Initial Statement of Beneficial Ownership (3)

September 24 2021 - 5:17PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Connett Bradford C |

2. Date of Event Requiring Statement (MM/DD/YYYY)

9/15/2021

|

3. Issuer Name and Ticker or Trading Symbol

HENRY SCHEIN INC [HSIC]

|

|

(Last)

(First)

(Middle)

C/O HENRY SCHEIN, INC., 135 DURYEA ROAD |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director _____ 10% Owner

___X___ Officer (give title below) _____ Other (specify below)

CEO, NA Distribution Group / |

|

(Street)

MELVILLE, NY 11747

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

_X_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Common Stock, par value $0.01 per share | 59636 (1)(2) | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Stock Option (Right to Buy) (3) | (4) | 3/3/2031 | Common Stock, par value $0.01 per share | 24851 | $62.71 | D | |

| SERP Phantom Stock (5) | (6) | (6) | Common Stock, par value $0.01 per share | 26 (7) | (8) | D | |

| Explanation of Responses: |

| (1) | Includes 11,242 shares of Issuer's common stock. |

| (2) | Also includes restricted stock units ("RSUs") pursuant to the Issuer's 2020 Stock Incentive Plan (f.k.a. 2013 Stock Incentive Plan). 21,510 RSUs will vest subject to (x) Issuer's achievement of a specified perf. goal and (y) reporting person's continued perf. of services for Issuer. 26,884 RSUs will vest subject to (x) passage of a specified period of time and (y) reporting person's continued perf. of services for Issuer. With respect to perf.-based RSUs, if the continued service requirement is satisfied and achievement of the perf. goal (x) exceeds 100% of target, Issuer may issue additional vested shares of common stock in an amount that corresponds to the incremental percentage of the perf. goal achieved in excess of 100% of target or (y) is less than 100% of target, the reporting person will surrender to Issuer shares of common stock in an amount that corresponds to the incremental percentage of the perf. goal achieved that is below 100% of target. |

| (3) | Acquired pursuant to the Issuer's 2020 Stock Incentive Plan. |

| (4) | Subject to certain exceptions, the options will vest in three equal installments on each of the first, second and third anniversary of the grant date, subject to reporting person's continued performance of services for the Issuer. |

| (5) | This Form 3 includes the reporting person's balance in the Issuer's Supplemental Executive Retirement Plan ("SERP") that is hypothetically invested in the Issuer's stock fund, representing exempt transactions in the SERP since the reporting person's initial participation therein. |

| (6) | The vested balance in the reporting person's SERP account is payable in cash only following the six-month anniverary of a termination of employment or within 30 days following a change in control of the Issuer. Subject to the terms of the SERP, the reporting person may change his hypothetical investment in the investment alternatives (including the Issuer's stock fund) to an alternative hypothetical investment at any time. |

| (7) | Represents the aggregate number of shares of phantom stock allocated to the reporting person under the SERP as of the date hereof based on the closing price of a share of the Issuer's common stock on September 15, 2021. |

| (8) | The investment return on contributions in the SERP is generally equal to the earnings and losses that would occur if 100% of the contributions were invested, as directed by the reporting person, among the investment alternatives available under the plan (including the Issuer's stock fund). Subject to the terms of the SERP, the reporting person may change his hypothetical investment in the investment alternatives (including the Issuer's stock fund) to an alternative hypothetical investment at any time. Vested balances in the SERP are cash-settled only. |

Remarks:

See Exhibit 24 - Limited Power of Attorney |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Connett Bradford C

C/O HENRY SCHEIN, INC.

135 DURYEA ROAD

MELVILLE, NY 11747 |

|

| CEO, NA Distribution Group |

|

Signatures

|

| /s/ Jennifer Ferrero (as Attorney-in-Fact for Bradford C. Connett) | | 9/24/2021 |

| **Signature of Reporting Person | Date |

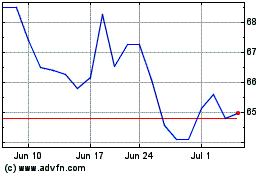

Henry Schein (NASDAQ:HSIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

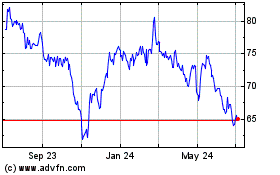

Henry Schein (NASDAQ:HSIC)

Historical Stock Chart

From Apr 2023 to Apr 2024