Gevo, Inc. Announces $50 Million Registered Direct Offering Priced At-the-Market under Nasdaq Rules

August 20 2020 - 11:48PM

Gevo, Inc. (“Gevo”) (Nasdaq: GEVO), today announced that it has

entered into definitive agreements with institutional and

accredited investors for the sale of an aggregate of 38,461,545

shares of common stock (or common stock equivalents) at a purchase

price of $1.30 per share in a registered direct offering priced

at-the-market under Nasdaq rules. The offering is expected to

close on or about August 25, 2020, subject to the satisfaction of

customary closing conditions.

H.C. Wainwright & Co. is acting as the

exclusive placement agent for the offering.

The gross proceeds of the offering are expected

to be approximately $50 million, prior to deducting placement

agent’s fees and other offering expenses payable by Gevo.

Gevo intends to use the net proceeds from the offering to fund

working capital and for general corporate purposes, which may

include the repayment of outstanding indebtedness.

The securities described above are being offered

by Gevo pursuant to a shelf registration statement on Form S-3

(File No. 333-226686) which was declared effective by the U.S.

Securities and Exchange Commission (“SEC”) on August 28, 2018. The

offering is being made only by means of a prospectus, including a

prospectus supplement, forming part of the effective registration

statement. A final prospectus supplement and accompanying

prospectus relating to the securities being offered will be filed

with the SEC. Electronic copies of the final prospectus supplement

and accompanying prospectus may be obtained, when available, by

visiting the SEC’s website at www.sec.gov or by contacting H.C.

Wainwright & Co., LLC, 430 Park Avenue, 3rd Floor, New York,

New York 10022, by email at placements@hcwco.com or by telephone at

646-975-6996.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy these securities, nor

shall there be any sale of these securities in any state or other

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or other jurisdiction.

About GevoGevo is commercializing the next

generation of renewable premium gasoline, jet fuel and diesel fuel

with the potential to achieve zero carbon emissions, addressing the

market need of reducing greenhouse gas emissions with sustainable

alternatives. Gevo uses low-carbon renewable resource-based

carbohydrates as raw materials, and is in an advanced state of

developing renewable electricity and renewable natural gas for use

in production processes, resulting in low-carbon fuels with

substantially reduced carbon intensity (the level of greenhouse gas

emissions compared to standard petroleum fossil-based fuels across

their lifecycle). Gevo’s products perform as well or better than

traditional fossil-based fuels in infrastructure and engines, but

with substantially reduced greenhouse gas emissions. In addition to

addressing the problems of fuels, Gevo’s technology also enables

certain plastics, such as polyester, to be made with more

sustainable ingredients. Gevo’s ability to penetrate the growing

low-carbon fuels market depends on the price of oil and the value

of abating carbon emissions that would otherwise increase

greenhouse gas emissions. Gevo believes that its proven, patented,

technology enabling the use of a variety of low-carbon sustainable

feedstocks to produce price-competitive low carbon products

such as gasoline components, jet fuel, and diesel fuel yields the

potential to generate project and corporate returns that justify

the build-out of a multi-billion dollar business. Learn more at our

website: www.gevo.com

Forward-Looking StatementsCertain statements in

this press release may constitute "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements relate to a variety of

matters, including, without limitation, statements related to

offering of securities described herein and the pricing of the

offering. These forward-looking statements are made on the basis of

the current beliefs, expectations and assumptions of the management

of Gevo and are subject to significant risks and uncertainty.

Investors are cautioned not to place undue reliance on any such

forward-looking statements. All such forward-looking statements

speak only as of the date they are made, and Gevo undertakes no

obligation to update or revise these statements, whether as a

result of new information, future events or otherwise. Although

Gevo believes that the expectations reflected in these

forward-looking statements are reasonable, these statements involve

many risks and uncertainties that may cause actual results to

differ materially from what may be expressed or implied in these

forward-looking statements. For a further discussion of risks and

uncertainties that could cause actual results to differ from those

expressed in these forward-looking statements, as well as risks

relating to the business of Gevo in general, see the risk

disclosures in the Annual Report on Form 10-K of Gevo for the year

ended December 31, 2019 and in subsequent reports on Forms 10-Q and

8-K and other filings made with the U.S. Securities and Exchange

Commission by Gevo.

Investor and Media Contact +1

720-647-9605 IR@gevo.com

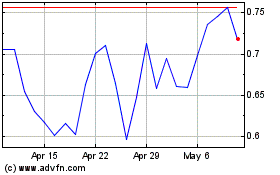

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

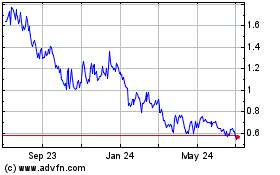

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Apr 2023 to Apr 2024