By William Mauldin and Vivian Salama

WASHINGTON -- President Trump moved Thursday to extend tariffs

to essentially all Chinese imports, escalating a trade conflict

that is poised to hit U.S. consumers directly in the pocketbook and

roiling financial markets.

The new tariffs would take effect Sept. 1 and cover $300 billion

in Chinese goods -- including smartphones, apparel, toys and other

consumer products. They would come on top of tariffs already

imposed on $250 billion in imports from China.

"If they don't want to trade with us anymore, that would be fine

with me, " Mr. Trump said at the White House.

According to a person familiar with the situation, the tariff

hike was opposed by U.S. Trade Representative Robert Lighthizer,

Treasury Secretary Steven Mnuchin, White House economic adviser

Lawrence Kudlow and national security adviser John Bolton. But Mr.

Trump was adamant in pushing the increase and was supported by

White House adviser Peter Navarro, this person said. A spokesman

for Mr. Lighthizer said he "supports the president's action."

Wall Street was rattled by the news, with the Dow Jones

Industrial Average erasing a rebound of more than 300 points. The

index closed down 281 points, or 1.1% lower. The S&P 500 slid

0.9% and the technology-heavy Nasdaq Composite lost 0.8%. Oil

prices sank almost 8%, their biggest drop since February 2015.

The U.S. action could prompt fresh retaliatory measures from

Beijing, although there is also the possibility Mr. Trump could

withdraw his threat before the new levies go into force.

Mr. Trump made public his plans to impose tariffs in a series of

tweets that followed a briefing from his trade team on this week's

negotiations in Shanghai. Those talks ended with neither side

detailing significant progress toward resolving the more than

yearlong dispute.

Mr. Trump said that senior officials still planned to resume

high-level discussions as scheduled next month, and he expressed

his interest in reaching "a comprehensive Trade Deal" with

China.

But Mr. Trump chided President Xi Jinping of China for not

following through on what the Trump administration views as prior

commitments. "China agreed to...buy agricultural products from the

U.S. in large quantities, but did not do so," he wrote on Twitter.

"Additionally, my friend President Xi said that he would stop the

sale of Fentanyl to the United States -- this never happened, and

many Americans continue to die."

An official at the Chinese embassy in Washington didn't respond

to a request for comment.

The Wall Street Journal reported this week that the slow

progress in trade talks was partly the result of a new tactic from

Beijing, which increasingly thinks waiting may produce a more

favorable agreement.

In the U.S., business groups condemned the escalation of

tariffs.

"Tariffs are not the answer, escalation is not the answer," said

Myron Brilliant, head of international affairs at the U.S. Chamber

of Commerce in Washington. "We have to be careful about actions

undertaken by either government that would stir the pot and not

create the best atmosphere for getting these complicated talks back

on track."

The tariffs, essentially a tax paid by importers in the U.S.,

affect practically all the groups of Chinese products not hit

previously, with the exception of select categories, such as

medicines.

Unlike previous rounds of tariffs, which have focused largely on

industrial goods, the $300 billion tranche is set to include a host

of consumer products, from electronics and cellphones to

apparel.

The tariffs would affect about $45 billion in cellphones, $39

billion in laptops and tablets, and $5.4 billion in videogame

consoles, according to the Consumer Technology Association, a trade

group.

The tariff plans threaten to undermine U.S. sales of iPhone and

other Apple products, which are largely produced in China. Apple

would either have to eat the tariff costs on iPhones -- which

analysts have estimated would be about $40 on the import price of

XS models -- or pass those costs on to customers.

Apple's business in China also faces risks from potential

Chinese retaliation, trade experts and analysts said. The company,

which has relied on China, Hong Kong and Taiwan for about a fifth

of sales, would be a potential target for China because it had a

nearly 6% share of the Chinese smartphone market in the June

quarter.

Shares of Apple fell 2.1% Thursday, erasing a 2% surge on

Wednesday after the company reported it returned to sales growth in

the three month period ended June 29.

Dow Jones & Co., publisher of The Wall Street Journal, has a

commercial agreement to supply news through Apple services.

The toy industry, which sources about 85% of products from

China, has been bracing for the tariffs, including moving

manufacturing to places like Vietnam, Indonesia and Mexico and

importing the goods into the U.S. sooner.

Hasbro Inc. has notified retailers that it plans to raise prices

on any toys hit by tariffs and it also expects that retailers will

take ownership of inventory in the U.S. instead of China, which

will add to the toy maker's shipping and warehousing costs,

according to Chief Financial Officer Deborah Thomas.

Like Hasbro, Mattel, which makes Barbie dolls and Hot Wheels

cars, is looking to reduce its manufacturing footprint in China.

"We have put together a contingency plan and are working closer

with retailers to make sure we mitigate the impact," Mattel CEO

Ynon Kreiz said in an interview last month. "There are different

levers we can pull," he said, including using manufacturers and

vendors in other countries.

Toy makers may struggle to raise prices during the holiday

season because they have already set prices with retailers, said

Steve Pasierb, president of the Toy Association trade group,

meaning that the tariffs will hit the manufacturers' profits. A

larger concern is that as prices rise for other consumer goods hit

by tariffs, consumers may think twice about spending as much on

discretionary purchases like toys.

"It's a big concern because holiday spending power is important

as we finish the year," Mr. Pasierb said.

North Carolina entrepreneur Brett Portaro, who has developed a

line of Powercharger Corp.-brand cellphone-charging accessories,

said he was disappointed by the tariff news.

"For a new company like Powercharger, we can't adjust our supply

chain fast enough since almost all of the lithium-ion batteries

used in our products are made in China," he said.

The tariffs plan is the latest move by Mr. Trump to put pressure

on the Chinese side in hopes of winning concessions to help U.S.

businesses and farmers. Previous warnings of additional tariffs

have often been postponed, but three rounds eventually took effect.

Economists say the trade conflict is souring investment and hurting

economic growth in both countries.

Many Republican and Democratic lawmakers have backed Mr. Trump's

strategy of confronting Beijing as a necessary step to achieve

structural changes in the Chinese economy.

"Tariffs aren't the only solution President Trump should use to

pressure China, but China isn't making any friends in Congress with

its behavior, " wrote Sen. Chuck Grassley (R., Iowa), the chairman

of the Senate Finance Committee, in a tweet. "China has a

responsibility to follow through on its commitments on fentanyl +

ag purchases + trade talks."

About three-quarters of Republican voters support tariffs on

China without approval from the World Trade Organization, while

about three-quarters of Democrats oppose them, according to a June

survey from the University of Maryland.

One Democratic presidential candidate, Rep. Tulsi Gabbard of

Hawaii, said in the primary debate on Wednesday that she would

remove the tariffs if elected.

The latest round of tariffs, if imposed, is likely to generate

more complaints from consumers and voters. On the other hand, Mr.

Trump also faces potential criticism going into a presidential

election year if he compromises deeply and cuts a deal with China,

since Democrats and hawks in his own party have signaled they would

criticize any perceived shortcomings.

The Trump administration appears to be aiming to alleviate

consumer and business concerns by starting with tariffs of only

10%, a move that also allows U.S. officials room to raise the

tariff level in the future if China doesn't follow through with

concessions.

"The 10% is for a short-term period and then I could always do

much more or less, depending on what happens with respect to a

deal," Mr. Trump said.

Meanwhile, U.S. farmers are increasingly suffering from

retaliation from China and other countries where the Trump

administration has penalized trade. Farm products are also facing a

disadvantage in Japan, which has opened its markets to other

countries through the Trans-Pacific Partnership, a deal Mr. Trump

withdrew from.

After meeting Mr. Xi in Osaka, Japan, in June, Mr. Trump and

administration officials said they had won commitments from Beijing

to purchase more U.S. agricultural products. The administration is

also seeking a quick trade agreement with Japan focused on

agriculture.

But Beijing hasn't said that it committed to the purchases, and

Chinese firms have made only limited purchases of agricultural

commodities in recent weeks.

The U.S. team in Shanghai this week, led by Mr. Lighthizer and

Mr. Mnuchin, was hoping the Chinese side would commit to purchasing

a defined quantity of U.S. agricultural goods, people following the

talks said.

China is likely holding out on buying large amounts of U.S. farm

goods while waiting for concessions from the U.S. side, the people

said.

Mr. Trump has said his administration would take a softer

approach on Chinese telecommunications giant Huawei Technologies

Co., allowing firms to do business with the blacklisted company if

it doesn't trigger security concerns.

So far the Trump administration hasn't formalized licenses for

U.S. firms to sell semiconductor chips and other products to

Huawei. Administration officials are looking at a plan that would

allow chip companies to sell to Huawei consumer products, such as

cellphones, but not sell advanced chips to the company's

telecommunications infrastructure, which many U.S. officials view

as a national-security threat.

--Katy Stech Ferek and Andrew Restuccia in Washington, Tripp

Mickle in San Francisco and Paul Ziobro in New York contributed to

this article.

Write to William Mauldin at william.mauldin@wsj.com and Vivian

Salama at vivian.salama@wsj.com

(END) Dow Jones Newswires

August 01, 2019 19:39 ET (23:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

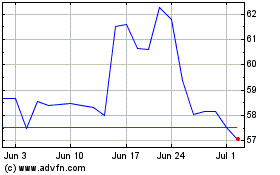

Hasbro (NASDAQ:HAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

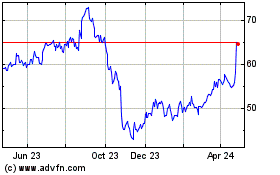

Hasbro (NASDAQ:HAS)

Historical Stock Chart

From Apr 2023 to Apr 2024