UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

|

Filed by the Registrant x

|

|

Filed by a Party other than the Registrant o

|

|

|

|

Check the appropriate box:

|

|

x

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material Pursuant to §240.14a-12

|

|

|

|

|

Gulf Resources, Inc.

(Name of Registrant as Specified in Its

Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

GULF RESOURCES, INC.

Level 11, Vegetable Building, Industrial

Park of the East City,

Shouguang City, Shandong Province 262700

The People’s Republic of China

___________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held on December 18, 2019

___________________________

TO THE STOCKHOLDERS OF Gulf Resources, Inc.:

The Annual Meeting

of the stockholders of Gulf Resources, Inc., a Nevada corporation (“Company”), will be held on December 18, 2019, at

10:00 a.m. (local time), at the company’s headquarters located at Level 11, Vegetable Building, Industrial Park of the East

City, Shouguang City, Shandong Province 262700, the People’s Republic of China, for the following purposes:

|

|

1.

|

To elect seven directors, consisting of Ming Yang, Xiaobin Liu, Naihui Miao, Shengwei Ma, Yang Zou, Shi Tong Jiang and Tengfei Zhang, to hold office for a one-year term or until their successors are elected and qualified;

|

|

|

2.

|

To ratify the appointment of Morison Cogen LLP, independent public accountants, as the auditor of the Company for the fiscal year 2019; and

|

|

|

3.

|

To approve a reverse split of the Company’s common stock, par value $0.0005 (the “Common Stock”) on the basis of one (1) share for every two (2) to eight (8) outstanding shares of Common Stock, subject to the discretion of the Board of Directors, so that two (2) to eight (8) outstanding shares of Common Stock before the reverse stock split shall represent one (1) share of Common Stock after the reverse stock split; and

|

|

|

|

|

|

|

4

|

To approve the Company’s 2019 Omnibus Equity Incentive Plan;

|

|

|

|

|

|

|

5

|

To transact any other business as may properly be presented at the Annual Meeting or any adjournment thereof.

|

Stockholders of record

of the Company’s Common Stock at the close of business on October 18, 2019 are entitled to notice of, and to vote at, the

Annual Meeting or any adjournment or postponement thereof.

Your attention is directed

to the Proxy Statement accompanying this Notice for a more complete statement of matters to be considered at the Annual Meeting.

All stockholders

are cordially invited to attend the meeting. Whether or not you expect to attend, you are respectfully requested by

the Board of Directors to sign, date and return the enclosed proxy promptly, or follow the instructions contained in the Notice

of Availability of Proxy Materials to vote on the Internet. Stockholders who execute proxies retain the right to revoke

them at any time prior to the voting thereof. If you received this proxy statement in the mail, a return envelope is

enclosed for your convenience.

YOUR VOTE IS IMPORTANT.

YOU ARE REQUESTED TO CAREFULLY READ THE PROXY STATEMENT. PLEASE VOTE ON THE INTERNET. IF THIS PROXY STATEMENT WAS MAILED TO YOU,

COMPLETE, DATE, SIGN AND RETURN YOUR PROXY IN THE ENCLOSED ENVELOPE. YOU MAY ALSO ATTEND THE MEETING TO VOTE IN PERSON.

By Order of the Board of Directors,

/s/ Ming Yang

Ming Yang

Chairman of the Board of Directors

Dated: October 21, 2019

GULF RESOURCES, INC.

Level 11, Vegetable Building, Industrial

Park of the East City,

Shouguang City, Shandong Province 262700

The People’s Republic of China

___________________________

PROXY STATEMENT

for

Annual Meeting of Stockholders

to be held on December 18, 2019

___________________________

INTRODUCTION

Your proxy is solicited

by the Board of Directors of Gulf Resources, Inc., a Nevada corporation (the “Company,” “we,”

“us” or “our”), for use at the Annual Meeting of Stockholders to be held on December

18, 2019, at 10:00 a.m. (local time) Beijing Standard Time (9:00 p.m. Eastern Standard Time, December 17, 2019) (the “Annual

Meeting”), at the company’s headquarters located at Level 11, Vegetable Building, Industrial Park of the East City,

Shouguang City, Shandong Province 262700, the People’s Republic of China, for the following purposes:

|

|

1.

|

To elect seven directors, consisting of Ming Yang, Xiaobin Liu, Naihui Miao, Shengwei Ma, Yang Zou, Shi Tong Jiang and Tengfei Zhang, to hold office for a one-year term or until their successors are elected and qualified;

|

|

|

2.

|

To ratify the appointment of Morison Cogen LLP, independent public accountants, as the auditor of the Company for the fiscal year 2019; and

|

|

|

3.

|

To approve a reverse split of the Company’s common stock, par value $0.0005 (the “Common Stock”) on the basis of one (1) share for every two (2) to eight (8) outstanding shares of Common Stock, subject to the discretion of the Board of Directors, so that two (2) to eight (8) outstanding shares of Common Stock before the reverse stock split shall represent one (1) share of Common Stock after the reverse stock split; and

|

|

|

|

|

|

|

4

|

To approve Company’s 2019 Omnibus Equity Incentive Plan;

|

|

|

5.

|

To transact any other business as may properly be presented at the Annual Meeting or any adjournment thereof.

|

|

The Board of Directors

set October 18, 2019 as the record date (the “Record Date”) to determine those holders of common stock of the

Company (the “Common Stock”), who are entitled to notice of, and to vote at, the Annual Meeting. A list of the

stockholders entitled to vote at the meeting may be examined at the Company’s office at Level 11, Vegetable Building, Industrial

Park of the East City, Shouguang City, Shandong Province 262700, the People’s Republic of China.

On or about November

4, 2019, the Company shall mail to all stockholders of record, as of the Record Date, a Notice of Availability of Proxy Materials

(the “Notice”). Please carefully review the Notice for information on how to access the Notice of Annual Meeting,

Proxy Statement, proxy card and Annual Report on www.proxyvote.com, in addition to instructions on how you may request to

receive a paper or email copy of these documents. There is no charge to you for requesting a paper copy of these documents.

GENERAL INFORMATION ABOUT VOTING

Who can vote?

You can vote your shares

of Common Stock if our records show that you owned the shares on the Record Date. As of the close of business on the Record Date,

a total of 47,583,072 shares of Common Stock are entitled to vote at the Annual Meeting. Each share of Common Stock

is entitled to one vote on matters presented at the Annual Meeting.

How do I vote by proxy?

If you have received

a printed copy of these materials by mail, you may simply complete, sign and return your proxy card in the mail. If

you did not receive a printed copy of these materials by mail and are accessing them on the Internet, you may simply follow the

instructions below to submit your proxy on the Internet.

What if I received a Notice of Availability of proxy materials?

In accordance with

rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), instead of mailing a printed

copy of our proxy materials to each stockholder of record, we may now furnish proxy materials to our stockholders on the Internet.

If you received a Notice by mail, you will not receive a printed copy of the proxy materials. Instead, the Notice will instruct

you as to how you may access and review all of the important information contained in the proxy materials. The Notice also instructs

you as to how you may submit your proxy on the Internet. If you received a Notice by mail and would like to receive a printed copy

of our proxy materials, including a proxy card, you should follow the instructions for requesting such materials included in the

Notice.

If I am a stockholder of record, how do I cast my vote?

If you are a stockholder

of record, you may vote in person at the Annual Meeting. We will give you a ballot when you arrive.

If you do not wish

to vote in person or you will not be attending the Annual Meeting, you may vote by proxy. If you received a printed copy of these

proxy materials by mail, you may vote by proxy using the enclosed proxy card, complete, sign and date your proxy card and return

it promptly in the envelope provided.

If you received a Notice

by mail, you may vote by proxy over the Internet by going to www.proxyvote.com to complete an electronic proxy card.

If you vote by proxy,

your vote must be received by 5:00 p.m. U.S. Eastern Standard Time on December 17, 2019 to be counted.

We provide Internet

proxy voting to allow you to vote your shares on-line, with procedures designed to ensure the authenticity and correctness of your

proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage

charges from Internet access providers and telephone companies.

What if other matters come up at the Annual Meeting?

The matters described

in this proxy statement are the only matters we know of that will be voted on at the Annual Meeting. If other matters

are properly presented at the meeting, the proxy holders will vote your shares as they see fit.

Can I change my vote after I return my proxy card?

Yes. You can revoke

your proxy at any time before it is exercised at the Annual Meeting in any of three ways:

|

|

·

|

by submitting written notice revoking your proxy card to the Secretary of the Company;

|

|

|

·

|

by submitting another proxy via the Internet or by mail that is later dated and, if by mail, that is properly signed; or

|

|

|

·

|

by voting in person at the Annual Meeting.

|

Can I vote in person at the Annual Meeting rather than by

completing the proxy card?

Although we encourage

you to complete and return the proxy card or vote by proxy on the Internet to ensure that your vote is counted, you can attend

the Annual Meeting and vote your shares in person.

How are votes counted?

We will hold the Annual

Meeting if holders representing a majority of the shares of Common Stock issued and outstanding and entitled to vote in person

or by proxy either sign and return their proxy cards, submit their proxy on the Internet, or attend the meeting. If

you sign and return your proxy card, or submit your proxy on the Internet, your shares will be counted to determine whether we

have a quorum even if you abstain or fail to vote on any of the proposals listed on the proxy card.

The election of directors

under Proposal 1 will be by the affirmative vote of a plurality of the shares of Common Stock, represented in person or by proxy

at the Annual Meeting.

Proposal 2 shall be

approved upon the vote of a majority of shares present in person or represented by proxy at the meeting. An abstention with respect

to Proposal 2 will have the effect of a vote “AGAINST” such proposal.

Proposal 3 shall

be approved upon the affirmative vote of the majority of shares of Common Stock issued and outstanding on the record date. Abstentions

and broker non-votes with respect to Proposal 3 will have the effect of a vote “AGAINST” such proposal.

Proposal 4 shall be

approved upon the vote of a majority of shares present in person or represented by proxy at the meeting. Abstention and broker

non-votes with respect to Proposal 4 will have the effect of a vote “AGAINST” such proposal.

Who pays for this proxy solicitation?

We do. In

addition to sending you these materials and posting them on the Internet, some of our employees may contact you by telephone, by

mail, by fax, by email, or in person. None of these employees will receive any extra compensation for doing this. We

may reimburse brokerage firms and other custodians for their reasonable out-of-pocket costs in forwarding these proxy materials

to stockholders.

Why are we seeking stockholder approval for these proposals?

Proposal No. 1: The

Nevada Revised Statutes, as amended and the NASDAQ Stock Market require corporations to hold elections for directors each year.

Proposal No. 2:

The Company appointed Morison Cogen LLP to serve as the Company’s independent auditors for the 2019 fiscal year. The

Company elects to have its stockholders ratify such appointment.

Proposal No. 3.

The Nevada Revised Statutes require corporations to obtain shareholder approval to amend its articles of incorporation to effect

the split.

Proposal No. 4.

The Nevada Revised Statutes and the NASDAQ Stock Market require corporations to obtain shareholder approval to adopt or materially

amend equity incentive plan.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table

sets forth certain information regarding beneficial ownership of Common Stock, as of the Record Date of the meeting, by each of

Company’s directors and executive officers; all executive officers and directors as a group, and each person known to Company

to own beneficially more than 5% of Company’s Common Stock. Except as otherwise noted, the persons identified have sole voting

and investment powers with respect to their shares. As of October 18, 2019, there were 47,583,072 shares of the Company’s

Common Stock outstanding.

|

Name of Beneficial Owner (1)

|

|

Number of Shares

|

|

Percent of Class

|

|

Ming Yang (Chairman)

|

|

14,053,102

|

|

(2)

|

|

29.5

|

%

|

|

Xiaobin Liu (CEO)

|

|

190,575

|

|

(3)

|

|

*

|

|

|

Min Li (CFO)

|

|

190,575

|

|

(3)

|

|

*

|

|

|

Naihui Miao (COO)

|

|

190,575

|

|

(3)

|

|

*

|

|

|

Yang Zou (Director)

|

|

17,695

|

|

(4)

|

|

*

|

|

|

Shi Tong Jiang (Director)

|

|

12,500

|

|

(4)

|

|

|

|

|

Tengfei Zhang (Director)

|

|

17,695

|

|

(4)

|

|

*

|

|

|

All Directors and Executive Officers as a Group (seven persons)

|

|

14,672,717

|

|

|

|

30.8

|

%

|

|

Chen Weijie

|

|

6,068,011

|

|

(5)

|

|

12.8

|

%

|

|

Wenxiang Yu

|

|

5,079,721

|

|

(6)

|

|

10.7

|

%

|

|

Shandong Haoyuan Industry Group Ltd.

|

|

4,124,733

|

|

(6)

|

|

8.7

|

%

|

________________

* Less than

1%.

(1) The address of each director and executive

officer is c/o Gulf Resources, Inc., Level 11, Vegetable Building, Industrial Park of the East City, Shouguang City , Shandong

Province, 262700, the People’s Republic of China.

(2) Consists of 3,173,848 shares owned

by Ming Yang, 5,079,721 shares owned by Ms. Wenxiang Yu, the wife of Mr. Yang, 1,674,800 shares owned by Mr. Zhi Yang, Mr.

Yang’s son, and 4,124,733 shares owned by Shandong Haoyuan Industry Group Ltd. (“SHIG”), of which

Mr. Yang is the controlling shareholder, chief executive officer and a director. Mr. Yang disclaims beneficial ownership

of the shares owned by his wife and SHIG.

(3) Consists of 100,000 shares issuable

upon exercise of options held by each beneficial owner.

(4) Consists of 12,500 shares issuable upon exercise of options

held by such beneficial owner.

(5) Based on Schedule 13D filed on August 12, 2015. Mr. Chen’s

address is North Weigao Road, Luocheng Sub-district Office, Shouguang, Shandong Province 262700, the People’s Republic of

China.

(6) The address of the shareholder is c/o Gulf Resources, Inc.,

Level 11, Vegetable Building, Industrial Park of the East City, Shouguang City , Shandong Province, 262700, the People’s

Republic of China.

PROPOSAL 1

ELECTION OF DIRECTORS

Nominees of the Board of Directors

The Board of Directors

has nominated seven (7) persons identified below for election as directors, to serve until the next annual meeting and their successors

have been elected and qualified. If any nominee becomes unavailable for election, which is not expected, the persons

named in the accompanying proxy intend to vote for any substitute whom the Board of Directors nominates.

|

Name

|

|

Age

|

|

Other positions with Company; other directorships held in last five years

|

|

Has served as Company director since

|

|

Ming Yang

|

|

51

|

|

Chairman of the Board of Director

|

|

December 2006

|

|

Xiaobin Liu

|

|

50

|

|

Chief Executive Officer and Director

|

|

March 2009

|

|

Naihui Miao

|

|

50

|

|

Secretary, Chief Operating Officer and Director

|

|

January 2006

|

|

Yang Zou (1)(3)

|

|

47

|

|

Independent Director

|

|

March 2011

|

|

Shengwei Ma(4)

|

|

51

|

|

Independent Director Nominee

|

|

N/A

|

|

Shitong Jiang (1) (2)(3)

|

|

50

|

|

Independent Director

|

|

April 2008

|

|

Tengfei Zhang (2)(3)

|

|

51

|

|

Independent Director

|

|

June 2011

|

(1) Serves as a member of the Audit Committee.

(2) Serves as a member of the Compensation Committee.

(3) Serves as a member of the Nominating and Corporate Governance

Committee.

(4) Mr. Ma will serve as a member of the Audit Committee and

the Compensation Committee upon election.

Ming Yang, Chairman of the Board

of Director – Mr. Yang has served as Chairman of Shouguang Vegetable Industry Group Holding Company since 2013. In addition,

he has served as Chairman of Shouguang City Yuxin Chemical Company Limited since July 2000. Since May 2005, Mr. Yang has served

as Chairman of Shouguang City Haoyuan Chemical Company Limited, Shouguang City He Mao Yuan Bromize Company Limited, and Shouguang

City Qing River Real Estate Construction Company. He was nominated as director of Qinghe Oil Field Office in 1993, where

he managed operations. In 1997 he was appointed Chairman and General Manager of Shouguang Qinghe Shiye LLC and during the next

three years its profits doubled. He took the position of general manager of Shouguang City Yu Xin Chemical Industry Co., Ltd. in

2000. During his stay, he focused on quality management and technology progress, which led to a 100 percent success rate of all

products. He also helped the company successfully pass the ISO certification and become a private high-tech enterprise. In 2005

he was appointed to the position of Chairman, where he has helped the company to become a leading producer of bromine and crude

salt in China. In 2006 he became the Chairman of Gulf Resources, Inc. Mr. Yang has been the representative of Shandong

Shouguang congress since 1995 and in 1998 he was awarded as Honorary Entrepreneur in Weifang City.

Xiaobin Liu, Chief Executive

Officer and Director – Mr. Liu was appointed as Chief Executive Officer and Director on March 10, 2009. Mr. Liu joined

the Company as Vice President in December 2007. He has served as Chairman of Chengdu Philosopher's Stone Culture Media Co. LTD

since August 2018. He served as Chairman of China Shouguang Vegetable Industry Group (Cayman) Inc. from 2011 to 2017. He currently

serves as a director of China Shouguang Vegetable Industry Group (Cayman) Inc. Before he joined the Company, Mr. Liu served as

project manager of Shenzhen Guangshen Accounting Firm from January 2007 to November 2007; the department manager of Hainan Zhongou

Accounting Firm from January 2003 to December 2006; the CFO (equivalent of Vice President) of Dasheng Real Estate Development Company,

which is the subsidiary of Saige Dasheng Co., Ltd from May 2002 to November 2002; the CFO of Shenzhen Securities Department of

Hainan Saige International Trust Investment Company from May 2000 to August 2004; and the financial manager of Hainan Wanquanyuan

Hot Spring Tourism Development Co., Ltd from 1995 to 2000. During this time, he also was the CFO of Qionghai City Guantang Hotspring

Leisure Center, the CFO of Qionghai City Wanquanhe Agricultural Development Co., Ltd, the CFO of Qionghai Wanquanhe Hotspring Tourist

Development Property Management Co., Ltd, and the CFO of Qionghai Guantangyuzhuang Resort Co., Ltd. Prior to that, Mr. Liu worked

in the financial department of Hainan Jinyuan Industrial Co., Ltd, which is a subsidiary of Chinese Black Metal Limited Company

Northwest Branch from 1992 to 1995, and the financial department of Shanxi Aircraft Manufacturing Company from 1988 to 1992. Mr.

Liu earned a master degree from the Economic and Management School at Hong Kong City University.

Naihui Miao, Secretary, Chief Operating

Officer and Director – Mr. Miao has served as Vice President of Shouguang City Haoyuan Chemical Company Limited

since January 2006. Since January 2006, Mr. Miao has served as Director, Secretary and Vice President of Gulf Resources,

Inc. and he is in charge of sales, human resource and business management. From 2005 to 2006, Mr. Miao served as Vice

President of Shouguang City Yuxin Chemical Company Limited as the deputy general manager. From 1991 to 2005, Mr. Miao

served as a Manager and then Vice President of Shouguang City Commercial Trading Center Company Limited. He was the

director of Shouguang Business Trade Center since 1986. He has served as Supervisor of Chengdu Philosopher's Stone Culture Media

Co. LTD since August 2018.

Yang Zou, Independent Director

– Mr. Zou was appointed a director on March 2, 2011. Mr. Zou served as Vice Director of Beijing Zhongtianhuamao Accounting

Firm (General Partnership) from July 1, 2017 to August 2018. He is a Certified Public Accountant of China and holds

the certificate of Certified Internal Auditor. From March 2003 to September 2009, Mr. Zou was chief financial officer

of Bohua Ziguang Zhiye Co., Ltd. From July 2001 to January 2003, Mr. Zou was the audit department manager of financial

center of Beijing Hengji Weiye Electronic Products Co., Ltd., where he was in charge of internal audit, financial budget management,

and coordination with external audit. From July 1999 to June 2001, Mr. Zou was manager of finance and audit department of Zhonglian

Online Information Development Co., Ltd. From September 1993 to June 1999, Mr. Zou had served as assistant auditor, auditor, and

head of project audit of Hainan Zhongou Certified Public Accountants Co., Ltd. From July 1991 to August 1993, Mr. Zou was an accountant

of department of finance of Hunan Department Store Co., Ltd. Mr. Zou graduated from Beijing University with bachelor’s

degree in finance.

Shitong Jiang, Independent Director

– Mr. Jiang was appointed a director on April 23, 2008. Mr. Jiang is Chief of the Shouguang City Audit Bureau,

Shandong Province, has been with the Audit bureau since 1990. During his career at the Shouguang City Audit Bureau he has held

multiple positions including, Auditing Officer and Audit Section Deputy Chief. The Shouguang City Audit Bureau is responsible for

the independent audit supervision of the affairs of the government. From 1987 to 1990 Mr. Jiang attended Shandong Financial Institution.

Tengfei Zhang, Independent Director

– Mr. Zhang was appointed a director on June 30, 2011. Mr. Zhang has served as Director of Shenzhen Kaili Industrial

Co., Ltd. since January 1, 2017. Prior to this position, he was the Chairman of the Board of Supervisors of Shenzhen Kaili

Industrial Co., Ltd. He is a Certified Public Accountant in China. From July 2000 to December 2004 , Mr. Zhang was Supervisor

of Shenzhen Kaili Industrial Co., Ltd. and Director of Finance of Changsha Kaili Real Estate Development Co., Ltd. From January

to June 2000, he was Manager of Financial Department of Shenzhen Kaili Industrial Co., Ltd. Mr. Zhang graduated from

Economics and Management Department of Hunan Business School with a college degree in 1989.

Shengwei Ma, Independent Director

Nominee – Mr. Ma has served as Department Manager of Shouguang City Urban Construction and Investment Group since March

2012. Mr. Ma holds a Senior Accountant Certificate. Mr. Ma graduated from Central Broadcasting and Television University

with bachelor’s degree in accounting in 2004.

Family Relationships

There are no family relationships among

our executive officers, directors and significant employees.

Involvement in Certain Legal Proceedings

To the best of our

knowledge, there have been no events under any bankruptcy act, no criminal proceedings and no judgments, injunctions, orders or

decrees material to the evaluation of the ability and integrity of any director, executive officer, promoter or control person

of our Company during the past ten years.

Board Operations

The positions of principal

executive officer and Chairman of the Board of Company are held by different persons. The Chairman of the Board chairs

Board and stockholder meetings and participates in preparing their agendas. The Chairman of the Board also serves as

a focal point for communication between management and the Board between Board meetings, although there is no restriction on communication

between directors and management. The Company believes that these arrangements afford the directors sufficient resources

to supervise management effectively, without being overly engaged in day-to-day operations.

The Board plays an

active role, as well as the independent committees, in overseeing the management of the Company’s risks. The Board regularly

reviews reports from members of senior management and committees on areas of material risk to the Company, including operational,

financial, legal, strategic and regulatory risks.

The Board of Directors

held 4 meetings during 2018. During 2018, no director attended fewer than 75% of the meetings of the Board of Directors and Board

committees of which the director was a member.

Director Qualifications

The Company seeks directors

with established strong professional reputations and experience in areas relevant to the strategy and operations of our businesses.

The Company also seeks directors who possess the qualities of integrity and candor, who have strong analytical skills and who are

willing to engage management and each other in a constructive and collaborative fashion, in addition to the ability and commitment

to devote time and energy to service on the Board and its committees. We believe that all of our directors and director nominee

meet the foregoing qualifications.

The Nominating and

Corporate Governance Committee and the Board believe that the leadership skills and other experience of the Board members, as described

below, provide the Company with a range of perspectives and judgment necessary to guide our strategies and monitor their execution.

Ming Yang is the founder of the

company and has been in the chemical industry for more than ten years. Mr. Yang has contributed to the Board’s strong leadership

and vision for the development of the Company.

Xiaobin Liu was appointed as Chief

Executive Officer and Director on March 10, 2009. Mr. Liu has years of experience in capital markets, financial and business management,

and strategic planning and development.

Naihui Miao has served as Vice President

of Shouguang City Haoyuan Chemical Company Limited since January 2006. Since January 2006, Mr. Miao has served as Director,

Secretary and Vice President of the Company. He is in charge of sales, human resource and business management. Mr. Miao has years

of experience in the chemical industry, business operations and management, and strategic planning and development.

Yang Zou was appointed as a Director

on March 2, 2011. Mr. Zou has served as the Vice Director of Beijing Zhongtianhuamao Accounting Firm (General Partnership) since

July 1, 2016. He is a Certified Public Accountant and holds the certificate of Certified Internal Auditor. Mr.

Zou has extensive experience in auditing and accounting related matters.

Nan Li was appointed as a Director

on November 8, 2010 and resigned as a Director on April 22, 2019. Mr. Li currently serves as Financial Controller at Global Pharm

Holdings Group, Inc., an OTC Bulletin Board listed company. He holds an Intermediate Accountant Certificate and is a

Certified Public Accountant. Mr. Li has extensive experience in financial, auditing and management related matters with

publicly listed companies.

Shitong Jiang was appointed as a

Director on April 23, 2008. Mr. Jiang is Chief of the Shouguang City Audit Bureau, Shandong Province. He has been with

the audit bureau since 1990. Mr. Jiang has many years of auditing and management experience with PRC government departments.

Tengfei Zhang was appointed as a

Director on June 30, 2011. Mr. Zhang has served as Director of Shenzhen Kaili Industrial Co., Ltd. He is a Certified Public Accountant.

Mr. Zhang has many years of experience in management, finance, business strategy and audit related matters.

Shengwei Ma was nominated as a Director

for election on September 16, 2019. Mr. Ma holds a Senior Accountant Certificate. Mr. Ma has extensive experience in financial,

accounting and management related matters with PRC government departments.

Code of Ethics

The Board has adopted

a code of ethics applicable to Company’s directors, officers, and employees. The code of ethics is available at

Company’s website, www.gulfresourcesinc.com.

Board Committees

The Board of Directors has standing audit,

compensation, and nominating committees, comprised solely of independent directors. Each committee has a charter, which

is available at Company’s website,www.gulfresourcesinc.com.

Audit Committee

The Audit Committee

is responsible for reviewing the results and scope of the audit, and other services provided by our independent auditors, and reviewing

and evaluating our system of internal controls. Mr. Li is the Audit Committee Financial Expert and Mr. Jiang is the chair

of the Audit Committee. Our Audit Committee met 4 times during 2018. Our Board of Directors has determined that Messrs. Jiang,

Zou, Li* and Ma are “independent directors” within the meaning of Rule 10A-3 under the Exchange Act, as determined

based upon the criteria for “independence” set forth in the rules of the NASDAQ Stock Market.

Audit Committee Report

With respect to the

audit of Company’s financial statements for the year ended December 31, 2018, the Audit Committee has:

|

|

·

|

reviewed and discussed the audited financial statements with management;

|

|

|

·

|

discussed with Company’s independent accountants the matters required to be discussed by Auditing Standard No. 1301, Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board; and

|

|

|

·

|

received the written disclosures and the letter from the independent accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant's communications with the Audit Committee concerning independence and has discussed with the independent accountant the independent accountant's independence.

|

Based on these reviews

and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in

the Company's annual report on Form 10-K for the year ended December 31, 2018.

Shitong Jiang, Chair

Yang Zou

Nan Li*

*Mr. Li resigned as a Director on April 22, 2019.

Compensation Committee

The Compensation Committee

is responsible for (a) reviewing and providing recommendations to the Board of Directors on matters relating to employee compensation

and benefit plans, and (b) assisting the Board in determining the compensation of the Chief Executive Officer and making recommendations

to the Board with respect to the compensation of the Chief Financial Officer, other executive officers of the Company and independent

directors. Each of Tengfei Zhang and Shitong Jiang are members of the Compensation Committee. The Compensation Committee operates

under a written charter. Mr. Zhang is the Chairman of Compensation Committee. The Compensation Committee met 1 time in 2018.

Nominating and Corporate Governance Committee

Our Board of Directors

established a Nominating and Corporate Governance Committee in June 2009. The purpose of the Nominating and Corporate Governance

Committee is to assist our Board of Directors in identifying qualified individuals to become board members, in determining the

composition of the Board of Directors and in monitoring the process to assess board effectiveness. Each of Tengfei Zhang, Shitong

Jiang and Yang Zou are members of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee

operates under a written charter. Mr. Jiang is the Chairman of Nominating and Corporate Governance Committee.

The Nominating and

Corporate Governance Committee met 1 time in 2018. The Nominating and Corporate Governance Committee will consider director candidates

recommended by security holders. Potential nominees to the Board of Directors are required to have such experience in business

or financial matters as would make such nominee an asset to the Board of Directors and may, under certain circumstances, be required

to be “independent”, as such term is defined under Rule 5605 of the listing standards of NASDAQ and applicable SEC

regulations. Security holders wishing to submit the name of a person as a potential nominee to the Board of Directors must send

the name, address, and a brief (no more than 500 words) biographical description of such potential nominee to the Nominating and

Corporate Governance Committee at the following address: Nominating and Corporate Governance Committee of the Board of Directors,

c/o Gulf Resources, Inc., Level 11, Vegetable Building, Industrial Park of the East City, Shouguang City , Shandong Province, the

People’s Republic of China. Potential director nominees will be evaluated by personal interview, such interview to be conducted

by one or more members of the Nominating and Corporate Governance Committee, and/or any other method the Nominating and Corporate

Governance Committee deems appropriate, which may, but needs not, include a questionnaire. The Nominating and Corporate Governance

Committee may solicit or receive information concerning potential nominees from any source it deems appropriate. The Nominating

and Corporate Governance Committee need not engage in an evaluation process unless (i) there is a vacancy on the Board of Directors,

(ii) a director is not standing for re-election, or (iii) the Nominating and Corporate Governance Committee does not intend to

recommend the nomination of a sitting director for re-election. Although it has not done so in the past, the Nominating and Corporate

Governance Committee may retain search firms to assist in identifying suitable director candidates.

The Board does not

have a formal policy on Board candidate qualifications. The Board may consider those factors it deems appropriate in

evaluating director nominees made either by the Board or stockholders, including judgment, skill, strength of character, experience

with businesses and organizations comparable in size or scope to the Company, experience and skill relative to other Board members,

and specialized knowledge or experience. Depending upon the current needs of the Board, certain factors may be weighed

more or less heavily. In considering candidates for the Board, the directors evaluate the entirety of each candidate’s

credentials and do not have any specific minimum qualifications that must be met. “Diversity,” as such, is not a criterion

that the Committee considers. The directors will consider candidates from any reasonable source, including current Board

members, stockholders, professional search firms or other persons. The directors will not evaluate candidates differently

based on who has made the recommendation.

Stockholder Communications

Stockholders can mail

communications to the Board of Directors, c/o Secretary, Gulf Resources, Inc., Level 11, Vegetable Building, Industrial Park of

the East City, Shouguang City, Shandong Province, the People’s Republic of China 262700, who will forward the correspondence

to each addressee.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the

Securities Exchange Act of 1934 requires Company’s directors and executive officers and any beneficial owner of more than

10% of any class of Company equity security to file reports of ownership and changes in ownership with the Securities and Exchange

Commission and furnish copies of the reports to Company. Based solely on the Company’s review of copies of such

forms and written representations by Company’s executive officers and directors received by it, Company believes that during

2018, all such reports were filed timely.

Executive Compensation

Compensation Discussion and Analysis

This compensation discussion describes the

overall compensation practices at the Company and specifically describes the compensation for the following named executive officers

(“Named Executive Officers”):

|

|

·

|

Xiaobin Liu, Chief Executive Officer

|

|

|

·

|

Min Li, Chief Financial Officer

|

|

|

·

|

Naihui Miao, Chief Operating Officer

|

The Board of Directors appointed the Compensation

Committee of our Board of Directors to evaluate and determine the compensation programs of the Company’s Named Executive

Officers, including the Chief Executive Officer and the Chief Financial Officer.

Compensation Philosophy and Objectives

Our primary goal with respect to our compensation

programs has been to attract and retain the most talented and dedicated employees in key positions in order to compete effectively

in the market place, successfully execute our growth strategies, and create lasting shareholder value. The Compensation Committee

evaluates both individual and Company performance when determining the compensation of our executives. The Compensation Committee

believes that a significant portion of our executive’s total compensation should be at-risk compensation that is linked to

stock-based incentives to align their interests with those of shareholders.

Additionally, the Compensation Committee

has determined that an executive officer who is a Chinese national and is based in China will be entitled to a locally competitive

package and an executive officer who is an expatriate or who is based in the U.S. will be paid a salary commensurate with those

paid to the executives in the U.S. The Compensation Committee evaluates the appropriateness of the compensation programs annually

and may make adjustments after taking account the subjective evaluation described previously.

We apply our compensation policies consistently

for determining compensation of our Chief Executive Officer as we do with the other executives. The Compensation Committee assesses

the performance of our Chief Executive Officer annually and determines the base salary and incentive compensation of our chief

executive officer.

Our Chief Executive Officer is primarily

responsible for the assessment of our other executive officers’ performance. Ultimately, it is the Compensation Committee’s

evaluation of the chief executive officer’s assessment along with competitive market data that determines each executive’s

total compensation.

Elements of Our Executive Compensation

Programs

Base Salary. All full time executives

are paid a base salary. Base salaries for our named executives are set based on their professional qualifications and experiences,

education background, scope of their responsibilities, taking into account competitive market compensation levels paid by other

similar sized companies for similar positions and reasonableness and fairness when compared to other similar positions of responsibility

within the Company. Base salaries are reviewed annually by the Compensation Committee, and may be adjusted annually as needed.

Annual Bonuses. The Company does

not pay guaranteed annual bonuses to our executives or to employees at any level because we emphasize pay-for-performance. The

Compensation Committee determines cash bonuses towards the end of each fiscal year to award our executive officers including our

Chief Executive Officer and Chief Financial Officer based upon a subjective assessment of the Company’s overall performance

and the contributions of the executive officers during the relevant period.

Equity Incentive Compensation. A

key element of our pay-for-performance philosophy is our reliance on performance-based equity awards through the Company’s

stock option plan. This program aligns executives’ and shareholders’ interests by providing executives an ownership

stake in the Company. Our Compensation Committee has the authority to award equity incentive compensation, i.e. stock options,

to our executive officers in such amounts and on such terms as the Compensation Committee determines in its sole discretion. The

Compensation Committee reviews each executive’s individual performance and his or her contribution to our strategic goals

and determines the amount of stock options to be awarded towards the end of the fiscal year. The Compensation Committee grants

equity incentive compensation at times when there are not material non-public information to avoid timing issues and the appearance

that such awards are made based on any such information. The exercise price is the closing market price on the date of the grant.

Other Compensation. We provide our

executives with certain other benefits, including reimbursement of business and entertainment expenses, health insurance, vacation

and sick leave plan. The Compensation Committee in its discretion may revise, amend or add to the officer’s executive benefits

as it deems necessary. We believe that these benefits are typically provided to senior executives of similar companies in China

and in the U.S.

The following table sets forth information

regarding compensation of the named executive officers for each of the two fiscal years in the period ended December 31, 2018.

|

FISCAL

2018 COMPENSATION TABLE

|

|

Name

and Principal Position

|

Year

|

Salary

($)

|

Bonus($)

|

Stock

Awards($)

|

Option

Awards$(1)

|

Non-Equity

Incentive Plan Compensation ($)

|

Nonqualified

Deferred Compensation Earnings ($)

|

All

Other Compensation ($)

|

Total

($)

|

|

Xiaobin Liu

|

2017

|

107,327

|

—

|

—

|

63,933

|

—

|

—

|

—

|

171,260

|

|

CEO

|

2018

|

109,029

|

—

|

—

|

118,233

|

—

|

—

|

—

|

227,262

|

|

Min Li

|

2017

|

107,327

|

—

|

—

|

63,933

|

—

|

—

|

—

|

171,260

|

|

CFO

|

2018

|

109,029

|

—

|

—

|

118,233

|

—

|

—

|

—

|

227,262

|

|

Naihui Miao

|

2017

|

107,327

|

—

|

—

|

63,933

|

—

|

—

|

—

|

171,260

|

|

COO

|

2018

|

109,029

|

—

|

—

|

118,233

|

—

|

—

|

—

|

227,262

|

(1) Represents the dollar amount recognized

for financial statement reporting purposes in accordance with Financial Accounting Standards Board Accounting Standards Codification

(FASB ASC) 718 – “Compensation - Stock Compensation.”

Except as disclosed

below under the caption “Directors Compensation,” we have not paid or accrued any fees to any of our executive directors

for serving as a member of our Board of Directors. We do not have any retirement, pension, profit sharing or insurance or medical

reimbursement plans covering our officers and directors. Our executive officers are reimbursed by us for any out-of-pocket expenses

incurred in connection with activities conducted on our behalf. There is no limit on the amount of these out-of-pocket expenses

and there will be no review of the reasonableness of such expenses by anyone other than our Board of Directors, which includes

persons who may seek reimbursement, or a court of competent jurisdiction if such reimbursement is challenged.

Grants of Plan-Based Awards

The Company granted options to purchase

400,000 shares of our Common Stock to each of our named executive officers, under Company’s Amended and Restated 2007 Equity

Incentive Plan, during fiscal 2018.

|

FISCAL

2018 GRANTS OF PLAN-BASED AWARDS

|

|

|

|

|

|

Estimated

Future Payouts

Under Non-Equity

Incentive Plan Awards

|

|

Estimated

Future Payouts

Under Equity Incentive

Plan Awards

|

|

All Other Stock Awards:

Number of Shares of

|

|

Option Awards: Number

of Securities

|

|

Exercise or Base Price

of

|

|

Grant Date

Fair Value of Stock

|

|

Name

|

|

Grant

Date

|

|

Threshold

|

|

Target

|

|

Maximum

|

|

Threshold

|

|

Target

|

|

Maximum

|

|

Stocks

or Units

|

|

Underlying

Options

|

|

Option

Award($)

|

|

and

Options ($)

|

|

Xiaobin

Liu,

CEO

|

|

December

03,

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

400,000

|

|

0.713

|

|

118,233

|

|

|

Min Li,

CFO

|

|

December

03,

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

400,000

|

|

0.713

|

|

118,233

|

|

|

Naihui

Miao,

COO

|

|

December

03,

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

400,000

|

|

0.713

|

|

118,233

|

|

Narrative Discussion

The following employment

agreements were entered into by the Company and the named executive officers:

Xiaobin Liu

The employment agreement

for Xiaobin Liu to serve as Chief Executive Officer of the Company was renewed on June 1, 2019 with a term of three years. Xiaobin

Liu is also a member of the Board of Directors. Pursuant to the agreement, Mr. Liu is entitled to receive annual compensation equal

to approximately $107,327, subject to changes in the foreign exchange rate and market conditions.

Min Li

The employment agreement

for Min Li to serve as Chief Financial Officer of the Company was renewed on January 1, 2019 with a term of one year. Pursuant

to the agreement, Mr. Li is entitled to receive annual compensation equal to approximately $107,327, subject to changes in the

foreign exchange rate and market conditions.

Naihui Miao

The employment agreement

for Naihui Miao to serve as Chief Operating Officer of the Company was renewed on June 1, 2019 with a term of three years. Mr.

Miao is also a member of the Board of Directors. Pursuant to the agreement, Mr. Miao is entitled to receive annual compensation

equal to approximately $107,327 subject to changes in the foreign exchange rate and market conditions.

In addition, each of

our named executive officers is entitled to participate in any and all benefit plans from time to time, in effect for employees,

along with vacation, sick and holiday pay in accordance with policies established and in effect from time to time.

Assuming the employment

of the Company’s named executive officers was to be terminated without cause or for good reason or in the event of change

in control, as of December 31, 2018, the following individuals would have been entitled to payments in the amounts set forth opposite

to their name in the below table:

|

Name

|

|

Cash Payment

|

|

Xiaboin Liu

|

|

$0

|

|

Min Li

|

|

$0

|

|

Naihui Miao

|

|

$0

|

Outstanding Equity Awards at Fiscal Year-End

The following

table sets forth, for each named executive officer, information regarding unexercised stock options, unvested stock awards, and

equity incentive plan awards outstanding as of December 31, 2018.

|

OUTSTANDING

EQUITY AWARDS AT 2018 FISCAL YEAR END

|

|

OPTION

AWARDS

|

|

STOCK

AWARDS

|

|

Name

|

|

Number

of Securities Underlying Unexercised Options (#) Exercisable

|

|

Number

of Securities Underlying Unexercised Options (#) Unexercisable

|

|

Equity

Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#)

|

|

Option

Exercise Price ($)

|

|

Option

Expiration Date

|

|

Number

of Shares or Units of Stock That Have Not Vested (#)

|

|

Market

Value of Shares or Units of Stock That Have Not Vested ($)

|

|

Equity

Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#)

|

|

Equity

Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)

|

|

Xiaobin

Liu, CEO

|

|

|

100,000

|

(1)

|

|

|

—

|

|

|

|

—

|

|

|

|

1.454

|

|

|

August

22, 2021

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

400,000

|

(2)

|

|

|

—

|

|

|

|

—

|

|

|

|

0.713

|

|

|

December

2, 2022

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Min

Li, CFO

|

|

|

100,000

|

(1)

|

|

|

—

|

|

|

|

—

|

|

|

|

1.454

|

|

|

August

22, 2021

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

400,000

|

(2)

|

|

|

—

|

|

|

|

—

|

|

|

|

0.713

|

|

|

December

2, 2022

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Naihui

Miao, COO

|

|

|

100,000

|

(1)

|

|

|

—

|

|

|

|

—

|

|

|

|

1.454

|

|

|

August

22, 2021

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

400,000

|

(2)

|

|

|

—

|

|

|

|

—

|

|

|

|

0.713

|

|

|

December

2, 2022

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

(1) Represents an option to purchase shares

of Common Stock granted on August 23, 2017, which vested and became exercisable beginning on August 23, 2017.

(2) Represents an option to purchase shares of Common Stock

granted on December 3, 2018, which vested and became exercisable immediately. And these options have been exercised.

Option Exercises and Stock Vested

The following table

sets forth aggregate information with respect to each named executive officer regarding the exercise of stock options, stock appreciation

rights, and similar instruments and the vesting of restricted stock, restricted stock units and similar instruments, for fiscal

2018.

|

FISCAL 2018 OPTION EXERCISES AND STOCK VESTED

|

|

|

|

|

OPTION AWARDS

|

|

|

|

STOCK AWARDS

|

|

|

Name

|

|

|

Number of Shares Acquired on Exercise (#)

|

|

|

|

Value Realized on Exercise ($)

|

|

|

|

Number of Shares Acquired on Vesting (#)

|

|

|

|

Value Realized on Vesting ($)

|

|

|

Xiaobin Liu, CEO

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

Min Li, CFO

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

Naihui Miao, COO

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

Pension Benefits Table

The Company does not

provide to any of its named executive officers any plans that provide for payments or other benefits at, following, or in connection

with retirement.

Nonqualified Defined Contribution and Other Nonqualified

Deferred Compensation Plans Table

None of our named executive

officers had any non-qualified defined contribution or other plan that provides for the deferral of compensation, for fiscal 2018.

Compensation of Directors

The following table

sets forth information regarding compensation of each director, excluding our executive directors, Xiaobin Liu and Naihui Miao,

who do not receive compensation in their capacity as executive directors, for fiscal 2018.

|

FISCAL 2018 DIRECTOR COMPENSATION

|

|

Name

|

|

Fees Earned or Paid in Cash ($)

|

|

Stock Awards

($)

|

|

Option Awards

$(l)

|

|

Non-Equity Incentive Plan Compensation

($)

|

|

Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)

|

|

All Other Compensation

($)

|

|

Total ($)

|

|

Ming Yang

|

|

35,253

|

|

-

|

|

-

|

|

|

|

-

|

|

-

|

|

35,253

|

|

Nan Li (2)

|

|

-

|

|

-

|

|

3,203

|

|

-

|

|

-

|

|

-

|

|

3,203

|

|

Shitong Jiang

|

|

-

|

|

-

|

|

3,203

|

|

-

|

|

-

|

|

-

|

|

3,203

|

|

Yang Zou

|

|

-

|

|

-

|

|

3,203

|

|

-

|

|

-

|

|

-

|

|

3,203

|

|

Tengfei Zhang

|

|

-

|

|

-

|

|

3,203

|

|

-

|

|

-

|

|

-

|

|

3,203

|

(1) Represents the dollar amount recognized

for financial statement reporting purposes in accordance with FASB ASC 718 – “Compensation – Stock Compensation.”

(2) Nan Li resigned as an independent director of the Company

and as member of the Company’s Audit Committee and Compensation Committee on April 22, 2019.

Pursuant to the terms of their director

agreements, each of our independent directors, Shitong Jiang, Yang Zou and Tengfei Zhang, receive options to purchase 12,500

shares of our Common Stock on an annual basis with exercise prices not less than the closing market price of our Common Stock on

the dates of grant. The grant of future options is contingent upon the director’s continued service with the Company. We

do not pay any cash compensation to the independent directors.

Compensation Committee Interlocks and Insider Participation

We are a smaller reporting

company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this

item.

Certain Relationships and Related Transactions

During the fiscal year

2018 and 2017, the Company borrowed $355,212 and $450,000, and fully repaid later during the same period, from Jiaxing Lighting

Appliance Company Limited (Jiaxing Lighting”), in which Mr. Ming Yang, a shareholder and the Chairman of the Company, has

a 100% equity interest. The amounts due to Jiaxing Lighting were unsecured, interest free and repayable on demand.

Our policy is that

a contract or transaction either between the Company and a director, or between a director and another company in which he is financially

interested is not necessarily void or void-able if the relationship or related party transactions are approved or ratified by the

Audit Committee.

Director Independence

The Board of Directors

has determined that Yang Zou, Shitong Jiang, Tengfei Zhang and Shengwei Ma are independent under Rule 5605(a)(2) of the NASDAQ

Listing Rules. In addition, under applicable rules and regulations, and as determined by the Board, all of the members of the Audit,

Compensation, and Nominating and Corporate Governance Committees are “independent” directors.

Directors are elected

by a plurality of votes cast.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

“FOR” THE ELECTION OF THE BOARD OF DIRECTORS’ NOMINEES.

PROPOSAL 2

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT

ACCOUNTANTS

The Audit Committee

has appointed Morison Cogen LLP (“MC”) as independent accountants for fiscal 2019. Representatives

of MC are expected to be present at the Annual Meeting to respond to appropriate questions and will have an opportunity to make

a statement, if they so desire.

Services and Fees of Independent Accountants

The aggregate fees billed to the Company

by MC for the last two fiscal years were as follows:

|

Fees

|

|

2018

|

|

2017

|

|

Audit Fees

|

|

$

|

208,000

|

|

|

$

|

265,000

|

|

|

Audit Related Fees

|

|

$

|

0

|

|

|

$

|

0

|

|

|

Tax Fees

|

|

$

|

9,000

|

|

|

$

|

7,000

|

|

|

All Other Fees

|

|

$

|

0

|

|

|

$

|

0

|

|

|

Total

|

|

$

|

217,000

|

|

|

$

|

272,000

|

|

Audit Fees

This category consists

of fees for the audit of our annual financial statements, review of the financial statements included in our quarterly reports

on Form 10-Q and services that are normally provided by the independent registered public accountants in connection with statutory

and regulatory filings or engagements for those fiscal years.

Audit-Related Fees

This category consists

of services by our independent auditors that are reasonably related to the performance of the audit or review of our financial

statements and are not reported above under Audit Fees. This category includes accounting consultations on transaction and proposed

transaction related matters.

Tax Fees

The tax fee of $7,000

and $9,000 relate to tax compliance services rendered in the year ended December 31,2017 and 2018, respectively.

All Other Fees

There are no other

fees to disclose.

Pre-Approval of Services

The Audit Committee

appoints the independent accountant each year and pre-approves the audit services. The Audit Committee chair is authorized

to pre-approve specified non-audit services for fees not exceeding specified amounts, if he promptly advises the other Audit Committee

members of such approval.

A majority of votes

present in person or by proxy is required to ratify appointment of the independent accountants.

THE BOARD OF DIRECTORS RECOMMENDS THAT

YOU VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT ACCOUNTANTS.

PROPOSAL 3

APPROVAL TO EFFECT A REVERSE SPLIT OF

THE COMPANY’S COMMON STOCK

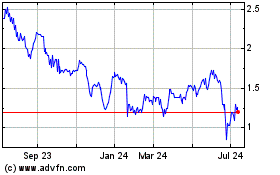

Purpose of the Reverse

Split

The Company’s

Board of Directors has determined that it is in our best interest to effect a reverse split of our Common Stock of one (1) share

for a to-be-determined number of shares within a spectrum of two (2) to eight (8) shares, so that, subject to the discretion of

the Board of Directors, every two (2) to eight (8) outstanding shares of Common Stock before the stock split shall represent one

(1) share of Common Stock after the stock split with all fractional shares rounded up to the next whole share (the “Reverse

Split”). The Company’s shareholders are voting to give the Board of Directors discretion in ultimately selecting what

the reverse stock split ratio will be. The Board of Directors believes that our Common Stock is undervalued and that the Reverse

Split will allow the Company’s Common Stock to trade in a more realistic price range.

Additionally, the Board

believes that the Reverse Split could help maintain the Company’s listing on The NASDAQ Global Select Market. On August 20,

2019, the Company received a letter from NASDAQ notifying the Company that, based on the previous thirty (30) consecutive business

days, the Company’s listed security no longer met the minimum $1.0 bid price per share requirement. Therefore, in accordance

with NASDAQ listing rules, the Company was provided 180 calendar days, or until February 17, 2020, to regain compliance.

Given the receipt of

such a deficiency letter from NASDAQ, the Board believes it is in the best interests of the Company and its shareholders to effect

the Reverse Split to increase the market price of the Company’s Common Stock so that the Company is able to regain compliance

with NASDAQ listing rules.

Certain Risks Associated

With the Reverse Split

While the Board believes

that the Company’s Common Stock would trade at higher prices after the consummation of the Reverse Split, there can be no

assurance that the increase in the trading price will occur, or, if it does occur, that it will equal or exceed two (2) to eight

(8) times the market price of the Common Stock prior to the Reverse Split. In some cases, the total market value of a company following

a reverse stock split is lower, and may be substantially lower, than the total market value before the reverse stock split. In

addition, the fewer number of shares that will be available to trade could possibly cause the trading market of the Common Stock

to become less liquid, which could have an adverse effect on the price of the Common Stock. We cannot provide any assurance that

the Company’s Common Stock will meet The NASDAQ Global Select Market continued listing requirements following the Reverse

Split. The market price of the Common Stock is based on our performance and other factors, some of which may be unrelated to the

number of our shares outstanding.

In addition, there

can be no assurance that the Reverse Split will result in a per share price that will attract brokers and investors who do not

trade in lower priced stock.

Principal Effects of

the Reverse Split

Subject to the discretion

of the Board of Directors, on the effective date of the Reverse Split, each two (2) to eight (8) shares of our Common Stock issued

and outstanding immediately prior to the Reverse Split effective date (the “Old Shares”) will automatically and without

any action on the part of the shareholders be converted into one (1) share of our Common Stock (the “New Shares”).

In the following discussion, we provide examples of the effects of a one-for-four reverse stock split.

Corporate Matters.

The Reverse Split would have the following effects based upon the number of shares of Common Stock outstanding as of October 21,

2019:

|

|

•

|

in the case of a one-for-four reverse stock split, every four (4) of our Old Shares owned by a shareholder would be exchanged for one (1) New Share; and

|

|

|

•

|

the number of shares of our Common Stock outstanding will be reduced from 47,583,072 shares to approximately 11,895,768 shares.

|

The Reverse Split will

be effected simultaneously for all of our outstanding Common Stock and the exchange ratio will be the same for all of our outstanding

Common Stock. The Reverse Split will affect all of our shareholders uniformly and will not affect any shareholder’s percentage

ownership interests in the Company, except to the extent that the Reverse Split results in any of our shareholders owning a fractional

share. As described below, shareholders and holders of options and warrants holding fractional shares will have their shares rounded

up to the nearest whole number. Common Stock issued pursuant to the Reverse Split will remain fully paid and non-assessable.

Fractional Shares.

No scrip or fractional share certificates will be issued in connection with the Reverse Split. Shareholders who otherwise would

be entitled to receive fractional shares because they hold a number of Old Shares not evenly divisible by the one (1) for four

(4) reverse stock split ratio, will be entitled, upon surrender of certificate(s) representing these shares, to a number of shares

of New Shares rounded up to the nearest whole number. The ownership of a fractional interest will not give the shareholder any

voting, dividend or other rights except to have his or her fractional interest rounded up to the nearest whole number when the

New Shares are issued.

Options and Warrants.

All outstanding options, warrants, notes, debentures and other securities convertible to Common Stock will be adjusted as a result

of the Reverse Split, as required by the terms of these securities. In particular, the conversion ratio for each instrument will

be reduced, and the exercise price, if applicable, will be increased, in accordance with the terms of each instrument and based

on the one-for-four ratio.

Authorized Shares.

The Company is presently authorized under its Articles of Incorporation to issue 80,000,000 shares of Common Stock. Upon effectiveness

of the Reverse Split, the number of authorized shares of Common Stock would remain the same, although the number of shares of Common

Stock issued and outstanding will decrease. Because the number of issued and outstanding shares of Common Stock will decrease,

the number of shares of Common Stock remaining available for issuance will increase. The issuance in the future of additional shares

of our Common Stock may have the effect of diluting the earnings per share and book value per share, as well as the stock ownership

and voting rights of the currently outstanding shares of our Common Stock. The effective increase in the number of authorized but

unissued and unreserved shares of the Company’s Common Stock may be construed as having an anti-takeover effect as further

discussed below. Authorized but unissued shares will be available for issuance, and we may issue such shares in future financings

or otherwise. If we issue additional shares, the ownership interest of holders of our Common Stock would be diluted. Also, the

issued shares may have rights, preferences or privileges senior to those of our Common Stock. The Company does not currently have

any plans, proposal or arrangement to issue any of its authorized but unissued shares of Common Stock.

Accounting Matters.

The Reverse Split will not affect the par value of our Common Stock. As a result, on the effective date of the Reverse Split, the

stated capital on our balance sheet attributable to our Common Stock will be reduced in proportion to the Reverse Split ratio (that

is, in a one-for-four reverse stock split, the stated capital attributable to our Common Stock will be reduced to 1/4 of its existing

amount) and the additional paid-in capital account shall be credited with the amount by which the stated capital is reduced. The

per share net income or loss and net book value of our Common Stock will also be increased because there will be fewer shares of

our Common Stock outstanding.

Potential Anti-Takeover

Effect. Although the increased proportion of unissued authorized shares to issued shares could, under certain circumstances,

have an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to

effect a change in the composition of our Board or contemplating a tender offer or other transaction for the combination of the

Company with another company), the Reverse Split was not proposed in response to any effort of which we are aware to accumulate

our shares of Common Stock or obtain control of us, nor is it part of a plan by management to recommend a series of similar actions

having an anti-takeover effect to our Board of Directors and shareholders. Other than the Reverse Split, our Board of Directors

does not currently contemplate recommending the adoption of any other corporate action that could be construed to affect the ability

of third parties to take over or change control of the Company.

The number of shares