Gulf Island Fabrication, Inc. ("Gulf Island" or the "Company")

(NASDAQ: GIFI) today reported a net loss of $5.2 million ($0.34 per

share) on revenue of $80.5 million for the second quarter 2019,

compared to a net loss of $3.0 million ($0.20 per share) on revenue

of $67.6 million for the first quarter 2019 and net income of $0.5

million ($0.04 per share) on revenue of $54.0 million for the

second quarter 2018. At June 30, 2019, the Company's cash and

short-term investments totaled $76.0 million and backlog totaled

$476.4 million.

"Results for the second quarter 2019 reflect

revenue growth on a sequential and year over year basis, continued

improvement in the utilization of our facilities, and positive

operating cash flow," said Kirk Meche, Gulf Island’s President and

Chief Executive Officer. "We also significantly added to our

backlog with the execution of contract options by Oregon State

University and the U.S. Navy, providing our highest quarter-end

backlog since 2012. In spite of these accomplishments, we

unfortunately experienced charges on two of our Shipyard projects,

which negatively impacted our quarterly results. Although I'm

disappointed in these project impacts, we completed the third and

fourth harbor tug vessels in the quarter, continued to make

progress on our remaining Shipyard projects, and commenced

construction activities on the ferries being constructed by our

Fabrication Division."

Backlog

The Company’s backlog at June 30, 2019 of $476.4

million represents an increase of $141.7 million from March 31,

2019, and an increase of $120.0 million from December 31, 2018.

Backlog by operating segment was $410.1 million for the Shipyard

Division, $53.5 million for the Fabrication Division, and $12.8

million for the Services Division. Backlog for the Shipyard

Division excludes customer options on contracts of approximately

$333.0 million, which include deliveries through 2025 should all

options be exercised. See "Non-GAAP Measures" below for the

Company's definition of Backlog.

Cash and Liquidity

The Company's cash and short-term investments at

June 30, 2019 of $76.0 million represents an increase of $5.7

million from March 31, 2019, and a decrease of $3.2 million from

December 31, 2018. The Company ended the quarter with no debt and

total working capital of $99.1 million, which includes $18.7

million of assets held for sale. On May 1, 2019, the Company

amended its $40.0 million credit facility ("Credit Agreement") to

extend its maturity to June 2021. At June 30, 2019, the

Company's total available liquidity was as follows (in

thousands):

|

Available Liquidity |

|

Total |

|

Cash and cash equivalents |

|

$ |

30,192 |

|

| Short-term investments |

|

45,791 |

|

|

Total cash, cash equivalents and short-term investments |

|

75,983 |

|

| Credit Agreement total

capacity |

|

40,000 |

|

| Outstanding letters of

credit |

|

(10,737 |

) |

|

Availability under Credit Agreement |

|

29,263 |

|

|

Total available liquidity |

|

$ |

105,246 |

|

Results of Operations(1) (in

thousands, except per share data)

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

2019 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Revenue |

$ |

80,456 |

|

|

$ |

67,605 |

|

|

$ |

54,014 |

|

|

$ |

148,061 |

|

|

$ |

111,304 |

|

| Cost of revenue |

82,054 |

|

|

67,052 |

|

|

54,713 |

|

|

149,106 |

|

|

111,324 |

|

|

Gross profit (loss) |

(1,598 |

) |

|

553 |

|

|

(699 |

) |

|

(1,045 |

) |

|

(20 |

) |

| General and administrative

expense |

3,987 |

|

|

3,834 |

|

|

5,092 |

|

|

7,821 |

|

|

9,801 |

|

| Asset impairments and (gain) loss

on assets held for sale, net |

— |

|

|

(70 |

) |

|

(6,579 |

) |

|

(70 |

) |

|

(5,829 |

) |

| Other (income) expense, net |

(201 |

) |

|

71 |

|

|

64 |

|

|

(130 |

) |

|

375 |

|

|

Operating income (loss) (2) |

(5,384 |

) |

|

(3,282 |

) |

|

724 |

|

|

(8,666 |

) |

|

(4,367 |

) |

| Interest income (expense),

net |

126 |

|

|

262 |

|

|

(92 |

) |

|

388 |

|

|

(238 |

) |

|

Net income (loss) before income taxes |

(5,258 |

) |

|

(3,020 |

) |

|

632 |

|

|

(8,278 |

) |

|

(4,605 |

) |

| Income tax (expense) benefit |

10 |

|

|

(22 |

) |

|

(83 |

) |

|

(12 |

) |

|

(142 |

) |

|

Net income (loss) |

$ |

(5,248 |

) |

|

$ |

(3,042 |

) |

|

$ |

549 |

|

|

$ |

(8,290 |

) |

|

$ |

(4,747 |

) |

| Per share data: |

|

|

|

|

|

|

|

|

|

|

Basic and diluted income (loss) per share - common

shareholders |

$ |

(0.34 |

) |

|

$ |

(0.20 |

) |

|

$ |

0.04 |

|

|

$ |

(0.55 |

) |

|

$ |

(0.32 |

) |

________________

(1) See "Results of Operations by Segment" below

for results by division and discussion of the Company's realigned

segments.

(2) Operating loss for the three and six months

ended June 30, 2019 includes project charges of $2.3 and $2.0

million, respectively, associated with the harbor tug projects and

a separate Shipyard project. Operating loss for the three months

ended June 30, 2019, March 31, 2019 and June 30, 2018, and six

months ended June 30, 2019 and 2018, includes legal fees and other

costs of $1.0 million, $0.3 million, $1.1 million, $1.3 million,

and $1.3 million, respectively, associated with two customer

disputes.

EBITDA(1) (in thousands)

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

2019 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net income (loss) |

$ |

(5,248 |

) |

|

$ |

(3,042 |

) |

|

$ |

549 |

|

|

$ |

(8,290 |

) |

|

$ |

(4,747 |

) |

| Less: Income tax (expense)

benefit |

10 |

|

|

(22 |

) |

|

(83 |

) |

|

(12 |

) |

|

(142 |

) |

| Less: Interest income (expense),

net |

126 |

|

|

262 |

|

|

(92 |

) |

|

388 |

|

|

(238 |

) |

|

Operating income (loss) |

(5,384 |

) |

|

(3,282 |

) |

|

724 |

|

|

(8,666 |

) |

|

(4,367 |

) |

| Add: Depreciation and

amortization |

2,422 |

|

|

2,552 |

|

|

2,593 |

|

|

4,974 |

|

|

5,308 |

|

|

EBITDA |

$ |

(2,962 |

) |

|

$ |

(730 |

) |

|

$ |

3,317 |

|

|

$ |

(3,692 |

) |

|

$ |

941 |

|

________________

(1) EBITDA is a non-GAAP measure. See "Non-GAAP

Measures" below for the Company's definition of EBITDA.

Condensed Cash Flow Information

(in thousands)

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

2019 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net cash provided by (used in) operating activities |

$ |

5,593 |

|

|

$ |

(8,477 |

) |

|

$ |

(12,331 |

) |

|

$ |

(2,884 |

) |

|

$ |

(26,427 |

) |

| Net cash provided by (used in)

investing activities |

(25,260 |

) |

|

(11,367 |

) |

|

47,843 |

|

|

(36,627 |

) |

|

50,246 |

|

| Net cash used in financing

activities |

(39 |

) |

|

(715 |

) |

|

(10,000 |

) |

|

(754 |

) |

|

(798 |

) |

Condensed Balance Sheet

Information (in thousands)

| |

June 30, |

|

March 31, |

|

December 31, |

| |

2019 |

|

2019 |

|

2018 |

|

Cash and cash equivalents |

$ |

30,192 |

|

|

$ |

49,898 |

|

|

$ |

70,457 |

|

| Short-term investments |

45,791 |

|

|

20,341 |

|

|

8,720 |

|

| Total current assets |

177,927 |

|

|

157,366 |

|

|

159,955 |

|

| Property, plant and equipment,

net |

75,862 |

|

|

77,660 |

|

|

79,930 |

|

| Total assets |

277,591 |

|

|

258,715 |

|

|

258,290 |

|

| Total current liabilities |

78,780 |

|

|

55,350 |

|

|

56,101 |

|

| Total shareholders’

equity |

193,442 |

|

|

197,904 |

|

|

201,100 |

|

Quarterly Conference Call

Gulf Island will hold a conference call on

Tuesday, August 6, 2019 at 9:00 a.m. Central Time (10:00 a.m.

Eastern Time) to discuss the Company’s financial results. The call

will be available by webcast and can be accessed on Gulf Island’s

website at www.gulfisland.com. Participants may also join the call

by dialing 1.800.353.6461 and requesting the “Gulf Island”

conference call. A replay of the webcast will be available on the

Company's website for seven days after the call.

About Gulf Island

Gulf Island is a leading fabricator of complex

steel structures, modules and marine vessels used in energy

extraction and production, petrochemical and industrial facilities,

power generation, alternative energy and shipping and marine

transportation operations. The Company also provides project

management, installation, hookup, commissioning, repair,

maintenance and civil construction services. The Company operates

and manages its business through three operating divisions:

Fabrication, Shipyard and Services, with its corporate headquarters

located in Houston, Texas and operating facilities located in

Houma, Jennings and Lake Charles, Louisiana.

Non-GAAP Measures

This Release includes certain non-GAAP measures,

including earnings before interest, taxes, depreciation and

amortization ("EBITDA") and Backlog. The Company believes EBITDA is

a useful supplemental measure as it reflects the Company's

operating results excluding the non-cash impacts of depreciation

and amortization. Reconciliations of EBITDA to the most comparable

GAAP measure are presented under "EBITDA" above and "Results of

Operations by Segment" below. The Company believes Backlog is a

useful supplemental measure as it represents work that the Company

is contractually obligated to perform under its current contracts.

Backlog represents the unearned value of new project awards and may

differ from the value of remaining performance obligations for

contracts as determined under GAAP. Backlog at June 30,

2019 of $476.4 million includes the Company's performance

obligations of $454.5 million, plus $21.9 million of backlog

subject to a contract termination dispute with a customer to build

two multi-purpose service vessels that does not meet the criteria

to be reported as remaining performance obligations under GAAP.

Non-GAAP measures are not intended to be

replacements or alternatives to the GAAP measures, and investors

are urged to consider these non-GAAP measures in addition to, and

not in substitution for, measures prepared in accordance with GAAP.

The Company may present or calculate non-GAAP measures differently

from other companies.

Company information

| Kirk J.

Meche |

Westley S.

Stockton |

| Chief Executive Officer |

Chief Financial Officer |

| 713.714.6100 |

713.714.6100 |

Cautionary Statement

This Release contains forward-looking statements

in which we discuss our potential future performance.

Forward-looking statements, within the meaning of the safe harbor

provisions of the U.S. Private Securities Litigation Reform Act of

1995, are all statements other than statements of historical facts,

such as projections or expectations relating to oil and gas prices,

operating cash flows, capital expenditures, liquidity and tax

rates. The words “anticipates,” “may,” “can,” “plans,” “believes,”

“estimates,” “expects,” “projects,” “targets,” “intends,” “likely,”

“will,” “should,” “to be,” “potential” and any similar expressions

are intended to identify those assertions as forward-looking

statements.

We caution readers that forward-looking

statements are not guarantees of future performance and actual

results may differ materially from those anticipated, projected or

assumed in the forward-looking statements. Important factors that

can cause our actual results to differ materially from those

anticipated in the forward-looking statements include the cyclical

nature of the oil and gas industry, competition, consolidation of

our customers, timing and award of new contracts, reliance on

significant customers, financial ability and credit worthiness of

our customers, nature of our contract terms, competitive pricing

and cost overruns on our projects, adjustments to previously

reported profits or losses under the percentage-of-completion

method, weather conditions, changes in backlog estimates,

suspension or termination of projects, ability to raise additional

capital, ability to amend or obtain new debt financing or credit

facilities on favorable terms, ability to remain in compliance with

our covenants contained in our Credit Agreement, ability to

generate sufficient cash flow, ability to sell certain assets,

customer or subcontractor disputes, ability to resolve the dispute

with a customer relating to the purported termination of contracts

to build two MPSVs, operating dangers and limits on insurance

coverage, barriers to entry into new lines of business, ability to

employ skilled workers, loss of key personnel, performance of

subcontractors and dependence on suppliers, changes in trade

policies of the U.S. and other countries, compliance with

regulatory and environmental laws, lack of navigability of canals

and rivers, shutdowns of the U.S. government, systems and

information technology interruption or failure and data security

breaches, performance of partners in our joint ventures and other

strategic alliances, and other factors described in Item 1A in

our Annual Report on Form 10-K for the Year Ended December 31,

2018, as updated by subsequent filings with the U.S. Securities and

Exchange Commission.

Investors are cautioned that many of the

assumptions upon which our forward-looking statements are based are

likely to change after the forward-looking statements are made,

which we cannot control. Further, we may make changes to our

business plans that could affect our results. We caution investors

that we do not intend to update forward-looking statements more

frequently than quarterly notwithstanding any changes in our

assumptions, changes in business plans, actual experience or other

changes, and we undertake no obligation to update any

forward-looking statements.

Results of Operations by Segment (in thousands,

except for percentages)

| Fabrication

Division(1) |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

2019 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Revenue |

$ |

22,415 |

|

|

$ |

12,631 |

|

|

$ |

9,472 |

|

|

$ |

35,046 |

|

|

$ |

26,815 |

|

| Cost of revenue |

23,092 |

|

|

13,403 |

|

|

10,596 |

|

|

36,495 |

|

|

28,466 |

|

|

Gross loss |

(677 |

) |

|

(772 |

) |

|

(1,124 |

) |

|

(1,449 |

) |

|

(1,651 |

) |

|

Gross loss percentage |

(3.0 |

)% |

|

(6.1 |

)% |

|

(11.9 |

)% |

|

(4.1 |

)% |

|

(6.2 |

)% |

| General and administrative

expense |

742 |

|

|

767 |

|

|

1,436 |

|

|

1,509 |

|

|

2,477 |

|

| Asset impairments and (gain)

loss on assets held for sale, net |

— |

|

|

(70 |

) |

|

(6,579 |

) |

|

(70 |

) |

|

(5,829 |

) |

| Other (income) expense,

net |

(208 |

) |

|

71 |

|

|

(193 |

) |

|

(137 |

) |

|

(4 |

) |

|

Operating income (loss) |

$ |

(1,211 |

) |

|

$ |

(1,540 |

) |

|

$ |

4,212 |

|

|

$ |

(2,751 |

) |

|

$ |

1,705 |

|

| |

|

|

|

|

|

|

|

|

|

|

EBITDA(2) |

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

$ |

(1,211 |

) |

|

$ |

(1,540 |

) |

|

$ |

4,212 |

|

|

$ |

(2,751 |

) |

|

$ |

1,705 |

|

|

Add: Depreciation and amortization |

891 |

|

|

967 |

|

|

1,047 |

|

|

1,858 |

|

|

2,196 |

|

|

EBITDA |

$ |

(320 |

) |

|

$ |

(573 |

) |

|

$ |

5,259 |

|

|

$ |

(893 |

) |

|

$ |

3,901 |

|

| Shipyard

Division |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

2019 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Revenue |

$ |

37,567 |

|

|

$ |

36,587 |

|

|

$ |

23,620 |

|

|

$ |

74,154 |

|

|

$ |

42,185 |

|

| Cost of revenue |

40,479 |

|

|

36,867 |

|

|

26,396 |

|

|

77,346 |

|

|

45,984 |

|

|

Gross loss |

(2,912 |

) |

|

(280 |

) |

|

(2,776 |

) |

|

(3,192 |

) |

|

(3,799 |

) |

|

Gross loss percentage |

(7.8 |

)% |

|

(0.8 |

)% |

|

(11.8 |

)% |

|

(4.3 |

)% |

|

(9.0 |

)% |

| General and administrative

expense |

590 |

|

|

624 |

|

|

597 |

|

|

1,214 |

|

|

1,393 |

|

| Other (income) expense,

net |

62 |

|

|

— |

|

|

4 |

|

|

62 |

|

|

164 |

|

|

Operating loss |

$ |

(3,564 |

) |

|

$ |

(904 |

) |

|

$ |

(3,377 |

) |

|

$ |

(4,468 |

) |

|

$ |

(5,356 |

) |

| |

|

|

|

|

|

|

|

|

|

|

EBITDA(2) |

|

|

|

|

|

|

|

|

|

|

Operating loss |

$ |

(3,564 |

) |

|

$ |

(904 |

) |

|

$ |

(3,377 |

) |

|

$ |

(4,468 |

) |

|

$ |

(5,356 |

) |

|

Add: Depreciation and amortization |

1,047 |

|

|

1,109 |

|

|

1,051 |

|

|

2,156 |

|

|

2,120 |

|

|

EBITDA |

$ |

(2,517 |

) |

|

$ |

205 |

|

|

$ |

(2,326 |

) |

|

$ |

(2,312 |

) |

|

$ |

(3,236 |

) |

| Services

Division |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

2019 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Revenue |

$ |

24,065 |

|

|

$ |

19,602 |

|

|

$ |

22,205 |

|

|

$ |

43,667 |

|

|

$ |

44,075 |

|

| Cost of revenue |

21,928 |

|

|

17,861 |

|

|

18,620 |

|

|

39,789 |

|

|

37,876 |

|

|

Gross profit |

2,137 |

|

|

1,741 |

|

|

3,585 |

|

|

3,878 |

|

|

6,199 |

|

|

Gross profit percentage |

8.9 |

% |

|

8.9 |

% |

|

16.1 |

% |

|

8.9 |

% |

|

14.1 |

% |

| General and administrative

expense |

464 |

|

|

452 |

|

|

762 |

|

|

916 |

|

|

1,496 |

|

| Other (income) expense,

net |

(55 |

) |

|

— |

|

|

(12 |

) |

|

(55 |

) |

|

(38 |

) |

|

Operating income |

$ |

1,728 |

|

|

$ |

1,289 |

|

|

$ |

2,835 |

|

|

$ |

3,017 |

|

|

$ |

4,741 |

|

| |

|

|

|

|

|

|

|

|

|

|

EBITDA(2) |

|

|

|

|

|

|

|

|

|

|

Operating income |

$ |

1,728 |

|

|

$ |

1,289 |

|

|

$ |

2,835 |

|

|

$ |

3,017 |

|

|

$ |

4,741 |

|

|

Add: Depreciation and amortization |

363 |

|

|

374 |

|

|

383 |

|

|

737 |

|

|

776 |

|

|

EBITDA |

$ |

2,091 |

|

|

$ |

1,663 |

|

|

$ |

3,218 |

|

|

$ |

3,754 |

|

|

$ |

5,517 |

|

| Corporate

Division |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

2019 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Revenue (eliminations) |

$ |

(3,591 |

) |

|

$ |

(1,215 |

) |

|

$ |

(1,283 |

) |

|

$ |

(4,806 |

) |

|

$ |

(1,771 |

) |

| Cost of revenue

(eliminations) |

(3,445 |

) |

|

(1,079 |

) |

|

(899 |

) |

|

(4,524 |

) |

|

(1,002 |

) |

|

Gross loss |

(146 |

) |

|

(136 |

) |

|

(384 |

) |

|

(282 |

) |

|

(769 |

) |

|

Gross loss percentage |

|

n/a |

|

|

|

n/a |

|

|

|

n/a |

|

|

|

n/a |

|

|

|

n/a |

|

| General and administrative

expense |

2,191 |

|

|

1,991 |

|

|

2,297 |

|

|

4,182 |

|

|

4,435 |

|

| Other (income) expense,

net |

— |

|

|

— |

|

|

265 |

|

|

— |

|

|

253 |

|

|

Operating loss |

$ |

(2,337 |

) |

|

$ |

(2,127 |

) |

|

$ |

(2,946 |

) |

|

$ |

(4,464 |

) |

|

$ |

(5,457 |

) |

| |

|

|

|

|

|

|

|

|

|

|

EBITDA(2) |

|

|

|

|

|

|

|

|

|

|

Operating loss |

$ |

(2,337 |

) |

|

$ |

(2,127 |

) |

|

$ |

(2,946 |

) |

|

$ |

(4,464 |

) |

|

$ |

(5,457 |

) |

|

Add: Depreciation and amortization |

121 |

|

|

102 |

|

|

112 |

|

|

223 |

|

|

216 |

|

|

EBITDA |

$ |

(2,216 |

) |

|

$ |

(2,025 |

) |

|

$ |

(2,834 |

) |

|

$ |

(4,241 |

) |

|

$ |

(5,241 |

) |

___________________

(1) During the first quarter 2019, the Company's

former EPC Division was operationally combined with its Fabrication

Division, and accordingly, the Company's current reportable

segments are "Fabrication", "Shipyard", "Services", and

"Corporate". The segment results for the EPC Division for the three

and six months ended June 30, 2018 were combined with the

Fabrication Division to conform to the presentation of the

Company's reportable segments for the 2019 period.

(2) EBITDA is a non-GAAP measure. See "Non-GAAP

Measures" above for the Company's definition of EBITDA.

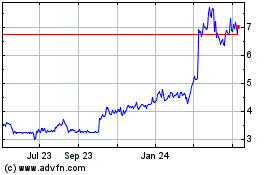

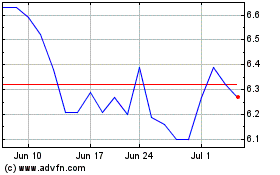

Gulf Island Fabrication (NASDAQ:GIFI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gulf Island Fabrication (NASDAQ:GIFI)

Historical Stock Chart

From Apr 2023 to Apr 2024