Filed by Comtech Telecommunications Corp.

Commission File No.: 000-07928

Pursuant to Rule 425 under the Securities

Act of 1933

Subject Company: Gilat Satellite Networks

Ltd.

Commission File No.: 000-21218

Date: January 30, 2020

The following is a

transcript of a conference call held on January 29, 2020 relating to the announcement of a proposed merger between Comtech Telecommunications

Corp. (“Comtech”) and Gilat Satellite Networks Ltd. (“Gilat”).

C O R P O R A T E P A R T I C I P A N T S

Dov

Baharav Gilat Satellite Networks Ltd. - Chairman of the Board

Fred

Kornberg Comtech Telecommunications Corp. - Chairman & CEO

Jason DiLorenzo

Comtech Telecommunications Corp. - VP of Tax

Michael A. Bondi

Comtech Telecommunications Corp. - CFO

Michael D. Porcelain

Comtech Telecommunications Corp. - President & COO

C O N F E R E N C E C A L L P A R T I C I P A N T S

Joseph Anthony

Gomes NOBLE Capital Markets, Inc., Research Division - Senior Generalist Analyst

Michael James

Latimore Northland Capital Markets, Research Division - MD & Senior Research Analyst

P R E S E N T A T I O N

Operator

Welcome to Comtech Telecommunication

Corp.'s Special Acquisition Conference Call. (Operator Instructions) As a reminder, this conference is being recorded, Wednesday,

January 29, 2020. I would now like to turn the conference over to Mr. Jason DiLorenzo of Comtech Communications. Please go ahead.

Jason DiLorenzo - Comtech Telecommunications

Corp. - VP of Tax

Thank you. Welcome to Comtech Telecommunication

Corp.'s Special Conference Call relating to our announcement earlier this morning of our agreement to acquire Gilat Satellite

Networks Ltd. A press release and investor presentation relating to this announcement has been posted on our website at www.comtechtel.com.

In addition, the company has posted a question-and-answer

document on its website and has filed these documents with the SEC this morning. With us on the call this morning are Fred Kornberg,

Chairman of the Board and Chief Executive Officer of Comtech; Michael D. Porcelain, President and Chief Operating Officer of Comtech;

and Michael Bondi, Comtech's Chief Financial Officer.

Also dialing in from Israel is the Chairman

of the Board of Gilat, Dov Baharav. Before we proceed, I must inform you that today's conference call is neither an offering of

securities nor a solicitation of a proxy vote. The information discussed today is qualified in its entirety by the registration

statement and proxy statement, and prospectus that Comtech and Gilat will be filing in the future. And Comtech's and Gilat's stockholders

are urged to read these filings carefully.

Today's discussion includes forward-looking

information. Actual outcomes and results may differ materially from those projected. You should refer to information contained

in the SEC filings of both Comtech and Gilat concerning factors that could cause future results to differ from the forward-looking

information.

Additionally, the

information we will discuss today contains certain financial measures that exclude amounts or are subject to adjustments that

have the effect of excluding amounts, that are included in the most directly comparable measure prepared in accordance with GAAP.

For reconciliation to the most comparable measures presented in accordance with GAAP, please refer to the table at the end of

our investor presentation available on our website and included as an exhibit to our Form 8-K filed today.

I am pleased now

to introduce the Chairman of the Board and Chief Executive Officer of Comtech, Fred Kornberg. Fred?

Fred Kornberg - Comtech Telecommunications

Corp. - Chairman & CEO

Thank you, Jason, and good morning,

everyone, and thank you for joining us on this call. As you can see by our press release this morning, I'm pleased to

announce that Comtech has agreed to acquire Gilat in a cash and stock transaction for $10.25. Let me give you some background

on Gilat for those not familiar with the company.

Founded in 1987 and headquartered in Israel,

Gilat is a worldwide leader in satellite networking technology, solutions and services, with a market-leading position in the

satellite ground station and also in the in-flight connectivity solutions markets. Gilat is a well-known for high-performance

TDMA-based satellite modems and next-generation solid-state amplifiers.

Gilat is also an exceptional business that

has developed extraordinary technology and has a well-respected product portfolio, supported by strong research and development

capabilities. This is why I am so truly excited to have reached this agreement with Gilat, and I believe this combination is beneficial

to the stakeholders of both companies.

Clearly, as we will discuss on this call,

this transaction has compelling financial and business rationale. In simple terms, the acquisition better positions Comtech to

take advantage of key marketplace trends, in particular, the growing demand for satellite connectivity and the enormous long-term

opportunity set that is emerging in a secure wireless communications market.

I believe that the combination of accelerating

satellite connectivity demand and increasing availability of low-cost satellite bandwidth makes this a perfect time to unify Comtech

and Gilat's solutions. It will allow us to offer our combined customers, best-in-class platform agnostic, satellite ground station

technologies, such as SCPC and TDMA.

I will make some additional remarks

about this important acquisition toward the end of this conference call. But for now, I would like to turn the call over to

the Chairman of the Chairman of Gilat, Mr. Dov Baharav, who would like to provide his comments and his views of the

transaction. Dov?

Dov Baharav - Gilat Satellite Networks

Ltd. - Chairman of the Board

Thank you, Fred, and good morning to

you. I'm very pleased to speak about the very exciting news that we announced earlier today. Like Fred, I will keep my

remarks brief as the press release and investor presentation provides a lot of information about this existing

combination.

I too believe this is a major step forward

for both Comtech and Gilat, as our combination will create a true leader in the rapidly changing global satellite connectivity

market. On a stand-alone basis, Gilat has over 1.5 TDMA VSAT satellite modems. In fact, Gilat estimates that there are over 500

networks operating today using Gilat modem, many of them, the most powerful and critical satellite networks in the world.

Together with Comtech, we can do more. This

transaction brings together 2 companies with highly aligned vision of the future, allowing the combined company to address the

complete range of customer needs for advanced satellite communication technology.

The Gilat Board of Directors and

Management believe this highly strategic combination is compelling. It is an excellent outcome for our shareholders, who

receive both cash and an equity interest in a strong company with a broader range of products and benefits of combined

expertise and resources that is well positioned to create future value against a highly favorable industry backdrop.

Gilat's very

large established commercial international customer installed base, offers vastly expanded opportunity for selling the full

range of current and future combined company solutions.

Additionally, Comtech's key U.S. DoD

customer relationships, including the U.S. Army, Marines and Navy, will benefit from improved access to Gilat's innovative

products such as our portfolio of modems, amplifier and communication on-the-move antennas. I have been following closely,

Comtech's highly appreciated technology leadership, and I firmly believe that both Comtech and Gilat employees will have

expanded opportunities for career development. No doubt, there is great opportunity ahead of Comtech and Gilat and all of our

stakeholders.

Comtech's intent to leverage Gilat's success

and achievement over the past several years in the satellite communications industry, including leadership position in the in-flight

connectivity and cellular backhaul, this will propel the combined companies to new levels of growth.

Under the leadership of Gilat's highly appreciated

management employees, Gilat will continue to support its customer with stronger capabilities from its headquarters in Israel under

the Gilat brand. In conclusion, this is an exciting opportunity and a win-win for everyone.

Now let me turn the call over to Mike Porcelain,

Comtech's President and Chief Operating Officer. Mike?

Michael D. Porcelain - Comtech Telecommunications

Corp. - President & COO

Thank you, Dov. Before I discuss the significant

strategic benefits of the transaction, I must take a moment and say thanks to the many Comtech and Gilat employees, who collaboratively

worked on making this deal happen. And for our new friends in Israel, Peru, Moldavia, Bulgaria and even California and elsewhere

around the world, I do say Shalom. Clearly, the acquisition and due diligence process was a great way to learn about each other's

company and cultures. And I think we are a perfect match. There are many strategic benefits to both Comtech and Gilat. Let me

walk through some of them.

First, the acquisition will drive Comtech's

global market access by creating a world leader with combined annual pro forma sales approaching nearly $1 billion. Second, it

will strengthen our position as a leading supplier of advanced communication solutions. We believe we will be uniquely capable

of servicing the expanding need for ground infrastructure to support both existing and emerging satellite networks. Third, the

acquisition will greatly expand Comtech's product portfolio with highly complementary technologies, including Gilat's, high-performance

TDMA-based satellite modems and Gilat's next-generation solid-state amplifiers. Fourth, the acquisition will broaden Comtech's

leadership position in the rapidly growing in-flight connectivity and cellular backhaul markets, which are expected to expand

given the availability of lower cost bandwidth and the adoption of satellite technologies into the 5G cellular backhaul ecosystem.

Fifth, the acquisition will bolster our world-class research and development capabilities, enabling both Comtech and Gilat to

offer customers more complete end-to-end technology solutions.

Sixth, we believe the acquisition will

allow us to accelerate shareholder value creation by contributing to our ongoing strategy to move towards higher-margin

solutions and by increasing customer diversification geographically and by market.

In addition, the acquisition potentially

offers shareholders increased liquidity for existing and new Comtech shareholders. Comtech also plans to pursue with dual listing

on the Nasdaq and Tel Aviv Stock Exchange to become effective upon the closing.

In addition to the strategic benefits I just

summarized, and as Mike Bondi will discuss, the acquisition has some clear financial benefits, including being cash accretive

in the first 12 months after close, after excluding our acquisition plan expenses.

Let me provide you with some background

on why both companies thought this marriage made sense. As many of you read about on the Internet, the satellite industry is

undergoing many changes. There is an accelerating growth in the supply of low-cost bandwidth. Like any technology, the lower

the cost, generally the more people can afford to use it. And in this case, we believe they will.

This growth in demand dynamic provides the

foundation for new applications, such as in-flight connectivity, satellite wireless backhaul over 5G and new C4ISR applications

for the U.S. government and other military commands around the world.

These growth factors provide an

excellent backdrop and an easy-to-understand reason why this was the right time to expand Comtech's satellite technology

leadership position.

As a combined company, I believe, over

time and with careful planning and execution, we could exploit this inflection point that the satellite industry is going

through.

In order to do this, Comtech felt we

needed to scale. Let me give you some examples of why. One example is on planes, no doubt, high-speed in-flight connectivity

is fast becoming a necessity for travelers and imperative for airlines. Free or more access to Wi-Fi, we believe, will drive

more demand for equipment by large international aeroplane companies.

The acquisition of Gilat adds to Comtech

a leading position in the IFEC market with end-to-end solutions and strong relationships with leading players in the

industry. Gilat has strong relationship with customers, including Gogo, Honeywell and Global Eagle.

Together, Comtech and Gilat will be able

to offer these customers and others more integrated solutions with increased capacity and processing to meet travelers' needs

for wireless connectivity on the plane.

Another example of the reason to scale is

the rapid change occurring in the mobile cellular industry. There is simply a massive increase in mobile phones on a worldwide

basis and new technologies that is driving new demand for satellite backhaul. Different parts of the world have different needs.

Some areas still use 3G and are upgrading to 4G and some 5G. As most everyone knows, the expected growth in 5G will revolutionize

mobile wireless communications, and we are all firm believers here.

As applications become more critical,

whether it be the need to connect to self-driving automobiles or sending 4K video to operating rooms in remote areas of the

world, satellite connectivity will play a role. Given the expected launch of new high-speed satellites, including LEO and MEO

satellites, this vision, we believe, will soon become a reality.

The acquisition of Gilat allows us to

meet the needs of mobile operators, many of which are rapidly adopting these technologies. So they, in turn, can meet their

own end customer needs. In order to do so, they need to use satellite cellular backhaul. In many cases, satellite backhaul is

cheaper than fiber, and this trend is expected to increase.

In order to address this need, the acquisition

of Gilat adds a more complete set of satellite backhaul capabilities to Comtech, including providing cellular managed services.

Things are the same on the military side of the business. We see lots of growth potential. Emerging threats of electronic warfare

and demand for high-bandwidth battlefield communications are driving increased focus on military communications. Here, Comtech

has a lot of relationships, and we believe that we can help Gilat greatly expand sales to the U.S. military. To date, it has sold

virtually nothing to the U.S. government, and we expect to change this.

Once this acquisition closes, Gilat will

be able to leverage Comtech's strong relationships with military customers. And we believe, over time, we will actually see

revenue synergies, something you rarely see when 2 companies combine.

Let me now provide some commentary on

what we expect to do when the transaction closes. Post closing, Gilat will become a wholly-owned subsidiary. Gilat will

maintain its corporate headquarters and research and development facility in Israel, under the leadership of its current

management. In fact, no Comtech or Gilat facility is expected to be closed as a result of the transaction. And each key

business area, both by Comtech and Gilat, is expected to be led by existing proven leadership. Unlike some mergers, which are

about immediate cost reductions and slashing headcount, this one is not. In fact, we are only expecting $2 million of

conservative cost synergies only from public company costs.

Both companies' talented global

workforces are expected to remain in place and focus intently on meeting all customer commitments and expectations, including

supporting all existing products, services and agreements.

It is one of the reasons why we do not expect

any Comtech or Gilat facility locations to close. Keeping local facilities is important to us. Gilat's global footprint adds a

significant physical presence in key markets for Comtech, where we do not have them today. This increased presence addresses a

growing need for local touch points that could offer integrated secure connectivity solutions, including public safety and location

solutions sold by Comtech today.

Looking forward,

several years out, Comtech believes it will emphasize and capture growth opportunities from these large favorable market trends.

Together with its previously announced pending acquisition of UHP Networks, Comtech believes it will be uniquely positioned to

take advantage of these important trends. All in all, I am truly excited about this Gilat acquisition, and I look forward to working

hand-in-hand with everyone to make this a success.

Now let me turn it over to Mike Bondi.

Michael A. Bondi - Comtech Telecommunications

Corp. - CFO

Thanks, Mike. Before going into some of

the financials, I want to briefly touch upon a few key terms of the transaction. Gilat shareholders will receive total

consideration of $10.25 per share, comprised of $7.18 per share in cash and 0.08425 of a share of Comtech common stock for

each share of Gilat held. When the transaction is closed, Gilat's shareholders will own approximately 16.1% of the combined

company.

As of September 30, 2019, Gilat had

approximately $53.1 million of unrestricted cash and cash equivalents with debt of approximately $8.2 million. So when you

run the calculation using those numbers, the transaction had an enterprise value of $532.5 million.

The transaction had an equity value of

approximately $577 million. As of October 31, 2019, Comtech had approximately $46.9 million of cash and cash equivalents and

debt of approximately $169 million. Comtech expects to fund the acquisition and related transaction costs by redeploying a

portion of the $100 million of pro forma combined cash and cash equivalents, plus additional cash expected to be generated

prior to closing, and by drawing on a new $800 million secured credit facility to be provided by major banking partners.

Comtech expects that the cash interest rate

on this facility will approximate 4% to 5% on an annual basis before origination fees.

Furthermore, Comtech expects the terms

of the facility will be based on a net leverage ratio, providing significant flexibility. The exact terms of the credit

facility will be finalized at or prior to the closing of the acquisition.

Given that 30% of the equity value would

be paid in stock, it leaves Comtech with a pretty strong post-merger balance sheet. In fact, we estimate that on a pro forma basis,

including preliminary estimated combined acquisition plan expenses of approximately $27 million, the assumed repayment of Gilat

bank debt and funding of Comtech's other pending acquisitions, Comtech would have approximately $45 million of unrestricted cash

at closing, with total net debt of approximately $500 million or net leverage approximating 3.85x. Total net debt is expected

to decrease quickly and significantly. Based on expected strong cash flows to be generated from the combined businesses, net leverage

12 months after closing is expected to decrease to approximately 3x.

Importantly, Comtech expects that it will

maintain its annual targeted dividend of $0.40 per share per year.

Let me give you some perspective on my

numbers. Although it is too early to tell exactly when the transaction will close and the ultimate impact of fiscal 2020 or

fiscal 2021, we provided you a sense of what last year would have looked like on a combined basis.

Based on Comtech's fiscal year 2019

actual results and Gilat's trailing 12-month results through June 30, 2019, on a pro forma basis, Comtech would have reported

approximately $926.1 million of revenue with adjusted EBITDA, a non-GAAP measure, of approximately $130.2 million.

If you think forward, Gilat announced on

November 19, 2019, that it expects to achieve sales of between $260 million and $270 million, with adjusted EBITDA ranging from

$38 million to $42 million for its fiscal year ended December 31, 2019. Comtech announced on December 4, 2019, that we expect

to achieve sales of between $712 million and $732 million, with adjusted EBITDA ranging from $99 million to $103 million for our

fiscal year ending July 31, 2020. Adding midpoints together, you get around $141 million of pro forma adjusted EBITDA.

Now one thing I do want to point out is

that Gilat does have a large infrastructure business based in Peru. It does around $50 million-or-so of revenue, and it

accounts for its revenue over time or what used to be called percentage of completion accounting.

Gilat's large infrastructure projects do

have low margins as compared to the rest of the business and its business is lumpy and often uneven. As such, I would tell you

to think about revenues and adjusted EBITDA on an annual basis for the first year of ownership to be no higher than the midpoint

of Gilat's last published guidance for sales and adjusted EBITDA. Additionally, as Mike mentioned, we do believe that Gilat can

be a catalyst for increased operating efficiencies and improved margins on a consolidated basis.

For example, when looking at Gilat's

trailing 12-month results through June 30, 2019, they have slightly higher margins than we do. With careful planning and

execution, we intend to make it a focus to improve our consolidated margins from where they are today. Although we are not

setting any specific targets, I do think we will be successful.

Finally, once the transaction closes,

Comtech will provide combined revenue, adjusted EBITDA and diluted earnings per share guidance in a future announcement. Now

let me turn it back over to Fred for his closing remarks. Fred?

Fred Kornberg - Comtech Telecommunications

Corp. - Chairman & CEO

Thank you, Mike. As I mentioned

previously, I'm very pleased about the Gilat acquisition. Fiscal 2020 is expected to be another terrific year for Comtech.

And with this great acquisition, I'm confident that we are looking at sustained growth for years to come.

I continue to have lots of optimism, and

I also believe we will create value for our shareholders in the long term. I believe that in an environment of increasing

market demand for global voice, video and data usage, customers will increasingly turn to Comtech to fulfill their needs for

secure wireless communications.

Before starting the question-and-answer

part of our conference call, I just want to say congratulations to Mike Porcelain, who earlier today was promoted to

President of Comtech. I believe Mike is abundantly qualified to assume his role, and the Gilat acquisition seemed to be the

perfect time to make this effective.

In conclusion, I and our Board of Directors

believe this is a transformational and highly strategic acquisition for Comtech. And the future looks very, very bright.

Now I'd like to proceed to the question-and-answer

part of our conference call. Operator?

Q U E S T I O N S A N D A N S W E R S

Operator

(Operator Instructions)

Our first question will come from Joe Gomes

with NOBLE Capital. Please go ahead.

Joseph Anthony Gomes - NOBLE Capital

Markets, Inc., Research Division - Senior Generalist Analyst

Good morning and congratulations on the deal,

and congratulations to Mike on today's promotion.

Michael D. Porcelain - Comtech Telecommunications

Corp. - President & COO

Thank you, Joe.

Joseph Anthony Gomes - NOBLE Capital

Markets, Inc., Research Division - Senior Generalist Analyst

Just from a

start, wondering if you could give us a little color about how the deal came about? Were you guys looking at Gilat over time?

Was Gilat shopping itself? Just kind of some more color as to how you 2 came together.

Fred Kornberg - Comtech Telecommunications

Corp. - Chairman & CEO

Sure. I think we've

known Gilat, I guess, probably from inception in whatever it was in 1987. So it's been a long, long time that we've known about

Gilat, as I'm sure that the Gilat has known about Comtech. We're competitors in a few areas, but mostly we're not really competitors.

We do products such as modems, but we do them in different market areas. We solve the same solutions, but in different ways. Our

strength and our dominant position has always been single channel per carrier, which is SCPC, and Gilat's position has always

been TDMA. We've never had that capability. So we now will have a complete product capability, not only in -- single channel per

carrier business, but also in the time-division multiplex area.

So yes, we've known

Gilat for a long time. We're also in the IFEC business, as is Gilat. Gilat produces modems for the IFEC area, and we produce amplifiers.

So a lot of overlap, a lot of combination, a lot of added product line to the company, I think, makes for an overall very successful

company going forward and being able to offer our combined products to their customers and our customers.

Joseph Anthony

Gomes - NOBLE Capital Markets, Inc., Research Division - Senior Generalist Analyst

Okay. And with this

today's announcement, not only of Gilat, but also of the CGC, and the other deals that you guys have announced recently, do you

now have a complete portfolio in your products to take full advantage of the market trend you guys talked about? Or are there

other, for lack of a better term, holes in the product portfolio that you'll still be looking to fill?

Fred Kornberg

- Comtech Telecommunications Corp. - Chairman & CEO

I think with

Gilat and UHP, I think we have covered, what -- I don't want to call it holes, but our product line area for time-division

multiplex type of products. So I think between Gilat's expertise and UHP's expertise, I think we're well covered to attack

that market, which we have not been able to do previously. As far as the antenna capability, the antenna capability is a

satellite motion -- in motion type of antenna capability. It is different than the antenna capability that Gilat has, which

is more of the electronic steering capability. So I think that too is very complementary to our portfolio now of offering

complete systems and products to our customers. I hope that answers your question.

Operator

We will take our next question from Mike Latimore

with Northland Capital Markets. Please go ahead.

Michael James

Latimore - Northland Capital Markets, Research Division - MD & Senior Research Analyst

Thanks a lot and

congratulations as well. I guess, just in terms of Gilat, do they have any customers that are relatively big, they were 10% or

20% of revenue?

Michael D. Porcelain

- Comtech Telecommunications Corp. - President & COO

There's a few customers

out there, and Mike had mentioned one of them. They have some large projects in Peru, which you could kind of think about that

is similar to the way we view the U.S. government, right? It's the government of Peru and it's provided through a third party,

but the end customer there is the Peruvian government, in different regions, if you will. Gilat does have a strong relationship

with Gogo and Honeywell. As you know, they recently just put out an announcement related to their electronic steerable antenna.

And other than that, I can't really say too much more, but those would be the key customers that they do have.

Michael James Latimore - Northland

Capital Markets, Research Division - MD & Senior Research Analyst

Sure. And just a basic question here. When

do you think this will close?

Michael D. Porcelain - Comtech Telecommunications

Corp. - President & COO

We're thinking that the transaction

would close pretty quickly, by our Q4 of 2020. But depending on how the process goes, there are some normal type things, and

maybe it slips into the first half, Q1, Q2 of next year. But we'll get a sense soon, and we'll update you as we learn.

Michael James Latimore - Northland

Capital Markets, Research Division - MD & Senior Research Analyst

Got it. And it sounds like there's not

much product overlap. So I guess, are there any products that Comtech won't sell anymore or Gilat won't sell anymore because

of this acquisition? Or is it -- you're really distinct there?

Fred Kornberg - Comtech Telecommunications

Corp. - Chairman & CEO

No. I think there's enough overlap and difference

in our products that there will be no -- let's say, no ending of any product line for either company.

Michael James Latimore - Northland

Capital Markets, Research Division - MD & Senior Research Analyst

Okay. Got it. And does Gilat have any recurring

revenue? Services revenue?

Michael D. Porcelain - Comtech Telecommunications

Corp. - President & COO

Yes. There's a few spots they do. I

mean, Gilat is in the managed cellular backhaul services, and so they do have multiyear contracts with mobile operators. And

they actually do it in the United States, which is quite impressive, and they do it also in the far east, Japan, in

particular. So that's an area where as 4G and 5G start to get adopted around the world, carriers want to get these networks

out very quickly. And what they're looking to do is to have a larger company, basically come in and install their modems, set

up the networks and operate them and maintain them, both from a maintenance perspective and from a performance capability.

And that's something that's a change. And Gilat actually created that. I'll say that market which really didn't exist a few

years ago, and it's something that as we work together with, we hope to see that part of the business grow, not only perhaps

in the United States, but elsewhere around the world.

Michael James Latimore - Northland

Capital Markets, Research Division - MD & Senior Research Analyst

Great, last question from me. You say

this will be cash accretive in the 12 months post deal. Just to clarify that. Does that mean for the full 12 months or at

some point during the 12 months post deal?

Michael D. Porcelain - Comtech Telecommunications

Corp. - President & COO

No, it would be the full 12 months.

Michael James Latimore - Northland

Capital Markets, Research Division - MD & Senior Research Analyst

Okay, great.

Operator

(Operator Instructions) We'll take a follow-up

from Mike Latimore, Northland Capital Markets.

Michael James Latimore - Northland

Capital Markets, Research Division - MD & Senior Research Analyst

I guess, I'll just keep going here. So I

guess, so on the first 12 months close -- post close cash accretive, I guess what does that assume for Gilat revenue? Does

that assume to be stable, growing, shrinking little bit?

Michael A. Bondi - Comtech Telecommunications

Corp. - CFO

Sure. In the speech, we were talking about,

looking at next year being similar to what their guidance was, that was released in November.

Michael James Latimore - Northland

Capital Markets, Research Division - MD & Senior Research Analyst

Okay, got it. All right. And then, I mean,

I think I can back into this calculation after the call, but you talked about paying down debt pretty aggressively. What are you

assuming from an operating cash flow perspective there to help pay down that debt?

Michael A. Bondi - Comtech Telecommunications

Corp. - CFO

Looking for next year, roughly, cash flow

similar to what we've produced historically and similar to what Gilat also produced historically. As we were mentioning, the Peru

contracts are very large, and so there are some quarters where there's cash investments up and down, but generally speaking, I

would say it's consistent with both companies' historical levered free cash flow.

Michael D. Porcelain - Comtech Telecommunications

Corp. - President & COO

Mike, one thing to help you think about

it. Again, Mike pointed to you towards the operating cash flow and you look for what Comtech did last year. We've given

targets out for this year with the growth that we're expecting to be somewhere in the $50 million to $60 million range. But

just to give you a sense, I mean, Gilat paid a special dividend to its shareholders of roughly $25 million, and so they do

have that type of cash flow characteristics similar to Comtech. And that is one of the attractiveness to Gilat that their

business characteristics are very similar to Comtech. You see that on the bottom line with -- they have a little better

margins than us. But we're trying to take a very -- kind of conservative approach as we learn the business, especially

because of the lumpiness with Peru. But we're going into this, thinking that this is going to be a cash accretive model, and

certainly, a cash flow generating business, just based on the actuals that we've seen to date.

Michael James Latimore - Northland

Capital Markets, Research Division - MD & Senior Research Analyst

Yes. And then in terms of the -- you highlighted

a couple of use cases, in-flight connectivity, wireless backhaul Sort of what percent of Gilat's revenue comes from those types

of use cases? Is it 10%, 20%, half? Just trying to get a sense.

Michael D. Porcelain - Comtech Telecommunications

Corp. - President & COO

It's a meaningful amount, certainly.

They are a key supplier to Gogo, and they are a leading provider of cellular backhaul. I mean, obviously, for competitive

reasons, I'm not going to give you a number because the market is competitive. But it's not an insignificant amount.

Michael James Latimore - Northland

Capital Markets, Research Division - MD & Senior Research Analyst

Okay, great. Thank you.

Operator

Our next follow-up is a question from Joe

Gomes with NOBLE Capital.

Joseph Anthony Gomes - NOBLE Capital

Markets, Inc., Research Division - Senior Generalist Analyst

Thanks for taking the follow up. Just real

quick. Fred, you mentioned some of their extraordinary tech for Gilat. I was wondering if you might provide a little more color

on that. Exactly what were you mentioning there?

Fred Kornberg - Comtech Telecommunications

Corp. - Chairman & CEO

Well, the way we've looked at Gilat's

technology, it's primarily in 2 areas that we have not had that technology. One major area is the TDMA or the time-division

multiple access. As I mentioned before, we've been dominant in the SCPC area. So we are essentially in the same markets,

supplying communications users, but supplying different products. Ours is more for the let's say, larger systems, such as the

SCPC systems that long-haul data or a video for long distances. Gilat has been the major player or the dominant player in the

TDMA area, which we've had no expertise in there. So that brings us this brand-new technology as well as another product line

to go to the same market and the same customers that require something less than a full-blown data haul over large distances.

So that's one technology. The other technology that they bring to us is the -- in the IFEC area, the in-flight entertainment

area. They have a modem expertise, which is quite different than the ground-based type of expertise, not to get into any

details about it. But they've been supplying Gogo and others in that area, and we have not participated in that area. We have

participated in the IFEC market in the solid-state amplifier area with Gogo, but not the modem area. So basically, it's

really 2 major areas, plus many, many other product areas, obviously. One being just to mention is they have a capability of

electronically steered antennas, which is a brand new product that will have a bright future in the IFEC market. So I think

-- but the main 2 areas are really the modems and the amplifiers.

Joseph Anthony Gomes - NOBLE Capital

Markets, Inc., Research Division - Senior Generalist Analyst

Okay, great. And I know it's been kind

of lost in the much larger acquisition, but I was wondering if you guys can just talk a little bit about the other

acquisition you announced today that the CGC acquisition and what that is -- what you're attempting to do there? And what

that could mean for the company?

Fred Kornberg - Comtech Telecommunications

Corp. - Chairman & CEO

That's -- it's really a very small

acquisition. I think it just rounds out our product line with an antenna capability. As again, I want to mention it's

different than the electronically steered antenna, if everybody understands what that difference is. It's basically a ground

station antenna capable of tracking systems, the new systems type of LEOs and MEOs, whereas the normal ground station antenna

with GEOs was just stationary. LEOs and MEOs take a tracking capability. So even though it's a mechanical structure, it has

some extra capability that's required. So that -- it's a small acquisition, but it does round us out into a product line

where Comtech and Gilat's products and antenna products can now provide a total solution to a customer should a customer

require that. Some customers want to buy products and do it themselves. Some customers want some system supplier to come in

and do the whole system. So we will be capable of doing both now.

Operator

(Operator Instructions) And there appear to

be no further questions at this time.

Joseph Anthony Gomes - NOBLE Capital

Markets, Inc., Research Division - Senior Generalist Analyst

Okay, great. Thanks guys, appreciate the

time.

Fred Kornberg - Comtech Telecommunications

Corp. - Chairman & CEO

Okay. Well, thanks again for joining us today.

We look forward to speaking with you again in March when we have our regular earnings conference call. To everybody, thank you

very much, and have a good day.

Operator

This does conclude today's program. Thank

you for your participation. You may now disconnect.

Additional Information and Where to

Find It

This filing is being made in respect of

a proposed business combination involving Comtech and Gilat. This document does not constitute an offer to sell or the solicitation

of an offer to buy or subscribe for any securities or a solicitation of any vote or approval nor shall there be any sale, issuance

or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. The proposed transaction will be submitted to the shareholders

of Gilat for their consideration. Comtech intends to file with the U.S. Securities and Exchange Commission (the “SEC”)

a Registration Statement on Form S-4 that will include a preliminary prospectus with respect to Comtech’s common stock to

be issued in the proposed transaction and a proxy statement of Gilat in connection with the proposed merger of an indirect subsidiary

of Comtech with and into Gilat, with Gilat surviving. The information in the preliminary proxy statement/prospectus is not complete

and may be changed. Comtech may not sell the common stock referenced in the proxy statement/prospectus until the Registration Statement

on Form S-4 becomes effective. The proxy statement/prospectus will be provided to Gilat shareholders. Comtech and Gilat also plan

to file other documents with the SEC regarding the proposed transaction.

This document is not a substitute for

any prospectus, proxy statement or any other document that Comtech or Gilat may file with the SEC in connection with the proposed

transaction. Investors and security holders of Comtech and Gilat are urged to read the proxy statement/prospectus and any other

relevant documents that will be filed with the SEC carefully and in their entirety when they become available because they will

contain important information about the proposed transaction.

You may obtain copies of all documents

filed with the SEC regarding the proposed transaction, free of charge, at the SEC’s website (www.sec.gov). In

addition, investors and security holders will be able to obtain a free copy of the

proxy statement/prospectus (when they become available) and other documents filed with the SEC by Comtech on Comtech’s Investor

Relations page on Comtech’s web site at www.comtechtel.com or by writing

to Comtech, Investor Relations, (for documents filed with the SEC by Comtech), or by Gilat on Gilat’s Investor Relations

page on Gilat’s web site at www.Gilat.com or by writing to Gilat, Investor Relations, (for documents filed with the

SEC by Gilat).

Cautionary Statement Regarding Forward-Looking

Statements

Certain information in this document contains

forward-looking statements, including, but not limited to, information relating to Comtech’s and Gilat’s future performance

and financial condition, plans and objectives of Comtech's management and Gilat’s management and Comtech's and Gilat’s

assumptions regarding such future performance, financial condition and plans and objectives that involve certain significant known

and unknown risks and uncertainties and other factors not under Comtech's or Gilat’s control which may cause their actual

results, future performance and financial condition, and achievement of plans and objectives of Comtech's management and Gilat’s

management to be materially different from the results, performance or other expectations implied by these forward-looking statements.

Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,”

“seeks,” “estimates,” variations of such words and similar expressions are intended to identify such forward-looking

statements, which generally are not historical in nature. Forward-looking statements could be affected by factors including, without

limitation: risks associated with the ability to consummate the proposed transaction and the timing of the closing of the proposed

transaction or the occurrence of any event, change or circumstance that could give rise to the termination of the merger agreement;

the risk that requisite regulatory approvals will not be obtained; the possibility that the expected synergies from the proposed

transaction or other recent acquisitions will not be fully realized, or will not be realized within the anticipated time periods;

the risk that Comtech’s and Gilat’s businesses will not be integrated successfully; the possibility of disruption from

the proposed transaction or other recent acquisitions making it more difficult to maintain business and operational relationships

or retain key personnel; the risk that Comtech will be unsuccessful in implementing a tactical shift in its Government Solutions

segment away from bidding on large commodity service contracts and toward pursuing contracts for its niche products with higher

margins; the risks associated with Comtech’s ongoing evaluation and repositioning of its location technologies solutions

offering in its Commercial Solutions segment; the nature and timing of receipt of, and Comtech’s performance on, new or existing

orders that can cause significant fluctuations in net sales and operating results; the timing and funding of government contracts;

adjustments to gross profits on long-term contracts; risks associated with international sales; rapid technological change; evolving

industry standards; new product announcements and enhancements, including the risks associated with Comtech's launch of its HeightsTM

Networking Platform; changing customer demands and or procurement strategies; changes in prevailing economic and political conditions;

changes in the price of oil in global markets; changes in foreign currency exchange rates; risks associated with legal proceedings,

customer claims for indemnification and other similar matters; risks associated with Comtech's obligations under its Credit Facility;

risks associated with large contracts; the impact of H.R.1, also known as the Tax Cuts and Jobs Act, which was enacted in December

2017 in the U.S.; and other factors described in this and Comtech's and Gilat’s other filings with the SEC. Neither Comtech

nor Gilat undertakes any duty to update any forward-looking statements contained herein.

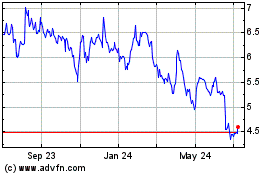

Gilat Satellite Networks (NASDAQ:GILT)

Historical Stock Chart

From Mar 2024 to Apr 2024

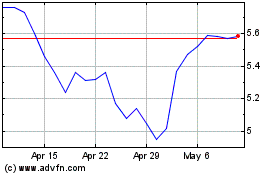

Gilat Satellite Networks (NASDAQ:GILT)

Historical Stock Chart

From Apr 2023 to Apr 2024