Geron Corporation (Nasdaq: GERN) today reported financial results

for the fourth quarter and full year ended December 31, 2018 and

recent events. As of year-end 2018, the Company had approximately

$182 million in cash and marketable securities, which is sufficient

to commence the planned Phase 3 clinical trial of imetelstat in

lower risk myelodysplastic syndromes (MDS) by mid-year 2019.

“We expect 2019 to be a pivotal year,” said John A. Scarlett,

M.D., Chairman and Chief Executive Officer. “We are making good

progress in the transition of the imetelstat program and expect to

assume sponsorship of the imetelstat clinical trials by the end of

the second quarter. We continue planning to open the Phase 3

clinical trial of imetelstat in lower risk MDS for enrollment by

mid-year, as well as evaluating the potential for late-stage

development in MF. In addition, we expect to further expand our

team with individuals who have strong development expertise that

will enable us to build a robust hematology-oncology

franchise.”

Recent Events

Building a Development Team with Hematology-Oncology

Expertise

The Company recently announced the hiring of two key development

executives. Aleksandra Rizo, M.D., Ph.D., the former clinical lead

for the imetelstat program at Janssen, joined Geron as Chief

Medical Officer. Israel Gutierrez, M.D., who has more than 20 years

of oncology clinical development experience, joined Geron as Vice

President, Pharmacovigilance and Drug Safety. In addition, Geron

plans to open an office in northern New Jersey to access

experienced personnel with late-stage hematology-oncology clinical

drug development expertise, as well as to enable efficient support

for global clinical trials, including the Phase 3 clinical trial of

imetelstat in lower risk MDS.

Fourth Quarter 2018 Highlights

IMerge Phase 2 Data Presented Support Initiation of Phase 3

Trial in Lower Risk MDS

Data for the Phase 2 portion of IMerge were presented in an oral

presentation at the American Society of Hematology (ASH) annual

meeting on December 2, 2018. Geron believes these data support

initiating the Phase 3 portion of IMerge to address an unmet

medical need for patients for whom erythropoiesis stimulating

agents (ESAs) are not effective and for whom currently available

therapies show only modest efficacy, especially in patients with

high baseline transfusion burdens who are difficult-to-treat. Lower

risk MDS patients in the U.S. represent a large unmet need as there

has not been a new drug approved by the Food and Drug

Administration (FDA) since 2006.

In the Phase 2 portion of IMerge, 38 patients were enrolled who

were transfusion dependent with Low or Intermediate-1 risk

non-del(5q) MDS who have relapsed after or are refractory to prior

treatment with an ESA and naïve to treatment with a hypomethylating

agent (HMA) or lenalidomide. In the trial, transfusion dependence

is defined as a patient requiring a minimum of four units of red

blood cells (RBC) over a consecutive 8-week time period to treat

anemia. The median baseline RBC transfusion burden in the Phase 2

portion of IMerge was eight units per eight weeks, ranging from

four to 14 units. The primary efficacy endpoint of the trial is the

rate of RBC transfusion-independence (RBC TI) lasting at least

eight weeks (8-week RBC TI rate), which is defined as the

proportion of patients who are transfusion free for at least eight

consecutive weeks since entry into the trial. Key secondary

endpoints include durability of response as evidenced through

24-week RBC TI rate and breadth of response through reduction in

RBC transfusion burden and rate of RBC transfusions, as well as

responses across MDS sub-types.

Primary Efficacy Endpoint:

- 37% (14/38) of patients achieved an 8-week RBC TI rate

Secondary Efficacy Endpoints:

Durability

- 26% (10/38) of patients achieved a 24-week RBC TI rate

Transfusion Reduction

- The rate of hematologic improvement-erythroid (HI-E) was 71%

(27/38), as measured by a reduction of at least four RBC units over

eight weeks compared with prior transfusion burden

- Mean relative reduction of RBC transfusion burden from baseline

was 68%

Broad Clinical Activity Observed

- Similar 8-week RBC TI rates were observed in patients with

baseline serum erythropoietin (sEPO) levels less than or greater

than 500mU/mL

- 8-week RBC TI rates were also consistent between

ringed-sideroblast (RS) positive patients and other patients

The ASH presentation reported data based on a data cut-off date

of October 26, 2018. As of the data cut-off date, the median

duration of RBC TI had not been reached. Geron expects more mature

data from patients continuing on treatment in the Phase 2 portion

of IMerge to be available in 2019 and anticipates submitting such

data for presentation at a future medical conference.

IMbark Phase 2 Data Presented Suggest Meaningful Survival

Outcome in Relapsed/Refractory MF Patients

Data from the Phase 2 IMbark clinical trial, including new

overall survival data, were presented in an oral presentation at

ASH on December 3, 2018.

The IMbark trial evaluated two starting dose levels of

imetelstat (either 4.7 mg/kg or 9.4 mg/kg administered by

intravenous infusion every three weeks) in more than 100 patients

with Intermediate-2 or High-risk myelofibrosis (MF) who were

relapsed or refractory to janus kinase inhibitor (JAKi) therapy. To

be eligible for enrollment in the IMbark trial, patients had to

meet rigorous criteria for having failed or not responded to JAKi

treatment, including documented progressive disease during or after

JAKi therapy. The ASH presentation highlighted efficacy and safety

data from the trial’s primary analysis, as well as overall survival

(OS) data with a clinical cutoff of October 22, 2018 and a median

follow up of 27 months.

The ASH presentation reported that the median OS for the 9.4

mg/kg dosing arm was 29.9 months, which suggests a meaningful

survival outcome with imetelstat treatment in this poor-prognosis,

relapsed/refractory patient population where there are currently no

approved treatments today. Other observational studies of similar

patient populations at academic medical centers published recently

in medical literature have reported median OS ranges of

approximately 12 to 14 months after failure of or discontinuation

of ruxolitinib, a JAKi.

Geron plans to discuss the potential for late-stage development

of imetelstat in MF with current IMbark investigators, other key

opinion leaders (KOLs) and regulatory authorities. The Company

expects to facilitate KOL discussions over the coming months.

Discussions with regulatory authorities are expected to begin after

the investigational new drug (IND) sponsorship has been transferred

back to Geron.

The Company plans to outline a decision regarding the potential

for future late-stage development in MF by the end of the third

quarter of 2019. In making this decision, Geron will conduct an

assessment of what would be required to achieve clinical and

regulatory success, including the cost and duration of any

potential clinical trials.

Imetelstat Safety Results

The safety profile reported in both ASH presentations for

imetelstat-treated patients was consistent with prior clinical

trials of imetelstat in hematologic malignancies, and no new safety

signals were identified. Cytopenias, particularly neutropenia and

thrombocytopenia, were the most frequently reported adverse events,

which were predictable, manageable and reversible.

Fourth Quarter and Year-End 2018 Results

For the fourth quarter of 2018, the company reported a net loss

of $7.3 million, or $0.04 per share, compared to $7.4 million, or

$0.05 per share, for the comparable 2017 period. For 2018, the

company reported a net loss of $27.0 million, or $0.15 per share,

compared to $27.9 million, or $0.18 per share, for 2017.

Revenues for the fourth quarter of 2018 were $375,000 compared

to $191,000 for the comparable 2017 period. Revenues for 2018 and

2017 were each $1.1 million and included royalty and license fee

revenues under various non-imetelstat license agreements. The

Company adopted a new revenue recognition accounting standard as of

January 1, 2018 using the modified retrospective transition method.

Revenue for 2018 is presented under the new accounting standard,

but revenue for 2017 has not been adjusted and continues to be

reported under accounting standards used historically. Therefore,

there is a lack of comparability between the periods presented.

However, the Company does not expect the adoption of the new

revenue recognition accounting standard to have a material impact

to its financial statements on an ongoing basis.

Total operating expenses for the fourth quarter of 2018 were

$10.0 million compared to $8.0 million for the comparable 2017

period. Total operating expenses for 2018 were $32.1 million

compared to $30.3 million for 2017.

Research and development expenses for the fourth quarter of 2018

were $5.1 million compared to $2.5 million for the comparable 2017

period. Research and development expenses for 2018 were $13.4

million compared to $11.0 million for 2017. The increase in

research and development expenses for the fourth quarter and

year-to-date 2018 periods compared to comparable 2017 periods

primarily reflects increases in Geron’s share of imetelstat

development costs under the former collaboration agreement with

Janssen Biotech, Inc. (Janssen) where Geron’s share increased from

50% to 100% as of the termination date of the collaboration

agreement and additional costs for the contract research

organization (CRO) and other consultants for the transition of the

imetelstat program from Janssen to Geron.

General and administrative expenses for the fourth quarter of

2018 were $4.9 million compared to $5.5 million for the comparable

2017 period. General and administrative expenses for 2018 were

$18.7 million compared to $19.3 million for 2017. The decrease in

general and administrative expenses in 2018 compared to 2017

primarily reflects the net result of reduced personnel related

expenses, including lower stock-based compensation expense,

partially offset by higher consulting expenses and higher patent

legal expenses with the termination of the imetelstat collaboration

with Janssen, as imetelstat patent costs previously were being

shared by the two companies on a 50/50 basis.

Interest and other income for the fourth quarter of 2018 was

$1.1 million compared to $375,000 for the comparable 2017 period.

Interest and other income for 2018 was $3.3 million compared to

$1.4 million for 2017. The increase in interest and other income

for 2018 compared to 2017 primarily reflects higher yields on the

Company’s marketable securities portfolio.

Planned 2019 Activities and Milestones

Geron’s plans for 2019 primarily focus on advancing imetelstat

development. The Company believes building a development team with

hematology-oncology expertise is essential to executing the Phase 3

clinical trial in lower risk MDS and evaluating the potential for

late-stage development in MF, as well as in the future, exploring

additional indications for imetelstat and being able to pursue

other innovative therapeutics in hematology-oncology. Geron expects

the following activities and milestones to occur in 2019:

Transition of Imetelstat Development Program

- Complete the transfer of the IND back to Geron by the end of

the second quarter.

- Complete the transfer of the imetelstat clinical development

program back to Geron by the end of the third quarter.

- Actively recruit highly-experienced personnel with drug

development expertise in myeloid malignancies.

MDS Development

- Commence screening and enrollment for the Phase 3 portion of

IMerge by mid-year.

- Present more mature data from patients in the Phase 2 portion

of IMerge at a medical conference.

MF Development

- Conduct discussions with IMbark investigators, other MF KOLs

and regulatory authorities to identify and consider potential

late-stage clinical development plans for relapsed/refractory MF

patients.

- Outline decision regarding the potential for late-stage

development of imetelstat in MF by the end of the third

quarter.

Projected 2019 Financial Guidance

The Company expects its operating expenses to increase as it

assumes full responsibility for the development and potential

commercialization of imetelstat. For fiscal year 2019, the Company

expects its operating expense burn to range from $65 to $70

million, of which approximately $10 to $15 million represents

one-time costs, such as imetelstat program transition activities

from Janssen to Geron, including the transfer of the IND

sponsorship, and purchase of raw materials and other supplies in

preparation for new drug manufacturing. In addition to the one-time

costs, projected 2019 operating expense guidance includes costs for

the expansion of the internal development team, the global Phase 3

clinical trial in MDS and the opening of the New Jersey office. The

Company plans to grow to a total of approximately 30 to 40

employees by year-end 2019, of which half will be research and

development personnel.

Conference Call

Geron will host a conference call to discuss fourth quarter and

full year financial results and recent events at 4:30 p.m. ET on

Thursday, March 7, 2019.

Participants may access the conference call live via telephone

by dialing domestically +1 (877) 303-9139 or internationally +1

(760) 536-5195. The conference ID is 6771719. A live, listen-only

webcast will also be available on the Company’s website at

www.geron.com/investors/events. If you are unable to listen to the

live call, an archived webcast will be available on the Company’s

website for 30 days.

About Imetelstat

Imetelstat is a novel, first-in-class telomerase inhibitor

exclusively owned by Geron and being developed in hematologic

myeloid malignancies. Early clinical data suggest imetelstat may

have disease-modifying activity through the suppression of

malignant progenitor cell clone proliferation, which allows

potential recovery of normal hematopoiesis. Ongoing clinical

studies of imetelstat include a Phase 2/3 trial called IMerge in

lower risk myelodysplastic syndromes (MDS) and a Phase 2 trial

called IMbark in Intermediate-2 or High-risk myelofibrosis.

Imetelstat has been granted Fast Track designation by the United

States Food and Drug Administration for the treatment of patients

with transfusion-dependent anemia due to lower risk MDS who are

non-del(5q) and refractory or resistant to an erythroid stimulating

agent.

About Geron

Geron is a late-stage clinical biopharmaceutical company focused

on the development and potential commercialization of a

first-in-class telomerase inhibitor, imetelstat, in hematologic

myeloid malignancies. For more information about Geron, visit

www.geron.com.

Use of Forward-Looking Statements

Except for the historical information contained herein, this

press release contains forward-looking statements made pursuant to

the “safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995. Investors are cautioned that such statements,

include, without limitation, those regarding: (i) the prospects for

imetelstat; (ii) that patient screening and enrollment for the

Phase 3 portion of IMerge will begin by mid-year 2019; (iii) that

IMbark and IMerge will continue; (iv) that imetelstat may have

disease-modifying activity; (v) that the IND will transfer to Geron

by the end of the second quarter of 2019; (vi) that the imetelstat

clinical development program will transfer to Geron by the end of

the third quarter of 2019; (vii) that more mature data will be

available from the Phase 2 portion of IMerge and will be presented

at a medical conference in 2019; (viii) that Geron will discuss

with IMbark investigators, other MF KOLs and regulatory authorities

the potential for late-stage clinical development of imetelstat for

relapsed/refractory MF patients and will outline its decision on

this matter by the end of the third quarter of 2019; (ix) that the

Company does not expect the adoption of the new revenue recognition

accounting standard to have a material impact to its financial

statements on an ongoing basis; (x) that the Company’s operating

expenses will be $65 to $70 million in 2019, and other financial

projections and expectations; (xi) that the Company will grow to a

total of 30 to 40 employees by year-end 2019; and (xii) other

statements that are not historical facts, constitute

forward-looking statements. These statements involve risks and

uncertainties that can cause actual results to differ materially

from those in such forward-looking statements. These risks and

uncertainties, include, without limitation, risks and uncertainties

related to: (i) whether the Company overcomes all the: (a)

challenges of the transfer of the IND and imetelstat clinical

development program from Janssen, and (b) clinical safety and

efficacy, technical, scientific, manufacturing and regulatory

challenges to enable the screening and enrollment of the Phase 3

portion of IMerge to begin by mid-year 2019; (ii) whether

regulatory authorities permit the further development of imetelstat

on a timely basis, or at all, without any clinical holds; (iii)

whether imetelstat is safe and efficacious, and whether any future

efficacy or safety results may cause the benefit-risk profile of

imetelstat to become unacceptable; (iv) whether the transfer of the

IND and the imetelstat clinical development program to the Company

occur in the second and third quarter of 2019, respectively; (v)

whether experts in MF and regulatory authorities support a

potential path for late-stage clinical development of imetelstat in

relapsed/refractory MF; (vi) whether Geron’s assessment of the

prospects for clinical and regulatory success, including the cost

and duration of any potential clinical trials, warrant pursuing

late-stage development of imetelstat in MF; (vii) whether Geron has

come to a decision regarding late-stage development in MF by the

end of the third quarter of 2019; (viii) whether the new revenue

recognition accounting standard has a material impact on Geron’s

financial statements on an ongoing basis; and (ix) whether

imetelstat demonstrates disease-modifying activity. Additional

information on the above risks and uncertainties and additional

risks, uncertainties and factors that could cause actual results to

differ materially from those in the forward-looking statements are

contained in Geron’s periodic reports filed with the Securities and

Exchange Commission under the heading “Risk Factors,” including

Geron’s annual report on Form 10-K for the year ended December 31,

2018. Undue reliance should not be placed on forward-looking

statements, which speak only as of the date they are made, and the

facts and assumptions underlying the forward-looking statements may

change. Except as required by law, Geron disclaims any obligation

to update these forward-looking statements to reflect future

information, events or circumstances.

Financial table follows.

GERON

CORPORATIONCONDENSED STATEMENTS OF

OPERATIONS

|

|

UNAUDITEDThree Months

EndedDecember 31, |

Year EndedDecember

31, |

| (In thousands, except

share and per share data) |

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| License fees and

royalties |

$ |

375 |

|

|

$ |

191 |

|

|

$ |

1,066 |

|

|

$ |

1,065 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and

development |

|

5,081 |

|

|

|

2,523 |

|

|

|

13,432 |

|

|

|

11,033 |

|

| General and

administrative |

|

4,883 |

|

|

|

5,454 |

|

|

|

18,707 |

|

|

|

19,287 |

|

| Total

operating expenses |

|

9,964 |

|

|

|

7,977 |

|

|

|

32,139 |

|

|

|

30,320 |

|

| Loss from operations |

|

(9,589 |

) |

|

|

(7,786 |

) |

|

|

(31,073 |

) |

|

|

(29,255 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and other

income |

|

1,120 |

|

|

|

375 |

|

|

|

3,291 |

|

|

|

1,416 |

|

| Gain on settlement |

|

1,460 |

|

|

|

— |

|

|

|

1,460 |

|

|

|

— |

|

| Change in fair value of

equity investment |

|

(271 |

) |

|

|

— |

|

|

|

(541 |

) |

|

|

— |

|

| Other expense |

|

(20 |

) |

|

|

(18 |

) |

|

|

(154 |

) |

|

|

(77 |

) |

| Net loss |

$ |

(7,300 |

) |

|

$ |

(7,429 |

) |

|

$ |

(27,017 |

) |

|

$ |

(27,916 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted

net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per

share |

$ |

(0.04 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.18 |

) |

| Shares used in

computing net loss per share |

|

186,348,551 |

|

|

|

159,339,385 |

|

|

|

176,504,996 |

|

|

|

159,224,986 |

|

CONDENSED BALANCE SHEETS

|

|

December 31, |

December 31, |

| (In thousands) |

2018 |

2017 |

| |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash, cash equivalents and restricted cash |

$ |

10,844 |

|

$ |

16,603 |

|

Current marketable securities |

|

152,714 |

|

|

78,351 |

|

Other current assets |

|

2,500 |

|

|

1,016 |

| Total current

assets |

|

166,058 |

|

|

95,970 |

|

|

|

|

|

|

|

| Noncurrent marketable

securities |

|

18,582 |

|

|

14,241 |

| Property and equipment,

net |

|

59 |

|

|

102 |

| Other assets |

|

585 |

|

|

— |

|

|

$ |

185,284 |

|

$ |

110,313 |

|

|

|

|

|

|

|

| Current liabilities |

$ |

7,551 |

|

$ |

6,516 |

| Stockholders’ equity |

|

177,733 |

|

|

103,797 |

|

|

$ |

185,284 |

|

$ |

110,313 |

CONTACT:

Suzanne MessereInvestor and Media

Relationsinvestor@geron.commedia@geron.com

CG Capital877-889-1972

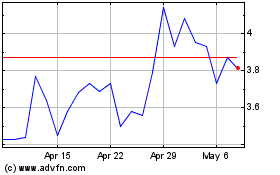

Geron (NASDAQ:GERN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Geron (NASDAQ:GERN)

Historical Stock Chart

From Apr 2023 to Apr 2024