EUROPE MARKETS: Europe's Indexes Sink As Geopolitical Tensions Between Pakistan And India Escalate; Metro Bank Plunges 20%

February 27 2019 - 7:28AM

Dow Jones News

By Emily Horton

Europe's markets were down on Wednesday, as escalating

geopolitical tensions between Pakistan and India heightened

investor fears.

Markets were also waiting for the second summit between

President Donald Trump and North Korean leader Kim Jong Un to kick

off in Vietnam's capital.

Metro Bank PLC tumbled by 20%.

How are markets performing?

The Stoxx Europe 600 lost 0.5% to 371.61 after it finished up

0.4% on Tuesday.

The FTSE 100 was the region's biggest decliner, falling 0.7% to

7,097.77. London markets were hit by a stronger pound after Theresa

May managed to reassure investors over the Brexit issue on Tuesday.

Since many FTSE 100 stocks earn substantial revenues outside the

country, strength in the U.K. currency can hurt the index.

The German DAX (DAX) followed just behind, dropping 0.6% to

11,465.45, while France's CAC 40 and Spain's IBEX 35 both lost

around 0.4%, to 5,219.98 and 9,181.60 respectively.

Italy's FTSE MIB index fell the least in the region, dropping by

0.2% to 20,428.85.

The pound remained strong from Tuesday's rally, fetching $1.3271

from $1.3252 late in New York on Tuesday. Meanwhile, the euro

remained mostly flat at $1.1392.

What's driving the markets?

Geopolitical tension between Pakistan and India has strongly

impacted equities across Europe, as Pakistan reportedly

(https://www.bbc.co.uk/news/world-asia-47383634) shot down two

Indian Air Force jets, with investors fearing further

escalation.

The second summit between President Donald Trump and North

Korean leader Kim Jong Un is set to kick off in Hanoi on Wednesday.

The two leaders first met in June 2018 in Singapore, where a

denuclearization agreement was signed by both parties.

Trump and Kim will have a private dinner Wednesday evening and

discussions on Thursday in hopes of building on the agreement made

eight months ago, given that little progress has been made toward

disarmament since.

Meanwhile, the House voted to block the White House from

redirecting federal funds toward building a border wall,

heightening the chances of Trump exercising his veto power for the

first time, The Wall Street Journal reported

(https://www.wsj.com/articles/house-set-to-pass-measure-blocking-trumps-national-emergency-on-wall-11551185964).

What stocks are active?

Metro Bank PLC (MTRO.LN) was Europe's biggest loser, plunging

20% on Wednesday, after it reportedly

(https://www.bloomberg.com/news/articles/2019-02-26/metro-bank-is-said-to-weigh-up-to-400-million-pound-share-sale)

disclosed that a British regulator was investigating how the bank

misclassified assets.

Air France-KLM (AF.FR) lost 12% after the Dutch government

announced a surprise decision to buy a stake in the airline, which

prompted fears that competing national agendas could interfere with

the company's latest efforts to streamline the business, Bloomberg

reported

(https://www.bloomberg.com/news/articles/2019-02-26/dutch-government-buys-air-france-klm-stake-aims-to-match-france).

Meanwhile, supermarket Marks & Spencer Group PLC (MKS.LN)

lost 8%, after it announced a new joint venture

(http://www.marketwatch.com/story/marks-spencer-ocado-form-new-joint-venture-2019-02-27)

with online delivery service Ocado Group PLC (OCDO.LN), which added

1% on the news.

"This deal is a case of the old meeting the new. M&S has

clearly decided if you can't beat them, join them, and in a digital

age it simply can't afford to ignore the online audience for food,"

said Laith Khalaf, a senior analyst at U.K. stockbroker Hargreaves

Lansdown.

"M&S basket sizes are small, under GBP30, which makes the

economics of online delivery especially challenging, because

customers are shopping for special occasions or food for that

night, rather than a full weekly grocery shop. By teaming up with

Ocado, where basket sizes are over GBP100, that makes an online

proposition viable", Khalaf added.

Leading the heavyweight miners, Rio Tinto PLC (RIO.LN) gained

almost 2%, after it announced it would pay a special dividend as

profits jumped

(http://www.marketwatch.com/story/rio-tinto-to-pay-special-dividend-as-profit-jumps-2019-02-27).

(END) Dow Jones Newswires

February 27, 2019 07:13 ET (12:13 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

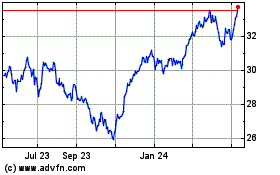

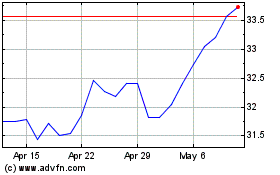

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Apr 2023 to Apr 2024