EUROPE MARKETS: European Markets Gain As Investors Wait For U.K. Vote On EU Exit Delay

March 14 2019 - 8:07AM

Dow Jones News

By Emily Horton

European markets gained on Thursday, as investors prepare for

U.K. parliament's next Brexit vote on whether to extend Britain's

March 29 deadline to leave the European Union.

Investors were also digesting another round of industrial data

from China that confirmed a slowdown in the country's economy.

German airline Deutsche Lufthansa AG lost 5% after its

fourth-quarter profits tumbled.

How did markets perform?

(http://www.marketwatch.com/story/dollar-weaker-as-british-pound-bounces-higher-ahead-of-hard-brexit-vote-2019-03-13)The

Stoxx Europe 600 added 0.5% to 377.43, after finishing up 0.6% on

Wednesday evening.

The U.K.'s FTSE 100 climbed by 0.5% to 7,194.28 after finishing

up 0.1% on Wednesday. The DAX (DAX) was flat at 11,570.84, while

France's CAC 40 gained 0.5% to 5,334.45.

Italy's FTSE MIB index was the region's biggest climber, adding

0.6% to 20,869.31.

On Wednesday evening the U.K. parliament voted against the

prospect of a no-deal Brexit, leading to an overnight surge in the

pound. However, by Thursday the pound had given back some of those

gains, falling 0.8% on the day to fetch $1.3230. The the euro slid

slightly to $1.1303 from $1.1327.

What's driving the markets?

The decision that the Britain should not leave the European

Union without a withdrawal deal in place was welcomed by sterling

traders. However, this vote doesn't remove the risk of the U.K.

crashing out of the EU completely, as it is a simple declaration by

parliament.

"The fact is that it is comforting to know that no deal Brexit

scenario is off the table, but at the same time there is no table.

This is because May's party is in more disarray and Brexit has

become a laughing matter for everyone. Unfortunately, the law

makers in the U.K. are like headless chickens with no clue which

way to go. This element is going to keep the lid on the sterling

price," Naeem Aslam, chief market analyst, Think Markets U.K. told

clients in a note.

U.K. lawmakers are set to vote again on Thursday, this time on

whether to delay the scheduled departure on March 29th.

Meanwhile, markets were dismayed by industrial data out of China

(http://www.marketwatch.com/story/china-slowdown-broadens-despite-beijings-support-2019-03-14),

released by the government on Thursday, which offered fresh

evidence the country's economy is slowing.

What stocks are active?

The share price of German airline Deutsche Lufthansa AG (LHA.XE)

fell by 4.8% on the news the group's fourth-quarter profit dropped

in 2018

(http://www.marketwatch.com/story/lufthansa-profit-falls-expects-2019-revenue-gain-2019-03-14).

U.K. cinema operation Cineworld Group PLC (CINE.LN) rose by 6.9%

after the FTSE 250 company announced its profit had doubled in 2018

(http://www.marketwatch.com/story/cineworld-profit-soars-on-regal-entertainment-deal-2019-03-14).

"The potential [for Cineworld] to make cost savings was always

one of the main drivers of the Regal purchase and the company said

today savings would be even better than previously expected at

$150m this year. Better still for investors was the news that the

dividend has been raised by 18% and will be paid in quarterly

installments in the future" Ian Forrest, investment research

analyst at The Share Centre said in a note to clients.

Meanwhile, heavyweight miner Royal Dutch Shell PLC (RDSA.LN)

gained 1.5%.

(END) Dow Jones Newswires

March 14, 2019 07:52 ET (11:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

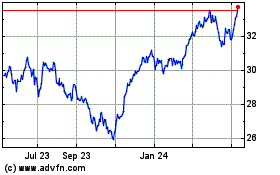

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Mar 2024 to Apr 2024

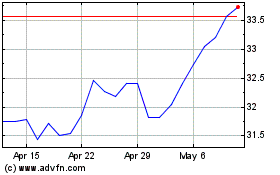

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Apr 2023 to Apr 2024