UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

(Mark One)

X ANNUAL REPORT PURSUANT TO

SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December

31, 2020

OR

__ TRANSITION

REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1943

For the transition period from

____________ to ____________

Commission File Number: 0-27078

A. Full

title of the plan and the address of the plan, if different from that of the

issuer named below:

Henry Schein, Inc. 401(k) Savings Plan

B. Name of issuer of the

securities held pursuant to the plan and the address of its principal executive

office:

Henry Schein, Inc.

135 Duryea Road

Melville, New

York 11747

HENRY

SCHEIN, INC. 401(k) SAVINGS PLAN

TABLE OF CONTENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Plan Administrator and Participants

Henry Schein Inc. 401(k) Savings Plan

Melville, New York

Opinion on

the Financial Statements

We have audited the

accompanying statements of net assets available for benefits of the Henry

Schein, Inc. 401(k) Savings Plan (the “Plan”) as of December 31, 2020 and 2019,

the related statements of changes in net assets available for benefits for the

years then ended, and the related notes (collectively, the “financial

statements”). In our opinion, the financial statements present fairly, in all

material respects, the net assets available for benefits of the Plan as of

December 31, 2020 and 2019, and the changes in net assets available for

benefits for the years then ended, in conformity with accounting principles

generally accepted in the United States of America.

Basis for

Opinion

These financial

statements are the responsibility of the Plan’s management. Our responsibility

is to express an opinion on the Plan’s financial statements based on our

audits. We are a public accounting firm registered with the Public Company

Accounting Oversight Board (United States) (“PCAOB”) and are required to be

independent with respect to the Plan in accordance with the U.S. federal

securities laws and the applicable rules and regulations of the Securities and

Exchange Commission and the PCAOB.

We conducted our audits

in accordance with the standards of the PCAOB. Those standards require that we

plan and perform the audit to obtain reasonable assurance about whether the

financial statements are free of material misstatement, whether due to error or

fraud. The Plan is not required to have, nor were we engaged to perform, an

audit of its internal control over financial reporting. As part of our audits

we are required to obtain an understanding of internal control over financial

reporting but not for the purpose of expressing an opinion on the effectiveness

of the Plan’s internal control over financial reporting. Accordingly, we

express no such opinion.

Our audits included

performing procedures to assess the risk of material misstatement of the

financial statements, whether due to error or fraud, and performing procedures

that respond to those risks. Such procedures included examining, on a test

basis, evidence regarding the amounts and disclosures in the financial

statements. Our audits also included evaluating the accounting principles used

and significant estimates made by the Plan’s management, as well as evaluating

the overall presentation of the financial statements. We believe that our

audits provide a reasonable basis for our opinion.

Supplemental

Information

The supplemental

information in the accompanying Schedule H, Line 4a-Schedule of Delinquent

Participant Contributions for the year ended December 31, 2020 and Schedule H,

Line 4i-Schedule of Assets (Held at End of Year) as of December 31, 2020 have been

subjected to audit procedures performed in conjunction with the audit of the

Plan’s financial statements. The supplemental information is presented for the

purpose of additional analysis and is not a required part of the financial

statements but included supplemental information required by the Department of

Labor’s Rules and Regulations for Reporting and Disclosure under the Employee

Retirement Income Security Act of 1974. The supplemental information is the

responsibility of the Plan’s management. Our audit procedures included

determining whether the supplemental information reconciles to the financial

statements or the underlying accounting and other records, as applicable, and

performing procedures to test the completeness and accuracy of the information

presented in the supplemental information. In forming our opinion on the

supplemental information, we evaluated whether the supplemental information,

including its form and content, is presented in conformity with the Department

of Labor’s Rules and Regulations for Reporting and Disclosure under the

Employee Retirement Income Security Act of 1974. In our opinion, the

supplemental information is fairly stated, in all material respects, in relation

to the financial statements as a whole.

/s/ BDO USA, LLP

We have served as the Plan’s auditor since 1984.

New York, New York

June 25, 2021

|

HENRY SCHEIN, INC. 401(k)

SAVINGS PLAN

|

|

|

|

|

|

|

|

|

|

|

|

STATEMENTS OF NET ASSETS

AVAILABLE FOR BENEFITS

|

|

|

|

|

|

December 31,

|

|

December 31,

|

|

|

|

|

|

2020

|

|

2019

|

|

|

|

|

|

|

|

|

|

Assets

|

|

|

|

|

Investments, at fair value (Note 4):

|

|

|

|

|

|

Money market accounts

|

$

|

171,284

|

|

$

|

399,044

|

|

|

Mutual funds

|

|

1,111,232,745

|

|

|

982,914,655

|

|

|

Common collective trust funds

|

|

160,039,452

|

|

|

144,032,727

|

|

|

Common stocks

|

|

53,852,721

|

|

|

64,782,656

|

|

|

|

Total investments

|

|

1,325,296,202

|

|

|

1,192,129,082

|

|

Receivables:

|

|

|

|

|

|

|

|

Notes receivable from participants

|

|

21,580,900

|

|

|

22,430,866

|

|

|

Employer’s contribution (Note 1(b))

|

|

12,527,572

|

|

|

28,372,172

|

|

|

Other

|

|

6,680

|

|

|

247,196

|

|

|

|

Total receivables

|

|

34,115,152

|

|

|

51,050,234

|

|

|

|

|

Total Assets

|

|

1,359,411,354

|

|

|

1,243,179,316

|

|

Liabilities

|

|

|

|

|

|

|

|

Benefits claims payable

|

|

36,095

|

|

|

111,175

|

|

|

|

Net assets available for benefits

|

$

|

1,359,375,259

|

|

$

|

1,243,068,141

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying Notes to

Financial Statements

|

|

HENRY

SCHEIN, INC. 401(k) SAVINGS PLAN

|

|

|

|

|

|

|

|

|

|

|

|

|

STATEMENTS OF CHANGES IN NET ASSETS

AVAILABLE FOR BENEFITS

|

|

|

|

|

|

|

Year Ended

|

|

|

|

|

|

|

December 31,

|

|

December 31,

|

|

|

|

|

|

|

2020

|

|

2019

|

|

|

|

|

|

|

|

|

|

|

|

|

Additions:

|

|

|

|

|

|

|

Investment income:

|

|

|

|

|

|

|

|

Interest and dividends:

|

|

|

|

|

|

|

|

|

Money market fund and mutual funds

|

$

|

30,294,030

|

|

$

|

74,955,760

|

|

Net appreciation (depreciation) in fair value of investments:

|

|

|

|

|

|

|

|

Mutual funds

|

|

139,770,708

|

|

|

134,410,290

|

|

|

Common stock

|

|

(266,837)

|

|

|

(6,068,337)

|

|

|

|

|

|

Total investment income

|

|

169,797,901

|

|

|

203,297,713

|

|

|

Participants’ contributions

|

|

55,376,112

|

|

|

58,611,774

|

|

|

Employer’s contribution (Note 1(b))

|

|

12,527,572

|

|

|

28,372,172

|

|

|

Interest income - notes receivable from participants

|

|

1,135,531

|

|

|

1,356,091

|

|

|

|

|

|

Total additions

|

|

238,837,116

|

|

|

291,637,750

|

|

Deductions:

|

|

|

|

|

|

|

|

Benefits paid to participants

|

|

121,315,257

|

|

|

107,047,260

|

|

|

Administrative expenses

|

|

1,214,741

|

|

|

1,224,907

|

|

|

|

|

|

Total deductions

|

|

122,529,998

|

|

|

108,272,167

|

|

Net increase in plan assets

|

|

116,307,118

|

|

|

183,365,583

|

|

Net assets available for benefits, beginning of year

|

|

1,243,068,141

|

|

|

1,059,702,558

|

|

Net assets available for benefits, end of year

|

$

|

1,359,375,259

|

|

$

|

1,243,068,141

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying Notes to

Financial Statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HENRY SCHEIN, INC. 401(k) SAVINGS PLAN

NOTES

TO FINANCIAL STATEMENTS

Note 1 – Description of Plan

The following description of the Henry Schein, Inc. 401(k) Savings

Plan (the “Plan”) provides only general information. Participants should refer

to the Plan document or Summary Plan Description for a more complete

description of the Plan’s provisions.

(a) Nature of Operations

The Plan is a contributory defined contribution 401(k) plan

originally effective January 1, 1970. The Plan was amended effective

December 26, 1993, to include an Internal Revenue Code Section 401(k)

feature. The Plan is subject to the provisions of the Employee

Retirement Income Security Act of 1974 (“ERISA”). The third-party

administrator is Fidelity Investments Institutional Operations Company, Inc.,

(the “Administrator”). The Plan trustee is Fidelity Management Trust

Company (the “Trustee”). Eligible employees are those employed by Henry

Schein, Inc. (the “Plan Sponsor” or the “Company”) and certain of the Company’s

affiliates (collectively, the “Employer”).

All employees (other than temporary employees) are eligible to

make salary reduction contributions to the Plan upon hire and become eligible

to be credited with Profit Sharing Contributions and the Employer Match (each

as described below) upon completion of a one year period of

service. Temporary employees are eligible to make salary reduction

contributions to the Plan and to be credited with Profit Sharing Contributions

and the Employer Match on the first July 1 or January 1 following the

completion of a twelve consecutive month period during which the temporary

employee is credited with at least one thousand hours of service. Effective December 1, 2015, if an individual is initially

classified as a temporary employee and then is reclassified as a regular

participant, the participant is immediately eligible to make salary reduction

contributions to the Plan, and is eligible to be credited with Profit Sharing

Contributions and the Employer Match upon the earlier of a completion of a one

year period of service or when he or she would have been eligible to be

credited with Profit Sharing Contributions and the Employer Match if he or she

would have remained a temporary employee.

On

March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief and

Economic Security (“CARES Act”) . The CARES Act, among other things, includes

several relief provisions available to tax-qualified retirement plans and their

participants. Plan management evaluated the relief provisions available to

plan sponsors under the CARES Act and implemented the following provisions:

•Special

Coronavirus Related Distributions for qualified individuals (impacted by

COVID-19 as set forth in the CARES Act) up to $100,000, available before

December 31, 2020

•

Increased available loan amount otherwise described in Note 1(f) for qualified

individuals to the lesser of $100,000 or 100% of the participant’s vested

account balance, available until September 22, 2020

• Allowed

qualified individuals to delay, up to one year, any loan repayments otherwise

due between the date the CARES Act was enacted and December 31, 2020

•

Suspended required minimum distributions for 2020

On May 1, 2020, the Plan was amended to (i) suspend all matching

contributions for all quarters commencing with the quarter that begins on June

28, 2020, (ii) provide for the recognition of prior service for employees of an

acquired entity, and (iii) provide for the elective transfer of any Eligible

Employee’s account balance under Modern Laboratory Services 401(k) Plan into

the Plan.

On October 29, 2020, the Plan was amended to reinstate matching

contributions effective for plan years beginning on and after January 1, 2021.

(b) Contributions

The Plan provides for a discretionary Employer contribution (the

“Profit Sharing Contribution”) of a percentage of a participant’s base

compensation, as defined under the Plan. There were no discretionary

Profit Sharing Contributions for the years ended December 31, 2020 and 2019.

The Plan allows employees to elect to contribute, through payroll deductions,

stated percentages from 1% to 50% of their compensation, as defined under the

Plan, not to exceed $19,500 and $19,000 for years 2020 and 2019, respectively,

in accordance with the deferral limitations for such years under the Internal

Revenue Code (“IRC”). Subject to the amendment described in Note

1(a), the Plan also provides for matching contributions (the “Employer Match”).

Prior to the fiscal quarter beginning on June 28, 2020, the Employer Match was 100%

of participant 401(k) contributions up to the lesser of 7% or the participant’s

deferral percentage, multiplied by the participant’s base compensation, as

defined under the Plan. For Plan years beginning on and after January 1, 2021,

the Employer Match is a percentage of participant 401(k) contributions set by

the Company in its discretion. Starting with the 2021 Plan Year, this

percentage was set at 100% of participant 401(k) contributions up to the lesser

of 7% or the participant’s deferral percentage, multiplied by the participant’s

base compensation, as defined under the Plan. For the 2020 and 2019 Plan

years, the Employer Match was allocated 100% to the participant’s investment

elections on file, subject to a 20% allocation limit to the Henry Schein, Inc.

Common Stock Fund.

Participants age 50 or over are permitted to make additional

catch-up tax deferred contributions once the participant has reached a limit on

those contributions imposed either by the Plan or by law. The extra

amount a participant may contribute may not exceed $6,500 in year 2020 and $6,000

in year 2019. Participants may also contribute amounts representing

distributions from other qualified defined benefit or defined contribution

plans (rollover).

The Plan provides for the automatic enrollment in the Plan, at a

deferral percentage of 3% of compensation, of eligible employees initially

hired by the Company or its participating affiliates on or after March 1, 2014,

unless the employee elects not to make 401(k) plan contributions or elects to

make elective 401(k) plan contributions at a different percentage.

(c)

Participants’ Accounts

Each participant’s account is credited with the participant’s

salary reduction contributions and the Employer contributions and an allocation

of net Plan earnings. Expenses directly related to participant

transactions are deducted from the respective participant’s account. Participants

also have the option to direct up to 20% of their account balances to common

shares of Henry Schein, Inc., and may have had an investment in the Covetrus,

Inc. Stock Fund in 2019 – see Note 4, Common Stock Funds for a

discussion of the Covetrus, Inc. Stock Fund.

(d) Vesting

Participants are immediately vested in their 401(k) contributions

plus actual earnings thereon. Vesting in the Profit Sharing

Contribution and the Employer Match, plus actual earnings thereon, is based on

years of continuous service, on a graded scale as follows:

|

|

|

|

Vested

|

|

|

|

Vesting

|

|

percentage

|

|

|

|

2 but less than 3 years

|

|

20%

|

|

|

|

3 but less than 4 years

|

|

40%

|

|

|

|

4 but less than 5 years

|

|

60%

|

|

|

|

5 or more years

|

|

100%

|

|

During 2019, the Plan was amended to provide for the full vesting,

effective February 7, 2019, of any participant who was a “Spinco Group Employee” pursuant to the merger

agreement with respect to the separation and subsequent merger of the Henry

Schein Animal Health Business with Vets First Choice. See Note 4, “Common

Stock” for a discussion of this separation and merger.

(e) Investments

Participants direct the investment of their

contributions and Company contributions into various investment options offered

by the Plan. The Plan currently offers twenty-three mutual funds, three common

collective trust funds, and a Company stock fund, subject to certain

limitations, as investment options for participants.

(f) Notes Receivable from Participants

Subject to the CARES Act amendment described in Note 1(a), participants

may borrow up to a maximum of the lesser of $50,000 or 50% of their vested

account balance from their accounts pursuant to rules set forth in the Plan

document. The minimum amount that may be borrowed is $1,000 and only

two loans may be made in any calendar year, and no more than two loans may be outstanding

at any time. The loans are secured by the balance in the

participants’ accounts and bear interest at prevailing rates. The

loans must be for a term of five years or less (ten years if the loan is for

the purpose of purchasing a principal residence). Principal and interest are

paid ratably through payroll deductions.

HENRY

SCHEIN, INC. 401(k) SAVINGS PLAN

NOTES TO

FINANCIAL STATEMENTS – (Continued)

If an employee is terminated and has an outstanding loan balance

at the time of termination, the employee will be permitted to repay any

outstanding loans directly to the Trustee. The employee may also

roll-over any outstanding loans, as part of a rollover of the terminated

employee’s entire vested account balance to certain other retirement plans in

which the terminated employee participates. Notes

receivable from participants are valued at the aggregate of the unpaid

principal balance and accrued but unpaid interest at the end of the period. No allowance for credit losses has been

provided as of December 31, 2020 and 2019. Delinquent participant loans are recorded as distributions based

on the terms of the Plan document.

(g) Payment of Benefits

The

Plan provides that, upon termination of service, retirement, disability or

death of the participant, a benefit equal to the vested, nonforfeitable portion

of the participant’s account is distributed as outlined in the Plan. Participants

may also receive in-service or hardship distributions based on criteria as

described in the Plan document. See Note 1(a) for discussion of relief

provisions available to plan participants under the CARES Act.

(h) Administrative

Expenses

All reasonable costs, charges and expenses incurred in connection

with the administration of the Plan may be paid by the Plan Sponsor but, if not

paid by the Plan Sponsor when due, shall be paid from Plan assets. For the

years ended December 31, 2020 and 2019, the Plan Sponsor did not use any Plan

assets from forfeited accounts to pay costs associated with the

Plan. Amounts reflected in the statements of changes in net assets

available for benefits reflect various participant directed expenses which have

been deducted from the respective participant accounts.

The Plan pays a flat administrative fee equal to $55 for each

participant in the Plan. Effective July 1, 2020, this fee was reduced to $53

per participant. Participants’ accounts are then charged the fee

proportionally based on their account balance. If participants elect to

make use of optional financial advisory services, fees are deducted directly

from the participants account. Fees are calculated and deducted quarterly, and

as a result, the actual fee per participant can vary.

(i) Forfeitures

Forfeiture allocations may be used to offset administrative

expenses of the Plan and to reduce the Employer Match. Forfeited invested

accounts totaled $604,835 and $608,734 at December 31, 2020 and 2019,

respectively, and are included primarily in the Fidelity Retirement Money

Market account in the statements of net assets available for

benefits. Forfeitures in the amount of $944,430 and $773,621 will be

or have been used to offset Employer contributions for the years ended December

31, 2020 and 2019, respectively.

Note 2 – Summary of Significant Accounting Policies

Basis of Accounting

The financial statements of the Plan are prepared under the

accrual method of accounting.

Use of Estimates

The preparation of financial statements in accordance with

accounting principles generally accepted in the United States of America

requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and changes therein and disclosure of

contingent assets and liabilities. Actual results could differ from

those estimates.

Investment Valuation and Income Recognition

Investments are stated at fair value based upon quoted market

prices. Gains and losses on investment transactions are recognized

when realized based on trade dates. Net appreciation (depreciation)

in fair value of investments includes realized and unrealized appreciation

(depreciation). Interest income is recorded on the accrual

basis. Dividends are recorded on the ex-dividend date.

HENRY

SCHEIN, INC. 401(k) SAVINGS PLAN

NOTES TO

FINANCIAL STATEMENTS – (Continued)

Notes Receivable from

Participants

Notes receivable from participants are valued at the aggregate of

the unpaid principal balance and accrued but unpaid interest at the end of the period. No

allowance for credit losses has been provided as of December 31, 2020

and 2019. Delinquent

participant loans are recorded as distributions based on the terms of the Plan

document.

Risk and Uncertainties

The Plan utilizes various investment instruments which are exposed

to various risks, such as interest rate, credit and overall market

volatility. Due to the level of risk associated with certain

investment securities, it is reasonably possible that changes in the values of

investment securities will occur in the near term and that such changes could

materially affect participants’ account balances and the amounts reported in

the financial statements. The Plan’s investments are not insured or

protected by the Plan’s Trustee, or any other governmental agency; accordingly,

the Plan is subject to the normal investment risks associated with money market

funds, mutual funds, stocks, bonds, and other similar types of investments. At

December 31, 2020 and December 31, 2019, two investments comprised 26.8% and

25.3% of net assets available for benefit, respectively.

Payment of Benefits

Benefits are recorded when paid.

Note 3 – Tax Status

The Internal Revenue Service (“IRS”) has determined

and informed the Company, by a letter dated April 24, 2017, that the Plan,

which was amended and restated effective as of January 1, 2015, with certain

amendments effective on subsequent dates, and related trust are designed in

accordance with the applicable sections of the IRC. Although the Plan has been

amended since receiving the determination letter, the Plan Administrator

believes that the Plan is currently designed and being operated in compliance

with the applicable requirements of the IRC. The related trust, therefore, is

not subject to tax under present income tax law. Accordingly, no provision for

income taxes has been included in the Plan’s financial statements.

The Plan Administrator has analyzed the tax positions taken by the

Plan and has concluded that as of December 31, 2020 and 2019, there are no uncertain

positions taken, or expected to be taken, that would require recognition of a

liability or disclosure in the financial statements. The Plan is

subject to routine audits by taxing jurisdictions; however, there are currently

no audits for any tax periods in progress.

Note 4 – Fair Value Measurements

Financial Accounting

Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 820 defines fair

value as the price that would be received to sell an asset or paid to transfer

a liability in an orderly transaction between market participants at the

measurement date. ASC 820 establishes a fair value hierarchy that

distinguishes between (1) market participant assumptions developed based on

market data obtained from independent sources (observable inputs) and (2) an

entity's own assumptions about market participant assumptions developed based

on the best information available in the circumstances (unobservable inputs).

The fair value hierarchy consists of three broad levels, which

gives the highest priority to unadjusted quoted prices in active markets for

identical assets or liabilities (Level 1) and the lowest priority to

unobservable inputs (Level 3). In accordance with ASC 820, the Plan

classifies its investments into:

· Level

1 - Unadjusted quoted prices in active markets for identical assets or

liabilities that are accessible at the measurement date.

· Level

2 - Inputs other than quoted prices included within Level 1 that are observable

for the asset or liability, either directly or indirectly. Level 2

inputs include quoted prices for similar assets or liabilities in active

markets; quoted prices for identical or similar assets or liabilities in

markets that are not active; inputs other than quoted prices that are observable

for the asset or liability; and inputs that are derived principally from or

corroborated by observable market data by correlation or other means.

· Level

3 - Inputs that are unobservable for the asset or liability.

HENRY

SCHEIN, INC. 401(k) SAVINGS PLAN

NOTES TO

FINANCIAL STATEMENTS – (Continued)

The following section describes

the valuation methodologies that were used to measure different financial

instruments at fair value, including an indication of the level in the fair

value hierarchy in which each instrument is classified. There have been no

changes in the methodologies used at December 31, 2020 and 2019.

Money Market Accounts

Funds held in money market accounts are valued at the net asset

value of shares held by the Plan as of December 31, 2020 and 2019, which

approximates fair value and are classified as Level 1 within the fair

value hierarchy.

Mutual Funds

Mutual funds are valued at the net asset value of shares held by the

Plan as of December 31, 2020 and 2019. The Company has classified

its mutual fund holdings as Level 1 within the fair value hierarchy based

upon unadjusted quoted prices in active markets for identical assets or

liabilities that were accessible.

Common Stock Funds

The Henry Schein, Inc. Common Stock Fund is a unitized stock

fund. The fund consists of both Henry Schein, Inc. common stock and a

short-term cash component that provides liquidity for daily trading. Henry

Schein, Inc. common stock is valued at the quoted market price from a national

securities exchange and the short-term cash investment is valued at cost, which

approximates fair value. The Henry Schein, Inc. Common Stock Fund is

classified within Level 1 of the fair value hierarchy based upon unadjusted

quoted prices in active markets for identical assets or liabilities that were

accessible at December 31, 2020 and 2019. The Henry Schein, Inc. common stock

component of $53,852,721 and $61,003,364 is included within “Common stocks” on

the Statement of Net Assets Available for Benefits and the short-term cash

component of $171,284 and $389,876 is included within “Money market accounts”

on the Statement of Net Assets Available for Benefits as of December 31, 2020

and 2019.

On February 7, 2019, the Company completed the separation and

subsequent merger of the Henry Schein Animal Health Business with Vets First Choice.

This merger was accomplished by a series of transactions among the Company,

Vets First Choice, Covetrus, Inc. (f/k/a HS Spinco, Inc. “Covetrus”), a wholly

owned subsidiary of Henry Schein, Inc. prior to February 7, 2019 and HS Merger

Sub, Inc., a wholly owned subsidiary of Covetrus. Following the separation and

merger, Covetrus was an independent, publicly traded company on the Nasdaq

Global Select Market.

As a result of this separation and merger, the Plan received a

distribution in the form of a certain number of shares of Covetrus, Inc. common

stock (“Covetrus Stock”) for each share of the Company’s common stock, par

value $.01 per share held in the Henry Schein, Inc. Common Stock Fund and the

Plan was amended to establish a “Covetrus, Inc. Stock Fund” to hold this

distribution. The Covetrus, Inc. Stock Fund was frozen immediately to

additional contributions and transfers into such fund, although Plan

participants were permitted to transfer amounts from the Covetrus, Inc. Stock

Fund to other investment options under the Plan prior to its termination. The

Covetrus, Inc. Stock Fund was terminated effective February 7, 2020. The

Covetrus, Inc. Stock Fund was an investment vehicle intended to invest solely

in shares of Covetrus Stock that were received by the Plan as a result of the

separation and merger, except to the extent short-term liquid investments are

necessary to satisfy the Covetrus, Inc. Stock Fund’s cash needs for transfers

and payments

As of December 31, 2019, the Covetrus, Inc. common stock component

of $3,779,292 is included within “Common stocks” on the Statement of Net Assets

Available for Benefits and the short-term cash component of $9,168 is included

within “Money market accounts” on the Statement of Net Assets Available for Benefits

as of December 31, 2019.

Common Collective Trust Funds

The

Common Collective Trust Funds are valued at net asset value per unit as a

practical expedient, which is calculated based on the fair values of the

underlying investments held by the fund less its liabilities as reported by the

issuer of the fund. The practical expedient is used for purposes of these

statements, but is not used in situations when it is determined to be probable

that the fund will sell the investments for an amount different than the

reported net asset value.

HENRY

SCHEIN, INC. 401(k) SAVINGS PLAN

NOTES TO

FINANCIAL STATEMENTS – (Continued)

The following tables

present the Company’s investments that are measured and recognized at fair

value on a recurring basis classified under the appropriate level of the fair

value hierarchy as of December 31,

2020 and 2019:

|

|

|

|

December 31, 2020

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market accounts

|

$

|

171,284

|

|

$

|

-

|

|

$

|

-

|

|

$

|

171,284

|

|

Mutual funds

|

|

1,111,232,745

|

|

|

-

|

|

|

-

|

|

|

1,111,232,745

|

|

Henry Schein, Inc. Common Stock Fund

|

|

53,852,721

|

|

|

-

|

|

|

-

|

|

|

53,852,721

|

|

|

Total investments in the fair value hierarchy

|

$

|

1,165,256,750

|

|

$

|

-

|

|

$

|

-

|

|

$

|

1,165,256,750

|

|

Investments measured at net asset value:

|

|

|

|

|

|

|

|

|

|

|

|

|

Common collective trust funds(1)

|

|

-

|

|

|

-

|

|

|

-

|

|

|

160,039,452

|

|

|

Total investments at fair value

|

$

|

1,165,256,750

|

|

$

|

-

|

|

$

|

-

|

|

$

|

1,325,296,202

|

|

|

|

|

December 31, 2019

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market accounts

|

$

|

399,044

|

|

$

|

-

|

|

$

|

-

|

|

$

|

399,044

|

|

Mutual funds

|

|

982,914,655

|

|

|

-

|

|

|

-

|

|

|

982,914,655

|

|

Henry Schein, Inc. Common Stock Fund

|

|

61,003,364

|

|

|

|

|

|

|

|

|

61,003,364

|

|

Covetrus, Inc. Common Stock Fund

|

|

3,779,292

|

|

|

-

|

|

|

-

|

|

|

3,779,292

|

|

|

Total investments in the fair value hierarchy

|

$

|

1,048,096,355

|

|

$

|

-

|

|

$

|

-

|

|

$

|

1,048,096,355

|

|

Investments measured at net asset value:

|

|

|

|

|

|

|

|

|

|

|

|

|

Common collective trust funds(1)

|

|

-

|

|

|

-

|

|

|

-

|

|

|

144,032,727

|

|

|

Total investments at fair value

|

$

|

1,048,096,355

|

|

$

|

-

|

|

$

|

-

|

|

$

|

1,192,129,082

|

(1)

This

class represents investments in the T. Rowe Price Stable Value Common Trust

Fund (“Stable Value Fund”), Prudential Core

Plus Bond Fund (“Prudential Fund”) and the BlackRock Strategic Completion

Non-Lendable Fund M (“BlackRock Fund”) that are measured at fair value using

the net asset value per unit (or its equivalent) and have not been categorized

in the fair value hierarchy. The Stable Value Fund invests primarily in

guaranteed investment contracts, separate account contracts, fixed income

securities, wrapper contracts, and short-term investments. The Prudential Fund

invests primarily in U.S Treasury, agency, corporate, mortgage-backed, and

asset-backed securities. The BlackRock Fund invests primarily in U.S. Treasury

Inflation Protected Securities, real estate investment trusts, and commodities.

The fair value amounts presented in this table are intended to permit

reconciliation of the fair value hierarchy to the line items presented in the

statements of net assets available for benefits.

During the years ended December 31, 2020 and 2019, there were no

transfers of investments between the levels of the fair value hierarchy.

The valuation methods as described above may produce a fair value

calculation that may not be indicative of net realizable value or reflective of

future fair values. Furthermore, although the Plan believes its valuation

methods are appropriate and consistent with other market participants, the use

of different methodologies or assumptions to determine the fair value of

certain financial instruments could result in a different fair value

measurement at the reporting date.

HENRY

SCHEIN, INC. 401(k) SAVINGS PLAN

NOTES TO

FINANCIAL STATEMENTS – (Continued)

The

following tables set forth additional disclosures of the Plan’s investments

that have fair value estimated using

net asset value:

|

|

|

|

Fair Value Estimated Using

Net Asset Value Per Share

|

|

|

|

|

December 31, 2020

|

|

|

|

|

|

|

Fair Value*

|

|

Unfunded Commitment

|

|

Redemption Frequency

|

|

Other Redemption

Restrictions

|

|

Redemption Notice Period

|

|

Investment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price Stable Value Common Trust Fund

|

$

|

76,318,125

|

|

$

|

n/a

|

|

|

Daily

|

|

|

n/a

|

|

12 months

|

|

Prudential Core Plus Bond Fund

|

|

66,279,377

|

|

|

n/a

|

|

|

Daily

|

|

|

n/a

|

|

n/a

|

|

BlackRock Strategic Completion Non-Lendable Fund M

|

|

17,441,950

|

|

|

n/a

|

|

|

Daily

|

|

|

n/a

|

|

n/a

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Estimated Using

Net Asset Value Per Share

|

|

|

|

|

December 31, 2019

|

|

|

|

|

|

|

Fair Value*

|

|

Unfunded Commitment

|

|

Redemption Frequency

|

|

Other Redemption

Restrictions

|

|

Redemption Notice Period

|

|

Investment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price Stable Value Common Trust Fund

|

$

|

50,435,333

|

|

$

|

n/a

|

|

|

Daily

|

|

|

n/a

|

|

12 months

|

|

Prudential Core Plus Bond Fund

|

|

72,295,988

|

|

|

n/a

|

|

|

Daily

|

|

|

n/a

|

|

n/a

|

|

BlackRock Strategic Completion Non-Lendable Fund M

|

|

21,301,406

|

|

|

n/a

|

|

|

Daily

|

|

|

n/a

|

|

n/a

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

The fair value of the investments have been estimated using the

net asset value of the investment.

|

Note 5 – Plan Termination

Although it has not expressed any intent to do so, the Company has

the right under the Plan to discontinue its contributions at any time and to

terminate the Plan subject to ERISA. In the event of Plan

termination, participants will become 100% vested in their accounts.

Note 6 – Party-in-Interest and Related Party Transactions

The Plan invests in shares of funds managed by an affiliate of the

Trustee as defined by the Plan and, therefore, these transactions in such

investments qualify as party-in-interest. The Plan invests in the

common stock of Henry Schein, Inc., and previously invested in the common stock

of Covetrus, Inc. which are parties-in-interest and related parties to the Plan. Notes

receivable from participants also qualify as party-in-interest transactions.

The Plan provides for an Employer Match, as discussed in Note 1(b), which

qualifies as a party-in-interest.

Note 7 – Delinquent Participant Contributions

In two incidents, the Company failed to remit certain

contributions and loan repayments to the Plan in a timely manner, according to

Department of Labor regulations for timing of transaction activity, in the

amounts of $8,810 for contributions and $1,296 for loan repayments in 2020.

The Company has since remitted the principal amount, and has calculated and

remitted lost earnings to the Plan related to these two incidents. While these

two transactions constituted prohibited transactions as defined by ERISA, they

were both found to be isolated and non-reoccurring incidents for which related

controls have been reviewed and remediated as necessary to mitigate the risk of

reoccurrence.

HENRY

SCHEIN, INC. 401(k) SAVINGS PLAN

NOTES TO

FINANCIAL STATEMENTS – (Continued)

Note 8 –

Subsequent Events

In preparing the financial statements, Plan management has

evaluated events and transactions for potential recognition or disclosure

through June 25, 2021, the date the Plan’s financial statements are available

to be issued.

HENRY SCHEIN, INC. 401(k) SAVINGS

PLAN

SCHEDULE H, PART IV, LINE 4a

DELINQUENT PARTICPANT CONTRIBUTIONS

(EIN: 11-3136595 Plan

Number: 003)

DECEMBER

31, 2020

|

|

|

|

|

Total That Constitutes Non-Exempt

Prohibited Transactions

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contributions

|

|

Total Fully

|

|

|

|

|

|

|

|

|

|

Contributions

|

|

Pending

|

|

Corrected Under

|

|

|

|

Participants Contributions

|

|

Contributions Not

|

|

Corrected

|

|

Correction in

|

|

VFCP and PTE

|

|

|

|

Transferred Late to the Plan

|

|

Corrected

|

|

Outside VFCP*

|

|

VFCP

|

|

2002-51

|

|

Check here if Late Participant Loan Repayments are included:

|

|

|

|

|

|

|

|

|

|

[x]

|

2020

|

$

|

10,106

|

|

|

$

|

10,106

|

$

|

0

|

$

|

10,106

|

HENRY

SCHEIN, INC. 401(k) SAVINGS PLAN

FORM 5500, SCHEDULE H, PART IV, LINE 4i SCHEDULE OF ASSETS

(HELD AT END OF YEAR)

(EIN:

11-3136595 Plan Number: 003)

DECEMBER

31, 2020

|

(a)

|

|

(b)

|

|

(c)

|

|

(d)

|

|

(e)

|

|

|

|

|

|

|

|

Description of investment

|

|

|

|

|

|

|

|

|

|

|

|

including maturity date,

rate

|

|

|

|

|

|

|

|

Identity of issue, borrower,

|

|

of interest, collateral, par

or

|

|

|

|

|

|

|

|

lessor or similar party

|

|

maturity value

|

|

Cost

|

|

Current Value

|

|

|

|

Money market/cash and cash equivalents:

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Government Money Market Fund

|

|

a

|

$

|

171,284

|

|

|

|

|

|

|

|

|

|

|

|

|

|

**

|

|

Common Stock Funds:

|

|

|

|

|

|

|

|

|

|

|

|

Henry Schein, Inc.

|

|

Common Stock Fund

|

|

a

|

$

|

53,852,721

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Collective Trust Funds:

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

Stable Value Common Trust Fund - Class A

|

|

a

|

$

|

76,318,125

|

|

|

|

|

|

Prudential

|

|

Core Plus Bond Fund

|

|

a

|

|

66,279,377

|

|

|

|

|

|

BlackRock

|

|

Strategic Completion Non-Lendable Fund M

|

|

a

|

|

17,441,950

|

|

|

|

|

|

Total common collective trust funds

|

|

|

|

|

|

160,039,452

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of registered investment companies:

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Spartan 500 Index Institutional Fund

|

|

a

|

$

|

192,058,184

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

American Funds

|

|

Growth Fund of America R6

|

|

a

|

|

168,902,850

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Freedom Index 2030 Fund - Class W

|

|

a

|

|

120,380,512

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Freedom Index 2040 Fund - Class W

|

|

a

|

|

83,407,492

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vanguard

|

|

Total Intl. Stock Index Fund

|

|

a

|

|

76,098,431

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vanguard

|

|

Total Bond Market Index Fund

|

|

a

|

|

65,683,471

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Funds are managed by an affiliate of

Fidelity Management Trust Company, a party-in-interest as defined by ERISA.

|

|

** A party-in-interest as defined by ERISA.

|

|

a The cost of participant-directed investments is not

required to be disclosed

|

|

|

|

|

|

|

|

|

|

|

|

|

HENRY SCHEIN, INC. 401(k) SAVINGS

PLAN

FORM 5500, SCHEDULE H, PART IV,

LINE 4i SCHEDULE OF ASSETS (Continued)

(HELD AT

END OF YEAR)

(EIN:

11-3136595 Plan Number: 003)

DECEMBER

31, 2020

|

(a)

|

|

(b)

|

|

(c)

|

|

(d)

|

|

(e)

|

|

|

|

|

|

|

|

Description of investment

|

|

|

|

|

|

|

|

|

|

|

|

including maturity date,

rate

|

|

|

|

|

|

|

|

Identity of issue, borrower,

|

|

of interest, collateral, par

or

|

|

|

|

|

|

|

|

lessor or similar party

|

|

maturity value

|

|

Cost

|

|

Current Value

|

|

|

|

Shares of registered investment companies

|

|

|

|

|

|

|

|

|

|

(continued):

|

|

|

|

|

|

|

|

|

|

|

|

Dodge & Cox Stock Fund

|

|

Stock Fund

|

|

a

|

|

61,586,041

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Freedom Index 2020 Fund - Class W

|

|

a

|

|

57,793,987

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vanguard Small Cap Index Institutional

|

|

Small Cap Index Institutional

|

|

a

|

|

53,414,124

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Freedom Index 2050 Fund - Class W

|

|

a

|

|

45,080,877

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Diversified Intl. Fund - Class K6

|

|

a

|

|

43,473,694

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Neuberger Berman

|

|

Genesis Trust

|

|

a

|

|

40,335,075

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Low Priced Stock Fund - Class K6

|

|

a

|

|

32,045,914

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Freedom Index 2025 Fund - Class W

|

|

a

|

|

16,680,600

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Funds are managed by an affiliate of

Fidelity Management Trust Company, a party-in-interest as defined by ERISA.

|

|

** A party-in-interest as defined by ERISA.

|

|

a The cost of participant-directed

investments is not required to be disclosed.

|

|

|

|

|

|

|

|

|

|

|

|

|

HENRY SCHEIN, INC. 401(k) SAVINGS

PLAN

FORM 5500, SCHEDULE H, PART IV,

LINE 4i SCHEDULE OF ASSETS (Continued)

(HELD AT

END OF YEAR)

(EIN:

11-3136595 Plan Number: 003)

DECEMBER

31, 2020

|

(a)

|

|

(b)

|

|

(c)

|

|

(d)

|

|

(e)

|

|

|

|

|

|

|

|

Description of investment

|

|

|

|

|

|

|

|

|

|

|

|

including maturity date,

rate

|

|

|

|

|

|

|

|

Identity of issue, borrower,

|

|

of interest, collateral, par

or

|

|

|

|

|

|

|

|

lessor or similar party

|

|

maturity value

|

|

Cost

|

|

Current Value

|

|

|

|

Shares of registered investment companies

|

|

|

|

|

|

|

|

|

|

|

|

(continued):

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Freedom Index 2035 Fund - Class W

|

|

a

|

|

14,118,717

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Freedom Index 2010 Fund - Class W

|

|

a

|

|

9,816,153

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Freedom Index 2060 Fund - Class W

|

|

a

|

|

8,413,199

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Freedom Index 2045 Fund - Class W

|

|

a

|

|

7,264,243

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Freedom Index Income Fund

|

|

a

|

|

5,375,304

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Freedom Index 2055 Fund - Class W

|

|

a

|

|

4,381,519

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Freedom Index 2015 Fund - Class W

|

|

a

|

|

3,969,128

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Freedom Index 2005 Fund - Class W

|

|

a

|

|

664,899

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

|

Fidelity Investments

|

|

Freedom Index 2065 Fund - Class W

|

|

a

|

|

288,331

|

|

|

|

|

Total value of registered investment companies

|

|

|

|

|

|

1,111,232,745

|

|

|

|

Total Investments

|

|

|

|

|

$

|

1,325,296,202

|

|

|

|

|

|

|

|

|

|

|

|

|

|

**

|

|

|

Notes Receivable from Participants

|

|

Fully secured loans with interest charges at current

|

|

-0-

|

$

|

21,580,900

|

|

|

|

|

|

|

|

commercial rates (current loans range from 4.25% to

|

|

|

|

|

|

|

|

|

|

|

|

9.75% maturing through December 9, 2030)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Funds are managed by an affiliate of

Fidelity Management Trust Company, a party-in-interest as defined by ERISA.

|

|

** A party-in-interest as defined by ERISA.

|

|

a The cost of participant-directed

investments is not required to be disclosed.

|

HENRY SCHEIN, INC. 401(k) SAVINGS PLAN

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Plan Administrator has duly caused

this annual report to be signed on its behalf by the undersigned hereunto duly

authorized.

|

|

|

|

|

|

|

HENRY SCHEIN, INC. 401(k) SAVINGS PLAN

|

|

Dated: June 25, 2021

|

/s/ Lorelei McGlynn

|

|

|

Lorelei McGlynn

|

|

|

Chairperson of the 401(k) Plan Administrative Committee

|

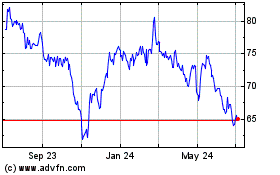

Henry Schein (NASDAQ:HSIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

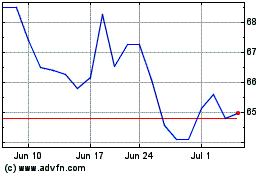

Henry Schein (NASDAQ:HSIC)

Historical Stock Chart

From Apr 2023 to Apr 2024