Gulf Island Fabrication, Inc. ("Gulf Island" or the "Company")

(NASDAQ: GIFI) today reported a net loss of $10.9 million ($0.73

per share) on revenue of $49.7 million for the third quarter 2018,

compared to a net loss of $3.1 million ($0.21 per share) on revenue

of $49.9 million for the third quarter 2017, and net income of $0.5

million ($0.04 per share) on revenue of $54.0 million for the

second quarter 2018. Operating cash flows for the third quarter

2018 were $7.8 million and the Company’s cash and short-term

investments totaled $54.5 million at September 30, 2018.

"Results for the third quarter 2018 reflect our

previously discussed challenges with the underutilization of our

Fabrication and Shipyard Divisions. However, awarded backlog is set

to ramp up over the next several quarters within our Shipyard

Division and we expect to realize improvement in the overall

utilization of our facilities. Our results were also impacted by

lower than desired margins due to competitive pricing on previously

awarded backlog and bad debt expense of $2.8 million for a

receivable reserve recorded during the quarter,” said Kirk Meche,

Gulf Island’s President and Chief Executive Officer. “In spite of

these challenges we had many positive accomplishments during the

quarter. Our Services Division once again delivered solid results

as demand for its services remains strong. We also increased

backlog across our Divisions, generated positive operating cash

flows, and entered into an agreement to sell our Texas North Yard

and certain associated equipment for $28.0 million.”

Backlog(1)

The Company’s revenue backlog was $370.3 million

at September 30, 2018, which includes deliveries through 2021, and

represents an increase of $33.8 million from June 30, 2018. Backlog

by operating segment at September 30, 2018, was $313.1 million for

Shipyard, $44.7 million for Fabrication, $11.7 million for Services

and $0.8 million for EPC. Backlog excludes approximately $28.4

million of new project awards received subsequent to September 30,

2018, through November 8, 2018. Backlog also excludes options on

contracts of approximately $534.0 million, which include deliveries

through 2025 should all options be exercised._____________

| (1) |

Backlog, a

non-GAAP financial measure, provides useful information to

investors. Backlog includes future performance obligations at

September 30, 2018, of $340.2 million, as defined by generally

accepted accounting principles in the United States ("GAAP"), plus

$30.1 million subject to a contract termination dispute with a

customer to build two MPSVs that does not meet the criteria to be

reported as future performance obligations under GAAP. Pending

resolution of the dispute, the Company has ceased all work and the

partially completed vessels and associated equipment and materials

remain at its shipyard in Houma, Louisiana. |

Cash and Liquidity

The Company generated $7.8 million in operating

cash flows during the third quarter 2018, and at September 30,

2018, had cash and short-term investments of $54.5 million and no

debt. Working capital at September 30, 2018, totaled $124.0 million

and includes $42.7 million of assets held for sale. During the

third quarter 2018, the Company amended its $40.0 million Credit

Agreement to extend its maturity to June 2020 and at

September 30, 2018, the Company's total available liquidity

was as follows:

|

Available Liquidity |

|

Total |

| |

|

(in thousands) |

| Cash and cash

equivalents |

|

$ |

45,020 |

|

| Short-term investments

(1) |

|

9,494 |

|

| Total cash, cash

equivalents and short-term investments |

|

54,514 |

|

| Credit Agreement

capacity |

|

40,000 |

|

| Less: Outstanding

letters of credit |

|

2,475 |

|

| Availability under

Credit Agreement |

|

37,525 |

|

| Total

available liquidity |

|

$ |

92,039 |

|

_____________

| (1) |

Short-term

investments include U.S. Treasuries and other investment-grade

commercial paper with original maturity dates of six months or less

that are traded on active markets with quoted prices. |

Condensed Cash Flow

Information

| |

Three months ended September 30, |

|

Nine months ended September 30, |

| |

2018 |

|

2017 |

|

2018 |

|

2017 |

|

|

|

|

|

|

| |

(in thousands) |

| Net cash provided by

(used in) operating activities |

$ |

7,761 |

|

|

$ |

(1,623 |

) |

|

$ |

(18,666 |

) |

|

$ |

(29,559 |

) |

| Net cash provided by

(used in) investing activities |

5,296 |

|

|

(2,691 |

) |

|

55,542 |

|

|

(2,395 |

) |

| Net cash used in

financing activities |

(41 |

) |

|

(177 |

) |

|

(839 |

) |

|

(1,421 |

) |

Condensed Balance Sheet

Information

| |

September 30, 2018 |

|

December 31, 2017 |

|

|

|

| |

(in thousands) |

| |

|

|

| Cash and cash

equivalents |

$ |

45,020 |

|

|

$ |

8,983 |

|

| Short-term

investments |

9,494 |

|

|

— |

|

| Total current

assets |

176,328 |

|

|

179,164 |

|

| Property, plant and

equipment, net |

80,707 |

|

|

88,899 |

|

| Total assets |

262,957 |

|

|

270,840 |

|

| Total current

liabilities |

52,297 |

|

|

48,665 |

|

| Total shareholders’

equity |

205,136 |

|

|

219,493 |

|

| |

|

|

|

|

|

Quarterly Earnings Conference

Call

Gulf Island management will hold a conference

call on Friday, November 9, 2018, at 9:00 a.m. Central Time (10:00

a.m. Eastern Time) to discuss the Company’s financial results for

the third quarter 2018. The call will be available by webcast which

can be accessed on Gulf Island’s website at www.gulfisland.com.

Participants may also join the conference call by dialing

1.800.289.0438 and requesting the “Gulf Island” conference call. A

digital replay of the call will be available from a link on our

Company's website two hours after the call and ending November 17,

2018.

Gulf Island is a leading fabricator of complex

steel structures, modules and marine vessels used in energy

extraction and production, petrochemical and industrial facilities,

power generation, alternative energy and shipping and marine

transportation operations. The Company also provides project

management for EPC projects along with installation, hookup,

commissioning and repair and maintenance services. In addition, the

Company performs civil, drainage and other work for state and local

governments. The Company operates and manages its business through

four operating divisions: Fabrication, Shipyard, Services and EPC,

with its corporate headquarters located in Houston, Texas and

fabrication facilities located in Houma, Jennings and Lake Charles,

Louisiana.

| Company

information:Kirk J. MecheChief Executive

Officer713.714.6100 |

Investor Relations:Westley S. StocktonChief

Financial Officer713.714.6106 |

| |

|

CAUTIONARY STATEMENT

This press release contains forward-looking

statements. Forward-looking statements are all statements other

than statements of historical facts, such as projections or

expectations relating to such topics as oil and gas prices,

operating cash flows, capital expenditures, liquidity and tax

rates. The words “anticipates,” “may,” “can,” “plans,” “believes,”

“estimates,” “expects,” “projects,” “targets,” “intends,” “likely,”

“will,” “should,” “to be,” “potential” and any similar expressions

are intended to identify those assertions as forward-looking

statements.

We caution readers that forward-looking

statements are not guarantees of future performance and actual

results may differ materially from those anticipated, projected or

assumed in the forward-looking statements. Important factors that

can cause our actual results to differ materially from those

anticipated in the forward-looking statements include the cyclical

nature of the oil and gas industry, changes in backlog estimates,

suspension or termination of projects, timing and award of new

contracts, financial ability and credit worthiness of our customers

and consolidation of our customers, competitive pricing and cost

overruns, entry into new lines of business, ability to raise

additional capital, ability to sell certain assets, advancement on

the SeaOne Project, ability to resolve dispute with a customer

relating to a purported termination of contracts to build MPSVs,

ability to remain in compliance with our covenants contained in our

credit agreement, ability to employ skilled workers, operating

dangers and limits on insurance coverage, weather conditions,

competition, customer disputes, adjustments to previously reported

profits under the percentage-of-completion method, loss of key

personnel, compliance with regulatory and environmental laws,

ability to utilize navigation canals, performance of

subcontractors, systems and information technology interruption or

failure and data security breaches and other factors described in

more detail in “Risk Factors” in Item 1A of our annual report on

Form 10-K for the year ended December 31, 2017, as updated by our

subsequent filings with the U.S. Securities and Exchange

Commission.

Investors are cautioned that many of the

assumptions upon which our forward-looking statements are based are

likely to change after the forward-looking statements are made,

which we cannot control. Further, we may make changes to our

business plans that could affect our results. We caution investors

that we do not intend to update forward-looking statements more

frequently than quarterly notwithstanding any changes in our

assumptions, changes in business plans, actual experience or other

changes, and we undertake no obligation to update any

forward-looking statements.

GULF ISLAND FABRICATION,

INC.CONSOLIDATED STATEMENTS OF

OPERATIONS(UNAUDITED)(in thousands, except per share

data)

| |

Three Months Ended |

|

Nine months ended |

| |

September 30, |

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

| |

2018 |

|

2017 |

|

2018 |

|

2018 |

|

2017 |

| Revenue (1) |

$ |

49,712 |

|

|

$ |

49,884 |

|

|

$ |

54,014 |

|

|

$ |

161,016 |

|

|

$ |

133,745 |

|

| Cost of revenue |

52,924 |

|

|

50,378 |

|

|

54,713 |

|

|

164,248 |

|

|

150,755 |

|

| Gross

loss |

(3,212 |

) |

|

(494 |

) |

|

(699 |

) |

|

(3,232 |

) |

|

(17,010 |

) |

| General and

administrative expenses |

7,672 |

|

|

4,370 |

|

|

5,092 |

|

|

17,473 |

|

|

12,940 |

|

| Asset impairment |

— |

|

|

— |

|

|

610 |

|

|

1,360 |

|

|

389 |

|

| Operating

loss |

(10,884 |

) |

|

(4,864 |

) |

|

(6,401 |

) |

|

(22,065 |

) |

|

(30,339 |

) |

| Interest income

(expense), net |

72 |

|

|

(45 |

) |

|

(92 |

) |

|

(166 |

) |

|

(262 |

) |

| Other income (expense),

net |

140 |

|

|

38 |

|

|

7,125 |

|

|

6,954 |

|

|

(209 |

) |

| Net

income (loss) before income taxes |

(10,672 |

) |

|

(4,871 |

) |

|

632 |

|

|

(15,277 |

) |

|

(30,810 |

) |

| Income taxes

(benefit) |

277 |

|

|

(1,761 |

) |

|

83 |

|

|

419 |

|

|

(10,322 |

) |

| Net

income (loss) |

$ |

(10,949 |

) |

|

$ |

(3,110 |

) |

|

$ |

549 |

|

|

$ |

(15,696 |

) |

|

$ |

(20,488 |

) |

| Per share data: |

|

|

|

|

|

|

|

|

|

| Basic and

diluted earnings (loss) per share - common shareholders |

$ |

(0.73 |

) |

|

$ |

(0.21 |

) |

|

$ |

0.04 |

|

|

$ |

(1.05 |

) |

|

$ |

(1.38 |

) |

| Cash

dividends declared per common share |

$ |

— |

|

|

$ |

0.01 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.03 |

|

________________

| (1) |

Revenue

includes non-cash amortization of deferred revenue related to

values assigned to contracts in a previous acquisition of $15,000,

$0.5 million and $0.1 million for the three months ended

September 30, 2018 and 2017 and June 30, 2018, respectively,

and $0.5 million and $2.4 million for the nine months ended

September 30, 2018 and 2017, respectively. |

Operating Results by Segment

The Company has structured its operations with

four operating divisions and one corporate non-operating division,

which represent its reportable segments. The Company's EPC Division

was created in December 2017 to manage work it expects to perform

for the SeaOne Project and other projects that may require EPC

project management services. The Company's results of operations by

segment for the three and nine months ended September 30, 2018 and

2017, are presented below (in thousands, except for

percentages).

|

Fabrication |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2018 |

|

2017 |

|

2018 |

|

2017 |

| Revenue |

$ |

2,311 |

|

|

$ |

18,318 |

|

|

$ |

28,171 |

|

|

$ |

42,517 |

|

| Gross profit

(loss) |

(4,032 |

) |

|

1,250 |

|

|

(5,918 |

) |

|

216 |

|

| Gross

profit (loss) percentage |

(174.5 |

)% |

|

6.8 |

% |

|

(21.0 |

)% |

|

0.5 |

% |

| General and

administrative expenses |

3,676 |

|

|

778 |

|

|

5,251 |

|

|

2,432 |

|

| Asset impairment |

— |

|

|

— |

|

|

1,360 |

|

|

— |

|

| Operating income

(loss) |

(7,708 |

) |

|

472 |

|

|

(12,529 |

) |

|

(2,216 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Shipyard |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2018 |

|

2017 |

|

2018 |

|

2017 |

| Revenue |

$ |

24,492 |

|

|

$ |

15,074 |

|

|

$ |

66,677 |

|

|

$ |

51,798 |

|

| Gross loss |

(1,764 |

) |

|

(3,504 |

) |

|

(5,563 |

) |

|

(19,061 |

) |

| Gross

loss percentage |

(7.2 |

)% |

|

(23.2 |

)% |

|

(8.3 |

)% |

|

(36.8 |

)% |

| General and

administrative expenses |

696 |

|

|

888 |

|

|

2,089 |

|

|

2,835 |

|

| Asset impairment |

— |

|

|

— |

|

|

— |

|

|

389 |

|

| Operating loss |

(2,460 |

) |

|

(4,392 |

) |

|

(7,652 |

) |

|

(22,285 |

) |

|

Services |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2018 |

|

2017 |

|

2018 |

|

2017 |

| Revenue |

$ |

22,617 |

|

|

$ |

17,651 |

|

|

$ |

66,692 |

|

|

$ |

43,758 |

|

| Gross profit |

3,191 |

|

|

1,912 |

|

|

9,390 |

|

|

2,335 |

|

| Gross

profit percentage |

14.1 |

% |

|

10.8 |

% |

|

14.1 |

% |

|

5.3 |

% |

| General and

administrative expenses |

705 |

|

|

695 |

|

|

2,201 |

|

|

2,008 |

|

| Operating income |

2,486 |

|

|

1,217 |

|

|

7,189 |

|

|

327 |

|

|

EPC |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2018 |

|

2017 |

|

2018 |

|

2017 |

| Revenue |

$ |

1,071 |

|

|

$ |

— |

|

|

$ |

2,026 |

|

|

$ |

— |

|

| Gross profit

(loss) |

(205 |

) |

|

— |

|

|

30 |

|

|

— |

|

| Gross

profit (loss) percentage |

(19.1 |

)% |

|

|

n/a |

|

|

1.5 |

% |

|

|

n/a |

|

| General and

administrative expenses |

503 |

|

|

— |

|

|

1,405 |

|

|

— |

|

| Operating loss |

(708 |

) |

|

— |

|

|

(1,375 |

) |

|

— |

|

|

Corporate |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2018 |

|

2017 |

|

2018 |

|

2017 |

| Revenue |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

| Gross loss |

(402 |

) |

|

(152 |

) |

|

(1,171 |

) |

|

(500 |

) |

| Gross

loss percentage |

|

n/a |

|

|

|

n/a |

|

|

|

n/a |

|

|

|

n/a |

|

| General and

administrative expenses |

2,092 |

|

|

2,009 |

|

|

6,527 |

|

|

5,665 |

|

| Operating loss |

(2,494 |

) |

|

(2,161 |

) |

|

(7,698 |

) |

|

(6,165 |

) |

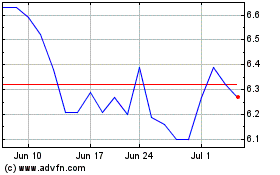

Gulf Island Fabrication (NASDAQ:GIFI)

Historical Stock Chart

From Mar 2024 to Apr 2024

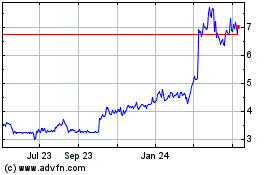

Gulf Island Fabrication (NASDAQ:GIFI)

Historical Stock Chart

From Apr 2023 to Apr 2024