Current Report Filing (8-k)

October 24 2018 - 4:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act 1934

Date of Report (date of earliest event reported):

October 18, 2018

Gulf Resources, Inc.

(Exact name of registrant as specified in

charter)

Nevada

(State or other jurisdiction of incorporation)

|

000-20936

(Commission File Number)

|

13-3637458

(IRS Employer Identification No.)

|

Level 11,Vegetable Building, Industrial

Park of the East City,

Shouguang City, Shandong, China

(Address of principal executive offices

and zip code)

+86 (536) 567 0008

(Registrant's telephone number including

area code)

(Registrant's former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 4.02. NON-RELIANCE ON PREVIOUSLY

ISSUED FINANCIAL STATEMENTS OR A RELATED AUDIT REPORT OR COMPLETED INTERIM REVIEW.

On October 18, 2018,

the Company’s independent public accounting firm, Morison Cogen LLP (“Morison”), advised the Company that disclosure

should be made and action should be taken to prevent further reliance on the Company’s previously issued unaudited financial

statements for the three months ended March 31, 2018, included in its Quarterly Report on Form 10-Q filed with the Securities and

Exchange Commission (the “SEC”) on May 10, 2018 and the three months ended June 30, 2018, included in its Quarterly

Report on Form 10-Q filed with the SEC on August 10, 2018 (collectively, the “Form 10-Qs”), and its audited financial

statements for the fiscal year ended December 31, 2017, included in its Annual Report on Form 10-K filed with the Securities and

Exchange Commission on March 16, 2018 (the “Form 10-K”).

Morison advised the

Company that as a result of the Tax Cuts and Jobs Act (“TCJA”) that was enacted into law on December 22, 2017, the

corporation income tax rate was reduced from 35% to 21% and there was a one-time mandatory transition tax on accumulated foreign

earnings. For the year ended December 31, 2017, the Company accrued $5,402,000 of income taxes associated with this one-time mandatory

transition tax on accumulated foreign earnings. Upon completion of the Company’s 2017 income tax return, it became apparent

that the Company can offset this entire transition tax by applying a portion of their net operating loss carryovers and foreign

tax credit carryovers. As a result, the Company did not need to accrue the $5,402,000 of income taxes and the financial statements

in the Form 10-K and Form 10-Qs will need to be restated to correct this error.

The results of the restatement will be

as follows on the Form 10-K:

|

|

·

|

On the December 31, 2017 consolidated

balance sheet, the current portion of taxes payable will be reduced by $433,000, the non-current portion of income taxes payable

will be reduced by $4,969,000 and the unappropriated retained earnings will increase by $5,402,000.

|

|

|

·

|

On the 2017 consolidated statement of

income and comprehensive income, the income tax expense will be reduced by $5,402,000 and the net income and comprehensive income

will each increase by $5,402,000. The basic and diluted earnings per share will increase by $0.12.

|

|

|

·

|

On the 2017 consolidated statement of

stockholders’ equity, the net income for the year ended December 31, 2017 will increase by $5,402,000 and the total retained

earnings will increase by the same amount.

|

|

|

·

|

There will be no effect to the consolidated

statement of cash flows.

|

The results of the restatements will be

as follows on the Form 10-Qs:

|

|

·

|

On the March 31, 2018 consolidated balance

sheet, the current portion of taxes payable will be reduced by $433,000, the non-current portion of income taxes payable will be

reduced by $4,969,000 and the unappropriated retained earnings will increase by $5,402,000.

|

|

|

·

|

On the March 31, 2018 consolidated statement

of stockholders’ equity, the December 31, 2017 unappropriated retained earnings will increase by $5,402,000. No other statements

are effected.

|

|

|

·

|

On the June 30, 2018 consolidated balance

sheet, the current portion of taxes payable will be reduced by $433,000, the non-current portion of income taxes payable will be

reduced by $4,969,000 and the unappropriated retained earnings will increase by $5,402,000.

|

|

|

·

|

On the June 30, 2018 consolidated statement

of stockholders’ equity the December 31, 2017 unappropriated retained earnings will increase by $5,402,000.

|

|

|

·

|

No other statements are effected.

|

The Company, including the Audit Committee

of the Board of Directors, has discussed the foregoing matters with Morison. The Audit Committee has authorized and directed the

officers of the Company to take the appropriate and necessary actions to restate the Form 10-Qs and the Form 10-K. The Company

is currently preparing the restatements.

The Company has provided Morison with a

copy of the foregoing disclosure and requested that it furnish the Company with a letter addressed to the Securities and Exchange

Commission stating whether it agrees with the statements made under this Item 4.02 and, if not, stating the respect in which it

does not agree. A copy of such letter, dated October 24, 2018, is filed as Exhibit 16.1 to this Report.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

GULF RESOURCES, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Min Li

|

|

|

|

Name:

|

Min Li

|

|

|

|

Title:

|

Chief Financial Officer

|

|

|

|

|

|

|

Dated: October 24 , 2018

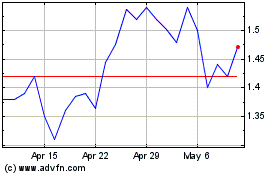

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Mar 2024 to Apr 2024

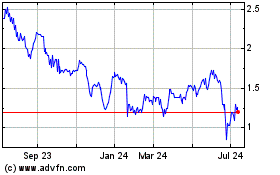

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Apr 2023 to Apr 2024