Revenues of $227.4 Million Exceeded

Guidance

GAAP EPS of $0.19 and Adjusted EPS of $0.28 In

Line with Expectations

Gibraltar Industries, Inc. (Nasdaq: ROCK), a leading

manufacturer and distributor of building products for the

residential, industrial, infrastructure, and renewable energy and

conservation markets, today reported its financial results for the

three-month period ended March 31, 2019. All financial metrics in

this release reflect only the Company’s continuing operations

unless otherwise noted.

First-quarter Consolidated Results

Gibraltar reported the following consolidated results:

Three Months Ended March 31, Dollars in

millions, except EPS

GAAP

Adjusted

2019

2018

%

Change

2019

2018

%

Change

Net Sales $227.4 $215.3 5.6% $227.4 $215.3 5.6% Net Income $6.3

$8.4 (25.0)% $9.2 $8.3 10.8% Diluted EPS $0.19 $0.26 (26.9)% $0.28

$0.26 7.7%

The Company reported first-quarter 2019 net sales of $227.4

million, exceeding its guidance as noted in its fourth-quarter 2018

earnings release. The 5.6 percent increase was mainly due to higher

demand for innovative products in the Industrial and Infrastructure

and Renewable Energy and Conservation segments, and increased

activity in the Infrastructure business.

GAAP and adjusted earnings were in line with guidance provided

in the Company’s fourth-quarter 2018 earnings release. GAAP

earnings were down year over year due to incremental costs incurred

in the field to improve durability and ensure performance of our

solar tracker, along with costs related to the Company’s senior

leadership transition plan and the recent repayment of its Senior

Subordinated 6.25% Notes. These costs were partially offset by

strong demand for higher-margin innovative products in the

Industrial and Infrastructure segment, ongoing benefits from 80/20

simplification initiatives and interest savings from the repayment

of the Company’s 6.25% Notes. The adjusted amounts for the first

quarter of 2019 and 2018 remove special items, such as

restructuring costs, senior leadership transition and debt

repayment costs from both periods, as further described in the

appended reconciliation of adjusted financial measures.

Management Comments

“With solid performance across our businesses in the first

quarter of 2019, we delivered revenues of $227 million, above our

guidance, and GAAP and non-GAAP earnings of $0.19 and $0.28,

respectively, in line with our expectations,” said President and

Chief Executive Officer William Bosway. “By executing on our

four-pillar strategy, we benefitted from higher-margin innovative

products, and continued operating improvement in the Industrial

& Infrastructure segment. In addition, we used cash generated

in prior years to repay our outstanding debt, resulting in

significant cost savings in the quarter.”

“During the quarter we saw continued demand for our innovative

tracker solution,” added Bosway. “While we incurred incremental

costs this quarter to improve durability and ensure performance of

this product, we expect it to continue to track towards our target

margin profile as we progress through the remainder of the

year.”

“We have made excellent operational progress across our

businesses, but our transformation is far from complete,” said

Bosway. “Our focus is on driving growth by reinforcing our 80/20

simplification strategy to create additional opportunity to enhance

our innovation and new product development programs. The

appointment of Pat Burns to the newly created COO position will

help accelerate these efforts.”

First-quarter Segment Results

Residential Products

For the first quarter, the Residential Products segment

reported:

Three Months Ended March 31, Dollars in

millions

GAAP

Adjusted

2019

2018

%

Change

2019

2018

%

Change

Net Sales $103.7 $103.9 (0.2)% $103.7 $103.9 (0.2)% Operating

Margin 11.7% 12.7% (100) bps 11.8% 12.6% (80) bps

First-quarter 2019 revenues in Gibraltar’s Residential Products

segment were essentially flat versus prior year, as unfavorable

weather impacted demand for building products, with volume declines

generally offset by selling price increases.

The first-quarter operating margin decline resulted from

unfavorable product mix and volume leverage, partially offset by

benefits from 80/20 simplification initiatives. The adjusted

operating margin for the first quarter of 2019 and 2018 removes the

special charges for restructuring initiatives under the 80/20

program from both periods.

Industrial & Infrastructure Products

For the first quarter, the Industrial & Infrastructure

Products segment reported:

Three Months Ended March 31, Dollars in

millions

GAAP

Adjusted

2019

2018

%

Change

2019

2018

%

Change

Net Sales $54.9 $54.4 0.9% $54.9 $54.4 0.9% Operating Margin 7.5%

4.8% 270 bps 7.5% 3.9% 360 bps

First-quarter 2019 revenues in Gibraltar’s Industrial &

Infrastructure Products segment were up 1 percent year over year,

driven by increased activity in the Infrastructure business and

continued demand for innovative products, partially offset by lower

volumes in the Industrial business for more commoditized

products.

GAAP and adjusted operating margin improvement for the segment

resulted from favorable product mix, higher volume leverage in the

Infrastructure business, and the continued benefit from 80/20

simplification initiatives. This segment’s adjusted operating

margin for the first quarter of 2019 and 2018 removes the special

charges for restructuring initiatives under the 80/20 program.

Renewable Energy & Conservation

For the first quarter, the Renewable Energy & Conservation

segment reported:

Three Months Ended March 31, Dollars in

millions

GAAP

Adjusted

2019

2018

%

Change

2019

2018

%

Change

Net Sales $68.8 $57.0 20.7% $68.8 $57.0 20.7% Operating Margin 2.4%

7.1% (470) bps 2.5% 7.7% (520) bps

Renewable Energy & Conservation segment revenues were up 21

percent year over year, driven by strong demand for its innovative

tracker solution and the contribution from the prior-year

acquisition of SolarBOS.

GAAP and adjusted operating margins decreased as incremental

costs incurred in the field to improve durability and ensure

performance of the recently launched tracker solution more than

offset the benefits of improved volumes. This segment’s adjusted

operating margin for the first quarter of 2019 and 2018 removes the

special charges for restructuring initiatives.

Business Outlook

“Looking into Q2 and beyond, we are confident in our ability to

execute on our operating plans,” said Bosway. “Through key resource

investments across our businesses, we are accelerating our ability

to innovate and become more relevant to our customers. With solid

end-market activity across our portfolio, we look forward to

another year of driving profitable growth and making more money at

a higher rate of return with a more efficient use of capital.”

Gibraltar is reiterating its guidance for revenues and earnings

for the full year 2019. Gibraltar expects 2019 consolidated

revenues to be in excess of $1 billion. GAAP EPS for full year 2019

are expected to be between $1.95 and $2.10, or $2.40 to $2.55 on an

adjusted basis, compared with $1.96 and $2.14, respectively, in

2018.

For the second quarter of 2019, the Company is expecting revenue

in the range of $268 million to $274 million. GAAP EPS for the

second quarter 2019 are expected to be between $0.60 and $0.65, or

$0.72 to $0.77 on an adjusted basis.

FY 2019 Guidance

Reconciliation

Gibraltar Industries Dollars in millions, except EPS

Operating Income

Net

DilutedEarnings

Income Margin Taxes

Income Per Share GAAP Measures $ 93-100

9.0-9.5 % $ 26-28 $ 64-69

$ 1.95-2.10 Restructuring Costs 17 1.6 % 3 15 $0.45

Adjusted Measures $ 110-117

10.6-11.1 % $ 29-31 $ 79-84 $ 2.40-2.55

First-quarter Conference Call Details

Gibraltar has scheduled a conference call today starting at 9:00

a.m. ET to review its results for the first quarter of 2019.

Interested parties may access the call by dialing (877) 407-5790 or

(201) 689-8328. The presentation slides that will be discussed in

the conference call are expected to be available this morning,

prior to the start of the call. The slides may be downloaded from

the Gibraltar website: www.gibraltar1.com. A webcast replay of the

conference call and a copy of the transcript will be available on

the website following the call.

About Gibraltar

Gibraltar Industries is a leading manufacturer and distributor

of building products for the residential, industrial,

infrastructure, and renewable energy and conservation markets. With

a four-pillar strategy focused on operational improvement, product

innovation, portfolio management and acquisitions, Gibraltar’s

mission is to drive best-in-class performance. Gibraltar serves

customers primarily throughout North America and to a lesser extent

Asia. Comprehensive information about Gibraltar can be found on its

website at www.gibraltar1.com.

Safe Harbor Statement

Information contained in this news release, other than

historical information, contains forward-looking statements and is

subject to a number of risk factors, uncertainties, and

assumptions. Risk factors that could affect these statements

include, but are not limited to, the following: the availability of

raw materials and the effects of changing raw material prices on

the Company’s results of operations; energy prices and usage;

changing demand for the Company’s products and services; changes in

the liquidity of the capital and credit markets; risks associated

with the integration and performance of acquisitions; and changes

in interest and tax rates. In addition, such forward-looking

statements could also be affected by general industry and market

conditions, as well as macroeconomic factors including government

monetary and trade policies, such as tariffs and expiration of tax

credits along with currency fluctuations and general political

conditions. Other risks and uncertainties that arise from time to

time are described in Item 1A “Risk Factors” of the Company’s

Annual Report on Form 10-K. The Company undertakes no obligation to

update any forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by applicable law or regulation.

Adjusted Financial Measures

To supplement Gibraltar’s consolidated financial statements

presented on a GAAP basis, Gibraltar also presented certain

adjusted financial measures in this news release. Adjusted

financial measures exclude special charges consisting of

restructuring costs primarily associated with the 80/20

simplification initiative, senior leadership transition costs, debt

repayment costs, and other reclassifications. These adjustments are

shown in the reconciliation of adjusted financial measures

excluding special charges provided in the supplemental financial

schedules that accompany this news release. The Company believes

that the presentation of results excluding special charges provides

meaningful supplemental data to investors, as well as management,

that are indicative of the Company’s core operating results and

facilitates comparison of operating results across reporting

periods as well as comparison with other companies. Special charges

are excluded since they may not be considered directly related to

the Company’s ongoing business operations. These adjusted measures

should not be viewed as a substitute for the Company’s GAAP

results, and may be different than adjusted measures used by other

companies.

Next Earnings Announcement

Gibraltar expects to release its financial results for the

three-month period ending June 30, 2019, on Friday, July 26, 2019,

and hold its earnings conference call later that morning, starting

at 9:00 a.m. ET.

GIBRALTAR INDUSTRIES, INC.CONSOLIDATED

STATEMENTS OF OPERATIONS(in thousands, except per share

data)(unaudited)

Three Months EndedMarch 31, 2019 2018 Net

Sales $ 227,417 $ 215,337 Cost of sales 183,517 167,019

Gross profit 43,900 48,318 Selling, general, and

administrative expense 33,334 34,475 Income from

operations 10,566 13,843 Interest expense 2,061 3,269 Other expense

(income) 589 (585 ) Income before taxes 7,916 11,159

Provision for income taxes 1,571 2,807 Net income $

6,345 $ 8,352 Net earnings per share: Basic $

0.20 $ 0.26 Diluted $ 0.19 $ 0.26 Weighted average

shares outstanding: Basic 32,279 31,786 Diluted 32,617

32,444

GIBRALTAR INDUSTRIES, INC.CONSOLIDATED

BALANCE SHEETS(in thousands, except per share data)

March 31,2019

December 31,2018

(unaudited)

Assets Current assets: Cash and cash equivalents

$ 43,509 $ 297,006 Accounts receivable, net 167,201 140,283

Inventories 98,594 98,913 Other current assets 8,282 8,351

Total current assets 317,586 544,553 Property, plant, and

equipment, net 95,856 95,830 Operating lease assets 31,823 —

Goodwill 323,573 323,671 Acquired intangibles 94,520 96,375 Other

assets 2,900 1,216 $ 866,258 $ 1,061,645

Liabilities and Shareholders’ Equity Current

liabilities: Accounts payable $ 84,462 $ 79,136 Accrued expenses

65,020 87,074 Billings in excess of cost 18,259 17,857 Current

maturities of long-term debt 400 208,805 Total

current liabilities 168,141 392,872 Long-term debt 1,600 1,600

Deferred income taxes 36,916 36,530 Non-current operating lease

liabilities 22,751 — Other non-current liabilities 31,017 33,950

Shareholders’ equity: Preferred stock, $0.01 par value; authorized

10,000 shares; none outstanding — — Common stock, $0.01 par value;

authorized 50,000 shares; 33,026 shares and 32,887 shares issued

and outstanding in 2019 and 2018 330 329 Additional paid-in capital

285,034 282,525 Retained earnings 346,922 338,995 Accumulated other

comprehensive loss (6,380 ) (7,234 ) Cost of 855 and 796 common

shares held in treasury in 2019 and 2018 (20,073 ) (17,922 ) Total

shareholders’ equity 605,833 596,693 $ 866,258

$ 1,061,645

GIBRALTAR INDUSTRIES, INC.CONSOLIDATED

STATEMENTS OF CASH FLOWS(in thousands)(unaudited)

Three Months EndedMarch 31,

2019 2018

Cash Flows from Operating Activities

Net income $ 6,345 $ 8,352 Adjustments to reconcile net income to

net cash used in operating activities: Depreciation and

amortization 4,941 5,189 Stock compensation expense 2,371 2,097

Exit activity recoveries, non-cash — (727 ) Provision for deferred

income taxes 393 — Other, net 2,456 353 Changes in operating assets

and liabilities, excluding the effects of acquisitions: Accounts

receivable (27,623 ) 4,947 Inventories 35 (8,907 ) Other current

assets and other assets 165 1,498 Accounts payable 5,332 (1,694 )

Accrued expenses and other non-current liabilities (31,903 )

(33,314 ) Net cash used in operating activities (37,488 ) (22,206 )

Cash Flows from Investing Activities Acquisitions, net of

cash acquired (264 ) — Net proceeds from sale of property and

equipment 22 2,823 Purchases of property, plant, and equipment

(3,132 ) (1,033 ) Net cash (used in) provided by investing

activities (3,374 ) 1,790

Cash Flows from Financing

Activities Long-term debt payments (210,000 ) — Payment of debt

issuance costs (1,235 ) — Purchase of treasury stock at market

prices (2,151 ) (850 ) Net proceeds from issuance of common stock

139 226 Net cash used in financing activities

(213,247 ) (624 ) Effect of exchange rate changes on cash 612

(499 ) Net decrease in cash and cash equivalents (253,497 )

(21,539 ) Cash and cash equivalents at beginning of year 297,006

222,280 Cash and cash equivalents at end of period $

43,509 $ 200,741

GIBRALTAR INDUSTRIES, INC.Reconciliation

of Adjusted Financial Measures (in thousands, except per share

data)(unaudited)

Three Months EndedMarch 31, 2019

AsReportedIn GAAPStatements

RestructuringCharges

SeniorLeadershipTransitionCosts

DebtRepayment

AdjustedFinancialMeasures

Net Sales Residential Products $ 103,709 $ — $ — $ — $ 103,709

Industrial & Infrastructure Products 55,188 — — — 55,188 Less

Inter-Segment Sales (317 ) — — — (317 ) 54,871

— — — 54,871 Renewable Energy & Conservation 68,837 —

— — 68,837 Consolidated sales 227,417 —

— — 227,417 Income from operations Residential Products

12,090 151 — — 12,241 Industrial & Infrastructure Products

4,129 (33 ) — — 4,096 Renewable Energy & Conservation 1,632

94 — — 1,726 Segments Income

17,851 212 — — 18,063 Unallocated corporate expense (7,285 ) 7

2,495 — (4,783 ) Consolidated income from

operations 10,566 219 2,495 — 13,280 Interest expense 2,061

— — (1,041 ) 1,020 Other expense 589 — — —

589 Income before income taxes 7,916 219 2,495 1,041

11,671 Provision for income taxes 1,571 54 621

260 2,506 Income from continuing operations $ 6,345

$ 165 $ 1,874 $ 781 $ 9,165

Income from continuing operations per share - diluted $ 0.19

$ 0.01 $ 0.06 $ 0.02 $ 0.28

Operating margin Residential Products 11.7 % 0.1 % — % — % 11.8 %

Industrial & Infrastructure Products 7.5 % (0.1 )% — % — % 7.5

% Renewable Energy & Conservation 2.4 % 0.1 % — % — % 2.5 %

Segments Margin 7.8 % 0.1 % — % — % 7.9 % Consolidated 4.6 % 0.1 %

1.1 % — % 5.8 %

GIBRALTAR INDUSTRIES, INC.Reconciliation

of Adjusted Financial Measures (in thousands, except per share

data)(unaudited)

Three Months EndedMarch 31, 2018

As Reported InGAAPStatements

RestructuringCharges

SeniorLeadershipTransitionCosts

Tax Reform

AdjustedFinancialMeasures

Net Sales Residential Products $ 103,948 $ — $ — $ — $ 103,948

Industrial & Infrastructure Products 54,624 — — — 54,624 Less

Inter-Segment Sales (221 ) — — — (221 ) 54,403

— — — 54,403 Renewable Energy & Conservation 56,986 —

— — 56,986 Consolidated sales 215,337 —

— — 215,337 Income from operations Residential Products

13,238 (166 ) — — 13,072 Industrial & Infrastructure Products

2,602 (485 ) — — 2,117 Renewable Energy & Conservation 4,062

136 178 — 4,376 Segments income

19,902 (515 ) 178 — 19,565 Unallocated corporate expense (6,059 )

44 305 — (5,710 ) Consolidated income from

operations 13,843 (471 ) 483 — 13,855 Interest expense 3,269

— — — 3,269 Other income (585 ) — — — (585 )

Income before income taxes 11,159 (471 ) 483 — 11,171 Provision for

income taxes 2,807 (146 ) 130 68 2,859

Net income $ 8,352 $ (325 ) $ 353 $ (68 ) $ 8,312

Net earnings per share - diluted $ 0.26 $ (0.01 ) $

0.01 $ — $ 0.26 Operating margin

Residential Products 12.7 % (0.2 )% — % — % 12.6 % Industrial &

Infrastructure Products 4.8 % (0.9 )% — % — % 3.9 % Renewable

Energy & Conservation 7.1 % 0.2 % 0.3 % — % 7.7 % Segments

margin 9.2 % (0.2 )% 0.1 % — % 9.1 % Consolidated 6.4 % (0.2 )% 0.2

% — % 6.4 %

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190503005205/en/

Timothy MurphyChief Financial Officer(716) 826-6500 ext.

3277tfmurphy@gibraltar1.com

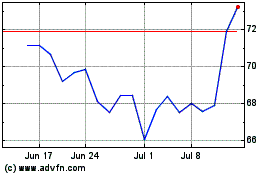

Gibraltar Industries (NASDAQ:ROCK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gibraltar Industries (NASDAQ:ROCK)

Historical Stock Chart

From Apr 2023 to Apr 2024