Current Report Filing (8-k)

September 09 2021 - 9:01AM

Edgar (US Regulatory)

false

0001392380

0001392380

2021-09-08

2021-09-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 8, 2021

Gevo, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-35073

|

87-0747704

|

|

(State or other jurisdiction

|

(Commission File Number)

|

(IRS Employer

|

|

of incorporation)

|

|

Identification No.)

|

|

345 Inverness Drive South, Building C, Suite 310

Englewood, CO 80112

|

|

(Address of principal executive offices)(Zip Code)

|

Registrant’s telephone number, including area code: (303) 858-8358

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading symbol

|

|

Name of exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

GEVO

|

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On September 8, 2021, Gevo, Inc. (the “Company”) and Chevron U.S.A. Inc. (“Chevron”), a subsidiary of Chevron Corporation, entered into a letter of intent (the “LOI”) to jointly invest in building and operating one or more new facilities that would process residual starch by separating the protein and oil from inedible, lower-carbon corn to produce sustainable aviation fuel.

Under the terms of the LOI, each party agreed, among other things, to make efforts to negotiate and execute (i) a co-investment agreement pursuant to which Chevron would co-invest with Gevo in one or more projects (the “Projects”) for the production of sustainable aviation fuel for up to 150 million gallons per year (the “Co-Investment Agreement”), and (ii) a fuel supply agreement pursuant to which the parties would agree to a total potential volume of offtake for the fuel produced under the Projects (the “FSA”).

The LOI also contemplates the issuance of warrants to Chevron to purchase up to 15 million shares of common stock of the Company at an exercise price equal to the 90-day volume weighted average price of the Company’s common stock at the time of the announcement of the LOI, not to be lower than $8.50 per share (the “Warrants,” and together with the Co-Investment Agreement and the FSA, the “Proposed Transactions”). The Warrants are expected to vest in tranches over time upon execution of the Co-Investment Agreement and the FSA as well as the determination of an investment amount, and are also expected to be contingent on the offtake volume of the Projects. In addition, the Warrants would not be issued if the Co-Investment Agreement and the FSA are not executed by May 31, 2022. The LOI also contemplates mutually agreeable standstill, voting obligations and registration rights for the shares of Company common stock underlying the Warrants.

The Proposed Transactions are subject to, among other things, the negotiation and execution of definitive agreements, customary closing conditions, including governmental and regulatory approvals, and legal, technical and financial due diligence by each party. The parties may withdraw from negotiations relating to the Proposed Transactions at any time and for any reason prior to the executing of binding definitive agreements. As such, there is no assurance the Proposed Transactions occur on terms favorable to the Company, or at all.

On September 9, 2021, the Company and Chevron issued a joint press release regarding the LOI, which is furnished herewith as Exhibit 99.1.

Forward-Looking Statements

Certain statements in this report may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to a variety of matters, without limitation, including the entrance by Gevo into the investment agreement and other statements that are not purely statements of historical fact. These forward-looking statements are made on the basis of the current beliefs, expectations and assumptions of the management of Gevo and are subject to significant risks and uncertainty. Investors are cautioned not to place undue reliance on any such forward-looking statements. All such forward-looking statements speak only as of the date they are made, and Gevo undertakes no obligation to update or revise these statements, whether as a result of new information, future events or otherwise. Although Gevo believes that the expectations reflected in these forward-looking statements are reasonable, these statements involve many risks and uncertainties that may cause actual results to differ materially from what may be expressed or implied in these forward-looking statements. For a further discussion of risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of Gevo in general, see the risk disclosures in the Annual Report on Form 10-K of Gevo for the year ended December 31, 2020, and in subsequent reports on Forms 10-Q and 8-K and other filings made with the U.S. Securities and Exchange Commission by Gevo.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (Formatted as Inline XBRL)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

GEVO, INC.

|

|

|

|

|

|

|

Dated: September 9, 2021

|

|

|

|

By:

|

|

/s/ Geoffrey T. Williams, Jr.

|

|

|

|

|

|

|

|

Geoffrey T. Williams, Jr.

|

|

|

|

|

|

|

|

Vice President - General Counsel and Secretary

|

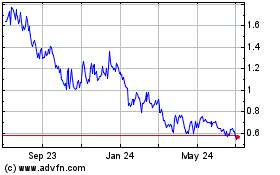

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

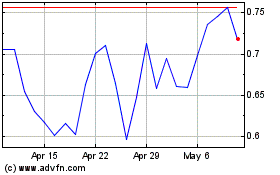

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Apr 2023 to Apr 2024