Statement of Beneficial Ownership (sc 13d)

March 23 2020 - 5:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

Golar LNG Limited

(Name of Issuer)

Common Shares, par value $1.00 per share

(Title of Class of Securities)

G9456A100

(CUSIP Number)

Nick Fell

BW Maritime Pte. Ltd.

Mapletree Business City, #18-01

10 Pasir Panjang Road

Singapore 117438

Telephone: +65 (0) 6434 5818

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

March 12, 2020

(Date of Event Which Requires Filing of this

Statement)

If the filing person has previously filed a

statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of § 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box o.

______________________

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom

copies are to be sent.

*The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of

this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other

provisions of the Act (however, see the Notes).

|

CUSIP No. G9456A100

|

SCHEDULE 13D

|

Page 2 of 7 Pages

|

|

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSONS

BW Group Limited

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ☐

(b) ☐

|

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

WC

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Bermuda

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

6.772,881

|

|

8

|

SHARED VOTING POWER

0

|

|

9

|

SOLE DISPOSITIVE POWER

6.772,881

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6.772,881

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.93%1

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

CO

|

|

|

1

|

This percentage is based on a total of 97.8 million common shares outstanding based on disclosures in the Issuer’s

current report on Form 6-K furnished to the Securities and Exchange Commission on February 25, 2020.

|

|

CUSIP No. G9456A100

|

SCHEDULE 13D

|

Page 3 of 7 Pages

|

|

Item 1.

|

Security and Issuer

|

This statement relates

to the common shares, par value $1.00 per share (the “Common Shares”), of Golar LNG Limited, a company incorporated

under the laws of Bermuda (the “Issuer”), whose principal executive offices are located at 2nd Floor, S.E. Pearman

Building, 9 Par-la-Ville Road, Hamilton HM 11, Bermuda.

|

Item 2.

|

Identity and Background

|

This statement is being

filed by BW Group Limited (“BWG”), an exempted company limited by shares incorporated under the laws of Bermuda. The

principal business of BWG is that of an investment holding company. The registered address of BWG is at c/o Inchona Services Limited,

Washington Mall Phase 2, 4th Floor, Suite 400, 22 Church Street, HM 1189, Hamilton HMEX, Bermuda and the correspondence address

of BWG is at Mapletree Business City, #18-01, 10 Pasir Panjang Road, Singapore 117438.

Set forth in Schedule A

to this Statement are the name, business address and present principal occupation or employment and citizenship of each director

and executive officer of each of BWG, which is incorporated herein by reference.

During the last five years

prior to the date hereof, none of BWG nor, to the knowledge of BWG, any of the other persons with respect to whom information is

given in response to this Item 2, has been convicted in a criminal proceeding or been a party to a civil proceeding of a judicial

or administrative body of competent jurisdiction ending in a judgment, decree or final order enjoining future violations of, or

prohibiting or mandating activities subject to, federal or state securities laws, or finding any violation with respect to such

laws.

|

Item 3.

|

Source and Amount of Funds or Other Consideration

|

The funds used for the

purchase of the Common Shares reported herein came from the working capital of BWG. A total of $13,415,197.46, excluding commissions,

was paid for the 1,923,558 Common Shares acquired by BWG since March 12, 2020 (the date on which the obligation to file this

Schedule 13D arose). No borrowed funds were used to purchase the Common Shares.

|

Item 4.

|

Purpose of Transaction

|

BWG has no present plans

or proposals that would result in:

|

|

a.

|

the acquisition by any person of additional securities of the Issuer, or the disposition of securities

of the Issuer;

|

|

|

b.

|

an extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving

the Issuer or any of its subsidiaries;

|

|

|

c.

|

a sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries;

|

|

|

d.

|

any change in the present board of directors or management of the Issuer, including any plans or

proposals to change the number or term of directors or to fill any existing vacancies on the board;

|

|

|

e.

|

any material change in the present capitalization or dividend policy of the Issuer;

|

|

|

f.

|

any other material change in the Issuer’s business or corporate structure including but not

limited to, if the Issuer is a registered closed-end investment company, any plans or proposals to make any changes in its investment

policy for which a vote is required by Section 13 of the Investment Company Act of 1940;

|

|

|

g.

|

changes in the Issuer’s charter, bylaws or instruments corresponding thereto or other actions

which may impede the acquisition of control of the Issuer by any person;

|

|

|

h.

|

causing a class of securities of the Issuer to be delisted from a national securities exchange

or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association;

|

|

CUSIP No. G9456A100

|

SCHEDULE 13D

|

Page 4 of 7 Pages

|

|

|

i.

|

a class of equity securities of the Issuer becoming eligible for termination of registration pursuant

to Section 12(g)(4) of the Act; or

|

|

|

j.

|

any action similar to any of those enumerated above.

|

BWG expects to review from

time to time its investment in the Issuer and may, depending on the Issuer’s business, assets, operations, financial condition,

prospects and other factors, decide to: (i) purchase additional Common Shares, options or other securities of the Issuer in

the open market, in privately negotiated transactions or otherwise; (ii) sell all or a portion of the Common Shares, options

or other securities now beneficially owned or hereafter acquired by it; (iii) propose one or more directors for the Issuer’s

board of directors; (iv) engage in discussions, negotiations or enter into other transactions with a view to obtaining direct

or indirect control of the Issuer; (v) acquire assets of the Issuer and its subsidiaries; and (vi) engage in such other

proposals as BWG may deem appropriate under the circumstances, including plans or proposals which may relate to, or could result

in, any of the matters referred to in clauses (a) through (j), above.

Also, consistent with the

above, BWG may engage in communications with, without limitation, one or more shareholders of the Issuer, one or more officers

of the Issuer and/or one or more members of the board of directors of the Issuer regarding the Issuer, including but not limited

to its operations, governance and control.

|

Item 5

|

Interest in Securities of the Issuer

|

|

(a)

|

As of March 23, 2020, BWG may be deemed

to beneficially own 6,772,881 Common Shares, representing approximately 6.93% of the outstanding Common Shares.

The foregoing beneficial ownership percentage

is based on a total of 97.8 million common shares outstanding based on disclosures in the Issuer’s current report on Form

6-K furnished to the Securities and Exchange Commission on February 25, 2020.

|

|

|

|

|

|

(b)

|

BWG has sole voting power and sole dispositive

power over 6,772,881 Common Shares.

|

|

|

|

|

(c)

|

On January 28, 2020, BWG purchased

500,000 Common Shares at a weighted average price of $10.9461 per share. The actual prices for these transactions ranged from

$10.705 to $11.00, inclusive. On January 29, 2020, BWG purchased 400,000 Common Shares at a weighted average price of

$10.6946 per share. The actual prices for these transactions ranged from $10.39 to $10.865, inclusive. On February 3, 2020,

BWG purchased 196,629 Common Shares at a weighted average price of $9.8439 per share. The actual prices for these

transactions ranged from $9.60 to $10.00, inclusive. On February 6, 2020, BWG purchased 138,546 Common Shares at a weighted

average price of $9.7886 per share. The actual prices for these transactions ranged from $9.695 to $10.00, inclusive. On

February 7, 2020, BWG purchased 300,000 Common Shares at a weighted average price of $9.7357 per share. The actual prices for

these transactions ranged from $9.46 to $10.00, inclusive. On February 10, 2020, BWG purchased 400,000 Common Shares at a

weighted average price of $9.7165 per share. The actual prices for these transactions ranged from $9.31 to $9.89, inclusive.

On March 9, 2020, BWG purchased 600,000 Common Shares at a weighted average price of $8.7318 per share. The actual prices for

these transactions ranged from $8.24 to $9.00, inclusive. On March 10, 2020, BWG purchased 57,352 Common Shares at a weighted

average price of $8.9835 per share. The actual prices for these transactions ranged from $8.74 to $9.00, inclusive. On

March 12, 2020, BWG purchased 500,000 Common Shares at a weighted average price of $7.6989 per share. The actual prices

for these transactions ranged from $7.25 to $8.00, inclusive. On March 13, 2020, BWG purchased 221,092 Common Shares at

a weighted average price of $6.3558 per share. The actual prices for these transactions ranged from $6.345 to $6.5,

inclusive. On March 16, 2020, BWG purchased 409,169 Common Shares at a weighted average price of $6.8549 per share. The

actual prices for these transactions ranged from $5.6 to $7.00, inclusive. On March 18, 2020, BWG purchased 140,251

Common Shares at a weighted average price of $6.7950 per share. The actual prices for these transactions ranged from $6.775

to $6.80, inclusive. On March 20, 2020, BWG purchased 153,046 Common Shares at a weighted average price of $6.80 per

share. The actual prices for these transactions ranged from $6.80 to $6.80, inclusive. On

March 23, 2020, BWG purchased 500,000 Common Shares at a weighted average price of $6.724 per

share. The actual prices for these transactions ranged from $6.49 to $6.80, inclusive.

These transactions were effected in

the open market through a broker.

|

|

|

|

|

(d)

|

As of the date hereof, no other person is known to have the right

to receive or the power to direct the receipt of dividends from, or any proceeds from the sale of, the securities beneficially

owned by BWG’s identified in Item 5.

|

|

|

|

|

(e)

|

This Item 5(e) is not applicable.

|

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer

|

There are no contracts,

arrangements, understandings or relationships (legal or otherwise) among the persons named in Item 2 of this Statement or between

such persons and any other person with respect to any securities of the Issuer.

|

CUSIP No. G9456A100

|

SCHEDULE 13D

|

Page 5 of 7 Pages

|

|

Item 7.

|

Material to be Filed as Exhibits

|

Not applicable.

|

CUSIP No. G9456A100

|

SCHEDULE 13D

|

Page 6 of 7 Pages

|

SIGNATURES

After reasonable inquiry and to the best of

his or its knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and

correct.

Date: March 23, 2020

|

|

BW Group Limited

|

|

|

|

|

|

|

|

|

By:

|

/s/ Nicholas John Oxleigh Fell

|

|

|

|

Name:

|

Nicholas John Oxleigh Fell

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

CUSIP No. G9456A100

|

SCHEDULE 13D

|

Page 7 of 7 Pages

|

SCHEDULE A

Directors and Executive Officers of BW Group

Limited

|

Name

|

Business Address

|

Principal Occupation or Employment

|

Citizenship

|

|

Board of Directors

|

|

Andreas Sohmen-Pao

|

c/o Mapletree Business City #18-01

10 Pasir Panjang Road Singapore 117438

|

Chairman and Company Director

|

Austrian

|

|

Thomas Thune Andersen

|

c/o Mapletree Business City #18-01

10 Pasir Panjang Road Singapore 117438

|

Company Director

|

Danish

|

|

Amaury de Seze

|

c/o Mapletree Business City #18-01

10 Pasir Panjang Road Singapore 117438

|

Company Director

|

French

|

|

Christian Clausen

|

c/o Mapletree Business City #18-01

10 Pasir Panjang Road Singapore 117438

|

Company Director

|

Danish

|

|

John B. Harrison

|

c/o Mapletree Business City #18-01

10 Pasir Panjang Road Singapore 117438

|

Company Director

|

British

|

|

Sir John Rose

|

c/o Mapletree Business City #18-01

10 Pasir Panjang Road Singapore 117438

|

Company Director

|

British

|

|

Tan Hwee Hua @ Lim Hwee Hua

|

c/o Mapletree Business City #18-01

10 Pasir Panjang Road Singapore 117438

|

Company Director

|

Singaporean

|

|

Executive officers

|

|

Christian Bonfils

|

c/o Mapletree Business City #18-01

10 Pasir Panjang Road Singapore 117438

|

Managing Director, BW Dry Cargo ApS

|

Danish

|

|

Nicholas John Oxleigh Fell

|

c/o Mapletree Business City #18-01

10 Pasir Panjang Road Singapore 117438

|

Senior Vice President, Corporate Services & General Counsel

|

British

|

|

Yngvil Signe Eriksson Asheim

|

c/o Mapletree Business City #18-01

10 Pasir Panjang Road Singapore 117438

|

Managing Director, BW LNG

|

Norwegian

|

|

Sebastien Brochet

|

c/o Mapletree Business City #18-01

10 Pasir Panjang Road Singapore 117438

|

Senior Vice President, Strategy, Corporate Development & HR

|

French

|

|

Billy Chiu

|

c/o Mapletree Business City #18-01

10 Pasir Panjang Road Singapore 117438

|

Senior Vice President

|

Singaporean

|

|

Jakob Bergholdt

|

c/o Mapletree Business City #18-01

10 Pasir Panjang Road Singapore 117438

|

Chief Financial Officer

|

Danish

|

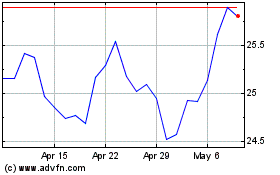

Golar LNG (NASDAQ:GLNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

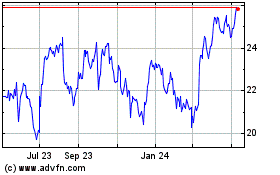

Golar LNG (NASDAQ:GLNG)

Historical Stock Chart

From Apr 2023 to Apr 2024