Harbor Custom Development, Inc. (Nasdaq: HCDI, HCDIP, HCDIW, HCDIZ)

(“Harbor,” “Harbor Custom Homes®,” or the “Company”), an innovative

and market leading real estate company involved in all aspects of

the land development cycle, today announced the pricing of its

underwritten public offering (the “Offering”) of 2,400,000 shares

of 8.0% Series A Cumulative Convertible Preferred Stock (the

“Series A Preferred Stock”) and 12,000,000 warrants to each

purchase one share of common stock (“Warrants”). Each share of

Series A Preferred Stock will be accompanied by five Warrants. Each

share of Series A Preferred Stock and accompanying five Warrants is

being offered at a price of $15.00. The shares of Series A

Preferred Stock and Warrants will be issued separately but can only

be purchased together in this Offering. Harbor Custom Development,

Inc. has granted the underwriters a 45-day option to purchase up to

360,000 additional shares of Series A Preferred Stock and/or

1,800,000 additional Warrants solely to cover over-allotments, if

any.

Each share of Series A Preferred Stock is

convertible into common shares at a conversion price of $4.50 per

common share, or 5.556 common shares, at any time at the option of

the holder, subject to certain customary adjustments. The Warrants

are exercisable immediately, have an exercise price of $2.97 per

share and expire five years from the date of issuance. If the

trading price of Harbor Custom Development, Inc.’s common stock

equals or exceeds $7.65 per share for at least 20 trading days in

any 30 consecutive trading day period, the Company can call for

mandatory conversion of the Series A Preferred Stock. Dividends on

the Series A Preferred Stock shall be cumulative and paid monthly

in arrears starting July 20, 2021, to the extent declared by the

board of directors of the Company. The Series A Preferred

Stock will not be redeemable for a period of three years from June

9, 2021, except upon a change of control of the Company.

The Offering is expected to close on October 7,

2021, subject to the satisfaction of customary closing

conditions. The Warrants will begin trading on The Nasdaq

Capital Market on October 5, 2021 under the symbol “HCDIZ.”

ThinkEquity is acting as sole book-running

manager for the Offering.

A registration statement on Form S-1 (File No. 333-259465) relating

to the offer and sale of the securities referred to herein was

filed by the Company with the Securities and Exchange Commission

(“SEC”) under the Securities Act of 1933, as amended, (the

“Securities Act”), and was declared effective by the SEC on October

4, 2021 and a related registration statement on Form S-1 was filed

pursuant to Rule 462(b) of the Securities Act to increase the size

of the Offering set forth in the earlier effective registration

statement on Form S-1. This offering is being made only by

means of a prospectus. Copies of the final prospectus, when

available, may be obtained from ThinkEquity, 17 State Street, 22nd

Floor, New York, New York 10004, by telephone at (877) 436-3673, by

email at prospectus@think-equity.com. The final prospectus

will be filed with the SEC and will be available on the SEC’s

website located at http://www.sec.gov.

The press release shall not constitute an offer

to sell or the solicitation of an offer to buy any of the

securities described herein, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Harbor Custom Development, Inc.

Harbor Custom Development, Inc. is a real estate

development company involved in all aspects of the land development

cycle including land acquisition, entitlements, construction of

project infrastructure, home building, marketing, sales, and

management of various residential projects in Western Washington's

Puget Sound region; Sacramento, California; Austin, Texas and Punta

Gorda, Florida. Harbor has active or recently sold-out residential

communities in Gig Harbor, Bremerton, Silverdale, Bainbridge

Island, Belfair, Allyn, Port Orchard, Lacey, Burien, Yelm and

Blaine in the state of Washington. In addition, Harbor has acquired

land and will begin constructing homes in three new markets. In the

Sacramento metro market, Harbor will be constructing homes in

completed subdivisions in both Rocklin and Auburn, California. In

the Austin metro market, Harbor has acquired developed lot

inventory in Dripping Springs, Driftwood, and Horseshoe Bay, Texas.

The Company recently acquired property in Punta Gorda, Florida, and

plans to begin construction of oceanfront condominiums there in

2022. Harbor Custom Development's business strategy is to acquire

and develop land strategically, based on an understanding of

population growth patterns, entitlement restrictions,

infrastructure development, and geo-economic forces. Harbor

focuses on real estate within target markets with convenient access

to metropolitan areas that are generally characterized by diverse

economic and employment bases and increasing populations. For

more information on Harbor Custom Development, Inc., please

visit www.harborcustomdev.com.

Forward Looking Statements

Certain statements in this press release

constitute “forward-looking statements” within the meaning of the

federal securities laws. Words such as “may,” “might,” “should,”

“believe,” “expect,” “anticipate,” “estimate,” “continue,”

“predict,” “forecast,” “project,” “plan,” “intend” or similar

expressions, or statements regarding intent, belief, or current

expectations, are forward-looking statements. These forward-looking

statements are based upon current estimates and assumptions and

include statements regarding the completion of the Offering, the

amount of proceeds, the listing of the Company’s securities and the

Company’s future operational plans. While the Company believes

these forward-looking statements are reasonable, undue reliance

should not be placed on any such forward-looking statements, which

are based on information available to us on the date of this

release. These forward-looking statements are subject to various

risks and uncertainties, including without limitation those set

forth in the Company’s filings with the SEC, including under the

heading “Risk Factors” in the Company’s registration statement on

Form S-1. Thus, actual results could be materially different. The

Company expressly disclaims any obligation to update or alter

statements whether as a result of new information, future events or

otherwise, except as required by law.

Investor Relations:

Hanover International

IR@harborcustomdev.com

866-744-0974

Harbor Custom Development (NASDAQ:HCDI)

Historical Stock Chart

From Mar 2024 to Apr 2024

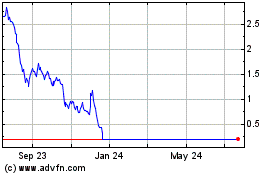

Harbor Custom Development (NASDAQ:HCDI)

Historical Stock Chart

From Apr 2023 to Apr 2024