GSI Technology, Inc. (NASDAQ:GSIT) today reported

financial results for its first fiscal quarter ended June 30, 2019.

| |

Three Months Ended |

|

|

|

| |

June 30, 2019 |

Mar. 31, 2019 |

June 30, 2018 |

| |

|

|

|

| Net revenues |

$13,019 |

$12,686 |

$11,266 |

| |

|

|

|

| Gross margin (%) |

63.3% |

61.3% |

51.4% |

| |

|

|

|

| Operating expenses |

$8,472 |

$8,135 |

$7,447 |

| |

|

|

|

| Operating loss |

$(229) |

$(365) |

$(1,659) |

| |

|

|

|

| Net loss |

$(125) |

$(102) |

$(1,646) |

| |

|

|

|

| Net loss per share, diluted |

$(0.01) |

$0.00 |

$(0.08) |

Lee-Lean Shu, Chairman and Chief Executive Officer, said,

“Fiscal year 2020 is off to a solid start with sequential and

year-over-year revenue growth as well as gross margin improvement,

driven by continued strong sales of our SigmaQuad SRAM line. In

particular, SigmaQuad sales have been concentrated in our highest

ASP and gross margin products. The performance of our core business

is supporting our new product roadmap.”

“Our new radiation hardened SigmaQuad product is nearing

completion of GSI’s internal qualification processes. The next step

will be customer qualifications, which we anticipate will put us on

track to ship initial orders by calendar year-end 2019,” continued

Mr. Shu. “In addition, we continue to meet our milestones for

Gemini™, our in-place associative computing technology for

artificial intelligence applications. Currently, we are testing the

second silicon that we received in May. Our AI team is placing the

device on evaluation boards and continues to develop software

libraries and algorithms. We anticipate broad customer demos later

this year. We will also perform a third tape-out and re-spin to fix

minor bugs in preparation for our expected release of Gemini™ in

fiscal 2020.”

Commenting on the outlook for GSI’s second quarter of fiscal

2020, Mr. Shu stated, “Our current expectations for the upcoming

quarter are net revenues in a range of $11.6 million to $12.6

million, with gross margin of approximately 54% to 56%. In

addition, we expect to incur a charge of approximately $3.0 million

during fiscal 2020 for purchased intellectual property that will be

incorporated into our next generation Gemini™ chip.”

First Quarter Fiscal Year 2020 Summary

Financials

The Company reported a net loss of $(125,000), or $(0.01) per

diluted share, on net revenues of $13.0 million for the first

quarter of fiscal 2020, compared to net loss of $(1.6 million), or

$(0.08) per diluted share, on net revenues of $11.3 million

for the first quarter of fiscal 2019 and a net loss of $(102,000),

or $0.00 per diluted share, on net revenues of $12.7 million

in the fourth quarter of fiscal 2019. Gross margin was 63.3%

compared to 51.4% in the prior year period and 61.3% in the

preceding fourth quarter.

In the first quarter of fiscal 2020, sales to Nokia were $6.0

million, or 45.7% of net revenues compared $5.2 million, or 46.5%

of net revenues, in the same period a year ago and $5.2 million, or

41.1% of net revenues in the prior quarter. Military/defense sales

were 21.0% of first quarter shipments compared to 19.7% of

shipments in the comparable period a year ago and 22.1% of

shipments in the prior quarter. SigmaQuad sales were 67.9% of first

quarter shipments compared to 59.7% in the first quarter of fiscal

2019 and 57.4% in the prior quarter.

Total operating expenses in the first quarter of fiscal 2020

were $8.5 million, compared to $7.4 million in the first quarter of

fiscal 2019 and $8.1 million in the preceding fourth quarter.

Research and development expenses were $5.6 million, compared to

$4.9 million in the prior year period and $5.6 million in the

preceding fourth quarter. Selling, general and administrative

expenses were $2.9 million in the quarter ended June 30, 2019

compared to $2.6 million in the prior year quarter ended June 30,

2018, and up sequentially from $2.6 million in the preceding fourth

quarter.

The first-quarter fiscal 2020 operating loss was $(229,000)

compared to an operating loss of $(1.7 million) a year ago and an

operating loss of $(365,000) in the prior quarter. The

first-quarter fiscal 2020 net loss included interest and other

income of $147,000 and a tax provision of $43,000, compared to

$23,000 in interest and other income and a tax provision of $10,000

for the same period a year ago. In the preceding fourth quarter,

net loss included interest and other income of $186,000 and a tax

benefit of $77,000.

Total first quarter pre-tax stock-based compensation expense was

$651,000 compared to $542,000 in the comparable quarter a year ago

and $580,000 in the prior quarter.

At June 30, 2019, the Company had $64.7 million in cash, cash

equivalents and short-term investments and $7.3 million in

long-term investments, compared to $61.8 million in cash, cash

equivalents and short-term investments and $9.0 million in

long-term investments at March 31, 2019. Working capital improved

to $73.1 million from $68.6 million at March 31, 2019, with no

debt, and stockholders’ equity for the first quarter was $96.1

million as compared to $93.2 million as of the fiscal year ended

March 31, 2019.

Conference Call

GSI Technology will review its financial results for the quarter

ended June 30, 2019 and discuss its current business outlook during

a conference call at 1:30 p.m. Pacific (4:30 p.m. Eastern) today,

July 25, 2019. To listen to the teleconference, please call

toll-free 888-254-3590 approximately 10 minutes prior to the above

start time and provide Conference ID 4748507. You may also listen

to the teleconference live via the Internet at

www.gsitechnology.com, where it will be archived.

About GSI Technology

Founded in 1995, GSI Technology, Inc. is a leading

provider of semiconductor memory solutions. GSI’s resources are

currently focused on bringing new products to market that leverage

existing core strengths, including radiation-hardened memory

products for extreme environments and the associative processing

unit that is designed to deliver performance advantages for diverse

artificial intelligence applications. GSI Technology is

headquartered in Sunnyvale, California and has sales

offices in the Americas, Europe and Asia. For

more information, please visit www.gsitechnology.com.

Forward-Looking Statements

The statements contained in this press release that are not

purely historical are forward-looking statements within the meaning

of Section 21E of the Securities Exchange Act of 1934, as amended,

including statements regarding GSI Technology’s expectations,

beliefs, intentions, or strategies regarding the future. All

forward-looking statements included in this press release are based

upon information available to GSI Technology as of the date hereof,

and GSI Technology assumes no obligation to update any such

forward-looking statements. Forward-looking statements involve a

variety of risks and uncertainties, which could cause actual

results to differ materially from those projected. These

risks include those associated with the normal quarterly and fiscal

year-end closing process. Examples of risks that could affect

our current expectations regarding future revenues and gross

margins include those associated with fluctuations in GSI

Technology’s operating results; GSI Technology’s historical

dependence on sales to a limited number of customers and

fluctuations in the mix of customers and products in any period;

the rapidly evolving markets for GSI Technology’s products and

uncertainty regarding the development of these markets; the need to

develop and introduce new products to offset the historical decline

in the average unit selling price of GSI Technology’s products; the

challenges of rapid growth followed by periods of contraction;

intensive competition; and delays or unanticipated costs that may

be encountered in the development of new products based on our

in-place associative computing technology and the establishment of

new markets and customer relationships for the sale of such

products. Further information regarding these and other risks

relating to GSI Technology’s business is contained in the Company’s

filings with the Securities and Exchange Commission, including

those factors discussed under the caption “Risk Factors” in such

filings.

Source: GSI Technology, Inc.

GSI Technology, Inc.Douglas M. SchirleChief Financial

Officer408-331-9802

Hayden IRKim RogersManaging

Director385-831-7337Kim@HaydenIR.com

|

GSI TECHNOLOGY, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(in thousands, except per share data) |

|

(Unaudited) |

| |

|

|

|

|

| |

Three Months Ended |

| |

June 30, |

|

Mar. 31, |

|

June 30, |

|

| |

2019 |

|

2019 |

|

2018 |

|

| |

|

|

|

| Net

revenues |

$13,019 |

|

$ |

12,686 |

|

$11,266 |

|

| Cost of goods

sold |

4,776 |

|

|

4,916 |

|

5,478 |

|

| |

|

|

|

|

|

|

| Gross

profit |

8,243 |

|

|

7,770 |

|

5,788 |

|

| |

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

| |

|

|

|

|

|

|

| |

Research &

development |

5,595 |

|

|

5,582 |

|

4,850 |

|

| |

Selling, general

and administrative |

2,877 |

|

|

2,553 |

|

2,597 |

|

|

|

|

|

Total operating expenses |

8,472 |

|

|

8,135 |

|

7,447 |

|

| |

|

|

|

|

|

|

| Operating income

(loss) |

(229 |

) |

|

(365 |

) |

(1,659 |

) |

| |

|

|

|

|

|

|

| Interest and other

income, net |

147 |

|

|

186 |

|

23 |

|

| |

|

|

|

- |

|

|

|

| Income (loss)

before income taxes |

(82 |

) |

|

(179 |

) |

(1,636 |

) |

| Provision

(benefit) for income taxes |

43 |

|

|

(77 |

) |

10 |

|

| Net income

(loss) |

($125 |

) |

$ |

(102 |

) |

($1,646 |

) |

| |

|

|

|

|

|

|

| |

|

|

|

| Net income (loss)

per share, basic |

($0.01 |

) |

$ |

- |

|

($0.08 |

) |

| Net income (loss)

per share, diluted |

($0.01 |

) |

$ |

- |

|

($0.08 |

) |

| |

|

|

|

|

| Weighted-average

shares used in |

|

|

|

| |

computing per

share amounts: |

|

|

|

| |

|

|

|

| Basic |

22,605 |

|

|

22,169 |

|

21,567 |

|

| Diluted |

22,605 |

|

|

22,169 |

|

21,567 |

|

| |

|

|

|

| |

|

|

|

| Stock-based

compensation included in the Condensed Consolidated Statements of

Operations: |

| |

|

|

|

| |

Three Months Ended |

| |

June 30, |

|

Mar. 31, |

|

June 30, |

|

| |

2019 |

|

2019 |

|

2018 |

|

| |

|

|

|

| Cost of goods

sold |

$55 |

|

$ |

49 |

|

$53 |

|

| Research &

development |

399 |

|

335 |

|

323 |

|

| Selling, general

and administrative |

197 |

|

196 |

|

166 |

|

| |

$651 |

|

$580 |

|

$542 |

|

| |

|

|

|

|

GSI TECHNOLOGY, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(in thousands) |

|

(Unaudited) |

| |

|

|

|

|

| |

June 30, 2019 |

|

March 31, 2019 |

|

Cash and cash equivalents |

$46,435 |

|

|

$ |

42,495 |

|

| Short-term investments |

18,282 |

|

|

|

19,346 |

|

| Accounts receivable |

7,375 |

|

|

|

7,339 |

|

| Inventory |

5,463 |

|

|

|

5,685 |

|

| Other current assets |

3,009 |

|

|

|

2,500 |

|

| Net property and

equipment |

8,726 |

|

|

|

9,001 |

|

| Long-term investments |

7,264 |

|

|

|

8,997 |

|

| Other assets |

11,712 |

|

|

|

10,860 |

|

| Total assets |

$108,266 |

|

|

$ |

106,223 |

|

| |

|

|

|

|

| Current liabilities |

$7,440 |

|

|

$ |

8,733 |

|

| Long-term liabilities |

4,744 |

|

|

|

4,335 |

|

| Stockholders' equity |

96,082 |

|

|

|

93,155 |

|

| Total liabilities and

stockholders' equity |

$108,266 |

|

|

$ |

106,223 |

|

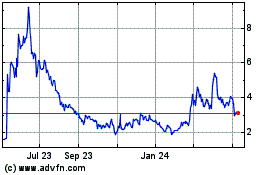

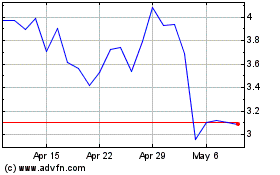

GSI Technology (NASDAQ:GSIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

GSI Technology (NASDAQ:GSIT)

Historical Stock Chart

From Apr 2023 to Apr 2024