of British Columbia once it receives the appropriate Authorizations in British Columbia. Any such expansion is subject to obtaining the required Authorizations.

KushBar

KushBar operates a retail cannabis chain with three branded stores operating in the Province of Alberta. Founded in 2018, KushBar is the Corporation's tertiary retail cannabis business, offering for retail sale various cannabis products and accessories through its provincially-authorized cannabis retail store locations.

KushBar's flagship retail concept is designed to expose customers to a clean and stylish ambiance and offer them a unique, modern customer experience that emphasizes the holistic and natural qualities of cannabis. Through its in-store displays, its highly trained and knowledgeable staff, and a tailored store atmosphere, KushBar aims at bringing the KushBar vibe to life, while educating customers and providing them with insight and guidance with respect to its product offerings.

As of the date of this Prospectus, the Corporation has entered into an amended and restated asset purchase agreement dated September 1, 2020 with Halo Labs Inc., pursuant to which the Corporation has agreed to sell its three operating KushBar retail cannabis stores to Halo Kushbar Retail Inc., a wholly owned subsidiary of Halo Labs Inc., for aggregate consideration of $5,700,000.

Grasscity Entities

Based in Amsterdam, Netherlands, SJV B.V. and SJV2 B.V. (together, the "Grasscity Entities") operate Grasscity.com, one of the world's premier online stores for smoking accessories and cannabis lifestyle products. Established in 2000, Grasscity.com is one of the most searched and visited smoking accessories retailers, with approximately 5,800,000 million site visits annually. Grasscity.com offers an extensive selection of hand-picked smoking accessories and cannabis lifestyle products, from grinders and rolling papers to one-of-a-kind glass bongs, smoking pipes, oil rigs and bubblers. The Grasscity.com e-commerce platform generates over 90% of its revenues from customers located in the United States.

The Grasscity Entities also operate CBDCity.com, one of the world's newest online stores selling a wide variety of CBD-focused products to international consumers. Established in May 2020, CBDCity.com is backed by a team with over 20 years of e-commerce experience and offers an extensive selection of hand-picked CBD oils and capsules, CBD skin care products, CBD edibles and CBD smoking accessories such as vaporizers and cartridges. CBDCity.com conducts its operations within those States of the United States in which activities relating to industrial hemp and industrial hemp-based CBD have been legalized under applicable laws.

Valiant Canada

Valiant Canada is the successor entity to RGR Canada and Famous Brandz, both of which were wholly-owned subsidiaries of the Corporation, and were amalgamated in November 2020 pursuant to the ABCA to form Valiant Canada.

As a successor to RGR Canada, Valiant Canada is an established designer and international leader in the manufacture and distribution of high-quality, innovative cannabis accessories. Valiant Canada represents the wholesale segment of the Business, offering a suite of proprietary brands which have over time become well known amongst consumers. Valiant Canada's proprietary brands include names such as "Atomik", "Evolution", "Puff Puff Pass", "Vodka Glass" and "Zoom Zoom".

Based in Calgary, Alberta, Valiant Canada's design and development team continues to design products tailored to evolving market trends and consumer preferences that reflect technological innovation and comply with applicable laws. Through its relationships with its manufacturers, based in Asia, Canada, the United States, and elsewhere, which specialize in various areas of assembly and manufacturing, Valiant Canada continues to deliver to market a suite of high quality, proprietary products (such as high-quality rolling papers) as well as third-party branded products (such as Juju, Zig Zag, and Pax).

As a successor to Famous Brandz, Valiant Canada is also an established leader in the manufacture and distribution of branded smoking accessories and other alternative lifestyle products. Valiant Canada utilizes licensed trademarks associated with leading smoking culture brands established by celebrities and entertainment companies (such as Snoop Dogg Pounds, Trailer Park Boys, Cheech & Chong's Up in Smoke, and Jay and Silent Bob) in its design and manufacture of various branded smoking accessories and other alternative lifestyle products. Valiant Canada distributes its products to wholesalers and retailers across the globe through business-to-business distribution channels and through a business-to-customer retail e-commerce platform. Valiant Canada has established relationships with a wide network of distributors, wholesalers and retailers with a presence across Canada, the United States and Europe, with the majority of its products being offered for sale in the United States.

Smoke Cartel

Smoke Cartel is one of the leading online retailers of glass water pipes, vaporizers, consumption accessories, and hemp derived CBD products. Smoke Cartel provides a marketplace with a wide variety of high-quality products, subscription boxes, reliable customer service, and rapid dependable shipping. Smoke Cartel leverages its proprietary marketplace technology to seamlessly connect brands & vendors with its growing customer base built over the last 7 years. Smoke Cartel's website at www.smokecartel.com offers fast load times and optimizations, making the customer experience quick, seamless, and engaging.

Retail Cannabis Stores

The following chart sets out the retail cannabis stores operated by the Corporation as at the date of this Prospectus:

|

Municipality and Province

|

Number of Stores

|

Store Brand

|

|

Airdrie, Alberta

|

3

|

Canna Cabana and NewLeaf

|

|

Banff, Alberta

|

1

|

Canna Cabana

|

|

Beaumont, Alberta

|

1

|

Canna Cabana

|

|

Bonnyville, Alberta

|

1

|

Canna Cabana

|

|

Brandon, Manitoba

|

1

|

Meta Growth

|

|

Burlington, Ontario

|

2

|

Canna Cabana

|

|

Calgary, Alberta

|

23

|

Canna Cabana and NewLeaf

|

|

Camrose, Alberta

|

1

|

KushBar

|

|

Canmore, Alberta

|

1

|

Canna Cabana

|

|

East York, Ontario

|

1

|

Canna Cabana

|

|

Edmonton, Alberta

|

7

|

Canna Cabana and NewLeaf

|

|

Edson, Alberta

|

1

|

Canna Cabana

|

|

Fort Saskatchewan, Alberta

|

1

|

Canna Cabana

|

|

Municipality and Province

|

Number of Stores

|

Store Brand

|

|

Grande Prairie, Alberta

|

1

|

Canna Cabana

|

|

Guelph, Ontario

|

1

|

Meta Growth

|

|

Hamilton, Ontario

|

1

|

Canna Cabana

|

|

Kitchener, Ontario

|

1

|

Meta Growth

|

|

Lacombe, Alberta

|

1

|

Canna Cabana

|

|

Leduc, Alberta

|

1

|

NewLeaf

|

|

Lethbridge, Alberta

|

2

|

Canna Cabana and NewLeaf

|

|

Lloydminster, Alberta

|

1

|

Canna Cabana

|

|

London, Ontario

|

1

|

Canna Cabana

|

|

Medicine Hat, Alberta

|

2

|

KushBar and Canna Cabana

|

|

Morinville, Alberta

|

1

|

KushBar

|

|

Moose Jaw, Saskatchewan

|

1

|

Meta Growth

|

|

Morden, Manitoba

|

1

|

Meta Growth

|

|

Niagara Falls, Ontario

|

1

|

Canna Cabana

|

|

Opaskwayak Cree Nation, Manitoba

|

1

|

Meta Growth

|

|

Okotoks, Alberta

|

1

|

Canna Cabana

|

|

Olds, Alberta

|

1

|

Canna Cabana

|

|

Ottawa, Ontario

|

1

|

Meta Growth

|

|

Red Deer, Alberta

|

1

|

Canna Cabana

|

|

Scarborough, Ontario

|

1

|

Meta Growth

|

|

St. Albert, Alberta

|

2

|

Canna Cabana and NewLeaf

|

|

Sudbury, Ontario

|

1

|

Canna Cabana

|

|