UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2020

Commission File Number: 001-34985

Globus

Maritime Limited

(Translation of registrant’s name into English)

128 Vouliagmenis Avenue, 3rd Floor, Glyfada,

Attica, Greece, 166 74

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

INFORMATION CONTAINED IN THIS FORM 6-K

REPORT

This Report on

Form 6-K is being filed by Globus Maritime Limited (“we”, “us”, or the "Company") to:

I.

Report certain recent developments relating to the Company's financing agreements, as follows:

We currently have one

senior secured loan facility with EnTrust Global’s Blue Ocean Fund with an aggregate outstanding balance as of the date of

this report on Form 6-K of approximately $37.0 million; a credit facility with Firment Shipping Inc., our largest shareholder and

a related party to us, with an aggregate outstanding balance as of the date of this report on Form 6-K of $800,000; and a Convertible

Note outstanding with an unrelated party with an aggregate outstanding balance as of the date of this this report on Form 6-K of

approximately $2.5 million.

Entrust Facility

On April 21, 2020, the

loan facility with EnTrust Global’s Blue Ocean Fund was amended to provide for, among other things, the deferral at the borrowers’

option of 50% of the amount of interest that accrued on the loan during the interest period that ended on March 31, 2020 and increased

the deferred fee from 1.50% to 1.60%, among other matters. The deferred interest that remains outstanding will accrue interest

at the same rate and on the same repayment terms as interest on the loan. The deferred interest must be paid on September 30, 2020

and may be paid at the borrowers’ option on June 30, 2020. In May of 2020 the lenders agreed to increase the maximum amount

of trade debt permitted to be incurred in respect of the vessels financed under the loan agreement from $400,000 to $600,000 per

ship. In addition, the covenant that the market value of our ships plus net realizable value of additional security granted plus

the amount standing to credit of the Liquidity Account and the Reserve Account must remain above 125% for the first two years of

the loan and then 135% thereafter, was waived by the lenders until September 30, 2020. Our minimum liquidity per ship of $250,000

and group liquidity, on a consolidated basis, at the end of each calendar quarter of liquid funds in an amount, in aggregate, of

not less than 5% of the consolidated financial indebtedness was also waived until September 30, 2020.

Firment Facility

On May 8, 2020, the

credit facility with Firment Shipping Inc. was amended and restated. This amended facility is unsecured and remains available

until its final maturity on October 31, 2021. We have the right to drawdown any amount up to $15 million (with $14.2 million

remaining) or prepay any amount in multiples of $100,000. Any prepaid amount cannot be re-borrowed. Interest on drawn and

outstanding amounts is charged at 3.5% per annum until December 31, 2020, and thereafter at 7% per annum. No commitment fee

is charged on the amounts remaining available and undrawn. Interest is payable the last day of a period of three months after

the Drawdown Date, after this period in case of failure to pay any sum due a default interest of 2% per annum above the

regular interest is charged. We have also the right, in our sole option, to convert in whole or in part the outstanding

unpaid principal amount and accrued but unpaid interest under this agreement into our common shares. The conversion price

shall equal the higher of (i) the average of the daily dollar volume-weighted average sale price for the common stock on the

principal market on any trading day during the period beginning at 9.30 a.m. New York City time and ending at 4.00 p.m. over

the Pricing Period multiplied by 80%, where the “Pricing Period” equals the ten consecutive trading days

immediately preceding the date on which the conversion notice was executed or (ii) $2.80 (subject to proportional adjustment

for share splits, share combinations, share dividends and similar events). The Firment Shipping Credit Facility requires that

Athanasios Feidakis remain our Chief Executive Officer and that, unless approved by Firment Shipping, Firment Shipping

maintains at least a 40% shareholding in us, other than due to actions taken by Firment Shipping, such as sales of

shares.

Convertible Note

On May 8, 2020, the holder of our

Convertible Note waived (the “May 8, 2020 Waiver”) its right to participate in (a) public offerings which close

before August 31, 2020, and (b) issuances of shares and other securities (including common shares, Class B common shares, and

new or existing series of preferred shares) to directors, officers, their respective affiliates, and to affiliates of the

Company. The holder of our Convertible Note also consented to the amendment and restatement of the Firment Shipping Credit

Facility and waived (a) without the Company having admitted fault, certain potential prior technical breaches of the

Convertible Note; (b) the holder’s right to require the redemption of the Convertible Note upon a change of control (as

such term is used within the Convertible Note), but only if such change of control results from certain underwritten offering

or issuances of our securities to directors, officers, their respective affiliates, and to affiliates of the Company; (c)

temporarily reduced, until August 31, 2020, the amount the noteholder will receive upon a redemption of the Convertible Note

at the Company’s option, such that the Convertible Note can be redeemed at the Company’s option by paying the

greater of (i) the aggregate amounts then outstanding pursuant to the Convertible Note (rather than 120% of such amounts) and

(ii) the product of (x) the number of shares issuable upon a conversion of the Convertible Note (with respect to the amount

being redeemed at the time) multiplied by (y) the greatest closing sale price of the Company’s common shares on any

trading day between the date immediately preceding the first such redemption at the Company’s option and the trading

day immediately prior to the final Company payment under the Convertible Note. All of the foregoing is subject to the

Company’s redemption of all or part of the Convertible Note in cash with an amount equal to the lesser of (a) the

aggregate amounts then outstanding pursuant to the Convertible Note and (b) 25% of the net proceeds of any public offering of

its securities that closes before August 31, 2020.

As of the date of this report on Form 6-K,

approximately $2.5 million in principal and interest was owed pursuant to the Convertible Note. If not converted or redeemed beforehand

pursuant to the terms of the Convertible Note, the Convertible Note is now scheduled to mature on March 13, 2021.

The Convertible Note provides for interest

to accrue at 10% annually, which interest shall be paid at maturity unless the Convertible Note is converted or redeemed pursuant

to its terms beforehand. The interest may be paid in common shares of the Company, if certain conditions described within the Convertible

Note are met. The conversion and redemption terms of the Convertible Note are, in principal, as follows:

|

|

·

|

The Convertible Note may be converted, in whole or in part, into the Company’s common stock

at any time by its holder, in which case all principal, interest, and other amounts owed pursuant to the Convertible Note shall

convert at a price per share which differs based upon the performance of the Company’s stock price. The price per share for

conversion purposes is the lowest of (a) the Conversion Price of $4.50 and (b) the highest of (i) $1.00 (the “Floor Price”)

and (ii) 87.5% of the average of the high and low bid price from any day chosen by the holder during the ten (10) consecutive trading

day period ending on and including the trading day immediately prior to the applicable conversion date (the “Alternate Conversion

Price”) regardless of the subsequent stock price. The Floor Price adjusts for share splits, share dividends, share combinations,

and similar transactions.

|

|

|

·

|

The Convertible Note may be redeemed, in whole or in part, by request of its holder upon:

|

|

|

o

|

an Event of Default (as defined within the Convertible Note), in exchange for the higher of (a)

120% of all amounts owed under the Convertible Note, and (b) the value of the stock to which the Convertible Note could be converted

(as calculated within Section 4(b) of the Convertible Note);

|

|

|

o

|

a Change in Control (as defined within the Convertible Note) of the Company, in exchange for the

higher of (a) 120% of all amounts owed under the Convertible Note and (b) the value of the stock to which the Convertible Note

could be converted (as calculated within Section 5(c) of the Convertible Note), unless such Change in Control occurs as described

in the May 8, 2020 Waiver described above; or

|

|

|

o

|

any time after an uninterrupted ten Trading Day period in which the common shares trade below the

Floor Price, in exchange for 100% of all amounts owed under the Convertible Note.

|

|

|

·

|

The Convertible Note may be redeemed, in whole or in part, at any time by the Company. If we elect

to redeem the Convertible Note, and such redemption does not occur as set forth within the May 8, 2020 Waiver, we shall be obligated

to pay the holder the greater of (a) 120% of all amounts owed under the Convertible Note and (b) the value of the stock to which

the Convertible Note could be converted (as calculated within Section 8(a) of the Convertible Note). If we elect to redeem the

Convertible Note, we (as a procedural matter) must first provide the holder notice, which could allow the holder to convert prior

to payment by us of the redemption amount.

|

|

|

·

|

If any portion of the Convertible Note is not redeemed or converted prior to its maturity date,

on the maturity date, we are required to pay all outstanding principal in cash and may elect whether to pay the interest (and any

other amounts owed) in cash or shares of our common stock. If interest is paid in common stock, the Alternate Conversion Price

per share shall apply.

|

The Convertible Note also forbids us from

undertaking certain major transactions (referred to within the Convertible Note as “Fundamental Transactions” or a

“Change of Control”) if we do not either (a) redeem the note at 120% of all amounts owed under the Convertible Note

beforehand or (b) we or our successor does not reaffirm its obligations under the Convertible Note.

The Company further entered into a registration

rights agreement (the “Registration Rights Agreement”) in which it agreed to register the resale of the common shares

issuable upon conversion of the Convertible Note. The Registration Rights Agreement includes liquidated damages provisions applicable

if the Company fails to meet its obligations. Pursuant to the Registration Rights Agreement, we filed a Registration Statement

on Form F-3 with respect to the resale of the common shares that may be issued upon the conversion of the Convertible Note. This

registration statement was declared effective on April 19, 2019.

The full conversion of the Convertible

Note would dilute the ownership percentage of the Company held by existing stockholders and could hurt our stock price, and will

dilute existing shareholders.

Under the terms of the Convertible Note,

we may not issue shares to the extent such issuance would cause a holder, together with its affiliates and attribution parties,

to beneficially own a number of common shares which would exceed 4.99% (which may be increased upon no less than 61 days’

notice, but not to exceed 9.99%) of our then outstanding common shares immediately following such issuance, excluding for purposes

of such determination common shares issuable upon subsequent conversion of principal or interest on the Convertible Note. This

provision does not limit a holder from acquiring up to 4.99% of our common shares, selling all of their common shares, and re-acquiring

up to 4.99% of our common shares.

The Purchase Agreement contained representations,

warranties and covenants that are typical for private placements by public companies. The Purchase Agreement, during the time that

the Convertible Note is outstanding, prohibits the Company from entering into certain “variable rate transactions”,

as defined within the Purchase Agreement, involving (a) the issuance by the Company of convertible securities at a price that is

based upon and/or varies with the trading prices of our common shares or with a conversion, exercise or exchange price that is

subject to being reset at some future date, other than pursuant to a customary “weighted average” anti-dilution provision,

or (b) a transaction whereby the Company or any Subsidiary may sell securities at a future determined price.

The Purchase Agreement also grants the

holder other rights. Within the Purchase Agreement, the Company also grants the holder(s) an option to acquire up to 50% of the

securities issued in certain placements of the Company (referred to within the Purchase Agreement as “Subsequent Placements”)

during the time that the Convertible Note is outstanding, and obligates the Company to notify the holder(s) before consummating

any Subsequent Placements. If the holder does not exercise its participation right within five business days of being noticed of

the terms of the offer, we then have 10 business days to consummate the transaction on terms no more favorable than what was offered

to the holder, and if we fail to close a transaction within such period, we must notice the holder again and offer another opportunity

to participate. We also agreed not to issue more than one offer notice to the holder within 60 days, unless the terms have changed

within five business days of our giving notice to the holder.

II.

Confirm, as indicated in a report on Schedule 13D furnished with the Commission on June 28, 2019, that Mr. Georgios Feidakis

beneficially owns 1,252,258 common shares through Firment Shipping Inc., a Marshall Islands corporation for which he exercises

sole voting and investment power. Mr. Georgios Feidakis and Firment Shipping Inc., disclaim beneficial ownership over such common

shares except to the extent of their pecuniary interests in such shares. Firment Shipping Inc. is the lender of the Firment Shipping

Credit Facility, which facility provides that debt may be repaid by us using our common shares at our election.

III.

Provide clarification about a consultancy agreement the Company entered into with our Chief Executive Officer, who is our

sole executive officer (and also a director):

In August 2016,

the Company entered into a consultancy agreement with an affiliated company of our CEO, Mr. Athanasios Feidakis, for the purpose

of providing consulting services to the Company in connection with the Company’s international shipping and capital raising

activities, including but not limited to assisting and advising the Company’s CEO. The annual fees for the services provided

amount to €200,000. The consultant is eligible to receive bonus compensation (whether in the form of cash and/or equity

and/or quasi-equity awards) for the services provided and such bonus shall be determined by the Remuneration Committee or the

Board of the Company. If the Company terminates the agreement without cause, or either party terminates after a change of

control of the Company, then we will pay the consultant €400,000 plus the average annual bonus (including the value of equity

awards) granted to the consultant throughout the term of the consultancy agreement.

Each of our other directors has a contract

relating to his appointment as a director.

EXHIBIT INDEX

|

99.1

|

Amended and Restated Agreement with Firment Shipping Inc. for

a Credit Facility of up to US Dollars $15,000,000 dated May 8, 2020

|

|

|

|

|

99.2

|

Supplemental

Letter dated April 21, 2020 relating to a Term Loan Facility relating to a loan of $37,000,000 dated June 24, 2019 among Devocean

Maritime Ltd., Domina Maritime Ltd., Dulac Maritime S.A., Artful Shipholding S.A. and Longevity Maritime Limited, as joint and

several borrowers and Globus Maritime Limited as parent guarantor and Lucid Agency Services Limited as facility agent and as security

agent

|

|

|

|

|

99.3

|

Consent and Waiver Letter to Senior Convertible Note dated May

8, 2020

|

THIS REPORT ON FORM 6-K IS HEREBY INCORPORATED BY REFERENCE

INTO THE COMPANY’S REGISTRATION STATEMENTS: (A) ON FORM F-3 (FILE NO. 333-222580)

FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JANUARY 17, 2018 AND DECLARED EFFECTIVE FEBRUARY 8, 2018; AND (B) ON FORM

F-3 (FILE NO. 333-230841) FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON APRIL 12, 2019 AND DECLARED EFFECTIVE APRIL 19,

2019.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: May 8, 2020

|

|

GLOBUS MARITIME LIMITED

|

|

|

|

|

|

|

By:

|

/s/ Athanasios Feidakis

|

|

|

Name:

|

Athanasios Feidakis

|

|

|

Title:

|

President, Chief Executive Officer and Chief Financial Officer

|

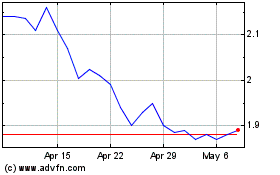

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Apr 2023 to Apr 2024