Glen Burnie Bancorp (“Bancorp”) (NASDAQ: GLBZ), the bank holding

company for The Bank of Glen Burnie (“Bank”), announced today net

income of $0.31 million, or $0.11 per basic and diluted common

share for the three-month period ended December 31, 2018, as

compared to a net loss of $153,000, or $0.05 per basic and diluted

common share for the three-month period ended December 31, 2017.

Bancorp reported net income of $1.58 million, or $0.56 per basic

and diluted common share for the year ended December 31, 2018,

compared to $0.91 million, or $0.33 per basic and diluted common

share for the same period in 2017. Net loans grew by $27.6

million, or 10.24% during the twelve-month period ended December

31, 2018, compared to $6.4 million, or 2.46% growth during the same

period of 2017. At December 31, 2018, Bancorp had total

assets of $413.0 million. Bancorp, the oldest independent

commercial bank in Anne Arundel County, paid its 106th consecutive

quarterly dividend on February 1, 2019.

During 2018, the Company conducted a periodic review of the

estimated direct cost to originate loans resulting in a change to

the estimated materiality of these costs. Prior to January 1,

2018, the Company expensed direct costs to originate loans in the

period incurred based on management’s judgement that the costs were

immaterial. This yearlong project resulted in a change in the

estimated materiality of these costs. Effective January 1,

2018, the Company increased its estimates for these costs and

changed its accounting method from expense as incurred to defer and

amortize in accordance with accounting standard 310-20 Receivables

– Nonrefundable Fees and Other Costs. This preferred method

recognizes loan interest income and costs incurred to generate the

revenue in the same period. The effect of this change in

accounting method was inseparable from the effect of the change in

accounting estimate, and therefore, accounted for as a change in

estimate. As a result, the Company began recognizing certain

direct loan origination costs over the life of the related loan as

a reduction of the loan’s yield by the interest method based on the

contractual term of the loan. In the fourth quarter of 2018,

the Company recorded a reduction of noninterest expense and an

increase in loan balances of $375,000, and reduced loan balances

and loan interest income by $51,000 due to the amortization of

deferred costs. The effect of these adjustments increased

income before taxes for the three- and twelve-month periods ended

December 31, 2018 by $324,000 and increased net income by $300,000

or $0.11 per basic and diluted common share for the twelve-month

period ended December 31, 2018.

“Consistent with the first three quarters of 2018, we continued

to show positive momentum during the fourth quarter even when

considering the impact of the change in estimate noted above.

We expanded our net interest margin and net interest income

reflects outstanding credit quality, disciplined loan pricing and a

beneficial balance sheet structure,” stated John D. Long, President

and CEO. “We continue to invest in technology systems that

allow us to remain competitive in the rapidly changing technology

environment. As such, our strong fundamental performance was

somewhat offset by the significant technology and infrastructure

investments made across the Company. We are encouraged by the

progress of the past year and remain confident that these

investments have built a foundation for sustainable growth in 2019

and beyond.”

“Tax law changes in the fourth quarter of 2017 impacted the

comparability of our quarterly and year-over-year income metrics,”

continued Mr. Long. “However, I am pleased about 2018

results, with net income of $0.31 million for the fourth quarter of

2018, an increase of 301% from the fourth quarter of 2017. In

addition, net income of $1.58 million for the year ended December

31, 2018 increased $0.67 million, or 74%, over the $0.91 million

for the year ended December 31, 2017. Headquartered in the

dynamic Northern Anne Arundel County market, we believe the Bank is

well positioned with sound asset growth, asset quality and capital

levels, a widening net interest margin, and an experienced and

seasoned executive team. We remain deeply committed to

serving the financial needs of the community through the

development of new loan and deposit products.”

Highlights for the Quarter and Year ended December 31,

2018

Bancorp continued to grow organically in the fourth quarter of

2018 driven primarily by favorable net loan growth. Bancorp

has strong liquidity and capital positions that provide ample

capacity for future growth, along with the Bank’s total regulatory

capital to risk weighted assets of 13.18% at December 31, 2018, as

compared to 13.84% for the same period of 2017.

Return on average assets for the three-month period ended

December 31, 2018 was 0.30%, as compared to -0.16% for the

three-month period ended December 31, 2017. Return on average

equity for the three-month period ended December 31, 2018 was

3.74%, as compared to -1.75% for the three-month period ended

December 31, 2017. Return on average assets for the year

ended December 31, 2018 was 0.39%, as compared to 0.23% for the

year ended December 31, 2017. Return on average equity for

the year ended December 31, 2018 was 4.74%, as compared to 2.65%

for the year ended December 31, 2017.

The Tax Cuts and Jobs Act (the Tax Act), signed into law on

December 22, 2017, reduced the US federal corporate tax rate from

34% to 21%. At December 31, 2018, we completed our accounting

for the tax effects of enactment of the Tax Act. We

re-measured all deferred tax assets (“DTA”) and liabilities (“DTL”)

based on the rates at which they are expected to reverse in the

future. We recognized an income tax expense of $0.6 million

for the year ended December 31, 2017 related to adjusting our net

deferred tax asset balance to reflect the new corporate tax

rate. In addition, DTAs/DTLs related to available for sale

(“AFS”) securities unrealized losses that were revalued as of

December 31, 2017 noted above created a “stranded tax effects” in

Accumulated Other Comprehensive Income (“AOCI”) due to enactment of

the Tax Act. The issue arose due to the nature of generally

accepted accounting principles recognition of tax rate

change-effects on the AFS DTA/DTL revaluation as an adjustment to

income tax provision. In February 2018, the Financial

Accounting Standards Board issued Accounting Standards Update

(“ASU”) 2018-02 - Income Statement – Reporting Comprehensive Income

(Topic 220). The Company early adopted the provisions of ASU

2018-02 and recorded a reclassification adjustment of $104,000 from

AOCI to retained earnings for stranded tax effects related to AFS

securities as a result of the newly enacted corporate tax

rate. The amount of the reclassification was the difference

between the 34% historical corporate tax rate and the newly enacted

21% corporate tax rate.

The book value per share of Bancorp’s common stock was $12.10 at

December 31, 2018, as compared to $12.15 per share at December 31,

2017.

At December 31, 2018, the Bank remained above all

“well-capitalized” regulatory requirement levels. The Bank’s

tier 1 risk-based capital ratio was approximately 12.27% at

December 31, 2018, as compared to 12.83% at December 31,

2017. Liquidity remained strong due to managed cash and cash

equivalents, borrowing lines with the FHLB of Atlanta, the Federal

Reserve and correspondent banks, and the size and composition of

the bond portfolio.

Balance Sheet Review

Total assets were $413.0 million at December 31, 2018, an

increase of $23.5 million or 6.03%, from $389.5 million at December

31, 2017. Investment securities were $81.6 million at

December 31, 2018, a decrease of $7.7 million or 8.62%, from $89.3

million at December 31, 2017. Loans, net of deferred fees and

costs, were $299.1 million at December 31, 2018, an increase of

$27.5 million or 10.13%, from $271.6 million at December 31,

2017. Bank owned life insurance (BOLI) decreased $0.9 million

or 9.80% from December 31, 2017 to December 31, 2018 primarily due

to the redemption of BOLI policies. Net deferred tax assets

decreased $1.0 million and accrued taxes receivable increased $0.7

million from December 31, 2017 to December 31, 2018 primarily due

to the elimination of the alternative minimum tax under the Tax

Act.

Total deposits were $322.5 million at December 31, 2018, a

decrease of $11.7 million or 3.50%, from $334.2 million at December

31, 2017. Noninterest-bearing deposits were $101.4 million at

December 31, 2018, a decrease of $2.5 million or 2.55%, from $104.0

million at December 31, 2017. Interest-bearing deposits were

$221.1 million at December 31, 2018, a decrease of $9.1 million or

3.95%, from $230.2 million at December 31, 2017. Total

borrowings were $55.0 million at December 31, 2018, an increase of

$35.0 million or 175.00%, from $20.0 million at December 31,

2017.

Stockholders’ equity was $34.1 million at December 31, 2018, an

increase of $9,000 from $34.0 million at December 31, 2017.

The unrealized gains on interest rate swap contracts, 2018 retained

earnings and stock issuances under the dividend reinvestment

program, offset by $0.8 million decrease in accumulated other

comprehensive loss associated with net unrealized losses on the

available for sale bond portfolio drove the increase in

stockholders’ equity.

Nonperforming assets, which consist of nonaccrual loans,

troubled debt restructurings, accruing loans past due 90 days or

more, and other real estate owned, represented 0.70% of total

assets at December 31, 2018, as compared to 0.94% for the same

period of 2017.

Review of Financial Results

For the three-month periods ended December 31, 2018 and

2017

Net income for the three-month period ended December 31, 2018

was $0.31 million, as compared to a net loss of $0.15 million for

the three-month period ended December 31, 2017.

Net interest income for the three-month period ended December

31, 2018 totaled $3.24 million, as compared to $3.01 million for

the three-month period ended December 31, 2017. Average loan

balances increased to $298 million for the three-month period ended

December 31, 2018, as compared to $270 million for the same period

of 2017.

Net interest margin for the three-month period ended December

31, 2018 was 3.26%, as compared to 3.20% for the same period of

2017. Higher average balances and yields on interest-earning

assets were the primary driver of year-over-year results, as the

average balance increased $22 million and the yield on

interest-earning assets increased 0.17% from 3.69% to 3.86%, offset

by the cost of funds which increased 0.12% from 0.51% to 0.63% for

the three-month periods ending December 31, 2017 and 2018,

respectively.

The provision for loan losses for the three-month period ended

December 31, 2018 was $255,000, as compared to $93,000 for the same

period of 2017. The increase for the three-month period ended

December 31, 2018 primarily reflects loan growth, increased net

charge offs, and change in product mix. As a result, the

allowance for loan losses was $2.54 million at December 31, 2018,

representing 0.85% of total loans, as compared to $2.59 million, or

0.95% of total loans at December 31, 2017.

Noninterest income for the three-month period ended December 31,

2018 was $313,000, as compared to $349,000 for the three-month

period ended December 31, 2017.

For the three-month period ended December 31, 2018, noninterest

expense was $2.94 million, as compared to $2.70 million for the

three-month period ended December 31, 2017. The primary

contributors to the $0.24 million increase, when compared to the

three-month period ended December 31, 2017 were increases in FDIC

insurance costs, other insurance costs and other loan expense.

For the twelve-month periods ended December 31, 2018 and

2017

Net income for the twelve-month period ended December 31, 2018

was $1.58 million, as compared to net income of $0.91 million for

the twelve-month period ended December 31, 2017.

Net interest income for the twelve-month period ended December

31, 2018 totaled $12.6 million, as compared to $11.7 million for

the twelve-month period ended December 31, 2017. Average

earning loan balances increased to $287 million for the

twelve-month period ended December 31, 2018, as compared to $270

million for the same period of 2017.

Net interest margin for the twelve-month period ended December

31, 2018 was 3.26%, as compared to 3.12% for the same period of

2017. Higher average balances and yields on interest-earning

assets were the primary driver of year-over-year results, as the

average balance increased $12 million and the yield on

interest-earning assets increased 0.17% from 3.64% to 3.81%, offset

by the cost of funds which increased 0.03% from 0.54% to 0.57% for

the three-month periods ending December 31, 2017 and 2018,

respectively.

The provision for loan losses for the twelve-month period ended

December 31, 2018 was $856,000, as compared to $336,000 for the

same period of 2017. The increase for the twelve-month period

ended December 31, 2018 was primarily driven by $700,000 increase

in net loan charge offs year-over-year. As a result, the

allowance for loan losses was $2.54 million at December 31, 2018,

representing 0.85% of total loans, as compared to $2.59 million, or

0.95% of total loans for the same period of 2017.

Noninterest income for the twelve-month period ended December

31, 2018 was $1.52 million, as compared to $1.29 million for the

twelve-month period ended December 31, 2017. The increase for

the twelve-month period ended December 31, 2018 was primarily

driven by $308,000 gain on redemptions of BOLI policies.

For the twelve-month period ended December 31, 2018, noninterest

expense was $11.5 million, as compared to $10.8 million for the

twelve-month period ended December 31, 2017. The primary

contributors to the $0.7 million increase, when compared to the

twelve-month period ended December 31, 2017 were increases in

salary and employee benefits, legal, accounting and other

professional fees, FDIC insurance costs, and loan collection costs,

partially offset by decreases in advertising and marketing related

expenses.

Glen Burnie Bancorp Information

Glen Burnie Bancorp is a bank holding company headquartered in

Glen Burnie, Maryland. Founded in 1949, The Bank of Glen

Burnie® is a locally-owned community bank with 8 branch offices

serving Anne Arundel County. The Bank is engaged in the

commercial and retail banking business including the acceptance of

demand and time deposits, and the origination of loans to

individuals, associations, partnerships and corporations. The

Bank’s real estate financing consists of residential first and

second mortgage loans, home equity lines of credit and commercial

mortgage loans. The Bank also originates automobile loans

through arrangements with local automobile dealers.

Additional information is available at

www.thebankofglenburnie.com.

Forward-Looking Statements

The statements contained herein that are not historical

financial information, may be deemed to constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements are subject to certain

risks and uncertainties, which could cause the company’s actual

results in the future to differ materially from its historical

results and those presently anticipated or projected. These

statements are evidenced by terms such as “anticipate,” “estimate,”

“should,” “expect,” “believe,” “intend,” and similar expressions.

Although these statements reflect management’s good faith

beliefs and projections, they are not guarantees of future

performance and they may not prove true. For a more complete

discussion of these and other risk factors, please see the

company’s reports filed with the Securities and Exchange

Commission.

For further information contact:

Jeffrey D. Harris, Chief Financial

Officer410-768-8883jdharris@bogb.net106 Padfield BlvdGlen Burnie,

MD 21061

|

|

|

GLEN BURNIE BANCORP AND SUBSIDIARIES |

|

CONSOLIDATED BALANCE SHEETS |

| (dollars

in thousands) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

December 31, |

|

September 30, |

|

December 31, |

| |

2018 |

|

2018 |

|

2017 |

| |

(unaudited) |

|

(unaudited) |

|

(audited) |

|

ASSETS |

|

|

|

|

|

| Cash and due from

banks |

$ |

2,605 |

|

|

$ |

5,282 |

|

|

$ |

2,610 |

|

| Interest bearing

deposits with banks and federal funds sold |

|

13,349 |

|

|

|

10,208 |

|

|

|

9,995 |

|

|

Total Cash and Cash Equivalents |

|

15,954 |

|

|

|

15,490 |

|

|

|

12,605 |

|

| |

|

|

|

|

|

| Investment securities

available for sale, at fair value |

|

81,572 |

|

|

|

84,029 |

|

|

|

89,349 |

|

| Restricted equity

securities, at cost |

|

2,481 |

|

|

|

2,073 |

|

|

|

1,232 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Loans, net of deferred

fees and costs |

|

299,120 |

|

|

|

294,981 |

|

|

|

271,612 |

|

|

Less: Allowance for loan losses |

|

(2,541 |

) |

|

|

(2,455 |

) |

|

|

(2,589 |

) |

|

Loans, net |

|

296,579 |

|

|

|

292,526 |

|

|

|

269,023 |

|

| |

|

|

|

|

|

| Real estate acquired

through foreclosure |

|

705 |

|

|

|

705 |

|

|

|

114 |

|

| Premises and equipment,

net |

|

3,106 |

|

|

|

3,154 |

|

|

|

3,371 |

|

| Bank owned life

insurance |

|

7,860 |

|

|

|

7,818 |

|

|

|

8,713 |

|

| Deferred tax assets,

net |

|

1,392 |

|

|

|

2,863 |

|

|

|

2,429 |

|

| Accrued interest

receivable |

|

1,198 |

|

|

|

1,233 |

|

|

|

1,133 |

|

| Accrued taxes

receivable |

|

1,177 |

|

|

|

- |

|

|

|

465 |

|

| Prepaid expenses |

|

466 |

|

|

|

516 |

|

|

|

433 |

|

| Other assets |

|

556 |

|

|

|

958 |

|

|

|

583 |

|

|

Total Assets |

$ |

413,046 |

|

|

$ |

411,365 |

|

|

$ |

389,450 |

|

| |

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

| Noninterest-bearing

deposits |

$ |

101,369 |

|

|

$ |

107,921 |

|

|

$ |

104,017 |

|

| Interest-bearing

deposits |

|

221,084 |

|

|

|

228,926 |

|

|

|

230,221 |

|

| Total

Deposits |

|

322,453 |

|

|

|

336,847 |

|

|

|

334,238 |

|

| |

|

|

|

|

|

| Short-term

borrowings |

|

55,000 |

|

|

|

40,000 |

|

|

|

20,000 |

|

| Defined pension

liability |

|

285 |

|

|

|

323 |

|

|

|

335 |

|

| Accrued Taxes

Payable |

|

- |

|

|

|

102 |

|

|

|

- |

|

| Accrued expenses and

other liabilities |

|

1,257 |

|

|

|

749 |

|

|

|

835 |

|

|

Total Liabilities |

|

378,995 |

|

|

|

378,021 |

|

|

|

355,408 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| STOCKHOLDERS'

EQUITY |

|

|

|

|

|

|

|

|

|

|

|

| Common stock, par value

$1, authorized 15,000,000 shares, issued and outstanding

2,814,157, 2,810,961, and 2,801,149, shares as of December 31,

2018, September 30, 2018, and December 31, 2017, respectively. |

|

2,814 |

|

|

|

2,811 |

|

|

|

2,801 |

|

| Additional paid-in

capital |

|

10,401 |

|

|

|

10,368 |

|

|

|

10,267 |

|

| Retained earnings |

|

22,066 |

|

|

|

21,936 |

|

|

|

21,605 |

|

| Accumulated other

comprehensive loss |

|

(1,230 |

) |

|

|

(1,771 |

) |

|

|

(631 |

) |

|

Total Stockholders' Equity |

|

34,051 |

|

|

|

33,344 |

|

|

|

34,042 |

|

|

Total Liabilities and Stockholders' Equity |

$ |

413,046 |

|

|

$ |

411,365 |

|

|

$ |

389,450 |

|

| |

|

|

|

|

|

| GLEN BURNIE BANCORP AND SUBSIDIARIES |

|

|

| CONSOLIDATED STATEMENTS OF INCOME |

|

|

| (dollars in thousands, except per share amounts) |

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three Months

Ended December 31, |

|

Twelve Months

Ended December 31, |

| |

2018 (unaudited) |

|

2017 (unaudited) |

|

2018 (unaudited) |

|

2017 (audited) |

| INTEREST

INCOME |

|

|

|

|

|

|

|

| Interest and fees on

loans |

$ |

3,249 |

|

|

$ |

2,918 |

|

|

$ |

12,348 |

|

$ |

11,421 |

| Interest and dividends

on securities |

|

515 |

|

|

|

484 |

|

|

|

2,100 |

|

|

2,007 |

| Interest on deposits

with banks and federal funds sold |

|

80 |

|

|

|

64 |

|

|

|

245 |

|

|

179 |

| Total

Interest Income |

|

3,844 |

|

|

|

3,466 |

|

|

|

14,693 |

|

|

13,607 |

| |

|

|

|

|

|

|

|

| INTEREST

EXPENSE |

|

|

|

|

|

|

|

| Interest on

deposits |

|

352 |

|

|

|

316 |

|

|

|

1,348 |

|

|

1,300 |

| Interest on short-term

borrowings |

|

247 |

|

|

|

143 |

|

|

|

754 |

|

|

452 |

| Interest on long-term

borrowings |

|

- |

|

|

|

- |

|

|

|

- |

|

|

185 |

| Total

Interest Expense |

|

599 |

|

|

|

459 |

|

|

|

2,102 |

|

|

1,937 |

| |

|

|

|

|

|

|

|

| Net

Interest Income |

|

3,245 |

|

|

|

3,007 |

|

|

|

12,591 |

|

|

11,670 |

| Provision for loan

losses |

|

255 |

|

|

|

93 |

|

|

|

856 |

|

|

336 |

| Net

interest income after provision for loan losses |

|

2,990 |

|

|

|

2,914 |

|

|

|

11,735 |

|

|

11,334 |

| |

|

|

|

|

|

|

|

| NONINTEREST

INCOME |

|

|

|

|

|

|

|

| Service charges on

deposit accounts |

|

61 |

|

|

|

73 |

|

|

|

248 |

|

|

281 |

| Other fees and

commissions |

|

210 |

|

|

|

228 |

|

|

|

774 |

|

|

802 |

| Gains on redemption of

BOLI policies |

|

- |

|

|

|

- |

|

|

|

308 |

|

|

- |

| Gain on securities

sold |

|

- |

|

|

|

- |

|

|

|

- |

|

|

1 |

| Income on life

insurance |

|

42 |

|

|

|

48 |

|

|

|

172 |

|

|

199 |

| Gains on sale of

OREO |

|

- |

|

|

|

- |

|

|

|

15 |

|

|

- |

| Other income |

|

- |

|

|

|

- |

|

|

|

- |

|

|

2 |

| Total

Noninterest Income |

|

313 |

|

|

|

349 |

|

|

|

1,517 |

|

|

1,285 |

| |

|

|

|

|

|

|

|

| NONINTEREST

EXPENSE |

|

|

|

|

|

|

|

| Salary and employee

benefits |

|

1,513 |

|

|

|

1,550 |

|

|

|

6,593 |

|

|

6,165 |

| Occupancy and equipment

expenses |

|

320 |

|

|

|

315 |

|

|

|

1,170 |

|

|

1,180 |

| Legal, accounting and

other professional fees |

|

196 |

|

|

|

220 |

|

|

|

917 |

|

|

780 |

| Data processing and

item processing services |

|

160 |

|

|

|

132 |

|

|

|

614 |

|

|

574 |

| FDIC insurance

costs |

|

127 |

|

|

|

63 |

|

|

|

314 |

|

|

251 |

| Advertising and

marketing related expenses |

|

39 |

|

|

|

52 |

|

|

|

104 |

|

|

162 |

| Loan collection

costs |

|

(8 |

) |

|

|

5 |

|

|

|

145 |

|

|

78 |

| Telephone costs |

|

73 |

|

|

|

64 |

|

|

|

253 |

|

|

276 |

| Other expenses |

|

518 |

|

|

|

296 |

|

|

|

1,429 |

|

|

1,329 |

| Total

Noninterest Expenses |

|

2,938 |

|

|

|

2,697 |

|

|

|

11,539 |

|

|

10,795 |

| |

|

|

|

|

|

|

|

| Income before income

taxes |

|

365 |

|

|

|

566 |

|

|

|

1,713 |

|

|

1,824 |

| Income tax expense |

|

58 |

|

|

|

719 |

|

|

|

130 |

|

|

913 |

| |

|

|

|

|

|

|

|

|

NET INCOME (LOSS) |

$ |

307 |

|

|

$ |

(153 |

) |

|

$ |

1,583 |

|

$ |

911 |

| |

|

|

|

|

|

|

|

| Basic and

diluted net income

(loss) per share of common

stock |

$ |

0.11 |

|

|

$ |

(0.05 |

) |

|

$ |

0.56 |

|

$ |

0.33 |

| |

|

|

|

|

|

|

|

|

GLEN BURNIE BANCORP AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS'

EQUITY |

|

For the year ended December, 2018 (unaudited) and

2017 |

| (dollars

in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Accumulated |

|

|

| |

|

|

|

|

|

|

Other |

|

|

| |

|

|

Additional |

|

|

|

Comprehensive |

|

Total |

| |

Common |

|

Paid-in |

|

Retained |

|

(Loss) |

|

Stockholders' |

| |

Stock |

|

Capital |

|

Earnings |

|

Income |

|

Equity |

| Balance,

December 31, 2016 |

$ |

2,787 |

|

$ |

10,130 |

|

$ |

21,707 |

|

|

$ |

(810 |

) |

|

$ |

33,814 |

|

| |

|

|

|

|

|

|

|

|

|

| Net income |

|

- |

|

|

- |

|

|

911 |

|

|

|

- |

|

|

|

911 |

|

| Cash dividends, $0.30

per share |

|

- |

|

|

- |

|

|

(1,117 |

) |

|

|

- |

|

|

|

(1,117 |

) |

| Dividends reinvested

under dividend reinvestment plan |

|

14 |

|

|

137 |

|

|

- |

|

|

|

- |

|

|

|

151 |

|

|

Reclassification adjustment for stranded income tax effects in

accumulated other comprehensive income stranded income tax

effects in accumulated other comprehensive income |

|

|

|

|

|

104 |

|

|

|

(104 |

) |

|

|

| Other comprehensive

income |

|

- |

|

|

- |

|

|

- |

|

|

|

283 |

|

|

|

283 |

|

| Balance,

December 31, 2017 |

$ |

2,801 |

|

$ |

10,267 |

|

$ |

21,605 |

|

|

$ |

(631 |

) |

|

$ |

34,042 |

|

| |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Accumulated |

|

|

| |

|

|

Additional |

|

|

|

Other |

|

Total |

| |

Common |

|

Paid-in |

|

Retained |

|

Comprehensive |

|

Stockholders' |

| |

Stock |

|

Capital |

|

Earnings |

|

(Loss) |

|

Equity |

| Balance,

December 31, 2017 |

$ |

2,801 |

|

$ |

10,267 |

|

$ |

21,605 |

|

|

$ |

(631 |

) |

|

$ |

34,042 |

|

| |

|

|

|

|

|

|

|

|

|

| Net income |

|

- |

|

|

- |

|

|

1,583 |

|

|

|

- |

|

|

|

1,583 |

|

| Cash dividends, $0.40

per share |

|

- |

|

|

- |

|

|

(1,122 |

) |

|

|

- |

|

|

|

(1,122 |

) |

| Dividends reinvested

under dividend reinvestment plan |

|

13 |

|

|

134 |

|

|

- |

|

|

|

- |

|

|

|

147 |

|

| Other comprehensive

loss |

|

- |

|

|

- |

|

|

- |

|

|

|

(599 |

) |

|

|

(599 |

) |

| Balance,

December 31, 2018 |

$ |

2,814 |

|

$ |

10,401 |

|

$ |

22,066 |

|

|

$ |

(1,230 |

) |

|

$ |

34,051 |

|

|

|

| THE

BANK OF GLEN BURNIE |

|

|

|

|

|

|

|

|

| CAPITAL

RATIOS |

|

|

|

|

|

|

|

|

|

|

|

| (dollars in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

To Be Well |

| |

|

|

|

|

|

|

|

|

|

Capitalized Under |

| |

|

|

|

|

|

To Be Considered |

|

|

Prompt Corrective |

| |

|

|

|

|

|

Adequately

Capitalized |

|

|

Action Provisions |

| |

Amount |

Ratio |

|

Amount |

Ratio |

|

Amount |

Ratio |

| As of December

31, 2018: |

|

|

|

|

|

|

|

|

|

|

|

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| Common Equity Tier 1

Capital |

$ |

34,778 |

12.27 |

% |

|

$ |

12,757 |

4.50 |

% |

|

$ |

18,427 |

6.50 |

% |

| Total Risk-Based

Capital |

$ |

37,354 |

13.18 |

% |

|

$ |

22,679 |

8.00 |

% |

|

$ |

28,349 |

10.00 |

% |

| Tier 1 Risk-Based

Capital |

$ |

34,778 |

12.27 |

% |

|

$ |

17,009 |

6.00 |

% |

|

$ |

22,679 |

8.00 |

% |

| Tier 1

Leverage |

$ |

34,778 |

8.52 |

% |

|

$ |

16,330 |

4.00 |

% |

|

$ |

20,413 |

5.00 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| As of September

30, 2018: |

|

|

|

|

|

|

|

|

|

|

|

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| Common Equity Tier 1

Capital |

$ |

32,781 |

11.75 |

% |

|

$ |

12,551 |

4.50 |

% |

|

$ |

18,130 |

6.50 |

% |

| Total Risk-Based

Capital |

$ |

35,260 |

12.64 |

% |

|

$ |

22,313 |

8.00 |

% |

|

$ |

27,892 |

10.00 |

% |

| Tier 1 Risk-Based

Capital |

$ |

32,781 |

11.75 |

% |

|

$ |

16,735 |

6.00 |

% |

|

$ |

22,313 |

8.00 |

% |

| Tier 1

Leverage |

$ |

32,781 |

8.08 |

% |

|

$ |

16,230 |

4.00 |

% |

|

$ |

20,287 |

5.00 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| As of December

31, 2017: |

|

|

|

|

|

|

|

|

|

|

|

| (audited) |

|

|

|

|

|

|

|

|

|

|

|

| Common Equity Tier 1

Capital |

$ |

32,944 |

12.83 |

% |

|

$ |

11,552 |

4.50 |

% |

|

$ |

16,686 |

6.50 |

% |

| Total Risk-Based

Capital |

$ |

35,541 |

13.84 |

% |

|

$ |

20,537 |

8.00 |

% |

|

$ |

25,671 |

10.00 |

% |

| Tier 1 Risk-Based

Capital |

$ |

32,944 |

12.83 |

% |

|

$ |

15,403 |

6.00 |

% |

|

$ |

20,537 |

8.00 |

% |

| Tier 1

Leverage |

$ |

32,928 |

8.43 |

% |

|

$ |

15,617 |

4.00 |

% |

|

$ |

19,521 |

5.00 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

GLEN BURNIE BANCORP AND SUBSIDIARIES |

|

SELECTED FINANCIAL DATA |

| (dollars in thousands, except per share amounts) |

| |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

| |

|

2018 |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(audited) |

| |

|

|

|

|

|

|

|

|

|

|

| Financial

Data |

|

|

|

|

|

|

|

|

|

|

| Assets |

|

$ |

413,046 |

|

|

$ |

411,365 |

|

|

$ |

389,450 |

|

|

$ |

413,046 |

|

|

$ |

389,450 |

|

| Investment

securities |

|

|

81,572 |

|

|

|

84,029 |

|

|

|

89,349 |

|

|

|

81,572 |

|

|

|

89,349 |

|

| Loans, (net of deferred

fees & costs) |

|

|

299,120 |

|

|

|

294,981 |

|

|

|

271,612 |

|

|

|

299,120 |

|

|

|

271,612 |

|

| Allowance for loan

losses |

|

|

2,541 |

|

|

|

2,455 |

|

|

|

2,589 |

|

|

|

2,541 |

|

|

|

2,589 |

|

| Deposits |

|

|

322,453 |

|

|

|

336,847 |

|

|

|

334,238 |

|

|

|

322,453 |

|

|

|

334,238 |

|

| Borrowings |

|

|

55,000 |

|

|

|

40,000 |

|

|

|

20,000 |

|

|

|

55,000 |

|

|

|

20,000 |

|

| Stockholders'

equity |

|

|

34,051 |

|

|

|

33,344 |

|

|

|

34,042 |

|

|

|

34,051 |

|

|

|

34,042 |

|

| Net income |

|

|

307 |

|

|

|

542 |

|

|

|

(153 |

) |

|

|

1,583 |

|

|

|

911 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Average

Balances |

|

|

|

|

|

|

|

|

|

|

| Assets |

|

$ |

408,958 |

|

|

$ |

407,660 |

|

|

$ |

391,254 |

|

|

$ |

400,930 |

|

|

$ |

392,363 |

|

| Investment

securities |

|

|

85,055 |

|

|

|

88,611 |

|

|

|

90,084 |

|

|

|

89,351 |

|

|

|

91,634 |

|

| Loans, (net of deferred

fees & costs) |

|

|

297,791 |

|

|

|

293,949 |

|

|

|

270,402 |

|

|

|

286,702 |

|

|

|

269,600 |

|

| Deposits |

|

|

332,284 |

|

|

|

338,412 |

|

|

|

335,312 |

|

|

|

335,167 |

|

|

|

335,805 |

|

| Borrowings |

|

|

42,748 |

|

|

|

34,487 |

|

|

|

20,501 |

|

|

|

31,595 |

|

|

|

21,458 |

|

| Stockholders'

equity |

|

|

32,580 |

|

|

|

33,831 |

|

|

|

34,638 |

|

|

|

33,392 |

|

|

|

34,322 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Performance

Ratios |

|

|

|

|

|

|

|

|

|

|

| Annualized return on

average assets |

|

|

0.30 |

% |

|

|

0.54 |

% |

|

|

-0.16 |

% |

|

|

0.39 |

% |

|

|

0.23 |

% |

| Annualized return on

average equity |

|

|

3.74 |

% |

|

|

6.50 |

% |

|

|

-1.75 |

% |

|

|

4.74 |

% |

|

|

2.65 |

% |

| Net interest

margin |

|

|

3.26 |

% |

|

|

3.34 |

% |

|

|

3.20 |

% |

|

|

3.26 |

% |

|

|

3.12 |

% |

| Dividend payout

ratio |

|

|

91 |

% |

|

|

52 |

% |

|

|

-183 |

% |

|

|

71 |

% |

|

|

123 |

% |

| Book value per

share |

|

$ |

12.10 |

|

|

$ |

11.86 |

|

|

$ |

12.15 |

|

|

$ |

12.10 |

|

|

$ |

12.15 |

|

| Basic and

diluted net income per share |

|

0.11 |

|

|

|

0.19 |

|

|

|

(0.05 |

) |

|

|

0.56 |

|

|

|

0.33 |

|

| Cash dividends declared

per share |

|

|

0.10 |

|

|

|

0.10 |

|

|

|

0.10 |

|

|

|

0.40 |

|

|

|

0.40 |

|

| Basic and diluted

weighted average shares outstanding |

|

|

2,813,045 |

|

|

|

2,809,834 |

|

|

|

2,799,832 |

|

|

|

2,808,031 |

|

|

|

2,794,381 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Asset Quality

Ratios |

|

|

|

|

|

|

|

|

|

|

| Allowance for loan

losses to loans |

|

|

0.85 |

% |

|

|

0.83 |

% |

|

|

0.95 |

% |

|

|

0.85 |

% |

|

|

0.95 |

% |

| Nonperforming loans to

avg. loans |

|

|

0.73 |

% |

|

|

0.82 |

% |

|

|

1.32 |

% |

|

|

0.76 |

% |

|

|

1.32 |

% |

| Allowance for loan

losses to nonaccrual & 90+ past due loans |

|

|

128.7 |

% |

|

|

112.1 |

% |

|

|

77.7 |

% |

|

|

128.7 |

% |

|

|

77.7 |

% |

| Net

charge-offs annualize to avg. loans |

|

0.23 |

% |

|

|

0.10 |

% |

|

|

0.19 |

% |

|

|

0.32 |

% |

|

|

0.09 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Capital

Ratios |

|

|

|

|

|

|

|

|

|

|

| Common Equity Tier 1

Capital |

|

|

12.27 |

% |

|

|

11.75 |

% |

|

|

12.83 |

% |

|

|

12.27 |

% |

|

|

12.83 |

% |

| Tier 1 Risk-based

Capital Ratio |

|

|

12.27 |

% |

|

|

11.75 |

% |

|

|

12.83 |

% |

|

|

12.27 |

% |

|

|

12.83 |

% |

| Leverage Ratio |

|

|

8.52 |

% |

|

|

8.08 |

% |

|

|

8.43 |

% |

|

|

8.52 |

% |

|

|

8.43 |

% |

| Total Risk-Based

Capital Ratio |

|

|

13.18 |

% |

|

|

12.64 |

% |

|

|

13.84 |

% |

|

|

13.18 |

% |

|

|

13.84 |

% |

| |

|

|

|

|

|

|

|

|

|

|

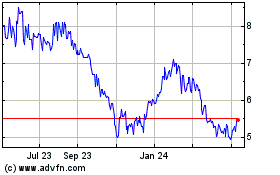

Glen Burnie Bancorp (NASDAQ:GLBZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

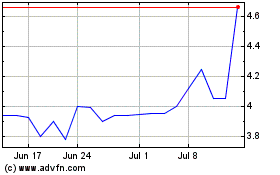

Glen Burnie Bancorp (NASDAQ:GLBZ)

Historical Stock Chart

From Apr 2023 to Apr 2024