Additional Proxy Soliciting Materials (definitive) (defa14a)

May 09 2023 - 4:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

x Definitive Additional Materials

¨ Soliciting Material under §240.14a-12

Gossamer Bio, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| x | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 with preliminary |

ote “FOR” Proposal 2. 2. Ratification of the appointment of Ernst & Young LLP as our independent registered public accountants for the year ending December 31, 2020. TO ATTEND the Annual Meeting of Gossamer Bio, Inc., please visit www.proxydocs.com/GOSS for virtual meeting registration details. The control number located in the shaded gray box will be required to register. INTERNET www.investorelections.com/GOSS TELEPHONE (866) 648-8133 *E-MAIL paper@investorelections.com ACCOUNT NO. SHARE

Additional Information Regarding the Annual Meeting of Stockholders to be Held on June 8, 2023

On April 28, 2023, Gossamer Bio, Inc. (the “Company”) filed with the Securities and Exchange Commission (the “SEC”) and provided to its stockholders of record as of April 18, 2023 a definitive proxy statement (the “Proxy Statement”) describing the matters to be voted on at our upcoming Annual Meeting of Stockholders, to be held on June 8, 2023 at 9:00 a.m. Pacific Time via live webcast (the “Annual Meeting”). This supplement, dated May 9, 2023 (the “Supplement), to the Proxy Statement updates the Proxy Statement for certain developments that occurred after the date of the Proxy Statement, as disclosed in the Company’s Quarterly Report on Form 10-Q filed by the Company with the SEC on May 9, 2023.

Recent Developments

Effective May 5, 2023, and in accordance with the terms of the Gossamer Bio, Inc. 2019 Incentive Award Plan (the “2019 Plan”), the Board of Directors (the “Board”) of Gossamer Bio, Inc. (the “Company”) approved a stock option repricing (the “Option Repricing”) whereby the exercise price of each Eligible Option (as defined below) was immediately reduced to $1.36 per share, the closing stock price on May 5, 2023. For purposes of the Option Repricing, “Eligible Options” are all outstanding stock options as of May 5, 2023 (vested or unvested) granted under the 2019 Plan prior to November 30, 2022 and held by those eligible employees of the Company identified by the Board, including the Company’s executive officers identified in the table below. The Board and Faheem Hasnain, the Company’s Chairman and Chief Executive Officer, collectively determined that Mr. Hasnain would not participate in the Option Repricing.

The participation of the executive officers of the Company in the Option Repricing was subject to their agreement to cancel a portion of their Eligible Options, as indicated in the table below, effective immediately (the “Cancelled Options”). Each executive was required to agree to cancel one-third of their Eligible Options, on a grant-by-grant basis. The Cancelled Options were deducted proportionately from the vested and unvested portions of each Repriced Option grant.

To the extent an Eligible Option is exercised prior to the Premium End Date (as defined below), or the eligible employee’s employment terminates prior to the Premium End Date, the eligible employee will be required to pay the original exercise price per share of the Eligible Options. The “Premium End Date” means the earliest of (i) May 5, 2024, (ii) the date of a change in control, (iii) the eligible employee’s death or disability, or (iv) if an eligible employee is an executive subject to the cancellation of a portion of Eligible Options and is terminated under circumstances giving rise to severance under his or her employment agreement, the date of such termination. Except for the reduction in the exercise prices of the Eligible Options as described above, the Eligible Options will retain their existing terms and conditions as set forth in the 2019 Plan and the applicable award agreements.

The Board believes that the Option Repricing with the Premium End Date is in the best interests of the Company, as the amended stock options will provide added incentives to retain and motivate key contributors of the Company, including the executive officers listed in the table below, without incurring the stock dilution resulting from significant additional equity grants to the eligible participants or significant additional cash expenditures resulting from additional cash compensation. In addition, in determining that the participation of the executive officers in the Option Repricing would be conditioned on the cancellation of 0.5 stock options for each Eligible Option retained by the executives, the Board considered that the Cancelled Options will be returned to the share reserve under the 2019 Plan and will be available for future issuance thereunder by the Company, resulting in an immediate reduction in dilution to the Company for the benefit of shareholders and ensuring the Company has sufficient shares to incentivize new and ongoing employees for the foreseeable future.

Information regarding the number of Cancelled Options and Eligible Options for each of the executive officers of the Company is provided in the table below.

| | | | | | | | | | | | | | |

Executive Officer | Original Number of Eligible Option | Original Exercise Price Range of Eligible Option | Number of Cancelled Options | Number of Eligible Options Remaining Following Option Repricing |

Bryan Giraudo, Chief Operating Officer and Chief Financial Officer | 721,500 | $9.79 – 22.10 | 240,499 | 481,001 |

Christian Waage, Executive Vice President, Technical Operations and Administration | 456,500 | $9.79 – 22.10 | 152,166 | 304,334 |

Richard Aranda, M.D., Chief Medical Officer | 372,925 | $8.47 – 22.10 | 124,307 | 248,618 |

Caryn Peterson, Executive Vice President, Regulatory | 346,425 | $8.49 – 22.10 | 115,472 | 230,953 |

Other Non-Executive Management Employees | 699,925 | $8.70 – 22.10 | 233,304 | 466,621 |

The foregoing description of the Option Repricing and the cancellation of the Cancelled Options is qualified in its entirety by reference to the form of Option Repricing and Cancellation Agreement to be filed by the Company as an exhibit to its Quarterly Report on Form 10-Q for the fiscal quarter ending June 30, 2023.

Important Information

Except as specifically supplemented or amended by this Supplement, this Supplement does not modify, amend, supplement or otherwise affect any matter presented for consideration in the Proxy Statement. This Supplement should be read in conjunction with the Proxy Statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, as each contains information that is important to your decisions in voting at the Annual Meeting. Additional information is contained in the Proxy Statement that was previously made available to our stockholders. If you have already voted, you do not need to vote again unless you would like to change or revoke your prior vote on any proposal. If you would like to revoke your prior vote on any proposal, please refer to page 4 of the Proxy Statement for instructions on how to do so.

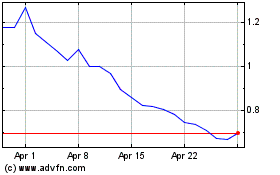

Gossamer Bio (NASDAQ:GOSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

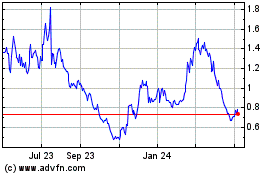

Gossamer Bio (NASDAQ:GOSS)

Historical Stock Chart

From Apr 2023 to Apr 2024